0001721741false00017217412024-03-082024-03-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of earliest event reported): | March 8, 2024 |

LAZYDAYS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38424 | | 82-4183498 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

4042 Park Oaks Blvd., Suite 350, Tampa, Florida | | 33610 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | | | | |

| Registrant’s telephone number, including area code | | (813) 246-4999 |

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock | | GORV | | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On March 8, 2024, Lazydays Holdings, Inc. issued a press release announcing its financial results for the fourth quarter ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section and shall not be deemed to be incorporated by reference into any filing of the Lazydays Holdings, Inc. under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| LAZYDAYS HOLDINGS, INC. |

| | |

| March 8, 2024 | By | /s/ Kelly Porter |

| Date | | Kelly Porter Chief Financial Officer |

Exhibit 99.1

LAZYDAYS REPORTS FOURTH QUARTER AND FISCAL YEAR 2023 FINANCIAL RESULTS, PROVIDES UPDATE ON 2024 PERFORMANCE

Tampa, FL (March 8, 2024) – Lazydays (NasdaqCM: GORV) today reported financial results for the fourth quarter ended December 31, 2023.

John North, Chief Executive Officer, commented, "The fourth quarter of 2023 proved to be a challenging operating environment, in particular due to industry wide economic pressures. However, after increasing our marketing budget and aggressively discounting 2022 and 2023 inventory our unit volumes increased meaningfully both sequentially and year-over-year in December, January and February. More importantly, we have seen gross profit on vehicle sales improve from December to February and an increasing percentage mix of current model year units sold relative to the total, generating more gross profit dollars. As of today, our new inventory is comprised of more than 80% current model year units, and we believe is among the healthiest in the industry. Additionally, our adjusted cash flow from operations is positive this quarter to date.”

Commenting on 2024, John stated, “We anticipate a pre-tax loss in the first quarter and a return to profitability thereafter. Given the significant corporate development actions taken in 2023, the first six months of this year will be focused on improving volume and store performance. For the full year 2024, we anticipate both positive net income and operational cash flow. The quality of our locations, the partnerships we have with our OEMs and the operational improvements we have made to our leadership team give me confidence in our future results and we look forward to demonstrating the earnings power of the company in the future.”

Fourth quarter 2023 revenue decreased to $198.0 million from $243.5 million in the fourth quarter of 2022. As a result of the decline in the price of our common equity in the fourth quarter of 2023, we determined a triggering event had occurred relative to the carrying value of goodwill, and, as a result, we recorded a non-cash goodwill impairment charge of $118.0 million in the quarter.

Fourth quarter 2023 net loss was $108.0 million compared to net loss of $1.4 million for the same period in 2022. Fourth quarter 2023 adjusted net loss, a non-GAAP measure, was $13.8 million compared to net income of $0.9 million for the same period in 2022. Fourth quarter 2023 net loss per diluted share was $7.59 compared to net loss per diluted share of $0.24 for the same period in 2022. Adjusted fourth quarter 2023 net loss per diluted share was $1.09 compared to net loss per diluted share of $0.02 for the same period in 2022.

The fourth quarter 2023 adjusted results exclude a net non-core charge of $6.50 per diluted share related to our non-cash goodwill impairment charge, LIFO adjustment, and acquisition expenses. The fourth quarter of 2022 adjusted results exclude a net non-core charge of $0.22 per diluted share related to the effects of changes in fair value of warrant liabilities, our LIFO adjustment, acquisition expenses and severance and transition costs.

Net loss for 2023 was $110.3 million compared to net income of $66.4 million for the same period in 2022. Adjusted net loss for 2023 was $11.5 million compared to net income of $64.1 million for the same period in 2022. Net loss per diluted share for 2023 was $8.45 compared to net income per diluted share of $2.42 for the same period in 2022, and adjusted net loss per diluted share was $1.24 compared to adjusted net income per diluted share of $3.05 for the same period in 2022.

The adjusted results for full year 2023 exclude a net non-core charge of $7.21 per diluted share related to the effects of a non-cash goodwill impairment charge, changes in the fair value of warrant liabilities, our LIFO adjustment, acquisition expenses, severance and transition costs and a storm reserve. The adjusted results for the same period in 2022 exclude a net non-core charge of $0.63 per diluted share related to the effects of changes in the fair value of warrant liabilities, our LIFO adjustment, acquisition expenses and severance and transition costs.

Corporate Developments

As previously announced, during the fourth quarter we acquired Orangewood RV in Surprise, Arizona and RVzz in St. George, Utah. We also opened our Ft. Pierce, Florida greenfield location. We estimate these stores will add $110.0 million in annual revenues at steady state.

Earlier this week we announced the opening of our Surprise, Arizona dealership, the fourth and final greenfield location we began development on in 2021. This marks our third location in the Phoenix metropolitan area is expected to generate estimated annual revenues of $50.0 million at steady state. As of today, we operate 25 locations nationwide.

