|

The information in this preliminary

pricing supplement is not complete and may be changed. A registration statement relating to these notes has been filed with the Securities

and Exchange Commission. This preliminary pricing supplement and the accompanying prospectus supplement and prospectus are not an offer

to sell these notes, nor are they soliciting an offer to buy these notes, in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER

12, 2024

|

| Citigroup Inc. |

September , 2024

Medium-Term Senior Notes, Series

G

Pricing Supplement No. 2024-CMTNG[

]

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-270327

|

Callable Fixed Rate Notes

Due September 30, 2039

| ▪ | The notes mature on the maturity date specified below. We have the right to call the notes for mandatory redemption prior to maturity

on a periodic basis on the redemption dates specified below. Unless previously redeemed, the notes pay interest periodically at the fixed

per annum rate indicated below. |

| ▪ | The notes are unsecured senior debt obligations of Citigroup Inc. All payments on the notes are subject to the credit risk of Citigroup

Inc. |

| ▪ | It is important for you to consider the information contained in this pricing supplement together with the information contained

in the accompanying prospectus supplement and prospectus. The description of the notes below supplements, and to the extent inconsistent

with replaces, the description of the general terms of the notes set forth in the accompanying prospectus supplement and prospectus. |

| KEY TERMS |

| Issuer: |

Citigroup Inc. Upon at least 15 business days’ notice, any wholly owned subsidiary of Citigroup Inc. may, without the consent of any holder of the notes, assume Citigroup Inc.’s obligations under the notes, and in such event Citigroup Inc. shall be released from its obligations under the notes, subject to certain conditions, including the condition that Citigroup Inc. fully and unconditionally guarantee all payments under the notes. See “Additional Terms of the Notes” in this pricing supplement. |

| Stated principal amount: |

$1,000 per note |

| Pricing date: |

September 26, 2024 |

| Original issue date: |

September 30, 2024 |

| Maturity date: |

September 30, 2039. If the maturity date is not a business day, then the payment required to be made on the maturity date will be made on the next succeeding business day with the same force and effect as if it had been made on the maturity date. No additional interest will accrue as a result of delayed payment. |

| Payment at maturity: |

$1,000 per note plus any accrued and unpaid interest |

| Interest rate per annum: |

From and including the original issue date to but excluding the maturity date, unless previously redeemed by us: 4.85% |

| Interest period: |

The period from and including the original issue date to but excluding the immediately following interest payment date, and each successive period from and including an interest payment date to but excluding the next interest payment date. |

| Interest payment dates: |

Semi-annually on the 30th day of each March and September, commencing March 30, 2025, provided that if any such day is not a business day, the applicable interest payment will be made on the next succeeding business day. No additional interest will accrue on that succeeding business day. Interest will be payable to the persons in whose names the notes are registered at the close of business on the business day preceding each interest payment date, which we refer to as a regular record date, except that the interest payment due at maturity or upon earlier redemption will be paid to the persons who hold the notes on the maturity date or earlier date of redemption, as applicable. |

| Day count convention: |

30/360 Unadjusted. See “Determination of Interest Payments” in this pricing supplement. |

| Redemption: |

Beginning on March 30, 2027, we have the right to call the notes for

mandatory redemption, in whole and not in part, on any redemption date and pay to you 100% of the principal amount of the notes plus accrued

and unpaid interest to but excluding the date of such redemption. If we decide to redeem the notes, we will give you notice at least five

business days before the redemption date specified in the notice.

So long as the notes are represented by global securities and are held

on behalf of The Depository Trust Company (“DTC”), redemption notices and other notices will be given by delivery to DTC.

