0001498382false00014983822024-07-032024-07-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 3, 2024

KINTARA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Nevada |

|

001-37823 |

|

99-0360497 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

9920 Pacific Heights Blvd, Suite 150 San Diego, CA |

|

|

|

92121 |

(Address of principal executive office) |

|

|

|

(Zip Code) |

Registrant’s telephone number, including area code: (858) 350-4364

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock |

|

KTRA |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On July 8, 2024, Kintara Therapeutics, Inc. (“Kintara”) and TuHURA Biosciences, Inc. (“TuHURA”) issued a press release announcing that TuHURA has entered into an Exclusivity and Right of First Offer Agreement (the “Agreement”) with Kineta, Inc. (Nasdaq: KA) (“Kineta”) for the potential acquisition of Kineta’s KVA12123 anti-VISTA antibody and related rights and assets associated with and derived from the asset.

The information in this Current Report on Form 8-K under Item 7.01, including the information contained in Exhibit 99.1, is being furnished to the Securities and Exchange Commission (the “SEC”), and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by a specific reference in such filing.

Item 8.01. Other Events.

On July 8, 2024, Kintara and TuHURA announced that TuHURA entered into the Agreement with Kineta for the potential acquisition of Kineta’s KVA12123 anti-VISTA antibody and related rights and assets associated with and derived from the asset. Capitalized terms used but not otherwise defined herein shall have the meaning ascribed to them in the Agreement.

KVA12123 is a rationally targeted, anti-VISTA antibody checkpoint inhibitor designed to reverse VISTA immune suppression and remodel the tumor microenvironment (TME) to overcome acquired resistance to immunotherapies. To date, KVA12123 has demonstrated a favorable clinical safety and tolerability profile observed with no dose limiting toxicities and no evidence of cytokine release syndrome (CRS) associated toxicities at the doses examined.

Pursuant to the Agreement, among other things, Kineta has granted TuHURA an exclusive right to acquire Kineta’s worldwide patents, patent rights, patent applications, product and development program assets, technical and business information, and other rights and assets associated with and derived from its development program related to KVA12123, Kinteta’s VISTA blocking immunotherapy, during the period commencing as of July 3, 2024 (the “Effective Date”) and continuing through the first to occur of (a) the execution of any Definitive Agreement with respect to a Potential Transaction by TuHURA or one or more of its affiliates and (b) 11:59 PM Eastern Time on October 1, 2024, subject to extension as noted in the following sentence (the “Exclusivity Period”). In the event that the Parties are engaged in good faith discussions regarding a Potential Transaction on the date on which the Exclusivity Period (or any renewal thereof) is scheduled to expire and TuHURA has not yet closed the transactions contemplated by that previously announced agreement and plan of merger (the “Merger Agreement”) by and among TuHURA, Kintara and Kayak Mergeco, Inc., a wholly-owned subsidiary of Kintara, then on such date, the Exclusivity Period shall automatically renew for an additional ten (10) day period (a “Renewal Period”) (up to a total of two (2) renewal periods for an aggregate of twenty (20) days).

Under the terms of the Agreement, TuHURA will pay Kineta $5.0 million, with $2.5 million paid at signing and, subject to certain provisions, an additional $2.5 million to be paid by July 15, 2024. No later than two (2) business days after a Renewal Period has started (to be confirmed in writing by both Parties), TuHURA shall pay an additional $150,000 as an additional Exclusivity Payment, in an amount not to exceed $300,000 for the two (2) available Renewal Periods. The Exclusivity Payment will be credited against the initial cash consideration that may be payable to Kineta pursuant to any Definitive Agreement (if any) between Kineta and TuHURA and/or its affiliates with respect to a Potential Transaction.

In conjunction with the Agreement, TuHURA sold $5.0 million of shares of its common stock in a private offering (the “July Private Placement”) to an existing TuHURA shareholder (the “Investor”). In connection with the July Private Placement, the Investor is entitled to a 1.5% royalty on certain sales of the product made by TuHURA as

set forth in the Agreement. The exclusivity period under the Agreement lasts for 90 days (until October 1, 2024), subject to extension for an additional 20 days. The concurrent $5.0 million investment from the existing TuHURA shareholder in the July Private Placement preserves TuHURA’s strong balance sheet for advancing its IFx-2.0 Phase 3 accelerated approval trial and novel bi-functional ADCs.

