Argo Group Shareholders Approve Proposed Merger with Brookfield Reinsurance

19 Abril 2023 - 3:12PM

Business Wire

Argo Group International Holdings, Ltd. (“Argo”) (NYSE: ARGO)

today announced that Argo shareholders voted to approve an

agreement for Brookfield Reinsurance Ltd. (“Brookfield

Reinsurance”) to acquire Argo in an all-cash transaction valued at

approximately $1.1 billion (the “Merger”).

The Merger remains subject to other customary closing

conditions, including receipt of required regulatory approvals.

Argo and Brookfield Reinsurance expect to complete the Merger in

the second half of 2023.

Argo will file the final vote results, as certified by the

independent Inspector of Election, on a Form 8-K with the U.S.

Securities and Exchange Commission.

About Argo

Argo Group International Holdings, Ltd. (NYSE: ARGO) is a U.S.

focused underwriter of specialty insurance products in the property

and casualty market. Argo offers a full line of products and

services designed to meet the unique coverage and claims-handling

needs of businesses. Argo and its insurance subsidiaries are rated

‘A-’ by Standard and Poor’s. Argo’s insurance subsidiaries are

rated ‘A-’ by A.M. Best. More information on Argo and its

subsidiaries is available at www.argogroup.com.

Cautionary Note Regarding Forward-Looking Statements

This press release may include, and Argo may make related oral,

forward-looking statements that reflect Argo’s current views with

respect to future events and financial performance. Such statements

include forward-looking statements both with respect to us in

general, and to the insurance and reinsurance sectors in particular

(both as to underwriting and investment matters). Statements that

include the words “expect,” “estimate,” “intend,” “plan,”

“believe,” “project,” “anticipate,” “seek,” “aim,” “likely,”

“will,” “may,” “could,” “should” or “would” and similar statements

of a future or forward-looking nature identify forward-looking

statements in this press release for purposes of the U.S. federal

securities laws or otherwise. We intend these forward-looking

statements to be covered by the safe harbor provisions for

forward-looking statements in the Private Securities Litigation

Reform Act of 1995.

The proposed transaction is subject to risks and uncertainties

and factors that could cause Argo’s actual results to differ,

possibly materially, from those in the specific projections, goals,

assumptions and statements herein including, but not limited to:

(i) that Argo may be unable to complete the proposed transaction

because, among other reasons, conditions to the closing of the

proposed transaction may not be satisfied or waived, including that

a governmental authority may prohibit, delay or refuse to grant

approval for the consummation of the transaction; (ii) uncertainty

as to the timing of completion of the proposed transaction; (iii)

the occurrence of any event, change or other circumstance that

could give rise to the termination of the merger agreement between

Argo, Brookfield Reinsurance and BNRE Bermuda Merger Sub Ltd.; (iv)

risks related to disruption of management’s attention from Argo’s

ongoing business operations due to the proposed transaction; (v)

the effect of the announcement of the proposed transaction on

Argo’s relationships with its clients, employees, operating results

and business generally; and (vi) the outcome of any legal

proceedings to the extent initiated against Argo or others

following the announcement of the proposed transaction, as well as

Argo management’s response to any of the aforementioned

factors.

The foregoing review of important factors should not be

construed as exhaustive and should be read in conjunction with the

other cautionary statements that are included herein or elsewhere,

including the risk factors included in Argo’s most recent Annual

Report on Form 10-K and Quarterly Report on Form 10-Q and other

documents of Argo on file with, or furnished to, the Securities and

Exchange Commission. Any forward-looking statements made in this

press release are qualified by these cautionary statements, and

there can be no assurance that the actual results or developments

anticipated by Argo will be realized or, even if substantially

realized, that they will have the expected consequences to, or

effects on, Argo or its business or operations. Argo undertakes no

obligation to update publicly or revise any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as required by the federal

securities laws. References to additional information about Argo

and Brookfield Reinsurance have been provided as a convenience, and

the information contained on such websites is not incorporated by

reference into this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230419005922/en/

Andrew Hersom Head of Investor Relations Tel: (860)

970-5845 Email: andrew.hersom@argogroupus.com

Gregory Charpentier AVP, Investor Relations and Corporate

Finance Tel: (978) 387-4150 Email:

gregory.charpentier@argogroupus.com

David Snowden Senior Vice President, Communications Tel:

(210) 321-2104 Email: david.snowden@argogroupus.com

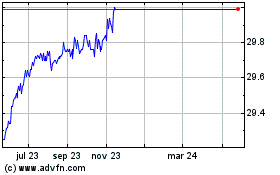

Argo (NYSE:ARGO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

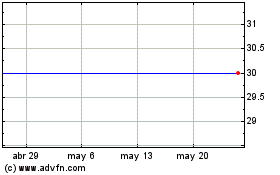

Argo (NYSE:ARGO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025