If the notes are no longer represented by global securities and are not held on behalf of DTC, redemption notices and other notices will

be published in a leading daily newspaper in New York City, which is expected to be The Wall Street Journal.

|

| Redemption dates: |

The 30th day of each March, June, September and December beginning in March 2027, provided that if any such day is not a business day, the applicable redemption date will be the next succeeding business day. No additional interest will accrue as a result of such delay in payment. |

| Business day: |

Any day that is not a Saturday or Sunday and that, in New York City, is not a day on which banking institutions are authorized or obligated by law or executive order to close |

| Business day convention: |

Following |

| Listing: |

The notes will not be listed on any securities exchange |

| CUSIP / ISIN: |

17290AFV7 / US17290AFV70 |

| Underwriter: |

Citigroup Global Markets Inc. (“CGMI”), an affiliate of the issuer, acting as principal. See “General Information—Supplemental information regarding plan of distribution; conflicts of interest” in this pricing supplement. |

| Underwriting fee and issue price: |

Issue price(1) |

Underwriting fee(2) |

Proceeds to issuer |

| Per note: |

$1,000.00 |

$ |

$ |

| Total: |

$ |

$ |

$ |

(1) The issue price for eligible institutional

investors and investors purchasing the notes in fee-based advisory accounts will vary based on then-current market conditions and the

negotiated price determined at the time of each sale; provided, however, that the issue price for such investors will not be less than

$970.00 per note and will not be more than $1,000 per note. The issue price for such investors reflects a forgone selling concession

or underwriting fee with respect to such sales as described in footnote (2) below. See “General Information—Fees and selling

concessions” in this pricing supplement.

(2) CGMI will receive an underwriting

fee of up to $30.00 per note, and from such underwriting fee will allow selected dealers a selling concession of up to $30.00 per note

depending on market conditions that are relevant to the value of the notes at the time an order to purchase the notes is submitted to

CGMI. Dealers who purchase the notes for sales to eligible institutional investors and/or to investors purchasing the notes in fee-based

advisory accounts may forgo some or all selling concessions, and CGMI may forgo some or all of the underwriting fee for sales it makes

to eligible institutional investors and/or to investors purchasing the notes in fee-based advisory accounts. The per note underwriting

fee in the table above represents the maximum underwriting fee payable per note. The total underwriting fee and proceeds to issuer in

the table above give effect to the actual total proceeds to issuer. You should refer to “Risk Factors” and “General

Information—Fees and selling concessions” in this pricing supplement for more information. In addition to the underwriting

fee, CGMI and its affiliates may profit from expected hedging activity related to this offering, even if the value of the notes declines.

See “Use of Proceeds and Hedging” in the accompanying prospectus.

Investing in the notes involves risks

not associated with an investment in conventional fixed rate debt securities. See “Risk Factors” beginning on page PS-2.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of the notes or determined that this pricing supplement and the accompanying

prospectus supplement and prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

You should read this pricing supplement together

with the accompanying prospectus supplement and prospectus, which can be accessed via the following hyperlink:

Prospectus Supplement and Prospectus each dated March 7, 2023

The notes are not bank deposits and are not insured

or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed

by, a bank.

Risk Factors

The following is a non-exhaustive list of certain key risk factors

for investors in the notes. You should read the risk factors below together with the risk factors included in the accompanying prospectus

supplement and in the documents incorporated by reference in the accompanying prospectus, including Citigroup Inc.’s most recent

Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, which describe risks relating to our business more generally.

We also urge you to consult your investment, legal, tax, accounting and other advisors before you decide to invest in the notes.

| § | The notes may be redeemed at our option, which limits your ability to accrue interest over the full term of the notes. We may

redeem the notes, in whole but not in part, on any redemption date, upon not less than five business days’ notice. In the event

that we redeem the notes, you will receive the principal amount of the notes and any accrued and unpaid interest to but excluding the

applicable redemption date. In this case, you will not have the opportunity to continue to accrue and be paid interest to the maturity

date of the notes. |

| § | Market interest rates at a particular time will affect our decision to redeem the notes. It is more likely that we will call

the notes for redemption prior to their maturity date at a time when the interest rate on the notes is greater than that which we would

pay on a comparable debt security of ours with a maturity comparable to the remaining term of the notes. Consequently, if we redeem the

notes prior to their maturity, you may not be able to invest in other securities with a similar level of risk that yield as much interest

as the notes. |

| § | An investment in the notes may be more risky than an investment in notes with a shorter term. By purchasing notes with a relatively

long term, you will bear greater exposure to fluctuations in interest rates than if you purchased a note with a shorter term. In particular,

