Form SC 13D - General statement of acquisition of beneficial ownership

10 Junio 2024 - 5:15AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

TIAN RUIXIANG Holdings Ltd.

(Name of Issuer)

Class A ordinary share, par value $0.005 per

share

(Title of Class of Securities)

G8884K128

(CUSIP Number)

Sheng Xu

Room 1001, 10 / F, No. 25, North East Third

Ring Road,

Chaoyang District, Beijing,

The People’s Republic of China

86-13501205319

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

April 18, 2024

(Date of Event Which Requires Filing of this Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of Rule 13d-1(e), 3d-1(f) or 13d-1(g), check the following box. ¨

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for

other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this

cover shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

SCHEDULE 13D

CUSIP No. G8884K128

| 1 |

Name of reporting person

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Min Zhou |

| 2 |

Check the appropriate box if a member of a group*

(a) ¨ (b) ¨

|

| 3 |

SEC use only

|

| 4 |

Source of funds*

OO |

| 5 |

Check box if disclosure of legal proceedings is required pursuant to

Item 2(d) or 2(e)

¨ |

| 6 |

Citizenship or place of organization

China |

|

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

Sole voting power

200,000 (1) |

| 8 |

Shared voting power

0 |

| 9 |

Sole dispositive power

200,000 (1) |

| 10 |

Shared dispositive power

0 |

| 11 |

Aggregate amount beneficially owned by each reporting person

200,000 (1) |

| 12 |

Check box if the aggregate amount in row (11) excludes certain shares*

¨ |

| 13 |

Percent of class represented by amount in row (11)

8.568% (2) |

| 14 |

Type of reporting person*

IN |

| (1) |

Includes 200,000 Class A ordinary shares acquired by the Reporting Person on April 18, 2024. The share numbers are retroactively adjusted to a 1-to-5 share consolidation effected on May 14, 2024. |

| |

|

| (2) |

The percentage of class is calculated based on 2,334,353 Class A ordinary shares outstanding as of June 3, 2024, which information was provided by the Issuer to the Reporting Person on June 3, 2024. |

Item 1. Security and Issuer.

| Securities acquired: (i) 200,000 Class A ordinary shares, par value $0.025 per share |

| |

| Issuer: |

TIAN RUIXIANG Holdings Ltd (the “Issuer”) |

| |

Room 1001, 10 / F, No. 25, North East Third Ring Road, Chaoyang District, Beijing, China |

Item 2. Identity and Background.

| |

(a) |

This statement is filed by Min Zhou (the “Reporting Person”), a director of the board of the Issuer. The Reporting Person is the holder of 8.568% of the Issuer’s outstanding Class A ordinary shares, representing a total of 6.18% of the Issuer’s voting power based on 2,384,353 ordinary shares outstanding as of June 3, 2024, consisting of 2,334,353 Class A ordinary shares (1 vote per share) and 50,000 Class B ordinary shares (18 votes per share). |

| |

(b) |

The principal business address of Min Zhou is Room 1001, 10 / F, No. 25, North East Third Ring Road, Chaoyang District, Beijing, People’s Republic of China. |

| |

(c) |

Min Zhou is a director of the Issuer. |

| |

(d) |

During the past five years, the Reporting Person has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors). |

| |

(e) |

During the past five years, the Reporting Person has not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was the subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal and state securities laws of findings any violation with respect to such laws. |

| |

(f) |

Citizenship of Min Zhou is China. |

Item 3. Source and Amount of Funds or Other Consideration.

The information set forth in Items 4 and 5 of this Schedule 13D are

hereby incorporated by reference into this Item 3.

Item 4. Purpose of Transaction.

On April 18, 2024, in connection

with the appointment of the Reporting Person as a director to the board of the Issuer, the Issuer issued 1,000,000 Class A ordinary shares

(the “Shares”) to the Reporting Person, in accordance with the following: (i) the Issuer’s Employee Performance Incentive

Plan; (ii) a Director Agreement between the Issuer and the Reporting Person, dated April 18, 2024; and (iii) a Share Award Agreement between

the Issuer and the Reporting Person, dated April 18, 2024.

On

May 14, 2024, the Issuer effected a 1-for-5 share consolidation of its issued and unissued share capital. As a result of the Share consolidation,

the number of the Shares was reduced to 200,000.

