UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

August

12, 2024

Commission

File Number: 001-37968

YATRA

ONLINE, INC.

Gulf

Adiba, Plot No. 272,

4th

Floor, Udyog Vihar, Phase-II,

Sector-20,

Gurugram-122008, Haryana

India

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Other

Events

On

August 12, 2024, Yatra Online, Inc. issued an earnings release announcing its unaudited financial and operating results for the three

months ended June 30, 2024. A copy of the earnings release is attached hereto as Exhibit 99.1.

This

Report on Form 6-K is hereby incorporated by reference into Yatra Online, Inc.’s registration statement on Form F-3 (Registration

Statement No. 333-256442) filed with the Securities and Exchange Commission on May 24, 2021 (and subsequently

amended on July 7, 2021), to be a part thereof from the date on which this report is submitted, to the extent not superseded

by documents or reports subsequently filed or furnished.

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

YATRA

ONLINE, INC. |

| |

|

|

| Date:

August 12, 2024 |

By: |

/s/

Dhruv Shringi |

| |

|

Dhruv

Shringi |

| |

|

Chief

Executive Officer |

Exhibit

99.1

YATRA

ONLINE, INC. ANNOUNCES RESULTS FOR

THE

THREE MONTHS ENDED JUNE 30, 2024

Gurugram,

India and New York August 12, 2024— Yatra Online, Inc. (NASDAQ: YTRA) (the “Company”), India’s leading corporate

travel services provider and one of India’s leading online travel companies, today announced its unaudited financial and operating

results for the three months ended June 30, 2024.

“For

the three months ended June 30, 2024, we reported revenue of INR 1,050.7 million (USD 12.6 million), representing a decline of 5.0% year-over-year. Adjusted Air Ticketing Margins were impacted by a 20.7% decrease driven by lower volumes.

The decline was primarily driven by reduced volumes in the B2C segment, as we optimized discounts amid intensifying price competition

in the market. Adjusted EBITDA came in at INR 65.6 million (USD 0.8 million), a decrease from INR 115.4 million in the

same period last year, reflecting the impact of lower volumes.

Despite

challenges in the B2C segment during the June quarter, the Corporate Travel segment showed robust growth across all key metrics. We

successfully secured 34 new corporate customer accounts, representing an annual billing potential of INR 2,028 million, with average

billing potential up 77% sequentially. As the leader in Corporate Travel services in India, our customer acquisition rates remain

strong, consistently outperforming industry benchmarks. We are currently exploring strategic M&A opportunities to further

bolster our Corporate Travel segment, with a promising pipeline of prospects under evaluation.

In

addition, we made significant strides in our Meetings, Incentives, Conferences, and Exhibitions (MICE) business. During the quarter,

a newly onboarded team began ramping up operations. While MICE contributions were muted for the June quarter, early indicators for the

current quarter are positive, with meaningful business already secured. We anticipate this business will become a significant

growth driver in the near future.

Progress

continues toward simplifying our corporate structure, with the Board-appointed restructuring committee actively engaging with

all relevant stakeholders. The committee is diligently working on developing a comprehensive proposal to streamline our operations and

enhance shareholder value.

The

June quarter posed challenges for our B2C segment; however, we are encouraged by the strong momentum we are witnessing in our Corporate

Travel business. The growth in new corporate accounts and the exciting developments in our MICE business underscore our commitment to

driving long-term value for our stakeholders. As we navigate the evolving landscape, we remain focused on our strategic priorities to

further strengthen our market leadership.” - Dhruv Shringi, Co-founder and CEO.

Financial

and operating highlights for the three months ended June 30, 2024:

| ● |

Revenue

of INR 1,050.7 million (USD 12.6 million), representing a decrease of 5.0% year-over-year basis (“YoY”). |

| ● |

Adjusted

Margin (1) from Air Ticketing of INR 919.0 million (USD 11.0 million), representing a decrease of 20.7%

YoY. |

| ● |

Adjusted

Margin (1) from Hotels and Packages of INR 277.1 million (USD 3.3 million), representing a decrease of 9.9%

YoY. |

| ● |

Total

Gross Bookings (Air Ticketing, Hotels and Packages and Other Services)(3) of INR 16,547.6 million (USD 198.6

million), representing a decrease of 16.6% YoY. |

| ● |

Loss

for the period was INR 0.8 million (USD 0.1 million) versus a loss of INR 23.9 million (USD 0.3 million) for the three

months ended June 30, 2023, reflecting a decline in loss by INR 23.1 million (USD 0.3 million) YoY. |

| ● |

Result

from operations were a loss of INR 34.1 million (USD 0.4 million) versus a profit of INR 52.7 million (USD 0.6

million) for the three months ended June 30, 2023, reflecting a decrease in profit by INR 86.8 million (USD 1.0 million)

YoY. |

| ● |

Adjusted

EBITDA(2) was INR 65.6 million (USD 0.8 million) reflecting a decrease by 43.2% YOY. |

| | |

Three months ended June 30, | | |

| |

| | |

2023 | | |

2024 | | |

2024 | | |

| |

| | |

Unaudited | | |

Unaudited | | |

Unaudited | | |

YoY Change | |

| (In thousands except percentages) | |

INR | | |

INR | | |

USD | | |

% | |

| Financial Summary as per IFRS | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

