Majority of US employees worried about meeting basic costs, WTW survey finds

24 Junio 2024 - 8:49AM

A majority (88%) of U.S. workers are struggling to meet basic

living costs, fueling a sharp decline in retirement confidence.

This is according to a new survey by WTW (NASDAQ: WTW), a leading

global advisory, broking and solutions company. The survey of

10,000 U.S. employees also revealed a sharp disconnect between the

financial wellbeing support employees want from their employer and

what companies are delivering.

The 2024 Global Benefits Attitudes Survey found nearly half of

employees (46%) are extremely worried about paying for basic living

costs. Employees ranked food (73%), healthcare (72%), housing (69%)

and transportation (66%) as their main cost concerns. The number of

employees who report living paycheck to paycheck climbed from 37%

in 2020 to 44% this year, while the number of employees who said

they were worse off financially compared with a year ago more than

doubled from 2019 (16%) to this year (33%).

Four in 10 employees (41%) are not on the right track with

respect to their finances, and nearly a quarter (21%) expect their

financial situation to worsen over the next year. Moreover, 59% of

employees said money concerns are having a negative impact on their

overall wellbeing, resulting in missed medical appointments, higher

levels of stress and anxiety, and less likelihood of meeting with

friends and family.

“High inflation combined with the aftermath of a

once-in-a-generation pandemic is causing many employees to feel

overwhelmed and discouraged about their financial situation, which

is affecting overall wellbeing,” said Mark Smrecek, senior

director, Retirement, WTW. “Employers should take action to improve

financial wellbeing within their organizations by adequately

educating employees on their resources to close financial gaps and

connecting employees with relevant elements of their total rewards

package.”

Growing financial problems and uncertainty with inflation are

also affecting employees’ retirement confidence and savings. Nearly

half (46%) of older workers (age 50 and higher) expect to work past

age 70, a sharp rise from 36% two years ago and 30% prior to the

pandemic. Additionally, eight in 10 workers (79%) admit they aren’t

saving as much for retirement as they should be, and only half

(52%) are on the right track to retirement.

Interestingly, the survey revealed a significant gap between the

financial wellbeing support employees want from their employers and

the priority employers are placing on financial wellbeing

initiatives. Two in three employees (66%) ranked financial

wellbeing as the area where they want the most support from their

employers over the next three years. In fact, almost half (47%) of

employees want employers to help grow their savings and wealth,

followed by making the most out of benefits (35%) and providing

access for emergency savings (33%). However, other WTW research

found only one in four employers (23%) ranked financial wellbeing

as a top priority for their wellbeing program over the next three

years.

“Employer retirement programs, and specifically defined

contribution plans such as 401(k)s, remain the primary path for

employees to save for retirement,” said Beth Ashmore, managing

director, Retirement, WTW. “With challenges meeting their

day-to-day expenses while still planning for retirement, employees

are looking for help from their employer to build a retirement nest

egg, but they also report needing flexibility for emergencies and

having a desire to maximize their benefits.

“Yet, there is a clear disconnect in priorities between

employers and employees,” continued Ashmore. “Employers have an

opportunity to align their focus with employee value, cost

pressures and talent objectives to address how their benefit

programs, particularly retirement and financial wellbeing

initiatives can help employees juggle their finances today while

being on track for retirement.”

About the study

The 2024 Global Benefits Attitudes Survey was conducted from

January to March 2024. Respondents include 10,000 U.S. employees

working at medium and large private sector employers, representing

a broad range of industries.

About WTW At WTW (NASDAQ: WTW), we provide

data-driven, insight-led solutions in the areas of people, risk and

capital. Leveraging the global view and local expertise of our

colleagues serving 140 countries and markets, we help organizations

sharpen their strategy, enhance organizational resilience, motivate

their workforce and maximize performance.

Working shoulder to shoulder with our clients, we uncover

opportunities for sustainable success—and provide perspective that

moves you. Learn more at wtwco.com.

Media contacts

Ed Emerman: +1 609 240 2766eemerman@eaglepr.com

Ileana Feoli: +1 212 309 5504ileana.feoli@wtwco.com

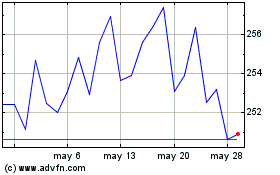

Willis Towers Watson Pub... (NASDAQ:WTW)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

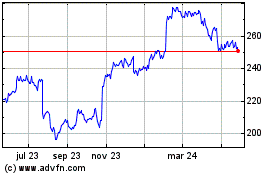

Willis Towers Watson Pub... (NASDAQ:WTW)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024