As filed with the Securities and Exchange Commission on December 18, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MICROALGO INC.

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of registrant’s name into English)

| Cayman Islands |

|

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

Unit 507, Building C, Taoyuan Street,

Long Jing High and New Technology Jingu Pioneer Park,

Nanshan District, Shenzhen, People’s Republic of China

+(86)0755-88600589

(Address and telephone number of registrant’s principal executive offices)

Puglisi & Associates

850 Library Ave., Suite 204

Newark, Delaware 19711

(302) 738-6680

(Name, address and telephone number of agent for service)

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † |

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Subject to Completion, dated December 18, 2023

Up to US$100,000,000 of

Ordinary Shares, Preferred Shares, Debt Securities, Warrants, Rights and Units

and

Up to 2,300,000 Ordinary Shares underlying previously-issued Warrants

MicroAlgo Inc.

This prospectus relates to the issuance by MicroAlgo Inc. (the “Company,” “we,” “our” or “us”) up to US$100,000,000 of any combination, together or separately, of ordinary shares, par value US$0.001 per share (“ordinary shares”), preferred shares, debt securities, warrants, rights and units as described in this prospectus. In this prospectus, references to the term “securities” refers collectively to our ordinary shares, preferred shares, debt securities, warrants, rights, and units. The prospectus supplement for each offering of securities will describe in detail the plan of distribution for that offering.

This prospectus describes the general terms of these securities and the general manner in which these securities will be offered. We will provide the specific terms of these securities in supplements to this prospectus. The prospectus supplements to be provided will also describe the manner in which these securities will be offered and may also add to, update or change information contained in this prospectus. You should read carefully this prospectus, the accompanying prospectus supplement, as well as any documents incorporated by reference, before you invest.

In addition, this prospectus relates to the issuance of up to 2,300,000 ordinary shares that are issuable by us upon exercise of 4,600,000 warrants, which were included in the units sold in the Venus Acquisition Corporation IPO (“Public Warrants”), with each Public Warrant exercisable to purchase one-half (1/2) of one ordinary share at an exercise price of US$11.50 per whole share. For more information please see the section titled “Description of the Securities” contained in this prospectus.

The aggregate offering price of all securities issued under this prospectus may not exceed US$126,450,000.00. The securities issued under this prospectus may be offered directly or through underwriters, agents or dealers. The names of any underwriters, agents or dealers will be included in a supplement to this prospectus. For more information, please refer to the section titled “Plan of Distribution”.

Our ordinary shares are

listed on the NASDAQ Capital Market as “MLGO”. The aggregate market value of our issued and outstanding ordinary shares held

by non-affiliates as of December 15, 2023 is approximately US$22,915,851, based on 13,559,675 ordinary shares held by non-affiliates

as of such date, and a closing price of our ordinary shares on the Nasdaq Capital Market was US$1.69 on December 15, 2023. As of the

date hereof, we have not sold any securities pursuant to General Instruction I.B.5 of Form F-3 during the period of twelve calendar months

immediately prior to and including the date hereof.

Pursuant to General Instruction

I.B.5. of Form F-3, in no event will we sell the securities covered hereby in a public primary offering with a value exceeding more than

one-third of the aggregate market value of our Class A Ordinary Shares in any 12-month period so long as the aggregate market value of

our voting and non-voting common equity held by non-affiliates remains below $75,000,000. During the 12 calendar months prior to and including

the date of this prospectus, we have not offered or sold any securities pursuant to General Instruction I.B.5 of Form F-3.

Our Public Warrants trading

on Over-The-Counter Market(“OTC”) under the trading symbols “VENAF”. On December 8, 2023, the closing price of

our Public Warrants were $0.1 per warrant.

On December 12, 2022, the Company (formerly known as Venus Acquisition Corporation), a Cayman Islands Special Purpose Acquisition Corporation, completed its business combination with VIYI Algorithm Inc., a Cayman Islands holding company. After the business combination, the Company changed its name to MicroAlgo Inc.

Investing in our securities involves risks. See the “Risk Factors” section contained in this prospectus, the applicable prospectus supplement and the documents we incorporate by reference in this prospectus, including our annual report on Form 10-K for year ended in 2022 filed with the SEC on March 29, 2023, to read about factors you should consider before investing in these securities.

The Company conducts its business operations in China primarily through its PRC subsidiaries. The Company owns and exerts control over its PRC subsidiaries through direct equity ownership. Nonetheless, given the Company’s holding structure, investors should be aware that investing in the Cayman holding company’s ordinary shares is not the same as purchasing equity interest in the Company’s Chinese operating entities. Instead, investors are purchasing equity interest in a Cayman Islands holding company whose revenues are derived from the operations conducted primarily by its PRC subsidiaries. For more information, please refer to the section titled “Corporate Information” in the summary section of this prospectus below. As of December 31, 2022, WiMi Hologram Cloud Inc. own 65.9% of our ordinary shares. As such, we are a “controlled company” under Nasdaq Listing Rules 5615(c) and are allowed to follow certain exemptions afforded to a “controlled company” under the Nasdaq Listing Rules. A controlled company is eligible for certain corporate governance requirements exemptions from the Nasdaq Listing Rules corporate governance requirements. See “Part I, Item 1A. Risk Factor—We are a “controlled company” within the meaning of the applicable Nasdaq listing rules and, as a result, will qualify for exemptions from certain corporate governance requirements. If we rely on these exemptions, you will not have the same protections afforded to shareholders of companies that are subjected to such requirements” on our annual report on Form 10-K for the year ended 2022 and incorporated by reference below.

We are a holding company incorporated in the Cayman Islands and not a Chinese operating company. As a holding company with no operations of our own, we conduct our operations through our operating entities in China, and this structure involves unique risks to investors. We have not adopted a variable interest entity (the “VIE”) structure. Investors in our securities are not purchasing equity interests in our subsidiaries but instead are purchasing equity interests in the Cayman Islands holding company. Therefore, investors will not directly hold any equity interests in our operating companies. The Chinese regulatory authorities could disallow our corporate structure, which would likely result in a material change in our operations and/or a material change in the value of our securities, including that it could cause the value of such securities to significantly decline or become worthless. For risks facing our Company and this offering as a result of our organizational structure, see “Part I, Item 1A. Risk Factor—Risks Related to Doing Business in China” in our annual report on Form 10-K for the fiscal year ended December 31, 2022.

