false0000922864APARTMENT INVESTMENT & MANAGEMENT CO00009228642024-02-292024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 29, 2024 |

Apartment Investment and Management Company

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Maryland |

1-13232 |

84-1259577 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

4582 South Ulster Street Suite 1450 |

|

Denver, Colorado |

|

80237 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 303 224-7900 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common Stock (Apartment Investment and Management Company) |

|

AIV |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On February 29, 2024, representatives of Apartment Investment and Management Company ("Aimco"), including Wes Powell, President and Chief Executive Officer, Lynn Stanfield, Executive Vice President and Chief Financial Officer, and Matt Foster, Sr. Director of Capital Markets and Investor Relations, will be meeting with investors at Wolfe Research Real Estate Conference 2024. During those meetings, Aimco representatives will discuss the attached presentation. The presentation is furnished herewith as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibits are filed with this report:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

APARTMENT INVESTMENT AND MANAGEMENT COMPANY |

|

|

|

|

Date: |

February 29, 2024 |

By: |

/s/ H. Lynn C. Stanfield |

|

|

|

H. Lynn C. Stanfield

Executive Vice President and Chief Financial Officer |

CONTENTS PRESENTATION TOPICS: About Aimco – Apartment specialists with a deep history and differentiated strategy Aimco Portfolio & Results – Strong stabilized operating performance with NOI up 9.3% in 2023, active developments on pace to deliver a stabilized average yield on cost of ~7%, supported by a solid balance sheet Capital Allocation – Prudent allocation of capital, currently favoring the return of capital to shareholders, sourced from cash on hand and planned asset sales Value Proposition – Continued value creation with opportunities to narrow the gap between share price and net asset value

AIMCO HISTORY 1994 1994-2008 2008 - 2015 2016-2020 IPO Apartment Investment and Management Company becomes publicly traded on the New York Stock Exchange. GROWTH Through portfolio and corporation M&A, Aimco grows to become one of the largest owners and operators of apartments in the nation. Portfolio Distillation Aimco narrows its geographic focus, trimming its target markets from 20+ to 12, and ramps up its redevelopment program. 2020 NEW AIMCO Aimco spins off AIR Communities into separate public REIT, appoints new executive management team and reconstitutes Board of Directors. Transition Aimco expands its development and opportunistic investing, exits the affordable apartment business and enhances its property management function. The 2020 spin-off of AIR Communities was completed in December 2020, with 88% of the market capitalization being separated into the new entity and 12% remaining in Aimco. 2020 Spin-off

SUCCESSFUL TRACK RECORD SELECT HIGHLIGHTS Since the spin-off of AIR Communities, Aimco has been active and delivered strong results. Aimco Stabilized Portfolio Delivered Strong Growth Net Operating Income (NOI) annual growth of >9% with NOI margins expanding by 525 basis points Exited Seattle and reduced California exposure through the sale of assets Developments and Redevelopments Completed On-Time and On-Budget Completed construction activities on $0.8Bn of development and redevelopment projects Monetized four of the completed projects for $669M – Levered Multiple on Invested Capital (MOIC) 5.9x Tripled Aimco’s pipeline providing optionality to maximize value through vertical development or monetization prior to construction Significantly Fortified the Balance Sheet Reduced total debt and leasehold liabilities by >$525M and increased average time to maturity by 25% Sourced $775M of fixed-rate non-recourse property debt at rates significantly below today’s potential refinancing levels – Rate 4.25% Hedged floating-rate debt so that 100% of Aimco’s total debt is either fixed-rate or hedged with interest rate cap protection Accretive Capital Allocation Unlocked $1.1Bn of asset value through development monetizations, stabilized asset dispositions, and selling partial interests in certain alternative investments with proceeds used to repay debt, acquire pipeline assets, and repurchase Aimco stock Repurchased 9.6M shares of Aimco common stock at an average price of $7.29 per share Committed to “Best in Class” Governance Complete Board refreshment Opted out of the provisions of the Maryland Unsolicited Takeover Act (MUTA) Enhanced financial and environmental disclosure including reporting to Task Force on Climate-Related Financial Disclosures (TCFD) Source: Company Records, as of 4Q 2023

Maintain a portfolio of Core and Core Plus Real Estate Provides stability and safety compared to a pure development portfolio Aimco’s diversified portfolio of apartments in major U.S. markets provides additional certainty of performance through local economic cycles Current portfolio of 5,600 units is producing $111M of annualized NOI. Investment in Value Add and Opportunistic Real Estate Provides outsized growth opportunities compared to a primarily stabilized apartment portfolio Aimco invests where it has the local knowledge and expertise that provides a comparative advantage over other developers and mitigates execution risk Recently completed developments and other opportunistic investments are producing $20M of annualized NOI. Active development projects projected to deliver $44M of annual NOI when stabilized. AIMCO INVESTMENTS Aimco couples outsized growth prospects from opportunistic investments with the safety of a stable apartment portfolio resulting in a nimble platform that can move the needle quickly. 6 Source: Company Records, as of 4Q 2023

HUMAN CAPITAL Executive team has an average Aimco tenure of 20 YEARS Development team has collectively built or renovated approximately $15Bn IN PROJECTS, including 50K APARTMENT HOMES, and has an average of 22 YEARS of industry experience Capital Markets and Transactions teams have participated in more than $16Bn OF TRANSACTIONS AND FINANCINGS and have an average of 17 YEARS of industry experience Aimco team had RECORD ENGAGEMENT SCORE OF 4.74 in 2023 Aimco maintains a team of highly engaged and deeply experienced real estate professionals