| 1,105,817 | | |

| 1,050,718 | | |

| 12,609 | | |

| (5.0 | )% |

| Results from operations | |

| 52,721 | | |

| (34,124 | ) | |

| (410 | ) | |

| (164.7 | )% |

| Loss for the period | |

| (23,944 | ) | |

| (763 | ) | |

| (9 | ) | |

| 96.8 | % |

| Financial Summary as per non-IFRS measures | |

| | | |

| | | |

| | | |

| | |

| Adjusted Margin (1) | |

| | | |

| | | |

| | | |

| | |

| Adjusted Margin - Air Ticketing | |

| 1,159,032 | | |

| 918,951 | | |

| 11,028 | | |

| (20.7 | )% |

| Adjusted Margin - Hotels and Packages | |

| 307,621 | | |

| 277,141 | | |

| 3,326 | | |

| (9.9 | )% |

| Adjusted Margin - Other Services | |

| 32,728 | | |

| 72,117 | | |

| 865 | | |

| 120.4 | % |

| Others (Including Other Income) | |

| 153,988 | | |

| 154,484 | | |

| 1,854 | | |

| 0.3 | % |

| Adjusted EBITDA (2) | |

| 115,405 | | |

| 65,590 | | |

| 787 | | |

| (43.2 | )% |

| Operating Metrics | |

| | | |

| | | |

| | | |

| | |

| Gross Bookings (3) | |

| 19,834,376 | | |

| 16,547,649 | | |

| 198,580 | | |

| (16.6 | )% |

| Air Ticketing | |

| 16,923,959 | | |

| 13,520,293 | | |

| 162,250 | | |

| (20.1 | )% |

| Hotels and Packages | |

| 2,404,142 | | |

| 2,398,832 | | |

| 28,787 | | |

| (0.2 | )% |

| Other Services (6) | |

| 506,275 | | |

| 628,524 | | |

| 7,543 | | |

| 24.1 | % |

| Adjusted Margin% (4) | |

| | | |

| | | |

| | | |

| | |

| Air Ticketing | |

| 6.8 | % | |

| 6.8 | % | |

| | | |

| | |

| Hotels and Packages | |

| 12.8 | % | |

| 11.6 | % | |

| | | |

| | |

| Other Services | |

| 6.5 | % | |

| 11.5 | % | |

| | | |

| | |

| Quantitative details (5) | |

| | | |

| | | |

| | | |

| | |

| Air Passengers Booked | |

| 1,825 | | |

| 1,330 | | |

| | | |

| (27.1 | )% |

| Stand-alone Hotel Room Nights Booked | |

| 491 | | |

| 417 | | |

| | | |

| (15.1 | )% |

| Packages Passengers Travelled | |

| 6 | | |

| 7 | | |

| | | |

| 17.4 | % |

Note:

| |

(1) |

As

certain parts of our revenue are recognized on a “net” basis and other parts of our revenue are recognized on a “gross”

basis, we evaluate our financial performance based on Adjusted Margin, which is a non-IFRS measure. |

| |

(2) |

See

the section below titled “Certain Non-IFRS Measures.” |

| |

(3) |

Gross

Bookings represent the total amount paid by our customers for travel services, freight services and products booked through us, including

taxes, fees and other charges, and are net of cancellation and refunds. |

| |

(4) |

Adjusted

Margin % is defined as Adjusted Margin as a percentage of Gross Bookings. |

| |

(5) |

Quantitative

details are considered on a gross basis. |

| |

(6) |

Other

Services primarily consists of freight business, IT services, bus, rail and cab and others services. |

As

of June 30, 2024, 61,576,370 ordinary shares (on an as-converted basis), par value $0.0001 per share, of the Company (the “Ordinary

Shares”) were issued and outstanding.

Convenience

Translation

The

unaudited condensed consolidated financial statements are stated in INR. However, solely for the convenience of readers, the unaudited

condensed consolidated statement of profit or loss and other comprehensive loss for the three months ended June 30, 2024, the unaudited

condensed consolidated statement of financial position as at June 30, 2024, the unaudited condensed consolidated statement of cash flows

for the three months ended June 30, 2024 and discussion of the results of the three months ended June 30, 2024 compared with three months

ended June 30, 2023, were converted into U.S. dollars at the exchange rate of 83.33 INR per USD, which is based on the noon buying rate

as at June 30, 2024, in The City of New York for cable transfers of Indian rupees as certified for customs purposes by the Federal Reserve

Bank of New York. This arithmetic conversion should not be construed as representation that the amounts expressed in INR may be converted

into USD at that or any other exchange rate as well as that such numbers are in compliance as per the requirements of the International

Financial Reporting Standards (“IFRS”).

Recent

developments

On

August 12, 2024, the Board of Directors of Yatra Online Limited, the Company’s Indian Subsidiary (“Yatra India”)

approved a Composite Scheme of Amalgamation (“Scheme”) involving Yatra India (the “Amalgamated Company”) and

its six wholly-owned subsidiaries (collectively referred to as the “Amalgamating Companies”). The primary objective of

this amalgamation is to simplify management, operational, and corporate structures, thereby enhancing efficiencies and generating

synergies.

The

management of Yatra India believes that, among other benefits, the Amalgamated Company will achieve greater operational and economic

efficiency. This will be accomplished through the pooling and more effective utilization of combined resources, reducing overhead

costs and expenses, achieving economies of scale, eliminating duplication of work, and rationalizing compliance

requirements.

The

Scheme is subject to requisite approvals/consents, as may be required in this regard

Results

of Three Months Ended June 30, 2024

Revenue.

We generated Revenue of INR 1,050.7 million (USD 12.6 million) in the three months ended June 30, 2024, a decrease of 5.0%

compared with INR 1,105.8 million (USD 13.3 million) in three months ended June 30, 2023. Decrease in revenue is mainly driven by

lower gross booking on account of optimization amid intensifying price competition in the market.

Service

cost. Our Service cost decreased to INR 204.0 million (USD 2.4 million) in the three months ended June 30, 2024, compared to

Service cost of INR 219.0 million (USD 2.6 million) in the three months ended June 30, 2023.

The

following table reconciles our Revenue (an IFRS measure) to Adjusted Margin (a non-IFRS measure), for further details, see section below

titled “Certain Non-IFRS Measures.”

Reconciliation

of Revenue (an IFRS measure) to Adjusted Margin (a non-IFRS measure)

| | |

Reportable Segments | |

| | |

Air Ticketing | | |

Hotels and Packages | | |

Other Services | |

| | |

Three months ended June 30, | |

| Amount in INR thousands (Unaudited) | |

2023 | | |

2024 | | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| Revenue as per IFRS - Rendering of services | |

| 489,369 | | |

| 456,909 | | |

| 452,555 | | |

| 383,136 | | |

| 26,718 | | |

| 67,787 | |

| Customer promotional expenses | |

| 669,663 | | |

| 462,042 | | |

| 74,086 | | |

| 97,959 | | |

| 6,010 | | |

| 4,330 | |

| Service cost | |

| - | | |

| - | | |

| (219,020 | ) | |

| (203,954 | ) | |

| - | | |

| - | |

| Adjusted Margin | |

| 1,159,032 | | |

| 918,951 | | |

| 307,621 | | |

| 277,141 | | |

| 32,728 | | |

| 72,117 | |

Air

Ticketing. Revenue from our Air Ticketing business was INR 456.9 million (USD 5.5 million) in the three months

ended June 30, 2024 as compared to INR 489.4 million (USD 5.9 million) in the three months ended June 30, 2023, reflecting a decrease

of 6.6%.