We are subject to certain legal and operational risks associated with being based in China as a result of uncertainties associated with the complex and evolving PRC laws and regulations under which we operate. These risks may result in material changes in the operations of the PRC subsidiaries, significant depreciation of the value of our ordinary shares, or a complete hindrance of our ability to offer, or continue to offer, our securities to investors. See “Part I, Item 1A. Risk Factor—Risks Related to Doing Business in China—We may be materially and adversely affected by the complexity, uncertainties and changes in PRC regulation of the Internet industry and companies” in our annual report on Form 10-K for the fiscal year ended December 31, 2022.

On February 17, 2023, the CSRC released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”), which came into effect on March 31, 2023. The Trial Measures apply to overseas securities offerings and/or listings conducted by (1) companies incorporated in the PRC, or PRC domestic companies, directly and (2) companies incorporated overseas with operations primarily in the PRC and valued on the basis of interests in PRC domestic companies, or indirect offerings. The Trial Measures requires (i) the filings of the overseas offering and listing plan by the PRC domestic companies with the CSRC under certain conditions, and (ii) the filing of their underwriters or placement agents with the CSRC under certain conditions and the submission of an annual report to the CSRC within the required timeline. On the same day, the Provisions on Strengthening Confidentiality and Archives Administration of Overseas Securities Offering and Listing by Domestic Companies (the “Confidentiality and Archives Administration Provisions”) promulgated by the CSRC came into effect. Confidentiality and Archives Administration Provisions stipulate that the PRC companies seeking overseas offerings and listings, either directly or indirectly, as well as securities firms and securities service providers (both the PRC and overseas) involved in relevant businesses, must not disclose any state secrets or confidential information of government agencies, nor harm national security and public interests. Additionally, if a domestic company provides accounting archives or copies of such archives to any entities, including securities firms, securities service providers, overseas regulators and individuals, it must comply with due procedures in accordance with applicable regulations. We believe that offerings under this prospectus do not involve the disclosure of any state secret or confidential information of government agencies, nor does it harm national security and public interests. However, we may need to perform additional procedures concerning the provision of accounting archives. The specific requirements of these procedures are currently unclear, and we cannot guarantee our ability to execute them.

According to the Notice on the Administrative Arrangements for the Filing of Overseas Securities Offering and Listing by Domestic Enterprises (the “Notice on Overseas Listing Measures”) published by the CSRC on February 17, 2023, issuers that had already been listed in an overseas market by March 31, 2023, the date the Trial Measures became effective, are not required to make any immediate filing and are only required to comply with the filing requirements under the Trial Measures when it subsequently seeks to conduct a follow-on offering. Therefore, we are required to go through filing procedures with the CSRC within three working days after the completion of an offering made pursuant to this prospectus or any accompanying prospectus supplement and for our future offerings of our securities in an overseas market, including Nasdaq, under the Trial Measures. Other than the CSRC filing procedure we are required to make within three working days after the completion of an offering made pursuant to this prospectus or any accompanying prospectus supplement, we and our PRC subsidiaries, as advised our PRC legal counsel, Guangdong Chong Li Law Firm, (1) are not required to obtain permissions from the CSRC, and (2) have not been required to obtain or denied such and other permissions by the CSRC, CAC, or any PRC government authority, under current PRC laws, regulations and rules in connection with a potential offering made pursuant to this prospectus or any accompanying prospectus supplement as of the date of this prospectus.

Since 2021, the Chinese government has strengthened its anti-monopoly supervision, mainly in three aspects: (i) establishing the National Anti-Monopoly Bureau; (ii) revising and promulgating anti-monopoly laws and regulations, including: the Anti-Monopoly Law of the PRC (amended on June 24, 2022 and effective on August 1, 2008), the anti-monopoly guidelines for various industries, and the Detailed Rules for the Implementation of the Fair Competition Review System; and (iii) expanding the anti-monopoly law enforcement targeting Internet companies and large enterprises. As of the date of this prospectus, the Chinese government’s recent statements and regulatory actions related to anti-monopoly concerns have not impacted our or our subsidiaries’ ability to conduct business, our ability to accept foreign investments or issue our securities to foreign investors because neither we nor our subsidiaries engage in monopolistic behaviors that are subject to these statements or regulatory actions.

As of the date of this prospectus, our Company and our PRC subsidiaries have not been involved in any investigations or review initiated by any PRC regulatory authority, not has any of them received any inquiry, notice or sanction for our operations or our issuance of securities to investors. Nevertheless, the Standing Committee of the National People’s Congress (“SCNPC”) or PRC regulatory authorities may in the future promulgate laws, regulations or implementing rules that requires us and our subsidiaries to obtain permissions from PRC regulatory authorities to conduct business operations in China.

In addition, as advised by the Company’s PRC counsel, Guangdong Chong Li Law Firm, as of the date of this prospectus, except for business license, foreign investment information report to the commerce administrative authority and foreign exchange registration or filing, our consolidated affiliated Chinese entities do not have to obtain any requisite licenses and permits from the PRC government authorities that are material for the business operations of our holding company and our subsidiaries in China. However, given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by government authorities, we may be required to obtain certain licenses, permits, filings or approvals for the functions and services that we provided in the future. See “Part I, Item 1A. Risk Factor—Risk Factors Relating to Doing Business in China” on our annual report on Form 10-K for the year ended 2022.

The Holding Foreign Companies Accountable Act

Our ordinary shares may be prohibited from trading on a national exchange or over-the-counter under the Holding Foreign Companies Accountable Act (“HFCA Act”) if the Public Company Accounting Oversight Board (United States) (the “PCAOB”) is unable to inspect our auditor for two consecutive years. Our current auditor, Onestop Assurance PAC (“Onestop”), and our prior auditor for 2021, and 2022 annual reports, Marcum LLP, the independent registered public accounting firms that issue the financial reports included elsewhere in this prospectus or our most recent annual report on Form 10-K, are registered with the PCAOB. The PCAOB conducts regular inspections to assess their compliance with the applicable professional standards. Onestop and Marcum LLP are headquartered in Singapore and New York, respectively. On December 16, 2021, the PCAOB issued a report notifying the SEC of its determinations (the “PCAOB Determinations”) that they are unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong. The report sets forth lists identifying the registered public accounting firms headquartered in mainland China and Hong Kong, respectively, that the PCAOB is unable to inspect or investigate completely, and as of the date of this prospectus, Onestop and Marcum LLP are not included in the list of PCAOB Identified Firms in the PCAOB Determinations issued on December 16, 2021. On August 26, 2022, the China Securities Regulatory Commission (the “CSRC”), the Ministry of Finance of the PRC (the “MOF”), and the PCAOB signed a Statement of Protocol (the “Protocol”), governing inspections and investigations of audit firms based in China and Hong Kong. Pursuant to the Protocol, the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to