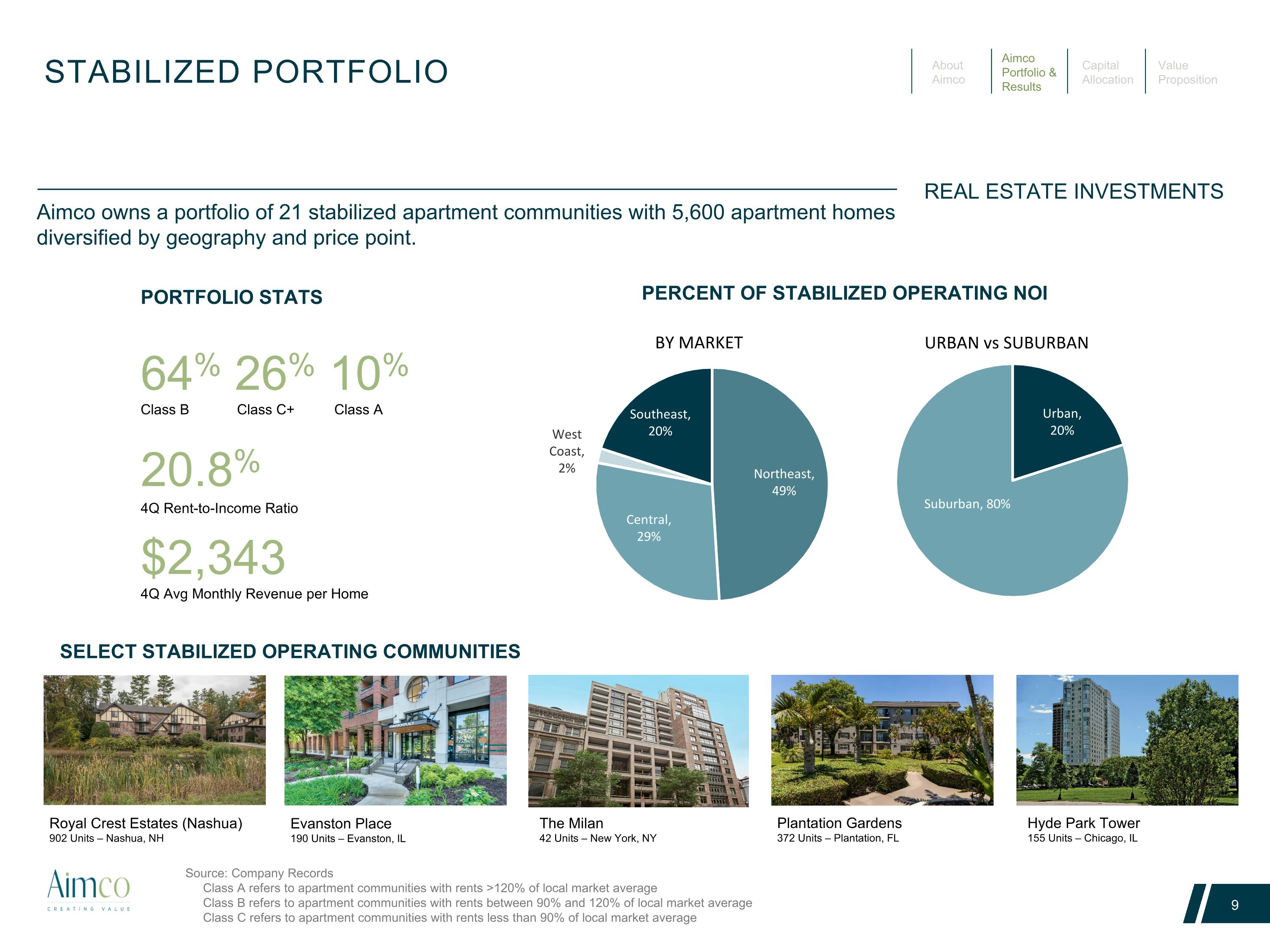

STABILIZED PORTFOLIO REAL ESTATE INVESTMENTS Royal Crest Estates (Nashua) 902 Units – Nashua, NH Plantation Gardens 372 Units – Plantation, FL Evanston Place 190 Units – Evanston, IL The Milan 42 Units – New York, NY Hyde Park Tower 155 Units – Chicago, IL URBAN vs SUBURBAN BY MARKET Aimco owns a portfolio of 21 stabilized apartment communities with 5,600 apartment homes diversified by geography and price point. PORTFOLIO STATS 64% 26% 10%�Class B Class C+ Class A 20.8% �4Q Rent-to-Income Ratio $2,343 4Q Avg Monthly Revenue per Home PERCENT OF STABILIZED OPERATING NOI SELECT STABILIZED OPERATING COMMUNITIES Source: Company Records Class A refers to apartment communities with rents >120% of local market average Class B refers to apartment communities with rents between 90% and 120% of local market average Class C refers to apartment communities with rents less than 90% of local market average

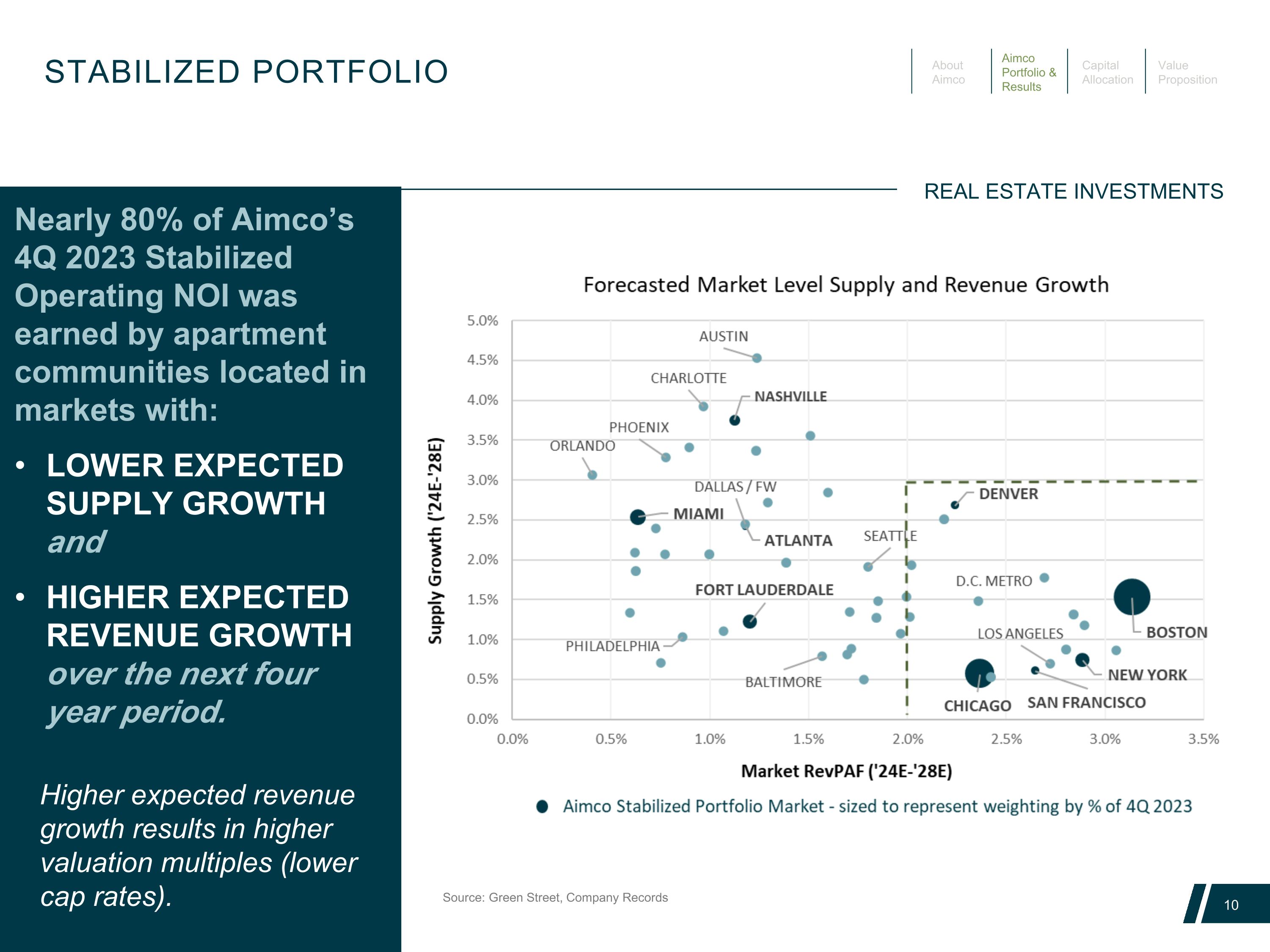

STABILIZED PORTFOLIO REAL ESTATE INVESTMENTS Nearly 80% of Aimco’s 4Q 2023 Stabilized Operating NOI was earned by apartment communities located in markets with: LOWER EXPECTED SUPPLY GROWTH and HIGHER EXPECTED REVENUE GROWTH over the next four year period. Higher expected revenue growth results in higher valuation multiples (lower cap rates). Source: Green Street, Company Records

