Verona Pharma Reports Second Quarter 2024 Financial Results and Provides Corporate Update

08 Agosto 2024 - 1:00AM

Verona Pharma plc (Nasdaq: VRNA) (“Verona Pharma” or the

“Company”), a biopharmaceutical company focused on respiratory

diseases, announces its financial results for the second quarter

ended June 30, 2024, and provides a corporate update.

“We are very pleased today to announce that

Ohtuvayre (ensifentrine) is now available in the US for the

maintenance treatment of chronic obstructive pulmonary disease

("COPD") in adults,” said David Zaccardelli, Pharm. D., President

and Chief Executive Officer. “Ohtuvayre is the first novel inhaled

product available for the treatment of COPD in more than 20 years.

Healthcare professionals ("HCPs") and patients are excited about

Ohtuvayre’s potential to relieve COPD symptoms and we believe its

bronchodilator and non-steroidal anti-inflammatory activity will

redefine the treatment paradigm for COPD.

“Our field sales force began interacting with

HCPs in late July and, to date, we have conducted over 2,000 HCP

visits and more than 100 unique HCPs have prescribed Ohtuvayre

through our exclusive network of specialty pharmacies. We are

confident in the launch of Ohtuvayre and look forward to updating

you on our progress.”

Program Updates and Key

Milestones

The Company’s near-term milestones include:

- In July 2024,

the Company submitted an investigational new drug application

(“IND”) to the FDA to allow initiation of the clinical program for

development of a fixed-dose combination of ensifentrine and

glycopyrrolate, a long-acting muscarinic antagonist (“LAMA”), for

the maintenance treatment of COPD via a nebulizer. Subject to

clearance of the IND, the Company intends to initiate a Phase 2

dose-ranging trial in the third quarter of 2024.

- Also in the

third quarter of 2024, the Company plans to initiate a Phase 2

clinical trial to assess the efficacy and safety of nebulized

ensifentrine in patients with non-cystic fibrosis bronchiectasis

(“NCFBE”).

- In the second

half of 2024, the Company plans to present further analyses from

the Phase 3 ENHANCE trials at the European Respiratory Society

International Congress 2024 and at CHEST Annual Meeting 2024.

Second Quarter Highlights

- On June 26,

2024, the FDA approved Ohtuvayre (ensifentrine) for the maintenance

treatment of COPD and the product is now available in the US.

- In June 2024,

the Company submitted the J-code application and local coverage

determination documents to support the launch and expects to

receive a permanent, product-specific J-code for Ohtuvayre

effective January 2025.

- In May 2024, the

Company refinanced its $400 million debt facility and entered into

a $250 million capped revenue interest purchase and sales agreement

(“RIPSA”) with Oaktree Capital and OMERS Life Sciences

(collectively the “$650 million strategic financing”).

- Also in May

2024, the Company presented eight posters including two oral

presentations, at the American Thoracic Society International

Conference (“ATS”) 2024. The posters highlighted additional pooled

analyses of the Phase 3 ENHANCE trials with ensifentrine for the

treatment of COPD. The abstracts are published on the ATS website

and in the American Journal of Respiratory and Critical Care

Medicine.

Second Quarter

2024 Financial Results

- Cash

position: Cash and cash equivalents at June 30, 2024 were

$404.6 million (December 31, 2023: $271.8 million). Following the

approval of Ohtuvayre, the Company drew $70 million under the debt

facility and $100 million under the RIPSA leading to the $404.6

million cash balance. The Company believes cash and cash

equivalents at June 30, 2024, along with the funding expected to

become available under the $650 million strategic financings will

enable Verona Pharma to fund planned operating expenses and capital

expenditure requirements beyond 2026 including the commercial

launch of Ohtuvayre in the US.

- R&D

Expenses: Research and development (“R&D”) expenses

were $19.4 million for the second quarter ended June 30, 2024 (Q2

2023: a net reversal of costs of $2.5 million). This increase of

$21.9 million was primarily driven by the accrual of the $6.3

million approval milestone due to Ligand, $2.5 million increase in

share-based compensation largely driven by the recognition of

performance restricted stock units (“PRSU”) expense and $1.7

million of expense related to pre-launch inventory production.

Further, we had $2.5 million in clinical trial and other

development costs in the three months ended June 30, 2024 while in

the three months ended June 30, 2023, we recorded a reversal of

costs of $6.3 million related to the resolution of a supplier

matter, which resulted in net negative research and development

expense for the three months ended June 30, 2023.