transfer information to the U.S. Securities and Exchange Commission. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate completely registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations issued in December 2021. As such, we do not expect to be identified as a “Commission-Identified Issuer” under the HFCA Act for the fiscal year ended December 31, 2022. Notwithstanding the foregoing, in the event it is later determined that the PCAOB is unable to inspect or investigate completely our auditor, then such lack of inspection could cause our securities to be delisted from Nasdaq Stock Market. In addition, whether the PCAOB will continue be able to conduct inspections and investigations completely to its satisfaction of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control, including positions taken by authorities of the PRC. The PCAOB is expected to continue to demand complete access to inspections and investigations against accounting firms headquartered in mainland China and Hong Kong in the future and states that it has already made plans to resume regular inspections in early 2023 and beyond. The PCAOB is required under the HFCA Act to make its determination on an annual basis with regards to its ability to inspect and investigate completely accounting firms based in the mainland China and Hong Kong. The possibility of being a “Commission-Identified Issuer” and risk of delisting could continue to adversely affect the trading price of our securities. Should the PCAOB again encounter impediments to inspections and investigations in mainland China or Hong Kong as a result of positions taken by any authority in either jurisdiction, the PCAOB will make determinations under the HFCA Act as and when appropriate. On December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act was enacted, which amended the Holding Foreign Companies Accountable Act, by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three. See “Risk Factors—Risks Related to Doing Business in China—If the PCAOB is unable to inspect our auditors as required under the Holding Foreign Companies Accountable Act, the SEC will prohibit the trading of our shares. A trading prohibition for our shares, or the threat of a trading prohibition, may materially and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct inspections of our auditors, if any, would deprive our investors of the benefits of such inspections.” of this prospectus.

Each time we sell these securities, we will provide a supplement to this prospectus that contains specific information about the offering and the terms of the securities offered. The supplement may also add, update or change information contained in this prospectus. You should carefully read this prospectus and any prospectus supplement before you invest in any of these securities.

We may offer and sell the securities from time to time at fixed prices, at market prices or at negotiated prices, to or through underwriters, to other purchasers, through agents, or through a combination of these methods, on a continuous or delayed basis. See “Plan of Distribution.” If any underwriters, dealers or agents are involved in the sale of any of the securities, their names, and any applicable purchase price, fee, commission or discount arrangements between or among them, will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement.

This prospectus may not be used to offer or sell any securities unless accompanied by a prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-3 that we filed with the U.S. Securities and Exchange Commission (the “SEC”), using a shelf registration process permitted under the Securities Act. By using a shelf registration statement, we may sell any of our securities to the extent permitted in this prospectus and the applicable prospectus supplement, from time to time in one or more offerings on a continuous or delayed basis. This prospectus only provides you with a summary description of these securities. Each time we sell the securities, we will provide a supplement to this prospectus that contains specific information about the securities being offered and the specific terms of that offering. The supplement may also add, update or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the prospectus supplement.

You should rely only on the information contained or incorporated by reference in this prospectus and in any prospectus supplement. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We will not make an offer to sell the securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the applicable supplement to this prospectus is accurate as of the date on its respective cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

You should read this prospectus and any prospectus supplement together with the additional information described under the heading “Where You Can Find More Information About Us” and “Incorporation of Documents by Reference.”

In this prospectus, unless otherwise indicated or unless the context otherwise requires,

| |

● |

“Exchange Act” are to the Securities Exchange Act of 1934, as amended; |

| |

|

|

| |

● |

“China” and “PRC” refers to the People’s Republic of China |

| |

|

|

| |

● |

“ordinary shares” refers to our ordinary shares, par value US$0.001 per share; |

| |

|

|

| |

● |

“RMB” and “Renminbi” refers to the legal currency of China; |

| |

|

|

| |

● |

“HKD” are to the legal currency of Hong Kong; |

| |

|

|

| |

● |

“Hong Kong” or “HK” are to the Hong Kong Special Administrative Region of the PRC; |

| |

|

|

| |

● |

“SAFE” are to the State Administration for Foreign Exchange; |

| |

|

|

| |

● |

“SEC” are to the Securities and Exchange Commission; |

| |

|

|

| |

● |

“US$” and “U.S. dollars” refers to the legal currency of the United States of America; |

| |

|

|

| |

● |

“MOFCOM” are to the Ministry of Commerce of the People’s Republic of China; |

| |

|

|

| |

● |

“we,” “us,” “our company,” “our,” and “our group” refers to MicroAlgo Inc., our Cayman Islands holding company, its predecessor entity and its subsidiaries, as the context requires. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and our SEC filings that are incorporated by reference into this prospectus contain or incorporate by reference forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical fact are “forward-looking statements,” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies, and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions, and objectives, and any statements of assumptions underlying any of the foregoing. The words “believe,” “anticipate,” “estimate,” “plan,” “expect,” “intend,” “may,” “could,” “should,” “potential,” “likely,” “projects,” “continue,” “will,” and “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements reflect our current views with respect to future events, are based on assumptions, and are subject to risks and uncertainties. We cannot guarantee that we actually will achieve the plans, intentions, or expectations expressed in our forward-looking statements and you should not place undue reliance on these statements. There are a number of important factors that could cause our actual results to differ materially from those indicated or implied by forward-looking statements. These important factors include those discussed under the heading “Risk Factors” contained or incorporated by reference in this prospectus and in the applicable prospectus supplement and any free writing prospectus we may authorize for use in connection with a specific offering. These factors and the other cautionary statements made in this prospectus should be read as being applicable to all related forward-looking statements whenever they appear in this prospectus. Except as required by law, we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus or incorporated by reference in this prospectus, and does not contain all of the information that you need to consider in making your investment decision. We urge you to read this entire prospectus (as supplemented or amended), including our consolidated financial statements, notes to the consolidated financial statements and other information incorporated by reference in this prospectus from our other filings with the SEC, before making an investment decision.