Adjusted

Margin (1) from our Air Ticketing business decreased to INR 919.0 million (USD 11.0 million) in the three months

ended June 30, 2024, as compared to INR 1,159 million (USD 13.9 million) in the three months ended June 30, 2023. In the three months

ended June 30, 2024, Adjusted Margin (1) for Air Ticketing includes the add-back of INR 462.0 million (USD 5.5 million) of

consumer promotion and loyalty program costs, which had been reduced from Revenue as per IFRS 15, against an add-back of

INR 669.7 million (USD 8.0 million) in the three months ended June 30, 2023 The decrease in Adjusted Margin – Air Ticketing was

largely due to lower gross booking on account of optimization of discount amid intensifying price competition in the market.

Hotels

and Packages. Revenue from our Hotels and Packages business was INR 383.1 million (USD 4.6 million) in the three months ended

June 30, 2024, as compared to INR 452.6 million (USD 5.4 million) in the three months ended June 30, 2023, reflecting a decrease of 15.3%.

Adjusted

Margin (1) for this segment decreased by 9.9% to INR 277.1 million (USD 3.3 million) in the three months ended June 30, 2024

from INR 307.6 million (USD 3.7 million) in the three months ended June 30, 2023. In the three months ended June 30, 2024, Adjusted Margin

(1)l for Hotels and Packages includes the add-back of customer promotional expenses, which had been reduced from Revenue as

per IFRS 15 of INR 98.0 million (USD 1.2 million) against an add-back of INR 74.1 million (USD 0.9 million) in the three months ended

June 30, 2023. The decrease in adjusted margin is driven by lower gross bookings of our affiliate’s hotels business.

Other

Services. Our Revenue from Other Services was INR 67.8 million (USD 0.8 million) in the three months ended June 30, 2024,

an increase from INR 26.7 million (USD 0.3 million) in the three months ended June 30, 2023.

Adjusted

Margin for this segment increased by 120.4% to INR 72.1 million (USD 0.9 million) in the three months ended June 30, 2024, from INR 32.7

million (USD 0.4 million) in the three months ended June 30, 2023. In the three months ended June 30, 2024, Adjusted Margin includes

the add-back of consumer promotion expenses, which had been reduced from Revenue of INR 4.3 million (USD 0.1 million) against an add-back

of INR 6.0 million (USD 0.1 million) in the three months ended June 30, 2023 pursuant to IFRS 15. The increase in adjusted margin of

other services is driven by increase in gross bookings of our other services products along with increase in margin %.

| |

(1) |

See

the section titled “Certain Non-IFRS Measures.” |

Other

Revenue. Our Other Revenue was INR 142.9 million (USD 1.7 million) in the three months ended June 30, 2024, an increase from

INR 137.2 million (USD 1.6 million) in the three months ended June 30, 2023 due to an increase in advertising revenue.

Other

Income. Our Other Income decreased to INR 11.6 million (USD 0.1 million) in the three months ended June 30, 2024 from

INR 16.8 million (USD 0.2 million) in the three months ended June 30, 2023 due to decrease in write back of liabilities no longer required

to be paid.

Personnel

Expenses. Our personnel expenses increased by 30.3% to INR 359.2 million (USD 4.3 million) in the three

months ended June 30, 2024 from INR 275.8 million (USD 3.3 million) in the three months ended June 30, 2023. Excluding employee share-based

compensation costs of INR 38.8 million (USD 0.5 million) in the three months ended June 30, 2024, compared to INR 14.4 million

(USD 0.2 million) in the three months ended June 30, 2023, personnel expenses increased by 22.6% in the three months ended June

30, 2024 on account of increase in our leadership strength (to venture into new business/products) and an impact of our annual appraisal

cycle.

Marketing

and Sales Promotion Expenses. Marketing and sales promotion expenses decreased by 29.7% to INR 92.2 million (USD 1.1 million)

in the three months ended June 30, 2024 from INR 131.0 million (USD 1.6 million) in the three months ended June 30, 2023. Adding back

the expenses for consumer promotions and loyalty program costs, which have been deducted from Revenue per IFRS 15, our marketing spend

would have been INR 656.5 million (USD 7.9 million) in the three months ended June 30, 2024 against INR 880.8 million (USD 10.6

million) in the three months ended June 30, 2023, decreased by 25.5% on a YoY.

Other

Operating Expenses. Other operating expenses decreased by 4.0% to INR 380.2 million (USD 4.6 million) in

the three months ended June 30, 2024 from INR 395.8 million (USD 4.7 million) in the three months ended June 30, 2023.

Depreciation

and Amortization. Our depreciation and amortization expenses increased by 26.2% to INR 60.9 million (USD 0.7 million) in the

three months ended June 30, 2024 from INR 48.3 million (USD 0.6 million) in the three months ended June 30, 2023 primarily due to an

increase in amortization.

Results

from Operations. As a result of the foregoing factors, our Results from Operations were a loss of INR 34.1 million (USD

0.4 million) in the three months ended June 30, 2024. Our results from operations for the three months ended June 30, 2023

was a profit of INR 52.7 million (USD 0.6 million). Excluding the employee share-based compensation costs, Adjusted Results from

Operations(1) would have been a profit of INR 4.7 million (USD 0.1 million) for three months ended June 30,

2024 as compared to a profit of INR 67.1 million (USD 0.8 million) for three months ended June 30, 2023.

| |

(1) |

See

the section titled “Certain Non-IFRS Measures.” |

Finance

Income. Our finance income increased to INR 65.8 million (USD 0.8 million) in the three months ended June 30, 2024 from INR 8.5

million (USD 0.1 million) in the three months ended June 30, 2023. This increase was primarily on account of increase in our term deposits

from 665.7 million as on June 30, 2023 to 3,461.2 million as on June 30, 2024.

Finance

Costs. Our finance costs of INR 28.6 million (USD 0.3 million) in the three months ended June 30, 2024 which includes interest

on the lease liability of INR 7.8 million (USD 0.1 million) decreased by INR 56.8 million (USD 0.7 million) from finance cost of INR

85.4 million (USD 1.0 million) in the three months ended June 30, 2023, which includes interest on the lease liability of INR 8.6

million (USD 0.1 million). This decrease is majorly driven by a decrease in our borrowings on account of re-payments of our certain

loans, non-convertible debentures (NCDs) and working capital facilities.

Listing

and related expenses. Listing and related expenses relate to the expenses incurred in connection with the initial public offering

of Yatra Online Limited, our Indian subsidiary (“Indian IPO”),. During the three month ended June 30, 2024, the Company has

incurred INR Nil (USD Nil) compared to a reversal of INR 14.0 million (USD 0.2 million) during the three months ended June 30,

2023.

