TABLE OF CONTENTS

As filed with the U.S. Securities and Exchange Commission on October 20, 2023

Registration No. 333-274489

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Lazydays Holdings, Inc.

(Exact name of registrant as specified in its charter)

Delaware | | | 5500 | | | 82-4183498 |

(State or other jurisdiction of incorporation or organization) | | | (Primary Standard Industrial Classification Code Number) | | | (I.R.S. Employer Identification Number) |

6130 Lazy Days Blvd.

Seffner, Florida 33584

Telephone: (813) 246-4999

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John North

Chief Executive Officer

Lazydays Holdings, Inc.

4042 Park Oaks Blvd., Suite 350

Tampa, Florida 33610

Telephone: (813) 246-4999

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Michael L. Zuppone

Gil Savir

Paul Hastings LLP

200 Park Avenue

New York, New York 10166

(212) 318-6000

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | | | ☐ | | | Accelerated filer | | | ☒ |

| | | | | | | | | |

Non-accelerated filer | | | ☐ | | | Smaller reporting company | | | ☒ |

| | | | | | | | | |

| | | | | | Emerging growth company | | | ☐ |

If an emerging growth company indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said section 8(a), may determine.

TABLE OF CONTENTS

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated October 20, 2023

Preliminary Prospectus

Rights to Purchase Up to $100,000,000 in Shares of Common Stock,

representing Up to 15,627,441 Shares of Common Stock

Lazydays Holdings, Inc. (the “Company,” “we,” “us” or “our”) is distributing to the holders (collectively, the “Holders”) of our common stock, par value $0.0001 per share (the “Common Stock”), our pre-funded warrants (the “Warrants”) and our series A convertible preferred stock (the “Series A Preferred Stock”) non-transferable rights (the “Rights”) to purchase up to an aggregate of $100,000,000 in shares of our Common Stock at a cash subscription price of $6.399 per share (the “Rights Offering”). Assuming the Rights Offering is fully subscribed, we currently expect to receive aggregate gross proceeds of $100,000,000. You will not be entitled to receive any Rights unless you are a Holder of record as of 5:00 p.m., New York City time, on October 23, 2023 (the “Record Date”). Holders, as of the Record Date, will receive one Right for every share of Common Stock owned or issuable upon exercise or conversion of Warrants and Series A Preferred Stock owned.

The Rights will expire if they are not exercised by 5:00 p.m., New York City time, on November 14, 2023, the expected expiration date of this Rights Offering. We, in our sole discretion, may extend the period for exercising the Rights. Rights which are not exercised by the expiration date of the Rights Offering will expire and will have no value. You should carefully consider whether or not to exercise your Rights before the expiration date. Once you have exercised your Rights, your exercise may not be revoked.

Rights may only be exercised in whole numbers of shares of Common Stock, and we will not issue fractional shares. Each Right will entitle you to purchase 0.770 of a share at a subscription price per whole share of Common Stock equal to $6.399. After aggregating all of the shares subscribed for by a particular Holder, including shares subscribed for pursuant to the Over-Subscription Right, any fractional shares of our Common Stock that would otherwise be created by the exercise of the Rights by that Holder will be rounded down to the nearest whole share for purposes of determining the number of shares of our Common Stock for which you may subscribe, with such adjustments as may be necessary to ensure that we offer a maximum of 15,627,441 shares of Common Stock in the Rights Offering. Each Right consists of a basic subscription right (the “Basic Subscription Right”) and an over-subscription right (the “Over-Subscription Right”). The Rights under the Basic Subscription Right will be distributed in proportion to Holders’ holdings on the Record Date. If you exercise your Basic Subscription Right in full, and other Holders do not, you will be entitled to an Over-Subscription Right to purchase a portion of the unsubscribed shares at the subscription price, subject to the availability and pro rata allocation of Common Stock among persons exercising this Over-Subscription Right. See “Questions & Answers — What are the limitations of the Over-Subscription Right?”

Exercising the Rights and investing in our Common Stock involve significant risks. We urge you to read carefully the section titled “Risk Factors” beginning on page

17 of this prospectus, the section titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 and in our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2023 and June 30, 2023, and all other information included or incorporated by reference in this prospectus in its entirety before you decide whether to exercise your Rights.

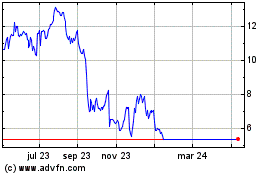

Our Common Stock is listed on the Nasdaq Capital Market tier of The Nasdaq Stock Market LLC (“Nasdaq”) under the symbol “LAZY.” On October 19, 2023, the last reported sale price of our Common Stock was $8.22. The Rights are non-transferrable, except that Rights will be transferable by operation of law (e.g., by death) or by such Holders that are closed-end funds to funds affiliated with such Holders. The Rights will not be listed for trading on Nasdaq or any other stock exchange or market. You are urged to obtain a current price quote for our Common Stock before exercising your Rights.

Neither the Company, the Special Committee (as defined below), nor our board of directors (the “Board”) makes any recommendation to Holders regarding whether they should exercise or let lapse their Rights. You should carefully consider whether to exercise your Rights before the expiration of the Rights Offering period. All exercises of Rights are irrevocable.

Christopher S. Shackelton, Chairman of our Board and a Managing Partner of Coliseum Capital Management, LLC (“Coliseum”), clients of which are the beneficial owners of approximately 56.2% of our Common Stock prior to this Rights Offering, has indicated that Coliseum’s clients currently intend to participate in the Rights Offering and subscribe for at least the full amount of their Basic Subscription Rights, but have not made any formal binding commitment to participate and have no obligation to participate.

The terms of the Rights Offering were determined by a special independent committee of our Board (the “Special Committee”), composed solely of independent directors from our Board, that has authority to approve any additional amendments (including pricing terms), modifications or termination of the Rights Offering. Our Special Committee reserves the right to terminate the Rights Offering for any reason any time before the completion of the Rights Offering. If we terminate the Rights Offering, all subscription payments received will be returned as soon as practicable, without interest or penalty.

This Rights Offering is being made directly by us. We are not using an underwriter or selling agent. Broadridge Corporate Issuer Solutions, LLC will serve as the subscription agent (“Subscription Agent”) and the information agent (“Information Agent”) for the Rights Offering. The Subscription Agent will hold the funds we receive from subscribers until we complete, abandon or terminate the Rights Offering. If you want to participate in this Rights Offering and you are the record holder of your securities, we recommend that you submit your subscription documents to the Subscription Agent well before the deadline. If you want to participate in this Rights Offering and you hold securities through your broker, dealer, bank, or other nominee, you should promptly contact your broker, dealer, bank, or other nominee and submit your subscription documents in accordance with the instructions and within the time period provided by your broker, dealer, bank, or other nominee. For a more detailed discussion, see “The Rights Offering — The Rights” beginning on page

28.

Subscription Price | | | $6.399 | | | $100,000,000 |

Proceeds to us, before expenses | | | $6.399 | | | $100,000,000 |

(1)

| Assumes the Rights Offering is fully subscribed. |

If you have any questions or need further information about this Rights Offering, please contact the Information Agent toll-free at 888-789-8409 or via email at shareholder@broadridge.com. It is anticipated that delivery of the shares of Common Stock purchased in this Rights Offering will be made on or about November 21, 2023 (the fifth business day following the expiration date), unless the expiration date is extended.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated , 2023

TABLE OF CONTENTS

Table of Contents

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

TABLE OF CONTENTS

Unless otherwise stated or the context otherwise requires, the terms “Lazydays,” the “Company,” “we,” “us” and “our” refer to Lazydays Holdings, Inc. and its subsidiaries.