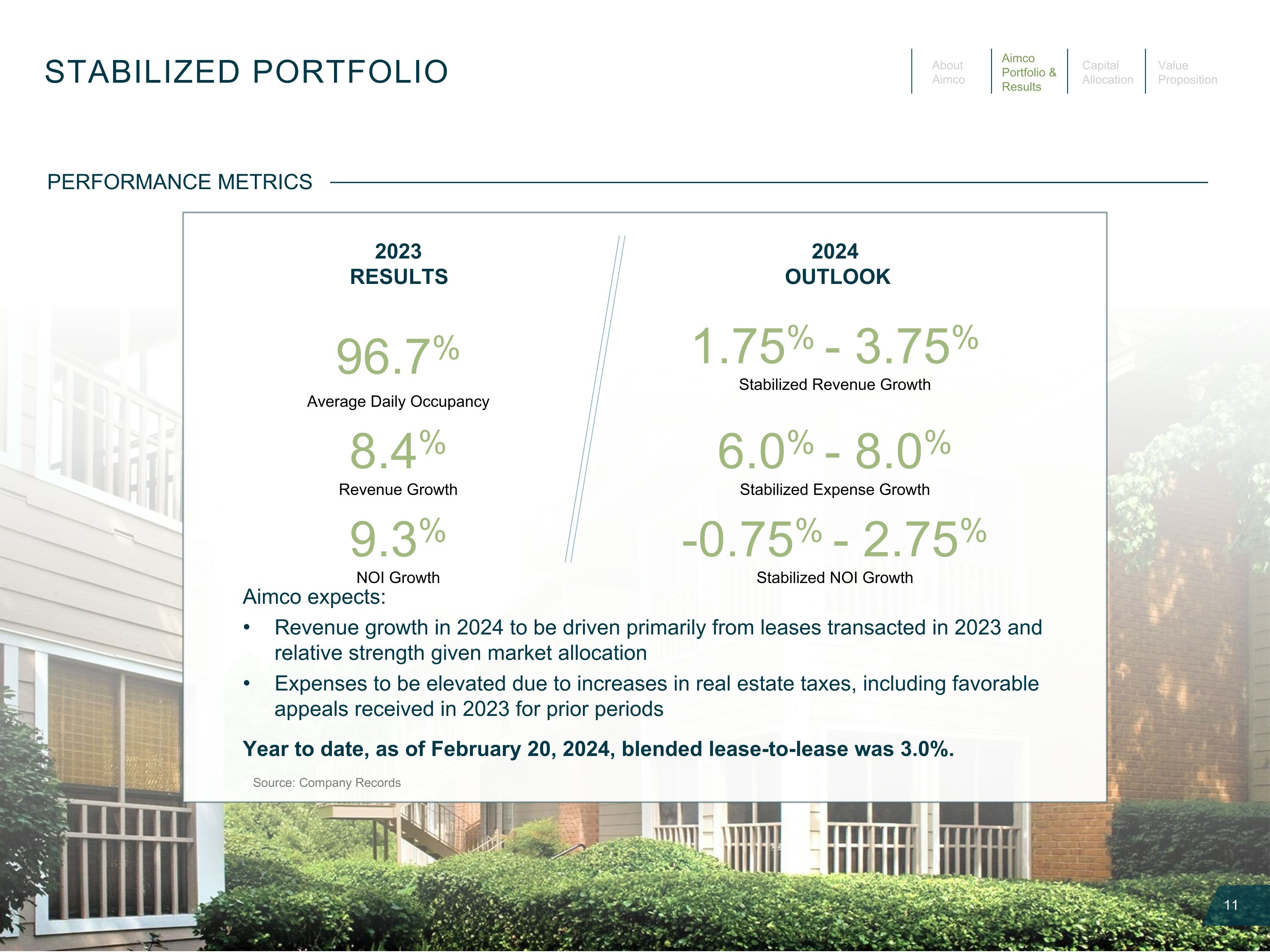

2023 RESULTS 2024 OUTLOOK 96.7% �Average Daily Occupancy 1.75% - 3.75% Stabilized Revenue Growth 8.4%�Revenue Growth 6.0% - 8.0% Stabilized Expense Growth 9.3%�NOI Growth -0.75% - 2.75% Stabilized NOI Growth STABILIZED PORTFOLIO PERFORMANCE METRICS Year to date, as of February 20, 2024, blended lease-to-lease was 3.0%. Aimco expects: Revenue growth in 2024 to be driven primarily from leases transacted in 2023 and relative strength given market allocation Expenses to be elevated due to increases in real estate taxes, including favorable appeals received in 2023 for prior periods Source: Company Records

In 2020, Aimco acquired a 271-unit apartment building fronting Biscayne Bay including additional unused density rights and an adjacent 0.6-acre waterfront parcel in the Edgewater submarket of Miami. In 2Q 2021, Aimco began construction, investing $98 million in the redevelopment and repositioning of The Hamilton. Aimco fully renovated all apartment homes and expanded rentable square footage, reimagined the amenity offerings, and upgraded all major building systems over a 24 month period. In 3Q 2023, Aimco completed the lease-up of the 276-unit community at rates more than 20% ahead of underwriting. RECENT REDEVELOPMENT THE HAMILTON

ACTIVE DEVELOPMENTS The Benson Hotel & Fac. Club Aurora, CO 106-Key Placemaking Development includes 18,000 sf of Event Space Construction Complete Critical placemaking addition to the build-out of the Anschutz Medical Campus Oak Shore Corte Madera, CA 24-Home Single Family Rental Development Five homes complete in 2023 Nine units leased or pre-leased at rates ahead of underwriting High Barrier Marin County submarket Upton Place Washington D.C. 689-Unit Mixed Use Development 450 Units delivered as of Feb 2024 70 homes leased or pre-leased at rates ahead of underwriting 105K sf of Commercial Space 80% pre-leased High Barrier to entry Upper-Northwest submarket Strathmore Square Bethesda, MD 220-Unit Phase I Development Initial Delivery on track for 3Q 2024 Infill site two miles from the main campus of the National Institutes of Health ON TRACK TO ADD VALUE Total direct investment of $648M and expected to produce $44M of NOI when stabilized Aimco equity fully deployed In 2023, Aimco delivered more than 350 new units and opened The Benson Hotel and Faculty Club In 2024, nearly 700 new units are projected to be delivered and construction is expected to be substantially complete on all currently active projects Sources: Company Records, Estimates as of 4Q 2023.

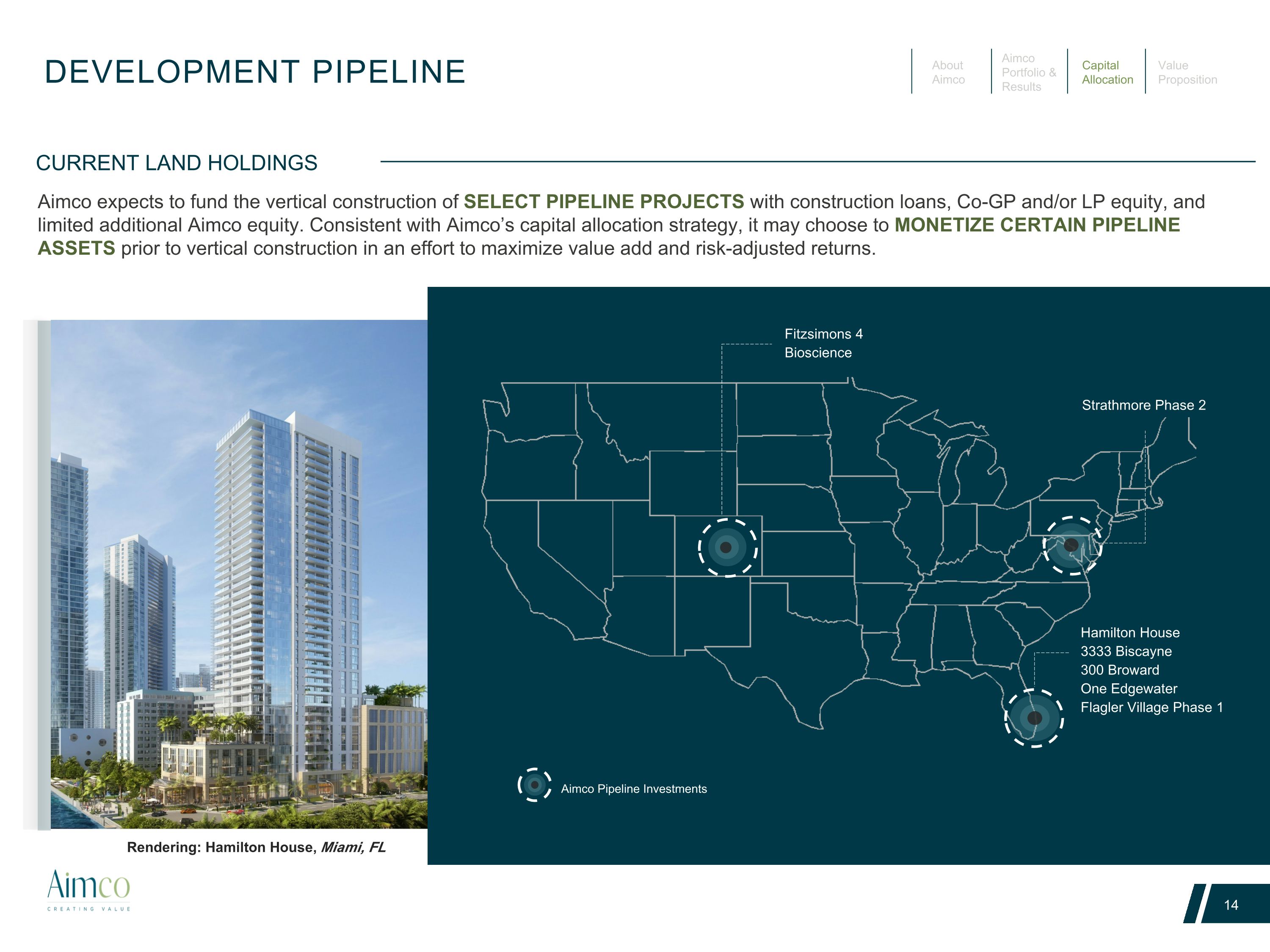

DEVELOPMENT PIPELINE Fitzsimons 4 Bioscience Strathmore Phase 2 Hamilton House�3333 Biscayne 300 Broward�One Edgewater Flagler Village Phase 1 Aimco Pipeline Investments CURRENT LAND HOLDINGS Aimco expects to fund the vertical construction of SELECT PIPELINE PROJECTS with construction loans, Co-GP and/or LP equity, and limited additional Aimco equity. Consistent with Aimco’s capital allocation strategy, it may choose to MONETIZE CERTAIN PIPELINE ASSETS prior to vertical construction in an effort to maximize value add and risk-adjusted returns. Rendering: Hamilton House, Miami, FL

