Company to Hold Conference Call Today at 8:30

a.m. ET to Discuss Update

Albany International Corp. (NYSE: AIN) announced today that it

is providing a preliminary update to its full year outlook largely

to reflect revised revenue and profitability expectations for the

aerospace business within its Engineered Composites (AEC)

segment.

Following its regular quarterly review of program costs and

estimates relative to certain large complex aerospace contracts the

Company has updated its labor, material input and scrap cost

assumptions over the duration of certain long-term contracts. These

increased cost assumptions as well as the impact of suspended

production at a key customer pending their union negotiations will

result in an approximate $24 million negative

Estimate-at-Completion (EAC) adjustment in the third quarter of

2024. Changes in other forecast assumptions are projected to lower

second-half pre-tax earnings by an additional $8 million.

“We continue to see momentum in both Machine Clothing and

Engineered Composites. The Heimbach integration remains on track,

and Albany’s differentiated innovation is translating into robust

demand across both segments,” said President and CEO, Gunnar

Kleveland. “At the same time, growth in our aerospace programs is

resulting in more complex projects, where the manufacturing

learning curve and labor ramp are steeper.”

“Notwithstanding these changes, we expect AEC will maintain

high-teen EBITDA margins that are well above peer averages. With

Chris Stone’s recent appointment as President of AEC, I am also

confident that we will successfully execute on the opportunities in

our growing aerospace business, which are being created by Albany’s

advanced technology and deep customer relationships. Combined with

the Company’s continued strong cash flows and financial strength,

Albany has a solid foundation for success and value creation.

Significant new orders to date this year and our substantial

backlog reinforce the financial upside available to the Company,”

concluded Kleveland.

Updated Outlook

The Company will review in detail its operating and financial

performance when it reports its third quarter results.

For the full year of 2024, the Company is updating its guidance

as follows:

- Total company revenue between $1.22 billion to $1.26

billion;

- Effective income tax rate of approximately 27%;

- Capital expenditures in the range of $90 million to $95

million;

- Adjusted diluted earnings per share between $2.90 and $3.40,

with the second half EPS weighted towards the fourth quarter;

- Total company Adjusted EBITDA between $230 million to $250

million;

- Machine Clothing revenue between $740 million to $760

million;

- Machine Clothing Adjusted EBITDA between $235 million and $245

million;

- Albany Engineered Composites revenue between $480 million to

$500 million; and

- Albany Engineered Composites Adjusted EBITDA between $65

million to $75 million.

The tables below provide a reconciliation of forecasted

full-year 2024 Adjusted EBITDA and Adjusted Diluted EPS (non-GAAP

measures) to the comparable GAAP measures:

Forecast of Full Year 2024 Adjusted

EBITDA

Machine Clothing

AEC

(in millions)

Low

High

Low

High

Net income attributable to the Company

(GAAP) (a)

$

195

$

207

$

8

$

18

Income attributable to the noncontrolling

interest

—

—

(1

)

(1

)

Interest expense, net

—

—

—

—

Income tax expense

—

—

—

—

Depreciation and amortization

34

32

53

53

EBITDA (non-GAAP)

229

239

60

70

Restructuring expenses, net (b)

7

7

3

3

Foreign currency revaluation

(gains)/losses (b)

(2

)

(2

)

—

—

Strategic/integration costs (b)

1

1

1

1

Pre-tax (income)/loss attributable to

non-controlling interest

—

—

1

1

Adjusted EBITDA (non-GAAP)

$

235

$

245

$

65

$

75

(a) Interest, Other income/expense and

Income taxes are not allocated to the business segments

Forecast of Full Year 2024 Adjusted

EBITDA

Total Company

(in millions)

Low

High

Net income attributable to the Company

(GAAP)

$

78

$

93

Income attributable to the noncontrolling

interest

(1

)

(1

)

Interest expense, net

14

14

Income tax expense

29

35

Depreciation and amortization

94

93

EBITDA (non-GAAP)

214

234

Restructuring expenses, net (b)

10

10

Foreign currency revaluation

(gains)/losses (b)

(2

)

(2

)

Strategic/integration costs (b)

4

4

Other transition expenses (b)

3

3

Pre-tax (income)/loss attributable to

non-controlling interest

1

1

Adjusted EBITDA (non-GAAP)

$

230

$

250

Total Company

Forecast of Full Year 2024 Earnings per

share (diluted) (c)

Low

High

Net income attributable to the Company

(GAAP)

$

2.48

$

2.98

Restructuring expenses, net (b)

0.29

0.29

Foreign currency revaluation

(gains)/losses (b)

(0.03

)

(0.03

)

Other transition expenses (b)

0.10

0.10

Strategic/integration costs (b)

0.06

0.06

Adjusted Earnings per share (non-GAAP)

$

2.90

$

3.40

(b) Due to the uncertainty of these items,

we are unable to forecast the full year impact of these items for

2024

(c) Calculations based on weighted average

shares outstanding estimate of approximately 31.2 million

Conference Call Today

A conference call to discuss today’s announcement will be held

today, October 3, 2024, at 8:30 a.m. Eastern Time. Interested

parties are invited to listen to the webcast via the Company’s

Investor Relations website at www.albint.com.

Interested parties may access dial information for the call by

registering via web link here. A replay of the webcast will be

available on the Company’s website at approximately Noon Eastern

Time on October 3, 2024.