KVA12123 is a VISTA blocking immunotherapy in development as a twice weekly monoclonal antibody infusion drug completing two clinical trials both as a monotherapy and in combination with Merck’s anti-PD1 therapy, KEYTRUDA® (pembrolizumab), in patients with advanced treatment refractory, solid tumors. Competitive therapies targeting VISTA have demonstrated either poor monotherapy anti-tumor activity in preclinical models or induction of CRS in human clinical trials. Through the combination of unique epitope binding and an optimized IgG1 Fc region, KVA12123 demonstrates strong monotherapy tumor growth inhibition in preclinical models without evidence of CRS in clinical trial participants. KVA12123 has been shown to de-risk the VISTA target and provides a novel approach to address immune suppression in the TME with a mechanism of action that is differentiated and complementary with T cell focused therapies. KVA12123 may be an effective immunotherapy for many types of cancer and represents the introduction of a new class of checkpoint inhibitors.

VISTA (V-domain Ig suppressor of T-cell activation) is a negative immune checkpoint that suppresses T cell function in a variety of solid tumors. High VISTA expression in tumor correlates with poor survival in cancer patients and has been associated with a lack of response to other immune checkpoint inhibitors. Blocking VISTA induces an efficient polyfunctional immune response to address immunosuppression and drives anti-tumor responses.

As previously announced, TuHURA entered into a definitive agreement (the “Merger Agreement”) for an all-stock transaction with Kintara to form a company combining expertise and resources to advance a risk diversified late-stage oncology pipeline. The combined company will focus on advancing TuHURA’s personalized cancer vaccine(s) and first-in-class bi-functional ADCs, two technologies that seek to overcome the major obstacles that limit the effectiveness of current immunotherapies in treating cancer. The combined company is expected to operate under the name “TuHURA Biosciences, Inc.” and to trade on The Nasdaq Capital Market under the ticker “HURA”. The transaction is subject to customary closing conditions, including stockholder approval of both companies, and is expected to close in the third quarter of 2024.

Additional Information about the Proposed Merger and Where to Find It

This Current Report on Form 8-K does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. This Current Report on Form 8-K relates to the proposed merger (the “Merger”) of Kintara and TuHURA. In connection with the proposed Merger, Kintara has filed a Registration Statement on Form S-4, which includes a preliminary proxy statement and a preliminary prospectus of Kintara (the “proxy statement/prospectus”). This registration statement has not yet been declared effective and Kintara has filed or may file other documents regarding the proposed Merger with the SEC. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY, WHEN THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN AND WILL CONTAIN IMPORTANT INFORMATION THAT STOCKHOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING THE PROPOSED MERGER. A definitive proxy statement/prospectus will be sent to Kintara’s stockholders once available. Investors and security holders will be able to obtain these documents (when available) free of charge from the SEC’s website at www.sec.gov. In addition, investors and stockholders should note that Kintara communicates with investors and the public using its website (www.kintara.com), the investor relations website (https://www.kintara.com/investors) where anyone will be able to obtain free copies of the proxy statement/prospectus and other documents filed by Kintara with the SEC, and stockholders are urged to read the proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed Merger.

Participants in the Solicitation

Kintara, TuHURA and their respective directors and executive officers and other members of management and employees and certain of their respective significant stockholders may be deemed to be participants in the solicitation of proxies from Kintara and TuHURA stockholders in respect of the proposed Merger. Information about

Kintara’s directors and executive officers is available in Kintara’s proxy statement, which was filed with the SEC on May 17, 2024 for the 2024 Annual Meeting of Stockholders, Kintara’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023, which was filed with the SEC on September 18, 2023. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holding or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed Merger when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from the SEC and Kintara as indicated above.