Except as set forth in this

Item 4, the Reporting Person has no plans or proposals that relate to or would result in: (a) the acquisition by any person of additional

securities of the Issuer, or the disposition of securities of the Issuer; (b) an extraordinary corporate transaction, such as a merger,

reorganization or liquidation, involving the Issuer or any of its subsidiaries; (c) a sale or transfer of a material amount of assets

of the Issuer or any of its subsidiaries; (d) any change in the present board or management of the Issuer, including any plans or proposals

to change the number or term of directors or to fill any existing vacancies on the board; (e) any material change in the present capitalization

or dividend policy of the Issuer; (f) any other material change in the Issuer’s business or corporate structure, including but not

limited to, if the issuer is a registered closed-end investment company; (g) changes in the Issuer’s charter, by-laws or instruments

corresponding thereto or other actions which may impede the acquisition of control of the Issuer by any person; (h) causing a class of

securities of the Issuer to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer

quotation system of a registered national securities association; (i) a class of equity securities of the Issuer becoming eligible for

termination of registration pursuant to Section 12(g)(4) of the Exchange Act; or (j) any action similar to any of those enumerated above.

Item 5.

Interest in Securities of the Issuer

| |

a) |

The aggregate number and percentage of shares beneficially or directly owned by the Reporting Person is based upon 2,334,353 Class A ordinary shares outstanding as of June 3, 2024. The Reporting Person beneficially owns 200,000 Class A ordinary shares, representing 8.568% of the outstanding Class A ordinary shares. |

| |

b) |

Min Zhou has the sole dispositive power over the 200,000 Class A ordinary shares, representing 8.568% of the outstanding Class A ordinary shares. |

| |

c) |

Other than as described herein, the Reporting Person has not effected any transactions in the Issuer’s securities during the 60 days preceding the date of this report. |

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer.

The information set forth in Items 4 of this Schedule 13D are hereby

incorporated by reference into this Item 6.

SCHEDULE 13D

CUSIP No. G8884K128

Item 7. Materials to be Filed as Exhibits.

SCHEDULE 13D

CUSIP No. G8884K128

SIGNATURES

After reasonable inquiry and to the best of our knowledge and belief,

the undersigned certifies that the information set forth in this statement is true, complete and correct.

Date: June 07, 2024

| By: |

/s/ Min Zhou |

|

| Name: |

Min Zhou |

|

Exhibit

99.1

Exhibit

99.2

| 1

TIAN RUIXIANG HOLDINGS LTD

天睿祥控股有限公司

2023 PERFORMANCE INCENTIVE PLAN

2023 年业绩激励计划

SHARE AWARD AGREEMENT

股份授予协议

Name of Participant:

周敏

(the “Participant”) “参与人”姓名:周敏

Staff ID/PRC National ID:

【43060219831214556X】

员工 ID/中国 ID:

【43060219831214556X】

Address: 【Shenzhen, Guangdong

Province 2C, Zhongxin Mangrove

Bay, Shahe Street, Nanshan

District】

地址:【广东省深圳市南山区沙河

街道中信红树湾2C】

Plan: TIAN RUIXIANG HOLDINGS LTD

“计划”:天睿祥控股有限公司

2023 PERFORMANCE INCENTIVE PLAN

2023 年业绩激励计划

Grant: 1,000,000 Class A Ordinary Shares (the “Shares”)

each with a par value of US$0.005

授予:1,000,000 股 A 类普通股(“股票”)

Offering Price: US$[0.00] Per Share (the “Offering Price”)

发售价格:每股[0.00]美元(“发售价格”)

Grant Date: 2024-4-18

授予日:2024-4-18

Vesting Date: 2024-4-18

归属日:2024-4-18

1. Grant. Effective on the Grant Date, you have been granted the Shares of TIAN

RUIXIANG HOLDINGS LTD (the “Company”) in accordance with the provisions of the TIAN

RUIXIANG HOLDINGS LTD 2023 PERFORMANCE INCENTIVE PLAN of the Company (the

“Plan”) and subject to the restrictions, terms and conditions set forth herein. All terms used but not

defined herein shall have the meanings assigned to them in the Plan. “授予”。根据《天睿祥控股有限公司(“公司”)的 2023 年业绩激励计划》(“计划”)

的规定,您已被授予“天睿祥控股有限公司”之“股票”,并受限于本“计划”所规定的限制、条款和

条件,自“授予日生效”。本“授予协议”中使用但未另行定义的所有术语应具有“计划”规定的含 |

| 2

义。

2. Vesting Schedule. Subject to the Plan and other terms of this Agreement, the Shares will

vest in accordance with the following schedule: 100% of the Awards shall be vested on the Vesting

