Chartis, a leading healthcare advisory firm, today announced

that it has entered into a definitive agreement to receive a

majority investment from funds managed by Blackstone

(”Blackstone”). This strategic investment will support the firm’s

continued growth as a leading advisor to providers, payers,

technology innovators, retail companies, and investors who are

making positive and transformative change within US healthcare. The

investment includes continued equity participation from Audax

Private Equity (“Audax”).

Blackstone is investing in Chartis through its core private

equity strategy, which partners with high-quality, market-leading

businesses for longer periods than traditional private equity. The

investment will enable Chartis to further extend its capabilities

across its strategic, digital and technology, clinical, and

financial transformation offerings for healthcare clients. This

funding is also anticipated to help further expand the full Chartis

family of companies, currently including HealthScape Advisors,

Jarrard, and Greeley.

“Chartis was founded with the mission to help clients

fundamentally improve healthcare delivery across the United States.

Over the past 23 years, since our inception, great strides have

been made. Looking to the future, we are excited to do even more.

Blackstone shares our commitment to supporting industry leaders

across the healthcare landscape as they strive to make care in the

US more accessible, more affordable, more reliable, more equitable,

and more human for patients and caregivers,” say co-founders Ken

Graboys, CEO of Chartis, and Ethan Arnold, Managing Partner.

“Blackstone’s expertise, scale, and resources align well with

Chartis’ transformative vision for the future of the industry,”

said Greg Maddrey, President of Chartis. “This investment will

provide us with the resources to grow our organic offerings, expand

our capabilities, and further enhance our infrastructure. We are

excited about the future and confident that this partnership will

help us enable our clients to reshape healthcare for the

better.”

“The increasing complexity of the healthcare landscape has only

amplified the need for trusted partners like Chartis,” said Ram

Jagannath, a Senior Managing Director at Blackstone. “Ken, Ethan,

Greg, and their team have done a tremendous job building a leading

advisory business for their clients by serving as a strategic

thought partner that leverages next-generation technology and care

models. The company’s powerful mission-driven culture is a

testament to its impressive leadership and people. We look forward

to bringing the resources of Blackstone’s global platform to bear

to support Chartis’ continued growth.”

Since Audax’ 2019 investment, Chartis has acquired and

integrated seven add-on acquisitions, expanding the firm into

complementary capabilities and new end markets. During this period,

Chartis has also established several new centers for research and

advancement, which contribute to better understanding and

addressing healthcare where it is most vulnerable.

“Our investment in Chartis is emblematic of our Buy & Build

strategy, backing a first-class management team, understanding and

collaborating around their vision for growth, and bringing capital

and resources to bear to help the company execute on its

purpose-driven strategy,” said Audax Private Equity Partner and

Co-President Young Lee. “We sincerely thank Ken, Ethan, Greg, and

the rest of the Chartis team for their continued partnership.”

The transaction is expected to close by the end of 2024, subject

to customary closing conditions and regulatory approvals. Terms of

the transaction were not disclosed.

Lincoln International and BofA Securities served as financial

advisors, and Ropes and Gray and Winston & Strawn LLP served as

legal counsel to Chartis and Audax Private Equity. Goldman Sachs

& Co. LLC served as financial advisor and Kirkland & Ellis

LLP served as legal counsel to Blackstone.

About Chartis The challenges facing US healthcare are

longstanding and all too familiar. We are Chartis, and we believe

in better. We work with more than 900 clients annually to develop

and activate transformative strategies, operating models, and

organizational enterprises that make US healthcare more affordable,

accessible, safe, and human. With more than 1,000 professionals, we

help providers, payers, technology innovators, retail companies,

and investors create and embrace solutions that tangibly and

materially reshape healthcare for the better. Our family of

brands—Chartis, Jarrard, Greeley, and HealthScape Advisors—is 100%

focused on healthcare and each has a longstanding commitment to

helping transform healthcare in big and small ways. Learn more at

www.chartis.com.

About Blackstone Blackstone is the world’s largest

alternative asset manager. We seek to deliver compelling returns

for institutional and individual investors by strengthening the

companies in which we invest. Our more than $1 trillion in assets

under management include global investment strategies focused on

real estate, private equity, infrastructure, life sciences, growth

equity, credit, real assets, secondaries and hedge funds. Further

information is available at www.blackstone.com. Follow @blackstone

on LinkedIn, X (Twitter), and Instagram.

About Audax Private Equity Headquartered in Boston, with

offices in San Francisco, New York, and London, Audax Private

Equity is a capital partner for middle and lower middle market

companies that seeks to facilitate transformational growth through

its private equity and strategic capital strategies. With

approximately $19 billion of assets under management, over 270

employees, and 100-plus investment professionals, the firm has

invested in more than 170 platforms and 1,300 add-on acquisitions

since its founding in 1999. Through our disciplined Buy & Build

approach, across six core industry verticals, Audax helps portfolio

companies execute organic and inorganic growth initiatives that

fuel revenue expansion, optimize operations, and significantly

increase equity value. For more information, visit

www.audaxprivateequity.com or follow us on LinkedIn.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240814816896/en/

Media Contacts

Chartis Amy Norwalk, Brand Manager

anorwalk@chartis.com

Thomas J. Rozycki, Jr. / John Perilli / Jack McCarthy Prosek

Partners for Chartis Pro-Chartis@prosek.com

Blackstone Matt Anderson matthew.anderson@blackstone.com

(518) 248-7310

Mariel Seidman-Gati mariel.seidmangati@blackstone.com (917)

698-1674

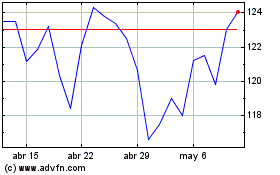

Blackstone (NYSE:BX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Blackstone (NYSE:BX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024