You should read this prospectus, the documents incorporated by reference into this prospectus, and any prospectus supplement or free writing prospectus that we may authorize for use in connection with this offering in their entirety before making an investment decision. You may read the other reports we file with the Securities and Exchange Commission (the “SEC”) at the SEC’s website or at the SEC’s offices described below under the heading “Incorporation of Information by Reference.” These documents contain important information you should consider when making your investment decision.

We have not authorized anyone to provide you with any information other than that contained in or incorporated by reference into this prospectus, or in any free writing prospectuses we have authorized for use in connection with this offering. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

You should assume that the information in this prospectus is accurate only as of the date on the front cover of this prospectus, and any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, in each case, regardless of the time of delivery of this prospectus or any exercise of the Rights. Our business, financial condition, results of operations and prospects may have changed since that date.

Market data and other statistical information incorporated by reference into this prospectus are based on independent industry publications, government publications, reports by market research firms and other published independent sources. Some data is also based on our good faith estimates, which we derive from our review of internal surveys and independent sources. Although we believe these sources are reliable, we have not independently verified the information. We neither guarantee its accuracy nor undertake a duty to provide or update such data in the future.

This prospectus and the documents incorporated by reference into this prospectus may include trademarks, service marks and tradenames owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference in this prospectus and the documents incorporated by reference into this prospectus are the property of their respective owners.

We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. No action is being taken in any jurisdiction outside the United States to permit a public offering of our securities or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to those jurisdictions.

This Rights Offering is being made directly by us. We have retained Broadridge Corporate Issuer Solutions, LLC to serve as our Subscription Agent and as our Information Agent for this Rights Offering.

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this Registration Statement on Form S-1 constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts included in this Registration Statement on Form S-1 and the prospectus, including, without limitation, the Company’s future financial position, revenue and EBITDA contribution of acquired businesses, business strategy, budgets, projected costs and plans and objectives of management for future operations, are “forward-looking” statements. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate” or “continue” or the negative of such words or variations of such words and similar expressions. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions, which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements and the Company can give no assurance that such forward-looking statements will prove to be correct. Important factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements, or “cautionary statements,” include, but are not limited to:

• | future market conditions and industry trends, including anticipated national new recreational vehicle (“RV”) wholesale shipments; |

• | changes in U.S. or global economic conditions; |

• | changes in expected operating results, such as store performance, selling, general and administrative expenses (“SG&A”) as a percentage of gross profit and all projections; |

• | our ability to procure and manage inventory levels to reflect consumer demand; |

• | our ability to find accretive acquisitions; |

• | changes in the planned integration, success and growth of acquired dealerships and greenfield locations; |

• | the underperformance of acquired businesses and the inability to achieve expected synergies and steady state contributions; |

• | changes in our expected liquidity from our cash, availability under our credit facility and unfinanced real estate; |

• | compliance with financial and restrictive covenants under our credit facility and other debt agreements; |

• | changes in our anticipated levels of capital expenditures in the future; |

• | the repurchase of shares under our share repurchase program; |

• | our business strategies for customer retention, growth, market position, financial results and risk management; and |

• | other factors beyond our control, including those listed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 or in our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2023 and June 30, 2023, each as incorporated herein by reference, and in other filings we may make from time to time with the SEC. |

Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements contained in this prospectus and the incorporated documents are not guarantees of future performance and our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate, may differ materially from such forward-looking statements. In addition, even if our results of operations, financial condition and liquidity, and events in the industry in which we operate, are consistent with such forward-looking statements, they may not be predictive of results or developments in future periods.

Any forward-looking statement that we make in this prospectus or the documents incorporated by reference speaks only as of the date of such statement. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this prospectus.

TABLE OF CONTENTS

The following are examples of what we anticipate will be common questions about the Rights Offering. The answers are based on selected information from this prospectus and the documents incorporated by reference in this prospectus. The following questions and answers do not contain all of the information that may be important to you and may not address all of the questions that you may have about the Rights Offering. This prospectus and the documents incorporated by reference in this prospectus contain more detailed descriptions of the terms and conditions of the Rights Offering and provide additional information about us and our business, including potential risks related to the Rights Offering and the shares of our Common Stock.

Exercising the Rights and investing in our Common Stock involves significant risks. We urge you to carefully read the section titled “Risk Factors” beginning on page

17 of this prospectus and the section titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 and in our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2023 and June 30, 2023, and all other information included or incorporated by reference in this prospectus in its entirety before you decide whether to exercise your Rights.

Q:

| What is the Rights Offering? |

A: The Rights Offering is a distribution of Rights on a pro rata basis to Holders of our Common Stock, Warrants and Series A Preferred Stock (in the case of the Warrants and the Series A Preferred Stock, on an as-converted basis) who hold such securities as of 5:00 p.m., New York City time, on October 23, 2023, the Record Date. “Pro rata” means, in proportion to the number of total shares of our Common Stock that our Holders hold on the Record Date on an as-converted basis. You will receive one Right for every share of Common Stock owned or issuable upon exercise or conversion of Warrants and Series A Preferred Stock owned as of the Record Date. We will not issue fractional shares of Common Stock in the Rights Offering. After aggregating all of the shares subscribed for by a particular Holder, including shares subscribed for pursuant to the Over-Subscription Right, any fractional shares of our Common Stock that would otherwise be created by the exercise of the Rights by that Holder will be rounded down to the nearest whole share, with such adjustments as may be necessary to ensure that we offer a maximum of 15,627,441 shares of Common Stock in the Rights Offering.

Q:

| Why are we conducting the Rights Offering? |

A: In alignment with our growth strategy, we anticipate the need for additional funding. Such additional funding is expected to place us in a stronger position to pinpoint and action potential partnerships and strategic acquisitions that align with our business interests. We believe the Rights Offering empowers our security holders to acquire more Common Stock, mitigating the dilution they might experience if we opted for conventional capital market fundraising methods. Our expectation is to use the net proceeds from the Rights Offering for our growth initiatives including acquisitions and new business development activities and general corporate purposes, which may include repaying or refinancing our existing or future debt facilities. See “Use of Proceeds” and “The Rights Offering—Reasons for the Rights Offering.”

A: Each Right entitles its Holder to purchase 0.770 of a share of our Common Stock at a subscription price of $6.399 per whole share of Common Stock. Each Right carries with it a Basic Subscription Right and an Over-Subscription Right, subject to certain limitations described below.

