Ebang International Holdings Inc. (Nasdaq: EBON, the “Company”), a

blockchain technology company, today issued an open letter from the

Company’s chairman to shareholders.

Dear Shareholders:

Now that we are past the first quarter of 2021,

I had planned to provide a shareholder update in connection with

the upcoming filing of our annual report. As a result of some of

the articles that surfaced last week and the input and questions

that I received from many shareholders, I have decided to

accelerate the timing of this letter in order to address some of

the questions and concerns that have been raised.

First and foremost, I want to reiterate the

vision and mission that led us to found Ebang and subsequently

enter into the cryptocurrency-related business, and drives me and

my loyal and hard-working colleagues each and every day.

Since we went public, we are committed to

serving the needs of all of our stakeholders and have been focused

on a primary goal -- to become a globally prominent blockchain

company driven by technological innovations. To that end, we have

worked tirelessly to position our company in the global crypto

market, maintained a healthy balance sheet with a strong cash

position in order to enable us to take advantage of opportunities

that frequently arise in this fast-paced and dynamic blockchain

industry, and have positioned ourselves to extend our global reach

through our self-developed proprietary cryptocurrency exchange

platform called Ebonex. Why? Because we are committed to serving

the needs of all of our stakeholders. Since our initial listing on

Nasdaq in June 2020, we have been relentless in our quest to create

value for our shareholders by achieving certain key milestones:

- In November 2020, we were granted

an exclusive license of the AsicBoost patent, a method that can

increase performance of Bitcoin mining by approximately 20%. The

increased performance is achieved through a high-level optimization

of the Bitcoin mining algorithm which allows for drastic reduction

in gate count on the mining chip;

- In February 2021, we completed the

design phase of a chip for simultaneous Litecoin and Dogecoin

mining;

- In March 2021, we completed the

design phase of the 6 nm ASIC chip; and

- In April 2021, we launched our

cryptocurrency exchange platform Ebonex (www.ebonex.io).

Looking ahead, the cryptocurrency market remains

a very large and attractive market that is growing globally. We are

focused on developing new technologies to improve efficiency of our

ASIC chips and mining machines and believe that Ebang is well

positioned to capture the market growth. For the remainder of 2021,

we will commit to increasing investments in high performance ASIC

chips and mining machines. I understand that the only way to really

judge our achievements is by our ability to hit operating and

financial performance milestones and have such milestones translate

into shareholder value. The milestones that we have set to achieve

by December 31, 2021 are:

- Rollout of 6 nm ASIC chips and

developing 5 nm ASIC chips;

- Expanding the global footprint of

our cryptocurrency exchange operation;

- Establishing or acquiring

cryptocurrency mining farms used primarily for Bitcoin, Litecoin

and Dogecoin mining with our self-developed and proprietary mining

machines and ASCI chips; and

- Forming a more concentrated

business strategy with the aim to phase out non-cryptocurrency

related business lines and strengthen our market position in the

global cryptocurrency mining and exchange businesses.

Originally, it was not my intention to respond

to the article that appeared on the Hindenburg website on April 6,

2021 (the “Hindenburg Report”). However, I understand the concerns

expressed by shareholders eager to get some validation of our

business plan and understanding of our position on these matters

and thus, to that end, please see the following responses:

1. We did not direct our proceeds from IPO or

any other company funds through “a series of opaque deals with

insiders and questionable counterparties.”

After we completed our initial public offering

in June 2020 (the “IPO”), we purchased redeemable bonds with funds

from offering proceeds that were not to be immediately used as part

of our treasury management practice designed to invest our cash

reserves in order to preserve the principal and earn a return on

the principal to preserve the time value of such cash reserves.

These bonds were issued in arm’s length transactions facilitated by

AMTD, a licensed financial institution in Hong Kong. These bonds

can be redeemed by us at any time prior to the maturity. As of the

date hereof, we have redeemed all such bonds, and collected the

principal and accrued interests in full. We intend to use the

redeemed funds to develop our business operations. Our annual

report on Form 20-F for the year ended December 31, 2020 will

fairly present the transactions undertaken during the course of the

2020 fiscal year.

Prior to our IPO, in order to replenish our

working capital, we borrowed from Hong Kong Dewang Limited, a

related party controlled by a relative of Mr. Dong Hu, in the

aggregated amount of US$24.1 million in principal at an interest

rate of 4.75% per annum. Such related party loans were properly

disclosed in our IPO prospectus on pages 141, F-126 and F-127.

After our IPO, to better manage our balance sheet and save

financing costs, the management decided to make early repayments of

such loans: (i) from July to October 2020 and prior to the launch

of our first secondary offering, we made the repayment using a

portion of the IPO proceeds in the amount of US$21 million in

principal; and (ii) from November to December 2020, we repaid the

balance of such loans in full in the amount of US$3.1 million in

principal and US$1.0 million in accrued interests. As of the date

hereof, we had cash and cash equivalents of approximately US$274

million on our balance sheet.

2. We are not related to Yindou or any of

Yindou’s schemes alleged in the Hindenburg Report.

