Performance Includes 176% Increase in Revenue

and Operating Profit Milestone

Soluna Holdings, Inc. (“SHI” or the “Company”), (NASDAQ: SLNH),

the parent company of Soluna Computing, Inc. (“SCI”), a developer

of green data centers for Bitcoin mining and other intensive

computing applications, reported financial results for the third

quarter ended September 30, 2023.

John Belizaire, CEO of Soluna Holdings, said, “We are delighted

to announce the successful completion of Project Dorothy 1B,

marking a significant milestone for Project Dorothy. The project is

now fully operational, and we are witnessing the tangible impact of

its earnings potential.”

Belizaire went further on to say, “Our dedicated team has

demonstrated exceptional execution across our four strategic focus

areas, as outlined in our shareholder letter: the energizing of

Project Dorothy, Cash Flow and Expense Management, Expanding our

Flagship, and Growing our Pipeline. The business transition

initiated in Q2 is yielding positive results, evident in our latest

financials. Despite the challenges posed by the summer heat in

Texas and Kentucky, our team's focused and meticulous efforts have

propelled us to our first quarter of gross profit and substantial

business growth from earlier lows.”

Belizaire concluded by saying, “With Project Dorothy 2 on the

immediate horizon, Project Kati setting up its robust earnings

power and the vast potential of AI at our doorstep, we have a solid

foundation for future growth.”

Finance and Operational Highlights:

Substantial cash balance - The

unrestricted cash balance as of September 30, 2023, was $5.6

million compared to $1.1 million as of December 31, 2022. This

is driven by new project-level investments, operational execution,

and expense management measures implemented in the first half of

the year.

EBITDA Milestone - The Company

achieved a positive Adjusted EBITDA for the first time since second

quarter 2022.

Revenue Ramp - Revenue in the third

quarter increased by 176% to $5.8 million compared to $2.1

million in the second quarter of 2023. The revenue increase is

driven by the continued ramp in the Project Dorothy sites,

including hosting and proprietary mining.

Project Dorothy 1A and 1B fully operational as of October 31

2023 - Installed hashrate of 1.76 EH/s in Project Dorothy 1A/1B

fully and it is fully operational. This brings the Company’s total

installed hashrate to 2.6 EH/s. Project Dorothy consumed over

4,000 MWh of curtailed energy through the end of October

solidifying the effectiveness of Soluna’s innovative solution to

monetizing curtailed energy.

Ancillary services revenue - The

Company completed its pre-registration for Ancillary Services with

ERCOT, bringing it closer to diversifying its revenue by having

Project Dorothy serve as a grid resource.

As of the end of the third quarter of 2023, Soluna deployed over

23,600 bitcoin miners (between hosting and prop mining) across all

sites. And, the Company operated at an average hashrate of 2.4 EH/s

across all sites as Project Dorothy became fully energized by late

summer.

AI initiative - The Company

launched a new initiative focused on a new data center

purpose-built for AI training workloads. The new design, code-named

“Helix”, will be part of Project Dorothy 2; due to start in the

first quarter of 2024. The Company also formed a new Advisory Board

to accelerate the Company’s AI initiatives and tapped Daniel

Golding, a former head of advanced engineering and data center

innovation at Google.

Financial Summary:

Key financial results for the third quarter include:

2023 Revenue By Quarter (in thousands) Revenue Q1 2023

Q2 2023 Q3 2023 YTD 2023 Data hosting revenue

$

286

$

1,153

$

4,011

$

5,451

Cryptocurrency mining revenue

2,796

915

1,786

5,497

Total revenue

$

3,082

$

2,068

$

5,797

$

10,948

*may not foot due to rounding

- Total revenue in the third quarter

of 2023 increased by 176% to $5.8 million compared to

$2.1 million in the second quarter of 2023. The increase is

primarily attributable to the ramping of Project Dorothy,

commissioning of proprietary mining and continued ramping of

hosting revenues.