Income

Tax Expense. Our income tax expense during the three months ended June 30, 2024 was INR 3.8 million (USD 0.1 million)

compared to income tax expense of INR 13.7 million (USD 0.2 million) during the three months ended June 30, 2023.

Loss

for the Period. As a result

of the foregoing factors, our loss in the three months ended June 30, 2024 was INR 0.8 million (USD 0.1 million) as compared to

a loss of INR 23.9 million (USD 0.3 million) in the three months ended June 30, 2023. Excluding the employee share based compensation

costs and listing and related expenses, the Adjusted Profit(1) would have been INR 38.0 million (USD 0.5 million)

for the three months ended June 30, 2024 against an Adjusted loss(1) of INR 23.5 million (USD 0.3 million) for the three months

ended June 30, 2023.

Adjusted

EBITDA(1). Due to the foregoing factors, Adjusted EBITDA (1) decreased

to INR 65.6 million (USD 0.8 million) in the three months ended June 30, 2024 from an Adjusted EBITDA (1) of

INR 115.4 million (USD 1.4 million) in the three months ended June 30, 2023.

Basic

Earnings/(Loss) per Share. Basic Loss per Share was INR 0.41 (USD 0.01) in the three months ended June 30,

2024 as compared to Basic Loss per share of INR 0.39 (USD 0.01) in the three months ended June 30, 2023. After excluding

the employee share-based compensation costs and listing and related expenses, Adjusted Basic Earnings per Share(1) would have

been INR 0.01 (USD 0.01) in the three months ended June 30, 2024, as compared to Adjusted Basic Loss per share of INR 0.39

(USD 0.01) in the three months ended June 30, 2023.

Diluted

Earnings/(Loss) per Share. Diluted Loss per Share was INR 0.41 (USD 0.01) in the three months ended June

30, 2024 as compared to Diluted Loss per share of INR 0.39 (USD 0.01) in the three months ended June 30, 2023. After excluding

the employee share-based compensation costs and listing and related expenses, Adjusted Diluted Earnings per Share(1) would

have been INR 0.01 (USD 0.01) in the three months ended June 30, 2024 as compared to Adjusted Diluted Loss of INR 0.39

(USD 0.01) in the three months ended June 30, 2023.

Liquidity.

As of June 30, 2024, the balance of cash and cash equivalents and term deposits on our balance sheet was INR 4,482.1 million (USD 53.8

million).

| |

(1) |

See

the section titled “Certain Non-IFRS Measures.” |

Conference

Call

The

Company will host a conference call to discuss its unaudited results for the three months ended June 30, 2024 beginning at 8:30 AM Eastern

Daylight Time (or 6:00 PM India Standard Time) on August 13, 2024. Dial in details for the conference call is as follows: US/International

dial-in number: +1 404 975 4839. Confirmation Code: 825008 (Callers should dial in 5-10 minutes prior to the start time and provide the

operator with the Confirmation Code). The conference call will also be available via webcast at https://events.q4inc.com/attendee/252250535.

Certain

Non-IFRS Measures

As

certain parts of our Revenue are recognized on a “net” basis and other parts of our Revenue are recognized on a “gross”

basis, we evaluate our financial performance based on Adjusted Margin, which is a non-IFRS measure.

We

believe that Adjusted Margin provides investors with useful supplemental information about the financial performance of our business

and more accurately reflects the value addition of the travel services that we provide to our customers. The presentation of this non-IFRS

information is not meant to be considered in isolation or as a substitute for our unaudited condensed consolidated financial results

prepared in accordance with IFRS as issued by the International Accounting Standards Board (“IASB”). Our Adjusted Margin

may not be comparable to similarly titled measures reported by other companies due to potential differences in the method of calculation.

In

addition to referring to Adjusted Margin, we also refer to Adjusted EBITDA, Adjusted Results from Operations, Adjusted Profit/(Loss)

for the Period and Adjusted Basic and Adjusted Diluted Earnings/(Loss) Per Share which are also non-IFRS measures. For our internal management

reporting, budgeting and decision-making purposes, including comparing our operating results to that of our competitors, these non-IFRS

financial measures exclude employee share-based compensation cost and listing and related expenses. Our non-IFRS financial measures reflect

adjustments based on the following:

| |

● |

Employee

share-based compensation cost - The compensation cost to be recorded is dependent on varying available valuation methodologies and

subjective assumptions that companies can use while valuing these expenses especially when adopting IFRS 2 “Share-based

Payment”. Thus, the management believes that providing non-IFRS financial measures that exclude such expenses allows investors

to make additional comparisons between our operating results and those of other companies. |

| |

|

|

| |

● |

Listing

and related expenses - These primarily reflect the non-recurring expenses incurred on the Indian IPO process. |

| |

|

|

| |

● |

Finance

income - These primarily reflect income on the bank deposit. |

| |

|

|

| |

● |

Finance

cost - These primarily reflect income on the borrowings and interest in lease liability. |

| |

|

|

| |

● |

Depreciation

and amortisation - These primarily reflect depreciation and amortisation on tangible and

intangible assets. |

| |

|

|

| |

● |

Tax

expense - These primarily reflect income tax and deferred tax. |

We

evaluate the performance of our business after excluding the impact of the above measures and believe it is useful to understand the

effects of these items on our results from operations, Profit/(Loss) for the period and Basic and Diluted Earnings/(Loss) Per

Share. The presentation of these non-IFRS measures is not meant to be considered in isolation or as a substitute for our unaudited condensed

consolidated financial results prepared in accordance with IFRS as issued by the IASB. These non-IFRS measures may not be comparable

to similarly titled measures reported by other companies due to potential differences in the method of calculation.

A

limitation of using Adjusted EBITDA, Adjusted Results from Operations, Adjusted Profit/(Loss) for the period and Adjusted Basic and Adjusted

Diluted Earnings/(Loss) Per Share as against using measures in accordance with IFRS as issued by the IASB are that these non-IFRS financial

measures exclude share-based compensation cost, depreciation and amortization, finance income, finance costs, listing and related expenses,

and tax expenses in case of Adjusted EBITDA. Management compensates for this limitation by providing specific information on the IFRS

amounts excluded from Adjusted EBITDA, Adjusted Results from Operations, Adjusted Profit/(Loss) for the Period and Adjusted Basic and

Adjusted Diluted Earnings/(Loss) Per Share.

