HF Foods Group Inc. (NASDAQ: HFFG) (“HF Foods”, or the “Company”),

a leading food distributor to Asian restaurants across the United

States, reported financial results for the third quarter and nine

months ended September 30, 2023.

Third Quarter 2023 Financial

Results

- Net revenue

decreased 6.4% to $281.5 million compared to $300.7 million in the

prior year.

- Gross profit

decreased 1.1% to $50.9 million, or 18.1% gross profit margin

compared to $51.5 million, or 17.1% gross profit margin in the

prior year.

- Net income (loss)

increased to net income of $2.0 million compared to net loss of

$3.9 million in the prior year.

- Adjusted EBITDA increased 151.0% to $10.0 million compared to

$4.0 million in the prior year.

Nine Months 2023 Financial

Results

- Net revenue

decreased 1.2% to $867.6 million compared to $878.6 million in the

prior year.

- Gross profit

decreased 2.0% to $151.8 million, or 17.5% gross profit margin

compared to $154.8 million, or 17.6% gross profit margin in the

prior year.

- Net (loss) income

decreased to a net loss of $5.4 million compared to net income of

$3.7 million in the prior year.

- Adjusted EBITDA decreased 32.9% to

$24.0 million compared to $35.8 million in the prior year.

Management Commentary

“In the third quarter we made significant

progress in enhancing our profitability, as our investments in

people and processes began to bear fruit. Building on that

momentum, we are very pleased to announce our comprehensive

operational transformation plan, which began earlier this year,

that we believe will have a significant, positive impact on both

our growth and profitability for years to come,” said Peter Zhang,

Chief Executive Officer of HF Foods. “We have a unique opportunity

ahead of us as we are the only scaled, nationwide operator serving

the growing Asian foodservice market, and because of the truly

personal experience we provide Asian restaurant owners in the U.S.,

which has led to consistent, long-term relationships. Over the past

year, we have meticulously analyzed every aspect of our business.

We believe that our resulting transformation initiative, which aims

to drive sales and cost efficiencies, will allow us to improve our

service and variety of offerings to customers and deliver value to

all stakeholders.”

Revenue by Product Category

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| ($ in thousands) |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Seafood |

|

$ |

87,475 |

|

31 |

% |

|

$ |

94,077 |

|

32 |

% |

|

$ |

271,748 |

|

32 |

% |

|

$ |

262,280 |

|

30 |

% |

| Asian Specialty |

|

|

74,384 |

|

26 |

% |

|

|

73,380 |

|

24 |

% |

|

|

228,545 |

|

26 |

% |

|

|

223,393 |

|

25 |

% |

| Meat and Poultry |

|

|

54,787 |

|

19 |

% |

|

|

63,647 |

|

21 |

% |

|

|

162,848 |

|

19 |

% |

|

|

187,671 |

|

22 |

% |

| Fresh Produce |

|

|

29,578 |

|

11 |

% |

|

|

31,260 |

|

10 |

% |

|

|

93,425 |

|

11 |

% |

|

|

92,215 |

|

10 |

% |

| Packaging and Other |

|

|

17,342 |

|

6 |

% |

|

|

20,867 |

|

7 |

% |

|

|

54,775 |

|

6 |

% |

|

|

64,176 |

|

7 |

% |

| Commodity |

|

|

17,887 |

|

7 |

% |

|

|

17,480 |

|

6 |

% |

|

|

56,279 |

|

6 |

% |

|

|

48,833 |

|

6 |

% |

| Total |

|

$ |

281,453 |

|

100 |

% |

|

$ |

300,711 |

|

100 |

% |

|

$ |

867,620 |

|

100 |

% |

|

$ |

878,568 |

|

100 |

% |

Third Quarter 2023 Results

Net revenue was $281.5 million for the third

quarter of 2023 compared to $300.7 million in the prior year

period, a decrease of $19.3 million, or 6.4%. The decline was

primarily attributable to decreases of $8.9 million in Meat and

Poultry revenue and $6.6 million in Seafood revenue, driven by

deflationary pricing of poultry and shrimp. During the three months

ended September 30, 2022, we benefited from the significant

inflation experienced in poultry pricing, which created a tough

year-over-year revenue compare.

