false

0001442236

0001442236

2024-08-12

2024-08-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of

earliest event reported): August 12, 2024

QUEST RESOURCE HOLDING

CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| Nevada |

|

001-36451 |

|

51-0665952 |

| (State or other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| 3481 Plano Parkway, The Colony, Texas |

|

75056 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (972) 464-0004

| |

| (Former name or former address if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the follow provisions:

☐ Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, $0.001 par value |

QRHC |

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 12, 2024, the Compensation Committee

of the Board of Directors (the “Compensation Committee”) of Quest Resource Holding Corporation (the “Company”)

approved the Company’s Long-Term Incentive Plan (the “2024 LTIP”), in which the Company’s named executive officers

and other key officers may participate. Under the 2024 LTIP, the participants are eligible to be granted performance stock units (“PSUs”)

and any such PSUs will be issued pursuant to and subject to the terms of the Company’s stockholder-approved 2024 Incentive Compensation

Plan and the form of Performance Stock Unit Award Agreement thereunder (the “Award Agreement”).

The PSUs will settle in common stock following

the end of a three-year performance and service period. The number of shares of common stock a participant will be eligible to receive

following such period will be determined based on the actual performance level achieved, either at threshold, target or the maximum level

as set forth in the applicable Award Agreement for such performance period, and the applicable payout percentage, which would be 50% at

threshold, 100% at target and 200% at maximum performance level with straight-line interpolations between threshold and target and target

and maximum. Any earned PSUs will be fully vested and paid following the end of the three-year performance period, with a target payment

date of March 15, 2027, subject to adjustment in accordance with the terms of the 2024 LTIP and the form of Award Agreement.

The Compensation Committee will retain the authority

to administer the 2024 LTIP and to exercise discretion in connection with awards and other determinations made thereunder. The foregoing

summary of the 2024 LTIP does not purport to be complete and is qualified in its entirety by reference to the complete text of the form

of Award Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

On August 12, 2024, in connection with the approval

of the 2024 LTIP, the Compensation Committee approved the following PSU awards for its named executive officers: (i) 30,000 PSUs to S.

Ray Hatch; (ii) 25,000 PSUs to David P. Sweitzer; and (iii) 20,000 PSUs to Brett W. Johnston.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

QUEST RESOURCE HOLDING CORPORATION |

|

| |

|

|

| |

|

|

|

|

| Dated: August 16, 2024 |

By: |

/s/ Brett W. Johnston |

|

| |

|

Name: |

Brett W. Johnston |

|

| |

|

Title: |

Senior Vice President of Finance and Chief Financial Officer |

|

Exhibit 10.1

PERFORMANCE STOCK UNIT AWARD AGREEMENT

This Performance Stock Unit Agreement (this “Agreement”),

dated as of the Grant Date set forth in the Performance Stock Unit Award Grant Notice (the “Grant Notice”), is made

between Quest Resource Holding Corporation (the “Company”) and the Participant. The Grant Notice is included in, and

made part of, this Agreement.

ARTICLE 1

GENERAL

1.1.

Defined Terms. Capitalized terms not specifically defined in this Agreement shall have the meanings specified in the Company’s

2024 Incentive Compensation Plan (the “Plan”) and the Grant Notice, as applicable.

1.2.

Incorporation of Terms of Plan. The PSUs are subject to the terms and conditions of the Plan, which are incorporated herein

by reference. In the event of any inconsistency between the Plan and this Agreement, the terms of the Plan shall control.

ARTICLE 2

PERFORMANCE CRITERIA AND AWARD DETERMINATION

2.1. Target Award Grant. Subject to the provisions of this Agreement and the Plan, the Company hereby grants to Participant the

number of performance stock units (the “Performance Stock Units” or “PSUs”) set forth in the Grant

Notice (the “Target Award”).

2.2. Final Award Determination. At the end of the Performance Period set forth in the Grant Notice and subject to the achievement

of the performance metrics set forth in the Grant Notice and further referenced in Section 2.3 (the “Performance Metrics”),

the Participant shall be entitled to receive that number of shares of common stock equal to (i) the Target Award, multiplied by (ii) the

Payout Percentage (as hereinafter defined) (the “Final Award”). The Payout Percentage shall be calculated with reference

to Section 2.3 after the achievement of the Performance Metrics are certified in writing by the Compensation Committee of the Company’s

Board of Directors (the “Committee”) following completion of the audit of the Company’s financial statements

for the period ending on the last day of the Performance Period.

2.3. Performance Metrics. The Performance Metrics are based on “Cumulative Adjusted EBITDA”, which shall

be determined by adding the Company’s cumulative earnings before interest, taxes, depreciation and amortization, for the fiscal

years covered by the Performance Period, as set forth in the Grant Notice. The Committee has established the threshold, target

and maximum values for each Performance Metric, which are set forth in the Grant Notice. The total number of PSUs earned, if any, shall

be the amounts earned as calculated in accordance with Section 2.2 with respect to the Performance Metrics.