In January 2024, we launched a comprehensive rebranding effort, including an all-new website, new logos, fonts and colors, and changed our stock symbol to "GORV." These actions are designed to enhance our digital retailing efforts as well as improve our customer experience on mobile devices, which account for over 80% of our website traffic today.

Balance Sheet Update

In the fourth quarter, we cancelled our planned rights offering to stockholders. We subsequently secured a $35.0 million mortgage facility collateralized by seven of our owned locations with a cost basis of approximately $109.9 million. The facility closed on December 29, 2023 and has a three-year term. It is structured to allow us to obtain alternative financing on a location-by-location basis at an increased loan-to-value advance rate with other lending partners including regional and national banks.

We ended the fourth quarter 2023 with cash of $58.1 million. We estimate we can generate an additional $47.5 million in mortgage loan proceeds as we refinance locations at a 75% loan-to-value, in line with advance rates obtained on other mortgage financing secured earlier in 2023. We also have other unencumbered real estate that we estimate can generate additional liquidity of approximately $18 million through financing transactions.

As a result of our financial performance in the fourth quarter of 2023 and overall market conditions, we received a waiver of our financial covenants associated with our syndicated credit facility for the fourth quarter of 2023 and the first two quarters of 2024, with relaxed covenants in the third quarter and a return to our standard covenant package as of the end of 2024.

As of March 7, 2024, we had cash and cash equivalents of approximately $45 million. The reduction in our cash balance from year end is primarily a function of capital expenditures associated with corporate development efforts that are substantially complete as of today.

Kelly Porter, Chief Financial Officer, stated, “With cash on hand of $45 million as of today, we believe we have a strong foundation on which to build. We have generated positive operational cash flow for the first 70 days of 2024 while continuing to make significant operational improvements and we expect to be operationally cash flow positive for the remainder of the year. I’d like to thank our syndicated lenders, lead by M&T Bank, for facilitating the modification to our credit facility to relax our financial covenants and provide room to navigate the current macroeconomic environment and prepare us for a strong 2024.”

Conference Call Information

We have scheduled a conference call at 8:30 AM Eastern Time on Friday, March 8, 2024 that will also be broadcast live over the internet.

The conference call may be accessed by telephone at (877) 407-8029 / +1 (201) 689-8029. To listen live on our website or for replay, visit https://www.lazydays.com/investor-relations.

About Lazydays

Lazydays has been a prominent player in the RV industry since our inception in 1976, earning a stellar reputation for delivering exceptional RV sales, service, and ownership experiences. Our commitment to excellence has led to enduring relationships with RVers and their families who rely on us for all of their RV needs.

With a strategic approach to rapid expansion, we are growing our network through both acquisitions and new builds. Our wide selection of RV brands from top manufacturers, state-of-the-art service facilities, and an extensive range of accessories and parts ensure that Lazydays is the go-to destination for RV enthusiasts seeking everything they need for their journeys on

the road. Whether you're a seasoned RVer or just starting your adventure, our dedicated team is here to provide outstanding support and guidance, making your RV lifestyle truly extraordinary.

Lazydays is a publicly listed company on the Nasdaq stock exchange under the ticker "GORV."

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “Safe-Harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward looking statements include statements regarding our goals, plans, projections and guidance regarding our financial position, results of operations, market position, pending and potential future acquisitions and business strategy, and often contain words such as “project,” “outlook,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” “may,” “seek,” “would,” “should,” “likely,” “goal,” “strategy,” “future,” “maintain,” “continue,” “remain,” “target” or “will” and similar references to future periods. Examples of forward-looking statements in this press release include, among others, statements regarding:

•Our anticipated financial condition and liquidity

•Sufficient working capital

•Full year 2024 results

•Anticipated revenues from acquired and open point stores; and

•Anticipated availability of liquidity from our credit facility and unfinanced operating real estate.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events that depend on circumstances that may or may not occur in the future. Forward-looking statements are not guarantees of future performance, and our actual results of operations, financial condition and liquidity and development of the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements in this press release. The risks and uncertainties that could cause actual results to differ materially from estimated or projected results include, without limitation, future economic and financial conditions (both nationally and locally), changes in customer demand, our relationship with, and the financial and operational stability of, vehicle manufacturers and other suppliers, risks associated with our indebtedness (including available borrowing capacity, compliance with financial covenants and ability to refinance or repay indebtedness on favorable terms), acts of God or other incidents which may adversely impact our operations and financial performance, government regulations, legislation and others set forth throughout “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in “Part I, Item 1A. Risk Factors” of our most recent Annual Report on Form 10-K, and from time to time in our other filings with the SEC. We urge you to carefully consider this information and not place undue reliance on forward-looking statements. We undertake no duty to update our forward-looking statements, including our earnings outlook, which are made as of the date of this release.