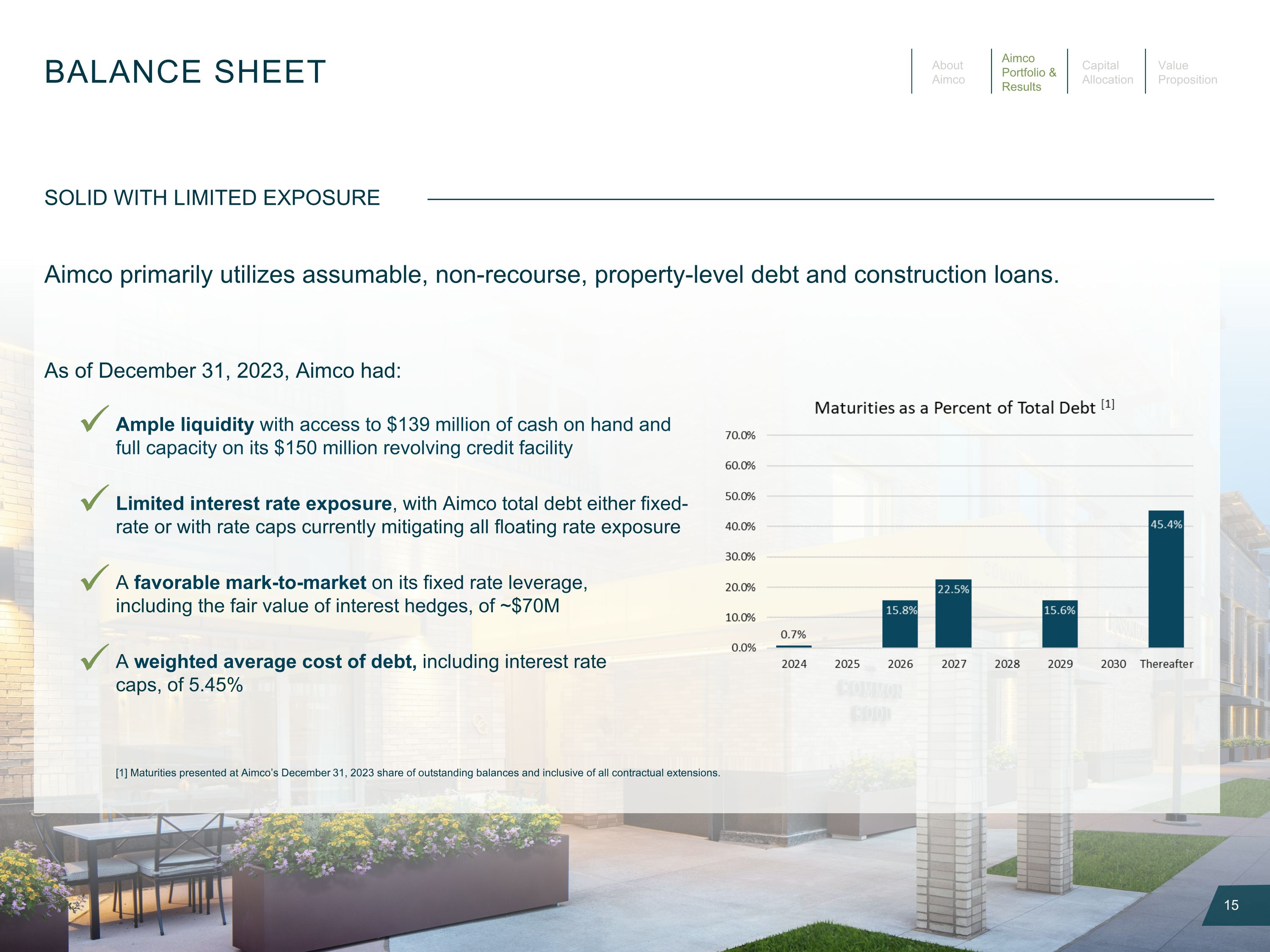

BALANCE SHEET SOLID WITH LIMITED EXPOSURE Aimco primarily utilizes assumable, non-recourse, property-level debt and construction loans. As of December 31, 2023, Aimco had: [1] Maturities presented at Aimco’s December 31, 2023 share of outstanding balances and inclusive of all contractual extensions. Limited interest rate exposure, with Aimco total debt either fixed-rate or with rate caps currently mitigating all floating rate exposure A favorable mark-to-market on its fixed rate leverage, including the fair value of interest hedges, of ~$70M Ample liquidity with access to $139 million of cash on hand and full capacity on its $150 million revolving credit facility A weighted average cost of debt, including interest rate caps, of 5.45%