Company Overview

We are dedicated to the development and application of bespoke central processing algorithms. We provide comprehensive solutions to customers by integrating central processing algorithms with software or hardware, or both, thereby helping them increase the number of customers, improve end-user satisfaction, achieve direct cost savings, reduce power consumption, and achieve technical goals. The range of our services include algorithm optimization, accelerating computing power without the need for hardware upgrades, lightweight data processing, and data intelligence services. Our ability to efficiently deliver software and hardware optimization to customers through bespoke central processing algorithms serves as a driving force for our long-term development.

Central processing algorithms refer to a range of computing algorithms, including analytical algorithms, recommendation algorithms, and acceleration algorithms. The businesses engaged in internet advertisement, game development, intelligent chip design, finance, retail, and logistics depend on the ability to efficiently process and analyze data with optimized computing software and hardware capable of handling the data workload. Bespoke central processing algorithms suitable to each customer’s distinct needs help them achieve this purpose.

In the mid-to-long term, we will continue to adhere to our strategic mindset. By improving upon each iteration of our one-stop intelligent data management solutions made possible by our proprietary central processing algorithm services, we can help customers to enhance their service efficiency and make model innovations in business, and actively enhance the industry value of the central processing algorithm services in the general field of data intelligent processing industry.

Corporate History and Structure

MicroAlgo Inc. (“MicroAlgo” or the “Company”) (f/k/a Venus Acquisition Corporation (“Venus”)), a Cayman Islands exempted company, entered into the Business Combination and Merger Agreement dated June 10, 2021 (as amended on January 24, 2022, August 2, 2022, August 3, 2022 and August 10, 2022, the “Merger Agreement”), by and among WiMi Hologram Cloud Inc. (“WiMi” or the “Majority Shareholder”), Venus, Venus Merger Sub Corporation (“Venus Merger Sub”), a Cayman Islands exempted company incorporated for the purpose of effectuating the Business Combination (as defined herein), and VIYI Algorithm Inc. (“VIYI”), a Cayman Islands exempted company.

Pursuant to the terms of the Merger Agreement, the Company effected a business combination with VIYI through the merger of Merger Sub with and into VIYI, with VIYI surviving as the surviving company and as our wholly-owned subsidiary. On December 12, 2022, the closing of the Business Combination (the “Closing”) occurred. Upon the closing of the Business Combination, the Company changed its name to MicroAlgo Inc.

Our ordinary shares and Public Warrants are listed on the Nasdaq Stock Market LLC(“ NASDAQ”) and Over-The-Counter Market(“OTC”) under the trading symbols “MLGO” and “VENAF” respectively.

MicroAlgo is not an operating company, but a holding company incorporated in the Cayman Islands. MicroAlgo operates its business through its subsidiaries in the PRC in which it owns equity interests.

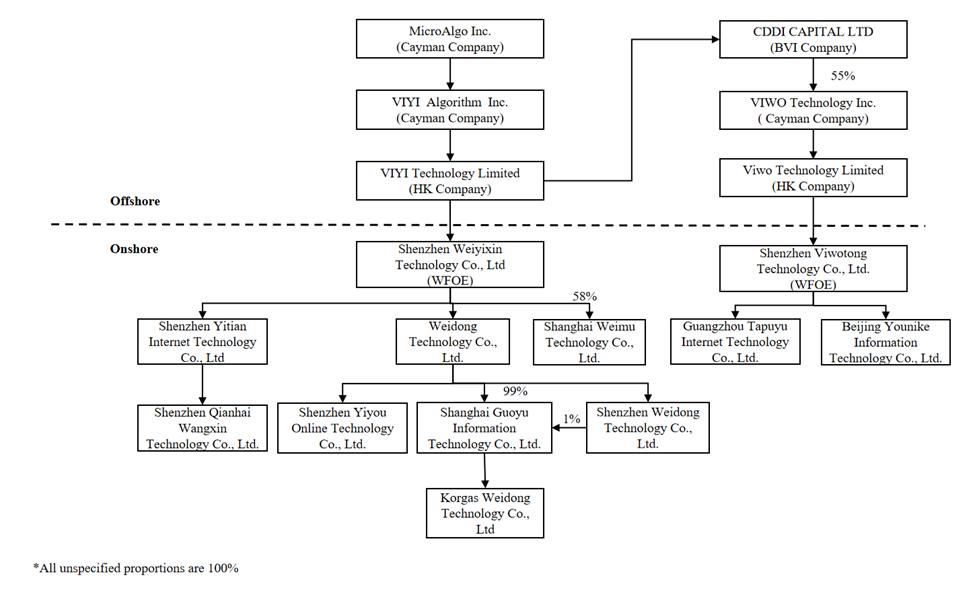

The following diagram illustrates our corporate structure as of the date of this prospectus:

Cash and Asset Flows through Our Organization

The Company is a holding company with no material operations of its own. We conduct our operations primarily through our subsidiaries in China. As a result, the Company’s ability to pay dividends depends upon dividends paid by our subsidiaries in China. If our existing PRC subsidiaries or any newly formed ones incur debt on their own behalf in the future, the instruments governing their debt may restrict their ability to pay dividends to us.

Funding PRC Subsidiaries

We are permitted under PRC laws and regulations as an offshore holding company to provide fundings to our wholly foreign-owned subsidiary in China only through loans or capital contributions, subject to the record-filing and registration with government authorities and limit on the amount of loans. Subject to satisfaction of the applicable government registration requirements, we may extend inter-company loans to our wholly foreign-owned subsidiaries in China or make additional capital contributions to the wholly foreign-owned subsidiaries to fund their capital expenditures or working capital. If we provide fundings to our wholly foreign-owned subsidiaries through loans, the total amount of such loans may not exceed the difference between the entity’s total investment as registered with the foreign investment authorities and our registered capital. Such loans must also be registered with SAFE (as defined herein) or their local branches. For more detailed information and risks associated with a transfer of funds by the Company to our PRC subsidiaries in the form of a loan or capital injection, please refer to our Annual Report on Form 10-K for 2022 in the section “Risk Factors — Risk Factors Relating to Doing Business in China — PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using the proceeds we receive from offshore financing activities to make loans to or make additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand business.”