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any proxy, consent, authorization, vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Forward-Looking Statements

This Current Report on Form 8-K and the press release attached hereto as Exhibit 99.1 contain forward-looking statements based upon Kintara’s and TuHURA’s current expectations. This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are identified by terminology such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “should,” “would,” “project,” “plan,” “expect,” “goal,” “seek,” “future,” “likely” or the negative or plural of these words or similar expressions. These statements are only predictions. Kintara and TuHURA have based these forward-looking statements largely on their then-current expectations and projections about future events, as well as the beliefs and assumptions of management. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond each of Kintara’s and TuHURA’s control, and actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to: (i) the risk that the conditions to the closing or consummation of the proposed Merger are not satisfied, including the failure to obtain stockholder approval for the proposed Merger; (ii) uncertainties as to the timing of the consummation of the proposed Merger and the ability of each of Kintara and TuHURA to consummate the transactions contemplated by the proposed Merger; (iii) risks related to Kintara’s and TuHURA’s ability to correctly estimate their respective operating expenses and expenses associated with the proposed Merger, as applicable, as well as uncertainties regarding the impact any delay in the closing would have on the anticipated cash resources of the resulting combined company upon closing and other events and unanticipated spending and costs that could reduce the combined company’s cash resources; (iv) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the proposed Merger by either Kintara or TuHURA; (v) the effect of the announcement or pendency of the proposed Merger on Kintara’s or TuHURA’s business relationships, operating results and business generally; (vi) costs related to the proposed Merger; (vii) the outcome of any legal proceedings that may be instituted against Kintara, TuHURA, or any of their respective directors or officers related to the Merger Agreement or the transactions contemplated thereby; (vii) the ability of Kintara or TuHURA to protect their respective intellectual property rights; (viii) competitive responses to the proposed Merger; (ix) unexpected costs, charges or expenses resulting from the proposed Merger; (x) whether the combined business of TuHURA and Kintara will be successful; (xi) legislative, regulatory, political and economic developments; (xii) additional risks described in the “Risk Factors” section of Kintara’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023, and the registration statement on Form S-4 related to the proposed Merger filed with the SEC; and (xiii) the risk that Kineta and TuHURA do not enter into a definitive agreement for a strategic transaction. Additional assumptions, risks and uncertainties are described in detail in Kintara’s registration statements, reports and other filings with the SEC, which are available on Kintara’s website, and at www.sec.gov. Accordingly, you should not rely upon forward-looking statements as predictions of future events. Neither Kintara nor TuHURA can assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. The forward-looking statements made in this communication relate only to events as of the date on which the statements are made. Except as required by applicable law or regulation, Kintara and TuHURA undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated

events. Investors should not assume that any lack of update to a previously issued “forward-looking statement” constitutes a reaffirmation of that statement.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KINTARA THERAPEUTICS, INC. |

|

|

|

Date: July 8, 2024 |

|

By: |

|

/s/ Robert E. Hoffman |

|

|

|

|

Name: Robert E. Hoffman |

|

|

|

|

Title: Chief Executive Officer |

Exhibit 99.1

TuHURA Biosciences Enters into Exclusivity and Right of First Offer Agreement for Kineta, Inc.’s KVA12123 Novel anti-VISTA Checkpoint Inhibitor

KVA12123 is a rationally targeted, anti-VISTA antibody checkpoint inhibitor to reverse VISTA immune suppression and remodel the tumor microenvironment (TME) to overcome acquired resistance to immunotherapies

KVA12123 is currently in a Phase 1/Phase 2 clinical study as a monotherapy and in combination with Merck’s anti-PD1 therapy, KEYTRUDA® (pembrolizumab), in patients with advanced solid tumors

To date, KVA12123 has demonstrated a favorable clinical safety and tolerability profile observed with no dose limiting toxicities and no evidence of Cytokine Release Syndrome (CRS) associated toxicities at doses examined

Concurrent $5 million investment from existing TuHURA shareholder preserves TuHURA’s strong balance sheet for advancing its IFx-2.0 Phase 3 accelerated approval trial and novel bi-functional ADCs

TAMPA, FL & SAN DIEGO, CA, July 8, 2024 –TuHURA Biosciences, Inc. (“TuHURA”), a Phase 3 registration-stage immune-oncology company developing novel technologies to overcome resistance to cancer immunotherapy, and Kintara Therapeutics, Inc. (Nasdaq: KTRA) (“Kintara”), a biopharmaceutical company focused on the development of new solid tumor cancer therapies, today announced TuHURA has entered into an Exclusivity and Right of First Offer Agreement (the “Agreement”) with Kineta, Inc. (Nasdaq: KA) (“Kineta”) for the potential acquisition of Kineta’s KVA12123 anti-VISTA antibody and related rights and assets associated with and derived from the asset.

