Alta Equipment Group Announces Proposed Private Offering of $500 Million of Senior Secured Second Lien Notes

20 Mayo 2024 - 6:35AM

Alta Equipment Group Inc. (NYSE: ALTG) (“Alta” or the “Company”),

today announced that it intends to offer, subject to market and

other conditions, $500 million in aggregate principal amount of its

senior secured second lien notes due 2029 in a private offering

(the “offering”) that is exempt from the registration requirements

of the Securities Act of 1933, as amended (the “Securities Act”).

The notes will be guaranteed by all of the Company’s domestic

subsidiaries and will be secured by a second lien on substantially

all of the assets of the Company and its domestic subsidiaries.

Concurrent with the closing of the offering, the Company expects to

amend and extend its existing $485 million senior secured

asset-based revolving credit facility due 2026 (the “Existing ABL

Facility”) and $70 million floor plan facility due 2026 (the

“Existing Floor Plan Facility”) with a $520 million senior secured

asset-based revolving credit facility due 2029 (the “New ABL

Facility”) and a $90 million floor plan facility due 2029 (together

with the New ABL Facility, the “First Lien Facilities”). The First

Lien Facilities will be secured by a first-priority lien on the

same assets securing the notes. The Company intends to use the net

proceeds from the offering, together with the proceeds of new

borrowings under the First Lien Facilities, (i) to refinance a

portion of the Existing ABL Facility and the Existing Floor Plan

Facility prior to the amendments thereto, pay accrued and unpaid

interest thereon, and pay related fees and expenses thereto, (ii)

to redeem all of its outstanding 5.625% Senior Secured Second Lien

Notes due 2026 (the “Existing Notes”), pay the premium, accrued and

unpaid interest thereon, and pay related fees and expenses thereto,

and (iii) for general corporate purposes to the extent there are

any remaining proceeds. The offering and related refinancing

is expected to be leverage neutral for the Company.

The notes and the related guarantees will be

offered only to persons reasonably believed to be qualified

institutional buyers pursuant to Rule 144A under the Securities Act

and to non-U.S. persons outside the United States in

reliance on Regulation S under the Securities Act. The offer and

sale of the notes and the related guarantees have not been

registered under the Securities Act or the securities laws of any

state or other jurisdiction and may not be offered or sold absent

registration or an applicable exemption from the registration

requirements under the Securities Act and any applicable securities

laws of any state or other jurisdiction.

This press release shall not constitute an offer

to sell, or the solicitation of an offer to buy, any of the notes,

nor shall there be any sale of the notes in any state or

jurisdiction in which such offer, solicitation, or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. This press release is

being issued pursuant to and in accordance with Rule 135(c) under

the Securities Act.

This press release does not constitute a notice of

redemption with respect to the Existing Notes.

Forward Looking Statements

This press release includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995. Alta’s actual

results may differ from their expectations, estimates and

projections and consequently, you should not rely on these

forward-looking statements as predictions of future events. Words

such as “expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,”

“believes,” “predicts,” “potential,” “continue,” and similar

expressions are intended to identify such forward-looking

statements. These forward-looking statements involve significant

risks and uncertainties that could cause the actual results to

differ materially from the expected results. Most of these factors

are outside Alta’s control and are difficult to predict. Factors

that may cause such differences include, but are not limited to:

supply chain disruptions, inflationary pressures resulting from

supply chain disruptions or a tightening labor market; negative

impacts on customer payment policies and adverse banking and

governmental regulations, resulting in a potential reduction to the

fair value of our assets; the performance and financial viability

of key suppliers, contractors, customers, and financing sources;

economic, industry, business and political conditions including

their effects on governmental policy and government actions that

disrupt our supply chain or sales channels; fluctuations in

interest rates; the market price for our equipment; collective

bargaining agreements and our relationship with our

union-represented employees; our success in identifying acquisition

targets and integrating acquisitions; our success in expanding into

and doing business in additional markets; our ability to raise

capital at favorable terms; the competitive environment for our

products and services; our ability to continue to innovate and

develop new business lines; our ability to attract and retain key

personnel, including, but not limited to, skilled technicians; our

ability to maintain our listing on the New York Stock Exchange; the

impact of cyber or other security threats or other disruptions to

our businesses; our ability to realize the anticipated benefits of

acquisitions or divestitures, rental fleet and other organic

investments or internal reorganizations; federal, state, and local

government budget uncertainty, especially as it relates to

infrastructure projects and taxation; currency risks and other

risks associated with international operations; and other risks and

uncertainties indicated from time to time in the section entitled

“Risk Factors” in Alta’s annual report on Form 10-K and other

filings with the U.S. Securities and Exchange Commission. Alta

cautions that the foregoing list of factors is not exclusive, and

readers should not place undue reliance upon any forward-looking

statements, which speak only as of the date made. Alta does not

undertake or accept any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statements

to reflect any change in its expectations or any change in events,

conditions, or circumstances on which any such statement is

based.

About Alta Equipment Group

Inc.

Alta owns and operates one of the largest

integrated equipment dealership platforms in North America. Through

our branch network, the Company sells, rents, and provides parts

and service support for several categories of specialized

equipment, including lift trucks and other material handling

equipment, heavy and compact earthmoving equipment, crushing and

screening equipment, environmental processing equipment, cranes and

aerial work platforms, paving and asphalt equipment, other

construction equipment and allied products. Alta has operated as an

equipment dealership for 40 years and has developed a branch

network that includes over 85 total locations across Michigan,

Illinois, Indiana, Ohio, Pennsylvania, Massachusetts, Maine,

Connecticut, New Hampshire, Vermont, Rhode Island, New York,

Virginia, Nevada and Florida and the Canadian provinces of Ontario

and Quebec. Alta offers its customers a one-stop-shop for their

equipment needs through its broad, industry-leading product

portfolio.

Contacts

Investors: Kevin Inda SCR

Partners, LLC kevin@scr-ir.com (225) 772-0254

Media: Glenn Moore Alta Equipment

glenn.moore@altg.com (248) 305-2134

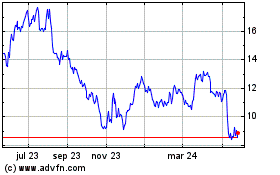

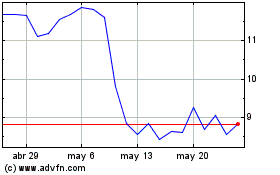

Alta Equipment (NYSE:ALTG)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Alta Equipment (NYSE:ALTG)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024