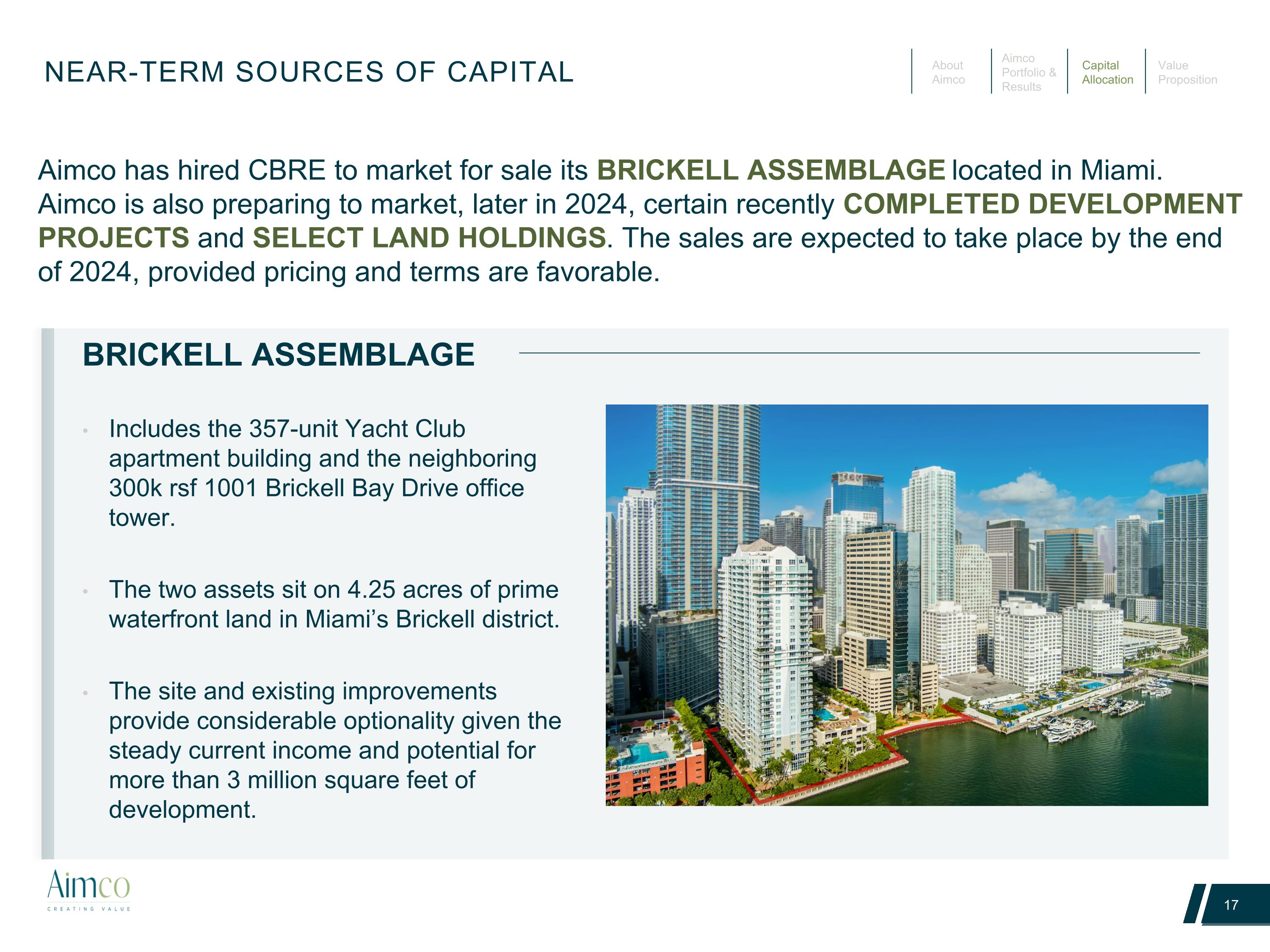

NEAR-TERM SOURCES OF CAPITAL Aimco has hired CBRE to market for sale its BRICKELL ASSEMBLAGE located in Miami. Aimco is also preparing to market, later in 2024, certain recently COMPLETED DEVELOPMENT PROJECTS and SELECT LAND HOLDINGS. The sales are expected to take place by the end of 2024, provided pricing and terms are favorable. 17 BRICKELL ASSEMBLAGE Includes the 357-unit Yacht Club apartment building and the neighboring 300k rsf 1001 Brickell Bay Drive office tower. The two assets sit on 4.25 acres of prime waterfront land in Miami’s Brickell district. The site and existing improvements provide considerable optionality given the steady current income and potential for more than 3 million square feet of development.

NEAR-TERM CAPITAL ALLOCATION 18 Return Of Capital To Shareholders Through Common Stock Repurchases, Partnership Unit Redemptions, And Special Cash Dividends. Over the past two years Aimco has repurchased 9.6 million shares at an average price of $7.29 per share and redeemed nearly 200,000 operating partnership units for cash In 2023, Aimco’s Board of Directors increased the repurchase authorization to 30 million shares Leverage Reduction Through The Retirement Of Asset-level Debt Upon Completion Of Planned Transactions. In 2023, Aimco proactively retired $72 million of high-cost floating-rate debt Select New Investments Which Offer The Prospect Of Strong Risk-adjusted Returns. Aimco anticipates maintaining an active development business but reducing the amount of Aimco capital allocated to development activity over the year ahead. Aimco expects to invest $12 - $22 million of Aimco equity into planning and new projects in 2024. Aimco currently favors the RETURN OF CAPITAL TO SHAREHOLDERS while continuing to ADVANCE THE BUSINESS and maintain BALANCE SHEET STABILITY.