Gross profit was $50.9 million compared to $51.5

million in the prior year period, a decrease of $0.6 million, or

1.1%. Gross profit margin increased to 18.1% from 17.1% in the

prior year period. The increase was primarily attributable to

improved Seafood margins due to a mix shift of higher gross margin

shrimp and other frozen food sales realized by the centralized

purchasing program and the exit of the lower margin chicken

processing business, partially offset by the deflationary pressure

in Meat and Poultry.

Distribution, selling and administrative

expenses decreased by $5.7 million to $48.8 million, primarily due

to decreases of $3.9 million in professional fees and $0.8 million

in delivery related costs, partially offset by higher payroll and

related labor costs. Distribution, selling and administrative

expenses as a percentage of net revenue decreased to 17.4% from

18.2% in the prior year period primarily due to lower professional

fees offset by increased headcount.

Net income (loss) increased to net income of

$2.0 million compared to a net loss of $3.9 million in the prior

year period. The increase was primarily attributable to the

decreased distribution, selling and administrative costs and the

$1.7 million change in the fair value of interest rate swaps,

partially offset by a $0.4 million increase in lower gross profit,

higher interest expense, and decreased tax benefit.

Adjusted EBITDA increased 151.0% to $10.0

million compared to $4.0 million in the prior year.

Nine Months 2023 Results

Net revenue was $867.6 million for the first

nine months of 2023 compared to $878.6 million in the prior year

period. The decline was primarily attributable to the $24.8 million

decrease in Meat and Poultry revenue, driven by deflationary

pricing in poultry as well as a $9.4 million decrease in Packaging

and Other due to lower volume, partially offset by an increase of

$7.4 million in Commodity revenue due to higher volume as well as

the Seafood revenue generated due to the Sealand Food, Inc.

acquisition (the “Sealand Acquisition”).

Gross profit was $151.8 million compared to

$154.8 million in the prior year period. The decline was primarily

attributable to decreases in Meat and Poultry, Packaging and Other

and Commodity revenue, partially offset by the additional Seafood

revenue generated due to the Sealand Acquisition. Notably, poultry

pricing decreased from the elevated levels we benefited from in the

prior year period. Gross profit margin remained relatively flat at

17.5%.

Distribution, selling and administrative

expenses increased by $13.2 million to $154.0 million primarily due

to an increase of $5.1 million in payroll and related labor costs,

inclusive of the additional costs due to the Sealand Acquisition,

and an increase of $1.9 million in insurance related costs.

Professional fees increased to $18.7 million, from $17.1 million in

the prior year period. In addition, the Company recognized asset

impairment of $1.2 million related to the exit of the chicken

processing facility. Distribution, selling and administrative

expenses as a percentage of net revenue increased to 17.8% from

16.0% in the prior year period, primarily due to increased

headcount and the higher costs described above.

Net (loss) income decreased to a net loss of

$5.4 million compared to net income of $3.7 million in the prior

year period. The decrease was primarily attributable to the

increased distribution, selling and administrative costs and lower

gross profit, as well as a $3.3 million increase in interest

expense, partially offset by the decrease of $6.1 million in lease

guarantee expense and the $1.2 million change in the fair value of

interest rate swaps.

Adjusted EBITDA decreased 32.9% to $24.0 million

compared to $35.8 million in the prior year.

Cash Flow and Liquidity

Cash flow from operating activities increased to

$20.6 million for the first nine months of 2023, compared to $6.9

million in the prior year period. The increase in cash flow from

operating activities was primarily due to the timing of working

capital outlays. As of September 30, 2023, the Company had a cash

balance of $14.3 million and access to approximately $48.6 million

in additional funds through its $100.0 million line of credit,

subject to a borrowing base calculation.

Transformation Plan

To position the business for long-term success,

HF Foods has initiated a comprehensive, operational transformation

plan in an effort to drive growth and cost savings. The

transformation is focused on four key areas, each of which the

Company expects will positively impact future growth or cost

savings. The components of the transformation are as follows:

- Centralized

Purchasing: The Company will formalize its national

category purchases and welcome new vendors into its ecosystem. This

will allow the Company to unlock synergies from its prior

acquisitions, and deliver savings in its largest categories.