2023 Gross Profit by Quarter (in thousands) Gross Profit Q1 2023 Q2

2023 Q3 2023 YTD Cryptocurrency mining revenue

$

2,796

$

915

$

1,786

$

5,497

Data Hosting Revenue

286

1,153

4,011

5,451

Total Revenue

3,082

2,068

5,797

10,948

Cost of cryptocurrency mining revenue, exclusive of depreciation

2,252

1,160

1,040

4,452

Cost of data hosting mining revenue, exclusive of depreciation

272

759

2,150

3,181

Cost of revenue - depreciation

625

539

1,200

2,364

Total cost of revenue

3,149

2,458

4,390

9,997

Gross Profit

$

(67

)

$

(390

)

$

1,407

$

950

*certain prior quarter amounts have been reclassified for

consistency in the current quarter presentation

- Gross profit improved to

$1.4 million in the third quarter of 2023, as

compared to $(390) thousand in the second quarter of 2023.

- General and Administrative,

exclusive of depreciation and amortization expenses, decreased by

52% to $2.7 million in the third quarter of

2023, as compared to $5.7 million in the third quarter of 2022,

primarily due to cost reductions related to salaries and benefits,

and reduced consulting and professional fees.

- Stock compensation expense during

the third quarter of 2023 was $595 thousand versus $890 thousand in

the third quarter of 2022.

- Net loss from continuing

operations improved to $6.0 million in the third quarter of

2023 from $56.2 million in the third quarter of 2022.

2023 Adjusted EBITDA by Quarter (in thousands) Q1 2023

Q2 2023 Q3 2023 YTD 2023 Net Loss

$

(7,432

)

$

(9,257

)

$

(6,016

)

$

(22,705

)

(+) Interest expense

1,374

486

495

2,355

(+) Income taxes

(547

)

(547

)

569

(524

)

(+) Depreciation and amortization

3,002

2,918

3,579

9,498

EBITDA Table

$

(3,603

)

$

(6,400

)

$

(1,373

)

$

(11,376

)

Adjustments non-cash

Stock based compensation

879

2,232

595

3,709

(Gain) loss on sale of fixed assets

78

(48

)

373

404

Impairment on fixed assets

209

169

41

418

Debt extinguishment and revaluation

(473

)

2,054

769

2,350

Adjusted EBITDA

$

(2,910

)

$

(1,993

)

$

405

(4,495

)

*may not foot due to rounding

- Adjusted EBITDA positive - The

measure improved to $405 thousand in the third quarter of 2023,

as compared to $(2.0) million in the second quarter of 2023 and

$(2.9) million in the first quarter of 2023, a quarter over quarter

improvement.

The unaudited financial statements are available online. A

presentation of this Third Quarter Update can also be

found online.

Safe Harbor Statement

This announcement contains forward-looking statements. These

statements are made under the "safe harbor" provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

"will," "expects," "anticipates," "future," "intends," "plans,"

"believes," "estimates," "confident" and similar statements. Soluna

Holdings, Inc. may also make written or oral forward-looking

statements in its periodic reports to the U.S. Securities and

Exchange Commission, in its annual report to shareholders, in press

releases and other written materials and in oral statements made by

its officers, directors or employees to third parties. Statements

that are not historical facts, including but not limited to

statements about Soluna’s beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties, further information regarding

which is included in the Company's filings with the Securities and

Exchange Commission. All information provided in this press release

is as of the date of the press release, and Soluna Holdings, Inc.

undertakes no duty to update such information, except as required

under applicable law.

In addition to figures prepared in accordance with GAAP, Soluna

from time to time presents alternative non-GAAP performance

measures, e.g., EBITDA, adjusted EBITDA, adjusted net profit/loss,

adjusted earnings per share, free cash flow. These measures should

be considered in addition to, but not as a substitute for, the

information prepared in accordance with GAAP. Alternative

performance measures are not subject to GAAP or any other generally

accepted accounting principle. Other companies may define these

terms in different ways.

