ALLETE, Inc. (NYSE: ALE) today reported third quarter 2023

earnings of $1.49 per share on net income of $85.9 million. Last

year’s third quarter results were 59 cents per share on net income

of $33.7 million.

“We are pleased with our solid financial results this quarter

and the positive momentum going into the end of the year,” said

ALLETE Chair, President, and Chief Executive Officer Bethany Owen.

“We continue to deliver on our Sustainability in Action strategy,

including our most recent announcement that Minnesota Power has

been awarded a $50 million grant by the U.S. Department of Energy

to modernize its high-voltage direct current transmission system.

As planned, Minnesota Power also filed a rate case yesterday in

support of its EnergyForward strategy, to align investments and our

work force with the state of Minnesota legislation requiring 100%

carbon-free energy by 2040. In addition, New Energy Equity has a

robust pipeline of renewable energy projects, which is expected to

result in strong financial results in the fourth quarter and

beyond. Together, these key steps forward demonstrate the

significant progress we are making in advancing a sustainable

clean-energy future.”

“Our results for the third quarter of 2023 reflect a favorable

arbitration award for a subsidiary of ALLETE Clean Energy,” said

ALLETE Senior Vice President and Chief Financial Officer Steve

Morris. “Our regulated operations results were lower in the

quarter, reflecting timing of interim rate reserves in 2023

compared to 2022. We continue to expect New Energy Equity to

achieve or slightly exceed our original full-year earnings

projections. Considering a number of factors occurring during the

year, as well as our expectations for the fourth quarter, we have

raised ALLETE’s 2023 full-year earnings guidance to a range of

$4.30 to $4.40 per share.”

“Specific items affecting ALLETE’s updated guidance include the

third quarter arbitration award, a third-party network outage

expected to negatively impact the Caddo wind facility in the fourth

quarter, and historically low wind across much of the nation

affecting earnings at ALLETE Clean Energy wind facilities

throughout the year. These items in total had a net positive impact

on our updated guidance of approximately 30 cents per share,” said

Morris.

ALLETE’s Regulated Operations segment, which includes Minnesota

Power, Superior Water, Light and Power and the Company’s investment

in the American Transmission Co., recorded third quarter 2023 net

income of $34.0 million, compared to $38.3 million in the third

quarter a year ago. Earnings at Minnesota Power were lower this

year compared to 2022, primarily due to interim rate refund

reserves recognized in 2023, resulting from Minnesota Power’s 2022

general rate case outcome; the full interim rate reserve was

recorded in the fourth quarter of 2022. These decreases were

partially offset by increased sales to industrial customers.

ALLETE Clean Energy recorded third quarter 2023 net income of

$54.8 million, which reflects the gain recognized for the favorable

arbitration award, compared to a net loss of $7.3 million in 2022.

Net income in 2022 included a $2.9 million after-tax reserve for an

anticipated loss on the sale of ALLETE Clean Energy’s Northern Wind

project.

Corporate and Other businesses, which include New Energy Equity,

BNI Energy, ALLETE Properties and investments in renewable energy

facilities, recorded a net loss of $2.9 million in the third

quarter of 2023, compared to net income of $2.7 million in 2022.

Third quarter net income in 2023 reflects increased income tax

expense, partially offset by earnings from Minnesota solar

projects. New Energy’s earnings in this quarter were slightly below

2022, primarily due to the timing of project closings, now expected

in the fourth quarter, and higher operating and maintenance expense

as compared to last year.

Live webcast on November 2, 2023; 2023 third quarter slides

posted on company website.

ALLETE’s earnings conference call will be at 10:00 a.m. (EST),

November 2, 2023, at which time management will discuss the third

quarter of 2023 financial results. Interested parties may

participate live by registering for the call at

www.allete.com/earningscall or may listen to the live audio-only

webcast, accompanied by supporting slides, which will be available

on ALLETE’s Investor Relations website

investor.allete.com/events-presentations. The webcast will be

accessible for one year at allete.com.

ALLETE is an energy company headquartered in Duluth, Minn. In

addition to its electric utilities, Minnesota Power and Superior

Water, Light and Power of Wisconsin, ALLETE owns ALLETE Clean

Energy, based in Duluth, BNI Energy in Bismarck, N.D., New Energy

Equity headquartered in Annapolis, MD, and has an eight percent

equity interest in the American Transmission Co. More information

about ALLETE is available at www.allete.com. ALE-CORP

The statements contained in this release and statements that

ALLETE may make orally in connection with this release that are not

historical facts, are forward-looking statements. Actual results

may differ materially from those projected in the forward-looking

statements. These forward-looking statements involve risks and

uncertainties and investors are directed to the risks discussed in

documents filed by ALLETE with the Securities and Exchange

Commission.

ALLETE's press releases and other communications may include

certain non-Generally Accepted Accounting Principles (GAAP)

financial measures. A "non-GAAP financial measure" is defined as a

numerical measure of a company's financial performance, financial

position or cash flows that excludes (or includes) amounts that are

included in (or excluded from) the most directly comparable measure

calculated and presented in accordance with GAAP in the company's

financial statements.

Non-GAAP financial measures utilized by the Company include

presentations of earnings (loss) per share. ALLETE's management

believes that these non-GAAP financial measures provide useful

information to investors by removing the effect of variances in

GAAP reported results of operations that are not indicative of

changes in the fundamental earnings power of the Company's

operations. Management believes that the presentation of the

non-GAAP financial measures is appropriate and enables investors

and analysts to more accurately compare the company's ongoing

financial performance over the periods presented.

ALLETE, Inc.