Date. “归属时间表”。受限于“计划”和 “本协议”的其他条款,“股票”将根据以下时间表予

以归属,“奖励”应在归属日予以 100%归属。

The Administrator or any of its delegation, in its discretion, may accelerate the vesting of

the balance, or some lesser portion of the balance, of the unvested Award at any time, subject to the

terms of the Plan. If so accelerated, such portion of the Award shall be considered as having vested as of

the date specified by the Board. “管理人”或其任何代表可在符合“计划”条款的前提下自行酌情决定在任何时间对未

被归属“奖励”的余额或较小部分加速归属。如在上述情况下被加速归属,该部分“奖励”应被视为

在“董事会”指定的日期已归属。

3. Termination of Service. In the event your employment or service for a Service Recipient

is terminated for any reason, whether such termination is occasioned by you, by the Service Recipient, with or without cause or by mutual agreement (“Termination of Service”), the Company shall have the

right (but not an obligation) to repurchase the unvested Shares at the Offering Price as of the earlier of:

(i) the date that you give or are provided with written notice of such termination, or (ii) if you are an

employee of a Service Recipient, the date that you are no longer actively employed and physically

present on the premises of the Service Recipient, regardless of any notice period or period of pay in lieu

of such notice required under any applicable statute or the common law (each, the “Notice Period”). Notwithstanding the foregoing, if your Termination of Service is by reason of Cause, the Company shall

have the right (but not an obligation) to repurchase your Shares, vested and unvested, at the Offering

Price. For the purpose of the Plan and this Agreement, “Cause” means: a termination of employment or

service based upon a finding by the Company or any of its Affiliates, acting in good faith and based on

its reasonable belief at the time, that the Participant: (i) has been negligent in the discharge of his or her

duties to the Company or any Affiliate, has refused to perform stated or assigned duties or is

incompetent in or (other than by reason of a disability or analogous condition) incapable of performing

those duties; (ii) has been dishonest or committed or engaged in an act of theft, embezzlement or fraud, a

breach of confidentiality, an unauthorized disclosure or use of inside information, customer lists, trade

secrets or other confidential information; (iii) has breached a fiduciary duty, non-competition duty, or

willfully and materially violated any other duty, law, rule, regulation or policy of the Company or any of

its Affiliates; or has been convicted of, or plead guilty or nolo contendere to, a felony or misdemeanor;

(iv) has breached any of the provisions of any agreement with the Company or any of its Affiliates, or

has violated any employee handbook of the Company or any of its Affiliates, including but not limited to

the current employment policy of the Company or any of its Affiliates; (v) has engaged in unfair

competition with, or otherwise acted intentionally in a manner injurious to the reputation, business or

assets of, the Company or any of its Affiliates; or (vi) has improperly induced a vendor or customer to

break or terminate any contract with the Company or any of its Affiliates or induced a principal for

whom the Company or any Affiliate acts as agent to terminate such agency relationship. A termination

for Cause shall be deemed to occur (subject to reinstatement upon a contrary final determination by the |

| 3

Administrator) on the date on which the Company or any Affiliate first delivers written notice to the

Participant of a finding of termination for Cause or the Administrator provides such notice; “服务终止”。如果您与“服务接受方”的雇用或服务由于任何原因而终止,无论该等

终止是由您、“服务接受方”、“因故”或无故或经共同协议所致(“服务终止”),“公司”有权(但

无义务)在以下日期(以较早发生者为准)按发售价格回购未被归属“股票”:(i)您发出或收

到该等终止的书面通知之日,或(ii)如您为“服务接受方”的雇员,您不再在“服务接受方”的场

所正常工作和出现之日,而无需考虑任何适用法令或普通法规定的任何通知期或免通知金(单称

“通知期”)。尽管有前述规定,如果您的“服务终止”系因“特定事由”所致,“公司”有权(但无义

务)以发售价格回购您的已归属和未归属“股票”。为“计划”和“本协议”之目的,“特定事由”意

指:“公司”或其任何“关联方”在届时善意行事的情况下依据其合理判断作出的认定:“参与人”:

(i)怠于履行其对“公司”或其任何“关联方”的职责,拒绝履行其规定或分配的职责,或不能胜

任或(因残疾或类似状况除外)不能履行该等职责;(ii)不诚实,有或参与盗窃、挪用或欺诈

行为,违反保密规定,擅自披露或使用内幕信息、客户名单、商业秘密或其他保密信息;(iii)

违反“公司”或其任何“关联方”的诚信义务、竞业禁止义务,或故意严重违反“公司”或其任何“关

联方”的任何其他义务、法律、规则、法规或政策;或被判犯有重罪或轻罪,或就该等重罪或轻

罪认罪/认罚;(iv)违反与“公司”或其任何“关联方”之间的任何协议的约定,或违反“公司”或其

任何“关联方”的任何员工守则,包括但不限于[];(v)与“公司”或其任何“关联方”进行不公平竞

争,或以其他方式故意损害“公司”或其任何“关联方”的声誉、业务或资产;或(vi)不当诱使供

应商或客户违反或终止与“公司”或其任何“关联方”之间的任何合同,或诱使“公司”或其任何“关

联方”作为代理的委托人终止该等代理关系。“特定事由”终止应被视为在“公司”或其任何“关联

方”首次向“参与人”交付认定“特定事由”终止的书面通知之日或“管理人”发出该等通知之日发生

(但受限于根据“管理人”作出相反的最终决定);