Q:

| How was the subscription price of $6.399 per share of Common Stock determined? |

A: In determining the subscription price, a special Board committee of independent directors (the “Special Committee”) considered a number of factors, including: the likely cost of capital from other sources and general conditions of the securities markets, the price at which our Holders might be willing to participate in the Rights Offering, our expected business need for liquidity and capital, historical and current trading prices of our Common Stock, and the desire to provide an opportunity to our Holders to participate in the Rights Offering on a pro rata basis. The Special Committee determined that it was in the best interests of the Company’s Holders to publicly announce the subscription price so that all Holders had the opportunity to determine whether to buy or sell the Common Stock prior to the Record Date. In accordance with best practices, the Special Committee is composed solely of independent directors. As such, Mr. Shackelton neither served as a member of the Special

TABLE OF CONTENTS

Committee nor participated in the Board’s decision to establish it. The Special Committee had sole authority to determine the type of offering and any other terms related to the Rights Offering. In selecting the subscription price, our Special Committee and management wanted to encourage participation in the Rights Offering and strike what they believe to be a fair balance between our capital needs and the market value of the shares of Common Stock sold to the Eligible Stockholders in this Rights Offering. The Company believes this disclosure has provided its Holders and the public with sufficient information about the Company’s expectation to sell a significant number of shares in the Rights Offering, as described herein. The subscription price is not necessarily related to our book value, net worth or any other established criteria of value and may or may not be considered the fair value of the Common Stock to be offered in the Rights Offering. You should not consider the subscription price as an indication of value of us or our Common Stock. The market price of our Common Stock may decline during or after the Rights Offering, including below the subscription price for the Common Stock. You should obtain a current quote for our Common Stock before exercising your Rights and make your own assessment of our business and financial condition, our prospects for the future, and the terms of the Rights Offering.

Q:

| What is the Basic Subscription Right? |

A: The Basic Subscription Right of each Right entitles you to purchase 0.770 of a share of Common Stock at a subscription price of $6.399 per whole share.

Q:

| What is the Over-Subscription Right? |

A: Subject to certain limitations described below, the Over-Subscription Right of each Right entitles you, if you fully exercise your Basic Subscription Right, to subscribe for additional shares of our Common Stock at the same $6.399 subscription price per share up to that number of shares of Common Stock that are offered in the Rights Offering but are not purchased by the other record holders under their Basic Subscription Rights.

Our Special Committee has decided that it is in the best interest of the Company that the Over-Subscription Right be subject to certain limitations as discussed below.

Q:

| What are the limitations of the Over-Subscription Right? |

A: We will be able to satisfy your exercise of the Over-Subscription Right only if other Rights holders do not fully exercise their Basic Subscription Rights. If sufficient shares of our Common Stock are available, we will honor the over-subscription requests in full, subject to the limitations below.

If over-subscription requests exceed the number of shares which are available, we will allocate the available shares pro rata among those Rights holders who oversubscribed based on the number of shares each Rights holder subscribed for under the Basic Subscription Right. Only Record Date Holders who exercise in full all Rights issued to them are entitled to exercise the Over-Subscription Right.

Q:

| Will fractional shares be issued upon exercise of the Rights? |

A: No. We will not issue fractional shares of Common Stock in the Rights Offering. After aggregating all of the shares subscribed for by a particular Holder, including shares subscribed for pursuant to the Over-Subscription Right, any fractional shares of our Common Stock that would otherwise be created by the exercise of the Rights by that Holder will be rounded down to the nearest whole share, with such adjustments as may be necessary to ensure that we offer a maximum of 15,627,441 shares of Common Stock in the Rights Offering. Any excess subscription payments received by the Subscription Agent in respect of fractional shares will be returned promptly after the expiration of the Rights Offering without interest or deduction.

Q:

| Has our Board, the Special Committee or the Company made a recommendation to our stockholders whether to exercise or let lapse their Rights in the Rights Offering? |

A: No. Neither the Company, the Special Committee nor our Board has, or will, make any recommendation to Holders whether to exercise or let lapse their Rights in the Rights Offering. You should make an independent investment decision about whether to exercise or let lapse your Rights based on your own assessment of our business and the Rights Offering. Holders who exercise Rights risk the loss of their investment.

TABLE OF CONTENTS

Q:

| Will the directors and executive officers participate in this Rights Offering? |

A: To the extent they hold Common Stock as of the Record Date or Common Stock issuable upon exercise or conversion of Warrants or Series A Preferred Stock, our directors and executive officers are entitled to participate in this Rights Offering on the same terms and conditions applicable to all Rights holders. We expect that each of our directors and executive officers will participate in this offering, although they have not committed to do so.

Christopher S. Shackelton, Chairman of our Board and a Managing Partner of Coliseum Capital Management, LLC, clients of which are the beneficial owners of approximately 56.2% of our Common Stock prior to this Rights Offering, has indicated that Coliseum’s clients currently intend to participate in the Rights Offering and subscribe for at least the full amount of their Basic Subscription Rights, but have not made any formal binding commitment to participate and have no obligation to participate.

Q:

| How do I exercise my Rights? |

A: If you wish to participate in the Rights Offering, you must take the following steps, unless your shares are held by a broker, dealer or other nominee:

• | deliver payment to the Subscription Agent using the method outlined in this prospectus; and |

• | deliver a properly completed rights certificate (the “Rights Certificate”) to the Subscription Agent before 5:00 p.m., New York City time, on November 14, 2023, unless the expiration date is extended. |

Please note that if you hold your shares in “street name” through a broker, dealer, or other nominee who uses the services of the Depository Trust Company (“DTC”), DTC must receive the subscription instructions, Notice of Guaranteed Delivery (if applicable), and payment for the new shares before 2:30 p.m., New York City time, on the expiration date. See “The Rights Offering — Procedures for DTC Participants.”

If you cannot deliver your Rights Certificate to the Subscription Agent before the expiration of the Rights Offering, you may use the procedures for guaranteed delivery as described in this prospectus under “The Rights Offering – Guaranteed Delivery Procedures” beginning on page

33 of this prospectus.

If you send a payment that is insufficient to purchase the number of shares of common stock you requested, or if the number of shares of Common Stock you requested is not specified in the forms, the Subscription Agent will have the right to reject and return your subscription for correction. If the payment exceeds the subscription price for the full exercise of your Rights (to the extent specified by you), the excess will be refunded to you.

Q:

| What should I do if I want to participate in the Rights Offering, but my shares are held in the name of my broker, dealer, or other nominee? |

A: If you hold your shares of our Common Stock in “street name” through a broker, dealer or other nominee, then your broker, dealer or other nominee is the record holder of the shares you own. The record holder must exercise the Rights on your behalf for the shares of Common Stock you wish to purchase.

If you wish to participate in the Rights Offering and purchase shares of Common Stock, please promptly contact the record holder of your shares. We will ask your broker, dealer, or other nominee to notify you of the Rights Offering. Holders in certain jurisdictions who hold through a nominee may be required to provide additional information to their nominees in order to exercise their Rights. Please note that if you hold your shares in “street name” through a broker, dealer, or other nominee who uses the services of DTC, DTC must receive the subscription instructions, Notice of Guaranteed Delivery (if applicable), and payment for the new shares before 2:30 p.m., New York City time, on the expiration date. See “The Rights Offering — Procedures for DTC Participants.”

Q:

| Will I be charged a sales commission or a fee if I exercise my Rights? |

A: No. We will not charge a brokerage commission or a fee to Rights holders for exercising their Rights. However, if you exercise your Rights through a broker or nominee, you will be responsible for any fees charged by your broker or nominee.

Q:

| Are there any conditions to my right to exercise my Rights? |

A: Yes. Your right to exercise your Rights is subject to the conditions described under “The Rights Offering — Conditions to the Rights Offering.”

TABLE OF CONTENTS

Q:

| May I participate in this Rights Offering if I sell my Common Stock after the Record Date? |

A: The Record Date for this Rights Offering is October 23, 2023. If you own Common Stock as of the Record Date, you will receive Rights and may participate in the Rights Offering even if you subsequently sell your Common Stock.