- Fleet and

Transportation: HF Foods will be establishing a national

fleet maintenance program. Within this, the Company plans to define

new truck specifications, initiate a replacement program for 50% of

the current fleet, implement a national fuel savings program to

maximize efficiency, and outsource domestic inbound freight

logistics to a third-party partner to adopt a cohesive national

approach to its supply chain. This is expected to deliver

substantial improvements to the Company’s transportation

system.

- Digital

Transformation: HF Foods will be implementing a modern ERP

solution across all of its distribution centers. This is expected

to deliver enhanced operational efficiency and responsiveness,

streamlined processes, and greater data driven

decision-making.

- Facility

Upgrades: The Company will be reorganizing and upgrading

its facilities and distribution centers to efficiently streamline

costs, and to capitalize on cross-selling opportunities with both

new and existing customers.

Earnings Conference Call and

Webcast

A pre-recorded conference call and webcast with

HF Foods’ management team discussing the results is now available

on the Investor Relations section of the Company’s website at

https://investors.hffoodsgroup.com/.

About HF Foods Group Inc.

HF Foods Group Inc. is a leading marketer and

distributor of fresh produce, frozen and dry food, and non-food

products to primarily Asian/Chinese restaurants and other

foodservice customers throughout the United States. HF Foods aims

to supply the increasing demand for Asian American restaurant

cuisine, leveraging its nationwide network of distribution centers

and its strong relations with growers and suppliers of fresh,

high-quality specialty restaurant food products and supplies in the

US, South America, and China. Headquartered in Las Vegas, Nevada,

HF Foods trades on Nasdaq under the symbol “HFFG”. For more

information, please visit www.hffoodsgroup.com.

Investor Relations Contact:

HFFG Investor Relations

hffoodsgroup@icrinc.com

Forward-Looking Statements

All statements in this news release other than

statements of historical facts are forward-looking statements which

contain our current expectations about our future results. We have

attempted to identify any forward-looking statements by using words

such as “believes,” “intends,” and other similar expressions.

Although we believe that the expectations reflected in all of our

forward-looking statements are reasonable, we can give no assurance

that such expectations will prove to be correct. Such statements

are not guarantees of future performance or events and are subject

to known and unknown risks and uncertainties that could cause the

Company’s actual results, events or financial positions to differ

materially from those included within or implied by such

forward-looking statements. Such factors include, but are not

limited to, statements of assumption underlying any of the

foregoing, and other factors disclosed under the caption “Risk

Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2022 and other filings with the SEC. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date made. Except as

required by law, we undertake no obligation to disclose any

revision to these forward-looking statements.

Non-GAAP Financial Measures

Discussion of our results includes certain

non-GAAP financial measures, including EBITDA, adjusted EBITDA and

non-GAAP net income (loss) attributable to HF Foods Group Inc.,

that we believe provides an additional tool for investors to use in

evaluating ongoing operating results and trends and in comparing

our financial performance with other companies in the same

industry, many of which present similar non-GAAP financial measures

to investors. The definitions of EBITDA, adjusted EBITDA and

non-GAAP net income (loss) attributable to HF Foods Group Inc. may

not be the same as similarly titled measures used by other

companies in the industry. EBITDA, adjusted EBITDA and non-GAAP net

income (loss) attributable to HF Foods Group Inc. are not defined

under GAAP and are subject to important limitations as analytical

tools and should not be considered in isolation or as substitutes

for analysis of our financial results as reported under GAAP.

We use non-GAAP financial measures to supplement

our GAAP financial results. Management uses EBITDA, defined as net

income (loss) before interest expense, interest income, income

taxes, and depreciation and amortization to measure operating

performance. In addition, management uses Adjusted EBITDA, defined

as net income (loss) before interest expense, interest income,

income taxes, and depreciation and amortization, further adjusted

to exclude certain unusual, non-cash, or non-recurring expenses. We

believe that Adjusted EBITDA is less susceptible to variances in

actual performance resulting from non-recurring expenses, and other

non-cash charges, provides useful information for our investors and

is more reflective of other factors that affect our operating

performance.