We cannot, and are not in the position to,

comment on Hindenburg’s allegations against Yindou. Nonetheless, we

confirm that we have never engaged in any business relationship

with Yindou, and our listing application with the Hong Kong Stock

Exchange (the “HKSE”) had nothing to do with Yindou. It is true

that our listing application with HKSE expired without any action

by HKSE. To our knowledge, in addition to Ebang, there are other

companies in the bitcoin mining machine industry whose listing

applications with HKSE also expired, and one of them completed its

US listing before Ebang.

3. We remain committed to the designing and

manufacturing of Bitcoin mining machines.

Our results of operations, especially the sales

of mining machines, have been and are expected to continue to be

subject to significant impact from the fluctuations of Bitcoin

price and market conditions. However, we remain committed to the

designing and manufacturing of Bitcoin mining machines as well as

mining machines for other cryptocurrencies because our management

team believes that there is a strong demand for high-performance

mining machines. We have recently completed the design of the 6 nm

ASIC chip and expect to officially launch several new models of

high-performance Bitcoin mining machines this summer. With

sufficient working capital, we believe that we are financially

well-positioned for the mass production of our mining machines.

4. We developed and own software and

technologies of our cryptocurrency exchange.

We did not purchase a white label online

exchange solution package from Bluehelix. Instead, our in-house

research and development team was in charge of the development of

the core software of the cryptocurrency exchange, Ebonex.

Therefore, we are very proud of our ownership in the technologies

embedded in the Ebonex platform. As of the date hereof, we are

preparing for the software copyright application in connection with

our Ebonex platform in China. To accelerate the development

progress, we purchased certain software source codes from

Bluehelix, and Ebonex has also used AWS cloud services as well as

licensed software from third party software providers such as

Tencent. We understand this is a common practice in the

industry.

5. We did not artificially inflate the trading

volume of Ebonex.

We have noticed the extraordinary trading volume

displayed on Ebonex, which is not representative of its actual

trading volume as a newly launched cryptocurrency exchange. After

an investigation, we confirmed that such displayed trading volume

was not correct due to a software glitch in the backend of the

Ebonex platform. Our developers and engineers are working

diligently to provide a correct display of trading volume on

Ebonex.

To our knowledge, both CoinMarketCap and FTX are

independent agencies, and it typically takes several months to

collect and analyze trading data before they can list a new

cryptocurrency exchange on their websites. As Ebonex was only

launched on April 5, 2021, its trading metrics have not been quoted

on crypto exchange trackers on CoinMarketCap or FTX.

Dear shareholders, we always appreciate your

support and our team will continue to work hard to achieve a

successful 2021 for you.

Yours, sincerely,

Dong HuCEO and Chairman

About Ebang International Holdings

Inc.

Ebang International Holdings Inc. is a

blockchain technology company with strong application-specific

integrated circuit (ASIC) chip design capability. With years of

industry experience and expertise in ASIC chip design, it has

become a leading bitcoin mining machine producer in the global

market with steady access to wafer foundry capacity. With its

licensed or registered entities in various jurisdictions, the

Company seeks to launch a professional, convenient and innovative

digital asset financial service platform to expand into the

upstream and the downstream of blockchain and cryptocurrency

industry value chain. For more information, please

visit https://ir.ebang.com.cn/.

Forward-Looking Statements

This letter contains forward-looking statements

within the meaning of Section 21E of the Securities Exchange Act of

1934, as amended, and as defined in the U.S. Private Securities

Litigation Reform Act of 1995. T Certain statements contained

herein and in our investor conference call related to these results

are “forward-looking” statements within the meaning of the

applicable securities laws and regulations. Generally, these

statements can be identified by the use of words such as “aim,”

“anticipate,” “believe,” “commit,” “continue,” “could,” “estimate,”

“expect,” “forecast,” “intend,” “may,” “outlook,” “plan,”

“potential,” “predict,” “project,” “remain,” “should,” “will,”

“would,” and similar expressions intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. Such statements are not

historical facts, and are based upon the Company’s current beliefs,

plans and expectations, and the current market and operating

conditions. Forward-looking statements involve inherent known or

unknown risks, uncertainties and other factors, all of which are

difficult to predict and many of which are beyond the Company’s

control, which may cause the Company’s actual results, performance

and achievements to differ materially from those contained in any

forward-looking statement. Further information regarding these and

other risks, uncertainties or factors is included in the Company's

filings with the U.S. Securities and Exchange Commission. These

forward-looking statements are made only as of the date indicated,

and the Company undertakes no obligation to update or revise the

information contained in any forward-looking statements as a result

of new information, future events or otherwise, except as required

under applicable law.

Investor Relations Contact

For investor and media inquiries, please contact:Ebang

International Holdings

Inc.Email: ir@ebang.com.cn

Ascent Investor Relations LLCMs. Tina XiaoTel: (917)

609-0333Email: tina.xiao@ascent-ir.com

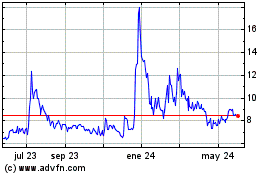

Ebang (NASDAQ:EBON)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

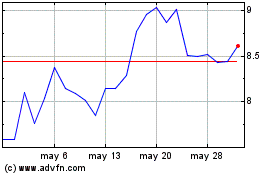

Ebang (NASDAQ:EBON)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024