Dividends

Under PRC law, our PRC subsidiaries are permitted to pay dividends to us only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Pursuant to the Company Law of the People’s Republic of China, or the PRC Company Law, our PRC subsidiaries are required to make contribution of at least 10% of their after-tax profits calculated in accordance with the PRC GAAP to the statutory common reserve. Contribution is not required if the reserve fund has reached 50% of the registered capital of our subsidiaries. See “Risk Factors — Risk Factors Relating to Doing Business in China — our PRC subsidiaries are subject to restrictions on paying dividends or making other payments to us, which may restrict our ability to satisfy liquidity requirements, conduct business and pay dividends to holders of our ordinary shares.

None of our PRC subsidiaries has issued any dividends or distributions to respective holding companies or any investors as of the date of this prospectus. Our PRC subsidiaries generate and retain cash generated from operating activities and re-invested it in our business. We do not have any present plan to pay any cash dividends on our ordinary shares in the foreseeable future after any offerings under this prospectus. We have, from time to time, transferred cash between our PRC subsidiaries to fund their operations, and we do not anticipate any difficulties or limitations on our ability to transfer cash between such subsidiaries. As of the date of this prospectus, no cash generated from our PRC subsidiaries has been used to fund operations of any of our non-PRC subsidiaries. We may encounter difficulties in our ability to transfer cash between PRC subsidiaries and non-PRC subsidiaries largely due to various PRC laws and regulations imposed on foreign exchange. However, so long as we are compliant with the procedures for approvals from foreign exchange authorities and banks in China, the relevant laws and regulations in China do not impose limitations on the amount of funds that we can transfer out of China. See “Risk Factor—Risk Factors Relating to Doing Business in China—Governmental control of currency conversion may limit our ability to utilize revenues effectively and affect the value of your investment.” of our annual report on Form 10-K for 2022.

We currently do not have any cash management policy that dictates the transfer of cash between our subsidiaries. See “Item 4. Information of the Company—B. Business Overview—Regulation—PRC Laws and Regulations relating to Foreign Exchange” of our annual report on Form 10-K for details of such procedures.

Risk Factors

The company faces various legal and operational risks and uncertainties as a company which its principal subsidiaries based in and primarily operating in the PRC. Most of the company’s subsidiaries operations are conducted in the PRC, and are governed by PRC laws, rules, and regulations. Because PRC laws, rules, and regulations are relatively new and quickly evolving, and because of the limited number of published decisions and the non-precedential nature of these decisions, and because the laws, rules and regulations often give the relevant regulator certain discretion in how to enforce them, the interpretation and enforcement of these laws, rules and regulations involve uncertainties and can be inconsistent and unpredictable. The PRC government has the power to exercise significant oversight and discretion over the conduct of our business, and the regulations to which we are subject may change rapidly. As a result, the application, interpretation, and enforcement of new and existing laws and regulations in the PRC are often uncertain. In addition, these laws and regulations may be interpreted and applied inconsistently by different agencies or authorities, and inconsistently with our current policies and practices.

See “Risk Factors — Risks Related to Doing Business in China — Because all of our operations are in China, our business is subject to the complex and rapidly evolving laws and regulations there. The Chinese government may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence our operations at any time, which could result in a material change in our operations and/or the value of our Ordinary Shares,” and “— Adverse changes in China’s economic, political or social conditions, laws, regulations or government policies could have a material adverse effect on our business, financial condition and results of operations..” as set forth in this prospectus and our Annual Report on Form 10-K, as filed with the SEC on March 29, 2023.

In addition, the PRC government has significant oversight and discretion over the conduct of our business, and may intervene in or influence our operations through adopting and enforcing rules and regulatory requirements. For example, in recent years the PRC government, has enhanced regulation in areas such as anti-monopoly, anti-unfair competition, cybersecurity and data privacy. See “Item 3 Key Information — D. Risk Factors — Risks Related to Our Business and Industry — The PRC government exerts substantial influence over the manner in which we and our PRC subsidiaries must conduct our business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S. exchanges, however, if we or our PRC subsidiaries were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange, which would materially affect the interest of the investors.”; and “— We may be materially and adversely affected by the complexity, uncertainties and changes in the PRC laws and regulations governing Internet-related industries and companies,” as set forth in the our annual report on Form 10-K filed with the Commission on March 29, 2023.

Before investing in the ordinary shares, you should carefully consider the risks and uncertainties described in this prospectus and as summarized below, the risks described under the “Risk Factors,” in addition to all of the other information in this prospectus and documents that are incorporated in this prospectus by Table of Contents reference, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, if applicable, in any accompanying prospectus supplement or documents incorporated by reference. The occurrence of one or more of the events or circumstances described in the section titled “Risk Factors,” alone or in combination with other events or circumstances, may adversely affect our business, results of operations and financial condition. Such risks include, but are not limited to:

Risk Factors Relating to our Business and Industry

|

● |

We operate in a relatively new and rapidly evolving market. |

| |

|

|

|

● |

Our competitive position and results of operations could be harmed if we do not compete effectively. |

| |

|

|

|

● |

We have a limited operating history, and it may not be able to sustain rapid growth, effectively manage growth or implement business strategies. |

| |

|

|

|

● |

Recent acquisitions could prove difficult to integrate, disrupt the business, dilute shareholder value and strain the resources. |

| |

|

|

|

● |

Failure to maintain adequate financial, information technology and management processes and controls could result in material weaknesses which could lead to errors in our financial reporting, which could adversely affect our business. |

| |

|

|

|

● |

If we fail to keep up with industry trends or technological developments, or develop, acquire, market and offer new products and services, our business, results of operations and financial condition may be materially and adversely affected. |

| |

|

|

|

● |

Our results of operations could materially suffer in the event of insufficient pricing to enable us to meet profitability expectations. |

| |

|

|

|

● |

We make significant investments in research and development of new products and services that may not achieve expected returns. |

| |

|

|

|

● |

We require a significant amount of capital to fund our research and development investments. If we cannot obtain sufficient capital on favorable terms or at all, our business, financial condition and prospects may be materially and adversely affected. |

| |

|

|

|

● |

Our success depends on our ability to attract, hire, retain and motivate key management personnel and highly skilled employees. |

| |

|

|

|

● |

Our business depends substantially on the market recognition of our brand and negative media coverage could adversely affect our business. |

| |

|

|

|

● |

Our failure to protect intellectual property rights may undermine our competitive position. |

| |

|

|

|

● |

Our services or solutions could infringe upon the intellectual property rights of others, or we might lose our ability to utilize the intellectual property of others. |