We believe non-GAAP net income (loss)

attributable to HF Foods Group Inc. is a useful measure of

operating performance because it excludes certain items not

reflective of our core operating performance. Non-GAAP net income

(loss) attributable to HF Foods Group Inc. is defined as net income

(loss) attributable to HF Foods Group Inc. adjusted for

amortization of intangibles, change in fair value of interest rate

swaps, stock based compensation, transaction related costs,

transformational project costs and certain unusual, non-cash, or

non-recurring expenses. We believe that non-GAAP net income (loss)

attributable to HF Foods Group Inc. facilitates period-over-period

comparisons and provides additional clarity for investors to better

evaluate our operating results. We present EBITDA, adjusted EBITDA,

non-GAAP net income (loss) attributable to HF Foods Group Inc. in

order to provide supplemental information that we consider relevant

for the readers of our consolidated financial statements included

elsewhere in its reports filed with the SEC, including its current

Quarterly Report on Form 10Q, and such information is not meant to

replace or supersede U.S. GAAP measures. Reconciliations of the

non-GAAP financial measures to their most comparable GAAP financial

measures are included in the schedules attached to this press

release.

|

HF FOODS GROUP INC. AND SUBSIDIARIESCONDENSED CONSOLIDATED

BALANCE SHEETS(In thousands)(Unaudited) |

| |

| |

September 30, 2023 |

|

December 31, 2022 |

| ASSETS |

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

Cash |

$ |

14,300 |

|

|

$ |

24,289 |

|

|

Accounts receivable, net |

|

43,461 |

|

|

|

44,399 |

|

|

Inventories |

|

115,942 |

|

|

|

120,291 |

|

|

Other current assets |

|

23,611 |

|

|

|

8,937 |

|

| TOTAL CURRENT

ASSETS |

|

197,314 |

|

|

|

197,916 |

|

| Property and equipment,

net |

|

135,350 |

|

|

|

140,330 |

|

| Operating lease right-of-use

assets |

|

12,520 |

|

|

|

14,164 |

|

| Long-term investments |

|

2,401 |

|

|

|

2,679 |

|

| Customer relationships,

net |

|

149,823 |

|

|

|

157,748 |

|

| Trademarks and other

intangibles, net |

|

32,055 |

|

|

|

36,343 |

|

| Goodwill |

|

85,118 |

|

|

|

85,118 |

|

| Other long-term assets |

|

8,203 |

|

|

|

3,231 |

|

| TOTAL

ASSETS |

$ |

622,784 |

|

|

$ |

637,529 |

|

| LIABILITIES AND

SHAREHOLDERS' EQUITY |

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

Checks issued not presented for payment |

$ |

6,888 |

|

|

$ |

21,946 |

|

|

Line of credit |

|

47,648 |

|

|

|

53,056 |

|

|

Accounts payable |

|

78,623 |

|

|

|

57,044 |

|

|

Current portion of long-term debt, net |

|

5,868 |

|

|

|

6,266 |

|

|

Current portion of obligations under finance leases |

|

1,832 |

|

|

|

2,254 |

|

|

Current portion of obligations under operating leases |

|

3,609 |

|

|

|

3,676 |

|

|

Accrued expenses and other liabilities |

|

17,157 |

|

|

|

19,648 |

|

| TOTAL CURRENT

LIABILITIES |

|

161,625 |

|

|

|

163,890 |

|

| Long-term debt, net of current

portion |

|

111,220 |

|

|

|

115,443 |

|

| Obligations under finance

leases, non-current |

|

11,174 |

|

|

|

11,441 |

|

| Obligations under operating

leases, non-current |

|

9,171 |

|

|

|

10,591 |

|

| Deferred tax liabilities |

|

31,976 |

|

|

|

34,443 |

|

| Other long-term

liabilities |

|

5,262 |

|

|

|

5,472 |

|

| TOTAL

LIABILITIES |

|

330,428 |

|

|

|

341,280 |

|

| Commitments and

contingencies |

|

|

|

| SHAREHOLDERS’

EQUITY: |

|

|

|

|

Preferred Stock |

|

— |

|

|

|

— |

|

|

Common Stock |

|

5 |

|

|

|

5 |

|

|

Additional paid-in capital |

|

600,696 |

|

|

|

598,322 |

|

|

Accumulated deficit |

|

(311,413 |

) |

|

|

(306,514 |

) |

| TOTAL SHAREHOLDERS’