4. Rights as a Shareholder. Neither you nor any person claiming under or through you will

have any of the rights or privileges of a shareholder of the Company in respect of any Shares deliverable

hereunder unless and until such Shares have been issued and registered on the Register of Members of

the Company under your name. After such issuance and registration, you will have all the rights of a

shareholder of the Company with respect to voting of such Shares and receipt of dividends and

distributions on such Shares; provided, however, that you will, upon the Company’s request, grant a

voting proxy with respect to such Shares to a person designated by the Company. “作为股东的权利”。除非且直至该等“股票”已以您的名义在“公司”股东名册上发行

并登记在您名下,否则您或通过您提出权利主张的任何人均不享有“公司”股东的任何权利或特

权。在该等发行和登记后,您将享有与该等“股票”的表决权以及就该等“股票”取得股息和分配相

关的“公司”股东的所有权利;但前提是,经“公司”要求,您将就该等“股票”向“公司”指定的人士 |

| 4

授予投票代理权。

5. Additional Conditions to Issuance of Shares. The Company will not be required to issue

Shares hereunder, and you agree not to hold any Share, prior to completion of governmental filings in

relation to the issuance of the Shares (including but not limited to the filing required by the stock

exchanges, foreign exchange and tax filing procedure). “股票”发行的附加条件。在与“股票”发行相关的政府备案完成(包括但不限于证券

交易所、外汇和税务备案程序要求的备案)之前,“公司”将不被要求根据本“计划”发行“股票”,

并且您同意不持有任何“股票”。

6. Award is Not Transferable Until Vested. Except to the limited extent provided in the

Plan, or pursuant to the written consent of the Board, the Shares and any right and privilege conferred

hereby shall not be transferred, assigned or otherwise disposed of in any way (whether by operation of

law or otherwise) until such Shares are vested. Upon any attempt to transfer, assign otherwise dispose

of the Shares, or any right or privilege conferred hereby, in violation of this Section 7, the Shares and the

rights and privileges conferred hereby immediately will become null and void. 归属前“奖励”不可转让。除非“计划”规定的有限范围内或根据“董事会”的书面同

意,在该等“股票”被归属之前,“股票”和“本“计划”授予的任何权利和特权不得转让、让与或以

其他方式处置(无论通过法律的运用或其他方式)。如果违反本“第 7 条”试图转让、让与或以其

他方式处置“股票”或“本“计划”授予的任何权利或特权”,“股票”和“本“计划”授予的权利和特权将

立即变为无效。

In the event of granting written consents for any transfer, the Administrator or any of its

delegation will have the fullest discretion permitted by applicable law in deciding the extent to which, and stipulating terms and conditions under which, such transfer of the Shares may be allowed (including, but not limited to, the transfer of part or all of the Shares, for each of the unvested portions of the

Shares). In the event of a transfer of part or all of the unvested Shares held by you as consented to by

the Board, you hereby acknowledge and agree that you have the obligation to ensure that the transferee

will be subject to and comply with the same terms, conditions, requirements and restrictions imposed on

you by the Company in connection with the Shares granted hereunder. 如果就任何转让给予书面同意,“管理人”或其任何受托机构将拥有适用法律允许的

最大自由裁量权来决定允许该等“股票”转让的范围、规定允许该等“股票”转让的条款和条件(包

括但不限于就“股票”中每一未归属部分转让部分或全部“股票”)。如果“董事会”同意您持有的部

分或全部未归属“股票”被转让,您在此确认并同意,您有义务确保受让人将受限于并遵守“公司” 就根据本“计划”授予的“股票”向您施加的相同条款、条件、要求和限制。

7. Withholding of Taxes. The Company has the authority to deduct or withhold, or require

you to remit to the Company, an amount sufficient to satisfy applicable national, state, local and foreign

taxes arising from the grant of the Shares. You may satisfy your tax obligation, in whole or in part, electing by the Administrator of any of its delegation: (i) to have the Company withhold Shares upon the

distribution of your Shares otherwise to be delivered with a Fair Market Value equal to the minimum |

| 5

amount of the tax withholding obligation; (ii) to have the Participant surrender to the Company

previously owned Shares with a Fair Market Value equal to the minimum amount of the tax withholding

obligation; or (iii) to have the Participant pay over to the Company in cash the amount of tax

withholding obligation. If the Board determines that you have not satisfied or performed your tax

obligations, then the Board will have the right, but not the obligation, to suspend the vesting of the