The

following table reconciles our Losses for the periods (an IFRS measure) to Adjusted EBITDA (a non-IFRS measure) for the periods indicated:

| Reconciliation of Adjusted EBITDA (unaudited) | |

Three months ended | |

| Amount in INR thousands | |

June 30, 2023 | | |

June 30, 2024 | |

| Loss for the period as per IFRS | |

| (23,944 | ) | |

| (763 | ) |

| Employee share-based compensation costs | |

| 14,414 | | |

| 38,792 | |

| Depreciation and amortization | |

| 48,271 | | |

| 60,922 | |

| Finance income | |

| (8,469 | ) | |

| (65,814 | ) |

| Finance costs | |

| 85,438 | | |

| 28,606 | |

| Listing and related expenses | |

| (13,983 | ) | |

| - | |

| Tax expense | |

| 13,678 | | |

| 3,847 | |

| Adjusted EBITDA | |

| 115,405 | | |

| 65,590 | |

| Reconciliation of Adjusted Results from Operations (unaudited) | |

Three months ended | |

| Amount in INR thousands | |

June 30, 2023 | | |

June 30, 2024 | |

| Results from operations (as per IFRS) | |

| 52,721 | | |

| (34,124 | ) |

| Employee share-based compensation costs | |

| 14,414 | | |

| 38,792 | |

| Adjusted Results from Operations | |

| 67,135 | | |

| 4,668 | |

| Reconciliation of Adjusted Profit/(Loss) (unaudited) | |

Three months ended | |

| Amount in INR thousands | |

June 30, 2023 | | |

June 30, 2024 | |

| Loss for the period (as per IFRS) | |

| (23,944 | ) | |

| (763 | ) |

| Employee share-based compensation costs | |

| 14,414 | | |

| 38,792 | |

| Listing and related expenses | |

| (13,983 | ) | |

| - | |

| Adjusted Profit/(Loss) for the period | |

| (23,513 | ) | |

| 38,029 | |

| | |

Three months ended | |

| Reconciliation of Adjusted Basic Earnings/(Loss) (Per Share)

(unaudited) | |

June 30, 2023 | | |

June 30, 2024 | |

| Basic Loss per share (as per IFRS) | |

| (0.39 | ) | |

| (0.41 | ) |

| Employee share-based compensation costs | |

| 0.22 | | |

| 0.42 | |

| Listing and related expenses | |

| (0.22 | ) | |

| - | |

| Adjusted Basic Earnings/(Loss) Per Share | |

| (0.39 | ) | |

| 0.01 | |

| | |

Three months ended | |

| Reconciliation of Adjusted Diluted Earnings/(Loss) (Per Share) (unaudited) | |

| June 30, 2023 | | |

| June 30, 2024 | |

| Diluted Loss per share (as per IFRS) | |

| (0.39 | ) | |

| (0.41 | ) |

| Employee share-based compensation costs | |

| 0.22 | | |

| 0.42 | |

| Listing and related expenses | |

| (0.22 | ) | |

| - | |

| Adjusted Diluted Earnings/(Loss) Per Share | |

| (0.39 | ) | |

| 0.01 | |

The

following table reconciles our Revenue (an IFRS measure), to Adjusted Margin (a non-IFRS measure):

Reconciliation

of Revenue (an IFRS measure) to Adjusted Margin (a non-IFRS measure)

| | |

Reportable Segments | |

| | |

Air Ticketing | | |

Hotels and Packages | | |

Other Services | |

| | |

Three months ended June 30, | |

| Amount in INR thousands (Unaudited) | |

2023 | | |

2024 | | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| Revenue as per IFRS - Rendering of services | |

| 489,369 | | |

| 456,909 | | |

| 452,555 | | |

| 383,136 | | |

| 26,718 | | |

| 67,787 | |

| Customer promotional expenses | |

| 669,663 | | |

| 462,042 | | |

| 74,086 | | |

| 97,959 | | |

| 6,010 | | |

| 4,330 | |

| Service cost | |

| - | | |

| - | | |

| (219,020 | ) | |

| (203,954 | ) | |

| - | | |

| - | |

| Adjusted Margin | |

| 1,159,032 | | |

| 918,951 | | |

| 307,621 | | |

| 277,141 | | |

| 32,728 | | |

| 72,117 | |

Safe

Harbor Statement

This

earnings release contains certain statements concerning the Company’s future growth prospects and forward-looking statements, as

defined in the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, as amended. These forward-looking

statements are based on the Company’s current expectations, assumptions, estimates and projections about the Company and its industry.

These forward-looking statements are subject to various risks and uncertainties. Generally, these forward-looking statements can be identified

by the use of forward-looking terminology such as “anticipate,” “believe,” “estimate,” “expect,”

“intend,” “will,” “project,” “seek,” “should” similar expressions and the

negative forms of such expressions. Such statements include, among other things, statements regarding the long-term growth trajectory

for the Indian travel market; growth of the MICE business; statements concerning management’s beliefs as well as our strategic

and operational plans; our pursuit of strategic M&A opportunities and the pipeline of prospects; the benefits of implementing the Composite Scheme of Amalgamation of Yatra India and its subsidiaries; the ability,

and the expected timing, to implement the Scheme; our ability to simplify

our corporate structure and operations and enhance shareholder value; and our future financial performance. Forward-looking

statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from

those contained in any forward-looking statement. Potential risks and uncertainties include, but are not limited to, the impact of increasing

competition in the Indian travel industry and our expectations regarding the development of our industry and the competitive environment

in which we operate; the slowdown in Indian economic growth and other declines or disruptions in the Indian economy in general and travel

industry in particular, including disruptions caused by safety concerns, terrorist attacks, regional conflicts (including the ongoing

conflict between Ukraine and Russia and the evolving events in Israel, Gaza and the Middle East), pandemics and natural calamities, our

ability to successfully negotiate our contracts with airline suppliers and global distribution system service providers and mitigate

any negative impacts on our Revenue that result from reduced commissions, incentive payments and fees we receive; the risk that airline

suppliers (including our GDS service providers) may reduce or eliminate the commission and other fees they pay to us for the sale of

air tickets; our ability to pursue strategic partnerships and the risks associated with our business partners; the potential impact of

recent developments in the Indian travel industry on our profitability and financial condition; political and economic stability in and

around India and other key travel destinations; our ability to maintain and increase our brand awareness; our ability to realize the

anticipated benefits of any past or future acquisitions; our ability to successfully implement our growth strategy; our ability to attract,

train and retain executives and other qualified employees, and our ability to successfully implement any new business initiatives;

our ability to effectively integrate artificial intelligence, machine learning and automated decision-making tools; non-compliance with

Nasdaq’s continued listing requirements and consequent delisting of our ordinary shares from Nasdaq; our ability to simplify

our multi-jurisdictional corporate structure or reduce resources and management time devoted to compliance requirement; and Yatra India’s ability to obtain the required consents and approvals

for implementing the Composite Scheme of Amalgamation of Yatra India and its subsidiaries. These and

other factors are discussed in our reports filed with the U.S. Securities and Exchange Commission. All information provided in this earnings

release is provided as of the date of issuance of this earnings release, and we do not undertake any obligation to update any forward-looking

statement, except as required under applicable law.