Q:

| How soon must I act to exercise my Rights? |

A: The Rights may be exercised beginning on October 23, 2023 through 5:00 p.m., New York City time, on November 14, 2023, the expiration date of the Rights Offering, unless extended by us. Please note that if you hold your shares in “street name” through a broker, dealer, or other nominee who uses the services of DTC, DTC must receive the subscription instructions, Notice of Guaranteed Delivery (if applicable), and payment for the new shares before 2:30 p.m., New York City time, on the expiration date. See “The Rights Offering – Procedures for DTC Participants.” If you elect to exercise any Rights, the Subscription Agent must actually receive all required documents and payments from you or your broker or nominee at or before the expiration date. We have the option of extending the expiration date of the subscription period in our sole discretion.

Q:

| When will I receive my Rights Certificate? |

A: As promptly as reasonably practicable after the date of this prospectus, the Subscription Agent will send a Rights Certificate to each registered Holder as of 5:00 p.m., New York City time, on the Record Date, based on our securities registry maintained at the transfer agent for our Common Stock and by our treasury department for the Warrants and Series A Preferred Stock. If you hold your shares of Common Stock through a brokerage account, bank or other nominee, you will not receive an actual Rights Certificate. Instead, as described in this prospectus, you must instruct your broker, bank or nominee whether or not to exercise Rights on your behalf. If you wish to obtain a separate Rights Certificate, you should promptly contact your broker, bank or other nominee and request a separate Rights Certificate.

Q:

| May I sell, transfer or assign my Rights? |

A: No. You may not transfer, sell or assign any of your Rights, except that Rights will be transferable by operation of law (e.g., by death) or by such holders that are closed-end funds to funds affiliated with such Holder. For purposes of any such transfer by a closed-end fund, “affiliated” means each other funds that owns or controls directly or indirectly the holder and any fund that controls or is controlled by or is under common control with the holder. The Rights are non-transferable and will not be listed on any securities exchange or included in any automated quotation system. Therefore, there will be no market for the Rights.

Q:

| Will I be able to trade my Rights on the Nasdaq? |

A: No.

Q:

| Am I required to subscribe in the Rights Offering? |

A: No.

Q:

| Am I required to exercise any or all of the Rights I receive in the Rights Offering? |

A: No. You may exercise any number of your Rights, or you may choose not to exercise any Rights. If you do not exercise any Rights, the number of shares of our Common Stock that you own will not change.

Q:

| Is the Company requiring a minimum subscription to complete the Rights Offering? |

A: No. We may choose to consummate, amend, extend or terminate the Rights Offering regardless of the number of shares of common stock actually subscribed for by stockholders.

Q:

| Can the Special Committee cancel, terminate, amend or extend the Rights Offering? |

A: Yes. Our Special Committee may decide to cancel or terminate the Rights Offering at any time before the expiration of the Rights Offering and for any reason. If our Special Committee cancels or terminates the Rights Offering, we will issue a press release notifying Holders of the cancellation or termination, and any money received from subscribing Holders will be promptly returned, without interest or deduction.

We may amend the terms of the Rights Offering or extend the subscription period of the Rights Offering.

Q:

| Will my percentage ownership interest in the Company be diluted by the Rights Offering? |

A: Your ownership interest will be diluted to the extent that you do not exercise your Rights.

TABLE OF CONTENTS

As a result of the Rights Offering, to the extent you do not exercise your Rights, you will lose any value represented by your unexercised Rights and the percentage that your original shares of Common Stock represent of our increased equity will be diluted.

See “Risk Factors — Risks Related to the Rights Offering — If you do not exercise your Rights in full, your percentage ownership and voting rights will experience enhanced dilution, including as a result of certain anti-dilution rights held by Warrant holders. Even if you decide to participate in this Rights Offering, you will experience certain dilution as a result of the anti-dilution provision of our Warrants.”

Q:

| If I exercise Rights in the Rights Offering, may I cancel or change my decision? |

A: No. Unless our Special Committee cancels or terminates the Rights Offering, all exercises of Rights are irrevocable. You should not exercise your Rights unless you are certain that you wish to purchase shares of Common Stock at a price of $6.399 per share. See “Risk Factors — Risks Related to the Rights Offering — There may be material developments regarding us during the subscription period”. In considering whether to exercise your Rights, you should consider that all exercises of Rights are irrevocable, even if you subsequently learn information about us that you consider to be unfavorable.”

Q:

| How much money will the Company receive from the Rights Offering? |

A: Assuming the Rights Offering is fully subscribed, we expect to receive aggregate net proceeds from this offering of approximately $99.6 million, after deducting estimated offering expenses incurred by us relating to the Rights Offering. We expect to use such proceeds for our growth initiatives including acquisitions and new business development activities and general corporate purposes, which may include repaying or refinancing our existing or future debt facilities.

For more information regarding the net proceeds to the Company in the Rights Offering, please refer to the section titled “Use of Proceeds.”

Q:

| Are there risks in exercising my Rights? |

A

: Yes. The exercise of your Rights involves risks. Exercising your Rights means buying shares of our Common Stock, and should be considered as carefully as you would consider any other equity investment. We urge you to carefully read the section titled “Risk Factors” beginning on page 17 of this prospectus and the section titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 and in our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2023 and June 30, 2023, and all other information included or incorporated by reference in this prospectus in its entirety before you decide whether to exercise your Rights. In addition, Holders of the Warrants and holders of the Series A Preferred Stock are entitled to participate in the Rights Offering. See “Risk Factors—Risks Related to the Rights Offering—Holders of the Warrants and holders of the Series A Preferred Stock are entitled to participate in the Rights Offering and, although such holders have waived certain anti-dilution adjustments in connection with the Rights Offering, there can be no assurance that they will do so in the future and such anti-dilution adjustments could cause dilution to our stockholders.”

Q:

| How many shares of Common Stock will be outstanding immediately after the Rights Offering? |

A: As of October 23, 2023, we had 17,431,605 shares of Common Stock issued and 14,019,383 shares of Common Stock outstanding.

The number of shares of our Common Stock that will be outstanding after the Rights Offering will depend on the number of shares of Common Stock that are purchased in the Rights Offering. Assuming no additional shares of Common Stock are issued by us prior to consummation of the Rights Offering and assuming all offered shares of Common Stock are sold in the Rights Offering at the subscription price, we will issue 15,627,441 shares of Common Stock. In that case, we will have approximately 30,114,585 shares of Common Stock outstanding after the Rights Offering, taking into account also the expected conversion of 467,761 Warrants into 467,761 shares of Common Stock. This would represent an increase of approximately 114.8% in the number of outstanding shares of Common Stock. See “Prospectus Summary—Recent Developments-Anti-Dilution Waivers” for further information regarding an applicable anti-dilution provision.

TABLE OF CONTENTS

The issuance of shares of our Common Stock in the Rights Offering will dilute, and thereby reduce, your proportionate ownership in our shares of Common Stock, unless you fully exercise your Basic Subscription Rights. See “Risk Factors — Risks Related to the Rights Offering — If you do not exercise your Rights in full, your percentage ownership and voting rights will experience enhanced dilution, including as a result of certain anti-dilution rights held by Warrant holders. Even if you decide to participate in this Rights Offering, you will experience certain dilution as a result of the anti-dilution provision of our Warrants.” In addition, the issuance of our Common Stock at a subscription price that is less than the market price as of the Record Date for the Rights Offering will likely reduce the price per share of our Common Stock held by you prior to the Rights Offering.