Consolidated Statement of

Income

Millions Except Per Share Amounts

- Unaudited

Quarter Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Operating Revenue

Contracts with Customers – Utility

$314.3

$322.6

$919.1

$960.3

Contracts with Customers – Non-utility

63.2

64.5

554.1

178.3

Other – Non-utility

1.3

1.2

3.9

6.3

Total Operating Revenue

378.8

388.3

1,477.1

1,144.9

Operating Expenses

Fuel, Purchased Power and Gas –

Utility

124.9

136.8

350.8

417.4

Transmission Services – Utility

22.7

19.3

66.3

57.5

Cost of Sales – Non-utility

33.0

38.4

436.7

96.9

Operating and Maintenance

83.6

83.2

254.2

238.1

Depreciation and Amortization

63.1

58.7

188.2

181.4

Taxes Other than Income Taxes

15.5

18.5

43.1

53.1

Total Operating Expenses

342.8

354.9

1,339.3

1,044.4

Operating Income

36.0

33.4

137.8

100.5

Other Income (Expense)

Interest Expense

(20.5)

(18.4)

(60.9)

(55.3)

Equity Earnings

4.7

2.3

16.1

13.1

Other

68.7

2.3

75.3

16.4

Total Other Income (Expense)

52.9

(13.8)

30.5

(25.8)

Income Before Income Taxes

88.9

19.6

168.3

74.7

Income Tax Expense (Benefit)

19.3

(7.2)

20.4

(19.4)

Net Income

69.6

26.8

147.9

94.1

Net Loss Attributable to Non-Controlling

Interest

(16.3)

(6.9)

(47.7)

(43.5)

Net Income Attributable to

ALLETE

$85.9

$33.7

$195.6

$137.6

Average Shares of Common Stock

Basic

57.4

57.1

57.3

55.5

Diluted

57.5

57.2

57.4

55.6

Basic Earnings Per Share of Common

Stock

$1.50

$0.59

$3.41

$2.48

Diluted Earnings Per Share of Common

Stock

$1.49

$0.59

$3.41

$2.48

Dividends Per Share of Common

Stock

$0.6775

$0.65

$2.0325

$1.95

Consolidated Balance

Sheet

Millions - Unaudited

Sep. 30,

Dec. 31,

Sep. 30,

Dec. 31,

2023

2022

2023

2022

Assets

Liabilities and Equity

Cash and Cash Equivalents

$125.5

$36.4

Current Liabilities

$413.5

$716.2

Other Current Assets

377.7

681.6

Long-Term Debt

1,686.1

1,648.2

Property, Plant and Equipment – Net

4,996.8

5,004.0

Deferred Income Taxes

171.2

158.1

Regulatory Assets

443.3

441.0

Regulatory Liabilities

549.3

526.1

Equity Investments

329.7

322.7

Defined Benefit Pension and Other

Postretirement Benefit Plans

164.2

179.7

Goodwill and Intangibles – Net

155.5

155.6

Other Non-Current Liabilities

263.8

269.0

Other Non-Current Assets

216.3

204.3

Equity

3,396.7

3,348.3

Total Assets

$6,644.8

$6,845.6

Total Liabilities and Equity

$6,644.8

$6,845.6

Quarter Ended

Nine Months Ended

ALLETE, Inc.

September 30,

September 30,

Income (Loss)

2023

2022

2023

2022

Millions

Regulated Operations

$34.0

$38.3

$112.4

$119.4

ALLETE Clean Energy

54.8

(7.3)

66.4

15.0

Corporate and Other

(2.9)

2.7

16.8

3.2

Net Income Attributable to ALLETE

$85.9

$33.7

$195.6

$137.6

Diluted Earnings Per Share

$1.49

$0.59

$3.41

$2.48

Statistical Data

Corporate

Common Stock

High

$59.22

$63.81

$66.69

$68.61

Low

$52.30

$49.89

$52.30

$49.89

Close

$52.80

$50.05

$52.80

$50.05

Book Value

$48.48

$46.93

$48.48

$46.93

Kilowatt-hours Sold

Millions

Regulated Utility

Retail and Municipal

Residential

250

251

812

851

Commercial

355

353

1,022

1,027

Industrial

1,742

1,665

5,178

5,047

Municipal

112

130

350

419

Total Retail and Municipal

2,459

2,399

7,362

7,344

Other Power Suppliers

526

769

2,008

2,544

Total Regulated Utility Kilowatt-hours

Sold

2,985

3,168

9,370

9,888

Regulated Utility Revenue

Millions

Regulated Utility Revenue

Retail and Municipal Electric Revenue

Residential

$36.0

$37.7

$111.6

$123.3

Commercial

48.6

47.8

135.5

135.8

Industrial

153.8

146.8

436.9

443.5

Municipal

8.7

9.8

25.2

31.9

Total Retail and Municipal Electric

Revenue

247.1

242.1

709.2

734.5

Other Power Suppliers

31.0

46.7

103.2

124.6

Other (Includes Water and Gas Revenue)

36.2

33.8

106.7

101.2

Total Regulated Utility Revenue

$314.3

$322.6

$919.1

$960.3

This exhibit has been furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, nor shall it be deemed incorporated by reference in any

filing under the Securities Act of 1933, except as shall be

expressly set forth by specific reference in such filing.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231102684352/en/

Investor Contact: Vince Meyer 218-723-3952 vmeyer@allete.com

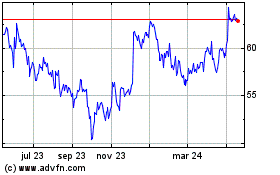

Allete (NYSE:ALE)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

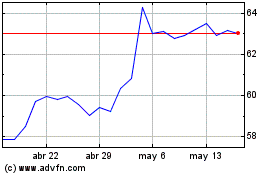

Allete (NYSE:ALE)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024