false

0001923891

0001923891

2024-12-26

2024-12-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): December 26, 2024 (December 18, 2024)

Nano

Nuclear Energy Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-42044 |

|

88-0861977 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

10

Times Square, 30th Floor

New

York, New York 10018

(Address

of principal executive offices, including zip code)

Registrant’s

telephone number, including area code: (212) 634-9206

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| |

|

|

|

|

| Common

Stock, par value $0.0001 per share |

|

NNE |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry Into a Material Definitive Agreement.

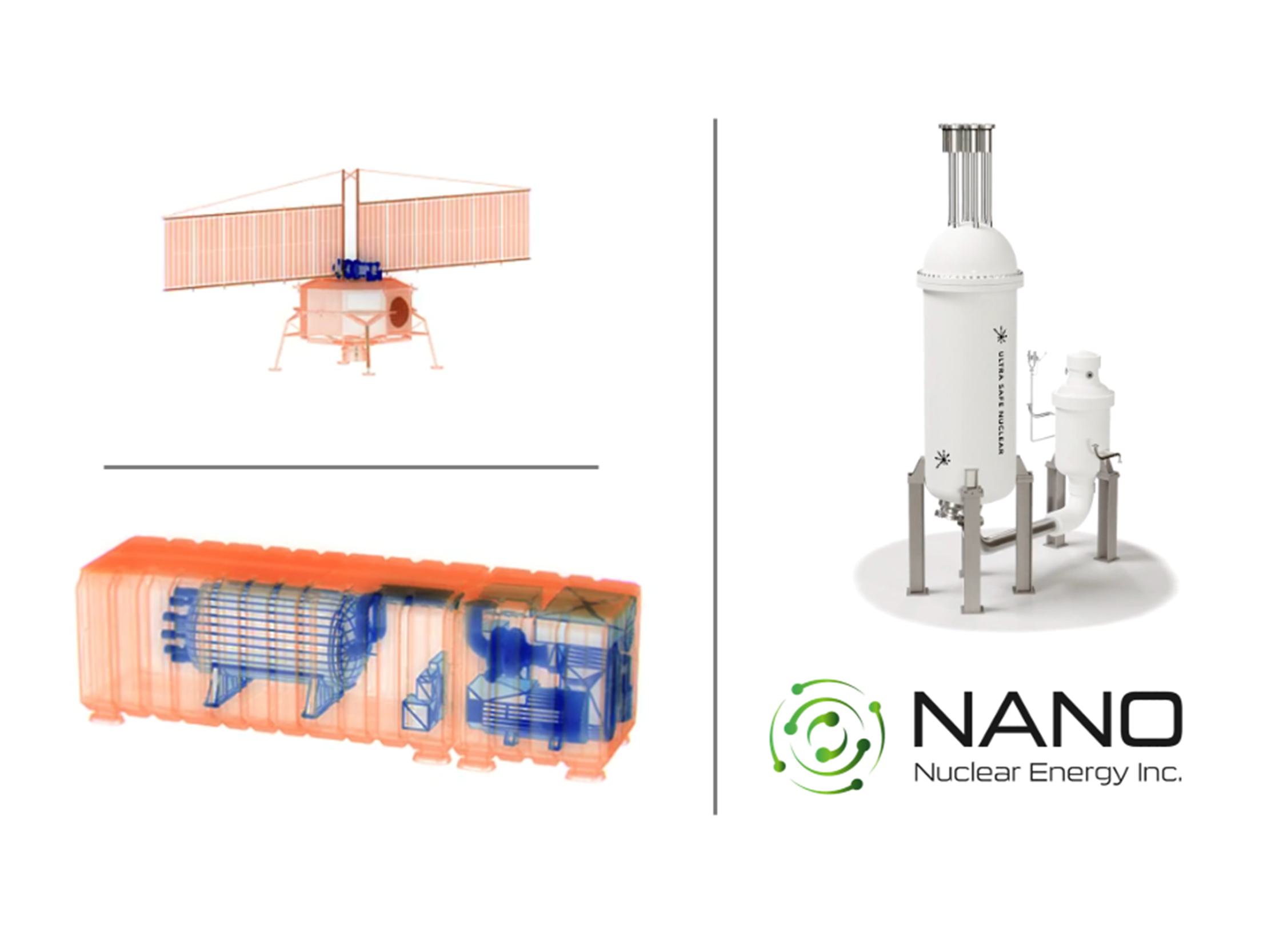

On

December 18, 2024, Nano Nuclear Energy Inc., a Nevada corporation (the “Company”) entered into an Asset Purchase Agreement

(the “APA”) with Ultra Safe Nuclear Corporation, a Delaware corporation, Ultra Safe Nuclear Corporation – Technologies,

a Washington corporation, USNC Holdings, LLC, a Washington limited liability company, Global First Power Limited, a Canadian corporation,

and USNC-Power, Ltd., a British Columbia corporation (collectively, “Sellers”), pursuant to which, subject to the

terms and conditions set forth in the APA, the Company agreed to acquire certain assets of Sellers on an as-is, where-is basis, relating

to Sellers’ micro modular nuclear reactor business marketed as a MMR Energy System, and transportable fission power system technology

business marketed as a Pylon Transportable Reactor Platform, including certain contracts, intellectual property rights, demonstration

projects and the equity interests of two non-U.S. entities (collectively, the “Assets”), free and clear of any liens

other than certain specified liabilities of Sellers that are being assumed (collectively, the “Liabilities” and such

acquisition of the Assets and assumption of the Liabilities together, the “Transaction”) for a total purchase price

of $8,500,000 in cash (the “Purchase Price”).

Sellers

are debtors in a voluntary Chapter 11 case before the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy

Court”), which commenced on October 29, 2024. The Company participated in an auction conducted by Sellers on December 12, 2024

for the sale of Sellers’ assets (the “Auction”) and was selected as the winning bidder with respect to the Assets.

Prior

to entering into the APA, in connection with the Auction, the Company delivered a total cash payment of $3,560,000 as a deposit towards

the Purchase Price, of which only $850,000 is subject to potential forfeiture in the event of a termination of the APA for the Company’s

material breach.

The

APA contains customary representations, warranties and covenants of the parties for a transaction involving the acquisition of assets

from a debtor in bankruptcy, including the condition that the Bankruptcy Court enter an order authorizing and approving the Transaction,

which sale order was entered by the Bankruptcy Court on December 19, 2024. The APA contains certain termination rights for both the

Company and Sellers, including the right to terminate the APA if the Transaction is not consummated by January 25, 2025. The Company

currently expects the consummation of the Transaction to occur in the very near future.

The

foregoing summary of the APA is not complete and is qualified in its entirety by reference to the full text of the APA, a copy of which

is attached hereto as Exhibit 10.1 and is incorporated herein by reference. The representations, warranties and covenants set forth in

the APA have been made only for purposes of the APA and solely for the benefit of the parties thereto, and may be subject to limitations

agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual

risk between the parties to the APA instead of establishing these matters as facts. In addition, information regarding the subject matter

of the representations and warranties made in the APA may change after the date of the APA. Accordingly, the APA is included with this

Current Report on Form 8-K only to provide investors with information regarding its terms and not to provide investors with any other

factual information regarding the Company, its subsidiaries, the Assets or Liabilities, or the Company’s or its subsidiaries’

respective businesses as of the date of the APA or as of any other date.

Item

7.01 Regulation FD

On

December 24, 2024, the Company issued a press release announcing the signing of the APA. A copy of such release is furnished hereto as

Exhibit 99.1.