Q.

| Is the Rights Offering similar to a forward stock split? |

A. No. These are completely different corporate actions. Among other differences between these actions, the numbers of shares owned by a stockholder is increased in a forward stock split by giving each stockholder an additional number of shares of Common Stock per each share owned. For example, a 5-for-1 forward stock split would give an additional four shares of Common Stock to each holder of record, such that each share held by the holder before the split would be five shares after the split. In contrast, no increase in shares owned by any Holder will occur as a result of the Rights Offering; rather, each Holder of record as of the Record Date will be entitled to purchase 0.770 shares of Common Stock for each Right received. If every Holder of record subscribes for the full number of shares underlying their Rights, then the outstanding shares of the Company following the Rights Offering will look as if we completed a 1.770-for-1 forward stock split.

Q.

| Is the Rights Offering similar to a reverse stock split? |

A. No. These are completely different corporate actions. Among other differences between these actions, the numbers of shares owned by a stockholder is reduced in a reverse stock split. No reduction in shares owned by any Holder will occur as a result of the Rights Offering. However, depending on the number of shares subscribed for in the Rights Offering, our existing Holder may incur substantial dilution.

Q:

| Will this Rights Offering result in the Company “going private” for purposes of Rule 13e-3 of the Exchange Act? |

A: No. The Rights Offering is not a transaction or series of transactions which has either a reasonable likelihood or a purpose or producing a “going private effect” as specified in Rule 13e-3 of the Exchange Act. Given the structure of the Rights Offering, as described in this prospectus, the Company will continue to be registered pursuant to Section 12 of the Exchange Act and intends to remain listed on the Nasdaq Capital Market following completion of the Rights Offering.

Q:

| If the Rights Offering is not completed, will my subscription payment be refunded to me? |

A: Yes. The Subscription Agent will hold all funds it receives in a segregated bank account until completion of the Rights Offering. If the Rights Offering is not completed, we will promptly instruct the Subscription Agent to return your payment in full. If you own shares in “street name,” it may take longer for you to receive payment because the Subscription Agent will send the refund payment through DTC, which will allocate the funds to your bank or broker. Any funds returned will be returned without interest or deduction.

Q:

| What should I do if I want to participate in the Rights Offering, but I am a stockholder with a foreign address? |

A: If you are a Rights holder whose address is outside the United States, the Subscription Agent will not mail Rights Certificates to you, and your Rights Certificates will be held by the Subscription Agent for your account until any instructions are received to exercise your Rights. To exercise your Rights, you must notify the Subscription Agent on or prior to 11:00 a.m., New York City time, on November 6, 2023, which is five business days prior to the expiration date for the Rights Offering, unless extended by us, and, if we so request, must establish to our satisfaction that you are permitted to exercise your Rights under applicable law. Any questions related to exercising Rights should be directed to the Subscription Agent. If you do not follow these procedures prior to the expiration of the Rights Offering, your Rights will expire. We will decide all questions concerning the timeliness, validity, form and eligibility of the exercise of your Rights and any such determinations by us will be final and binding.

TABLE OF CONTENTS

This Rights Offering is not being made in any state or other jurisdiction in which it would be unlawful to do so, nor are we selling to you, or accepting any offers from you to purchase, shares of Common Stock if you are a resident of any such state or other jurisdiction. If necessary, we may delay commencement of the Rights Offering in certain states or other jurisdictions in order to comply with the securities law requirements of those states or other jurisdictions. In addition, in certain circumstances, in order to comply with applicable state securities laws, we may not be able to honor all Rights even if we have shares of Common Stock available. We do not anticipate that there will be any changes in the Rights Offering, and we may, in our sole discretion, decline to make modifications to the terms of the Rights Offering requested by regulators in states or other jurisdictions, in which case Holders who live in those states or other jurisdictions will not be eligible to participate in the Rights Offering.

Q:

| What are the U.S. federal income tax considerations applicable to holders of receiving or exercising Rights? |

A: Although the authorities governing transactions such as the Rights Offering are complex and unclear in certain respects (including with respect to the effects of the Over-Subscription Right), we believe and intend to take the position that a holder’s receipt of Rights pursuant to the Rights Offering may be treated as a taxable distribution with respect to such holder’s existing shares of Common Stock (including all shares of Common Stock received pursuant to the conversion of all Series A Preferred Stock prior to the Record Date) and should not be taxable with respect to such holder’s Series A Preferred Stock and Warrants for U.S. federal income tax purposes. This position regarding the non-taxable treatment of the Rights Offering is not binding on the U.S. Internal Revenue Service (the “IRS”) or the courts. For a more detailed discussion, see “Material U.S. Federal Income Tax Consequences.” You should consult your tax advisor as to the particular considerations applicable to you of the Rights Offering.

Q:

| To whom should I send my forms and payment? |

A: If your shares are held in the name of a custodian bank, broker, dealer or other nominee, the nominee will notify you of the Rights Offering and provide you with the Rights Offering materials. You should send any required documents and payment, as provided therein to the nominee, at the deadline that your nominee sets which may be earlier than the expiration of the Rights Offering. You should contact your custodian bank, broker, dealer or other nominee if you believe you are entitled to participate in the Rights Offering but you have not received your materials.

If your shares are held in your name such that you are the record holder, then you should send your subscription documents, Rights Certificate and subscription payment, as provided herein, by first class mail or courier service to the Subscription Agent. The address for delivery to the Subscription Agent is as follows:

By Mail: | | | By Overnight Delivery: |

Broadridge Corporate Issuer Solutions, LLC

Attn: BCIS Re-Organization Dept.

P.O. Box 1317

Brentwood, NY 11717-0718 | | | Broadridge Corporate Issuer Solutions, LLC

Attn: BCIS IWS

51 Mercedes Way

Edgewood, NY 11717 |

Your delivery to a different address or other than by the methods set forth above will not constitute valid delivery. You, or, if applicable, your nominee, are solely responsible for ensuring the Subscription Agent receives your subscription documents, Rights Certificate, and subscription payment. You should allow sufficient time for delivery of your subscription materials to the Subscription Agent and clearance of payment before the expiration of the Rights Offering period.

Q:

| What should I do if I have other questions? |

A: If you have questions or need assistance, please contact the Information Agent toll-free at 888-789-8409, by e-mail at shareholder@broadridge.com, or by mail at:

Broadridge Corporate Issuer Solutions, LLC

Attn: BCIS Re-Organization Dept.

P.O. Box 1317

Brentwood, NY 11717-0718

For a more complete description of the Rights Offering, see “The Rights Offering” included elsewhere in this prospectus.

TABLE OF CONTENTS

This summary highlights certain information about us, this Rights Offering and selected information contained in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our Common Stock. For a more complete understanding of the Company and this Rights Offering, we encourage you to read and consider the more detailed information included or incorporated by reference in this prospectus, including risk factors, see “Risk Factors” beginning on page

17, and our most recent consolidated financial statements and related notes.

Overview

We were originally formed for the purpose of effecting a business combination with one or more businesses or entities. On March 15, 2018, the initial business combination was consummated. As a result, the business of Lazy Days’ R.V. Center, Inc. (“Lazydays RV”) and its subsidiaries became the Company’s business. Accordingly, we are now a holding company operating through our direct and indirect subsidiaries.