| |

|

|

|

● |

We may not be able to protect our source code from copying if there is an unauthorized disclosure. |

| |

|

|

|

● |

Third parties may register trademarks or domain names or purchase internet search engine keywords that are similar to our trademarks, brand or websites, or misappropriate our data and copy our platform, all of which could cause confusion to our users, divert online customers away from our products and services or harm our reputation. |

| |

|

|

|

● |

Our business is highly dependent on the proper functioning and improvement of our information technology systems and infrastructure. Our business and operating results may be harmed by service disruptions, or by our failure to timely and effectively scale up and adjust our existing technology and infrastructure. |

|

● |

Our operations depend on the performance of the Internet infrastructure and fixed telecommunications networks in China, which may experience unexpected system failure, interruption, inadequacy or security breaches. |

| |

|

|

|

● |

We use third-party services and technologies in connection with our business, and any disruption to the provision of these services and technologies to us could result in adverse publicity and a slowdown in the growth of our users, which could materially and adversely affect our business, financial condition and results of operations. |

| |

|

|

|

● |

Our insurance policies may not provide adequate coverage for all claims associate with our business operations. |

| |

|

|

|

● |

We may be subject to claims, disputes or legal proceedings in the ordinary course of our business. If the outcome of these proceedings is unfavorable to us, then our business, results of operations and financial condition could be adversely affected. |

| |

|

|

|

● |

We may need additional capital to support or expand our business, and we may be unable to obtain such capital in a timely manner or on acceptable terms, if at all. |

| |

|

|

|

● |

We are a “controlled company” within the meaning of the applicable Nasdaq listing rules and, as a result, will qualify for exemptions from certain corporate governance requirements. If we rely on these exemptions, you will not have the same protections afforded to shareholders of companies that are subjected to such requirements. |

| |

|

|

|

● |

Our business may be materially and adversely affected by the effects of natural disasters, health epidemics or similar situation. In particular, the COVID-19 pandemic has already and may continue to cause negative impacts to our business, results of operations and financial condition. |

| |

|

|

|

● |

We may be materially and adversely affected by the complexity, uncertainties and changes in PRC regulation of the Internet industry and companies. |

| |

|

|

|

● |

Our business generates and processes a large amount of data, and we are required to comply with PRC laws and regulations relating to cyber security. These laws and regulations could create unexpected costs, subject us to enforcement actions for compliance failures, or restrict portions of our business or cause us to change our data practices or business model. |

| |

|

|

|

● |

We may be liable for improper use or appropriation of personal information provided directly or indirectly by our customers or end users. |

| |

|

|

|

● |

We and our subsidiaries have a limited customer base and depend on a small number of customers for a significant portion of revenues which may result in heightened concentration risk. |

| |

|

|

|

● |

We and our subsidiaries depend on a limited number of vendors for a significant portion of our purchase which may result in heightened concentration risk. |

Risk Factors Relating to Doing Business in China

|

● |

Substantial uncertainties exist with respect to the enactment timetable, interpretation and implementation of PRC Foreign Investment Law and how it may impact the viability of our current corporate structure, corporate governance and business operations. |

| |

|

|

|

● |

If the chops of our PRC subsidiaries and their respective subsidiaries, are not kept safely, are stolen or are used by unauthorized persons or for unauthorized purposes, the corporate governance of these entities could be severely and adversely compromised. |

| |

|

|

|

● |

The PRC government exerts substantial influence over the manner in which we, our subsidiaries must conduct our business activities. We are currently not required to obtain approval from Chinese authorities to list on U.S. exchanges, however, if we are required to obtain approval in the future and was denied permission from Chinese authorities to list on U.S. exchanges, we will not be able to continue listing on U.S. exchange, which would materially affect the interest of the investors. |

| |

|

|

|

● |

We are or may be required to obtain certain permissions from Chinese authorities to issue securities to foreign investors. |

|

● |

Adverse changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business, financial condition and results of operations. |

| |

|

|

|

● |

A severe or prolonged downturn in the PRC or global economy and political tensions between the United States and China could materially and adversely affect our business and our financial condition. |

| |

|

|

|

● |

The recent joint statement by the SEC and PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies, including companies based in China, upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. |

| |

|

|

|

● |

Uncertainties in the promulgation, interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us. |

| |

|

|

|

● |

We are subject to extensive and evolving legal system in the PRC, non-compliance with which, or changes in which, may materially and adversely affect our business and prospects, and may result in a material change in our operations and/or the value of our ordinary shares or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our securities to significantly decline or be worthless. |

| |

|

|

|

● |

Under the PRC enterprise income tax law, we may be classified as a “PRC resident enterprise”, which could result in unfavorable tax consequences to us and our shareholders and have a material adverse effect on our results of operations and the value of your investment. |

| |

|

|

|

● |

We may not be able to obtain certain benefits under relevant tax treaties on dividends paid by our PRC subsidiaries to us through our Hong Kong subsidiaries. |

| |

|

|

|

● |

We face uncertainty with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies. |

| |

|

|

|

● |

Certain judgments obtained against us by our shareholders may not be enforceable. |

| |

|

|

|

● |

Implementation of labor laws and regulations in China may adversely affect our business and results of operations. |

| |

|

|

|

● |

The M&A Rules and certain other PRC regulations may make it more difficult for us to pursue growth through acquisitions. |

|

● |

PRC regulations relating to offshore investment activities by PRC residents may limit our PRC subsidiaries’ ability to increase their registered capital or distribute profits to us or otherwise expose us to liability and penalties under PRC law. |

| |

|

|

|

● |

PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using the proceeds it receives from offshore financing activities to make loans to or make additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand business. |

| |

|

|

|

● |

Our PRC subsidiaries are subject to restrictions on paying dividends or making other payments to us, which may restrict our ability to satisfy liquidity requirements, conduct business and pay dividends to holders of our ordinary shares. |

| |

|

|

|

● |

Fluctuations in exchange rates could have a material adverse effect on our results of operations and the value of your investment. |

| |

|

|

|

● |

Governmental control of currency conversion may limit our ability to utilize revenues effectively and affect the value of your investment. |

| |

|

|

|

● |

Failure to comply with PRC regulations regarding the registration requirements for employee stock ownership plans or share option plans may subject the PRC plan participants or we to fines and other legal or administrative sanctions. |

| |

|

|

|

● |

Our leased property interests may be defective and our right to lease the properties affected by such defects may be challenged, which could adversely affect our business. |

| |

|

|

|

● |

If we are classified as a PRC resident enterprise for PRC enterprise income tax purposes, such classification could result in unfavorable tax consequences to us and our non-PRC shareholders. |

