0001803901false00018039012024-08-062024-08-060001803901us-gaap:CommonStockMember2024-08-062024-08-060001803901talk:WarrantsToPurchaseCommonStockMember2024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 6, 2024

Talkspace, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-39314 |

|

84-4636604 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

622 Third Avenue, New York, New York |

|

10017 |

(Address of principal executive offices) |

|

(Zip Code) |

(212) 284-7206

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common stock, $0.0001 par value per share |

|

TALK |

|

Nasdaq Global Select Market |

Warrants to purchase common stock |

|

TALKW |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

Talkspace, Inc. (the “Company”) issued a press release on August 6, 2024 announcing its financial results for the quarter ended June 30, 2024. A copy of the press release issued in connection with this announcement is furnished as Exhibit 99.1 attached hereto.

The information in this Item 2.02, including the information contained in Exhibit 99.1 of this Current Report on Form 8-K, is being furnished hereby and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 7.01. Regulation FD Disclosure.

On August 6, 2024, the Company posted supplementary slides (the “Slides”) regarding the Company’s financial results for the quarter ended June 30, 2024 on the Company’s investor relations website at https://investors.talkspace.com/investor-relations. The Slides are furnished as Exhibit 99.2. The Company may use the Slides, in whole or in part, and possibly with minor modifications, in connection with presentations to investors after such date.

The information contained in the Slides is summary information that is intended to be considered in the context of the Company’s Securities and Exchange Commission (“SEC”) filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Company undertakes no duty or obligation to publicly update or revise the information contained in this report, although it may do so from time to time as its management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosures.

This information in this Item 7.01, including the information contained in Exhibit 99.2 of this Current Report on Form 8-K, is being furnished hereby and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Talkspace, Inc. |

|

|

|

|

Date: |

August 6, 2024 |

By: |

/s/ Ian Harris |

|

|

|

Ian Harris Chief Financial Officer |

Exhibit 99.1

Talkspace Announces Second Quarter 2024 Results

2Q 2024 Total revenue grew 29% year-over-year, driven by 62%

year-over-year growth in Payor revenue

Reduced GAAP Net loss to $0.5 million from $4.7 million year-over-year

2Q 2024 Adjusted EBITDA1 of $1.2 million

Board approved an additional $25 million share repurchase program

NEW YORK, New York - August 6, 2024 – Talkspace, Inc. (“Talkspace” or the “Company”) (NASDAQ: TALK), today reported second quarter 2024 financial results.

|

|

|

|

|

|

|

|

|

|

|

Three Months |

|

Six Months |

|

|

|

June 30, 2024 (Unaudited) |

|

Results |

|

% Variance from Prior Year |

|

Results |

|

% Variance from Prior Year |

(In thousands unless otherwise noted) |

|

|

|

|

|

|

|

|

Number of eligible lives at period end (in millions) |

|

145.3 |

|

33% |

|

145.3 |

|

33% |

Number of completed Payor sessions |

|

298.6 |

|

49% |

|

582.8 |

|

57% |

Number of Consumer active members at period end |

|

10.7 |

|

(22)% |

|

10.7 |

|

(22)% |

|

|

|

|

|

|

|

|

|

Total revenue |

|

$46,058 |

|

29% |

|

$91,474 |

|

33% |

Gross profit |

|

$20,951 |

|

18% |

|

$42,682 |

|

24% |

Gross margin % |

|

45.5% |

|

|

|

46.7% |

|

|

Operating expenses |

|

$24,437 |

|

1% |

|

$47,847 |

|

(4)% |

Net loss |

|

$(474) |

|

90% |

|

$(1,940) |

|

86% |

Adjusted EBITDA1 |

|

$1,179 |

|

130% |

|

$1,953 |

|

119% |

Cash and cash equivalents at period end |

|

$114,913 |

|

— |

|

$114,913 |

|

— |

(1)Adjusted EBITDA is a non-GAAP financial measure. For a definition of the measure and a reconciliation to the most direct comparable GAAP measure, see “Reconciliation of Non-GAAP Results to GAAP Results.”

“Our robust second quarter performance reflects continued business execution, resulting in 29% revenue growth and our second consecutive quarter of Adjusted EBITDA profitability. We expanded our covered lives to over 145 million, launched our Medicare offering in 12 states, and made strides in optimizing our marketing efforts,” said Dr. Jon Cohen, CEO of Talkspace.

Dr. Cohen added, “This positive momentum stems from our ongoing commitment to enhancing both provider experience and patient journey, while focusing on product quality - key differentiators for Talkspace. I’m encouraged by our results, which underscore our dedication to making high-quality mental health care more accessible.”

Second Quarter 2024 Key Performance Metrics

•Revenue increased 29% over the prior-year period to $46.1 million, driven by a 62% year-over-year increase in Payor revenue and a 20% year-over-year increase in Direct to Enterprise (“DTE”) revenue; partially offset by a 28% year-over-year Consumer revenue decline.

•Gross profit increased 18% over the prior-year period to $21 million, and gross margin declined to 45.5% from 50% in the prior-year period, driven by a shift in revenue mix towards Payor.

•Operating expenses were $24.4 million, an increase of 1% year-over-year, driven primarily by higher general and administrative expenses.

•Net loss was $(0.5) million, an improvement from $(4.7) million net loss in the second quarter of 2023, primarily driven by an increase in revenues, partially offset by an increase in cost of revenues.

•Adjusted EBITDA was $1.2 million, an improvement from $(4.0) million in the second quarter of 2023, primarily driven by an increase in revenues, partially offset by an increase in cost of revenues.

Financial Guidance

Talkspace continues to expect fiscal year 2024 revenue to be in the range of $185 million to $195 million, growth of 23-30%, and adjusted EBITDA to be in the range of $4 million to $8 million.

Share Repurchase Program

During the second quarter of 2024, Talkspace repurchased $8.0 million of common stock under its initial share repurchase program. On August 1, 2024 the Company’s Board of Directors approved an additional share repurchase program authorizing the Company to repurchase up to twenty-five million dollars ($25 million) over the next 24 months. With the new authorization, the Company may repurchase, in aggregate, up to thirty-two million dollars ($32 million) of its outstanding shares of common stock during the remainder of the programs. The Company may repurchase the shares periodically through various methods in compliance with applicable state and federal securities laws. The timing of purchases and the target number of shares will be determined by Management at its discretion based on an evaluation of the Company’s stock price, market conditions and other corporate considerations. Such repurchases will be funded from cash on hand. The repurchase program may be modified, suspended, or discontinued at any time at the Company’s discretion without prior notice.

Conference Call, Presentation Slides, and Webcast Details

The Second Quarter 2024 earnings conference call and webcast will be held Tuesday, August 6, 2024, at 8:30 a.m. E.T. The conference call will be available via audio webcast at investors.talkspace.com and can also be accessed by dialing (888) 330-2391 for U.S. participants, or +1 (240) 789-2702 for international participants, and referencing participant code 2348878. A replay will be available shortly after the call’s completion and remain available for approximately 90 days.

About Talkspace

Talkspace (NASDAQ: TALK) is a leading virtual behavioral healthcare provider committed to helping people lead healthier, happier lives through access to high-quality mental healthcare. At Talkspace, we believe that mental healthcare is core to overall health and should be available to everyone.

Talkspace pioneered the ability to text with a licensed therapist from anywhere and now offers a comprehensive suite of mental health services, including therapy for individuals, teens, and couples, as well as psychiatric treatment and medication management (18+). With Talkspace’s core therapy offerings, members are matched with one of thousands of licensed therapists within days and can engage in live video, audio, or chat sessions, and/or unlimited asynchronous text messaging sessions.

All care offered at Talkspace is delivered through an easy-to-use, fully-encrypted web and mobile platform that meets HIPAA, federal, and state regulatory requirements. More than 151 million Americans have access to Talkspace through their health insurance plans, employee assistance programs, our partnerships with leading healthcare companies, or as a free benefit through their employer, school, or government agency.

For more information, visit www.talkspace.com.

For Investors:

ICR Westwicke

TalkspaceIR@westwicke.com

For Media:

John Kim

SKDK

(310) 997-5963

jkim@skdknick.com

Forward Looking Statements

This press release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking, including statements regarding our financial condition, anticipated financial performance, achieving profitability, business strategy and plans, market opportunity and expansion and objectives of our management for future operations. These forward-looking statements generally are identified by the words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “forecast”, “future”, “intend,” “may,” “might”, “opportunity”, “plan,” “possible”, “potential,” “predict,” “project,” “should,” “strategy”, “strive”, “target,” “will,” or “would”, the negative of these words or other similar terms or expressions. The absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many important factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to factors and the other risks and uncertainties described under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 13, 2024, subsequent quarterly reports on Form 10-Q and our other documents filed from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and we assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise unless required to do so under applicable law. We do not give any assurance that we will achieve our expectations.

Talkspace, Inc.

Condensed Consolidated Statements of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

|

|

|

Six Months Ended

June 30, |

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

% Change |

|

|

2024 |

|

|

2023 |

|

|

% Change |

|

(in thousands, except percentages, share and per share data) |

|

Unaudited |

|

|

Unaudited |

|

|

|

|

|

Unaudited |

|

|

Unaudited |

|

|

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payor revenue |

|

$ |

29,945 |

|

|

$ |

18,539 |

|

|

|

61.5 |

|

|

$ |

58,453 |

|

|

$ |

33,350 |

|

|

|

75.3 |

|

DTE revenue |

|

|

9,628 |

|

|

|

8,039 |

|

|

|

19.8 |

|

|

|

19,541 |

|

|

|

16,715 |

|

|

|

16.9 |

|

Consumer revenue |

|

|

6,485 |

|

|

|

9,067 |

|

|

|

(28.5 |

) |

|

|

13,480 |

|

|

|

18,916 |

|

|

|

(28.7 |

) |

Total revenue |

|

|

46,058 |

|

|

|

35,645 |

|

|

|

29.2 |

|

|

|

91,474 |

|

|

|

68,981 |

|

|

|

32.6 |

|

Cost of revenues |

|

|

25,107 |

|

|

|

17,833 |

|

|

|

40.8 |

|

|

|

48,792 |

|

|

|

34,421 |

|

|

|

41.8 |

|

Gross profit |

|

|

20,951 |

|

|

|

17,812 |

|

|

|

17.6 |

|

|

|

42,682 |

|

|

|

34,560 |

|

|

|

23.5 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

2,163 |

|

|

|

4,171 |

|

|

|

(48.1 |

) |

|

|

5,902 |

|

|

|

9,524 |

|

|

|

(38.0 |

) |

Clinical operations, net |

|

|

1,661 |

|

|

|

1,675 |

|

|

|

(0.8 |

) |

|

|

3,125 |

|

|

|

3,276 |

|

|

|

(4.6 |

) |

Sales and marketing |

|

|

13,269 |

|

|

|

13,045 |

|

|

|

1.7 |

|

|

|

26,278 |

|

|

|

26,514 |

|

|

|

(0.9 |

) |

General and administrative |

|

|

7,344 |

|

|

|

5,329 |

|

|

|

37.8 |

|

|

|

12,542 |

|

|

|

10,693 |

|

|

|

17.3 |

|

Total operating expenses |

|

|

24,437 |

|

|

|

24,220 |

|

|

|

0.9 |

|

|

|

47,847 |

|

|

|

50,007 |

|

|

|

(4.3 |

) |

Operating loss |

|

|

(3,486 |

) |

|

|

(6,408 |

) |

|

|

45.6 |

|

|

|

(5,165 |

) |

|

|

(15,447 |

) |

|

|

66.6 |

|

Financial (income), net |

|

|

(3,044 |

) |

|

|

(1,712 |

) |

|

|

77.8 |

|

|

|

(3,422 |

) |

|

|

(2,136 |

) |

|

|

60.2 |

|

Loss before taxes on income |

|

|

(442 |

) |

|

|

(4,696 |

) |

|

|

90.6 |

|

|

|

(1,743 |

) |

|

|

(13,311 |

) |

|

|

86.9 |

|

Taxes on income |

|

|

32 |

|

|

|

8 |

|

|

|

300.0 |

|

|

|

197 |

|

|

|

151 |

|

|

|

30.5 |

|

Net loss |

|

$ |

(474 |

) |

|

$ |

(4,704 |

) |

|

|

89.9 |

|

|

$ |

(1,940 |

) |

|

$ |

(13,462 |

) |

|

|

85.6 |

|

Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

$ |

(0.00 |

) |

|

$ |

(0.03 |

) |

|

|

90.0 |

|

|

$ |

(0.01 |

) |

|

$ |

(0.08 |

) |

|

|

87.5 |

|

Weighted average number of common shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

|

169,148,522 |

|

|

|

164,195,697 |

|

|

|

|

|

|

168,997,734 |

|

|

|

163,003,363 |

|

|

|

|

Talkspace, Inc.

Condensed Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

(in thousands) |

|

Unaudited |

|

|

|

|

ASSETS |

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

114,913 |

|

|

$ |

123,908 |

|

Accounts receivable, net |

|

|

11,554 |

|

|

|

10,174 |

|

Other current assets |

|

|

2,302 |

|

|

|

5,718 |

|

Total current assets |

|

|

128,769 |

|

|

|

139,800 |

|

Other long-term assets |

|

|

5,021 |

|

|

|

2,421 |

|

Total assets |

|

$ |

133,790 |

|

|

$ |

142,221 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

Accounts payable |

|

$ |

7,733 |

|

|

$ |

6,111 |

|

Deferred revenues |

|

|

2,733 |

|

|

|

3,069 |

|

Accrued expenses and other current liabilities |

|

|

7,313 |

|

|

|

12,468 |

|

Total current liabilities |

|

|

17,779 |

|

|

|

21,648 |

|

Warrant liabilities |

|

|

1,332 |

|

|

|

1,842 |

|

Other liabilities |

|

|

635 |

|

|

|

85 |

|

Total liabilities |

|

|

19,746 |

|

|

|

23,575 |

|

STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

Common stock |

|

|

16 |

|

|

|

16 |

|

Additional paid-in capital |

|

|

386,352 |

|

|

|

389,014 |

|

Accumulated deficit |

|

|

(272,324 |

) |

|

|

(270,384 |

) |

Total stockholders’ equity |

|

|

114,044 |

|

|

|

118,646 |

|

Total liabilities and stockholders’ equity |

|

$ |

133,790 |

|

|

$ |

142,221 |

|

Talkspace, Inc.

Condensed Consolidated Statements of Cash Flows

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

June 30, |

|

|

|

2024 |

|

|

2023 |

|

(in thousands) |

|

Unaudited |

|

|

Unaudited |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(1,940 |

) |

|

$ |

(13,462 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

421 |

|

|

|

608 |

|

Stock-based compensation |

|

|

5,359 |

|

|

|

4,432 |

|

Remeasurement of warrant liabilities |

|

|

(510 |

) |

|

|

(119 |

) |

(Increase) decrease in accounts receivable |

|

|

(1,380 |

) |

|

|

1,220 |

|

Decrease in other current assets |

|

|

3,416 |

|

|

|

1,452 |

|

Increase (decrease) in accounts payable |

|

|

1,622 |

|

|

|

(977 |

) |

Decrease in deferred revenues |

|

|

(336 |

) |

|

|

(672 |

) |

Decrease in accrued expenses and other current liabilities |

|

|

(5,155 |

) |

|

|

(6,058 |

) |

Other |

|

|

(79 |

) |

|

|

(172 |

) |

Net cash provided by (used in) operating activities |

|

|

1,418 |

|

|

|

(13,748 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Capitalized internal-use software costs |

|

|

(2,110 |

) |

|

|

— |

|

Purchase of computer and equipment |

|

|

(40 |

) |

|

|

(10 |

) |

Other |

|

|

— |

|

|

|

28 |

|

Net cash (used in) provided by investing activities |

|

|

(2,150 |

) |

|

|

18 |

|

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from exercise of stock options |

|

|

1,584 |

|

|

|

1,490 |

|

Payments for employee taxes withheld related to vested stock-based awards |

|

|

(1,843 |

) |

|

|

(201 |

) |

Repurchase and cancellation of common stock |

|

|

(8,004 |

) |

|

|

— |

|

Net cash (used in) provided by financing activities |

|

|

(8,263 |

) |

|

|

1,289 |

|

Net decrease in cash and cash equivalents |

|

|

(8,995 |

) |

|

|

(12,441 |

) |

Cash and cash equivalents at the beginning of the period |

|

|

123,908 |

|

|

|

138,545 |

|

Cash and cash equivalents at the end of the period |

|

$ |

114,913 |

|

|

$ |

126,104 |

|

Non-GAAP Financial Measures

In addition to our financial results determined in accordance with GAAP, we believe adjusted EBITDA, a non-GAAP measure, is useful in evaluating our operating performance, and our management uses it as a key performance measure to assess our operating performance. Because adjusted EBITDA facilitates internal comparisons of our historical operating performance on a more consistent basis, we use this measure for business planning purposes and in evaluating acquisition opportunities. We also use adjusted EBITDA to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that this non-GAAP financial measure, when taken together with the corresponding GAAP financial measures, provides meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our business, results of operations or outlook. We believe that the use of adjusted EBITDA is helpful to our investors as it is a metric used by management in assessing the health of our business and our operating performance. However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP.

Some of the limitations of adjusted EBITDA include (i) adjusted EBITDA does not necessarily reflect capital commitments to be paid in the future and (ii) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and adjusted EBITDA does not reflect these requirements. In evaluating adjusted EBITDA, you should be aware that in the future we will incur expenses similar to the adjustments described herein. Our presentation of adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or non-recurring items. Our adjusted EBITDA may not be comparable to similarly titled measures of other companies because they may not calculate adjusted EBITDA in the same manner as we calculate the measure, limiting its usefulness as a comparative measure. Adjusted EBITDA should not be considered as an alternative to loss before income taxes, net loss, loss per share, or any other performance measures derived in accordance with U.S. GAAP. When evaluating our performance, you should consider adjusted EBITDA alongside other financial performance measures, including our net loss and other GAAP results.

A reconciliation is provided below for adjusted EBITDA to net loss, the most directly comparable financial measure stated in accordance with GAAP. Investors are encouraged to review our financial statements prepared in accordance with GAAP and the reconciliation of our non-GAAP financial measure to its most directly comparable GAAP financial measure, and not to rely on any single financial measure to evaluate our business. We do not provide a forward-looking reconciliation of adjusted EBITDA guidance as the amount and significance of the reconciling items required to develop meaningful comparable GAAP financial measures cannot be estimated at this time without unreasonable efforts. These reconciling items could be meaningful.

Adjusted EBITDA

We calculate adjusted EBITDA as net loss adjusted to exclude (i) depreciation and amortization, (ii) interest and other expenses (income), net, (iii) tax benefit and expense, (iv) stock-based compensation expense, and (v) certain non-recurring expenses, where applicable.

Talkspace, Inc.

Reconciliation of Non-GAAP Results to GAAP Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

(in thousands) |

|

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

Net loss |

|

$ |

(474 |

) |

|

$ |

(4,704 |

) |

|

$ |

(1,940 |

) |

|

$ |

(13,462 |

) |

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

220 |

|

|

|

302 |

|

|

|

421 |

|

|

|

608 |

|

Financial (income), net (1) |

|

|

(3,044 |

) |

|

|

(1,712 |

) |

|

|

(3,422 |

) |

|

|

(2,136 |

) |

Taxes on income |

|

|

32 |

|

|

|

8 |

|

|

|

197 |

|

|

|

151 |

|

Stock-based compensation |

|

|

3,107 |

|

|

|

2,129 |

|

|

|

5,359 |

|

|

|

4,432 |

|

Non-recurring expenses (2) |

|

|

1,338 |

|

|

|

— |

|

|

|

1,338 |

|

|

|

— |

|

Adjusted EBITDA |

|

$ |

1,179 |

|

|

$ |

(3,977 |

) |

|

$ |

1,953 |

|

|

$ |

(10,407 |

) |

(1)For the three months ended June 30, 2024 and 2023, financial (income), net, primarily consisted of $1.5 million (for both periods) of interest income from our money market accounts, and $1.7 million and $0.3 million, respectively, in unrealized gains resulting from the remeasurement of warrant liabilities. For the six months ended June 30, 2024 and 2023, financial (income), net, primarily consisted of $3.1 million and $2.1 million, respectively, of interest income from our money market accounts and $0.5 million and $0.1 million, respectively, in unrealized gains resulting from the remeasurement of warrant liabilities.

(2)For the three and six months ended June 30, 2024, non-recurring expenses, primarily consisted of severance costs related to the departure of key executives of Talkspace and other related costs.

2024 Second Quarter �Earnings Presentation August 6, 2024 Exhibit 99.2

Disclaimer This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements contained in this presentation that do not relate to matters of historical fact should be considered forward-looking, including statements regarding our financial condition, anticipated financial performance, achieving profitability, business strategy and plans, market opportunity and expansion and objectives of our management for future operations. These forward-looking statements generally are identified by the words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “forecast”, “future”, “intend,” “may,” “might”, “opportunity”, “plan,” “possible”, “potential,” “predict,” “project,” “should,” “strategy”, “strive”, “target,” “will,” or “would”, the negative of these words or other similar terms or expressions. The absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many important factors could cause actual future events to differ materially from the forward-looking statements in this presentation, including but not limited to: our history of losses; the rapid evolution of our business and the markets in which we operate; our ability to continue growing at the rates we have historically grown, or at all; the development of the virtual behavioral health market; a deterioration in general economic conditions as a result of inflation, increased interest rates or otherwise; competition in our industry; and our relationships with affiliated professional entities to provide physician and other professional services. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in under the caption “Risk Factors” in our Annual Report on Form 10-K for the annual period ended December 31, 2023 filed with the Securities and Exchange Commission (“SEC”) on March 13, 2024, subsequent quarterly reports on Form 10-Q and in our other documents filed from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and we assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. We do not give any assurance that we will achieve our expectations. Certain information contained in this presentation relate to or are based on studies, publications, surveys and other data obtained from third-party sources and the Company’s own internal estimates and research. While the Company believes these third-party sources to be reliable as of the date of this presentation, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources, and you are urged not to give undue weight to such third-party information. While the Company believes its internal research is reliable, such research has not been verified by any independent source. This presentation may contain the measure Adjusted EBITDA, Adjusted EBITDA margin, and non-GAAP costs and expenses (including non-GAAP cost of revenue, research and development, sales and marketing, and general and administrative) which are non-GAAP financial measure. For additional information about the measure and a reconciliation to the most closely comparable GAAP measure see the Talkspace Investors Relations website at investors.talkspace.com. 2 2024 SECOND QUARTER EARNINGS PRESENTATION

Q2’23 $4 $39�34% Q2’24 USD, Millions Q2’23 $50 $40 $30 $20 $10 $0 Revenue1 and % Composition $35.6 $64�54% $39�34% Payor Sessions2 Adjusted EBITDA3 PAYOR DTE 2Q 2024 Performance Highlights 3 $9.1 25% $8.0 23% $18.5 52% Q2’24 $46.1 $6.5 14% $9.6 21% $29.9 65% CONSUMER Q2’23 Q2’24 Thousands USD, Millions $1.2 ($4.0) $0 ($2) ($6) Revenue is presented on an as-reported basis. Includes sessions from Managed Behavioral Health (“MBH”) and Employee Assistance Programs (“EAP”). Adjusted EBITDA is a non-GAAP financial measure. For a reconciliation to the most directly comparable GAAP measure, see the appendix to this presentation. $64�54% $39�34% 200 299 2024 SECOND QUARTER EARNINGS PRESENTATION ($4) $2 300 100 0 200

4 Strong Top-Line Growth Robust YOY revenue growth reflects significant demand for behavioral healthcare and our ability to drive new members to the platform Cost discipline and benefits of scale highlight operating leverage in the business reflected in continued Adjusted EBITDA progress Continued Payor Progress Payor revenue increased 62% YOY Sessions increased 49% and unique members increased 30% YoY Increased covered lives to 145m and made platform available to Medicare beneficiaries in 12 states Provider Network Expansion & Brand Awareness Grew provider network to 5,700+; up 34% YOY and 2% sequentially, intentionally slowing growth as efficiency improves to balance availability with patient demand Development of partner ecosystem and referral network strengthens brand recognition and increases cost effectiveness of member acquisition Direct-to-Enterprise Momentum Revenue increased 20% YOY with growing pipeline Continue to develop enhanced product features like the suicide ideation algorithm which identifies high risk patients New wins include a school district in NY state serving faculty �and staff 2Q 2024 Business Highlights (1) Adjusted EBITDA is a non-GAAP financial measure. For a reconciliation to the most directly comparable GAAP measure, see the appendix to this presentation. 2024 SECOND QUARTER EARNINGS PRESENTATION

Revenue PAYOR DTE Revenue and Gross Profit 5 CONSUMER $0 $10 $20 $30 Q3‘23 $35 $38.6 Q4‘23 $18.5 $8.5 $7.9 $25 $15 $5 $9.5 $18.5 $22.1 $8.0 $42.4 $8.2 $25.4 $8.9 $40 Q1‘24 $45 $50 $45.4 $7.0 $28.5 $9.9 $6.5 $29.9 $9.6 $46.1 Q2‘24 Q2‘23 $35.6 $9.1 $18.5 $8.0 USD, Millions Gross Profit and % Margin GROSS PROFIT % MARGIN $0 $5 $10 $15 Q3‘23 $18.8 Q4‘23 $21.0 $20 Q1‘24 $25 $21.7 $21.0 Q2‘24 Q2‘23 $17.8 50.0% USD, Millions 48.8% 49.4% 47.8% 55% 50% 45% 40% 35% 2024 SECOND QUARTER EARNINGS PRESENTATION 45.5%

Appendix 6 2024 SECOND QUARTER EARNINGS PRESENTATION

Operating Expenses NORMALIZED OPEX Operating Expense and Adjusted EBITDA1 7 SBC + NON-RECURRING $0 $10 $15 $20 Q3‘23 Q4‘23 $2.1 $7.9 $9.5 $22.1 $2.0 $22.1 $25 Q1‘23 $30 $23.6 $21.6 $21.2 Q2‘24 Q2‘23 USD, Millions Adjusted EBITDA1 $24.2 $24.0 $2.0 $2.3 $23.4 51% 57% 62% 47% $0 USD, Millions Q2‘23 Q4‘23 ($4.0) Q1‘24 ($2.8) ($2) ($4) ($6) $2 ($0.3) $0.8 Q2‘24 Q3‘23 $(6.4) NORMALIZED OPEX AS % OF REVENUE (1) Adjusted EBITDA is a non-GAAP financial measure. For a reconciliation to the most directly comparable GAAP measure, see the appendix to this presentation. 2024 SECOND QUARTER EARNINGS PRESENTATION $20.0 $4.4 $24.4 43% $1.2

2024 Guidance1 Unchanged 8 Guidance based on current market conditions and expectations and what we know today. Adjusted EBITDA is a non-GAAP financial measure. We do not provide a forward-looking reconciliation of our guidance for adjusted EBITDA as the amount and significance of items required to develop meaningful comparable GAAP financial measures cannot be estimated at this time without unreasonable efforts. These special items could be meaningful. Reduce stress, build resilience, and increase self-understanding with self-guided courses, online classes, reflections and journal prompts Building mental fitness Revenue $185M to $195M +23% to +30% Y/Y Adjusted EBITDA2 $4M to $8M +$18M to $22M Y/Y 2024 SECOND QUARTER EARNINGS PRESENTATION

Strong Long-Term Growth Plan 9 Grow Covered Lives Grow Member Base Continued DTE �momentum with teens Pioneer investments �in clinical A.I. tools Grow Revenue Grow Profitability Launch long-term strategic partnerships 2024 SECOND QUARTER EARNINGS PRESENTATION

Non-GAAP Financial Measures In addition to our financial results determined in accordance with GAAP, we believe adjusted EBITDA, a non-GAAP measure, is useful in evaluating our operating performance, and our management uses it as a key performance measure to assess our operating performance. Because adjusted EBITDA facilitates internal comparisons of our historical operating performance on a more consistent basis, we use this measure for business planning purposes and in evaluating acquisition opportunities. We also use adjusted EBITDA to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that this non-GAAP financial measure, when taken together with the corresponding GAAP financial measures, provides meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our business, results of operations or outlook. We believe that the use of adjusted EBITDA is helpful to our investors as it is a metric used by management in assessing the health of our business and our operating performance. However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. Some of the limitations of adjusted EBITDA include (i) adjusted EBITDA does not necessarily reflect capital commitments to be paid in the future and (ii) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and adjusted EBITDA does not reflect these requirements. In evaluating adjusted EBITDA, you should be aware that in the future we will incur expenses similar to the adjustments described herein. Our presentation of adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or non-recurring items. Our adjusted EBITDA may not be comparable to similarly titled measures of other companies because they may not calculate adjusted EBITDA in the same manner as we calculate the measure, limiting its usefulness as a comparative measure. Adjusted EBITDA should not be considered as an alternative to loss before income taxes, net loss, loss per share, or any other performance measures derived in accordance with U.S. GAAP. When evaluating our performance, you should consider adjusted EBITDA alongside other financial performance measures, including our net loss and other GAAP results. A reconciliation is provided below for adjusted EBITDA to net loss, the most directly comparable financial measure stated in accordance with GAAP. Investors are encouraged to review our financial statements prepared in accordance with GAAP and the reconciliation of our non-GAAP financial measure to its most directly comparable GAAP financial measure, and not to rely on any single financial measure to evaluate our business. We do not provide a forward-looking reconciliation Adjusted EBITDA guidance as the amount and significance of the reconciling items required to develop meaningful comparable GAAP financial measures cannot be estimated at this time without unreasonable efforts. These reconciling items could be meaningful. 10 2024 SECOND QUARTER EARNINGS PRESENTATION

Reconciliation of Net Loss to Adjusted EBITDA Adjusted EBITDA We calculate adjusted EBITDA as net loss adjusted to exclude (i) depreciation and amortization, (ii) interest and other expenses (income), net, (iii) tax benefit and expense, (iv) stock-based compensation expense, and (v) certain non-recurring expenses, where applicable. 11 2024 SECOND QUARTER EARNINGS PRESENTATION

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=talk_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

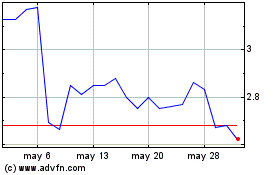

Talkspace (NASDAQ:TALK)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Talkspace (NASDAQ:TALK)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024