Company History

Andina Acquisition Corp. II (“Andina”) was formed as an exempted company incorporated in the Cayman Islands on July 1, 2015 for the purpose of entering into a merger, share exchange, asset acquisition, share purchase, recapitalization, reorganization or other similar business combination with one or more target businesses.

From the consummation of the initial public offering of Andina until October 27, 2017, Andina was searching for a suitable target business to acquire. On October 27, 2017, a merger agreement was entered into by and among Andina, Andina II Holdco Corp., a Delaware corporation and wholly owned subsidiary of Andina (“Holdco”), Andina II Merger Sub Inc., a Delaware corporation and wholly owned subsidiary of Holdco (“Merger Sub”), Lazydays RV and solely for certain purposes set forth in the merger agreement, A. Lorne Weil (the “Merger Agreement”). The Merger Agreement provided for a business combination transaction by means of: (i) the merger of Andina with and into Holdco, with Holdco surviving and becoming a new public company (the “Redomestication Merger”); and (ii) the merger of Lazydays RV with and into Merger Sub with Lazydays RV surviving and becoming a direct wholly owned subsidiary of Holdco (the “Transaction Merger” and together with the Redomestication Merger, the “Mergers”). On March 15, 2018, we held an extraordinary general meeting of the shareholders, at which the Andina shareholders approved the Mergers and other related proposals. On the same date, the Mergers were closed. In connection with the Mergers, the business of Lazydays RV and its subsidiaries became the business of Holdco. As a result of the Mergers, the Company’s stockholders and the shareholders of Andina became stockholders of Holdco and the Company changed the name of Holdco to “Lazydays Holdings, Inc.”

Our Business

We operate RV dealerships and offer a comprehensive portfolio of products and services for RV owners and outdoor enthusiasts. We generate revenue by providing RV owners and outdoor enthusiasts a full spectrum of products: RV sales, RV repair and services, financing and insurance products, third-party protection plans, and after-market parts and accessories. During the second quarter of 2023, we closed the campground facilities at our Tampa, Florida location.

Based on industry research and management’s estimates, we believe we operate the world’s largest RV dealership, measured in terms of on-site inventory, located on approximately 126 acres outside Tampa, Florida. We also have dealerships located at The Villages, Florida; Tucson and Phoenix, Arizona; two near Minneapolis, Minnesota; Knoxville, Nashville and Maryville, Tennessee; Loveland and Denver, Colorado; Elkhart and Burns Harbor, Indiana; Portland, Oregon; Vancouver, Washington; Milwaukee, Wisconsin; Tulsa, Oklahoma, Houston, Texas and Las Vegas, Nevada.

Lazydays offers one of the largest selections of leading RV brands in the nation, featuring more than 4,000 new and pre-owned RVs. We have more than 575 service bays, and each location has an RV parts and accessories store. We employ approximately 1,500 people at our twenty dealership locations. Our locations are staffed with knowledgeable local team members, providing customers access to extensive RV expertise. We believe our locations are strategically located in key RV markets. Based on information collected by us from

TABLE OF CONTENTS

reports prepared by Statistical Surveys, these RV markets (Florida, Colorado, Arizona, Minnesota, Tennessee, Indiana, Oregon, Washington, Wisconsin, Oklahoma, Texas and Nevada) account for a significant portion of new RV units sold on an annual basis in the U.S. Our dealerships in these key markets attract customers from all states, except Hawaii.

We attract new customers primarily through Lazydays dealership locations as well as digital and traditional marketing efforts. Once we acquire customers, those customers become part of our customer database where we leverage customer relationship management tools and analytics to actively engage, market and sell our products and services.

Our principal executive offices are located at 4042 Park Oaks Boulevard, Suite 350, Tampa, Florida 33610 and our telephone number is (813) 246-4999. Our Internet website is www.lazydays.com. Our reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are available, free of charge, under the Investor Relations – Finance Information tab of our website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The SEC also maintains an Internet website located at www.sec.gov that contains the information we file or furnish electronically with the SEC. The information on our website is not incorporated by reference in this prospectus, and you should not consider it a part of this prospectus.

Growth Through Acquisitions and Greenfields

The RV dealership industry is highly fragmented with primarily independent owners. We target increasing our physical number of stores through acquisitions to strategically grow our presence and create density in our network to provide convenience for our customers across the country. Our value-based acquisition strategy targets relatively higher revenue stores with strong brands in desirable markets. As we integrate these stores into our network, we focus on increasing profitability through gaining market share, elevating the customer experience and leveraging our cost structure.

We target acquisitions that are accretive to our adjusted EBITDA at inception and that are expected to achieve an average annual 20% after-tax return on equity. To date in 2023, we have acquired businesses with approximately $95 million of estimated annualized revenue and approximately $6 million in estimated annualized adjusted EBTIDA, based upon 2022 fiscal year financial results, reflecting an estimated 4.0x valuation multiple before synergies. At steady state, we anticipate these acquisitions to generate approximately $130 million of estimated annualized revenue and approximately $9 million of estimated annualized EBITDA.

Currently, we are party to signed purchase agreements or non-binding letters of intent to acquire locations with approximately $600 million of estimated annualized revenues and approximately $35 million of estimated annualized adjusted EBITDA at steady state.

In addition to acquisitions, we will, from time to time, open greenfield sites de novo in new or existing markets. We opened our Council Bluffs, Iowa and Wilmington, Ohio locations earlier this year and we remain on track to open Fort Pierce, Florida in October and Surprise, Arizona later in the fourth quarter of this year.

Leveraging Our Scale and Cost Structure to Create Operational Efficiencies

As we grow, we are positioned to leverage our scale to improve operating margins. We have centralized many administrative functions to drive efficiencies and streamline store-level operations. The reduction of administrative functions at our stores allows our local teams to focus on customer-facing opportunities to increase revenues and gross profit. Our stores also receive supply chain management support, ensuring optimal levels of new and used RV inventory; and finance and insurance product and training support to provide a full array of offerings to our customers.

Recent Developments

Business Expansion Developments

As previously announced, as part of our strategic expansion we recently announced that we completed the acquisition of Century RV in Longmont, Colorado. This acquisition is expected to strengthen our presence in Denver, making us the premier choice for RVers in Colorado. In addition, in July 2023 we completed the acquisition of Buddy Gregg RVs & Motor Homes in Knoxville, Tennessee. Earlier this year, we acquired a dealership Findlay RV in Las Vegas, Nevada. The dealership is strategically located bordering 4 of the top 15 RV market states, and complements our existing operations in Arizona.

TABLE OF CONTENTS

In July, we completed mortgages on our Murfreesboro, Tennessee store and on our Knoxville property purchased with the Buddy Gregg acquisition. These mortgages generated net proceeds of $30.6 million.

In September, we entered into asset purchase agreements with two different dealerships. Primary assets to be acquired include new and used vehicle inventories, parts inventory, furniture, fixtures and equipment, and real estate.

Acquisitions during the year fiscal year 2023 did not individually meet the significance test thresholds under Rule 3-05 of Regulation S-X that would have required the inclusion of historical financial statements. However, on a combined basis such acquisitions aggregated more than 50% significance on a combined basis, which would have required pro forma presentation, as described in Article 11 of Regulation S-X as amended by the final rule, Release No. 33-10786 “Amendments to Financial Disclosures about Acquired and Disposed Businesses.” See “Unaudited pro forma condensed combined financial information.”