Shares for a period (the “Vesting Suspension Period”) commencing upon your failure or default until the

time you have fully satisfied or performed such tax obligations. For the avoidance of doubt, the Board

will have discretion in determining (i) whether or not you have satisfied or performed, fully or

otherwise, your tax obligations; and (ii) the vesting schedule of the unvested portion of the Shares after

the Vesting Suspension Period ends. “税款代扣”。“公司”有权扣除或代扣,或要求您向“公司”汇付足够的款项,以满足

因授予“股票”而产生的适用的国家、州、地方和外国税款。通您须按照“管理人”或其任何受托机

构的选择全部或部分履行“纳税义务”:(i)在分配您本应交付的、具有等于最低税款代扣义务

金额的“股票”时,由“公司”预扣“股票”;(ii)让“参与人”向“公司”让与“公司”先前持有的、具有

等于最低税款代扣义务金额的“股票”;或(iii)让“参与人”以现金向“公司”缴付税款代扣义务金

额。如果“董事会”确定您未满足或履行您的“纳税义务”,则“董事会”有权但无义务,在您未满足

或不履行时起至“股票”完全满足或履行该等“纳税义务”之前的一定期限(“归属暂停期”)内暂停

“股票”的归属。为避免疑问,“董事会”有权酌情决定(i)您是否已完全或以其他方式满足或履

行您的“纳税义务”;及(ii)归属暂停期结束后未被归属部分“股票”的归属时间表。

8. Chinese Participants. You agree that the Administrator may set up and administer a

centralized account management system to ensure that any proceeds from the sale of the Shares will be

remitted back to the People’s Republic of China (the “PRC”). In addition, the Company may also

impose other conditions or administrative measures to ensure or facilitate compliance of any applicable

law to which you or the Company is subject. Notwithstanding any other provision of the Plan, this

Agreement or other agreements entered into by the Company pursuant to the Plan, the Company shall

not be obligated, nor shall it have any liability for failure to issue or deliver any Shares under the Plan

unless the issuance and delivery of the Shares comply with (or are exempt from) all Applicable Laws, and the regulations of any stock exchange or other securities market on which the Company’s securities

are traded, and shall be further subject to the approval of counsel for the Company with respect to such

compliance. “中国参与人”。您同意“管理人”可设立并管理一个集中账户管理系统,以确保出售

“股票”所得的任何收益将汇回中华人民共和国(“中国”)。此外,“公司”还可施加其他条件或行

政措施,以确保或促进遵守您或“公司”应遵守的任何适用“法律”。尽管“计划”、“本协议”或“公

司”根据“计划”订立的其他协议有任何其他规定,除非“股票”的发行和交付遵守(或免于遵守)

所有“适用法律”以及“公司”证券交易所在的任何证券交易所或其他证券市场的法规,“公司”将无

义务也不对未能根据“计划”发行或交付任何“股票”承担任何责任,且还应取得“公司”法律顾问对

公司该等守法行为的认同。 |

| 6

9. Personal Data. You acknowledge and consent to the collection, use, processing and

transfer of personal data as described in this paragraph. The Company, its affiliates and your employer

hold certain personal information, including your name, home address and telephone number, date of

birth, identification number, salary, nationality, job title, any shares awarded, cancelled, purchased, vested, unvested or outstanding in your favor, for the purpose of managing and administering the Plan

(“Data”). The Company and its affiliates will transfer Data to any third parties assisting the Company in

the implementation, administration and management of the Plan. These recipients may be located in the

PRC or elsewhere such as the Hong Kong, European Economic Area or the United States. You

authorize them to receive, possess, use, retain and transfer the Data, in electronic or other form, for the

purposes of implementing, administering and managing your participation in the Plan, including any

requisite transfer of such Data as may be required for the administration of the Plan and/or the

subsequent holding of shares on your behalf to a broker or other third party with whom you may elect to

deposit any shares acquired pursuant to the Plan. You may, at any time, review Data, require any

necessary amendments to it or withdraw the consent herein in writing by contacting the Company;

however, withdrawing the consent may affect your ability to participate in the Plan. 个人数据。您承认并同意收集、使用、处理和传输本段规定的个人数据。“公司”、