Item

8.01 Other Events.

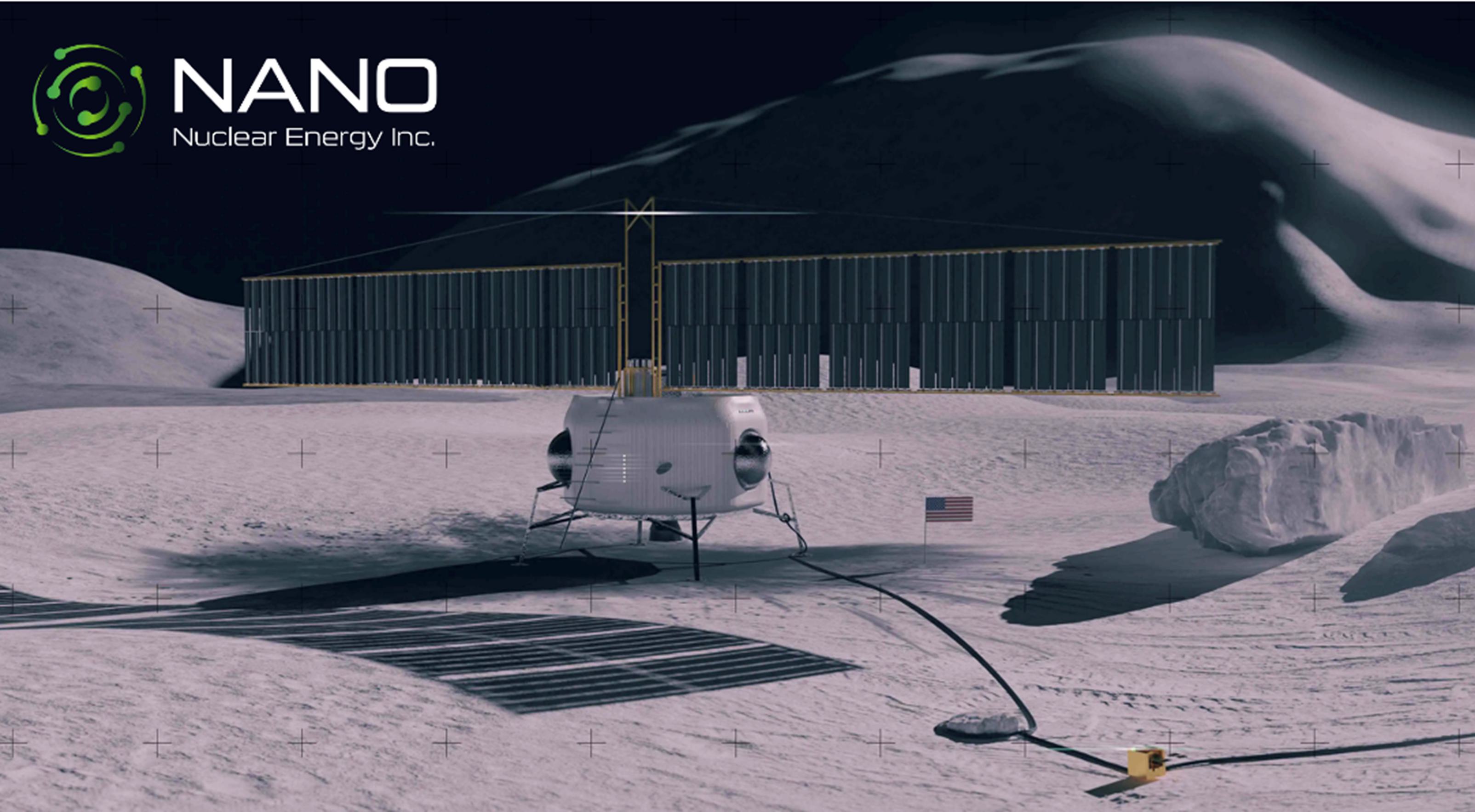

In

the Auction, the Company submitted a bid for the acquisition of substantially all of the assets of Sellers, including their fuel

business and their technology assets marketed as EmberCore and Nuclear Thermal Propulsion (NTP) (such assets other than the Assets,

the “Other Assets”), and was selected as the back-up bidder for the

Other Assets in the Auction. In the event that the winning bidder of the Other Assets in the Auction fails to consummate such

acquisition, the Company will be required to acquire all such Other Assets in addition to the Assets for a total purchase price,

inclusive of the $8,500,000 for the Assets, of $36,190,000.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

*In

accordance with Item 601(a)(5) of Regulation S-K, certain schedules or similar attachments to this exhibit have been omitted from this

filing.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated:

December 26, 2024 |

NANO

Nuclear Energy Inc. |

| |

|

|

| |

By: |

/s/

James Walker |

| |

Name:

|

James

Walker |

| |

Title: |

Chief

Executive Officer |

Exhibit

10.1

Execution

Version

CERTAIN

SCHEDULES OR SIMILAR ATTACHMENTS HAVE BEEN OMITTED FROM THIS EXHIBIT IN ACCORDANCE WITH ITEM 601(a)(5) of REGULATION S-K.

ASSET

PURCHASE AGREEMENT

BY

AND AMONG

ULTRA

SAFE NUCLEAR CORPORATION,

a

Delaware corporation,

ULTRA

SAFE NUCLEAR CORPORATION - TECHNOLOGIES,

a

Washington corporation,

USNC

HOLDINGS, LLC,

a

Washington limited liability company,

GLOBAL

FIRST POWER LIMITED,

a

Canadian corporation,

USNC-POWER,

LTD.,

a

British Columbia corporation,

collectively

as Seller

AND

NANO

NUCLEAR ENERGY INC.,

a

Nevada corporation, as buyer

Dated

as of: December 18, 2024

ASSET

PURCHASE AGREEMENT

This

Asset Purchase Agreement (this “Agreement”) is made and entered into as of December 18, 2024 (the “Effective

Date”), by and among Ultra Safe Nuclear Corporation, a Delaware corporation (“USNC”), Ultra Safe

Nuclear Corporation – Technologies, a Washington corporation (“USNC Tech”), USNC Holdings, LLC, a Washington

limited liability company (“USNC Holdings”, Global First Power Limited, a Canadian corporation (“GFP”),

and USNC-Power, Ltd., a British Columbia corporation (together with USNC, USNC Tech, USNC Holdings, and GFP, collectively, “Seller”),

and Nano Nuclear Energy Inc., a Nevada corporation (including all designee(s), assignee(s), or nominee(s) of Buyer (if any), collectively,

“Buyer”). Buyer and Seller may each, individually, be hereinafter referred to as a “Party”

and, collectively, as the “Parties”.

RECITALS:

WHEREAS,

on October 28, 2024, Seller entered into an Asset Purchase Agreement (as amended pursuant to the Auction (as defined below), the “Stalking

Horse Agreement”) by and among Seller and Standard Nuclear, Inc., a Delaware corporation (the “Stalking Horse

Bidder”), which Stalking Horse Bidder was successful in the Auction with respect to the businesses of Seller covered by

the Stalking Horse Agreement of (i) developing and selling nuclear fuel projects and (ii) developing and selling nuclear technologies

through their EmberCore and Nuclear Thermal Propulsion technologies (but excluding the Pylon Transportable Nuclear Systems technology)

(together, the “Stalking Horse Businesses”);

WHEREAS,

on October 29, 2024 (the “Petition Date”), Seller filed voluntary petitions for relief (the “Bankruptcy

Case”) under Chapter 11, Title 11 of the United States Code, 11 U.S.C. §§ 101, et seq. (the “Bankruptcy

Code”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”);

and

WHEREAS,

subject to approval of the Bankruptcy Court and on the terms and subject to the conditions set forth herein and pursuant to a Sale

Order (as hereafter defined), the parties desire to enter into this Agreement pursuant to which, among other things, Seller shall sell

to Buyer, and Buyer shall purchase from Seller all of Seller’s right, title and interest in and to the Purchased Assets (as hereafter

defined), and Buyer shall assume from Seller and thereafter pay, discharge and perform the Assumed Obligations (as hereafter defined).

NOW,

THEREFORE, in consideration of the respective representations, warranties, covenants, and agreements of the Parties hereinafter set

forth, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree

as follows:

SECTION

1

DEFINITIONS

For

purposes of this Agreement, the following capitalized terms have the meanings specified or referred to in this Section 1:

“Action”

means any claim, action, cause of action, demand, lawsuit, arbitration, hearing, inquiry, audit, notice of violation, proceeding, litigation,

citation, summons, subpoena, or investigation of any nature, civil, criminal, administrative, regulatory, or otherwise, whether at law

or in equity.

“Affiliate”

of a Person means any other Person that directly or indirectly, through one or more intermediaries, controls, is controlled by, or is

under common control with, such Person. The term “control” (including the terms “controlled by” and “under

common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management

and policies of a Person, whether through the ownership of voting securities, by Contract or otherwise.

“Agreement”

has the meaning set forth in the Preamble.

“Additional

Assignable Contracts” means the Contracts identified as Additional Assignable Contracts on Schedule 2.2(a)-1.

“Assignable

Contracts” has the meaning set forth in Section 2.2(a).

“Assignment

and Assumption Agreement” means the Assignment and Assumption Agreement between Seller and Buyer, in the form attached

hereto as Exhibit A, to be executed and delivered at the Closing.

“Assumed

Liabilities” has the meaning set forth in Section 3.1(a).

“Auction”

has the meaning set forth in Section 8.1(a).

“Avoidance

Action” means any claim, right, or cause of action of Seller arising under Chapter 5 of the Bankruptcy Code and any analogous

state law claims relating to the Purchased Assets or the Business.

“Backup

Agreement” has the meaning set forth in Section 8.1(e).

“Backup

Bidder” has the meaning set forth in the Bid Procedures. “Bankruptcy Case” has the meaning set

forth in the Recitals. “Bankruptcy Code” has the meaning set forth in the Recitals. “Bankruptcy

Court” has the meaning set forth in the Recitals.

“Bid

Procedures” means bid procedures set forth in the Bidding Procedures Order.

“Bidder

Confidentiality Agreements” means any confidentiality or non-disclosure agreements between Seller or its Affiliates and

any potential purchaser of the Business, whether entered into prior to the Effective Date or during the Effective Date and the Closing.

“Bidding

Procedures Order” means the Order (I) Approving Bidding Procedures In Connection With Sale Of The Debtors’ Assets

And Related Bid Protections; (II) Approving Form And Manner of Notice; (III) Scheduling Auction And Sale Hearing; (IV) Authorizing Procedures

Governing Assumption And Assignment Of Certain Contracts And Unexpired Leases; And (V) Granting Related Relief entered by the Bankruptcy

Court in the Bankruptcy Case on November 21, 2024.