Anti-Dilution Waivers

The Series A Preferred Stock and the Warrants may be subject to anti-dilution adjustments in connection with certain events, including the Rights Offering. The holders of the Series A Preferred Stock have fully waived these anti-dilution adjustments in connection with the Rights Offering. The holders of the Warrants have partially waived these anti-dilution adjustments agreeing to accept an adjustment that increases number of shares issuable upon exercise equal to one-half of the number of shares of our Common Stock that would result from the adjustment in the absence of the waiver. These holders have also agreed to exercise all of the Warrants (giving effect to the foregoing one-half adjustment) held by them upon consummation of the Rights Offering. Holders of the Warrants represent 100% of all Warrant holders. Consequently, once the Rights Offering is completed, there will be no outstanding Warrants. For illustrative purposes, if the Rights in this Rights Offering are fully exercised, we anticipate an adjustment to the exercise price of the Warrants resulting in the issuance of 467,761 additional shares of Common Stock upon exercise, in accordance with the anti-dilution provision. Therefore, if the Rights in this Rights Offering are fully exercised, the expected total number of shares of Common Stock to be issued upon the exercise of the Warrants, after accounting for the foregoing anti-dilution adjustment, will be 30,114,585 shares of Common Stock. The holders of the Warrants have agreed to exercise all the Warrants held by them upon consummation of the Rights Offering.

TABLE OF CONTENTS

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

We prepared the following unaudited pro forma condensed combined financial statements by applying certain pro forma adjustments to the historical consolidated financial statements of Lazydays Holdings, Inc. The pro forma adjustments give effect to the following transactions (the “Transactions”):

•

| Our acquisition on February 15, 2023 of Hohl-Findlay, LLC (“Findlay”); |

•

| Our acquisition on July 24, 2023 of Buddy Gregg Motor Homes, LLC (“Buddy Gregg”); |

•

| Our acquisition on August 7, 2023 of Century RV, Inc. (“Century”); |

•

| Two planned acquisitions. |

We determined that the Transactions during the year fiscal year 2023 did not individually meet the significance test thresholds under Rule 3-05 that would have required the inclusion of historical financial statements. However, such acquisitions aggregated more than 50% significance on a combined basis under the investment test, which would have required pro forma presentation, as described in Article 11 of Regulation S-X as amended by the final rule, Release No. 33-10786 “Amendments to Financial Disclosures about Acquired and Disposed Businesses.” As a result, we did not include in this Prospectus financial statements of the acquired entities.

The unaudited pro forma condensed combined statements of operations for the year ended December 31, 2022 and for the six months ended June 30, 2023 gives effect to the Transactions as if each of them had occurred on January 1, 2022. The unaudited pro forma condensed combined balance sheet as of June 30, 2023 gives effect to each of our acquisitions completed, planned acquisitions after the reporting date that are “probable,” additional borrowings under our Floor plan arrangement and long-term mortgages obtained on acquired real estate, as if each of them had occurred on January 1, 2022. The unaudited pro forma condensed combined balance sheet as of June 30, 2023 does not give effect to the potential raise of the proceeds in this Prospectus.

We have based the pro forma adjustments upon available information and certain assumptions that we believe are reasonable under the circumstances. We describe in greater detail the assumptions underlying the pro forma combined financial statements in the notes to the unaudited pro forma combined financial statements. In many cases, we based these assumptions on preliminary information and estimates. The actual adjustments to our pro forma combined financial statements will depend upon a number of factors and additional information that will be available on or after the closing date of this offering. Accordingly, the actual adjustments that will appear in our financial statements will differ from these pro forma adjustments, and those differences may be material.

We will account for each of the acquisitions in the Transactions using the acquisition method of accounting for business combinations under GAAP. Under the acquisition method of accounting, the total consideration paid is allocated to an acquired company's tangible and intangible assets, and liabilities, based on their estimated fair values as of the acquisition date. As of the date of this prospectus, we have not completed the valuation studies necessary to finalize the acquisition date fair values of the assets acquired and liabilities assumed and the related allocation of purchase price for the Transactions. Accordingly, the values of the assets and liabilities set forth in these unaudited pro forma condensed combined financial statements for these businesses are preliminary. Once we complete our final valuation processes, for both our consummated and planned acquisitions, we may report changes to the value of the assets acquired and liabilities assumed, as well as the amount of goodwill, and those changes could differ materially from what we present here.

We provide these unaudited pro forma condensed combined financial statements for informational purposes only. These unaudited pro forma condensed combined financial statements do not purport to represent what our results of operations or financial condition would have been had the Transactions actually occurred on the assumed dates, nor do they purport to project our results of operations or financial condition for any future period or future date. Additionally, some transactions appear in our unaudited pro forma condensed combined financial statements due to their “probable” status under Rule 3-05. However, these “probable” Transactions depend on meeting certain closing conditions. If any of these conditions are not fulfilled, we might not proceed with the applicable Transaction. You should read these unaudited pro forma condensed combined financial statements in conjunction with “Use of Proceeds,” “Capitalization,” and “Management's Discussion and Analysis of Financial Condition and Results of Operations,” and our historical financial statements, including the related notes thereto, appearing elsewhere in, or incorporated into, this prospectus.

TABLE OF CONTENTS

Lazydays Holdings, Inc

Unaudited Pro Forma Condensed Combined Statement of Operations

For the year ended December 31, 2022

Revenues

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

New vehicle retail | | | 777,807 | | | 11,247 | | | 23,355 | | | 25,587 | | | 60,189 | | | 21,799 | | | — | | | | | | 859,796 |

Pre-owned vehicle retail | | | 394,582 | | | 6,082 | | | 8,828 | | | 6,519 | | | 21,429 | | | 8,564 | | | — | | | | | | 424,574 |

Vehicle wholesale | | | 21,266 | | | — | | | 8 | | | — | | | 8 | | | — | | | — | | | | | | 21,274 |

Finance and insurance | | | 75,482 | | | 716 | | | 2,059 | | | 2,809 | | | 5,584 | | | 907 | | | — | | | | | | 81,973 |

Service, body, parts and other | | | 57,824 | | | 2,036 | | | 3,990 | | | 1,583 | | | 7,609 | | | 4,376 | | | — | | | | | | 69,809 |

Total Revenue | | | 1,326,961 | | | 20,081 | | | 38,241 | | | 36,498 | | | 94,819 | | | 35,646 | | | — | | | | | | 1,457,427 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cost applicable to revenues (excluding depreciation, and amortization as shown below)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

New vehicle retail | | | 632,316 | | | 9,637 | | | 19,757 | | | 21,718 | | | 51,112 | | | 17,025 | | | — | | | | | | 700,453 |

Pre-owned vehicle retail | | | 301,565 | | | 4,987 | | | 6,725 | | | 4,699 | | | 16,410 | | | 6,221 | | | — | | | | | | 324,196 |

Vehicle wholesale | | | 21,620 | | | — | | | — | | | | | | — | | | — | | | — | | | | | | 21,620 |

Finance and insurance | | | 2,729 | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | 2,729 |

Service, body, parts and other | | | 27,657 | | | 963 | | | 1,640 | | | 1,095 | | | 3,698 | | | 2,196 | | | — | | | | | | 33,552 |