Non-GAAP Financial Measures

This press release contains non-GAAP financial measures such as adjusted cash flow from operations, adjsuetd net loss, adjusted net income, adjusted diluted earnings per share, adjusted cost applicable to revenues, adjusted income before income taxes, adjusted income tax benefit, adjusted SG&A, adjusted SG&A as a percentage of revenue, adjusted SG&A as a percentage of gross profit, adjusted income from operations as a percentage of revenue, adjusted income from operations as a percentage of gross profit, adjusted income before income taxes as a percentage of revenue and adjusted net income as a percentage of revenue. Non-GAAP measures do not have definitions under GAAP and may be defined differently by and not comparable to similarly titled measures used by other companies. As a result, we review any non-GAAP financial measures in connection with a review of the most directly comparable measures calculated in accordance with GAAP. We caution you not to place undue reliance on such non-GAAP measures, and also to consider them with the most directly comparable GAAP measures. We present cash flows from operations in the following tables, adjusted to include the change in non-trade floor plan debt to improve the visibility of cash flows related to vehicle financing. As required by SEC rules, we have reconciled these measures to the most directly comparable GAAP measures in the attachments to this release. We believe the non-GAAP financial measures we present improve the transparency of our disclosures; provide a meaningful presentation of our results from core business operations, because they exclude items not related to core business operations and other non-cash items; and improve the period-to-period comparability of our results from core business operations. These presentations should not be considered an alternative to GAAP measures.

Contact:

investors@lazydays.com

Results of Operations

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | | Year Ended December 31, | |

| (In thousands except share and per share amounts) | 2023 | 2022 | Change | | 2023 | 2022 | % Change |

| Revenues | | | | | | | |

| New vehicle retail | $ | 99,351 | | $ | 137,729 | | (27.9) | % | | $ | 631,748 | | $ | 777,807 | | (18.8) | % |

| Pre-owned vehicle retail | 72,433 | | 74,927 | | (3.3) | % | | 323,258 | | 394,582 | | (18.1) | % |

| Vehicle wholesale | 2,526 | | 2,416 | | 4.5 | % | | 8,006 | | 21,266 | | (62.4) | % |

| Finance and insurance | 11,054 | | 13,891 | | (20.4) | % | | 62,139 | | 75,482 | | (17.7) | % |

| Service, body and parts and other | 12,665 | | 14,527 | | (12.8) | % | | 57,596 | | 57,824 | | (0.4) | % |

| Total revenue | 198,029 | | 243,490 | | (18.7) | % | | 1,082,747 | | 1,326,961 | | (18.4) | % |

| | | | | | | |

| Cost applicable to revenue | | | | | | | |

| New vehicle retail | 86,655 | | 115,155 | | (24.7) | % | | 552,311 | | 632,316 | | (12.7) | % |

| Pre-owned vehicle retail | 59,848 | | 59,186 | | 1.1 | % | | 259,494 | | 301,565 | | (14.0) | % |

| Vehicle wholesale | 2,746 | | 2,395 | | 14.7 | % | | 8,178 | | 21,620 | | (62.2) | % |

| Finance and insurance | 475 | | 513 | | (7.5) | % | | 2,547 | | 2,729 | | (6.7) | % |

| Service, body and parts, other | 5,916 | | 7,714 | | (23.3) | % | | 27,723 | | 27,657 | | 0.2 | % |

| LIFO | (297) | | 4,153 | | NM | | 3,752 | | 12,383 | | (69.7) | % |

| Total cost applicable to revenue | 155,343 | | 189,116 | | (17.9) | % | | 854,005 | | 998,270 | | (14.5) | % |

| Gross profit | 42,686 | | 54,374 | | (21.5) | % | | 228,742 | | 328,691 | | (30.4) | % |

| | | | | | | |

| Depreciation and amortization | 5,048 | | 4,420 | | 14.2 | % | | 18,512 | | 16,758 | | 10.5 | % |

| Selling, general, and administrative expenses | 46,679 | | 47,649 | | (2.0) | % | | 198,962 | | 222,218 | | (10.5) | % |

| Goodwill impairment | 117,970 | | — | | NM | | 117,970 | | — | | NM |

| (Loss) income from operations | (127,011) | | 2,305 | | NM | | (106,702) | | 89,715 | | NM |

| Other income (expense) | | | | | | | |

| | | | | | | |

| Floor plan interest expense | (7,196) | | (3,534) | | 103.6 | % | | (24,820) | | (8,596) | | 188.7 | % |

| Other interest expense | (3,578) | | (2,158) | | 65.8 | % | | (10,062) | | (7,996) | | 25.8 | % |