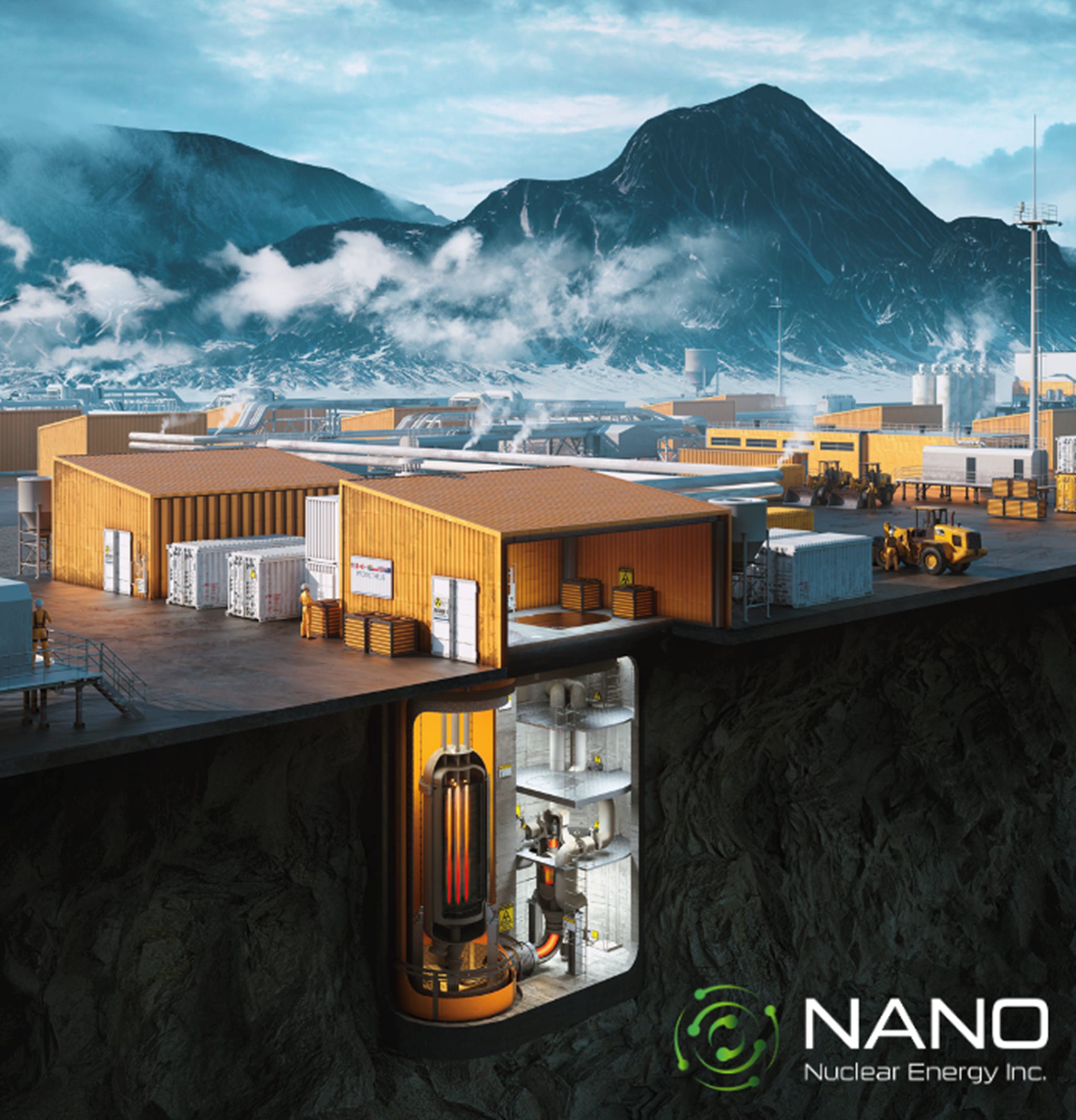

“Business”

means the business of Seller of (i) developing and selling micro modular nuclear reactors, including micro modular nuclear reactors marketed

as a “MMR Energy System” and (ii) developing and selling technologies for transportable fission power systems, including

transportable fission power systems marketed as a “Pylon Transportable Reactor Platform.” Notwithstanding anything to the

contrary contained herein, the “Business” shall exclude the Stalking Horse Businesses.

“Business

Day” means any day except Saturday, Sunday or any other day on which commercial banks located in New York, New York, are

authorized or required by Law to be closed for business.

“Business

Employees” has the meaning set forth in Section 5.11.

“Business

Records” has the meaning set forth in Section 2.1(d).

“Buyer”

has the meaning set forth in the Preamble.

“Buyer’s

Closing Certificate” has the meaning set forth in Section 4.5(b)(iii).

“Cash

Consideration” has the meaning set forth in Section 4.6.

“Claim”

means a claim as defined in Section 101 of the Bankruptcy Code. “Closing” has the meaning set forth in Section

4.4.

“Closing

Date” has the meaning set forth in Section 4.4.

“Code”

means the Internal Revenue Code of 1986, as amended.

“Contracts”

means all contracts, leases, subleases, deeds, mortgages, licenses, instruments, notes, commitments, purchase orders, customer orders,

undertakings, indentures, joint ventures, and all other agreements, commitments, and legally binding arrangements, whether written or

oral, and with respect to any of the foregoing, all amendments, supplements, extensions, addenda, or restatements relating thereto.

“Cure

Costs” means all monetary Liabilities that must be paid or otherwise satisfied in order to cure any monetary defaults required

to be cured under section 365(b)(1) of the Bankruptcy Code or otherwise to effectuate, pursuant to the Bankruptcy Code, the assumption

of the Designated Contracts.

“Demonstration

Projects” means the University of Illinois, Chalk River, and the UK Advanced Modular Reactor demonstration projects being

conducted by Seller, UK Project Company, and the Project Partnership as part of the Business.

“Designated

Contracts” has the meaning set forth in Section 2.2(a).

“Disclosure

Schedules” collectively means the Disclosure Schedules delivered by Seller to Buyer concurrently with the execution and

delivery of this Agreement, composed of the Schedules referenced throughout this Agreement.

“Effective

Date” has the meaning set forth in the Preamble.

“Employee

Benefit Plans” means (i) a bonus, deferred compensation, incentive compensation, stock purchase, stock option, profits

interest, severance or termination pay, hospitalization or other medical, life or other insurance, fringe benefit, supplemental unemployment

benefits, profit-sharing, 401(k) pension, or retirement plan, program, agreement, or arrangement; and (ii) each other employee benefit

plan, program, agreement, or arrangement, sponsored, maintained, or contributed to or required to be contributed to by Seller or by any

trade or business, whether or not incorporated, that together with Seller would be deemed a “single employer” within the

meaning of Section 414 of the Code or Section 4001(b)(l) of ERISA (each, individually, an “ERISA Affiliate”),

for the benefit of any employee or former employee of Seller, whether formal or informal, oral or written, and whether legally binding

or not, or in connection with which Seller or any ERISA Affiliate has any Liability.

“Encumbrance”

means any charge, Lien, Claim, right, demand, mortgage, lease, debt, losses, damage, demand, fine, judgment, penalty, liability, obligation,

commitment, assessment, cost, expense, loss, expenditure, charge, fee, penalty, fine, contribution, premium, sublease, hypothecation,

deed of trust, pledge, security interest, option, right of use or possession, right of first offer or first refusal, rights of others,

easement, restrictive covenant, right of way, preemptive right, conditional sale, servitude, conditional sale agreement, or restriction

(whether on voting, sale, transfer, defenses, set-off or recoupment rights, disposition or otherwise), encroachment, encumbrance, third

party interest, or other restriction or limitation of any kind, whether imposed by contract, Law, equity, or otherwise.

“Escrow

Account” has the meaning set forth in Section 4.7(a).

“Escrow

Agent” has the meaning set forth in Section 4.7(a).

“Escrow

Amount” has the meaning set forth in Section 4.7(a).

“Excluded

Liabilities” has the meaning set forth in Section 3.2.

“Final

Order” means an order or judgment of the Bankruptcy Court, the operation or effect of which has not been reversed, stayed,

modified, or amended and which is in full force and effect, and as to which the time to appeal, petition for certiorari, or move for

a new trial, reargument, or rehearing has expired and as to which no appeal, petition for certiorari, or other proceedings for a new

trial, reargument, or rehearing shall then be pending.

“Forfeitable

Deposit Amount” has the meaning set forth in Section 4.7(a).

“Governmental

Authority” means any federal, state, local, or foreign government or political subdivision thereof, or any agency or instrumentality

of such government or political subdivision, or any self-regulated organization, or other non-governmental regulatory authority, or quasi-governmental

authority (to the extent that the rules, regulations, or orders of such organization or authority have the force of Law), or any arbitrator,

court, or tribunal of competent jurisdiction.

“Initial

Designated Contracts” has the meaning set forth in Section 2.2(a).

“Intellectual

Property Assignments” has the meaning set forth in Section 4.5(a)(v).

“Intellectual

Property” means all copyrightable works, all registered and unregistered copyrights and applications therefor, registered

and unregistered trademarks and applications therefor, registered and unregistered service marks and applications therefor, trade secrets,

patent or invention disclosures, patent rights, inventions, research and development, ideas, discoveries, trade names and trade name

rights used in connection with and/or otherwise relating to the Business and/or the Purchased Assets, trade dress, websites, including

website code, content, functionality, graphics, domain names, URLs, e-mail addresses, computer software, and all related source code

and object code, all architectural drawings, designs, templates, and sketches and related library resources available to Seller and any

excel or software templates used by Seller in the Business, all goodwill of the Business as a going concern, including lists of customers,

prospective customers, suppliers, correspondence, purchase orders, market surveys, marketing plans, marketing research, and marketing

know-how; and all general intangibles of the Business, including techniques, processes, inventions, designs, logos, databases, including

databases of historical designs, formulae, and know-how that pertain to the Business. Notwithstanding anything to the contrary contained

herein, the term “Intellectual Property” shall not include any items constituting a Retained Asset.

