Form 497 - Definitive materials

24 Mayo 2024 - 3:04PM

Edgar (US Regulatory)

INVESCO QQQ TRUSTSM, SERIES 1

SUPPLEMENT DATED MAY 24, 2024

TO THE PROSPECTUS DATED JANUARY 31, 2024

Effective May 28, 2024 (the “Effective Date”), the standard settlement cycle for the creation and redemption of the

Trust’s units will generally be one (1) business day after the trade date. Accordingly, the following changes are made to the Prospectus as of the Effective Date:

| |

• |

The first full paragraph on page 21 of the Prospectus, under the section

captioned “Highlights—Risk Factors,” is changed to the following: |

The time frames for delivery of Securities, cash,

or Invesco QQQ Shares in connection with creation and redemption activity within the Invesco QQQ Clearing Process as set forth herein are based on NSCC’s current “regular way” settlement period – which is generally one

(1) day during which NSCC is open for business (each such day an “NSCC Business Day”), unless as otherwise agreed to by the Trust and a Participating Party. NSCC may, in the future, reduce such “regular way” settlement

period, in which case it is anticipated that there would be a corresponding reduction or increase in settlement periods applicable to Invesco QQQ Shares creations and redemptions.

| |

• |

On page 46 of the Prospectus, the sixth sentence of the first paragraph under the section captioned

“The Trust—Procedures for Creation of Creation Units” is changed to the following: |

In such cases, the Participating

Party intending to utilize this procedure will be required to post collateral with the Trustee outside of NSCC consisting of cash at least equal to 115% of the closing value, on the day the order is deemed received, of the portion of the Portfolio

Deposit not expected to be available in the account of the Participating Party for delivery to the Trust on the first NSCC Business Day following placement of such order, as such amount

is marked-to-the-market daily by the Trustee only for increases in such value.

| |

• |

On page 46 of the Prospectus, the ninth, tenth and eleventh sentences of the first paragraph under the

section captioned “The Trust—Procedures for Creation of Creation Units” are changed to the following: |

NSCC will normally

guarantee to the Trustee the delivery of the securities portion of the Portfolio Deposit on the first NSCC Business Day following receipt of such order. Provided that the NSCC guarantee is established, the Trustee will issue the Invesco QQQ Shares

(in Creation Unit size aggregations) so ordered on such first NSCC Business Day, relying on the NSCC guarantee to make good on the delivery of the Portfolio Deposit. In the event that the required securities are not delivered on such first NSCC

Business Day, the Trustee will take steps to “buy-in” the missing portion of the Portfolio Deposit in accordance with NSCC rules.

| |

• |

On page 47 of the Prospectus, the last sentence under the section captioned “The Trust—Placement

of Creation Orders Using the Invesco QQQ Clearing Process” is changed to the following: |

Pursuant to such trade instructions from

the Trustee to NSCC, the Participating Party agrees to transfer the requisite Index Securities (or contracts to purchase such Index Securities that are expected to be delivered in a “regular way” manner through NSCC) and the Cash Component

(if required) to the Trustee, together with such additional information as may be required by the Trustee.

| |

• |

On page 47 of the Prospectus, the last sentence under the section captioned “The Trust—Placement

of Creation Orders Outside the Invesco QQQ Clearing Process” is changed to the following: |

The delivery of Invesco QQQ Shares so created generally will occur no later than the first (1st) Business Day

following the day on which the creation order is deemed received by the Distributor, unless as otherwise agreed to by the Trust and a Participating Party.

| |

• |

On page 51 of the Prospectus, the fourth and fifth sentences of the second paragraph under the section

captioned “Redemption of Invesco QQQ Shares—Procedure for Redemption of Invesco QQQ Shares” are changed to the following: |

