Senior BofA Executive Has Died -- WSJ

27 Octubre 2018 - 2:02AM

Noticias Dow Jones

By Rachel Louise Ensign

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 27, 2018).

Bank of America Corp. on Friday said Vice Chairman Terry

Laughlin, who oversaw the bank's sprawling wealth-management

business, died unexpectedly at age 63.

Mr. Laughlin, a member of the bank's executive-management team,

was a close adviser to Chief Executive Brian Moynihan. The two men

had worked together on and off for decades.

After Mr. Moynihan took the top job in 2010 with a mandate to

repair the teetering bank, he appointed Mr. Laughlin to a variety

of senior roles, including salvaging the bank's troubled mortgage

portfolio and helping the lender resubmit its Federal Reserve

stress test.

"He just had a great intellectual capability and tremendous work

ethic," Mr. Moynihan said in an interview. "He could sit down and

do the math and at the same time do the strategy."

In the ensuing years, the bank largely put its crisis-era issues

behind it and pursued a conservative strategy that earned it the

praise of Warren Buffett, whose Berkshire Hathaway Inc. is now the

bank's largest investor.

"For years, he's been the go-to problem solver in that company

and its predecessors for the most difficult, vexing banking

issues," said Edward Herlihy, a partner at law firm Wachtell,

Lipton, Rosen & Katz who worked closely with Mr. Laughlin over

the years.

Most recently, Mr. Laughlin oversaw Bank of America's

wealth-management franchises, Merrill Lynch Global Wealth

Management and U.S. Trust. That business has total client balances

of more than $2.8 trillion and around 19,000 wealth advisers.

The son of an accountant for a coking factory, Mr. Laughlin grew

up in southwestern Pennsylvania. He held odd jobs to earn extra

money, from caddying to working at the coking oven, a boyhood

friend told The Wall Street Journal in 2011. After working for a

local bank, Mr. Laughlin left Pittsburgh for a banking job at Fleet

Financial Group Inc. in Providence, R.I., where he met Mr. Moynihan

in the 1990s. Fleet was eventually acquired by Bank of America, one

of a series of deals that built the lender into a coast-to-coast

behemoth and the second-largest U.S. bank by assets.

Over the years, Mr. Moynihan came to rely heavily on Mr.

Laughlin's counsel. Mr. Laughlin, for instance, long ago helped

teach Mr. Moynihan a method of valuing potential bank acquisitions,

the Bank of America CEO said.

"We got along because both of us were about getting the work

done," Mr. Moynihan said.

Mr. Laughlin later went to work at Merrill Lynch before its own

crisis-era acquisition by Bank of America. There, top executives

rejected his calls for severe write-downs on banking assets

purchased just before the U.S. housing market collapsed.

In 2009, he became the chief executive of OneWest Bank, a

California-based lender born out of the rubble of failed IndyMac.

He was then hired by Bank of America in 2010, just months after Mr.

Moynihan took the CEO role.

Write to Rachel Louise Ensign at rachel.ensign@wsj.com

(END) Dow Jones Newswires

October 27, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

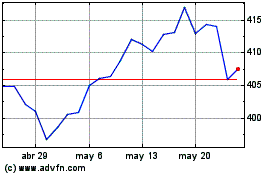

Berkshire Hathaway (NYSE:BRK.B)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

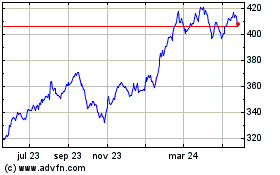

Berkshire Hathaway (NYSE:BRK.B)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024