“Intellectual

Property Licenses” means any grant to Seller of a right to use a third Person’s Intellectual Property rights on a

royalty-free basis, including, without limitation, any Intellectual Property Licenses for the use of Intellectual Property embedded or

included in any Purchased Assets by Seller or manufacturer of such Purchased Assets.

“Law”

means any statute, law, ordinance, regulation, rule, code, constitution, treaty, common law, Order, or other requirement or rule of law

of any Governmental Authority.

“Liabilities”

means liabilities, claims, obligations, or commitments of any nature whatsoever, asserted or unasserted, known or unknown, absolute or

contingent, accrued or unaccrued, matured or unmatured, or otherwise.

“Liens”

means any “interest” as that term is used in Section 363(f) of the Bankruptcy Code, mortgage, deed of trust, pledge, assignment,

security interest, encumbrance, easement, condition, covenant, reservation, lien, mechanics lien, claim, charge, hypothecation, deemed

trust, action, easement, charge, or otherwise, or claim of any kind or nature whatsoever in respect of any property other than any Intellectual

Property License, including any of the foregoing created by, arising under, or evidenced by any conditional sale or other title retention

agreement, the interest of a lessor under a capital lease, any financing lease having substantially the same economic effect as any of

the foregoing, or the filing of a financing statement naming the owner of the property as to which such lien relates as the debtor under

the Uniform Commercial Code or any comparable Law in any other jurisdiction.

“Material

Adverse Effect” means any event, occurrence, fact, condition, prospect, or change that is, or could reasonably be expected

to become, individually or in the aggregate, materially adverse to (a) the Business or Seller; (b) the business, results of operations,

assets, Liabilities, value or condition of any one or more of the Purchased Assets; or (c) the ability of Seller or any Affiliate(s)

thereof to consummate the Transactions, or to fully perform, satisfy, and discharge all obligations, covenants, and agreements of Seller

contemplated under this Agreement or any of the other Transaction Documents, on a timely basis; provided, however, the

following shall not constitute a Material Adverse Effect and shall not be taken into account in determining whether or not there has

been or would reasonably be expected to be a Material Adverse Effect: (i) changes in general economic conditions or securities or financial

markets in general; (ii) any changes in law applicable to Seller or any of Seller’s properties or assets or interpretations thereof

by any Governmental Authority; (iii) any outbreak or escalation of hostilities or war (whether declared or not declared) or any act of

terrorism; (iv) any changes to the extent resulting from the announcement or the existence of, or Seller’s compliance with, this

Agreement and the transactions contemplated hereby; (v) any changes in accounting practices or policies that Seller is required to adopt

after the date of this Agreement; (vi) matters occurring in, or arising from the Bankruptcy Case, including any events, occurrences,

or other actions required to be taken as a result thereof; and (vii) any event, circumstance, development, change, occurrence, or effect

to the extent resulting from, arising out of, or relating to any epidemic, pandemic or disease outbreak; provided further, in

the case of clauses (i), (ii), (iii), (v), and (vii) such effects shall be taken into account in determining whether a Material Adverse

Effect has occurred to the extent that any such effects have a disproportionate adverse effect on Seller, the Business, the Purchased

Assets, or the Assumed Liabilities as compared to other similarly situated businesses.

“Order”

means any order, injunction, judgment, decree, ruling, writ, temporary or permanent restraining order, assessment, stipulation, determination,

or award of any Governmental Authority.

“Organizational

Documents” means, individually or collectively (as applicable), with respect to any Person: (i) the certificate of formation

or incorporation, articles of organization, or similar formation and charter documents; (ii) any and all joint venture, limited liability

company agreement, operating agreement, and other similar documents adopted or filed in connection with the creation, formation, incorporation,

governance, operations, management, and/or organization of such Person; and (iii) all side letters, side agreements, regulations, voting

agreements, and similar documents, instruments, or agreements relating to the governance, operations, management, and/or organization

of such Person, in each case, as amended, restated, supplemented, and/or otherwise modified.

“Outside

Date” has the meaning set forth in Section 4.2(a).

“Party”

and “Parties” have the respective meanings set forth in the Preamble.

“Permitted

Encumbrances” collectively means (i) the Encumbrances set forth on Schedule 1; (ii) Encumbrances for Taxes, assessments

and similar charges related to the Purchased Assets that are not yet due or are being contested in good faith by appropriate proceedings

and for which appropriate reserves have been established in accordance with GAAP; and (iii) that are mechanic’s, materialman’s,

carrier’s, supplier’s, vendor’s, repairer’s, or other similar Encumbrances arising in the ordinary course of

business and securing amounts that are not delinquent or are being contested in good faith.

“Permits”

has the meaning set forth in Section 5.8.

“Person”

means any individual, corporation, partnership, limited liability company, association, trust, joint stock company, unincorporated organization,

labor union, collective bargaining unit, joint venture, Governmental Authority, or other similar entity, whether or not a legal entity.

“Petition

Date” has the meaning set forth in the Recitals.

“Proceeding”

means any pending Action or other pending of any kind involving any Governmental Authority or any other Person.

“Project

Partnership” means Global First Power Limited Partnership, an Ontario limited partnership, that is not a debtor in the

Bankruptcy Case and in which all general and limited partnership interests are owned by Seller.

“Purchase

Price” collectively means the amount of (i) the Cash Consideration, minus (ii) the aggregate amount of any adjustments

made for Cure Costs actually incurred in respect of the Initial Designated Contracts.

“Purchased

Assets” has the meaning set forth in Section 2.1.

“Purchased

Equity Interests” means (i) all equity interests in the UK Project Company, (ii) all limited partnership interests in the

Project Partnership, and (iii) all general partnership interests in the Project Partnership.

“Purchased

Subsidiary” collectively means the Project Partnership and the UK Project Company.

“Representative”

means, with respect to any Person, any director, manager, officer, agent, independent contractor, consultant, advisor, Affiliate, employee,

or similar Person acting in a representative capacity for such Person.

“Retained

Assets” has the meaning set forth in Section 2.3.

“Retained

Contracts” has the meaning set forth in Section 2.3(b).

“Retained

Records” has the meaning set forth in Section 2.3(c).

“Sale

Motion” has the meaning set forth in Section 8.1(b).

“Sale

Order” has the meaning set forth in Section 8.1(b).

“Seller”

has the meaning set forth in the Preamble.

“Seller’s

Closing Certificate” has the meaning set forth in Section 4.5(a)(viii).

“Seller’s

Knowledge” or any other similar knowledge qualification in respect of Seller, means the actual knowledge of Kurt Terrani

after reasonable inquiry.

“Stalking

Horse Agreement” has the meaning set forth in the Recitals. “Stalking Horse Bidder” has the meaning

set forth in the Recitals.

“Tax

Return” means any return, declaration, report, claim for refund, information return or statement, or other document relating

to Taxes, including any schedule or attachment thereto, and including any amendment thereof.

“Taxes”

means all federal, state, local, foreign, and other income, commercial activity, gross receipts, sales, use, production, ad valorem,

transfer, franchise, registration, profits, license, lease, service, service use, withholding, payroll, employment, unemployment, estimated,

excise, severance, environmental, stamp, occupation, premium, property (real or personal), real property gains, windfall profits, customs,

duties, or other taxes, fees, assessments, or charges of any kind whatsoever, together with any interest, additions, or penalties with

respect thereto, and any interest in respect of such additions or penalties.

“Transfer

Taxes” means, to the extent not exempt under Section 1146(a) of the Bankruptcy Code in connection with the Bankruptcy Case,

all excise, sales, use, value added, registration stamp, recording, documentary, conveyance, franchise, property, transfer, and similar

Taxes, levies, charges and fees, including any interest and penalties incurred in connection with any of the Transactions.

“Transaction

Documents” means this Agreement, the Assignment and Assumption Agreement, the Bidding Procedures Order, the Sale Order,

the Intellectual Property Assignments, the Seller’s Closing Certificate, and all other agreements, instruments, certificates, and

other documents required to be executed and/or delivered by Seller pursuant to any of the foregoing documents, or otherwise in connection

with any of the contemplated Transactions.

“Transactions”

means the transactions contemplated by the Transaction Documents.

“UK

Project Company” means Ultra Safe Nuclear Corporation UK Limited, a company formed under the laws of England and

Wales, that is not a debtor in the Bankruptcy Case and in which all equity interests are owned by Seller.

“US

Contracts” has the meaning set forth in Section 2.2(e).