About

Yatra Online, Inc.

Yatra

Online, Inc. is the ultimate parent company of Yatra Online Limited, a public listed company on the NSE and BSE (Formerly known as Yatra

Online Private Limited, hereinafter referred to as “Yatra India”), whose corporate office is based in Gurugram, India. Yatra

India is India’s largest corporate travel services provider in terms of number of corporate clients with approximately 800 large

corporate customers and approximately 50,000 registered SME customers and the third largest online travel company (OTC) in India among

key OTA players in terms of gross booking revenue and operating revenue for Fiscal 2023 (Source: CRISIL Report). Leisure and business

travelers use Yatra India’s mobile applications, its website, www.yatra.com, and its other offerings and services to explore, research,

compare prices and book a wide range of travel-related services. These services include domestic and international air ticketing on nearly

all Indian and international airlines, as well as bus ticketing, rail ticketing, cab bookings and ancillary services within India. With

approximately 108,000 hotels in approximately 1,500 cities and towns in India as well as more than 2 million hotels around the world,

Yatra India has the largest hotel inventory amongst key Indian online travel agency (OTA) players (Source: CRISIL Report).

For

more information, please contact:

Manish

Hemrajani

Yatra

Online, Inc.

VP,

Head of Corporate Development and Investor Relations

ir@yatra.com

Yatra

Online, Inc.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE LOSS FOR THREE MONTHS ENDED JUNE 30, 2024

(Amount

in thousands, except per share data and number of shares)

| | |

Three months ended June 30, | |

| | |

2023 | | |

2024 | |

| | |

INR | | |

INR | | |

USD | |

| | |

Unaudited | | |

Unaudited | | |

Unaudited | |

| Revenue | |

| | |

| | |

| |

| Rendering of services | |

| 968,642 | | |

| 907,832 | | |

| 10,894 | |

| Other revenue | |

| 137,175 | | |

| 142,886 | | |

| 1,715 | |

| Total revenue | |

| 1,105,817 | | |

| 1,050,718 | | |

| 12,609 | |

| Other income | |

| 16,813 | | |

| 11,598 | | |

| 139 | |

| | |

| | | |

| | | |

| | |

| Service cost | |

| 219,020 | | |

| 203,954 | | |

| 2,448 | |

| Personnel expenses | |

| 275,799 | | |

| 359,249 | | |

| 4,311 | |

| Marketing and sales promotion expenses | |

| 131,017 | | |

| 92,157 | | |

| 1,106 | |

| Other operating expenses | |

| 395,802 | | |

| 380,158 | | |

| 4,562 | |

| Depreciation and amortization | |

| 48,271 | | |

| 60,922 | | |

| 731 | |

| Results from operations | |

| 52,721 | | |

| (34,124 | ) | |

| (410 | ) |

| | |

| | | |

| | | |

| | |

| Finance income | |

| 8,469 | | |

| 65,814 | | |

| 790 | |

| Finance costs | |

| (85,438 | ) | |

| (28,606 | ) | |

| (343 | ) |

| Listing and related expenses | |

| 13,983 | | |

| - | | |

| - | |

| Profit/(Loss) before taxes | |

| (10,265 | ) | |

| 3,084 | | |

| 37 | |

| Tax expense | |

| (13,679 | ) | |

| (3,847 | ) | |

| (46 | ) |

| Loss for the period | |

| (23,944 | ) | |

| (763 | ) | |

| (9 | ) |

| | |

| | | |

| | | |

| | |

| Other comprehensive income/ (loss) | |

| | | |

| | | |

| | |

| Items not to be reclassified to profit or loss in subsequent periods (net of taxes) | |

| | | |

| | | |

| | |

| Remeasurement gain on defined benefit plan | |

| 70 | | |

| (1,205 | ) | |

| (14 | ) |

| Items that are or may be reclassified subsequently to profit or loss (net of taxes) | |

| | | |

| | | |

| | |

| Foreign currency translation differences gain | |

| 15,212 | | |

| 3,131 | | |

| 38 | |

| Other comprehensive profit for the period, net of tax | |

| 15,282 | | |

| 1,926 | | |

| 24 | |

| Total comprehensive profit/(loss) for the period, net of tax | |

| (8,662 | ) | |

| 1,163 | | |

| 15 | |

| | |

| | | |

| | | |

| | |

| Loss attributable to : | |

| | | |

| | | |

| | |

| Owners of the Parent Company | |

| (24,796 | ) | |

| (25,492 | ) | |

| (306 | ) |

| Non-Controlling interest | |

| 852 | | |

| 24,729 | | |

| 297 | |

| Loss for the period | |

| (23,944 | ) | |

| (763 | ) | |

| (9 | ) |

| | |

| | | |

| | | |

| | |

| Total comprehensive profit/(loss) attributable to : | |

| | | |

| | | |

| | |

| Owners of the Parent Company | |

| (9,516 | ) | |

| (23,137 | ) | |

| (277 | ) |

| Non-Controlling interest | |

| 854 | | |

| 24,300 | | |

| 292 | |

| Total comprehensive profit/(loss) for the period | |

| (8,662 | ) | |

| 1,163 | | |

| 15 | |

| | |

| | | |

| | | |

| | |

| Loss per share | |

| | | |

| | | |

| | |

| Basic | |

| (0.39 | ) | |

| (0.41 | ) | |

| (0.01 | ) |

| Diluted | |

| (0.39 | ) | |

| (0.41 | ) | |

| (0.01 | ) |

| | |

| | | |

| | | |

| | |

| Weighted average no. of shares | |

| | | |

| | | |

| | |

| Basic | |

| 63,737,220 | | |

| 61,887,848 | | |

| 61,887,848 | |

| Diluted | |

| 63,737,318 | | |

| 61,887,848 | | |

| 61,887,848 | |

Yatra

Online, Inc.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT JUNE 30, 2024

(Amounts

in thousands, except per share data and number of shares)