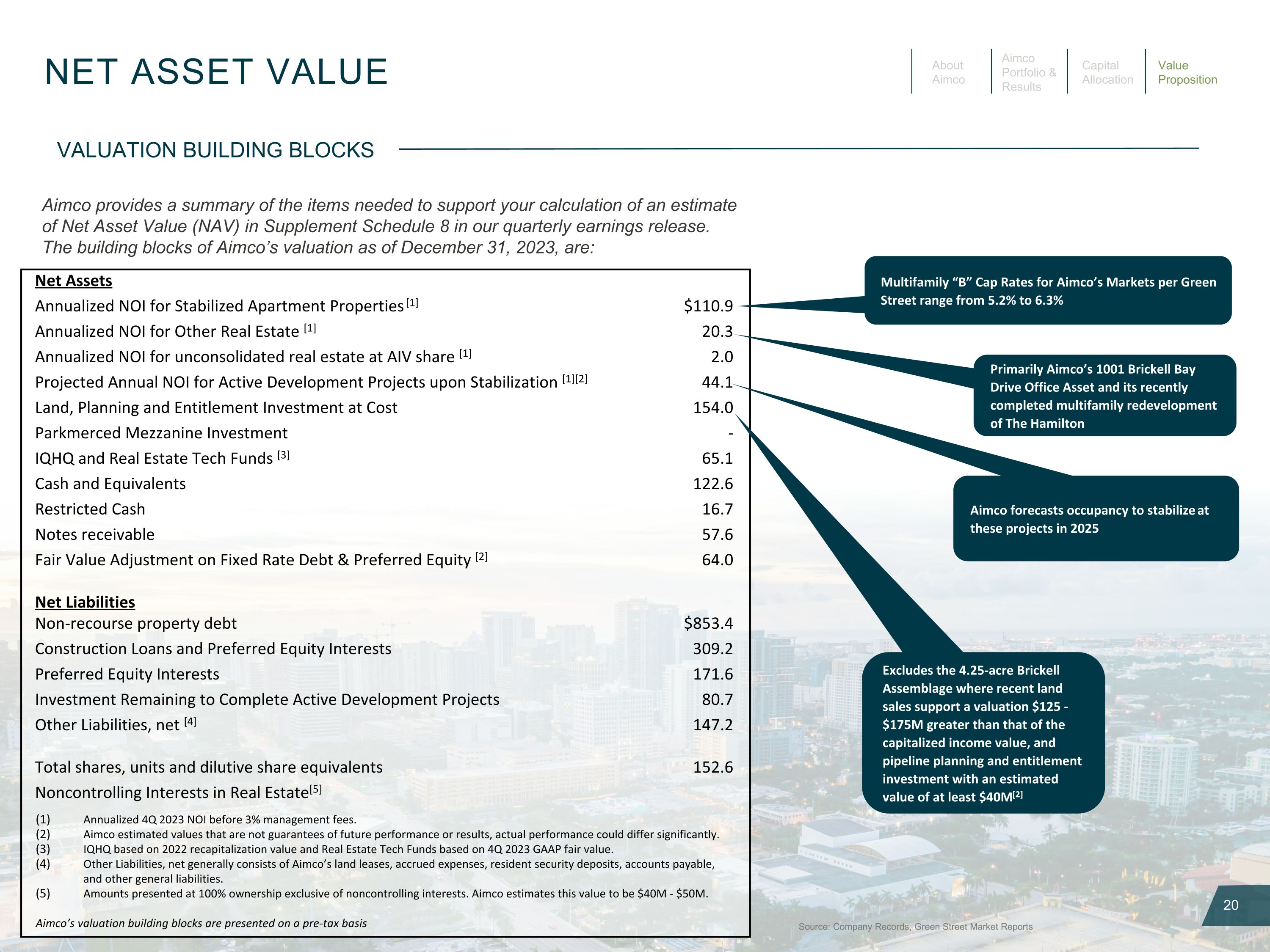

NET ASSET VALUE VALUATION BUILDING BLOCKS Aimco provides a summary of the items needed to support your calculation of an estimate of Net Asset Value (NAV) in Supplement Schedule 8 in our quarterly earnings release. The building blocks of Aimco’s valuation as of December 31, 2023, are: Source: Company Records, Green Street Market Reports Net Assets Annualized NOI for Stabilized Apartment Properties [1] $110.9 Annualized NOI for Other Real Estate [1] 20.3 Annualized NOI for unconsolidated real estate at AIV share [1] 2.0 Projected Annual NOI for Active Development Projects upon Stabilization [1][2] 44.1 Land, Planning and Entitlement Investment at Cost 154.0 Parkmerced Mezzanine Investment - IQHQ and Real Estate Tech Funds [3] 65.1 Cash and Equivalents 122.6 Restricted Cash 16.7 Notes receivable 57.6 Fair Value Adjustment on Fixed Rate Debt & Preferred Equity [2] 64.0 Net Liabilities Non-recourse property debt $853.4 Construction Loans and Preferred Equity Interests 309.2 Preferred Equity Interests 171.6 Investment Remaining to Complete Active Development Projects 80.7 Other Liabilities, net [4] 147.2 Total shares, units and dilutive share equivalents 152.6 Noncontrolling Interests in Real Estate[5] Annualized 4Q 2023 NOI before 3% management fees. Aimco estimated values that are not guarantees of future performance or results, actual performance could differ significantly. IQHQ based on 2022 recapitalization value and Real Estate Tech Funds based on 4Q 2023 GAAP fair value. Other Liabilities, net generally consists of Aimco’s land leases, accrued expenses, resident security deposits, accounts payable, and other general liabilities. Amounts presented at 100% ownership exclusive of noncontrolling interests. Aimco estimates this value to be $40M - $50M. Aimco’s valuation building blocks are presented on a pre-tax basis Multifamily “B” Cap Rates for Aimco’s Markets per Green Street range from 5.2% to 6.3% Primarily Aimco’s 1001 Brickell Bay Drive Office Asset and its recently completed multifamily redevelopment of The Hamilton Aimco forecasts occupancy to stabilize at these projects in 2025 Excludes the 4.25-acre Brickell Assemblage where recent land sales support a valuation $125 - $175M greater than that of the capitalized income value, and pipeline planning and entitlement investment with an estimated value of at least $40M[2]

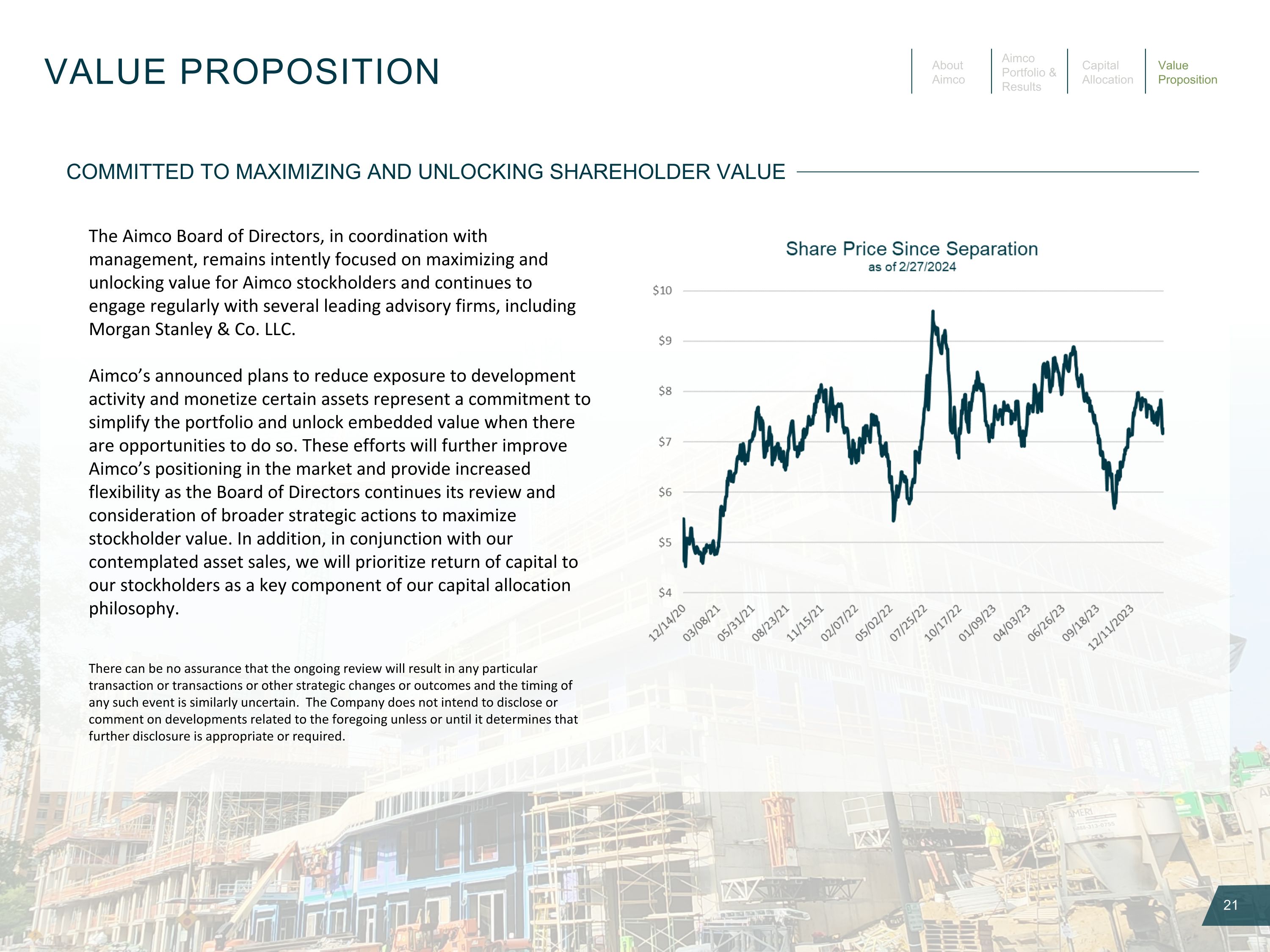

VALUE PROPOSITION COMMITTED TO MAXIMIZING AND UNLOCKING SHAREHOLDER VALUE There can be no assurance that the ongoing review will result in any particular transaction or transactions or other strategic changes or outcomes and the timing of any such event is similarly uncertain. The Company does not intend to disclose or comment on developments related to the foregoing unless or until it determines that further disclosure is appropriate or required. The Aimco Board of Directors, in coordination with management, remains intently focused on maximizing and unlocking value for Aimco stockholders and continues to engage regularly with several leading advisory firms, including Morgan Stanley & Co. LLC. Aimco’s announced plans to reduce exposure to development activity and monetize certain assets represent a commitment to simplify the portfolio and unlock embedded value when there are opportunities to do so. These efforts will further improve Aimco’s positioning in the market and provide increased flexibility as the Board of Directors continues its review and consideration of broader strategic actions to maximize stockholder value. In addition, in conjunction with our contemplated asset sales, we will prioritize return of capital to our stockholders as a key component of our capital allocation philosophy.