EQUITY ATTRIBUTABLE TO HF FOODS GROUP INC. |

|

289,288 |

|

|

|

291,813 |

|

| Noncontrolling interests |

|

3,068 |

|

|

|

4,436 |

|

| TOTAL SHAREHOLDERS’

EQUITY |

|

292,356 |

|

|

|

296,249 |

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

$ |

622,784 |

|

|

$ |

637,529 |

|

|

HF FOODS GROUP INC. AND SUBSIDIARIESCONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS(In thousands, except share and per share

data)(Unaudited) |

| |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net revenue |

$ |

281,453 |

|

|

$ |

300,711 |

|

|

$ |

867,620 |

|

|

$ |

878,568 |

|

| Cost of revenue |

|

230,528 |

|

|

|

249,218 |

|

|

|

715,857 |

|

|

|

723,778 |

|

|

Gross profit |

|

50,925 |

|

|

|

51,493 |

|

|

|

151,763 |

|

|

|

154,790 |

|

| |

|

|

|

|

|

|

|

| Distribution, selling and

administrative expenses |

|

48,841 |

|

|

|

54,589 |

|

|

|

154,013 |

|

|

|

140,840 |

|

|

Income (loss) from operations |

|

2,084 |

|

|

|

(3,096 |

) |

|

|

(2,250 |

) |

|

|

13,950 |

|

| |

|

|

|

|

|

|

|

| Other (income) expenses: |

|

|

|

|

|

|

|

|

Interest expense |

|

2,715 |

|

|

|

2,274 |

|

|

|

8,430 |

|

|

|

5,101 |

|

|

Other income |

|

(490 |

) |

|

|

(462 |

) |

|

|

(845 |

) |

|

|

(1,401 |

) |

|

Change in fair value of interest rate swap contracts |

|

(1,984 |

) |

|

|

(284 |

) |

|

|

(2,094 |

) |

|

|

(850 |

) |

|

Lease guarantee expense |

|

(95 |

) |

|

|

(58 |

) |

|

|

(305 |

) |

|

|

5,831 |

|

|

Total Other expenses, net |

|

146 |

|

|

|

1,470 |

|

|

|

5,186 |

|

|

|

8,681 |

|

|

Income (loss) before income taxes |

|

1,938 |

|

|

|

(4,566 |

) |

|

|

(7,436 |

) |

|

|

5,269 |

|

| |

|

|

|

|

|

|

|

| Income tax (benefit)

expense |

|

(36 |

) |

|

|

(672 |

) |

|

|

(2,053 |

) |

|

|

1,529 |

|

|

Net income (loss) |

|

1,974 |

|

|

|

(3,894 |

) |

|

|

(5,383 |

) |

|

|

3,740 |

|

| Less: net income (loss)

attributable to noncontrolling interests |

|

90 |

|

|

|

(30 |

) |

|

|

(484 |

) |

|

|

(74 |

) |

|

Net income (loss) attributable to HF Foods Group Inc. |

$ |

1,884 |

|

|

$ |

(3,864 |

) |

|

$ |

(4,899 |

) |

|

$ |

3,814 |

|

| |

|

|

|

|

|

|

|

| Earnings (loss) per common

share - basic |

$ |

0.03 |

|

|

$ |

(0.07 |

) |

|

$ |

(0.09 |

) |

|

$ |

0.07 |

|

| Earnings (loss) per common

share - diluted |

$ |

0.03 |

|

|

$ |

(0.07 |

) |

|

$ |

(0.09 |

) |

|

$ |

0.07 |

|

| |

|

|

|

|

|

|

|

| Weighted average shares -

basic |

|

54,142,396 |

|

|

|

53,798,131 |

|

|

|

54,005,010 |

|

|

|

53,716,464 |

|

| Weighted average shares -

diluted |

|

54,513,314 |

|

|

|

53,798,131 |

|

|

|

54,005,010 |

|

|

|

53,981,687 |

|

|

HF FOODS GROUP INC. AND SUBSIDIARIESCONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS(In thousands), (Unaudited) |