SECTION

2

TRANSFER

OF ASSETS

2.1

Transfer of Assets. Subject to the terms and conditions hereof, at the Closing, Seller shall sell, assign, transfer, and deliver

to Buyer, and Buyer shall purchase from Seller, all of Seller’s right, title, and interest in and to all of assets, properties,

and rights of Seller used or held for use in, or related to, the Business, including those described under this Section 2.1, wherever

located, other than the Retained Assets (collectively, the “Purchased Assets”):

(a)

the prepaid expenses, prepaid deposits, retainers, customer deposits, security deposits, and utility deposits of Seller related to any

of the Designated Contracts;

(b)

all right, title, and interest of Seller in the Designated Contracts listed on Schedule 2.2(a)-3 (as determined by Buyer in accordance

with Section 2.2);

(c)

all of the Intellectual Property owned by Seller and primarily used or held for use in the Business, including the Intellectual Property

set forth on Schedule 2.1(c);

(d)

the books, papers, records, advertising materials, studies, existing customer lists (including the names and addresses of current, past,

and prospective customers related to the Purchased Assets and/or the operation of the Business in connection therewith, together with

copies of all records, compilations, and files relating to such customers), price lists, supplier lists, drawings, designs, quality control

specifications, cost analyses, flow sheets, equipment and parts lists, depreciation schedules, process sheets, instruction manuals, employee

and accounting records, and other records of Seller relating to the Purchased Assets, the Assumed Liabilities, the Designated Contracts,

or the operation of the Business, including licensing documentation prepared for Governmental Authorities in Canada, the United States

and the United Kingdom, other than the Retained Records (collectively, the “Business Records”);

(e)

the Purchased Equity Interests;

(f)

any rights of Seller under any Bidder Confidentiality Agreements relating to the Purchased Assets or Assumed Liabilities;

(g)

all rights of Seller with respect to the Demonstration Projects;

(h)

any quality assurance programs, including any NQA-1 program, that was put in place or used in the Business; and

(i)

to the extent assignable, all right, title, and interests of Seller in the Permits.

2.2

Assignable Contracts; Designated Contracts.

(a)

Schedule 2.2(a)-1 lists all assignable Contracts that are used in, held for use in or otherwise related to the operation of the

Business (as presently conducted), and/or the use, ownership, maintenance, and operation of any of the Purchased Assets (collectively,

the “Assignable Contracts”), each of which Buyer may (but shall in no event be required to) elect to assume

and have Seller assign to Buyer. Buyer shall have until December 26, 2024 (such date being referred to herein as the “Contract

Designation Date”) to designate which of such Assignable Contracts Buyer wishes to assume and have Seller assign to Buyer

at, or, in the case of Additional Assignable Contracts, after, the Closing (collectively, the “Designated Contracts”).

Schedule 2.2(a)-2 sets forth a list of the initial Designated Contracts that Buyer has designated be assumed by and assigned to

Buyer at Closing as of the date of this Agreement (collectively, the “Initial Designated Contracts”). Schedule

2.2(a)-3 contains a list of all of the Designated Contracts, which shall be prepared by Buyer and delivered to Seller on or before

the Contract Designation Date. In all cases, appropriate additions and deletions to Schedule 2.2(a)-3 shall be made to reflect

such elections made by Buyer with respect to the Designated Contracts. Any amendment to Schedule 2.2(a)-3 pursuant to the foregoing

provisions of this Section 2.2(a) shall be served by Seller on the parties to the Assignable Contracts that have been added to

or deleted from Schedule 2.2(a)-3. For the avoidance of doubt, Buyer shall be responsible for all Cure Costs with respect to any

Designated Contracts, other than Cure Costs in respect of Initial Designated Contracts which shall be and remain obligations of Seller.

Notwithstanding the foregoing, (i) the assignment and assumption of any Additional Assignable Contracts designated by Buyer as Designated

Contracts shall be subject Seller’s delivery of a notice of assignment to the counterparties under such Additional Assignable Contracts

and determination of any applicable Cure Costs in respect of any such Additional Assignable Contracts designated as Designated Contracts,

(ii) the assignment and assumption of any Additional Assignable Contracts designated as Designated Contracts shall occur after the expiration

of any applicable notice period and entry of an Order of the Bankruptcy Court, and (iii) Seller shall provide notice of assignment of

any Additional Assignable Contracts designated as Designated Contracts to the counterparties under any such Additional Assignable Contracts

within two (2) Business Days after the Contract Designation Date.

(b)

[reserved].

(c)

Subject to Buyer providing adequate assurance of future performance to the counterparty to each Designated Contract (to the extent required

by the Bankruptcy Court), on the Closing Date, Seller shall assign to Buyer (or cause the assignment to Buyer of, as applicable), and

Buyer shall assume, the Designated Contracts, all pursuant to an Order of the Bankruptcy Court (which may be the Sale Order).

(d)

The Sale Order shall provide that, as of the Closing, Seller (as applicable) shall assign to Buyer the Designated Contracts and the Designated

Contracts shall be identified by (i) the name and date of the Designated Contracts (if available), (ii) the counterparty or counterparties

to the Designated Contract, and (iii) the address of such party for notice purposes, all included on an exhibit attached to either the

motion filed in connection with the Sale Order or a motion for authority to assume and assign such Designated Contracts or a notice filed

pursuant to the Bidding Procedures Order. Such exhibit shall also (A) set forth the amounts necessary to cure any defaults under each

of the Designated Contracts, as determined by the Bankruptcy Court, and (B) provide that Buyer is entitled to the benefit of and rights

to any security deposits in the form of cash on deposit with the counterparty or counterparties to any Designated Contract.

(e)

Notwithstanding anything contained in this Agreement to the contrary, this Agreement shall not constitute an agreement to assign or transfer

any Designated Contract or any Permit, if, notwithstanding the provisions of Sections 363 and 365 of the Bankruptcy Code, an attempt

at assignment or transfer thereof, without the consent or approval required or necessary for such assignment or transfer, would constitute

a breach thereof or in any way adversely affect any of the rights of Buyer, as the assignee or transferee of such Designated Contract

or Permit (as the case may be) thereunder. Notwithstanding the provisions of Sections 363 and 365 of the Bankruptcy Code and the commercially

reasonable efforts of Seller, if such consent or approval is required but not obtained with respect to a Designated Contract or an applicable

Permit, Buyer may (in Buyer’s sole and absolute discretion) but shall not be required to elect to proceed with the Closing, and

in the event Buyer elects to proceed with the Closing then with respect to any Designated Contract or applicable Permit for which consent

or approval is required but not obtained, Seller shall cooperate diligently and in good faith, without further consideration, with Buyer

in any commercially reasonable arrangement Buyer may request to provide Buyer with all of the benefits of, or under, the applicable Designated

Contract or applicable Permit, including enforcement for the benefit of Buyer of any and all rights of Seller against any party to the

applicable Designated Contract or applicable Permit arising out of the breach or cancellation thereof by such party; provided further,

to the extent that any such arrangement has been made to provide Buyer with the benefits of, or under, the applicable Designated Contract

or applicable Permit, from and after Closing, Buyer shall be responsible for, and shall promptly pay all payments and other Liabilities

under such Designated Contract or Permit (all of which shall constitute, and shall be deemed to be, Assumed Liabilities hereunder) to

the same extent as if such Designated Contract or such applicable Permit had been assigned or transferred at Closing (excluding Cure

Costs in respect of Initial Designated Contracts, which shall be and remain obligations of Seller); and provided further that

with respect to contracts with the United States of America (“US Contracts”) or any Permit which cannot be

assigned as a matter of law, the failure of the Seller to assign such US Contract or Permit shall not constitute a breach of this Agreement

or otherwise relieve the Buyer from its obligation to perform hereunder. Any assignment to Buyer of any Designated Contract or Permit

that shall, notwithstanding the provisions of Sections 363 and 365 of the Bankruptcy Code, require the consent or approval of any Person

for such assignment as aforesaid shall be made subject to such consent or approval being obtained.

2.3

Retained Assets. Seller shall retain Seller’s right, title, and interest in all assets, properties, and rights of Seller

in and to only the following assets, properties and rights of Seller described under this Section 2.3, wherever located (except

to the extent expressly identified as a Purchased Asset in Section 2.2) (collectively, the “Retained Assets”):

(a)

all cash, cash equivalents, marketable securities, bank accounts, and other funds of Seller;

(b)

any Contracts that are not specifically included in the Designated Contracts (collectively, the “Retained Contracts”);

(c)

all corporate books and records that are solely and directly related to the Retained Assets, such as organizational and financial documents,

minutes, stock ledgers, Tax Returns, all personnel and other records relating to Seller’s employees who do not become employees

of Buyer upon the Closing or that Seller is otherwise required by Law to retain, all records of Seller which specifically and exclusively

pertain to the Retained Assets or Excluded Liabilities, and all attorney- client privileged materials, including those related to any

of the contemplated Transactions (collectively, the “Retained Records”);

(d)

any shares of capital stock or other equity interest in or issued by Seller or any securities convertible into, exchangeable, or exercisable

for shares of capital stock or other equity interest in or issued by Seller or any records regarding same (including minute books or

stock or membership interest certificates) and shares of capital stock or equity interest of Seller in any subsidiaries or Affiliates

(other than the Purchased Equity Interests);

(e)

the rights that accrue or will accrue to Seller under this Agreement or any of the other Transaction Documents;

(f)

all Tax refunds due Seller in respect of any payment of Taxes made by, or on behalf of, Seller prior to the Closing Date, including,

for the avoidance of doubt, all employee retention tax refunds or credits arising as a result of the pre-Closing operation of the Business;

(g)

all current and prior director and officer insurance policies of Seller and all rights of any nature with respect thereto, including

all insurance recoveries thereunder and rights to assert claims with respect to any such insurance recoveries;

(h)

any security deposits or pre-paid expenses paid prior to the Closing Date and not associated with the Purchased Assets;

(i)

prepaid insurance;

(j)

all insurance policies and binders, all claims, refunds, and credits from insurance claims, insurance policies, or binders due or to

become due with respect to such policies or binders and all rights to proceeds thereof;

(k)

all Avoidance Actions; and

(l)

all litigation claims, rights, or causes of action of Seller, including, but not limited to, commercial tort claims, but excluding claims,

rights or causes of action under any Designated Contract.