About Soluna Holdings, Inc (SLNH)

Soluna Holdings, Inc. is the leading developer of green data

centers that convert excess renewable energy into global computing

resources. Soluna builds modular, scalable data centers for

computing intensive, batchable applications such as Bitcoin mining,

AI, and machine learning. Soluna provides a cost-effective

alternative to battery storage or transmission lines. Soluna uses

technology and intentional design to solve complex, real-world

challenges. Up to 30% of the power of renewable energy projects can

go to waste. Soluna’s data centers enable clean electricity asset

owners to ‘Sell. Every. Megawatt.’

Soluna Holdings, Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets

As of September 30, 2023

(Unaudited) and December 31, 2022

(Dollars in thousands, except per

share)

September 30,

December 31,

2023

2022

Assets

Current Assets:

Cash

$

5,625

$

1,136

Restricted cash

3,428

685

Accounts receivable

2,024

320

Notes receivable

446

219

Prepaid expenses and other current

assets

1,593

1,107

Deposits and credits on equipment

975

1,175

Equipment held for sale

248

295

Total Current Assets

14,339

4,937

Restricted cash

1,000

-

Other assets

2,957

1,150

Property, plant and equipment,

net

45,938

42,209

Intangible assets, net

29,370

36,432

Operating lease right-of-use

assets

483

233

Total Assets

$

94,087

$

84,961

Liabilities and Stockholders’

Equity

Current Liabilities:

Accounts payable

$

3,005

$

3,548

Accrued liabilities

4,447

2,721

Line of credit

-

350

Convertible notes payable

10,796

11,737

Current portion of debt

9,053

10,546

Deferred revenue

-

453

Operating lease liability

215

161

Total Current Liabilities

27,516

29,516

Other liabilities

1,497

203

Long-term debt

1,050

-

Operating lease liability

273

84

Deferred tax liability, net

8,362

8,886

Total Liabilities

38,698

38,689

Commitments and Contingencies (Note

10)

-

-

Stockholders’ Equity:

9.0% Series A Cumulative Perpetual

Preferred Stock, par value $0.001 per share, $25.00 liquidation

preference; authorized 6,040,000; 3,061,245 shares issued and

outstanding as of September 30, 2023 and December 31, 2022

3

3

Series B Preferred Stock, par value

$0.0001 per share, authorized 187,500; 62,500 shares issued and

outstanding as of September 30, 2023 and December 31, 2022

—

—

Common stock, par value $0.001 per share,

authorized 75,000,000; 1,492,729 shares issued and 1,451,988 shared

outstanding as of September 30, 2023 and 788,578 shares issued and

747,837 shares outstanding as of December 31, 2022(1)

1

1

Additional paid-in capital

286,799

277,429

Accumulated deficit

(244,268

)

(221,769

)

Common stock in treasury, at cost, 40,741

shares at September 30, 2023 and December 31, 2022(1)

(13,798

)

(13,798

)

Total Soluna Holdings, Inc.

Stockholders’ Equity

28,737

41,866

Non-Controlling Interest

26,652

4,406

Total Stockholders’ Equity

55,389

46,272

Total Liabilities and Stockholders’

Equity

$

94,087

$

84,961

(1) Prior period results have been adjusted to reflect the Reverse

Stock Split of the Common Stock at a ratio of 1-for-25 that became

effective October 13, 2023.

Soluna Holdings, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Operations (Unaudited)

For the Three and Nine Months

Ended September 30, 2023 and 2022

(Dollars in thousands, except per

share)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Cryptocurrency mining revenue

$

1,786

$

5,387

$

5,497

$

20,696

Data hosting revenue

4,011

985

5,451

3,668

Total revenue

5,797

6,372

10,948

24,364

Operating costs:

Cost of cryptocurrency mining revenue,

exclusive of depreciation

1,040

4,100

4,451

11,092

Cost of data hosting revenue, exclusive of

depreciation

2,150

1,078

3,181

3,192

Costs of revenue- depreciation

1,200

6,010

2,364

15,872

Total costs of revenue

4,390

11,188

9,996

30,156

Operating expenses:

General and administrative expenses,

exclusive of depreciation and amortization

2,723

5,686

11,219

15,441

Depreciation and amortization associated

with general and administrative expenses

2,379

2,378

7,134

7,127

Total general and administrative

expenses

5,102

8,064

18,353

22,568

Impairment on equity investment

-

750

-

750

Impairment on fixed assets

41

28,086

418

28,836

Operating loss

(3,736

)

(41,716

)

(17,819

)

(57,946

)

Interest expense

(495

)

(1,671

)

(2,355

)

(7,856

)

Loss on debt extinguishment and

revaluation, net

(769

)

(12,317

)

(2,350

)

(12,317

)

Loss on sale of fixed assets

(373

)

(988

)

(404

)

(2,606

)

Other (expense) income, net

(74

)

2

(301

)

2

Loss before income taxes from continuing

operations

(5,447

)

(56,690

)

(23,229

)

(80,723

)

Income tax (expense) benefit from

continuing operations

(569

)

547

524

1,344

Net loss from continuing operations

(6,016

)

(56,143

)

(22,705

)

(79,379

)

Income before income taxes from

discontinued operations

-

(21

)

-

7,681

Income tax benefit from discontinued

operations

-

-

-

70

Net income from discontinued

operations

-

(21

)

-

7,751

Net loss

(6,016

)

(56,164

)

(22,705

)

(71,628

)

(Less) Net (income) loss attributable to

non- controlling interest

(646

)

272

206

272

Net loss attributable to Soluna Holdings,

Inc.

$

(6,662

)

$

(55,892

)

$

(22,499

)

$

(71,356

)

Basic and Diluted (loss) earnings per

common share:

Net loss from continuing operations per

share (Basic & Diluted) (1)

$

(4.40

)

$

(95.49

)

$

(20.11

)

$

(146.46

)

Net income from discontinued operations

per share (Basic & Diluted) (1)

$

-

$

(0.04

)

$

-

$

13.64

Basic & Diluted loss per share (1)

$

(4.40

)

$

(95.53

)

$

(20.11

)

$

(132.82

)

Weighted average shares outstanding (Basic

and Diluted) (1)

1,374,364

587,921

1,149,745

568,307

(1) Prior period results have been

adjusted to reflect the Reverse Stock Split of the Common Stock at

a ratio of 1-for-25 that became effective October 13, 2023.

Soluna Holdings, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Cash Flows (Unaudited)

For the Nine Months Ended

September 30, 2023 and 2022

(Dollars in thousands)

Nine Months Ended September

30,

2023

2022

Operating Activities

Net loss

$

(22,705

)

$

(71,628

)

Net income from discontinued

operations

-

(7,751

)

Net loss from continuing operations

(22,705

)

(79,379

)

Adjustments to reconcile net loss to net

cash (used in) provided by operating activities:

Depreciation expense

2,387

15,888

Amortization expense

7,111

7,111

Stock-based compensation

3,640

2,747

Consultant stock compensation

69

121

Deferred income taxes

(524

)

(1,344

)

Impairment on fixed assets

418

28,836

Amortization of operating lease asset

177

151

Impairment on equity investment

-

750

Loss on debt extinguishment and

revaluation, net

2,350

12,317

Amortization on deferred financing costs

and discount on notes

748

6,630

Loss on sale of fixed assets

404

2,606

Changes in operating assets and

liabilities:

Accounts receivable

(1,552

)

(1,498

)

Prepaid expenses and other current

assets

(484

)

(154

)

Other long-term assets

(307

)

(69

)

Accounts payable

551

884

Deferred revenue

(453

)

118

Operating lease liabilities

(172

)

(148

)

Other liabilities

1,294

(306

)

Accrued liabilities

2,644

(382

)

Net cash (used in) provided by operating

activities

(4,404

)

(5,121

)