| Change in fair value of warrant liabilities | — | | 1,782 | | (100.0) | % | | 856 | | 12,453 | | (93.1) | % |

| Total other expense, net | (10,774) | | (3,910) | | 175.5 | % | | (34,026) | | (4,139) | | NM |

| (Loss) income before income tax expense | (137,785) | | (1,605) | | NM | | (140,728) | | 85,576 | | NM |

| Income tax benefit (expense) | 29,820 | | 205 | | NM | | 30,462 | | (19,183) | | NM |

| Net (loss) income | (107,965) | | (1,400) | | NM | | (110,266) | | 66,393 | | NM |

| Dividends on Series A convertible preferred stock | (1,210) | | (1,210) | | — | % | | (4,800) | | (4,801) | | — | % |

| Net (loss) income and comprehensive (loss) income attributable to common stock and participating securities | $ | (109,175) | | $ | (2,610) | | NM | | $ | (115,066) | | $ | 61,592 | | NM |

| | | | | | | |

| EPS: | | | | | | | |

| Basic | $ | (7.59) | | $ | (0.24) | | NM | | $ | (8.41) | | $ | 3.47 | | NM |

| Diluted | $ | (7.59) | | $ | (0.24) | | NM | | $ | (8.45) | | $ | 2.42 | | NM |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 14,384,961 | 10,928,362 | 31.6 | % | | 13,689,001 | 11,701,302 | 17.0 | % |

| Diluted | 14,384,961 | 10,928,362 | 31.6 | % | | 13,689,001 | 12,797,796 | 7.0 | % |

| | | | | | | |

| | | | | | | |

NM - not Meaningful

Total Results Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | | | Year Ended December 31, | | |

| 2023 | 2022 | Change | | | 2023 | 2022 | Change | |

| Gross profit margins | | | | | | | | | |

| New vehicle retail | 12.8 | % | 16.4 | % | (360) | | bps | | 12.6 | % | 18.7 | % | (610) | | bps |

| Pre-owned vehicle retail | 17.4 | % | 21.0 | % | (360) | | bps | | 19.7 | % | 23.6 | % | (390) | | bps |

| Vehicle wholesale | (8.7) | % | 0.9 | % | (960) | | bps | | (2.2) | % | (1.7) | % | (50) | | bps |

| Finance and insurance | 95.7 | % | 96.3 | % | (60) | | bps | | 95.9 | % | 96.4 | % | (50) | | bps |

| Service, body and parts and other | 53.3 | % | 46.9 | % | 640 | | bps | | 51.9 | % | 52.2 | % | (30) | | bps |

| Total gross profit margin | 21.6 | % | 22.3 | % | (70) | | bps | | 21.1 | % | 24.8 | % | (370) | | bps |

| Total gross profit margin (excluding LIFO) | 21.4 | % | 24.0 | % | (260) | | bps | | 21.5 | % | 25.7 | % | (420) | | bps |

| | | | | | | | | |

| Retail units sold | | | | | | | | | |

| New vehicle retail | 1,264 | | 1,501 | | (15.8) | % | | | 7,269 | | 8,603 | | (15.5) | % | |

| Pre-owned vehicle retail | 1,164 | | 999 | | 16.5 | % | | | 5,018 | | 5,409 | | (7.2) | % | |

| Total retail units sold | 2,428 | | 2,500 | | (2.9) | % | | | 12,287 | | 14,012 | | (12.3) | % | |

| | | | | | | | | |

| Average selling price per retail unit | | | | | | | | | |

| New vehicle retail | $ | 78,600 | | $ | 91,758 | | (14.3) | % | | | $ | 86,910 | | $ | 90,411 | | (3.9) | % | |

| Pre-owned vehicle retail | 62,228 | | 75,001 | | (17.0) | % | | | 64,420 | | 72,949 | | (11.7) | % | |

| | | | | | | | | |

| Average gross profit per retail unit (excluding LIFO) | | | | | | | | | |

| New vehicle retail | $ | 10,044 | | $ | 15,040 | | (33.2) | % | | | $ | 10,928 | | $ | 16,912 | | (35.4) | % | |

| Pre-owned vehicle retail | 10,812 | | 15,756 | | (31.4) | % | | | 12,707 | | 17,197 | | (26.1) | % | |

| Finance and insurance | 4,357 | | 5,351 | | (18.6) | % | | | 4,850 | | 5,192 | | (6.6) | % | |

| | | | | | | | | |

| Revenue mix | | | | | | | | | |

| New vehicle retail | 50.2 | % | 56.6 | % | | | | 58.3 | % | 58.6 | % | | |

| Pre-owned vehicle retail | 36.6 | % | 30.8 | % | | | | 29.9 | % | 29.7 | % | | |