| |

| |

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

| Cash flows from

operating activities: |

|

|

|

|

Net (loss) income |

$ |

(5,383 |

) |

|

$ |

3,740 |

|

|

Adjustments to reconcile net (loss) income to net cash

provided by operating activities: |

|

|

|

|

Depreciation and amortization expense |

|

19,551 |

|

|

|

18,245 |

|

|

Asset impairment charges |

|

1,200 |

|

|

|

422 |

|

|

Gain from disposal of property and equipment |

|

(278 |

) |

|

|

(1,327 |

) |

|

Provision for credit losses |

|

56 |

|

|

|

226 |

|

|

Deferred tax benefit |

|

(2,467 |

) |

|

|

(3,391 |

) |

|

Change in fair value of interest rate swap contracts |

|

(2,094 |

) |

|

|

(849 |

) |

|

Stock-based compensation |

|

2,605 |

|

|

|

673 |

|

|

Non-cash lease expense |

|

2,668 |

|

|

|

2,562 |

|

|

Lease guarantee expense |

|

(305 |

) |

|

|

5,831 |

|

|

Other expense (income) |

|

446 |

|

|

|

54 |

|

|

Changes in operating assets and liabilities (excluding

effects of acquisitions): |

|

|

|

|

Accounts receivable |

|

997 |

|

|

|

(8,221 |

) |

|

Accounts receivable - related parties |

|

(115 |

) |

|

|

(178 |

) |

|

Inventories |

|

4,349 |

|

|

|

(15,988 |

) |

|

Prepaid expenses and other current assets |

|

(14,074 |

) |

|

|

(3,769 |

) |

|

Other long-term assets |

|

(2,878 |

) |

|

|

(593 |

) |

|

Accounts payable |

|

22,618 |

|

|

|

8,953 |

|

|

Accounts payable - related parties |

|

(1,039 |

) |

|

|

(443 |

) |

|

Operating lease liabilities |

|

(2,511 |

) |

|

|

(2,530 |

) |

|

Accrued expenses and other liabilities |

|

(2,722 |

) |

|

|

3,515 |

|

|

Net cash provided by operating activities |

|

20,624 |

|

|

|

6,932 |

|

| Cash flows from

investing activities: |

|

|

|

|

Purchase of property and equipment |

|

(3,495 |

) |

|

|

(5,745 |

) |

|

Proceeds from sale of property and equipment |

|

900 |

|

|

|

7,805 |

|

|

Payment made for acquisition of Sealand |

|

— |

|

|

|

(34,849 |

) |

|

Payment made for acquisition of Great Wall Group |

|

— |

|

|

|

(17,445 |

) |

|

Net cash used in investing activities |

|

(2,595 |

) |

|

|

(50,234 |

) |

| Cash flows from

financing activities: |

|

|

|

|

Checks issued not presented for payment |

|

(15,058 |

) |

|

|

682 |

|

|

Proceeds from line of credit |

|

891,510 |

|

|

|

938,251 |

|

|

Repayment of line of credit |

|

(896,959 |

) |

|

|

(922,080 |

) |

|

Proceeds from long-term debt |

|

— |

|

|

|

45,956 |

|

|

Repayment of long-term debt |

|

(4,653 |

) |

|

|

(9,614 |

) |

|

Payment of debt financing costs |

|

— |

|

|

|

(556 |

) |

|

Repayment of obligations under finance leases |

|

(1,974 |

) |

|

|

(1,876 |

) |

|

Repayment of promissory note payable - related party |

|

— |

|

|

|

(4,500 |

) |

|

Proceeds from noncontrolling interests shareholders |

|

— |

|

|

|

240 |

|

|

Cash distribution to shareholders |

|

(884 |

) |

|

|

(187 |

) |

|

Net cash (used in) provided by financing

activities |

|

(28,018 |

) |

|

|

46,316 |

|

| Net (decrease)