- SG&A

Expenses: Selling general and

administrative expenses (“SG&A”) were $49.0 million for the

second quarter ended June 30, 2024 (Q2 2023: $12.4 million). This

increase of $36.6 million was driven primarily by an accrual of the

$15.0 million first sale milestone payment due to Ligand, an

increase of $7.4 million for marketing and other commercial launch

related activities and an increase of $2.3 million in other support

costs including travel, professional and consulting fees and

information technology costs. Additionally, share-based

compensation increased by $8.0 million largely driven by the

recognition of PRSU expense as well as an increase of $4.3 million

in people-related costs as we built out our commercial organization

including much of the field sales team.

- Net

loss: Net loss was $70.8 million for the second quarter

ended June 30, 2024 (Q2 2023: net loss $8.8 million).

Conference Call and Webcast

InformationVerona Pharma will host an investment community

webcast and conference call at 9:00 a.m. EDT / 2:00 p.m. BST on

Thursday, August 8, 2024, to discuss the second quarter 2024

financial results and the corporate update.

To participate, please dial one of the following

numbers and ask to join the Verona Pharma call:

- +1-833-816-1396 for callers in the

United States

- +1-412-317-0489

for international callers

A live webcast will be available on the Events

and Presentations link on the Investors page of the Company's

website, www.veronapharma.com, and the audio replay will be

available for 90 days. An electronic copy of the second quarter

2024 results press release will also be made available today on the

Company’s website.

For further information please contact:

|

Verona Pharma plc |

Tel: +1-844-341-9901 |

|

Victoria Stewart, Senior Director of Investor Relations and

Communications |

IR@veronapharma.com |

|

Argot Partners US Investor Enquiries |

Tel: +1-212-600-1902 verona@argotpartners.com |

|

Ten Bridge Communications International / US Media

Enquiries |

Tel: +1-312-523-5016 tbcverona@tenbridgecommunications.com |

|

Leslie Humbel |

|

About Verona Pharma

Verona Pharma is a biopharmaceutical company

focused on developing and commercializing innovative therapies for

the treatment of chronic respiratory diseases with significant

unmet medical needs. OhtuvayreTM (ensifentrine) is the Company’s

first commercial product and the first inhaled therapy for the

maintenance treatment of COPD that combines bronchodilator and

non-steroidal anti-inflammatory activities in one molecule.

Ensifentrine has potential applications in non-cystic fibrosis

bronchiectasis, cystic fibrosis, asthma and other respiratory

diseases. For more information, please

visit www.veronapharma.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements contained in this press release

other than statements of historical fact should be considered

forward-looking statements. Words such as “anticipate,” “believe,”

“plan,” “expect,” “intend,” “may,” “potential,” “prepare,”

“possible” and similar words and expressions are intended to

identify forward-looking statements. These forward-looking

statements include, but are not limited to, statements regarding

the potential benefits, efficacy and commercial strategy for

Ohtuvayre, including, but not limited to, statements relating to

the potential to change the treatment paradigm for adult COPD

patients, the Company’s ability to successfully market and sell

Ohtuvayre, the timing of the Company’s Phase 2 trial for the

development of a fixed-dose combination of ensifentrine and

glycopyrrolate for the maintenance treatment of COPD via delivery

in a nebulizer and the Phase 2 clinical trial to assess the

efficacy and safety of nebulized ensifentrine in patients with

non-cystic fibrosis bronchiectasis, the potential applications of

ensifentrine, the Company’s participation in upcoming events and

presentations, and the Company’s cash runway.

These forward-looking statements are based on

management's current expectations. These statements are neither

promises nor guarantees, but involve known and unknown risks,

uncertainties and other important factors that may cause our actual

results, performance or achievements to be materially different

from our expectations expressed or implied by the forward-looking

statements, including, but not limited to, the following: our

limited operating history; our need for additional funding to

complete development and commercialization of Ohtuvayre which may

not be available and which may force us to delay, reduce or

eliminate our development or commercialization efforts; our

reliance on the success of Ohtuvayre, our only commercial product;

