Financial Institutions, Inc. Announces Intent to Begin Winding Down BaaS, Reflecting Strategic Focus on Core Franchise

16 Septiembre 2024 - 3:05PM

Financial Institutions, Inc. (NASDAQ: FISI) (the "Company," "we" or

"us"), a diversified financial services company and parent company

of Five Star Bank (the “Bank”) and Courier Capital, LLC (“Courier

Capital”), today announced its intent to begin an orderly wind down

of its Banking-as-a-Service (“BaaS”) offerings, following a careful

review by the Company’s executive management and Board of Directors

undertaken in conjunction with its annual strategic planning

process.

“Since our entry into BaaS, we have moved forward at a measured

and conservative pace to balance growth with effective risk

management. Following an internal review that considered many

factors, including the contribution of BaaS to our core financial

results, evolving regulatory expectations and a proposed rule

regarding the re-classification of BaaS deposits as brokered, in

addition to the future investments in talent and technology

necessary to achieve scale, we are prioritizing our core community

banking franchise and intend to begin winding down our BaaS

offerings,” said Martin K. Birmingham, President and Chief

Executive Officer of the Company and the Bank. “We see significant

opportunity and growth potential for our retail banking, commercial

banking and wealth management business lines within our existing

geographic markets. This decision allows us to continue to nurture

those lines of business and drive value into the Company for the

benefit of our shareholders, customers, associates and

communities.”

As of June 30, 2024, the Company’s balance sheet included

approximately $108 million of deposits, representing about 2% of

total deposits, and $31 million of loans, representing less than 1%

of total loans, related to its BaaS offerings. Of the Bank’s 12

current BaaS partnerships, four are live, two are in onboarding,

four have not yet begun testing, and two have already been in the

process of offboarding. Given the modest size of the business, the

financial impact is expected to be immaterial, and the Company

looks forward to providing additional detail on its third quarter

earnings call in October.

As the Bank begins the process of working to support orderly

transitions for its BaaS partner firms, the Bank is preliminarily

targeting completion of the wind down of its BaaS business sometime

in 2025.

The Bank expects to retain all personnel positions supporting

the BaaS line of business, both through the wind down period and

beyond, refocusing those roles on supporting the growth of its core

banking operations.

About Financial Institutions, Inc.Financial

Institutions, Inc. (NASDAQ: FISI) is an innovative financial

holding company with approximately $6.1 billion in assets offering

banking and wealth management products and services. Its Five Star

Bank subsidiary provides consumer and commercial banking and

lending services to individuals, municipalities and businesses

through banking locations spanning Western and Central New York and

a commercial loan production office serving the Mid-Atlantic

region. Courier Capital, LLC offers customized investment

management, financial planning and consulting services to

individuals and families, businesses, institutions, non-profits and

retirement plans. Learn more at Five-StarBank.com and

FISI-Investors.com.

Safe Harbor Statement This press release may

contain forward-looking statements as defined by Section 21E of the

Securities Exchange Act of 1934, as amended, that involve

significant risks and uncertainties. In this context,

forward-looking statements often address our expected future

business and financial performance and financial condition, and

often contain words such as "believe," "anticipate," "continue,"

"estimate," "expect," "focus," "forecast," "intend," "may," "plan,"

"preliminary," "should," or "will." Statements herein are based on

certain assumptions and analyses by the Company and factors it

believes are appropriate in the circumstances. Actual results could

differ materially from those contained in or implied by such

statements for a variety of reasons including, but not limited to:

additional information regarding the deposit fraudulent activity;

changes in interest rates; inflation; changes in deposit flows and

the cost and availability of funds; the Company’s ability to

implement its strategic plan, including by expanding its commercial

lending footprint and integrating its acquisitions; whether the

Company experiences greater credit losses than expected; whether

the Company experiences breaches of its, or third party,

information systems; the attitudes and preferences of the Company's

customers; legal and regulatory proceedings and related matters,

including any action described in our reports filed with the SEC,

could adversely affect us and the banking industry in general; the

competitive environment; fluctuations in the fair value of

securities in its investment portfolio; changes in the regulatory

environment and the Company's compliance with regulatory

requirements; and general economic and credit market conditions

nationally and regionally; and the macroeconomic volatility related

to the impact of a pandemic or global political unrest.

Consequently, all forward-looking statements made herein are

qualified by these cautionary statements and the cautionary

language and risk factors included in the Company's Annual Report

on Form 10-K, its Quarterly Reports on Form 10-Q and other

documents filed with the SEC. Except as required by law, the

Company undertakes no obligation to revise these statements

following the date of this press release.

For additional information contact:Kate

CroftDirector of Investor and External Relations (716)

817-5159klcroft@five-starbank.com

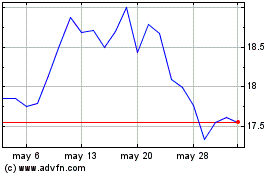

Financial Institutions (NASDAQ:FISI)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

Financial Institutions (NASDAQ:FISI)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024