increase in cash |

|

(9,989 |

) |

|

|

3,014 |

|

| Cash at beginning of

the period |

|

24,289 |

|

|

|

14,792 |

|

| Cash at end of the

period |

$ |

14,300 |

|

|

$ |

17,806 |

|

|

HF FOODS GROUP INC. AND SUBSIDIARIESRECONCILIATION OF NET

(LOSS) INCOME TO EBITDA AND ADJUSTED EBITDA(In

thousands)(Unaudited) |

| |

|

Three Months EndedSeptember

30, |

|

Change |

| |

|

|

2023 |

|

|

|

2022 |

|

|

Amount |

|

% |

|

Net income (loss) |

|

$ |

1,974 |

|

|

$ |

(3,894 |

) |

|

$ |

5,868 |

|

|

NM |

|

Interest expense |

|

|

2,715 |

|

|

|

2,274 |

|

|

|

441 |

|

|

19.4% |

|

Income tax expense |

|

|

(36 |

) |

|

|

(672 |

) |

|

|

636 |

|

|

(94.6)% |

|

Depreciation and amortization |

|

|

6,422 |

|

|

|

6,386 |

|

|

|

36 |

|

|

0.6% |

| EBITDA |

|

|

11,075 |

|

|

|

4,094 |

|

|

|

6,981 |

|

|

170.5% |

|

Lease guarantee expense |

|

|

(95 |

) |

|

|

(58 |

) |

|

|

(37 |

) |

|

63.8% |

|

Change in fair value of interest rate swaps |

|

|

(1,984 |

) |

|

|

(284 |

) |

|

|

(1,700 |

) |

|

NM |

|

Stock-based compensation expense |

|

|

757 |

|

|

|

162 |

|

|

|

595 |

|

|

NM |

|

Business transformation costs(1) |

|

|

105 |

|

|

|

— |

|

|

|

105 |

|

|

NM |

|

Acquisition, integration and other costs (2) |

|

|

146 |

|

|

|

71 |

|

|

|

75 |

|

|

105.6% |

| Adjusted EBITDA |

|

$ |

10,004 |

|

|

$ |

3,985 |

|

|

$ |

6,019 |

|

|

151.0% |

| |

Nine Months EndedSeptember

30, |

|

Change |

| |

|

2023 |

|

|

|

2022 |

|

|

Amount |

|

% |

|

Net (loss) income |

$ |

(5,383 |

) |

|

$ |

3,740 |

|

|

$ |

(9,123 |

) |

|

NM |

|

Interest expense |

|

8,430 |

|

|

|

5,101 |

|

|

|

3,329 |

|

|

65.3% |

|

Income tax (benefit) expense |

|

(2,053 |

) |

|

|

1,529 |

|

|

|

(3,582 |

) |

|

NM |

|

Depreciation and amortization |

|

19,551 |

|

|

|

18,245 |

|

|

|

1,306 |

|

|

7.2% |

| EBITDA |

|

20,545 |

|

|

|

28,615 |

|

|

|

(8,070 |

) |

|

(28.2)% |

|

Lease guarantee expense |

|

(305 |

) |

|

|

5,831 |

|

|

|

(6,136 |

) |

|

NM |

|

Change in fair value of interest rate swaps |

|

(2,094 |

) |

|

|

(849 |

) |

|

|

(1,245 |

) |

|

146.6% |

|

Stock-based compensation expense |

|

2,605 |

|

|

|

673 |

|

|

|

1,932 |

|

|

NM |

|

Business transformation costs (1) |

|

223 |

|

|

|

— |

|

|

|

223 |

|

|

NM |

|

Acquisition, integration and other costs (2) |

|

1,850 |

|

|

|

1,130 |

|

|

|

720 |

|

|

63.7% |

|

Asset impairment charges |

|

1,200 |

|

|

|

422 |

|

|

|

778 |

|

|

184.4% |

| Adjusted EBITDA |

$ |

24,024 |

|

|

$ |

35,822 |

|

|

$ |

(11,798 |

) |

|

(32.9)% |

____________

|

NM - Not meaningful |

|

(1) |

Represents non-recurring expenses prior to the launch of strategic

projects including supply chain strategy improvements and

technology infrastructure initiatives. |

|

(2) |

Includes contested proxy and related legal and consulting costs for

the nine months ended September 30, 2023. During the three months

ended September 30, 2023, we identified non-recurring expenses

related to our contested proxy and related legal defense which

occurred in prior periods. |