其关联方和您的雇主为管理“计划”之目的,持有特定的个人信息,包括您的姓名、家庭地址、电

话号码、出生日期、身份号码、薪资、国籍、工作职位、任何给予、撤销、购买、授予或未授予

或流通的以您为受益人的“股票”(“数据”)。“公司”及其关联方将向任何第三方传输数据,以协

助“公司”执行、管理和管理“计划”。这些接收人可能位于“中国”或其他地方,例如香港、欧洲经

济区或美国。您授权他们接收、持有、使用、保留和传输数据,以电子或其他形式,以执行、管

理和管理您对“计划”的参与,包括为管理“计划”和/或随后代表您持有股票所需的任何数据传输

给经纪人或其他第三方,您可选择将根据“计划”获得的任何股票存入该经纪人或其他第三方。您

可在任何时候联系“公司”以书面形式审阅“数据”、要求对“数据”进行任何必要的修改或撤回“同

意”;但是,撤回“同意”可能会影响您参与“计划”的能力。

10. Trade Sale and Winding Up. 商业出售和清盘。

In the event of Trade Sale or winding-up of the Company, your vested or unvested Shares shall

survive through the date of the Board’s or shareholders’ resolution of such Trade Sale or winding-up

(the “Resolution Date”). 如果“公司”进行商业出售或清盘,您已归属或未归属的“股票”应在董事会或股东就该等商

业出售或清盘作出决议之日(“决议日”)继续有效。

“Trade Sale” means any of the following events: (i) a sale, lease, transfer or other disposition of

all or substantially all of the assets of the Company (taken as a whole), (ii) a transfer or an exclusive

licensing of all or substantially all of the intellectual property rights of the Company (taken as a whole), (iii) a sale, transfer or other disposition of a majority of the issued and outstanding share capital or equity

interests of the Company or a majority of the voting power of the Company; or (iv) a merger, |

| 7

consolidation or other business combination of the Company with or into any other business entity in

which the shareholders of the Company immediately prior to such merger, consolidation or business

combination hold less than a majority of the voting power of the surviving business entity. “商业出售”意指以下任何事件:(i)出售、租赁、转让或以其他方式处置“公司”的全部或

绝大部分资产(作为一个整体);(ii)转让或排他性许可“公司”的全部或绝大部分知识产权(作

为一个整体);(iii)出售、转让或以其他方式处置“公司”多数已发行且发行在外的股本或股权或

“公司”多数表决权权力;或(iv)“公司”与任何其他商业实体兼并、合并或其他商业联合,或将

任何其他商业实体并入其中,且在该等兼并、合并或商业联合之前,“公司”的股东持有存续的商

业实体少于多数表决权权力。

11. Reservation of Rights. The grant of the Award shall not affect in any way the rights or

power of the Company to make adjustments, reclassifications, reorganizations, or changes of its capital

or business structure, to merge or consolidate, or to dissolve, liquidate, sell, or transfer all or any part of

its business or assets. 权利保留。“奖励”的授予将不会以任何方式影响“公司”对其资本或业务结构进行调整、重

新分类、重组或变更的权利或权力,或兼并、合并、或解散、清算、出售或转让其全部或部分业

务或资产的权利或权力。

12. Voluntary Participation. Your participation in the Plan is voluntary. The value of the

Shares is an extraordinary item of compensation outside the scope of your employment contract, if any. As such, the Shares are not part of normal or expected compensation for purposes of calculating any

severance, resignation, redundancy, end of service payments, bonuses, long-service awards, pensions or

retirement benefits or similar payments unless specifically and otherwise provided. Rather, the

awarding of the Shares under the Plan represents a mere investment opportunity. And the Plan, this

Agreement and any award hereunder, or any issue related to the Plan or the Agreement, will not be

governed by any labor law, and the Participant shall not try to find any remedy or compensation from

any labor law.“自愿参与”。您参与“计划”是自愿的。“股票”的价值是在您的雇佣合同范围之外的

额外奖励项目。因此,除非有特别规定,“股票”不是计算任何离职、辞职、解雇、服务终了付

款、奖金、长期服务奖励、退休金或退休福利或类似款项时的正常或预期补偿的一部分。相反,

根据“计划”授予的“股票”仅代表一个投资机会。同时,“计划”、“协议”和“计划”或“协议”项下的

任何奖励,或与“计划”或“协议”相关的任何事项,均不受任何劳动法的管辖,且“参与者”不得试

图从任何劳动法中寻求任何补救或补偿。

13. Discretionary Plan. The Shares are granted under and governed by the terms and

conditions of the Plan. You acknowledge and agree that the Plan is discretionary in nature and may be

amended, cancelled or terminated by the Company, in its sole discretion, at any time. The grant of the