| | |

March 31, 2024 | | |

June 30, 2024 | | |

June 30, 2024 | |

| | |

INR | | |

INR | | |

USD | |

| | |

Audited | | |

Unaudited | |

| Assets | |

| | |

| | |

| |

| Non-current assets | |

| | | |

| | | |

| | |

| Property, plant and equipment | |

| 73,835 | | |

| 96,713 | | |

| 1,161 | |

| Right-of-use assets | |

| 160,037 | | |

| 162,132 | | |

| 1,946 | |

| Intangible assets and goodwill* | |

| 913,434 | | |

| 982,449 | | |

| 11,790 | |

| Prepayments and other assets | |

| 755 | | |

| 1,612 | | |

| 19 | |

| Other financial assets | |

| 24,039 | | |

| 28,808 | | |

| 346 | |

| Term deposits | |

| 137,169 | | |

| 146,579 | | |

| 1,759 | |

| Other non financial assets | |

| 207,555 | | |

| 208,543 | | |

| 2,503 | |

| Deferred tax asset | |

| 10,932 | | |

| 10,862 | | |

| 130 | |

| Total non-current assets | |

| 1,527,756 | | |

| 1,637,698 | | |

| 19,654 | |

| | |

| | | |

| | | |

| | |

| Current assets | |

| | | |

| | | |

| | |

| Inventories | |

| 53 | | |

| 53 | | |

| 1 | |

| Trade and other receivables | |

| 4,637,243 | | |

| 4,638,995 | | |

| 55,670 | |

| Prepayments and other assets | |

| 1,487,861 | | |

| 1,284,569 | | |

| 15,415 | |

| Income tax recoverable | |

| 339,316 | | |

| 339,641 | | |

| 4,076 | |

| Other financial assets | |

| 134,931 | | |

| 156,115 | | |

| 1,873 | |

| Term deposits | |

| 2,620,655 | | |

| 3,184,648 | | |

| 38,217 | |

| Cash and cash equivalents | |

| 1,741,950 | | |

| 1,150,842 | | |

| 13,811 | |

| Total current assets | |

| 10,962,009 | | |

| 10,754,863 | | |

| 129,063 | |

| | |

| | | |

| | | |

| | |

| Total assets | |

| 12,489,765 | | |

| 12,392,561 | | |

| 148,717 | |

| | |

| | | |

| | | |

| | |

| Equity and liabilities | |

| | | |

| | | |

| | |

| Equity | |

| | | |

| | | |

| | |

| Share capital | |

| 857 | | |

| 859 | | |

| 10 | |

| Share premium | |

| 20,511,478 | | |

| 20,535,209 | | |

| 246,432 | |

| Treasury shares | |

| (222,152 | ) | |

| (418,555 | ) | |

| (5,023 | ) |

| Other capital reserve | |

| 378,695 | | |

| 393,934 | | |

| 4,727 | |

| Accumulated deficit | |

| (20,266,628 | ) | |

| (20,292,304 | ) | |

| (243,517 | ) |

| Total | |

| 5,032,282 | | |

| 5,032,282 | | |

| 60,390 | |

| Foreign currency translation reserve | |

| (46,059 | ) | |

| (42,928 | ) | |

| (515 | ) |

| Total equity attributable to equity holders of the Company | |

| 5,388,473 | | |

| 5,208,497 | | |

| 62,504 | |

| Non-controlling

interest | |

| 2,371,799 | | |

| 2,396,099 | | |

| 28,754 | |

| Total equity | |

| 7,760,272 | | |

| 7,604,596 | | |

| 91,258 | |

| | |

| | | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Borrowings | |

| 114,677 | | |

| 92,561 | | |

| 1,111 | |

| Deferred tax liability | |

| 4,669 | | |

| 4,669 | | |

| 56 | |

| Employee benefits | |

| 55,850 | | |

| 55,379 | | |

| 665 | |

| Lease liability | |

| 164,418 | | |

| 163,802 | | |

| 1,966 | |

| Total non-current liabilities | |

| 339,614 | | |

| 316,411 | | |

| 3,798 | |

| | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Borrowings | |

| 523,515 | | |

| 117,668 | | |

| 1,412 | |

| Trade and other payables | |

| 2,608,087 | | |

| 2,634,647 | | |

| 31,617 | |

| Employee benefits | |

| 41,307 | | |

| 43,796 | | |

| 526 | |

| Deferred revenue | |

| 3,360 | | |

| 3,217 | | |

| 39 | |

| Income taxes payable | |

| 251 | | |

| 543 | | |

| 7 | |

| Lease liability | |

| 51,324 | | |

| 51,217 | | |

| 615 | |

| Other financial liabilities | |

| 418,969 | | |

| 428,477 | | |

| 5,142 | |

| Other current liabilities | |

| 743,066 | | |

| 1,191,989 | | |

| 14,303 | |

| Total current liabilities | |

| 4,389,879 | | |

| 4,471,554 | | |

| 53,661 | |

| Total liabilities | |

| 4,729,493 | | |

| 4,787,965 | | |

| 57,459 | |

| Total equity and liabilities | |

| 12,489,765 | | |

| 12,392,561 | | |

| 148,717 | |

*Pursuant

to Share Purchase Agreement executed on June 19, 2024, the Company has acquired additional 49% of the equity share capital of Adventure

and Nature Network Pvt. Ltd. (a Joint Venture Entity of the Group prior to acquisition of additional stake) from Snow Leopard Adventures

Private Limited i.e. Joint Venture Partner for a cash consideration of INR 9.8 million resulting in a goodwill amounting to INR 29.4

million (provisional) as purchase price allocation amounts are yet to be finalised. The results for the quarter are not significantly

impacted from the acquisition.

Yatra

Online, Inc.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THREE MONTHS ENDED JUNE 30, 2024

(Amount

in INR thousands, except per share data and number of shares)

| | |

Attributable to shareholders

of the Parent Company | | |

| | |

| |

| | |

Equity share capital | | |

Equity share premium | | |

Treasury shares | | |

Accumulated deficit | |

|

Non-controlling

interest

reserve |

|

| |

Other capital reserve | | |

Foreign currency translation

reserve | | |

Total | | |

Non controlling interest | | |

Total Equity | |

| Balance as at April 1, 2024 | |

| 857 | | |

| 20,511,478 | | |

| (222,152 | ) | |

| (20,266,628 | ) |

|

|

5,032,282 |

|

| |

| 378,695 | | |

| (46,059 | ) | |

| 5,388,473 | | |

| 2,371,799 | | |

| 7,760,272 | |

| | |

| | | |

| | | |

| | | |

| | |

|

|

|

|

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Profit/(Loss) for the period | |