For redemptions outside the Invesco QQQ Clearing Process, the Trustee on behalf of the Trust generally will transfer the Cash Redemption Amount (if required)

and the securities to the redeeming Beneficial Owner by the first (1st) Business Day following the date on which the request for redemption is deemed received. In cases in which the Cash Redemption Amount is payable by the redeemer to the Trustee,

the redeeming Beneficial Owner (via the DTC and the relevant DTC Participant(s)) generally is required to make payment of such cash amount by the first (1st) NSCC Business Day following the date on which the request for redemption is deemed

received.

| |

• |

On page 53 of the Prospectus, the last two sentences under the section captioned “Redemption of

Invesco QQQ Shares—Placement of Redemption Orders Using the Invesco QQQ Clearing Process” are changed to the following: |

Pursuant to such trade instructions from the Trustee to NSCC, the Trustee generally will transfer the requisite Securities (or contracts to purchase such

Securities which are expected to be delivered in a “regular way” manner through NSCC) by the first (1st) NSCC Business Day following the date on which such request for redemption is deemed received, and the Cash Redemption Amount, if any,

unless as otherwise agreed to by the Trust and a Participating Party. If the Cash Redemption Amount is owed by the Beneficial Owner to the Trustee, such amount generally must be delivered by the first (1st) NSCC Business Day following the date on

which the redemption request is deemed received.

| |

• |

On page 54 of the Prospectus, the second paragraph under the section captioned “Redemption of Invesco QQQ

Shares—Placement of Redemption Orders Outside the Invesco QQQ Clearing Process” is changed to the following: |

The Trustee

generally will initiate procedures to transfer the requisite Securities and the Cash Redemption Amount to the redeeming Beneficial Owner (where such amount is payable from the Trustee to the Beneficial Owner) by the first (1st) Business Day

following the Transmittal Date on which such redemption order is deemed received by the Trustee.

| |

• |

On page 56 of the Prospectus, the fourth sentence of the fifth paragraph under the section captioned “The

Portfolio—Adjustments to the Portfolio” is changed to the following: |

Specifically, the Trustee is required to adjust the

composition of the Portfolio at any time that there is a change in the identity of any Index Security (i.e., a substitution of one security in replacement of another), which adjustment is to be made within one (1) Business Day before or after

the day on which the change in the identity of such Index Security is scheduled to take effect at the close of the market.

| |

• |

On page 57 of the Prospectus, the fourth sentence of the seventh paragraph under the section captioned

“The Portfolio—Adjustments to the Portfolio” is changed to the following: |

In the case of any adjustment to the Portfolio due to a Misweighting as described herein, the purchase or sale of

securities necessitated by such adjustment shall be made within one (1) Business Day of the day on which such Misweighting is determined.

| |

• |

Beginning on page 58 of the Prospectus, the 13th paragraph under the section captioned “The

Portfolio—Adjustments to the Portfolio” is changed to the following: |

The Trustee relies on information made publicly

available by Nasdaq as to the composition and weighting of the Index Securities. If the Trustee becomes incapable of obtaining or processing such information or NSCC is unable to receive such information from the Trustee on any Business Day, then

the Trustee shall use the composition and weighting of the Index Securities for the most recently effective Portfolio Deposit for the purposes of all adjustments and determinations described herein (including, without limitation, determination of

the securities portion of the Portfolio Deposit) until the earlier of (a) such time as current information with respect to the Index Securities is available or (b) one (1) Business Day has elapsed. If such current information is not

available and one (1) Business Days has elapsed, the composition and weighting of the Securities (as opposed to the Index Securities) shall be used for the purposes of all adjustments and determinations herein (including, without limitation,

determination of the securities portion of the Portfolio Deposit) until current information with respect to the Index Securities is available.

Please Retain This Supplement For Future Reference.

P-QQQ-PRO-SUP-1

052424

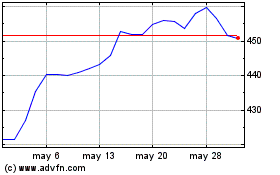

Invesco QQQ Trust Series 1 (NASDAQ:QQQ)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Invesco QQQ Trust Series 1 (NASDAQ:QQQ)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024