|

HF FOODS GROUP INC. AND SUBSIDIARIESRECONCILIATION OF NET

INCOME (LOSS) ATTRIBUTABLE TO HF FOODS GROUP INC.TO NON-GAAP NET

INCOME ATTRIBUTABLE TO HF FOODS GROUP INC.(In

thousands)(Unaudited) |

| |

| |

|

Three Months Ended September 30, |

|

Change |

| |

|

|

2023 |

|

|

|

2022 |

|

|

Amount |

|

% |

|

Net income (loss) attributable to HF Foods Group Inc. |

|

$ |

1,884 |

|

|

$ |

(3,864 |

) |

|

$ |

5,748 |

|

|

NM |

|

Amortization of intangibles |

|

|

4,071 |

|

|

|

4,071 |

|

|

|

— |

|

|

NM |

|

Lease guarantee income |

|

|

(95 |

) |

|

|

(58 |

) |

|

|

(37 |

) |

|

63.8% |

|

Change in fair value of interest rate swaps |

|

|

(1,984 |

) |

|

|

(284 |

) |

|

|

(1,700 |

) |

|

NM |

|

Stock-based compensation expense |

|

|

757 |

|

|

|

162 |

|

|

|

595 |

|

|

NM |

|

Business transformation costs (1) |

|

|

105 |

|

|

|

— |

|

|

|

105 |

|

|

NM |

|

Acquisition, integration and other costs (2) |

|

|

146 |

|

|

|

71 |

|

|

|

75 |

|

|

105.6% |

|

Aggregate adjustment for income taxes |

|

|

137 |

|

|

|

(582 |

) |

|

|

719 |

|

|

NM |

| Non-GAAP net income (loss)

attributable to HF Foods Group Inc. |

|

$ |

5,021 |

|

|

$ |

(484 |

) |

|

$ |

5,505 |

|

|

NM |

| |

|

Nine Months Ended September 30, |

|

Change |

| |

|

|

2023 |

|

|

|

2022 |

|

|

Amount |

|

% |

|

Net (loss) income attributable to HF Foods Group Inc. |

|

$ |

(4,899 |

) |

|

$ |

3,814 |

|

|

$ |

(8,713 |

) |

|

NM |

|

Amortization of intangibles |

|

|

12,213 |

|

|

|

11,673 |

|

|

|

540 |

|

|

4.6% |

|

Lease guarantee (income) expense |

|

|

(305 |

) |

|

|

5,831 |

|

|

|

(6,136 |

) |

|

NM |

|

Change in fair value of interest rate swaps |

|

|

(2,094 |

) |

|

|

(849 |

) |

|

|

(1,245 |

) |

|

NM |

|

Stock-based compensation expense |

|

|

2,605 |

|

|

|

673 |

|

|

|

1,932 |

|

|

NM |

|

Business transformation costs (1) |

|

|

223 |

|

|

|

— |

|

|

|

223 |

|

|

NM |

|

Acquisition, integration costs and other (2) |

|

|

1,850 |

|

|

|

1,130 |

|

|

|

720 |

|

|

63.7% |

|

Asset impairment charges |

|

|

1,200 |

|

|

|

422 |

|

|

|

778 |

|

|

184.4% |

|

Aggregate adjustment for income taxes |

|

|

(4,704 |

) |

|

|

(5,475 |

) |

|

|

771 |

|

|

(14.1)% |

| Non-GAAP net income

attributable to HF Foods Group Inc. |

|

$ |

6,089 |

|

|

$ |

17,219 |

|

|

$ |

(11,130 |

) |

|

(64.6)% |

____________

|

NM - Not meaningful |

|

(1) |

Represents non-recurring expenses prior to the launch of strategic

projects including supply chain strategy improvements and

technology infrastructure initiatives. |

|

(2) |

Includes contested proxy and related legal and consulting costs for

the nine months ended September 30, 2023. During the three months

ended September 30, 2023, we identified non-recurring expenses

related to our contested proxy and related legal defense which

occurred in prior periods. |

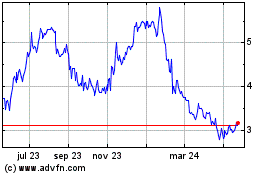

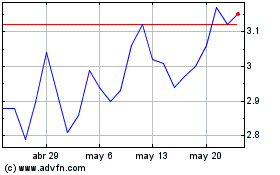

HF Foods (NASDAQ:HFFG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

HF Foods (NASDAQ:HFFG)

Gráfica de Acción Histórica

De May 2023 a May 2024