Net cash provided by operating activities-

discontinued operations

-

369

Investing Activities

Purchases of property, plant, and

equipment

(12,534

)

(61,867

)

Purchases of intangible assets

(49

)

(114

)

Proceeds from disposal on property, plant,

and equipment

2,266

2,525

Deposits and credits on equipment, net

200

6,441

Net cash used in investing activities

(10,117

)

(53,015

)

Net cash provided by investing activities-

discontinued operations

-

9,004

Financing Activities

Proceeds from preferred offerings

-

16,658

Proceeds from common stock securities

purchase agreement offering

817

-

Proceeds from notes and debt issuance

3,100

29,736

Costs of preferred offering

-

(1,910

)

Costs of common stock securities purchase

agreement offering

(10

)

-

Costs and payments of notes and short-term

debt issuance

(510

)

(2,428

)

Cash dividend distribution on preferred

stock

-

(3,852

)

Payments on NYDIG loans and line of

credit

(350

)

(3,841

)

Contributions from non-controlling

interest

19,706

4,293

Proceeds from stock option exercises

-

153

Proceeds from common stock warrant

exercises

-

779

Net cash provided by financing

activities

22,753

39,588

Increase (decrease) in cash &

restricted cash-continuing operations

8,232

(18,548

)

Increase in cash & restricted cash-

discontinued operations

-

9,373

Cash & restricted cash – beginning of

period

1,821

10,258

Cash & restricted cash – end of

period

$

10,053

$

1,083

Supplemental Disclosure of Cash Flow

Information

Noncash equipment financing

-

4,620

Interest paid on NYDIG loans and cash

interest paid on line of credit

567

1,179

Noncash disposal of NYDIG collateralized

equipment

2,576

-

Proceed receivable from sale of MTI

Instruments

-

205

Notes converted to common stock

2,444

2,441

Warrant consideration in relation to

promissory notes and convertible notes

1,330

14,602

Promissory note and interest conversion to

common shares

845

15,236

Noncash note receivable from sale of

equipment

240

-

Noncash non-controlling interest

contributions

2,746

290

Series B preferred dividend prefunded

warrant and common stock issuance

657

-

Noncash activity right-of-use assets

obtained in exchange for lease obligations

403

20

Reconciliations of Adjusted EBITDA to net income from continuing

operations, the most comparable GAAP financial metric, for

historical periods are presented in the table below:

(Dollars in thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

2023

2022

2023

2022

Net loss from continuing operations

$

(6,016

)

$

(56,143

)

$

(22,705

)

$

(79,379

)

Interest expense, net

495

1,671

2,355

7,856

Income tax expense (benefit) from

continuing operations

569

(547

)

(524

)

(1,344

)

Depreciation and amortization

3,579

8,388

9,498

22,999

EBITDA

(1,373

)

(46,631

)

(11,376

)

(49,868

)

Adjustments: Non-cash items

Stock-based compensation costs

595

890

3,709

2,869

Loss on sale of fixed assets

373

988

404

2,606

Impairment on equity investment

-

750

-

750

Impairment on fixed assets

41

28,086

418

28,836

Loss on debt extinguishment and

revaluation, net

769

12,317

2,350

12,317

Adjusted EBITDA

$

405

$

(3,600

)

$

(4,495

)

$

(2,490

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231115093396/en/

David Michaels Soluna Holdings, Inc. Chief Financial Officer

Hello@soluna.io

For Media Inquiries: Sam Sova Founder and CEO SOVA

Sam@teamsova.biz

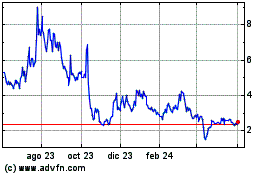

Soluna (NASDAQ:SLNH)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

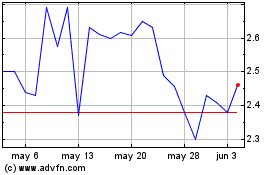

Soluna (NASDAQ:SLNH)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025