“KVA12123 has multiple synergies with both of our IFx and Delta receptor technologies and could be a promising addition to our pipeline, bringing in a potential Phase 2 ready, novel checkpoint inhibitor,” commented Dr. James Bianco, Chief Executive Officer of TuHURA. “Unlike other checkpoint inhibitors which work on activated T-cells, KVA12123 focuses on VISTA, which is the only known checkpoint on quiescent T-cells preventing their activation and represents a promising new target in cancer immunotherapy. VISTA is highly overexpressed on tumors known not to respond to currently marketed checkpoint inhibitors most notably gynecologic cancers like ovarian cancer. They are also expressed on myeloid cells including tumor associated myeloid-derived suppressor cells (“MDSCs”), which, like VISTA, are also implicated in TME immunosuppression. Our novel bi-functional Antibody Drug Conjugates (“ADCs”) are intended to target and block the delta receptor on MDSCs.”

Under the terms of the Agreement, TuHURA will pay Kineta $5.0 million, with $2.5 million paid at signing and, subject to certain provisions, an additional $2.5 million to be paid by July 15, 2024. In conjunction with the Agreement, TuHURA sold $5.0 million of shares of its common stock in a private offering to an existing shareholder. The exclusivity period under the Agreement lasts for 90 days (until October 1, 2024), subject to extension for an additional 20 days.

About KVA12123

KVA12123 is a VISTA blocking immunotherapy in development as a twice weekly monoclonal antibody infusion drug completing two clinical trials both as a monotherapy and in combination with Merck’s anti-PD1 therapy, KEYTRUDA® (pembrolizumab), in patients with advanced treatment refractory, solid tumors. Competitive therapies targeting VISTA have demonstrated either poor monotherapy anti-tumor activity in preclinical models or induction of cytokine release syndrome (CRS) in human clinical trials. Through the combination of unique epitope binding and an optimized IgG1 Fc region, KVA12123 demonstrates strong monotherapy tumor growth inhibition in preclinical models without evidence of CRS in clinical trial participants. KVA12123 has been shown to de-risk the VISTA target and provides a novel approach to address immune suppression in the TME with a mechanism of action that is differentiated and complementary with T cell focused therapies. KVA12123 may be an effective immunotherapy for many types of cancer and represents the introduction of a new class of checkpoint inhibitors.

VISTA (V-domain Ig suppressor of T-cell activation) is a negative immune checkpoint that suppresses T cell function in a variety of solid tumors. High VISTA expression in tumor correlates with poor survival in cancer patients and has been associated with a lack of response to other immune checkpoint inhibitors. Blocking VISTA induces an efficient polyfunctional immune response to address immunosuppression and drives anti-tumor responses.

“TuHURA Biosciences is well positioned to advance KVA12123,” said Craig W. Philips, President of Kineta. “TuHURA has significant expertise and deep experience in the field. We believe they will make an excellent partner for this program and in advancing this novel drug program which could provide an important new treatment option for cancer patients.”

As previously announced, TuHURA entered into a definitive agreement for an all-stock transaction with Kintara to form a company combining expertise and resources to advance a risk diversified late-stage oncology pipeline. The combined company will focus on advancing TuHURA’s personalized cancer vaccine(s) and first-in-class bi-functional ADCs, two technologies that seek to overcome the major obstacles that limit the effectiveness of current immunotherapies in treating cancer. The combined company is expected to operate under the name “TuHURA Biosciences, Inc.” and to trade on The Nasdaq Capital Market under the ticker “HURA”. The transaction is subject to customary closing conditions, including stockholder approval of both companies, and is expected to close in the third quarter of 2024.

About Kineta, Inc.

Kineta (Nasdaq: KA) is a clinical-stage biotechnology company with a mission to develop next-generation immunotherapies that transform patients’ lives. Kineta has leveraged its expertise in innate immunity and is focused on discovering and developing potentially differentiated immunotherapies that address the mechanisms of cancer immune resistance. For more information on Kineta, please visit www.kinetabio.com, and follow Kineta on X (Twitter) and LinkedIn.