| Vehicle wholesale | 1.3 | % | 1.0 | % | | | | 0.7 | % | 1.6 | % | | |

| Finance and insurance | 5.6 | % | 5.7 | % | | | | 5.7 | % | 5.7 | % | | |

| Service, body and parts and other | 6.3 | % | 5.9 | % | | | | 5.4 | % | 4.4 | % | | |

| 100.0 | % | 100.0 | % | | | | 100.0 | % | 100.0 | % | | |

| | | | | | | | | |

| Gross profit mix | | | | | | | | | |

| New vehicle retail | 29.7 | % | 41.5 | % | | | | 34.7 | % | 44.3 | % | | |

| Pre-owned vehicle retail | 29.5 | % | 28.9 | % | | | | 27.9 | % | 28.3 | % | | |

| Vehicle wholesale | (0.5) | % | — | % | | | | (0.1) | % | (0.1) | % | | |

| Finance and insurance | 24.8 | % | 24.6 | % | | | | 26.1 | % | 22.1 | % | | |

| Service, body and parts and other | 15.8 | % | 12.5 | % | | | | 13.1 | % | 9.2 | % | | |

| LIFO | 0.7 | % | (7.6) | % | | | | (1.6) | % | (3.8) | % | | |

| 100.0 | % | 100.0 | % | | | | 100.0 | % | 100.0 | % | | |

Other Metrics

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted | | As Reported | | Adjusted | | As Reported |

| Three Months Ended December 31, | | Three Months Ended December 31, | | Year Ended December 31, | | Year Ended December 31, |

| 2023 | 2022 | | 2023 | 2022 | | 2023 | 2022 | | 2023 | 2022 |

| SG&A as a % of revenue | 23.0 | % | 19.4 | % | | 23.6 | % | 19.6 | % | | 18.0 | % | 16.7 | % | | 18.4 | % | 16.7 | % |

| SG&A as % of gross profit, excluding LIFO | 107.4 | % | 80.6 | % | | 110.1 | % | 81.4 | % | | 83.6 | % | 64.8 | % | | 85.6 | % | 65.2 | % |

| Income from operations as a % of revenue | NM | 2.9 | % | | NM | 0.9 | % | | 1.8 | % | 7.8 | % | | NM | 6.8 | % |

| Income from operations as a % of gross profit, excluding LIFO | NM | 11.9 | % | | NM | 3.9 | % | | 8.4 | % | 30.3 | % | | NM | 26.3 | % |

| Income (loss) before income taxes as % of revenue | NM | 0.5 | % | | NM | NM | | NM | 6.5 | % | | NM | 6.4 | % |

| Net income (loss) as a % of revenue | NM | 0.4 | % | | NM | NM | | NM | 4.8 | % | | NM | 5.0 | % |

NM - not meaningful

Other Highlights

| | | | | | | | | | | | | | |

| | As of December 31, |

| | 2023 | | 2022 |

| Store Count | | | | |

| Dealerships | | 24 | | 18 |

| | | | |

| | | | |

| Days Supply* | | | | |

| New vehicle inventory | | 380 | | | 250 | |

| Pre-owned vehicle inventory | | 132 | | 78 |

*Days supply calculated based on current inventory levels and a 90 day historical average cost of sales level.

Financial Covenants

| | | | | | | | | | | | | | |

| | | | As of |

| | Requirement | | December 31, 2023 |

| Fixed charge coverage ratio | | Not less than 1.25 to 1 | | 1.27 |

| Leverage ratio | | Waived | | NM |

| Current ratio | | Waived | | NM |

NM - not meaningful

Same-Store Results Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | | | Year Ended December 31, | | | |

| (In thousands except share and per share amounts) | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change | |

| Revenues | | | | | | | | | | | | |

| New vehicle retail | $ | 84,837 | | | $ | 129,866 | | | (34.7) | % | | $ | 557,176 | | | $ | 731,572 | | | (23.8) | % | |

| Pre-owned vehicle retail | 62,307 | | | 72,739 | | | (14.3) | % | | 290,242 | | | 378,117 | | | (23.2) | % | |

| Vehicle wholesale | 2,334 | | | 2,377 | | | (1.8) | % | | 7,567 | | | 21,167 | | | (64.2) | % | |

| Finance and insurance | 9,138 | | | 13,310 | | | (31.3) | % | | 54,395 | | | 71,899 | | | (24.3) | % | |

| Service, body and parts and other | 11,108 | | | 13,901 | | | (20.1) | % | | 51,392 | | | 55,603 | | | (7.6) | % | |

| Total revenue | 169,724 | | | 232,193 | | | (26.9) | % | | 960,772 | | | 1,258,358 | | | (23.6) | % | |

| | | | | | | | | | | | |

| Gross profit | | | | | | | | | | | | |

| New vehicle retail | 10,811 | | | 21,355 | | | (49.4) | % | | 69,710 | | | 137,015 | | | (49.1) | % | |