our reliance on third-party manufacturers and suppliers; the

efficacy of Ohtuvayre compared to competing drugs; our ability to

successfully commercialize Ohtuvayre; serious adverse, undesirable

or unacceptable side effects associated with Ohtuvayre which could

adversely affect our ability to commercialize Ohtuvayre; failure to

develop Ohtuvayre for additional indications, alternate delivery

methods, or as a combination therapy; failure to obtain approval

for and commercialize Ohtuvayre in multiple major pharmaceutical

markets; our commercial capabilities and infrastructure, including

sales, marketing, operations, distribution, and reimbursement

infrastructure, may not be adequate to successfully commercialize

Ohtuvayre; lawsuits related to patents covering Ohtuvayre and the

potential for our patents to be found invalid or unenforceable;

lawsuits related to our licensing of patents and know-how from

third parties for the commercialization of Ohtuvayre; changes in

our tax rates, unavailability of certain tax credits or reliefs or

exposure to additional tax liabilities or assessments that could

affect our profitability, and audits by tax authorities that could

result in additional tax payments for prior periods; the terms of

our credit agreement and the revenue interest purchase and sale

agreement ("RIPSA”) place restrictions on our operating and

financial flexibility, and if we fail to comply with certain

covenants in the RIPSA, our results of operations and financial

condition may be harmed; and our vulnerability to natural

disasters, global economic factors, geo-political actions and

unexpected events, including health epidemics or pandemics. These

and other important factors discussed under the caption “Risk

Factors” in our Quarterly Report on Form 10-Q for the period ended

June 30, 2024 filed with the Securities and Exchange Commission

(“SEC”) on August 8, 2024, and our other reports filed with the

SEC, could cause actual results to differ materially from those

indicated by the forward-looking statements made in this press

release. Any such forward-looking statements represent management's

estimates as of the date of this press release. While we may elect

to update such forward-looking statements at some point in the

future, we disclaim any obligation to do so, even if subsequent

events cause our views to change, except as required under

applicable law. These forward-looking statements should not be

relied upon as representing our views as of any date subsequent to

the date of this press release.

|

|

|

Verona Pharma plcConsolidated Financial

Summary(unaudited)(in thousands, except

share and per share amounts) |

|

|

|

|

|

Three months ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Operating expenses |

|

|

|

|

|

Research and development |

|

$ |

19,388 |

|

|

$ |

(2,474 |

) |

|

Selling, general and administrative |

|

|

49,035 |

|

|

|

12,439 |

|

|

Total operating expenses |

|

|

68,423 |

|

|

|

9,965 |

|

|

Operating loss |

|

|

(68,423 |

) |

|

|

(9,965 |

) |

|

Other income/(expense) |

|

|

|

|

|

Research and development tax credit |

|

|

847 |

|

|

|

(1,934 |

) |

|

Loss on extinguishment of debt |

|

|

(3,653 |

) |

|

|

- |

|

|

Interest income |

|

|

3,140 |

|

|

|

3,402 |

|

|

Interest expense |

|

|

(1,757 |

) |

|

|

(740 |

) |

|

Foreign exchange gain |

|

|

25 |

|

|

|

740 |

|

|

Total other (expense)/income, net |

|

|

(1,398 |

) |

|

|

1,468 |

|

|

Loss before income taxes |

|

|

(69,821 |

) |

|

|

(8,497 |

) |

|

Income tax expense |

|

|

(1,014 |

) |

|

|

(310 |

) |

|

Net loss |

|

$ |

(70,835 |

) |

|

$ |

(8,807 |

) |

|

|

|

|

|

|

|

Weighted-average shares outstanding – basic and diluted |

|

|

648,217,411 |

|

|

|

634,469,423 |

|

|

Loss per ordinary share – basic and diluted |

|

$ |

(0.11 |

) |

|

$ |

(0.01 |

) |

|

|

|

|

|

|

|

|

|

Jun-30 |

|

Mar-31 |

|

|

|

|

2024 |

|

|

|

2024 |

|

|

Cash and cash equivalents |

|

$ |

404,599 |

|

|

$ |

254,882 |

|

|

Total assets |

|

$ |

434,123 |

|

|

$ |

289,912 |

|

|

Shareholders’ equity |

|

$ |

168,274 |

|

|

$ |

224,988 |

|

|

|

|

|

|

|

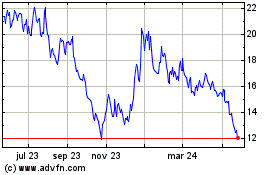

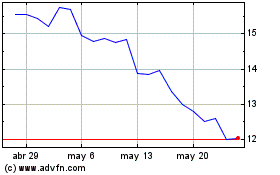

Verona Pharma (NASDAQ:VRNA)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Verona Pharma (NASDAQ:VRNA)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024