Risk Factors Relating to an Investment in our Ordinary Shares

|

● |

Certain judgments obtained against us by our shareholders may not be enforceable. |

| |

|

|

|

● |

The market price for our ordinary shares have fluctuated and may be volatile. |

| |

|

|

|

● |

Our Key Projected Financial Metrics are subject to significant risks, assumptions, estimates and uncertainties, including assumptions regarding future market and changes in regulations. As a result, our projected revenues, market share, expenses and profitability may differ materially from our expectations. |

| |

|

|

|

● |

We may be unable to obtain additional financing to fund our operations or growth. |

| |

|

|

|

● |

Our share price may be volatile and could decline substantially. |

| |

|

|

|

● |

We do not intend to pay cash dividends for the foreseeable future. |

| |

|

|

|

● |

We may be subject to securities litigation, which is expensive and could divert management attention. |

| |

|

|

|

● |

The sale or availability for sale of substantial amounts of our ordinary shares could adversely affect their market price. |

| |

|

|

|

● |

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about us or our business, our ordinary shares price and trading volume could decline. |

| |

|

|

|

● |

We may redeem your unexpired warrants prior to their exercise at a time that is disadvantageous to you, thereby making your warrants worthless. |

| |

|

|

|

● |

If we cannot satisfy, or continue to satisfy, the initial listing requirements and other rules of Nasdaq, our securities may not be listed or may be delisted, which could negatively impact the price of our securities and your ability to sell them. |

| |

|

|

|

● |

You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law. |

| |

|

|

|

● |

You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in China against us or our management named in the report based on foreign laws. |

| |

|

|

|

● |

Changes in laws or regulations, or a failure to comply with any laws and regulations, may adversely affect our business, investments and results of operations. |

| |

|

|

|

● |

Future changes to tax laws could adversely affect us. |

| |

|

|

|

● |

We are an emerging growth company within the meaning of the Securities Act, and if we take advantage of certain exemptions from disclosure requirements available to emerging growth companies, this could make our securities less attractive to investors and may make it more difficult to compare our performance with other public companies. |

| |

|

|

|

● |

We became a PFIC, which could result in adverse U.S. federal income tax consequences to U.S. Holders. |

Corporate Information

We are a Cayman Islands exempted company, and our principal executive office is located at Unit 507, Building C, Taoyuan Street, Long Jing High and New Technology Jingu Pioneer Park, Nanshan District, Shenzhen, People’s Republic of China. Our registered office address in the Cayman Islands is located at 215-245 N Church St., 2nd Floor White Hall House, Grand Cayman, Cayman Islands. Information contained on, or that can be accessed through, our website does not constitute a part of this prospectus and is not incorporated by reference herein. We have included our website address in this prospectus solely for informational purposes. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers, such as we, that file electronically, with the SEC at www.sec.gov. Our agent for service of process in the United States is Puglisi & Associates, 850 Library Avenue, Suite 204, Newark, Delaware 19711.

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

| |

|

For the

Six Months Ending

June 30, |

|

| |

|

2022 |

|

|

2023 |

|

|

2023 |

|

| |

|

RMB |

|

|

RMB |

|

|

USD |

|

| OPERATING REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

| Products |

|

|

84,859,926 |

|

|

|

9,935,513 |

|

|

|

1,434,690 |

|

| Services |

|

|

260,914,275 |

|

|

|

253,706,643 |

|

|

|

36,635,280 |

|

| Total operating revenues |

|

|

345,774,201 |

|

|

|

263,642,156 |

|

|

|

38,069,970 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| COST OF REVENUES |

|

|

(276,424,458 |

) |

|

|

(183,095,184 |

) |

|

|

(26,438,974 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS PROFIT |

|

|

69,349,743 |

|

|

|

80,546,972 |

|

|

|

11,630,996 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling expenses |

|

|

(2,540,086 |

) |

|

|

(1,237,770 |

) |

|

|

(178,734 |

) |

| General and administrative expenses |

|

|

(12,257,955 |

) |

|

|

(7,638,938 |

) |

|

|

(1,103,062 |

) |

| Research and development expenses |

|

|

(40,202,571 |

) |

|

|

(92,239,461 |

) |

|

|

(13,319,393 |

) |

| Total operating expenses |

|

|

(55,000,612 |

) |

|

|

(101,116,169 |

) |

|

|

(14,601,189 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME (LOSS) FROM OPERATIONS |

|

|

14,349,131 |

|

|

|

(20,569,197 |

) |

|

|

(2,970,193 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss on disposal of subsidiaries |

|

|

(1,064,203 |

) |

|

|

(23,025,499 |

) |

|

|

(3,324,886 |

) |

| Interest income |

|

|

307,726 |

|

|

|

1,251,127 |

|

|

|

180,663 |

|

| Finance expenses, net |

|

|

(264,358 |

) |

|

|

(225,537 |

) |

|

|

(32,568 |

) |

| Other income, net |

|

|

1,400,850 |

|

|

|

611,158 |

|

|

|

88,251 |

|

| Total other (expenses) income, net |

|

|

380,015 |

|

|

|

(21,388,751 |

) |

|

|

(3,088,540 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME (LOSS) BEFORE INCOME TAXES |

|

|

14,729,146 |

|

|

|

(41,957,948 |

) |

|

|

(6,058,733 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| BENEFIT OF (PROVISION FOR) INCOME TAXES |

|

|

|

|

|

|

|

|

|

|

|

|

| Current |

|

|

(286,789 |

) |

|

|

(52,912 |

) |

|

|

(7,640 |

) |

| Deferred |

|

|

786,966 |

|

|

|

- |

|

|

|

- |

|

| Total (provision for) benefit of income tax |

|

|

500,177 |

|

|

|

(52,912 |

) |

|

|

(7,640 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME (LOSS) |

|

|

15,229,323 |

|

|

|

(42,010,860 |

) |

|

|

(6,066,373 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Less: Net income (loss) attributable to non-controlling interests |

|

|

228,367 |

|

|

|

(4,937,217 |

) |

|

|

(712,935 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME (LOSS) ATTRIBUTABLE TO MICROALGO INC. |

|

|

15,000,956 |

|

|

|

(37,073,643 |

) |

|

|

(5,353,438 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME (LOSS) |

|

|

15,229,323 |

|

|

|

(42,010,860 |

) |

|

|

(6,066,373 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER COMPREHENSIVE INCOME (LOSS) |