The Committee may, in its sole discretion, modify

such threshold, target and maximum values for any Performance Metric to account for changed circumstances in the Company’s business

occurring during the Performance Period, including, without limitation, acquisitions, new lines of business, divestitures, audit adjustments

or changes in business lines.

2.4. Performance Period. The Performance Period, for purposes of this Agreement, shall be determined by the Committee and shall

be the period set forth in the Grant Notice.

2.5. Settlement of Final Award. As soon as reasonably practicable following the expiration of the Performance Period and with

a target date of no later than March 15 of the year following the year in which the Performance Period ends, subject to adjustment or

extension as needed, the Committee shall certify the achievement of the Performance Metrics, determine the Final Award earned by the Participant

and issue shares of common stock to the Participant in the amount of the Final Award.

2.6. Consideration to the Company. In consideration of the grant of the award of PSUs pursuant hereto, the Participant agrees

to render faithful and efficient services to the Company or any Subsidiary in compliance with any applicable employment agreement, offer

letter, and non-competition or non-solicitation agreement.

2.7. Forfeiture, Termination and Cancellation upon Termination of Service. Notwithstanding any contrary provision of this Agreement

or the Plan, upon the Participant’s termination of Continuous Service for any or no reason (other than in connection with a Change

in Control), any PSUs that have not been earned shall thereupon automatically be forfeited, terminated and cancelled as of the applicable

termination date without payment of any consideration by the Company, and the Participant, or the Participant’s beneficiary or personal

representative, as the case may be, shall have no further rights hereunder. No portion of the PSUs which have not been earned as of the

date on which the Participant incurs a termination of Continuous Service shall thereafter become vested.

2.8. Conditions to Delivery of Shares. The Shares deliverable hereunder may be either previously authorized but unissued Shares,

treasury Shares or issued Shares which have then been reacquired by the Company. Such Shares shall be fully paid and nonassessable. The

Participant shall, as of the date hereof, be an Eligible Person as defined in the Plan and must be providing Continuous Service to the

Company through the Final Payment Date to be eligible to receive the full Final Award, unless otherwise determined by the Committee in

its sole discretion.

2.9. Rights as Stockholder. The holder of the PSUs shall not be, nor have any of the rights or privileges of, a stockholder of

the Company, including, without limitation, voting rights and rights to dividends, in respect of the PSUs and Shares that may be issued

following the Performance Period in connection with a Final Award unless and until such Shares shall have been issued by the Company and

held of record by such holder (as evidenced by the appropriate entry on the books of the Company or of a duly authorized transfer agent

of the Company). No adjustment shall be made for a dividend or other right for which the record date is prior to the date the Shares are

issued, except as provided in Section 9(c) of the Plan.

2.10. No Effect on Capital Structure. No award or right granted under this Agreement shall affect the right of the Company or

any Subsidiary to reclassify, recapitalize or otherwise change its capital or debt structure or to merge, consolidate, convey any or all

of its assets, dissolve, liquidate, windup, or otherwise reorganize.

2.11. Change In Control. In the event of a Change in Control at any time prior to the end of the Performance Period, the PSUs

shall be accelerated and deemed fully vested as of the date of the Change in Control and the Final Award shall be calculated based on

the target performance value, unless either (i) the Company is the surviving entity in the Change in Control and the PSU Award continues

to be outstanding after the Change in Control on substantially the same terms and conditions as were applicable immediately prior to the

Change in Control or (ii) the successor company assumes or substitutes for the PSU Award, as determined in accordance with Section 9(c)(ii)

of the Plan.

ARTICLE 3

OTHER PROVISIONS

3.1. Administration. The Committee shall have the power to interpret the Plan and this Agreement and to adopt such rules for

the administration, interpretation and application of the Plan as are consistent therewith and to interpret, amend or revoke any such

rules. All actions taken and all interpretations and determinations made by the Committee in good faith shall be final and binding upon

the Participant, the Company and all other interested persons. No member of the Committee or the Board shall be personally liable for

any action, determination or interpretation made in good faith with respect to the Plan, this Agreement or the PSUs.

3.2. PSUs Not Transferable. The PSUs shall be subject to the restrictions on transferability set forth in Section 9(b) of the

Plan.

3.3. Tax Consultation. The Participant understands that the Participant may suffer adverse tax consequences in connection with

the PSUs granted pursuant to this Agreement and the Shares issuable with respect thereto. The Participant represents that the Participant

has consulted with any tax consultants the Participant deems advisable in connection with the PSUs and the issuance of Shares with respect

thereto and that the Participant is not relying on the Company for any tax advice.

3.4. Binding Agreement. Subject to the limitation on the transferability of the PSUs contained in this Agreement, this Agreement

will be binding upon and inure to the benefit of the heirs, legatees, legal representatives, successors and assigns of the parties hereto.