Shares under the Plan is a one-time benefit and does not create any contractual or other right to receive

an award of Shares or benefits in lieu of the award in the future. Future awards of Shares, if any, will be |

| 8

at the sole discretion of the Company, including, but not limited to, the timing of the award, the number

of shares underlying such Shares, and vesting provisions. By execution of this Agreement, you consent

to the provisions of the Plan and this Agreement. 全权处理的“计划”。“股票”是根据“计划”的条款和条件授予的,并受其管辖。您承

认并同意“计划”在性质上是全权处理的,可由“公司”自行决定在任何时候修改、取消或终止。

“计划”项下“股票”的授予是一次性福利,并不创设任何合同权利或其他权利以在未来获得“股票” 或代替该等授予的福利的权利。未来的“股票”授予(如有)将由“公司”自行决定,包括但不限于

授予的时间、该等“股票”的标的“股票”数量和归属规定。签署“本协议”即表示您同意“计划”和“本

协议”的规定。

14. Governing Law. This Agreement shall be governed by and construed in accordance with

the laws of the Cayman Islands. “管辖法律”。“本协议”应受开曼群岛法律管辖并依其解释。

15. Dispute Resolution. “争议解决”。

(a) Negotiation between Parties; Mediations. The Parties agree to negotiate in good faith to

resolve any dispute between them regarding this Agreement. If the negotiations do not resolve the

dispute to the reasonable satisfaction of all Parties within thirty (30) days after the commencement of

such negotiations, the remainder of this Section 16 shall apply. 各方之间的协商;调解。各方同意善意协商解决相互之间与“本协议”有关的任何争

议。如果协商未能在协商开始后三十(30)日内以各方合理满意的方式解决争议,则本“第 16

条”的其他规定应适用。

(b) Arbitration. In the event the Parties are unable to settle a dispute between them

regarding this Agreement in accordance with subsection 16(a) above, such dispute shall be referred to

and finally settled by arbitration at Hong Kong International Arbitration Centre (“HKIAC”) in

accordance with the HKIAC Arbitration Rules in effect at the time of the arbitration, which rules are

deemed to be incorporated by reference in this subsection 16(b). The arbitration tribunal shall consist of

three (3) arbitrators with the claimant(s) of the dispute, on the one hand, being entitled to designate one

arbitrator, and with the respondent(s) involved in such dispute, on the other hand, being entitled to

designate one arbitrator, while the third arbitrator shall be selected by agreement between the two

designated arbitrators or, failing such agreement within ten (10) Business Days of initial consultation

between the two arbitrators, by the Hong Kong International Arbitration Centre pursuant to HKIAC

Arbitration Rules. The language of the arbitration shall be Chinese. “仲裁”。如果各方未能根据上文“第 16(a)条”解决各方之间与“本协议”有关的争

议,该等争议应提交至香港国际仲裁中心(“HKIAC”)根据仲裁时有效的“HKIAC 仲裁规则”最

终仲裁解决,该等规则被视为通过援引纳入本“第 16 (b)条”。仲裁庭应由三(3)名仲裁员组 |

| 9

成,争议的申请人作为一方有权指定一名仲裁员,争议的被申请人作为另一方有权指定一名仲裁

员,第三名仲裁员应由被指定的两名仲裁员协商选定,或如果在该两名仲裁员初步协商后的十

(10)个工作日内无法就第三名仲裁员的人选达成一致意见,则由香港国际仲裁中心根据

“HKIAC 仲裁规则”选定。仲裁语言为中文。

(c) The arbitral award made by the arbitration tribunal shall be final and binding upon the

Parties. Each Party may apply to a court of competent jurisdiction for the enforcement of such award. 仲裁庭作出的仲裁裁决为终局裁决,对各方均有约束力。各方可向有管辖权的法院申

请强制执行该等裁决。

(d) Unless otherwise determined by the arbitration tribunal, the costs of the arbitration shall

be borne by the losing Party. In the event that any arbitration award is enforced through any litigation

process, the losing Party shall bear all of the reasonable counsel fees and expenses of itself and of each

of the winning Party incurred thereby. 除非仲裁庭另有裁定,仲裁费用应由败诉方承担。如果任何仲裁裁决通过任何诉讼程

序强制执行,败诉方应承担败诉方和胜诉方由此产生的所有合理的律师费用和开支。

16. Language. This Agreement is written in English, and any Chinese translation is for

convenience purposes only. In the event of any discrepancy between the English portion of this

Agreement and the Chinese translation, the English portion shall govern. 语言。“本协议”以英文书就,任何中文翻译仅为方便而设。如果“本协议”的英文部分

与中文翻译之间存在任何不一致之处,应以英文部分为准。

17. No Retention Rights. Neither the Plan nor any Award shall confer upon any Participant

any right to continue his or her relationship as an employee with the Company nor any of its Affiliates

for any period of specific duration or interfere in any way with his or her right or the right of the