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation adjustment |

|

|

1,377,873 |

|

|

|

8,517,608 |

|

|

|

(991,206 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| COMPREHENSIVE INCOME (LOSS) |

|

|

16,607,196 |

|

|

|

(33,493,252 |

) |

|

|

(7,057,579 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Less: Comprehensive income (loss) attributable to non-controlling interests |

|

|

228,367 |

|

|

|

(4,937,217 |

) |

|

|

(33,493,252 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO MICROALGO INC |

|

|

16,378,829 |

|

|

|

(28,556,035 |

) |

|

|

26,435,673 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE NUMBER OF ORDINARY SHARES |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

300,000,000 |

|

|

|

43,856,706 |

|

|

|

43,856,706 |

|

| Diluted |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS (LOSS) PER SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

0.05 |

|

|

|

(0.85 |

) |

|

|

(0.12 |

) |

| Diluted |

|

|

- |

|

|

|

- |

|

|

|

- |

|

UNAUDTED INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS

| |

|

December 31,

2022 |

|

|

June 30

2023 |

|

|

June 30

2023 |

|

| |

|

RMB |

|

|

RMB |

|

|

USD |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

297,710,673 |

|

|

|

138,675,781 |

|

|

|

19,191,755 |

|

| Accounts receivable, net |

|

|

18,125,011 |

|

|

|

37,723,534 |

|

|

|

5,220,672 |

|

| Inventories |

|

|

909,047 |

|

|

|

- |

|

|

|

- |

|

| Prepaid services fees |

|

|

25,929,098 |

|

|

|

46,500,506 |

|

|

|

6,435,344 |

|

| Other receivables and prepaid expenses |

|

|

1,858,512 |

|

|

|

1,024,682 |

|

|

|

141,808 |

|

| Other receivable-related parties |

|

|

39,987,762 |

|

|

|

179,780,988 |

|

|

|

24,880,427 |

|

| Total current assets |

|

|

384,520,103 |

|

|

|

403,705,491 |

|

|

|

55,870,006 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| PROPERTY PLANT AND EQUIPMENT, NET |

|

|

1,012,107 |

|

|

|

887,228 |

|

|

|

122,786 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost method investments |

|

|

1,200,000 |

|

|

|

1,200,000 |

|

|

|

166,072 |

|

| Prepaid expenses and deposits |

|

|

1,281,860 |

|

|

|

83,600 |

|

|

|

11,570 |

|

| Intangible assets, net |

|

|

6,716,250 |

|

|

|

6,343,125 |

|

|

|

877,844 |

|

| Operating lease right-of-use assets |

|

|

1,050,922 |

|

|

|

434,414 |

|

|

|

60,120 |

|

| Goodwill |

|

|

106,274,006 |

|

|

|

106,274,006 |

|

|

|

14,707,577 |

|

| Total non-current assets |

|

|

116,523,038 |

|

|

|

114,335,145 |

|

|

|

15,823,183 |

|

| Total assets |

|

|

502,055,248 |

|

|

|

518,927,864 |

|

|

|

71,815,975 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

|

14,221,369 |

|

|

|

35,484,975 |

|

|

|

4,910,872 |

|

| Deferred revenues |

|

|

11,205,880 |

|

|

|

17,996,560 |

|

|

|

2,490,598 |

|

| Other payables and accrued liabilities |

|

|

5,523,915 |

|

|

|

28,867,759 |

|

|

|

3,995,095 |

|

| Amount due to a related party |

|

|

1,067,903 |

|

|

|

1,107,954 |

|

|

|

153,333 |

|

| Operating lease liabilities |

|

|

1,049,326 |

|

|

|

363,450 |

|

|

|

50,299 |

|

| Taxes payable |

|

|

385,591 |

|

|

|

72,448 |

|

|

|

10,026 |

|

| Total current liabilities |

|

|

33,453,984 |

|

|

|

83,893,146 |

|

|

|

11,610,223 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating lease liabilities - noncurrent |

|

|

214,189 |

|

|

|

140,895 |

|

|

|

19,499 |

|

| Deferred tax liabilities, net |

|

|

1,679,063 |

|

|

|

1,679,063 |

|

|

|

232,370 |

|

| Total other liabilities |

|

|

1,893,252 |

|

|

|

1,819,958 |

|

|

|

251,869 |

|

| Total liabilities |

|

|

35,347,236 |

|

|

|

85,713,104 |

|

|

|

11,862,092 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred shares, $0.001 par value; 1,000,000 shares authorized; no share issued |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Ordinary shares, $0.001 par value, 200,000,000 shares authorized, 43,856,706 issued |

|

|

312,543 |

|

|

|

312,543 |

|

|

|

43,857 |

|

| Additional paid-in capital |

|

|

320,210,652 |

|

|

|

320,210,652 |

|

|

|

47,394,444 |

|

| Retained earnings |

|

|

129,602,088 |

|

|

|

96,798,730 |

|

|

|

14,420,927 |

|

| Statutory reserves |

|

|

11,964,279 |

|

|

|

11,964,279 |

|

|

|

1,798,310 |

|

| Accumulated other comprehensive income (loss) |

|

|

2,834,688 |

|

|

|

7,082,011 |

|

|

|

(3,246,375 |

) |

| Total MicroAlgo Inc.shareholders’ equity |

|

|

464,924,250 |

|

|

|

436,368,215 |

|

|

|

60,411,163 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NONCONTROLLING INTERESTS |

|

|

1,783,762 |

|

|

|

(3,153,455 |

) |

|

|

(457,280 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

466,708,012 |

|

|

|

433,214,760 |

|

|

|

59,953,883 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders’ equity |

|

|

502,055,248 |

|

|

|

518,927,864 |

|

|

|

71,815,975 |

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

| |

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Ordinary shares |

|

|

Additional |

|

|

Retained earnings |

|

|

Other |

|

|

|

|

|

|

|

|

|

|

| |

|

Shares |

|

|

Par

Value |

|

|

paid-in

capital |

|

|