| Pre-owned vehicle retail | 10,664 | | | 15,170 | | | (29.7) | % | | 56,773 | | | 88,854 | | | (36.1) | % | |

| Vehicle wholesale | (223) | | | 19 | | | NM | | (171) | | | (354) | | | NM | |

| Finance and insurance | 8,733 | | | 12,823 | | | (31.9) | % | | 52,132 | | | 69,285 | | | (24.8) | % | |

| Service, body and parts and other | 5,941 | | | 8,059 | | | (26.3) | % | | 26,593 | | | 29,109 | | | (8.6) | % | |

| LIFO | 298 | | | (4,153) | | | NM | | (3,752) | | | (12,383) | | | NM | |

| Total gross profit | 36,224 | | | 53,273 | | | (32.0) | % | | 201,285 | | | 311,526 | | | (35.4) | % | |

| | | | | | | | | | | | |

| Gross profit margins | | | | | | | | | | | | |

| New vehicle retail | 12.7 | % | | 16.4 | % | | (370) | | bps | 12.5 | % | | 18.7 | % | | (460) | | bps |

| Pre-owned vehicle retail | 17.1 | % | | 20.9 | % | | (380) | | bps | 19.6 | % | | 23.5 | % | | (390) | | bps |

| Vehicle wholesale | (9.5) | % | | 0.8 | % | | NM | bps | (2.3) | % | | (1.7) | % | | (60) | | bps |

| Finance and insurance | 95.6 | % | | 96.3 | % | | (70) | | bps | 95.8 | % | | 96.4 | % | | (60) | | bps |

| Service, body and parts and other | 53.5 | % | | 58.0 | % | | (450) | | bps | 51.7 | % | | 52.4 | % | | (70) | | bps |

| Total gross profit margin | 21.3 | % | | 22.9 | % | | (170) | | bps | 21.0 | % | | 24.8 | % | | (190) | | bps |

| Total gross profit margin (excluding LIFO) | 21.2 | % | | 24.7 | % | | (350) | | bps | 21.3 | % | | 25.7 | % | | (440) | | bps |

| | | | | | | | | | | | |

| Retail units sold | | | | | | | | | | | | |

| New vehicle retail | 1,033 | | | 1,396 | | | (26.0) | % | | 6,142 | | | 7,867 | | | (21.9) | % | |

| Pre-owned vehicle retail | 958 | | | 951 | | | 0.7 | % | | 4,362 | | | 5,049 | | | (13.6) | % | |

| Total retail units sold | 1,991 | | | 2,347 | | | (15.2) | % | | 10,504 | | | 12,916 | | | (18.7) | % | |

| | | | | | | | | | | | |

| Average selling price per retail unit | | | | | | | | | | | | |

| New vehicle retail | $ | 82,127 | | | $ | 93,027 | | | (11.7) | % | | $ | 90,716 | | | $ | 92,993 | | | (2.4) | % | |

| Pre-owned vehicle retail | 65,039 | | | 76,487 | | | (15.0) | % | | 66,539 | | | 74,889 | | | (11.2) | % | |

| | | | | | | | | | | | |

| Average gross profit per retail unit (excluding LIFO) | | | | | | | | | | | | |

| New vehicle retail | $ | 10,465 | | | $ | 15,297 | | | (31.6) | % | | $ | 11,350 | | | $ | 17,417 | | | (34.8) | % | |

| Pre-owned vehicle retail | 11,132 | | | 15,951 | | | (30.2) | % | | 13,015 | | | 17,598 | | | (26.0) | % | |

| Finance and insurance | 4,386 | | | 5,464 | | | (19.7) | % | | 4,963 | | | 5,364 | | | (7.5) | % | |

| Total vehicle retail | 15,172 | | | 21,026 | | | (28) | % | | 17,004 | | | 22,852 | | | (25.6) | % | |

NM - not meaningful

Condensed Consolidated Balance Sheets

| | | | | | | | | | | | | | |

| | As of December 31, |

| (In thousands) | | 2023 | | 2022 |

| Current assets | | | | |

| Cash | | $ | 58,085 | | | $ | 61,687 | |

| Receivables, net of allowance for doubtful accounts | | 22,694 | | | 25,053 | |