SECTION

3

ASSUMPTION

OF CERTAIN LIABILITIES OF SELLER

3.1

Assumption of Certain Liabilities.

(a)

In consideration for the transfer of the Purchased Assets by Seller, Buyer shall assume only (i) those Liabilities of Seller relating

solely to the Purchased Assets (other than the Cure Costs in respect of any Designated Contracts that are Initial Designated Contracts

and the Transfer Taxes) which first arise and relate to, or become due and payable in the ordinary course of business at, any time after

the Closing and (ii) any Cure Costs in respect of Designated Contracts that are not Initial Designated Contracts (collectively, the “Assumed

Liabilities”).

(b)

ANYTHING CONTAINED HEREIN TO THE CONTRARY NOTWITHSTANDING, EXCEPT FOR THE ASSUMED LIABILITIES SPECIFICALLY DESCRIBED IN SECTION 3.1(a)

AND AS PROVIDED IN SECTION 4.7(c) AND SECTION 7.6, BUYER DOES NOT AND SHALL NOT ASSUME, AND BUYER EXPRESSLY DISCLAIMS

THE ASSUMPTION OF, ANY AND ALL LIABILITIES, TAXES, OR OBLIGATIONS (FIXED OR CONTINGENT, KNOWN OR UNKNOWN, MATURED OR UNMATURED, OR OTHERWISE)

OF SELLER OR ANY OTHER PERSON(S), WHETHER OR NOT ARISING OUT OF OR RELATING TO ANY OF THE PURCHASED ASSETS, THE BUSINESS, THE DESIGNATED

CONTRACTS, OR ANY OTHER BUSINESS OF SELLER OR ANY OTHER PERSON(S), ALL OF WHICH LIABILITIES, TAXES, AND OBLIGATIONS SHALL, AT AND AFTER

THE CLOSING, REMAIN THE EXCLUSIVE RESPONSIBILITY OF SELLER.

3.2

Excluded Liabilities. All of the Excluded Liabilities will remain the sole responsibility of Seller. The term “Excluded

Liabilities” collectively means each and every Liability of Seller and/or any Affiliate(s) of Seller (other than the Assumed

Liabilities), including, without limitation:

(a)

all Liabilities under any of the Transaction Documents;

(b)

all Liabilities for federal, state, local, or foreign Taxes, including Taxes incurred in respect of or measured by (i) the income of

Seller earned on or realized prior to the Closing Date, or (ii) any gain and income from the sale of the Purchased Assets and any of

the other Transactions;

(c)

all Liabilities under any Employee Benefit Plans or relating to payroll, vacation, sick leave, workers’ compensation, unemployment

benefits, pension benefits, employee stock option or profit-sharing plans, health care plans or benefits, or any other employee plans

or benefits of any kind for Seller’s employees, former employees, or both;

(d)

all Liabilities to indemnify any Person by reason of the fact that such Person was an officer, employee, member, manager, or other Representative

of Seller;

(e)

all Liabilities or other obligations resulting from any Proceeding relating to Seller, the Business, any of the Purchased Assets, and/or

any of the Assumed Liabilities arising out of applicable Law, transactions, actions, or omissions occurring prior to the Closing (for

the avoidance of doubt, any obligations to Governmental Authorities relating to the manufacture, distribution and sale of products by

Seller prior to the Closing shall remain the sole responsibility of Seller and any obligations to Governmental Authorities relating to

the manufacture, distribution and sale of products by Buyer after the Closing, shall be the sole responsibility of Buyer);

(f)

all Liabilities for the payment of the Cure Costs in respect of Initial Designated Contracts;

(g)

all Liabilities for the payment of the Transfer Taxes; and

(h)

all other Liabilities not set forth in Section 3.1(a).

SECTION

4

PURCHASE

PRICE

4.1

The Asset Purchase. Upon the terms and subject to the conditions set forth in this Agreement, at the Closing, Buyer hereby

agrees to purchase from Seller all of the Purchased Assets and assume all of the Assumed Liabilities and Seller hereby agrees to sell

to Buyer all of the Purchased Assets, free and clear of any and all Encumbrances other than Assumed Liabilities and Permitted Encumbrances,

for the Purchase Price.

4.2

Conditions to Buyer’s Obligations. Buyer’s obligation to make the deliveries required of Buyer at the Closing

and otherwise consummate the contemplated Transactions shall be subject to the satisfaction of each of the following conditions (unless

such condition is waived in writing by Buyer):

(a)

the Sale Order shall become a Final Order on or before January 21, 2025 (the “Outside Date”);

(b)

all of the representations and warranties of Seller contained herein shall continue to be true, correct, and complete when made and at

the Closing (except to the extent expressly made with respect to another date or period, in which case it shall be true, correct, and

complete as of such other date) in all material respects, and Seller shall have substantially performed or tendered performance of each

and every covenant on Seller’s part to be performed which, by its terms, is required to be performed at or before the Closing (including,

without limitation, Seller’s performance, in all respects, of its covenants hereunder to sell, assign, transfer, convey, and deliver

to Buyer all of Seller’s right, title, and interest in and to all Purchased Assets free and clear of all Encumbrances);

(c)

[reserved];

(d)

subject to Section 2.2(e), all of the Permits, to the extent assignable, shall have been assigned to Buyer;

(e)

[reserved];

(f)

Seller shall have tendered delivery of all items required to be delivered by Seller under Section 4.5(a);

(g)

[reserved];

(h)

subject to Section 2.2(e), the Designated Contracts shall have been assigned to Buyer; and

(i)

no Proceeding that is not stayed by the Bankruptcy Court shall be pending before any Governmental Authority seeking to restrain or prohibit

the consummation of the contemplated Transactions, or seeking to obtain substantial damages in respect thereof, or involving a claim

that consummation thereof would result in the violation of any Law of any Governmental Authority having appropriate jurisdiction.

4.3

Conditions to Seller’s Obligations. Seller’s obligation to make the deliveries required of Seller at the Closing

and otherwise consummate the contemplated Transactions shall be subject to the satisfaction of each of the following conditions (unless

such condition is waived in writing by Seller):

(a)

all of the representations and warranties of Buyer contained herein shall continue to be true, correct, and complete when made and at

the Closing (except to the extent expressly made with respect to another date or period, in which case it shall be true, correct, and

complete as of such other date) in all material respects, and Buyer shall have substantially performed or tendered performance of each

and every covenant on Buyer’s part to be performed which, by its terms, is required to be performed at or before the Closing;

(b)

no Proceeding that is not stayed by the Bankruptcy Court shall be pending before any Governmental Authority seeking or threatening to

restrain or prohibit the consummation of the contemplated Transactions, or seeking to obtain substantial damages in respect thereof,

or involving a claim that consummation thereof would result in the violation of any Law of any Governmental Authority having appropriate

jurisdiction; and

(c)

Buyer shall have tendered delivery of all items required to be delivered by Buyer under Section 4.5(b).

4.4

Closing. The closing of the Transactions (the “Closing”) shall take place via the electronic exchange

of documents upon the full satisfaction of the conditions set forth under Section 4.2, Section 4.3 and Section 4.5

(the date upon which the Closing actually occurs is herein referred to as the “Closing Date”), and the Closing

shall be effective as of 12:01 a.m. Eastern Time on the Closing Date. Notwithstanding any other provision contained in this Agreement

to the contrary, in the event the Closing does not occur on or before the Outside Date, Buyer shall have the right to elect to terminate

this Agreement, which Buyer may exercise by delivering written notice of such election to Seller at any time after the Outside Date (but

prior to the Closing).

