Wynn Resorts Announces Private Offering of $800 Million of Wynn Resorts Finance Senior Notes Due 2033

10 Septiembre 2024 - 6:53AM

Business Wire

Wynn Resorts, Limited (NASDAQ: WYNN) (“Wynn Resorts”) announced

today that Wynn Resorts Finance, LLC (“Wynn Resorts Finance”) and

its subsidiary Wynn Resorts Capital Corp. (“Wynn Resorts Capital”

and, together with Wynn Resorts Finance, the “Issuers”), each an

indirect wholly-owned subsidiary of Wynn Resorts, are offering $800

million aggregate principal amount of Senior Notes due 2033 (the

“Notes”) in a private offering.

The Notes will initially be jointly and severally guaranteed by

all of Wynn Resorts Finance’s domestic subsidiaries (collectively,

the “Guarantors”) that guarantee the Issuers’ existing senior

secured credit facilities (the “Senior Credit Facilities”), except

Wynn Resorts Capital, which is the co-issuer of the Notes, the

Issuers’ 5.125% Senior Notes due 2029 (the “2029 WRF Notes”) and

the Issuers’ 7.125% Senior Notes due 2031 (the “2031 WRF Notes”).

The Notes and guarantees will be senior unsecured obligations of

the Issuers and the Guarantors and will rank equal in right of

payment with all existing and future liabilities of the Issuers and

such Guarantors that are not subordinated, including their

obligations under the 2029 WRF Notes and the 2031 WRF Notes, and,

with respect to Wynn Las Vegas, LLC (“Wynn Las Vegas”) and certain

of its subsidiaries, their obligations under the existing senior

notes issued by Wynn Las Vegas. The Notes and guarantees will be

effectively subordinated to all of the Issuers’ and the Guarantors’

existing and future secured debt (to the extent of the value of the

collateral securing such debt), including the Senior Credit

Facilities and the existing senior notes issued by Wynn Las

Vegas.

Wynn Resorts Finance plans to (a) contribute and/or lend a

portion of the net proceeds from the offering to its subsidiary,

Wynn Las Vegas, who will use the amounts to (i) redeem in full Wynn

Las Vegas and Wynn Las Vegas Capital Corp.’s outstanding 5.500%

Senior Notes due 2025 (the “2025 LV Notes”) and (ii) pay fees and

expenses related to the redemption and (b) use the remainder of the

net proceeds for general corporate purposes, which may include

covering all or a portion of the $130 million forfeiture under the

non-prosecution agreement described in our Current Report on Form

8-K filed with the Securities and Exchange Commission on September

6, 2024.

The Issuers will make the offering pursuant to an exemption

under the Securities Act of 1933, as amended (the “Securities

Act”). The initial purchasers of the Notes will offer the Notes

only to persons reasonably believed to be qualified institutional

buyers in reliance on Rule 144A under the Securities Act or outside

the United States to certain persons in reliance on Regulation S

under the Securities Act. The Notes have not been and will not be

registered under the Securities Act or under any state securities

laws. Therefore, the Issuers may not offer or sell the Notes within

the United States to, or for the account or benefit of, any United

States person unless the offer or sale would qualify for a

registration exemption from the Securities Act and applicable state

securities laws.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy the Notes described in this press

release, nor shall there be any sale of the Notes in any state or

jurisdiction in which such an offer, sale or solicitation would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

Wynn Las Vegas intends to redeem all of the outstanding 2025 LV

Notes on or after the closing of this offering. This press release

does not constitute a notice of redemption or an offer to purchase

or the solicitation of an offer to sell such notes.

Forward-Looking Statements

This release contains forward-looking statements, including

those related to the offering of Notes and whether or not the

Issuers will consummate the offering. Such forward-looking

statements are subject to a number of risks and uncertainties that

could cause actual results to differ materially from those we

express in these forward-looking statements, including, but not

limited to, reductions in discretionary consumer spending, adverse

macroeconomic conditions and their impact on levels of disposable

consumer income and wealth, changes in interest rates, inflation, a

decline in general economic activity or recession in the U.S.

and/or global economies, extensive regulation of our business,

pending or future legal proceedings, ability to maintain gaming

licenses and concessions, dependence on key employees, general

global political conditions, adverse tourism trends, travel

disruptions caused by events outside of our control, dependence on

a limited number of resorts, competition in the casino/hotel and

resort industries, uncertainties over the development and success

of new gaming and resort properties, construction and regulatory

risks associated with current and future projects (including Wynn

Al Marjan Island), cybersecurity risk and our leverage and ability

to meet our debt service obligations. Additional information

concerning potential factors that could affect Wynn Resorts’

financial results is included in Wynn Resorts’ Annual Report on

Form 10-K for the year ended December 31, 2023, as supplemented by

Wynn Resorts’ other periodic reports filed with the Securities and

Exchange Commission from time to time. Neither Wynn Resorts nor the

Issuers are under any obligation to (and expressly disclaim any

such obligation to) update or revise their forward-looking

statements as a result of new information, future events or

otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240910166956/en/

Price Karr 702-770-7555 investorrelations@wynnresorts.com

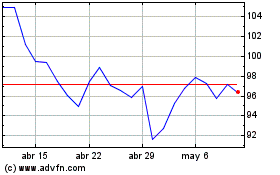

Wynn Resorts (NASDAQ:WYNN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

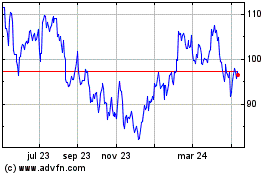

Wynn Resorts (NASDAQ:WYNN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024