Preliminary Information

The unaudited financial and operational information presented in

this press release is preliminary and may change. Albany’s

International’s financial closing procedures with respect to the

estimated financial information provided in this press release are

not yet complete, and as a result, the Company’s final results may

vary materially from the preliminary results included in this press

release. The Company undertakes no obligation to update or

supplement the information provided in this press release until the

Company releases its financial statements for the three months

ended September 30, 2024. The preliminary financial information

included in this press release reflects the Company’s current

estimates based on information available as of the date of this

press release and has been prepared by Company management. This

preliminary financial and operational information should not be

viewed as a substitute for full financial statements prepared in

accordance with GAAP and is not necessarily indicative of the

results to be achieved for any future periods. This preliminary

financial and operational information could be impacted by the

effects of financial closing procedures, final adjustments, and

other developments.

Non-GAAP Measures

This release, including the conference call commentary

associated with this release, contains certain non-GAAP measures,

which should not be considered in isolation or as a substitute for

the related GAAP measures. Such non-GAAP measures include EBITDA,

Adjusted EBITDA, and Adjusted EBITDA margin; and Adjusted diluted

earnings per share (or Adjusted Diluted EPS). Management believes

that these non-GAAP measures provide additional useful information

to investors regarding the Company’s operational performance.

EBITDA (calculated as net income excluding interest, income

taxes, depreciation, and amortization), Adjusted EBITDA, and

Adjusted Diluted EPS are performance measures that relate to the

Company’s continuing operations. The Company defines Adjusted

EBITDA as EBITDA excluding costs or benefits that are not

reflective of the Company’s ongoing or expected future operational

performance. Such excluded costs or benefits do not consist of

normal, recurring cash items necessary to generate revenues or

operate our business. Adjusted EBITDA margin represents Adjusted

EBITDA expressed as a percentage of net revenues.

The Company defines Adjusted Diluted EPS as diluted earnings per

share (GAAP), adjusted by the after tax per share amount of costs

or benefits not reflective of the Company’s ongoing or expected

future operational performance. The income tax effects are

calculated using the applicable statutory income tax rate of the

jurisdictions where such costs or benefits were incurred or the

effective tax rate applicable to total company results.

The Company’s Adjusted EBITDA, Adjusted EBITDA margin, and

Adjusted Diluted EPS may not be comparable to similarly titled

measures of other companies.

We encourage investors to review our financial statements and

publicly filed reports in their entirety and not to rely on any

single financial measure.

Forward-Looking Statements

This press release may contain statements, estimates, guidance,

or projections that constitute “forward-looking statements” as

defined under U.S. federal securities laws. Generally, the words

“believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,”

“will,” “should,” “look for,” “guidance,” “guide,” and similar

expressions identify forward-looking statements, which generally

are not historical in nature. Because forward-looking statements

are subject to certain risks and uncertainties (including, without

limitation, those set forth in the Company’s most recent Annual

Report on Form 10-K or Quarterly Report on Form 10-Q), actual

results may differ materially from those expressed or implied by

such forward-looking statements.

Forward-looking statements in this release or in the webcast

include, without limitation, statements about macroeconomic

conditions, including inflationary cost pressures, as well as

global events, which include but are not limited to geopolitical

events; paper-industry trends and conditions during the current

year and in future years; expectations in the current period and in

future periods of revenues, EBITDA, Adjusted EBITDA (both in

dollars and as a percentage of net revenues), Adjusted Diluted EPS,

income, gross profit, gross margin, cash flows and other financial

items in each of the Company’s businesses, and for the Company as a

whole; the timing and impact of production and development programs

in the Company’s AEC business segment and the revenues growth

potential of key AEC programs, as well as AEC as a whole; the

amount and timing of capital expenditures, future tax rates and

cash paid for taxes, depreciation and amortization; future debt and

net debt levels and debt covenant ratios; and changes in currency

rates and their impact on future revaluation gains and losses.

Furthermore, a change in any one or more of the foregoing factors

could have a material effect on the Company’s financial results in

any period. Such statements are based on current expectations, and

the Company undertakes no obligation to publicly update or revise

any forward-looking statements.

Statements expressing management’s assessments of the growth

potential of its businesses, or referring to earlier assessments of

such potential, are not intended as forecasts of actual future

growth, and should not be relied on as such. While management

believes such assessments to have a reasonable basis, such

assessments are, by their nature, inherently uncertain. This

release and earlier releases set forth a number of assumptions

regarding these assessments, including historical results,

independent forecasts regarding the markets in which these

businesses operate, and the timing and magnitude of orders for our

customers’ products. Historical growth rates are no guarantee of

future growth, and such independent forecasts and assumptions could

prove materially incorrect in some cases.

About Albany International Corp.

Albany International is a leading developer and manufacturer of

engineered components, using advanced materials processing and

automation capabilities, with two core businesses.

- Machine Clothing is the world’s leading producer of

custom-designed, consumable belts essential for the manufacture of

paper, paperboard, tissue and towel, pulp, non-wovens and a variety

of other industrial applications.

- Albany Engineered Composites is a growing designer and

manufacturer of advanced materials-based engineered components for

demanding aerospace applications, supporting both commercial and

military platforms.

Albany International is headquartered in Rochester, New

Hampshire, operates 32 facilities in 14 countries, employs

approximately 6,000 people worldwide, and is listed on the New York

Stock Exchange (Symbol: AIN). Additional information about the

Company and its products and services can be found at

www.albint.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241002196084/en/

Investors / Media:

JC Chetnani VP-Investor Relations and Treasurer +1 (603)

330-5851 jc.chetnani@albint.com

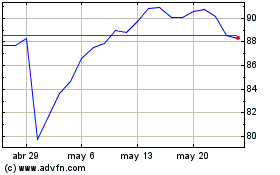

Albany (NYSE:AIN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Albany (NYSE:AIN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024