4.5

Closing Deliveries. At the Closing:

(a)

Seller will deliver to Buyer:

(i)

[reserved]

(ii)

[reserved];

(iii)

the Assignment and Assumption Agreement, duly executed by Seller, effecting the assignment to and assumption by Buyer of the Purchased

Assets, including the Designated Contracts (other than Additional Assignable Contracts), and the Assumed Liabilities;

(iv)

[reserved];

(v)

one or more assignments, each in the form attached hereto as Exhibit B and duly executed by Seller, to effectuate and evidence

the transfer of all of Seller’s right, title, and interest in and to the Intellectual Property (including, without limitation,

the trademark registrations and applications and domain name registrations included in the Intellectual Property) to Buyer (collectively,

the “Intellectual Property Assignments”);

(vi)

subject to Section 2.2(e), all written consents required to be obtained or given by any Person in order to consummate any of the

contemplated Transactions, and a waiver of any claims on the Business or the Purchased Assets, in such form and substance reasonably

acceptable to Buyer;

(vii)

[reserved];

(viii)

a certificate from a duly-authorized and appointed manager or other officer of Seller, certifying that attached to such certificate are

true, correct, and complete copies of (A) Seller’s Organizational Documents (including, to the extent applicable, certified copies

from each applicable Governmental Authority, and each dated as of a recent date reasonably acceptable to Buyer), (B) the duly and validly

adopted resolutions of Seller’s member(s), manager(s), and general partners, being in full force and effect, authorizing the execution

and delivery by Seller of all of the Transaction Documents to which it is a party, all of the contemplated Transactions, and the performance

by Seller of its obligations under the Transaction Documents, and (C) a certificate of status, certificate of good standing, or similar

certificate for Seller issued by each applicable Governmental Authority (each dated as of a recent date reasonably acceptable to Buyer)

(the “Seller’s Closing Certificate”);

(ix)

original stock certificates representing all of the equity interests in the UK Project Company, with a duly executed stock power, or

powers of attorney duly executed or, if such stock certificates cannot be located, a lost share affidavit or other documentation, in

each instance, in a form reasonably acceptable to Buyer and necessary to transfer the equity interests in the UK Project Company to Buyer

on the books and records of the UK Project Company;

(x)

assignments or other documentation necessary to transfer the general partnership interests and limited partnership interests in the Project

Partnership, in each instance, in a form reasonably acceptable to Buyer and necessary to transfer the general partnership interests and

limited partnership interests in the Project Partnership to Buyer;

(xi)

all deliverables required to assign or issue the Permits to Buyer; and

(xii)

such other documents or instruments, in form and substance reasonably acceptable to Buyer, as Buyer may deem reasonably necessary, or

as may be required to consummate any of the contemplated Transactions.

(b)

At the Closing, Buyer shall deliver or cause to be delivered to Seller:

(i)

evidence reasonably satisfactory to Seller that Buyer has made the Cash Consideration payment required by Section 4.6;

(ii)

the Assignment and Assumption Agreement duly executed by Buyer;

(iii)

a certificate from a duly-authorized and appointed manager or other officer of Buyer, certifying that attached to such certificate are

true, correct, and complete copies of (A) Buyer’s Organizational Documents (including, to the extent applicable, certified copies

from each applicable Governmental Authority, and each dated as of a recent date reasonably acceptable to Seller), (B) the duly and validly

adopted resolutions of Buyer’s authorized governing body, being in full force and effect, authorizing the execution and delivery

by Buyer of all of the Transaction Documents to which it is a party, all of the contemplated Transactions, and the performance by Buyer

of its obligations under the Transaction Documents, and (C) a certificate of status, certificate of good standing, or similar certificate

for Buyer issued by each applicable Governmental Authority (each dated as of a recent date reasonably acceptable to Seller) (the “Buyer’s

Closing Certificate”); and

(iv)

such other documents or instruments, in form and substance reasonably acceptable to Buyer, as Buyer may deem reasonably necessary, or

as may be required to consummate any of the contemplated Transactions.

4.6

Purchase Price. The cash consideration payable at Closing by Buyer to Seller for the transfer of the Purchased Assets shall

equal $8,500,000.00 (as adjusted pursuant to Section 4.7, the “Cash Consideration”).

4.7

Payment of Purchase Price; Escrow Deposit.

(a)

Seller has established and maintained a separate escrow account (the “Escrow Account”) with Western Alliance

Bank (the “Escrow Agent”), pursuant to an escrow agreement, dated as of November 15, 2024, a copy of which

has been provided to Buyer. On December 9, 2024, Buyer made a payment of $1,000,000 to the Escrow Account as an initial deposit of a

portion of the Cash Consideration, and on December 12, 2024, Buyer made an additional deposit payment to the Escrow Account of $2,560,000,

for an aggregate deposit amount of $3,560,000 (the “Escrow Amount”). The Escrow Amount shall be held in escrow

in the Escrow Account and shall be released as follows: (i) if the Closing occurs, the Escrow Amount and shall be applied towards the

Cash Consideration payable by Buyer pursuant to Section 4.6; (ii) if the Closing does not occur due to the termination of this

Agreement pursuant to Section 8.4(c)(i), then Seller, upon notice to Buyer of such termination, shall promptly submit written

instructions to the Escrow Agent to release (i) $850,000 (the “Forfeitable Deposit Amount”) of the Escrow Amount

to Seller (and such Forfeitable Deposit Amount will be deemed fully earned by Seller as compensation and consideration for entering into

this Agreement and liquidated damages for Buyer’s breach of this Agreement) and (ii) the balance of the Escrow Amount to Buyer,

and Escrow Agent shall be required to disburse the Escrow Amount as directed by Seller in accordance with the foregoing requirements

within ten (10) days thereafter unless Buyer objects, in good faith, to such disbursements prior to the expiration of such ten-day period;

or (iii) if the Closing does not occur due to the termination of this Agreement for any reason other than pursuant to Section 8.4(c)(i),

then Buyer, upon notice to Seller, shall submit written instructions to the Escrow Agent to release the Escrow Amount to Buyer and Escrow

Agent shall be required to disburse the Escrow Amount to Buyer ten (10) days thereafter unless Seller objects, in good faith, to such

disbursement prior to the expiration of such ten-day period. The Escrow Amount shall only constitute property of Seller’s bankruptcy

estate in the event that the Escrow Amount is required to be released to Seller by the Escrow Agent in accordance with the terms of this

Agreement.

(b)

At the Closing, Buyer shall pay to Seller an amount equal to the difference of (x) the Cash Consideration less (y) the Escrow

Amount, in immediately available funds in accordance with the wire instructions delivered by Seller to Buyer in writing prior to the

Closing.

(c)

Taxes (other than Taxes imposed or assessed on income) shall be prorated between Seller and Buyer as of the Closing Date based upon the

number of days elapsed in the applicable taxable period as of the Closing Date. All ad valorem property and personal taxes payable upon

the Purchased Assets will be prorated between Seller and Buyer for the tax year in which the Closing is held, on the basis of the tax

statements for such year; provided, however, if tax statements for the current year are not available as of the Closing

Date, the tax proration between Seller and Buyer will be made on the basis of 106% of the taxes for the immediately prior tax year. Notwithstanding

anything to the contrary, the tax proration made at Closing will be a final proration between Buyer and Seller.

4.8

Allocation of Purchase Price. Within ninety (90) days after the Closing Date, Buyer shall prepare and deliver to Seller a

schedule showing the allocation of the Purchase Price and Assumed Liabilities (together with other items properly treated as purchase

price for federal income Tax purposes, including Liabilities deemed to be assumed by Buyer) (the “Allocation Schedule”).

Buyer shall provide to Seller a preliminary, non-binding Allocation Schedule based on Seller’s balance sheet dated as of October

31, 2024 (a true, complete, and accurate copy of which is attached as Schedule 4.8) no later than three (3) days prior to Closing,

and Buyer agrees to utilize the same methodologies and proportionate allocation in the final Allocation Schedule as it did in preparing

the preliminary, non-binding Allocation Schedule. Seller shall promptly adopt such Allocation Schedule as reasonably proposed by Buyer,

and both Parties shall utilize such allocations for all Tax reporting purposes and shall defend any examination or audit relating thereto

in a manner consistent with such allocation. Such allocation shall be reflected, as well, on Form 8594 (Asset Acquisition Statement under

Section 1060), which Seller and Buyer shall each file separately with the Internal Revenue Service pursuant to the requirements of Section

1060 of the Code. Any adjustment to the Purchase Price shall be allocated as provided by Treasury Regulation Section 1.1060-1(c).

SECTION

5

REPRESENTATIONS

AND WARRANTIES OF SELLER

Seller

hereby represents and warrants to Buyer that the following statements are correct and complete as of both the Effective Date and as of

the Closing:

5.1

Existence, Good Standing, and Enforceability.

(a)

Each Seller is a corporation duly formed, validly existing, and in good standing under the Law of the jurisdiction of such Seller’s

incorporation or formation and has all requisite power and authority to own and operate the Purchased Assets and to conduct the Business

as presently conducted. Schedule 5.1 sets forth Seller’s jurisdiction of organization, the other jurisdictions in which

Seller is qualified to do business. Seller is duly licensed or qualified to do business as a foreign corporation, and is in good standing

under the Law of each other jurisdiction under which such licensing or qualification is necessary pursuant to applicable Law, except

where the failure to be so licensed, qualified or in good standing would not reasonably be expected to result in a Material Adverse Effect.

(b)

Seller has the requisite corporate power and authority to execute and deliver this Agreement and the other Transaction Documents to which

it is a party, to perform Seller’s obligations hereunder and thereunder, and, subject to entry of the Sale Order, to consummate

each of the Transactions. The execution and delivery of this Agreement and the other Transaction Documents to which Seller is a party,

the performance by Seller of Seller’s obligations hereunder and thereunder, and the consummation of each of the Transactions have

been duly authorized by all requisite corporate action on the part of Seller, and, subject to entry of the Sale Order, no other authorization

or proceedings on the part of Seller is required therefor.

(c)

This Agreement has been, and each of the other Transaction Documents to which Seller is a party will be at or prior to the Closing, duly

and validly executed and delivered by Seller and (assuming due authorization, execution, and delivery by Buyer and entry of the Sale

Order) this Agreement constitutes, and each of the other Transaction Documents to which Seller is a party when so executed and delivered

will constitute, legal, valid, and binding obligations of Seller, enforceable against Seller in accordance with their respective terms.