About TuHURA Biosciences, Inc.

TuHURA Biosciences, Inc. is a Phase 3 registration-stage immuno-oncology company developing novel technologies to overcome resistance to cancer immunotherapy. TuHURA’s lead personalized cancer vaccine candidate, IFx-2.0, is designed to overcome primary resistance to checkpoint inhibitors. TuHURA is preparing to initiate a single randomized placebo-controlled Phase 3 registration trial of IFx-2.0 administered as an adjunctive therapy to Keytruda® (pembrolizumab) in first line treatment for advanced or metastatic Merkel Cell Carcinoma.

In addition to its cancer vaccine product candidates, TuHURA is leveraging its Delta receptor technology to develop first-in-class bi-functional ADCs, targeting Myeloid Derived Suppressor Cells to inhibit their immune suppressing effects on the tumor microenvironment to prevent T cell exhaustion and acquired resistance to checkpoint inhibitors and cellular therapies.

For more information, please visit tuhurabio.com and connect with TuHURA on Facebook, X, and LinkedIn.

About Kintara

Located in San Diego, California, Kintara is dedicated to the development of novel cancer therapies for patients with unmet medical needs. Kintara is developing therapeutics for clear unmet medical needs with reduced risk development programs. Kintara’s lead program is REM-001 Therapy for cutaneous metastatic breast cancer (CMBC).

Kintara has a proprietary, late-stage photodynamic therapy platform that holds promise as a localized cutaneous, or visceral, tumor treatment as well as in other potential indications. REM-001 Therapy, which consists of the laser light source, the light delivery device, and the REM-001 drug product, has been previously studied in four Phase 2/3 clinical trials in patients with CMBC who had previously received chemotherapy and/or failed radiation therapy. In CMBC, REM-001 has a clinical efficacy to date of 80% complete responses of CMBC evaluable lesions and an existing robust safety database of approximately 1,100 patients across multiple indications.

For more information, please visit www.kintara.com or follow us on X at @Kintara_Thera, Facebook and LinkedIn.

No Offer or Solicitation

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any proxy, consent, authorization, vote or approval, nor shall there

be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended (the “Securities Act”).

Additional Information About the Proposed Merger and Where to Find It

This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. This communication relates to the proposed merger of Kintara and TuHURA (the “proposed Merger”). In connection with the proposed Merger, Kintara has filed relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including a Registration Statement on Form S-4 that contains a preliminary proxy statement and preliminary prospectus of Kintara (the “proxy statement/prospectus”). This Registration Statement has not yet been declared effective and Kintara has filed or may file other documents regarding the proposed Merger with the SEC. This press release is not a substitute for the Registration Statement or for any other document that Kintara has filed or may file with the SEC in connection with the proposed Merger. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE PRELIMINARY PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY, WHEN THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN AND THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT KINTARA, TUHURA, THE PROPOSED MERGER AND RELATED MATTERS THAT STOCKHOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING THE PROPOSED MERGER. A definitive proxy statement/prospectus will be sent to Kintara’s stockholders once available. Investors and security holders will be able to obtain the proxy statement/prospectus and other documents filed by Kintara with the SEC (when available) free of charge from the SEC’s website at www.sec.gov. In addition, investors and stockholders should note that Kintara communicates with investors and the public using its website (www.kintara.com), the investor relations website (https://www.kintara.com/investors) where anyone will be able to obtain free copies of the preliminary proxy statement/prospectus and other documents filed by Kintara with the SEC, and stockholders are urged to read the definitive proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed Merger.

Participants in the Solicitation

Kintara, TuHURA and their respective directors and executive officers and other members of management and employees and certain of their respective significant stockholders may be deemed to be participants in the solicitation of proxies from Kintara and TuHURA stockholders in respect of the proposed Merger. Information about Kintara’s directors and executive officers is available in Kintara’s proxy statement, which was filed with the SEC on May 17, 2024 for the 2024 Annual Meeting of Stockholders, Kintara’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023, which was filed with the SEC on September 18, 2023. Information regarding the

persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holding or otherwise, has been and will be contained in the preliminary proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed Merger when they become available. Investors should read the definitive proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from the SEC and Kintara as indicated above.

