Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

31 Octubre 2023 - 2:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ý Filed by a party other than the Registrant ¨

Check the appropriate box:

| | | | | |

¨ | Preliminary Proxy Statement |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ý | Definitive Additional Materials |

¨ | Soliciting Material under §240.14a-12 |

Axos Financial, Inc.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| ý | No fee required |

¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-–6(i)(1) and 0-11. |

The additional materials provided herein supplement and clarify information regarding Item 4 of the definitive proxy statement (the “Proxy Statement”) of Axos Financial, Inc. (the “Company”) filed with the Securities and Exchange Commission on September 25, 2023 regarding the 2023 Annual Meeting of Stockholders of Axos Financial, Inc. (the ‘‘Annual Meeting’’) to be held on November 9, 2023 at 2:00 p.m. Pacific Time. The information set forth in the Proxy Statement remains unchanged and should continue to be considered in casting votes by proxy or in person at the Annual Meeting. This additional material solely provides further information to be considered with respect to a stockholder’s evaluation of Item 4 of the Proxy Statement.

As described in the Proxy Statement, our Board of Directors unanimously recommends a vote FOR the approval of the Amended and Restated 2014 Stock Incentive Plan (“the Plan”).

As more specifically described in the Proxy Statement, we are seeking stockholder approval to add 1,000,000 shares under the Plan. The following points outline the reasons why we think stockholders should support the proposal.

1) Equity usage and needs.

•The Plan allows us to award stock incentives to almost all our employees as a retention incentive and to ensure that their compensation incentives are aligned with stock price appreciation.

◦100% of full-time employees who have reached the end of their first bonus period are provided a portion of their incentive compensation in the form of RSUs.

◦Multi-year vesting supports employee retention.

•As of September 30, 2023, approximately 4.8 million of the 5.7 million shares in the Plan have been used to support our retention goals over the past 10 years.

•1,000,000 shares represent only 1.7% of our current outstanding shares and their addition to the current reserve should provide for approximately 3 years of our equity compensation needs assuming the current 3-year average burn rate.

◦Since the initial adoption of the Plan in 2014, our full-time employees have increased from 366 to 1,455, including the additions of a securities clearing and custody business that Axos did not have in 2014.

◦Additionally, we intend to use a portion of the increased share reserve to opportunistically hire talent which has become available due to the dislocations in the banking industry to accelerate the advancement of existing and new businesses.

•Our compensation approach more strongly ties our employees’ interests with that of our stockholders.

◦Our peers offer higher levels of cash compensation and lower levels of equity compensation to their senior officers compared to Axos; we believe this dynamic is true for all employees.

◦Approximately 75% of our employees own Axos’ stock, which we believe is a greater ownership level than our peers.

2) Burn rate and potential dilution.

•The Company has been prudent in the use of equity awards. The 3-year gross and net burn rate (excluding shares withheld for income tax purposes) have been 1.32% and 0.94% respectively. By comparison, the gross burn rate for two relevant ISS benchmarks is 1.05% (banks) and 3.61% (diversified financial services industries).

•We outperform our peers in terms of total compensation expense ratio. Our Bank’s salaries and benefits, including equity compensation, were 0.82% of average assets compared to a peer ratio of 1.32% for banks with greater than $1 billion in assets.

•We have returned value to our stockholders through our share repurchase program that has more than offset dilution from this share increase. Through October 20, 2023, we have been aggressively repurchasing shares with over 2.9 million shares repurchased in calendar year 2023 and we have approximately $44 million remaining share repurchase authorization.

3) Stockholder-friendly plan provisions.

•The Plan contains many provisions that safeguard stockholders’ interests:

◦No evergreen or re-pricing revisions are included in the Plan.

◦No tax gross-ups; no dividends on unvested awards;

◦Double-trigger upon change-in-control.

◦The proposal amends the Plan to incorporate our minimum stock ownership requirements for executives and directors. The ownership requirement is 8x salary for the CEO, 5x salary for the CFO and 3x salary for all other EVPs. The ownership requirement for the directors is 5x their annual cash retainer.

We believe our program appropriately incentivizes and rewards our employees and has been effective in aligning our employees’ interests with those of other stockholders as evidenced by the Company’s strong financial and stock performance.

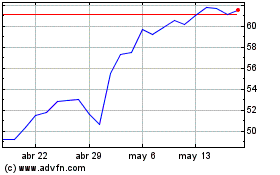

Axos Financial (NYSE:AX)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

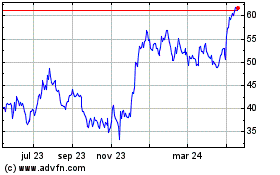

Axos Financial (NYSE:AX)

Gráfica de Acción Histórica

De May 2023 a May 2024