| Inventories | | 456,087 | | | 378,881 | |

| Income tax receivable | | 7,419 | | | 7,912 | |

| Prepaid expenses and other | | 2,614 | | | 3,316 | |

| Total current assets | | 546,899 | | | 476,849 | |

| | | | |

| Long-term assets | | | | |

| Property and equipment, net | | 265,726 | | | 158,991 | |

| Operating lease assets | | 26,377 | | | 26,984 | |

| Goodwill | | — | | | 83,460 | |

| Intangible assets, net | | 80,546 | | | 81,665 | |

| Other assets | | 2,750 | | | 2,769 | |

| Deferred income tax asset | | 15,444 | | | — | |

| Total assets | | $ | 937,742 | | | $ | 830,718 | |

| | | | |

| | | | |

| Current liabilities | | | | |

| Floor plan notes payable | | 446,783 | | | 348,735 | |

| Other current liabilities | | 53,197 | | | 50,890 | |

| Total current liabilities | | 499,980 | | | 399,625 | |

| | | | |

| Long-term liabilities | | | | |

| Financing liability, non-current portion, net | | 91,401 | | | 89,770 | |

| Revolving line of credit | | 49,500 | | | — | |

| Long-term debt, non-current portion, net | | 61,429 | | | 10,131 | |

| Other long-term liabilities | | 22,242 | | | 39,197 | |

| Total liabilities | | 724,552 | | | 538,723 | |

| | | | |

| Series A Convertible Preferred Stock | | 56,193 | | | 54,983 | |

| Stockholders' Equity | | 156,997 | | | 237,012 | |

| Total liabilities and stockholders' equity | | $ | 937,742 | | | $ | 830,718 | |

Condensed Statements of Cash Flows

| | | | | | | | | | | | | | |

| | Year Ended December 31, |

| (In thousands) | | 2023 | | 2022 |

| Cash Flows From Operating Activities | | | | |

| Net (loss) income | | $ | (110,266) | | | $ | 66,393 | |

| Adjustments to reconcile net (loss) income to net cash used in operating activities: | | | | |

| Stock-based compensation | | 2,249 | | | 2,813 | |

| Bad debt expense | | 12 | | | (526) | |

| Depreciation and amortization of property and equipment | | 10,954 | | | 9,480 | |

| Amortization of intangible assets | | 7,558 | | | 7,278 | |

| Amortization of debt discount | | 312 | | | 431 | |

| Non-cash lease expense | | 296 | | | 173 | |

| Loss (gain) on sale of property and equipment | | 28 | | | (20) | |

| Goodwill Impairment | | 117,970 | | | — | |

| Deferred income taxes | | (30,980) | | | 1,872 | |

| Change in fair value of warrant liabilities | | (856) | | | (12,453) | |

| Impairment charges | | 629 | | | — | |

| Changes in operating assets and liabilities: | | | | — | |

| Receivables | | 2,347 | | | 6,512 | |

| Inventories | | (42,901) | | | (127,594) | |

| Prepaid expenses and other | | 450 | | | (613) | |

| Income tax receivable/payable | | 492 | | | (6,725) | |

| Other assets | | (199) | | | (1,146) | |

| Accounts payable and Accrued expenses and other current liabilities | | 5,425 | | | (17,835) | |

| Total Adjustments | | 73,786 | | | (138,353) | |

| Net Cash Used In Operating Activities | | $ | (36,480) | | | $ | (71,960) | |

| | | | |

| | | | |

| | Year Ended December 31, |

| (In thousands) | | 2023 | | 2022 |

| Net cash provided by operating activities, as reported | | $ | (36,480) | | | $ | (71,960) | |

| Net borrowings on floor plan notes payable | | 98,530 | | | 148,180 | |

| Minus borrowings on floor plan notes payable associated with acquired new inventory | | (28,751) | | | — | |

| Net cash provided by operating activities, as adjusted | | $ | 33,299 | | | $ | 76,220 | |

Reconciliation of Non-GAAP Measures

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| ($ in thousands, except per share amounts) | As reported | LIFO | Acquisition expense | Impairment charge | Adjusted |

| Costs applicable to revenues | $ | 155,343 | | $ | 298 | | $ | — | | $ | — | | $ | 155,642 | |

| Selling, general and administrative expenses | 46,679 | | | (1,142) | | — | | 45,537 | |

| Goodwill impairment | 117,970 | | — | | — | | (117,970) | | — | |

| (Loss) income from operations | (127,011) | | (298) | | 1,142 | | 117,970 | | (8,197) | |

| | | | | |

| (Loss) income before income tax expense | $ | (137,785) | | $ | (298) | | $ | 1,142 | | $ | 117,970 | | $ | (18,971) | |

| Income tax benefit (expense) | 29,820 | | 62 | | (236) | | (24,427) | | 5,219 | |

| Net (loss) income | $ | (107,965) | | $ | (236) | | $ | 906 | | $ | 93,543 | | $ | (13,752) | |

| | | | | |

| Diluted net loss per share | $ | (7.59) | | | | | $ | (1.09) | |

| Shares used for diluted calculation | 14,384,961 | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2022 | |

| ($ in thousands, except per share amounts) | As reported | Gain on change in fair value of warrant liabilities | LIFO | Acquisition expense | Severance and transition costs | | Adjusted |