LIFO | | | 12,383 | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | 12,383 |

Total cost applicable to revenue | | | 998,270 | | | 15,587 | | | 28,122 | | | 27,512 | | | 71,220 | | | 25,442 | | | — | | | | | | 1,094,932 |

Gross profit | | | 328,691 | | | 4,494 | | | 10,119 | | | 8,986 | | | 23,599 | | | 10,205 | | | — | | | | | | 362,495 |

Depreciation and amortization | | | 16,758 | | | 18 | | | 150 | | | 47 | | | 215 | | | — | | | 375 | | | (3) | | | 17,348 |

Selling, general and administrative expenses | | | 222,218 | | | 4,029 | | | 6,105 | | | 5,973 | | | 16,107 | | | 7,071 | | | (1,936) | | | (4) | | | 243,460 |

Income from operations | | | 89,715 | | | 447 | | | 3,864 | | | 2,966 | | | 7,276 | | | 3,133 | | | 1,561 | | | | | | 101,686 |

Other income (expense)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Floorplan interest expense | | | (8,596) | | | (86) | | | (692) | | | (205) | | | (983) | | | (202) | | | (1,454) | | | (5) | | | (11,236) |

Other interest expense | | | (7,996) | | | 0 | | | (0) | | | (1) | | | (1) | | | (25) | | | (2,884) | | | (6) | | | (10,906) |

Interest income | | | — | | | — | | | — | | | — | | | — | | | 98 | | | — | | | | | | 98 |

Change in fair value of warrant liabilities | | | 12,453 | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | 12,453 |

Total other (expense) income, net | | | (4,139) | | | (86) | | | (692) | | | (207) | | | (984) | | | (129) | | | (4,338) | | | | | | (9,590) |

Income before income tax expense | | | 85,576 | | | 361 | | | 3,172 | | | 2,759 | | | 6,292 | | | 3,004 | | | (2,777) | | | | | | 92,096 |

Income tax expense | | | (19,183) | | | (81) | | | (711) | | | (618) | | | (1,410) | | | (673) | | | 622 | | | (7) | | | (20,644) |

Net income | | | 66,393 | | | 280 | | | 2,461 | | | 2,141 | | | 4,882 | | | 2,331 | | | (2,154) | | | | | | 71,451 |

Dividends on Series A Convertible Preferred Stock | | | (4,801) | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | (4,801) |

Net income and comprehensive income attributable to common stock and participating securities | | | 61,592 | | | 280 | | | 2,461 | | | 2,141 | | | 4,882 | | | 2,331 | | | (2,154) | | | | | | 66,650 |

EPS:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | $3.47 | | | | | | | | | | | | | | | | | | | | | | | | $3.76 |

Diluted | | | $2.42 | | | | | | | | | | | | | | | | | | | | | | | | $2.68 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Weighted average shares outstanding

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | 11,701,302 | | | | | | | | | | | | | | | | | | | | | | | | 11,701,302 |

Diluted | | | 12,797,796 | | | | | | | | | | | | | | | | | | | | | | | | 12,797,796 |

TABLE OF CONTENTS

Notes:

Statement of Operations Adjustments

(1)

| Refers to the historical financial statements of Lazydays Holdings, Inc. appearing elsewhere in or incorporated into, this prospectus |

(2)

| Refers to the historical financial results of the Transactions prior to the respective acquisitions. Note each of the completed and planned acquisitions is individually insignificant under S-X Rule 3-05. |

(3)

| Adjustment to Depreciation and amortization of $375 thousand and $158 thousand for the year ended December 31, 2022 and six months ended June 30, 2023 represents the depreciation and amortization related to the step up in fair value of the acquired tangible and intangible assets. |

(4)

| Adjustment to Selling, general and administrative expense of $(1,936) thousand and $(809) thousand for the year ended December 31, 2022 and six months ended June 30, 2023 represents the reversal of rent expense for those Transactions where the real property has been or is anticipated to be acquired as a part of the acquisition. In addition, rent expense for Century RV has been adjusted to reflect a lease agreement entered into as a part of the transaction. |

(5)

| Adjustment to floor plan interest expense of $1,454 thousand and $2,693 thousand for the year ended December 31, 2022 and six months ended June 30, 2023 represents interest expense related to the $40 million decrease to our floor plan offset account. The adjustments are based upon variable interest rates. Our floor plan facility accrues interest at 30-day SOFR plus a margin ranging from 2% to 2.15% depending upon our leverage ratio. The adjustments have been calculated at 3.64% and 6.73%, respectively, using average SOFR throughout the period. The effect of 1/8 percent variance in the variable interest rates for the floor plan liability would change interest expense, net by approximately $50 thousand and $25 thousand for the year ended December 31, 2022 and six months ended June 30, 2023, respectively. |

(6)

| Adjustment to other interest expense of $2,884 thousand and $1,232 thousand for the year ended December 31, 2022 and six months ended June 30, 2023 represents the interest expense for mortgages obtained or planned to be obtained on the acquired real property for the Buddy Gregg acquisition and both planned acquisitions as well as the mortgage obtained on our Murfreesboro location during July 2023. The adjustments are based on the fixed interests rates of 6.85% -7.1% on the mortgages obtained or estimated rates at the date the mortgage is expected to be obtained. |

(7)

| Adjustment represents the income tax effect of the financial information of the Transactions and pro forma adjustments. For pro forma purposes, a blended federal and statutory rate of 22.4% and 26.2% for the year ended December 31, 2022 and six months ended June 30, 2023 has been assumed for pro forma adjustments. |

Balance Sheet Adjustments

The adjustments included in the unaudited pro forma condensed combined balance sheet as of June 30, 2023 are as follows:

(1)

| Refers to the historical financial statements of Lazydays Holdings, Inc. appearing elsewhere in or incorporated into, this prospectus |

(2)

| Represents the preliminary purchase price allocation for the Buddy Gregg and Century RV acquisitions completed subsequent to June 30, 2023 and the two planned acquisitions not yet completed. The adjustments consider cash consideration for the acquisition, and preliminary estimated fair value of inventories acquired, ROU asset and lease liabilities obtained, real and tangible property acquired, goodwill and floor plan arrangements entered into at the time of acquisition to add the acquired inventory to the Company’s existing floor plan. For each immaterial acquisition, we did not acquire the historical working capital balances and thus no adjustments have been made to reflect the impact of such amounts. |

(3)

| Represents the cash proceeds and corresponding increase to the Company’s existing floor plan facility for a decrease in the floorplan offset account of $40 million and increased floorplan borrowings obtained for acquired inventory and mortgage liabilities on the acquired real property to consummate the Transactions. |

Non-GAAP Reconciliation for year ended December 31, 2022

We define adjusted EBITDA as net income or loss before interest income and expense, income taxes, depreciation and amortization, and other non-operating items from our statements of operations as well as certain other items considered outside the normal course of our operations specifically described below. Adjusted EBITDA is not a presentation made in accordance with GAAP. Our definition of adjusted EBITDA may vary from the use of similarly-titled measures by others in our industry due to the potential inconsistencies in the method of calculation and differences due to items subject to interpretation. Adjusted EBITDA should not be considered as an alternative to net income or loss, operating income/(loss), cash flows from operating activities or any other performance measures derived in accordance with GAAP as measures of operating performance or liquidity. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP.