Filed by Coincheck Group B.V.

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Thunder Bridge Capital Partners IV, Inc.

(Commission File No.: 001-40555)

Date: January 30, 2024

Announcement of Subsidiary’s Release

TOKYO, January 30, 2024 – Coincheck, Inc.,

a subsidiary of Monex Group, Inc., issued the following press release today.

Attachment: Summary of Coincheck, Inc. press release

Coincheck announced the

business transfer of its virtual shareholders’ meeting support service “Sharely”

- The business will be

transferred to Excite Holdings through a corporate separation (incorporation-type company split) -

|

Contact:

|

Akiko Kato

Corporate Communications Office

Monex Group, Inc.

+81-3-4323-8698 |

Yuki Nakano, Taishi Komori

Investor Relations, Financial Control Department

Monex Group, Inc.

+81-3-4323-8698 |

This material is an English translation of a Japanese

announcement made on the date above. Although the Company intended to faithfully translate the Japanese document into English, the accuracy

and correctness of this English translation is not guaranteed and thus you are encouraged to refer to the original Japanese document.

This translation was made as a matter of record only and does not constitute an offer to sell or to solicit an offer to buy securities

in the U.S.

【Press Release】

January 30, 2024

Coincheck, Inc.

Coincheck announced the business transfer of its

virtual

shareholders’meeting support service “Sharely”

- The business will be transferred to Excite Holdings through a

corporate separation (incorporation-type company split) -

Coincheck, Inc. (Headquartered in Shibuya-ku, Tokyo: Satoshi

Hasuo, Representative Director & President; hereinafter“Coincheck”or“we”) announced today that it will

transfer its virtual shareholder meeting support service “Sharely” business (hereinafter referred to as “Sharely

business”) to Excite Holdings Co., Ltd. (Headquartered in Minato-ku, Tokyo: Shinichi Saijo, President & CEO, hereinafter

“Excite Holdings”) through a corporate separation (incorporation-type company

split).

Coincheck will transfer its Sharely business to a new company and

then transfer the shares of the newly established company to Excite Holdings.

Purpose of Business Transfer

Sharely business has been supporting virtual shareholder meetings

for listed companies since its launch in 2020, just in time to anticipate the introduction of laws regulating such meetings. Leveraging

the clear and intuitive UI/UX design developed through our cryptocurrency exchange service “Coincheck” and the speed of functional

improvements due to in-house development as our strengths, we have increased the number of virtual shareholder meeting support cases

and acquired the top domestic market share in the virtual shareholder meeting support business in 2022 (*1) and 2023 (*2). While the

Sharely business has further growth potential, to align with our mission “Making Exchange of New Value Easier” and with our

management policy to focus more on improving the performance of our crypto asset business, including the cryptocurrency trading service,

we have decided to transfer the Sharely business.

Excite Holdings, the transferee, has been pursuing a growth strategy

called “ambidextrous management”. They aim to achieve “growth of their existing businesses”by expanding the number

of users on their platform and broadband businesses. They also plan to “build new business pillars” by actively investing

in SaaS and DX businesses and taking advantage of their earnings base. Additionally, they aim to achieve sustainable growth by strengthening

their business portfolio through mergers and acquisitions (M&As).

To build new business pillars, Excite Holdings is focusing on the

SaaS/DX business and has decided to acquire Sharely business to expand their product range. As Excite Holdings’ current management team

has created and grown numerous Internet-related businesses, they believe their management skills will accelerate the further growth of

the Sharely business. Consequently, we have decided to transfer the business to Excite Holdings.

| *1 | January 18, 2023 Press Release “Sharely, a Virtual Shareholders’

Meeting Support Service, Wins No. 1 in Number of Virtual-only Shareholders’ Meetings Supported in 2022” |

| *2 | Number of shareholder meetings supported by Sharely in the number

of virtual-only shareholder meetings held by publicly listed companies at their annual and extraordinary shareholder meetings from January

to December 2023, according to our research. |

Future Outlook

After transferring Sharely business to the newly established

company, Coincheck will transfer all shares of the newly established company to Excite Holdings. The newly established company will

take over the“Sharely”brand and provide Sharely business users with the services of the same quality and standard as up

to now.

The effective date of the corporate split and the share transfer

to Excite Holdings is scheduled for March 8, 2024. The impact of the business transfer on our financial results for the current

fiscal year (ending March 31, 2024) is expected to be limited. We will promptly disclose any further information that needs to be

disclosed.

Comment by Shinichi Saijo (President & CEO of Excite Holdings Co.,

Ltd.)

I am honored and pleased to announce that Excite Holdings is

welcoming Sharely. Sharely’s Virtual Shareholder Meeting Support SaaS is a visionary product created with the idea of solving the

challenges that has been unveiled during the period of COVID-19 pandemic. We strongly believe that the need for virtual shareholder

meetings will continue to accelerate in the future. Sharely has already proven its strength by providing practical solutions in the

shareholder meetings of listed companies, and we have received high praise for its capabilities from fellow executives. Sharely’s

team has achieved Product-Market Fit (PMF) in a short period due to their excellent product development capabilities.

As Sharely enters its Go-To-Market phase, we will further support

it in the areas of talent and marketing to foster its growth. At Excite Holdings, we are looking forward to working with Sharely’s team

and contributing to the future success of both our companies.

Comment by Yusuke Otsuka (Executive Director, Head of web3Cloud Business

Division at Coincheck)

We announced that Sharely business, a SaaS service that supports virtual

shareholder meetings launched in 2020, will be joining Excite Holdings group as Sharely Co., Ltd.

Since its launch three years ago, Sharely business has achieved a

certain level of Product Market Fit (PMF) and is now entering the Go-To-Market phase. To further accelerate our growth, we have been

looking for a group of operating companies with knowledge, experience, and management capabilities in the BtoB SaaS business. As a

result, we have decided to transfer the business to Excite Holdings group.

The Sharely business will be separated from us, Coincheck, and I

will be departing from Sharely’s business operations, but we are very grateful that the growth potential of Sharely business is

recognized by Excite Holdings and welcomed into their group. which is strongly led by Representative Director Shinichi Saijo and

Director Masaya Ishii, who successfully listed Excite Holdings on the Tokyo Stock Exchange Standard Market in 2023 after the TOB for

Excite Japan Co., Ltd. in 2018.

About Excite Holdings, Co., Ltd.

Excite Holdings operate a range of businesses, including platform

operations, broadband businesses through optical lines, SaaS, and DX ventures under our mission of “Creating an exciting future

with a digital-native mindset”.‘The company was listed on the Tokyo Stock Exchange Standard Market in April 2023.

| Address |

: 3-20-1, Minamiazabu, Minato-ku, Tokyo |

| Incorporated |

: July 2018 |

| Representative |

: Shinichi Saijo, President & CEO |

| Business Activities |

: Platform, Broadband, SaaS・DX |

| URL |

: https://www.excite-holdings.co.jp/ |

| Contact |

: https://www.excite-holdings.co.jp/contact/ |

About Sharely

Sharely is a comprehensive support service for virtual

shareholder meetings. In addition to providing a cloud system that can be used for various types of virtual shareholder meetings,

from hybrid type including both“participation-type”and “remote attendance-type”, and“virtual-only

type,” Sharely proposes scenarios and management methods tailored to virtual shareholder meetings, and provides operational

support on shareholders’ meeting days.

About Coincheck, Inc.

Coincheck, Inc. operates the crypto asset

trading service “Coincheck,“which has been “Japan’s No.1*“downloaded trading app for five consecutive years.

The company’s mission is“Making Exchange of New Value Easier”by providing better services based on the latest technology

and advanced security measures. Coincheck aims to make the“exchange of new value”created by crypto assets and blockchain

more easily accessible to its customers.

* This data is supported by App Tweak and

refers to domestic crypto asset trading apps from January 2019 to December 2023.

For inquiries from the press regarding this release,

please contact

Coincheck, Inc. PR Group

Mail: pr@coincheck.com

Additional Information and Where to Find It

In connection with the business combination agreement among Coincheck,

Inc. (“Coincheck”), Coincheck Group B.V. (“CCG”), Thunder Bridge Capital Partners IV, Inc. (“Thunder Bridge

IV”) and others with regards to the proposed transaction, the parties intend to file relevant materials with the Securities and

Exchange Commission, including a registration statement on Form F-4 to be filed by Coincheck Group, B.V. with the SEC, which will include

a proxy statement/prospectus of Thunder Bridge IV, and will file other documents regarding the proposed transaction with the SEC. Thunder

Bridge IV’s shareholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus

and the amendments thereto and the definitive proxy statement and documents incorporated by reference therein filed in connection with

the proposed business combination, as these materials will contain important information about CCG, Coincheck, Thunder Bridge IV and the

proposed business combination. Promptly after the Form F-4 is declared effective by the SEC, Thunder Bridge IV will mail the definitive

proxy statement/prospectus and a proxy card to each shareholder entitled to vote at the meeting relating to the approval of the business

combination and other proposals set forth in the proxy statement/prospectus. Before making any voting or investment decision, investors

and stockholders of Thunder Bridge IV are urged to carefully read the entire registration statement and proxy statement/prospectus, when

they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents,

because they will contain important information about the proposed transaction. The documents filed by Thunder Bridge IV with the SEC

may be obtained free of charge at the SEC’s website at www.sec.gov, or by directing a request to Thunder Bridge Capital Partners

IV, Inc., 9912 Georgetown Pike, Suite D203, Great Falls, Virginia 22066, Attention: Secretary, (202) 431-0507.

Participants in the Solicitation

Thunder Bridge IV and its directors and executive officers may be deemed

participants in the solicitation of proxies from its shareholders with respect to the business combination. A list of the names of those

directors and executive officers and a description of their interests in Thunder Bridge IV will be included in the proxy statement/prospectus

for the proposed business combination when available at www.sec.gov. Information about Thunder Bridge IV’s directors and executive

officers and their ownership of Thunder Bridge IV common stock is set forth in Thunder Bridge IV prospectus, dated June 29, 2021, as modified

or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing. Other information regarding the interests of

the participants in the proxy solicitation will be included in the proxy statement/prospectus pertaining to the proposed business combination

when it becomes available. These documents can be obtained free of charge from the source indicated above.

CCG, Coincheck and their respective directors and executive officers

may also be deemed to be participants in the solicitation of proxies from the shareholders of Thunder Bridge IV in connection with the

proposed business combination. A list of the names of such directors and executive officers and information regarding their interests

in the proposed business combination will be included in the proxy statement/prospectus for the proposed business combination.

Forward Looking Statements

This communication contains “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements

about future financial and operating results, our plans, objectives, expectations and intentions with respect to future operations, products

and services; and other statements identified by words such as “will likely result,” “are expected to,” “will

continue,” “is anticipated,” “estimated,” “believe,” “intend,” “plan,”

“projection,” “outlook” or words of similar meaning. These forward-looking statements include, but are not limited

to, statements regarding Coincheck’s industry and market sizes, future opportunities for CCG, Coincheck and Thunder Bridge IV, Coincheck’s

estimated future results and the proposed business combination between Thunder Bridge IV and Coincheck, including the implied enterprise

value, the expected transaction and ownership structure and the likelihood, timing and ability of the parties to successfully consummate

the proposed transaction. Such forward-looking statements are based upon the current beliefs and expectations of our management and are

inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict

and generally beyond our control. Actual results and the timing of events may differ materially from the results anticipated in these

forward-looking statements.

In addition to factors previously disclosed in Thunder Bridge IV’s

reports filed with the SEC and those identified elsewhere in this communication, the following factors, among others, could cause actual

results and the timing of events to differ materially from the anticipated results or other expectations expressed in the forward-looking

statements: inability to meet the closing conditions to the business combination, including the occurrence of any event, change or other

circumstances that could give rise to the termination of the definitive agreement; the inability to complete the transactions contemplated

by the definitive agreement due to the failure to obtain approval of Thunder Bridge IV’s shareholders, the failure to achieve the

minimum amount of cash available following any redemptions by Thunder Bridge IV shareholders, redemptions exceeding a maximum threshold

or the failure to meet The Nasdaq Stock Market’s initial listing standards in connection with the consummation of the contemplated

transactions; costs related to the transactions contemplated by the definitive agreement; a delay or failure to realize the expected benefits

from the proposed transaction; risks related to disruption of management’s time from ongoing business operations due to the proposed

transaction; changes in the cryptocurrency and digital assets markets in which Coincheck competes, including with respect to its competitive

landscape, technology evolution or regulatory changes; changes in domestic and global general economic conditions, risk that Coincheck

may not be able to execute its growth strategies, including identifying and executing acquisitions; risks related to the ongoing COVID-19

pandemic and response; risk that Coincheck may not be able to develop and maintain effective internal controls; and other risks and uncertainties

indicated in Thunder Bridge IV’s final prospectus, dated June 29, 2021, for its initial public offering, and the proxy statement/prospectus

relating to the proposed business combination, including those under “Risk Factors” therein, and in Thunder Bridge IV’s

other filings with the SEC. Thunder Bridge IV and Coincheck caution that the foregoing list of factors is not exclusive.

Actual results, performance or achievements may differ materially,

and potentially adversely, from any projections and forward-looking statements and the assumptions on which those forward-looking statements

are based. There can be no assurance that the data contained herein is reflective of future performance to any degree. You are cautioned

not to place undue reliance on forward-looking statements as a predictor of future performance as projected financial information and

other information are based on estimates and assumptions that are inherently subject to various significant risks, uncertainties and other

factors, many of which are beyond our control. All information set forth herein speaks only as of the date hereof in the case of information

about Thunder Bridge IV and Coincheck or the date of such information in the case of information from persons other than Thunder Bridge

IV or Coincheck, and we disclaim any intention or obligation to update any forward looking statements as a result of developments occurring

after the date of this communication. Forecasts and estimates regarding Coincheck’s industry and end markets are based on sources

we believe to be reliable, however there can be no assurance these forecasts and estimates will prove accurate in whole or in part. Annualized,

pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

No Offer or Solicitation

This press release shall not constitute a solicitation of a proxy,

consent, or authorization with respect to any securities or in respect of the proposed business combination. This press release shall

also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities

in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements

of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

7

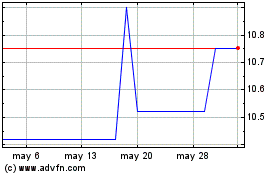

Thunder Bridge Captial P... (NASDAQ:THCPU)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

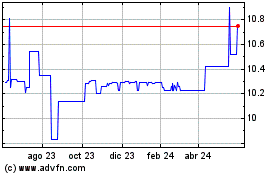

Thunder Bridge Captial P... (NASDAQ:THCPU)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024