Forward-Looking Statements

This press release contains forward-looking statements based upon Kintara’s and TuHURA’s current expectations. This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are identified by terminology such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “should,” “would,” “project,” “plan,” “expect,” “goal,” “seek,” “future,” “likely” or the negative or plural of these words or similar expressions. Examples of such forward-looking statements include but are not limited to express or implied statements regarding Kintara's or TuHURA's management team's expectations, hopes, beliefs, intentions or strategies regarding the future including, without limitation, statements regarding: the anticipated benefits of the Agreement or a strategic transaction with Kineta, the proposed Merger and the expected effects, perceived benefits or opportunities and related timing with respect thereto, expectations regarding clinical trials and research and development programs, in particular with respect to TuHURA's IFx-Hu2.0 product candidate and its TME modulators development program, and any developments or results in connection therewith; the anticipated timing of the results from those studies and trials; expectations regarding the use of capital resources, including the net proceeds from the financing that closed in connection with the signing of the definitive agreement, and the time period over which the combined company's capital resources will be sufficient to fund its anticipated operations; and the expected trading of the combined company's stock on the Nasdaq Capital Market. These statements are only predictions. Kintara and TuHURA have based these forward-looking statements largely on their then-current expectations and projections about future events, as well as the beliefs and assumptions of management. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond each of Kintara’s and TuHURA’s control, and actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to: (i) the risk that the conditions to the closing or consummation of the proposed Merger are not satisfied, including the failure to obtain stockholder approval for the proposed Merger; (ii) uncertainties as to the timing of the consummation of the proposed Merger and the ability of each of Kintara and TuHURA to consummate the transactions contemplated by the proposed Merger; (iii) risks related to Kintara’s and TuHURA’s ability to correctly estimate their respective operating expenses and expenses associated with the proposed Merger, as applicable, as well as uncertainties regarding the impact any delay in the closing would have on the anticipated cash resources of the resulting combined company upon closing and other events and unanticipated spending and costs that could reduce the combined company’s cash resources; (iv) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the proposed Merger

by either Kintara or TuHURA; (v) the effect of the announcement or pendency of the proposed Merger on Kintara’s or TuHURA’s business relationships, operating results and business generally; (vi) costs related to the proposed Merger; (vii) the outcome of any legal proceedings that may be instituted against Kintara, TuHURA, or any of their respective directors or officers related to the Merger Agreement or the transactions contemplated thereby; (vii) the ability of Kintara or TuHURA to protect their respective intellectual property rights; (viii) competitive responses to the proposed Merger; (ix) unexpected costs, charges or expenses resulting from the proposed Merger; (x) whether the combined business of TuHURA and Kintara will be successful; (xi) legislative, regulatory, political and economic developments; (xii) additional risks described in the “Risk Factors” section of Kintara’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023, and the Registration Statement on Form S-4 related to the proposed Merger filed with the SEC; and (xiii) the risk that Kineta and TuHURA do not enter into a definitive agreement for a strategic transaction. Additional assumptions, risks and uncertainties are described in detail in Kintara’s registration statements, reports and other filings with the SEC, which are available on Kintara’s website, and at www.sec.gov. Accordingly, you should not rely upon forward-looking statements as predictions of future events. Neither Kintara nor TuHURA can assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. The forward-looking statements made in this communication relate only to events as of the date on which the statements are made. Except as required by applicable law or regulation, Kintara and TuHURA undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Investors should not assume that any lack of update to a previously issued “forward-looking statement” constitutes a reaffirmation of that statement.

Investor Contacts:

TuHURA Biosciences, Inc.

Jenene Thomas

JTC Team, LLC

tuhura@jtcir.com

Kintara Therapeutics, Inc.

Robert E. Hoffman

Kintara Therapeutics

rhoffman@kintara.com

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

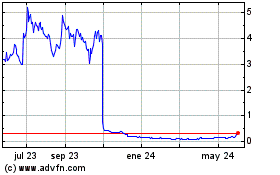

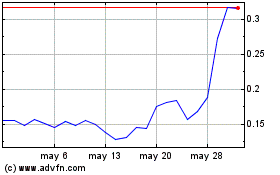

Kintara Therapeutics (NASDAQ:KTRA)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Kintara Therapeutics (NASDAQ:KTRA)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024