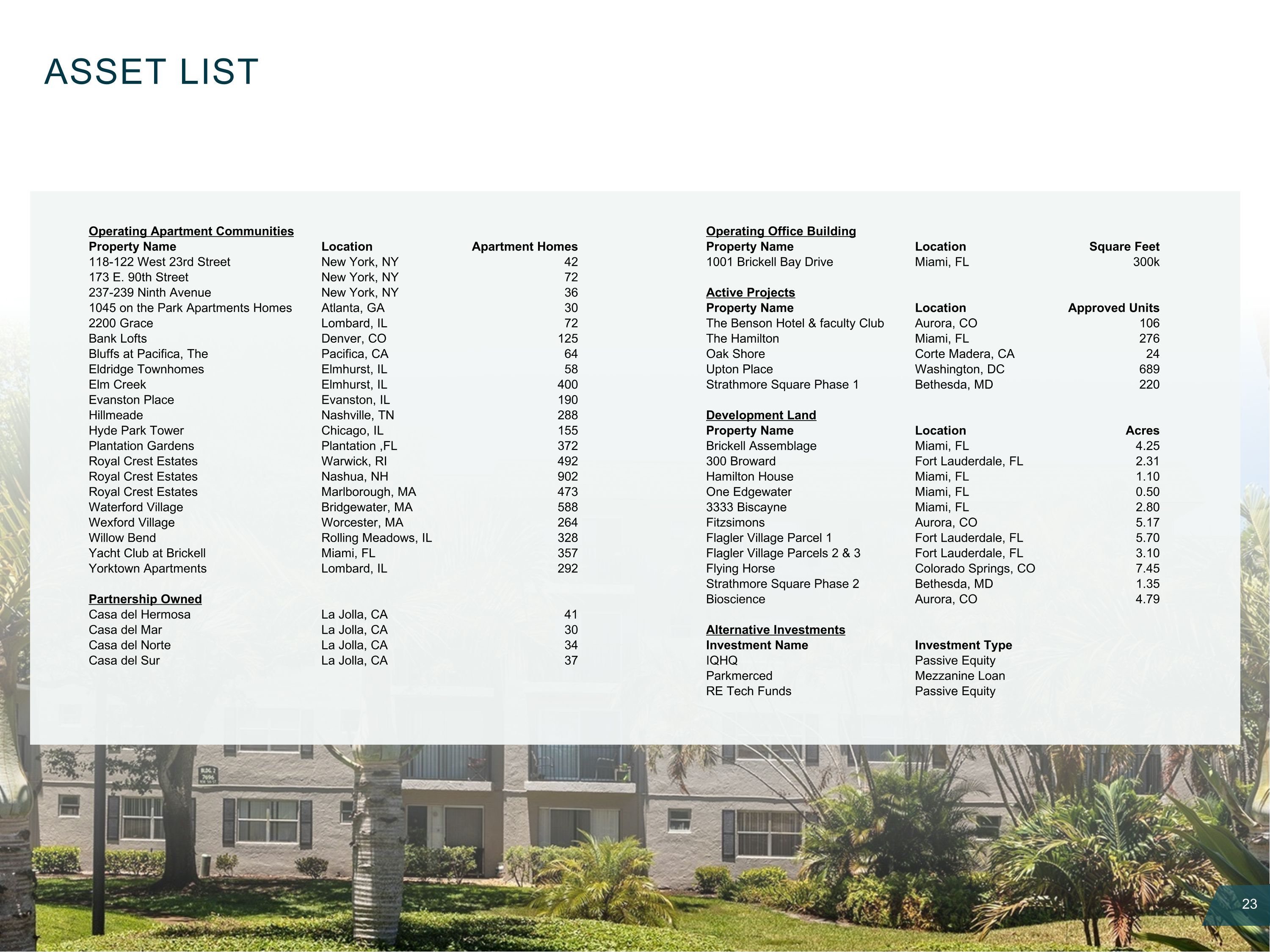

ASSET LIST Operating Apartment Communities Operating Office Building Property Name Location Apartment Homes Property Name Location Square Feet 118-122 West 23rd Street New York, NY 42 1001 Brickell Bay Drive Miami, FL 300k 173 E. 90th Street New York, NY 72 237-239 Ninth Avenue New York, NY 36 Active Projects 1045 on the Park Apartments Homes Atlanta, GA 30 Property Name Location Approved Units 2200 Grace Lombard, IL 72 The Benson Hotel & faculty Club Aurora, CO 106 Bank Lofts Denver, CO 125 The Hamilton Miami, FL 276 Bluffs at Pacifica, The Pacifica, CA 64 Oak Shore Corte Madera, CA 24 Eldridge Townhomes Elmhurst, IL 58 Upton Place Washington, DC 689 Elm Creek Elmhurst, IL 400 Strathmore Square Phase 1 Bethesda, MD 220 Evanston Place Evanston, IL 190 Hillmeade Nashville, TN 288 Development Land Hyde Park Tower Chicago, IL 155 Property Name Location Acres Plantation Gardens Plantation ,FL 372 Brickell Assemblage Miami, FL 4.25 Royal Crest Estates Warwick, RI 492 300 Broward Fort Lauderdale, FL 2.31 Royal Crest Estates Nashua, NH 902 Hamilton House Miami, FL 1.10 Royal Crest Estates Marlborough, MA 473 One Edgewater Miami, FL 0.50 Waterford Village Bridgewater, MA 588 3333 Biscayne Miami, FL 2.80 Wexford Village Worcester, MA 264 Fitzsimons Aurora, CO 5.17 Willow Bend Rolling Meadows, IL 328 Flagler Village Parcel 1 Fort Lauderdale, FL 5.70 Yacht Club at Brickell Miami, FL 357 Flagler Village Parcels 2 & 3 Fort Lauderdale, FL 3.10 Yorktown Apartments Lombard, IL 292 Flying Horse Colorado Springs, CO 7.45 Strathmore Square Phase 2 Bethesda, MD 1.35 Partnership Owned Bioscience Aurora, CO 4.79 Casa del Hermosa La Jolla, CA 41 Casa del Mar La Jolla, CA 30 Alternative Investments Casa del Norte La Jolla, CA 34 Investment Name Investment Type Casa del Sur La Jolla, CA 37 IQHQ Passive Equity Parkmerced Mezzanine Loan RE Tech Funds Passive Equity

PIPELINE INVESTMENTS Pipeline Project Summaries As of December 31, 2023 (unaudited) Project Location Project Name / Description Estimated / Currently Planned [1] Acreage [2] Gross Sq Ft Multifamily Units Leasable Commercial Sq Ft Earliest Vertical Construction Start Southeast Florida 556-640 NE 34th Street (Miami) Hamilton House 1.10 560,000 114 6,500 3Q 2024 3333 Biscayne Boulevard (Miami) 3333 Biscayne [3] 2.80 1,760,000 650 176,000 2025 510-532 NE 34th Street (Miami) One Edgewater 0.50 533,000 204 — 2025 300 Broward Boulevard (Fort Lauderdale) 300 Broward [3] 2.31 1,700,000 935 40,000 2025 901 N Federal Highway (Fort Lauderdale) Flagler Village Phase I 5.70 1,830,000 690 230,000 2025 1001-1111 Brickell Bay Drive (Miami) Brickell Assemblage 4.25 3,200,000 1,500 500,000 2027 NE 9th Street & NE 5th Avenue (Fort Lauderdale) Flagler Village Phase III 1.70 400,000 300 — 2027 NE 9th Street & NE 5th Avenue (Fort Lauderdale) Flagler Village Phase IV 1.40 400,000 300 — 2028 Washington D.C. Metro Area 5300 Block of Tuckerman Lane (Bethesda) Strathmore Square Phase II [3] 1.35 525,000 399 11,000 2025 Colorado's Front Range E 23rd Avenue & N Scranton Street (Aurora) Fitzsimons 4 [3] 1.77 415,000 285 — 4Q 2024 1765 Silversmith Road (Colorado Springs) Flying Horse 7.45 300,000 95 — 2025 E 23rd Avenue & N Scranton Street (Aurora) Bioscience 4 1.53 232,000 — 225,000 2025 E 22nd Avenue & N Scranton Street (Aurora) Fitzsimons 2 2.29 390,000 275 — 2026 E 23rd Avenue & N Scranton Street (Aurora) Bioscience 5 1.22 230,000 — 190,000 2026 E 23rd Avenue & Uvalda (Aurora) Fitzsimons 3 1.11 400,000 225 — 2027 E 23rd Avenue & N Scranton Street (Aurora) Bioscience 6 2.04 385,000 — 315,000 2028 Total Future Pipeline 38.52 13,260,000 5,972 1,693,500 Aimco estimates are not guarantees of future plans which could differ significantly Acreage for the Bioscience project is presented proportionate base on the buildable gross square feet Owned in a joint venture structure

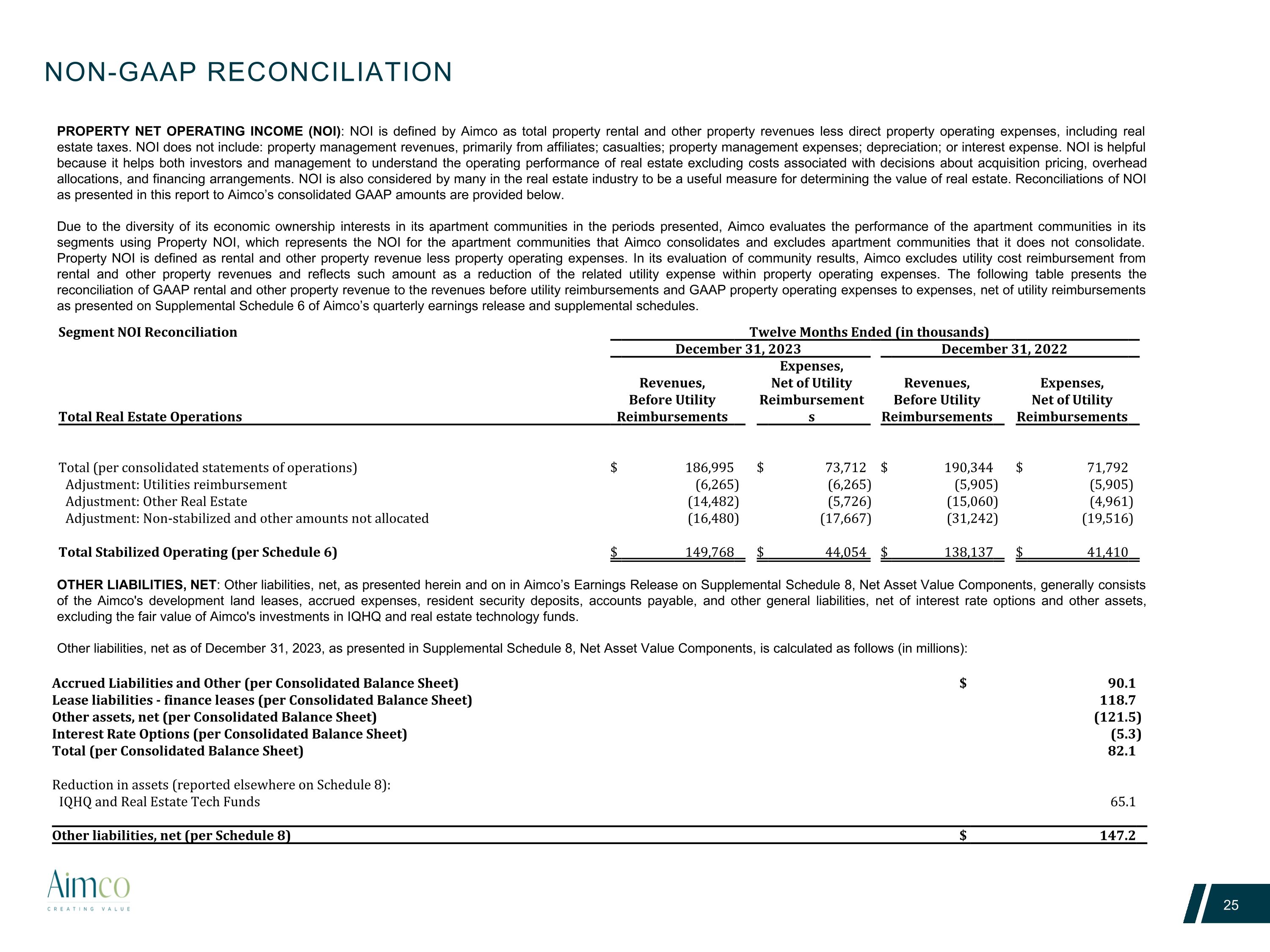

NON-GAAP RECONCILIATION PROPERTY NET OPERATING INCOME (NOI): NOI is defined by Aimco as total property rental and other property revenues less direct property operating expenses, including real estate taxes. NOI does not include: property management revenues, primarily from affiliates; casualties; property management expenses; depreciation; or interest expense. NOI is helpful because it helps both investors and management to understand the operating performance of real estate excluding costs associated with decisions about acquisition pricing, overhead allocations, and financing arrangements. NOI is also considered by many in the real estate industry to be a useful measure for determining the value of real estate. Reconciliations of NOI as presented in this report to Aimco’s consolidated GAAP amounts are provided below. Due to the diversity of its economic ownership interests in its apartment communities in the periods presented, Aimco evaluates the performance of the apartment communities in its segments using Property NOI, which represents the NOI for the apartment communities that Aimco consolidates and excludes apartment communities that it does not consolidate. Property NOI is defined as rental and other property revenue less property operating expenses. In its evaluation of community results, Aimco excludes utility cost reimbursement from rental and other property revenues and reflects such amount as a reduction of the related utility expense within property operating expenses. The following table presents the reconciliation of GAAP rental and other property revenue to the revenues before utility reimbursements and GAAP property operating expenses to expenses, net of utility reimbursements as presented on Supplemental Schedule 6 of Aimco’s quarterly earnings release and supplemental schedules. OTHER LIABILITIES, NET: Other liabilities, net, as presented herein and on in Aimco’s Earnings Release on Supplemental Schedule 8, Net Asset Value Components, generally consists of the Aimco's development land leases, accrued expenses, resident security deposits, accounts payable, and other general liabilities, net of interest rate options and other assets, excluding the fair value of Aimco's investments in IQHQ and real estate technology funds. Other liabilities, net as of December 31, 2023, as presented in Supplemental Schedule 8, Net Asset Value Components, is calculated as follows (in millions): Accrued Liabilities and Other (per Consolidated Balance Sheet) $ 90.1 Lease liabilities - finance leases (per Consolidated Balance Sheet) 118.7 Other assets, net (per Consolidated Balance Sheet) (121.5 ) Interest Rate Options (per Consolidated Balance Sheet) (5.3 ) Total (per Consolidated Balance Sheet) 82.1 Reduction in assets (reported elsewhere on Schedule 8): IQHQ and Real Estate Tech Funds 65.1 Other liabilities, net (per Schedule 8) $ 147.2 Segment NOI Reconciliation Twelve Months Ended (in thousands) December 31, 2023 December 31, 2022 Total Real Estate Operations Revenues,�Before Utility�Reimbursements Expenses,�Net of Utility�Reimbursements Revenues,�Before Utility�Reimbursements Expenses,�Net of Utility�Reimbursements Total (per consolidated statements of operations) $ 186,995 $ 73,712 $ 190,344 $ 71,792 Adjustment: Utilities reimbursement (6,265 ) (6,265 ) (5,905 ) (5,905 ) Adjustment: Other Real Estate (14,482 ) (5,726 ) (15,060 ) (4,961 ) Adjustment: Non-stabilized and other amounts not allocated (16,480 ) (17,667 ) (31,242 ) (19,516 ) Total Stabilized Operating (per Schedule 6) $ 149,768 $ 44,054 $ 138,137 $ 41,410

Forward Looking Statement This presentation contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements include all statements that are not historical statements of fact and those regarding our intent, belief, or expectations, including, but not limited to, the statements in this document regarding our future plans and goals, including our pipeline investments and projects, our plans to eliminate certain near term debt maturities, our estimated value creation and potential, our timing, scheduling and budgeting, projections regarding lease growth, our plans to form joint ventures, our plans for new acquisitions or dispositions, our strategic partnerships and value added therefrom, and changes to our corporate governance. We caution investors not to place undue reliance on any such forward-looking statements. Words such as “anticipate(s),” “expect(s),” “intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,” “seek(s)” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the control of Aimco that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statement. Important factors, among others, that may affect actual results or outcomes include, but are not limited to: (i) the risk that the 2023 plans and goals may not be completed, as expected, in a timely manner or at all, (ii) the inability to recognize the anticipated benefits of the pipeline investments and projects, and (iii) changes in general economic conditions, including, increases in interest rates and other force-majeure events. Although we believe that the assumptions underlying the forward-looking statements are reasonable, we can give no assurance that our expectations will be attained. Readers should carefully review Aimco’s financial statements and the notes thereto, as well as the section entitled “Risk Factors” in Item 1A of Aimco’s Annual Report on Form 10-K for the year ended December 31, 2023, and subsequent Quarterly Reports on Form 10-Q and other documents Aimco files from time to time with the SEC. These filings identify and address important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. These forward-looking statements reflect management’s judgment and expectations as of this date, and Aimco assumes no (and disclaims any) obligation to revise or update them to reflect future events or circumstances. Certain financial and operating measures found herein are used by management and are not defined under accounting principles generally accepted in the United States, or GAAP. These measures are reconciled to the most comparable GAAP measures at the end of this presentation. Definitions can be found in Aimco’s Earnings Release and Supplemental Schedules for the quarter ended December 31, 2023.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

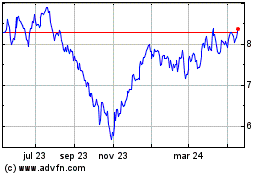

Apartment Investment and... (NYSE:AIV)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Apartment Investment and... (NYSE:AIV)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024