3.5. Notices. Any notice to be given under the terms of this Agreement to the Company shall be addressed to the Company in care

of the Secretary of the Company at the Company’s principal office, and any notice to be given to the Participant shall be addressed

to the Participant at the Participant’s last address reflected on the Company’s records. By a notice given pursuant to this

Section 3.5, either party may hereafter designate a different address for notices to be given to that party. Any notice shall be deemed

duly given when sent via email or when sent by certified mail (return receipt requested) and deposited (with postage prepaid) in a post

office or branch post office regularly maintained by the United States Postal Service.

3.6. Participant’s Representations. If the Shares issuable hereunder have not been registered under the Securities Act

of 1933, as amended (the “Securities Act”) or any applicable state laws on an effective registration statement at the

time of such issuance, the Participant shall, if required by the Company, concurrently with such issuance, make such written representations

as are deemed necessary or appropriate by the Company or its counsel.

3.7. Titles. Titles are provided herein for convenience only and are not to serve as a basis for interpretation or construction

of this Agreement.

3.8. Governing Law. The laws of the State of Nevada shall govern the interpretation, validity, administration, enforcement and

performance of the terms of this Agreement regardless of the law that might be applied under principles of conflicts of laws.

3.9. Conformity to Securities Laws. The Participant acknowledges that the Plan and this Agreement are intended to conform to

the extent necessary with all provisions of the Securities Act and the Exchange Act and any other applicable law. Notwithstanding anything

herein to the contrary, the Plan shall be administered, and the PSUs are granted, only in such a manner as to conform to applicable law.

To the extent permitted by applicable law, the Plan and this Agreement shall be deemed amended to the extent necessary to conform to such

applicable law.

3.10. Amendment, Suspension and Termination. The Committee may waive any conditions or rights under, or amend, alter, suspend,

discontinue or terminate this Award or this Agreement, except as otherwise provided in the Plan; provided that, except as otherwise permitted

by the Plan or this Agreement, without the consent of the Participant, no such Committee or Board action may materially and adversely

affect the rights of the Participant under terms of such Award.

3.11. Successors and Assigns. The Company may assign any of its rights under this Agreement to single or multiple assignees, and

this Agreement shall inure to the benefit of the successors and assigns of the Company.

3.12. Limitations Applicable to Section 16 Persons. Notwithstanding any other provision of the Plan or this Agreement, if the

Participant is subject to Section 16 of the Exchange Act, then the Plan, the PSUs and Shares issued in connection with a Final Award and

this Agreement shall be subject to any additional limitations set forth in any applicable exemptive rule under Section 16 of the Exchange

Act (including any amendment to Rule 16b-3 of the Exchange Act) that are requirements for the application of such exemptive rule. To the

extent permitted by applicable law, this Agreement shall be deemed amended to the extent necessary to conform to such applicable exemptive

rule.

3.13. Not a Contract of Service Relationship. Nothing in this Agreement or in the Plan shall confer upon Participant any right

to continue to serve as an employee or other service provider of the Company or any of its Subsidiaries or interfere with or restrict

in any way with the right of the Company or any of its Subsidiaries, which rights are hereby expressly reserved, to discharge or to terminate

for any reason whatsoever, with or without cause, the services of the Participant at any time.

3.14. Entire Agreement. The Plan, the Grant Notice and this Agreement (including all Schedules thereto, if any) constitute the

entire agreement of the parties and supersede in their entirety all prior undertakings and agreements of the Company and the Participant

with respect to the subject matter hereof.

3.15. Section 409A. This Award is not intended to constitute “nonqualified deferred compensation” within the meaning

of Section 409A of the Code (together with any Department of Treasury regulations and other interpretive guidance issued thereunder, including

without limitation any such regulations or other guidance that may be issued after the date hereof, “Section 409A”).

However, notwithstanding any other provision of the Plan, the Grant Notice or this Agreement, if at any time the Committee determines

that this Award (or any portion thereof) may be subject to Section 409A, the Committee shall have the right in its sole discretion (without

any obligation to do so or to indemnify Participant or any other person for failure to do so) to adopt such amendments to the Plan, the

Grant Notice or this Agreement, or adopt other policies and procedures (including amendments, policies and procedures with retroactive

effect), or take any other actions, as the Committee determines are necessary or appropriate for this Award either to be exempt from the

application of Section 409A or to comply with the requirements of Section 409A.

3.16. Limitation on Participant’s Rights. Participation in the Plan confers no rights or interests other than as provided

in this Agreements. This Agreement creates only a contractual obligation on the part of the Company as to amounts payable and shall not

be construed as creating a trust. Neither the Plan nor any underlying program, in and of itself, has any assets. The Participant shall

have only the rights of a general unsecured creditor of the Company and its Subsidiaries with respect to amounts credited and benefits

payable, if any, with respect to the PSUs and Shares, as and when payable under this Agreement.

* * * * *

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

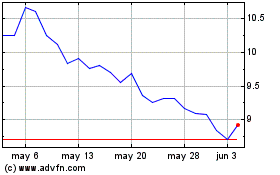

Quest Resource (NASDAQ:QRHC)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Quest Resource (NASDAQ:QRHC)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025