The Person(s) signing this Agreement and the other Transaction Documents on behalf of Seller has been duly authorized to execute and

deliver this Agreement and the other Transaction Documents.

5.2

Capitalization; Subsidiaries. Schedule 5.2 sets forth the capitalization of each Purchased Subsidiary, including a list

of all officers and managers of each Purchased Subsidiary. Seller owns all of the issued and outstanding equity interests of each Purchased

Subsidiary. Seller has provided to Buyer true and correct copies of the Organizational Documents of each Purchased Subsidiary.

5.3

No Conflict. The consummation of the Transactions contemplated by this Agreement and the other Transaction Documents, or compliance

by Seller with any of the provisions thereof, after giving effect to the Sale Order, will not conflict with, or result in any violation

or breach of, or default (with or without notice or lapse of time, or both) under, or give rise to a right of termination, cancellation,

or acceleration of any obligation or to loss of a monetary, economic, or other material benefit under, or give rise to any obligation

of Seller to make any payment under, or to the increased, additional, accelerated, or guaranteed rights or entitlements of any Person

under, or result in the creation of any Liens upon any of the Purchased Assets under any provision of (a) the Organizational Documents

of Seller, (b) any Contract or Permit, (c) any Order, or (d) any applicable Law, except, in each case, where such violation, breach or

default would not reasonably be expected to result in a Material Adverse Effect. Except for entry of the Sale Order and as set forth

on Schedule 5.3, no consent, waiver, approval, Order, Permit, or authorization of, or declaration or filing with, or notification

to, any Governmental Authority or other Person is required on the part of Seller in connection with (i) the execution and delivery of

this Agreement and the other Transaction Documents, the compliance by Seller with any of the provisions hereof and thereof, or the consummation

of any of the Transactions, (ii) the transfer of the Purchased Assets, or (iii) the continuing validity and effectiveness, immediately

following the Closing, of all Designated Contracts.

5.4

Litigation. Except as set forth on Schedule 5.4-1, there has not been in the last three (3) years, and currently is

no, Proceeding pending or threatened in writing against Seller or any of the Purchased Assets. To Seller’s Knowledge, there are

no existing facts or circumstances that would reasonably be expected to result in such a Proceeding. Except as set forth on Schedule

5.4-2, Seller is not subject to any outstanding Order. Seller does not hold or possess any commercial tort claims as of the Effective

Date with respect to the Purchased Assets.

5.5

Title to Assets. Seller has good, valid, and marketable title to all the Purchased Assets, and at the Closing will deliver

the Purchased Assets free and clear of all Encumbrances other than Permitted Encumbrances. The transfer of the Purchased Assets hereunder

will convey to Buyer good, valid, and indefeasible title to the Purchased Assets, including the Purchased Equity Interests, free and

clear of all Encumbrances other than Permitted Encumbrances.

5.6

Brokers. Other than Intrepid Investment Bankers LLC (“Intrepid”), no broker, finder, investment

banker, or other Person is entitled to any brokerage, finder’s, or other fee or commission from Seller in connection with any of

the contemplated Transactions. The obligations and Liabilities for the payment of all amounts due to Intrepid hereunder shall be borne

solely by Seller.

5.7

[Reserved].

5.8

Permits. All permits, approvals, licenses, franchises, and other authorizations from any Governmental Authority or other Persons

maintained by Seller under applicable Law (i) to operate the Business, (ii) to use, own, maintain, and/or operate any of the Purchased

Assets, and/or (iii) in connection with the Designated Contracts and the Assumed Liabilities are set forth on Schedule 5.8 (collectively,

the “Permits”). At all times from and after its formation, Seller has obtained and maintained in good standing

all necessary Permits as required under applicable Law, except where the failure to maintain such Permits would not reasonably be expected

to result in a Material Adverse Effect. Seller has not received any written notice regarding the pending, threatened, or anticipated

suspension, revocation, impairment, forfeiture, cancellation, invalidation, termination, denial, or nonrenewal of any Permit and, to

Seller’s Knowledge there are no existing facts, events, or circumstances that would reasonably be expected to result in such any

such actions.

5.9

[Reserved].

5.10 Compliance.

Seller, for the immediately preceding three (3) years, (a) is and has been in compliance with all Laws, Permits, and Orders

applicable to Seller, the Business, and the Purchased Assets (including, without limitation, with respect to its employees and

independent contractors), except where any noncompliance by Seller would not reasonably be expected to result in a Material Adverse

Effect, and (b) has not been charged with, received any notice of, or to Seller’s Knowledge been under investigation or audit

with respect to any alleged default under, breach or violation of, or nonconformity with any such applicable Laws, Permits, and

Orders.

5.11

Employees. Seller has delivered a true, accurate, and complete list of all persons presently employed by Seller who are in

involved in the operation of the Business and/or the use, operation, or maintenance of any of the Purchased Assets (including any such

person who is absent from employment due to illness, vacation, injury, military service, or other authorized absence) (such persons,

together with any additional employees hired by Seller in connection with the foregoing prior to the Closing, the “Business

Employees”) indicating their: (i) employer; (ii) job title or position; (iii) principal place of employment; (iv) date

of commencement of service and seniority or service date if different than the date of commencement of service; (v) status as full-time

or part-time; (vi) status as exempt or non-exempt; (vii) base wages or salary; (viii) other remuneration, including any bonus received

or earned by any of them during the present and immediately preceding calendar year and a description of all perquisites, bonuses, and

benefits (including vacation, severance, and fringe benefits) they receive or are eligible to receive; (ix) benefit elections in effect;

and (x) leave status if absent from active employment.

(a)

With respect to the Business Employees, except as set forth on Schedule 5.11-2: (i) all Business Employees are retained

“at will”; (ii) to Seller’s Knowledge, no Business Employees intends to terminate their employment with Seller

and/or its Affiliates prior to the Closing, or not accept employment with Buyer at the Closing; (iii) to Seller’s Knowledge,

there is not in existence any pending or threatened strike, slowdown, work stoppage, picketing, interruption of work, lockout or any

other similar dispute or controversy, labor-related organizational effort, formal claim or charge of unfair labor practice, other

union- or labor-related action or other claim, or other employment dispute against Seller and/or any of its Affiliates; and (iv)

none of the Business Employees are subject to or covered by any collective bargaining agreement, arrangement, or understanding, work

rules or practice, or arbitration award, or is represented by any labor organization.

(b)

With respect to each Business Employees, Seller has copies of such Business Employee’s Form I-9 (Employment Eligibility Verification

Form) and all other records, documents, or other papers which are required to be retained with the Form I-9 by the employer pursuant

to applicable Laws.

(c)

To Seller’s Knowledge, all Business Employees are properly treated as “exempt” or “non-exempt” from overtime

requirements under applicable Law.

5.12

Insurance. Schedule 5.12 sets forth a true, accurate, and complete list of all current insurance policies maintained

by Seller relating to the conduct of the Business thereupon, and/or any of the Purchased Assets or Assumed Liabilities. All such policies

are in full force and effect (and all premiums due and payable thereon have been or will be paid in full on a timely basis), and no written

notice of cancellation, termination, nonrenewal, or other notice that any such policy is no longer in full force or effect or that the

issuer of any such policy is not willing or able to perform its obligations thereunder has been received by Seller.

DISCLAIMER;

NO OTHER WARRANTIES. EXCEPT FOR THE REPRESENTATIONS OF SELLER EXPRESSLY SET FORTH IN THIS AGREEMENT OR ANY OTHER TRANSACTION DOCUMENTS

TO WHICH SELLER IS PARTY, SELLER MAKES NO REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, AT LAW OR IN EQUITY CONCERNING ANY OF THE PURCHASED

ASSETS (INCLUDING WITH RESPECT TO MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE). EXCEPT AS EXPRESSLY SET FORTH IN THIS SECTION

5, THE PURCHASED ASSETS ARE PROVIDED “AS IS,” “WHERE IS,” AND IN “WITH ALL FAULTS” CONDITION.

SECTION

6

REPRESENTATIONS

AND WARRANTIES OF BUYER

Buyer

hereby represents and warrants to Seller that the following statements are correct and complete as of the Closing:

6.1

Organization; Authority. Buyer is a corporation duly organized, validly existing, and in good standing under the Law of the

State of Nevada, and has all requisite power and authority to acquire the Purchased Assets, to enter into this Agreement and the other

Transaction Documents, and to perform its obligations hereunder and thereunder.

6.2

Enforceability. The execution and delivery of this Agreement and the other Transaction Documents by Buyer, and the performance

of its obligations hereunder and thereunder, have been duly authorized by Buyer. Assuming due authorization, execution, and delivery

by Seller and entry of the Sale Order, this Agreement and the other Transaction Documents constitute the valid and binding obligations

of Buyer enforceable in accordance with their terms. The Person(s) signing this Agreement and the other Transaction Documents on behalf

of Buyer has been duly authorized to execute and deliver this Agreement and the other Transaction Documents.

6.3

Acknowledgement by Buyer. BUYER HEREBY ACKNOWLEDGES AND AGREES THAT, EXCEPT AS OTHERWISE EXPRESSLY PROVIDED IN THIS AGREEMENT,

SELLER MAKES NO REPRESENTATIONS OR WARRANTIES WHATSOEVER, EXPRESS OR IMPLIED, WITH RESPECT TO ANY MATTER RELATING TO THE PURCHASED ASSETS