| Costs applicable to revenues | $ | 189,116 | | $ | — | | $ | (4,153) | | $ | — | | $ | — | | | $ | 184,963 | |

| Selling, general and administrative expenses | 47,649 | | — | | — | | (203) | | (299) | | | 47,147 | |

| Income from operations | 2,305 | | — | | 4,153 | | 203 | | 299 | | | 6,960 | |

| Gain on change in fair value of warrant liabilities | 1,782 | | (1,782) | | — | | — | | — | | | — | |

| | | | | | | |

| (Loss) income before income taxes | $ | (1,605) | | $ | (1,782) | | $ | 4,153 | | $ | 203 | | $ | 299 | | | 1,268 | |

| Income tax benefit (expense) | 205 | | — | | (458) | | (46) | | (33) | | | (332) | |

| Net (loss) income | $ | (1,400) | | $ | (1,782) | | $ | 3,695 | | $ | 157 | | $ | 266 | | | $ | 936 | |

| | | | | | | |

| Diluted net loss per share | $ | (0.24) | | | | | | | $ | (0.02) | |

| Shares used for diluted calculation | 10,928,362 | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Twelve Months Ended December 31, 2023 |

| ($ in thousands, except per share amounts) | As reported | Gain on change in fair value of warrant liabilities | LIFO | Acquisition expense | Severance and transition costs | Impairment charge | Storm Reserve | Adjusted |

| Costs applicable to revenues | $ | 854,005 | | $ | — | | $ | (3,752) | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 850,253 | |

| Selling, general and administrative expenses | 198,962 | | — | | — | | (2,340) | | (1,278) | | (629) | | (300) | | 194,415 | |

| Goodwill impairment | 117,970 | | | | | | (117,970) | | | — | |

| (Loss) income from operations | (106,702) | | — | | 3,752 | | 2,340 | | 1,278 | | 118,599 | | 300 | | 19,567 | |

| Gain on change in fair value of warrant liabilities | 856 | | (856) | | — | | — | | — | | — | | — | | — | |

| | | | | | | | |

| (Loss) income before income taxes | $ | (140,728) | | $ | (856) | | $ | 3,752 | | $ | 2,340 | | $ | 1,278 | | $ | 118,599 | | $ | 300 | | $ | (15,315) | |

| Income tax benefit (expense) | 30,462 | | — | | (788) | | (492) | | (360) | | (24,920) | | (106) | | 3,796 | |

| Net (loss) income | $ | (110,266) | | $ | (856) | | $ | 2,964 | | $ | 1,848 | | $ | 918 | | $ | 93,679 | | $ | 194 | | $ | (11,519) | |

| | | | | | | | |

| Diluted net loss per share | $ | (8.45) | | | | | | | | $ | (1.24) | |

| Shares used for diluted calculation | 13,689,001 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Twelve Months Ended December 31, 2022 |

| ($ in thousands, except per share amounts) | As reported | Gain on change in fair value of warrant liabilities | LIFO | Acquisition expense | Severance and transition costs | | Adjusted |

| Costs applicable to revenues | $ | 998,270 | | $ | — | | (12,383) | | $ | — | | $ | — | | | $ | 985,887 | |

| Selling, general and administrative expenses | 222,218 | | — | | — | | (286) | | (900) | | | 221,032 | |

| Income from operations | 89,715 | | — | | 12,383 | | 286 | | 900 | | | 103,284 | |

| Gain on change in fair value of warrant liabilities | 12,453 | | (12,453) | | — | | — | | — | | | — | |

| | | | | | | |

| Income (loss) before income taxes | $ | 85,576 | | $ | (12,453) | | $ | 12,383 | | $ | 286 | | $ | 900 | | | $ | 86,692 | |

| Income tax expense | (19,183) | | — | | (3,143) | | (73) | | (228) | | | (22,627) | |

| Net income (loss) | $ | 66,393 | | $ | (12,453) | | $ | 9,240 | | $ | 213 | | $ | 672 | | | $ | 64,065 | |

| | | | | | | |

| Diluted earnings per share | $ | 2.42 | | | | | | | $ | 3.05 | |

| Shares used for diluted calculation | 12,797,796 | | | | | | |

* In periods where the change in fair value of warrants is a gain, the diluted EPS calculation is not affected by this line item.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

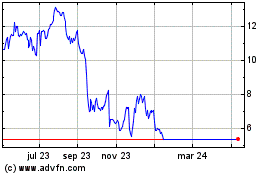

Lazydays (NASDAQ:LAZY)

Gráfica de Acción Histórica

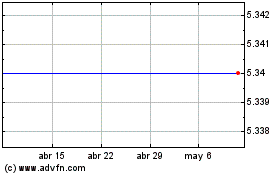

De Mar 2024 a Abr 2024

Lazydays (NASDAQ:LAZY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024