Company or any of its Affiliates, which rights are hereby expressly reserved by each, to terminate this

relationship at any time, with or without notice, subject to Applicable Laws. “无保留权”。“计划”和任何“奖励”均不得授予任何“参与人”在任何特定期限内继续其

与“公司”或其任何“关联方”的雇员关系的任何权利,或以任何方式干扰其或“公司”或其任何“关

联方”享有的在符合“适用“法律”的前提下随时终止该等关系的权利,该等权利特此由每一“参与

人”明确保留。

18. Representation and Undertakings. 陈述和承诺。

18.1 The Participant represents and warrants that: |

| 10

“参与人”陈述和保证如下:

(i) The Participant is a ____China________ (Nationality) resident, holding the ID / Passport

number of _____43060219831214556X_______;

“ 参 与 人 ” 为 ______ 中 ______ 国 ( 国 籍 ) 居 民 , 身 份 证 / 护 照 号 码 为 :

______43060219831214556X______;

(ii) the Participant has received, read and understood the Plan, this Agreement, including the

exhibits attached hereto, and agrees to abide by and be bound by their terms and conditions; “参与人”已经收到、阅读并理解“计划”、“本协议”,包括其附件,并同意遵守其条款

和条件并受其约束;

(iii) the Participant has the full power and capacity to execute this Agreement, comply with the

provisions hereof and perform all [his] / [her] obligations under this Agreement; “参与人”拥有完全的权力和能力签署“本协议”,遵守“本协议”的规定并履行“本协议” 项下所有“他/她”的义务;

(iv) the relevant information provided by the Participant to the Company (including the

information as set forth in this Agreement) as of the date of this Agreement is true, accurate, complete and not misleading; “参与人”于“本协议”签署之日向“公司”提供的相关信息(包括“本协议”规定的信息)

均真实、准确、完整及不具误导性;

(v) neither the execution of this Agreement nor the performance by the Participant of any of

[his] / [her] obligations or the exercise of any of [his] / [her] rights hereunder will conflict

with or result in a breach of any Applicable Law, judgment, order, authorization, agreement

or obligation applicable to [him] / [her]. “本协议”的签署、“参与人”履行“本协议”项下的任何“其”义务或行使“本协议”项下的

任何“其”权利,均不抵触或导致违反适用于“其”的任何“适用法律”、判决、命令、授

权、协议或义务。

18.2 The Participant undertakes that: “参与人”承诺如下:

(i) in the event that there is any change in the personal information and documents provided by

the Participant to the Company or the Administrator in connection with this Agreement, the

Participant shall promptly provide the updated personal information and documents to the

Company or the Administrator within five (5) days of such change; “参与人”就“本协议”向“公司”或“管理人”提供的个人信息和文件发生任何变更的,“参

与人”应在该等变更后五(5)日内及时向“公司”或“管理人”提供更新后的个人信息和 |

| 11

文件;

(ii) the Participant will comply with the employment agreement and any other agreement entered

into by the Participant and any Affiliate of the Company; “参与人”将遵守雇佣协议及“参与人”与“公司”的任何“关联方”订立的任何其他协议;

(iii) the Participant will comply with all of the Applicable Laws, and the provisions of this

Agreement and the Plan, including those applicable to the holding of the Award; and

“参与人”将遵守所有“适用法律”以及“本协议”和“计划”的规定,包括适用于“奖励”的持

有的该等规定;及

(iv) the Participant will bear all the taxes (including income tax) arising out of or in connection

with the Award under the Applicable Law. “参与人”将根据“适用法律”承担“奖励”产生的或与之相关的所有税项(包括所得

税)。

(Signature page to follow) |

| (下接签字页)

(Signature page of Share Award Agreement)

(本页无正文,为《股份授予协议》之签字页)

TIAN RUIXIANG HOLDINGS LTD

天睿祥控股有限公司

Name: Sheng Xu

姓名:徐盛

Title: CEO

职务:首席执行官

ACKNOWLEDGED AND AGREED BY:

由以下各方确认并同意:

(Participant)

(参与人)

_________________________________________ Name:Zhou Min

姓名:周敏 |

| 13 10 |

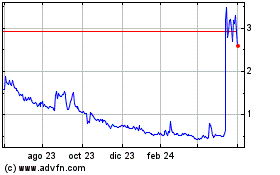

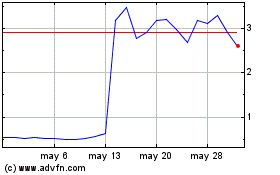

Tian Ruixiang (NASDAQ:TIRX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Tian Ruixiang (NASDAQ:TIRX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024