| | | |

| | | |

| | | |

| (25,492 | ) |

|

|

- |

|

| |

| | | |

| | | |

| (25,492 | ) | |

| 24,729 | | |

| (763 | ) |

| | |

| | | |

| | | |

| | | |

| | |

|

|

|

|

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive loss | |

| | | |

| | | |

| | | |

| | |

|

|

|

|

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation differences | |

| | | |

| | | |

| | | |

| - | |

|

|

- |

|

| |

| | | |

| 3,131 | | |

| 3,131 | | |

| - | | |

| 3,131 | |

| Re-measurement gain on defined benefit plan | |

| | | |

| | | |

| | | |

| (776 | ) |

|

|

- |

|

| |

| | | |

| - | | |

| (776 | ) | |

| (429 | ) | |

| (1,205 | ) |

| Total other comprehensive loss | |

| - | | |

| - | | |

| - | | |

| (776 | ) |

|

|

- |

|

| |

| - | | |

| 3,131 | | |

| 2,355 | | |

| (429 | ) | |

| 1,926 | |

| | |

| | | |

| | | |

| | | |

| | |

|

|

|

|

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive loss | |

| - | | |

| - | | |

| - | | |

| (26,268 | ) |

|

|

- |

|

| |

| - | | |

| 3,131 | | |

| (23,137 | ) | |

| 24,300 | | |

| 1,163 | |

| | |

| | | |

| | | |

| | | |

| | |

|

|

|

|

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Share based payments | |

| - | | |

| - | | |

| - | | |

| 592 | |

|

|

- |

|

| |

| 38,972 | | |

| - | | |

| 39,564 | | |

| - | | |

| 39,564 | |

| Exercise of options | |

| 2 | | |

| 23,731 | | |

| - | | |

| - | |

|

|

|

|

| |

| (23,733 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Own shares repurchase | |

| - | | |

| - | | |

| (196,403 | ) | |

| | |

|

|

- |

|

| |

| | | |

| - | | |

| (196,403 | ) | |

| - | | |

| (196,403 | ) |

| Change in non-controlling interest | |

| - | | |

| - | | |

| - | | |

| - | |

|

|

- |

|

| |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

|

|

|

|

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Total contribution by owners | |

| 2 | | |

| 23,731 | | |

| (196,403 | ) | |

| 592 | |

|

|

- |

|

| |

| 15,239 | | |

| - | | |

| (156,839 | ) | |

| - | | |

| (156,839 | ) |

| | |

| | | |

| | | |

| | | |

| | |

|

|

|

|

| |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as at June 30, 2024 | |

| 859 | | |

| 20,535,209 | | |

| (418,555 | ) | |

| (20,292,304 | ) |

|

|

5,032,282 |

|

| |

| 393,934 | | |

| (42,928 | ) | |

| 5,208,497 | | |

| 2,396,099 | | |

| 7,604,596 | |

Yatra

Online, Inc.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS FOR THREE MONTHS ENDED JUNE 30, 2024

(Amount

in thousands, except per share data and number of shares)

| | |

Three months ended June 30, 2024 | |

| | |

2023 | | |

2024 | | |

2024 | |

| | |

INR | | |

INR | | |

USD | |

| | |

| | |

| | |

| |

| Profit/(Loss) before tax | |

| (10,265 | ) | |

| 3,084 | | |

| 37 | |

| Adjustments for non-cash and non-operating items | |

| 73,448 | | |

| 17,129 | | |

| 206 | |

| Change in working capital | |

| 36,306 | | |

| 681,390 | | |

| 8,177 | |

| Direct taxes paid (net of refunds) | |

| (38,073 | ) | |

| (3,819 | ) | |

| (46 | ) |

| Net cash flows from operating activities | |

| 61,416 | | |

| 697,784 | | |

| 8,374 | |

| Net cash flows (used in) investing activities | |

| (109,035 | ) | |

| (633,673 | ) | |

| (7,604 | ) |

| Net cash flows (used in) financing activities | |

| (31,091 | ) | |

| (667,685 | ) | |

| (8,013 | ) |

| Net decrease in cash and cash equivalents | |

| (78,710 | ) | |

| (603,575 | ) | |

| (7,243 | ) |

| Effect of exchange differences on cash and cash equivalents | |

| 27,998 | | |

| 12,466 | | |

| 150 | |

| Cash and cash equivalents at the beginning of the period | |

| 503,601 | | |

| 1,741,950 | | |

| 20,904 | |

| Cash and cash equivalents at the end of the period | |

| 452,889 | | |

| 1,150,842 | | |

| 13,811 | |

Yatra

Online, Inc.

OPERATING

DATA

The

following table sets forth certain selected unaudited condensed consolidated financial and other data for the periods indicated:

| | |

For the three months ended June 30, | |

| (In thousands except percentages) | |

2023 | | |

2024 | |

| Quantitative details * | |

| | | |

| | |

| Air Passengers Booked | |

| 1,825 | | |

| 1,330 | |

| Stand-alone Hotel Room Nights Booked | |

| 491 | | |

| 417 | |

| Packages Passengers Travelled | |

| 6 | | |

| 7 | |

| Gross Bookings (in INR) | |

| | | |

| | |

| Air Ticketing | |

| 16,923,959 | | |

| 13,520,293 | |

| Hotels and Packages | |

| 2,404,142 | | |

| 2,398,832 | |

| Other Services | |

| 506,275 | | |

| 628,524 | |

| Total | |

| 19,834,376 | | |

| 16,547,649 | |

| Adjusted Margin (in INR) | |

| | | |

| | |

| Adjusted Margin - Air Ticketing | |

| 1,159,032 | | |

| 918,951 | |

| Adjusted Margin - Hotels and Packages | |

| 307,621 | | |

| 277,141 | |

| Adjusted Margin - Other Services | |

| 32,728 | | |

| 72,117 | |

| Others (Including Other Income) | |

| 153,988 | | |

| 154,484 | |

| Total | |

| 1,653,369 | | |

| 1,422,693 | |

| Adjusted Margin%** | |

| | | |

| | |

| Air Ticketing | |

| 6.8 | % | |

| 6.8 | % |

| Hotels and Packages | |

| 12.8 | % | |

| 11.6 | % |

| Other Services | |

| 6.5 | % | |

| 11.5 | % |

*

Quantitative details are considered on Gross basis.

**

Adjusted Margin % is defined as Adjusted Margin as a percentage of Gross Bookings.

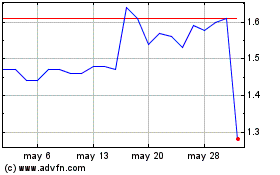

Yatra Online (NASDAQ:YTRA)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

Yatra Online (NASDAQ:YTRA)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024