you may be negatively affected if interest rates begin to rise, because the likelihood that we will redeem your notes will decrease and

the interest rate on the notes may be less than the amount of interest you could earn on other investments with a similar level of risk

available at such time. In addition, if you tried to sell your notes at such time, the value of your notes in any secondary market transaction

would also be adversely affected. |

| § | The notes are subject to the credit risk of Citigroup Inc., and any actual or anticipated changes to its credit ratings or credit

spreads may adversely affect the value of the notes. You are subject to the credit risk of Citigroup Inc. If Citigroup Inc. defaults

on its obligations under the notes, your investment would be at risk and you could lose some or all of your investment. As a result, the

value of the notes will be affected by changes in the market’s view of Citigroup Inc.’s creditworthiness. Any decline, or

anticipated decline, in Citigroup Inc.’s credit ratings or any increase, or anticipated increase, in the credit spreads charged

by the market for taking Citigroup Inc. credit risk is likely to adversely affect the value of the notes. |

| § | The notes will not be listed on any securities exchange and you may not be able to sell them prior to maturity. The notes will

not be listed on any securities exchange. Therefore, there may be little or no secondary market for the notes. CGMI currently intends

to make a secondary market in relation to the notes and to provide an indicative bid price for the notes on a daily basis. Any indicative

bid price for the notes provided by CGMI will be determined in CGMI’s sole discretion, taking into account prevailing market conditions

and other relevant factors, and will not be a representation by CGMI that the notes can be sold at that price or at all. CGMI may suspend

or terminate making a market and providing indicative bid prices without notice, at any time and for any reason. If CGMI suspends or terminates

making a market, there may be no secondary market at all for the notes because it is likely that CGMI will be the only broker-dealer that

is willing to buy your notes prior to maturity. Accordingly, an investor must be prepared to hold the notes until maturity. |

| § | Immediately following issuance, any secondary market bid price provided by CGMI, and the value that will be indicated on any brokerage

account statements prepared by CGMI or its affiliates, will reflect a temporary upward adjustment. The amount of this temporary upward

adjustment will steadily decline to zero over the temporary adjustment period. See “General Information—Temporary adjustment

period” in this pricing supplement. |

| § | Secondary market sales of the notes may result in a loss of principal. You will be entitled to receive at least the full stated

principal amount of your notes, subject to the credit risk of Citigroup Inc., only if you hold the notes to maturity or redemption. If

you are able to sell your notes in the secondary market prior to maturity or redemption, you are likely to receive less than the stated

principal amount of the notes. |

| § | The inclusion of underwriting fees and projected profit from hedging in the issue price is likely to adversely affect secondary

market prices. Assuming no changes in market conditions or other relevant factors, the price, if any, at which CGMI may be willing

to purchase the notes in secondary market transactions will likely be lower than the issue price since the issue price of the notes will

include, and secondary market prices are likely to exclude, any underwriting fees paid with respect to the notes, as well as the cost

of hedging our obligations under the notes. The cost of hedging includes the projected profit that our affiliates may realize in consideration

for assuming the risks inherent in managing the hedging transactions. The secondary market prices for the notes are also likely to be

reduced by the costs of unwinding the related hedging transactions. Our affiliates may realize a profit from the expected hedging activity

even if the value of the notes declines. In addition, any secondary market prices for the notes may differ from values determined by pricing

models used by CGMI, as a result of dealer discounts, mark-ups or other transaction costs. |

| § | The price at which you may be able to sell your notes prior to maturity will depend on a number of factors and may be substantially

less than the amount you originally invest. A number of factors will influence the value of the notes in any secondary market that

may develop and the price at which CGMI may be willing to purchase the notes in any such secondary market, including: interest rates in

the market and the volatility of such rates, the time remaining to maturity of the notes, hedging activities by our affiliates, any fees

and projected hedging fees and profits, expectations about whether we are likely to redeem the notes and any actual or anticipated changes

in the credit ratings, financial condition and results of Citigroup Inc. The value of the notes will vary and is likely to be less than

the issue price at any time prior to maturity or redemption, and sale of the notes prior to maturity or redemption may result in a loss. |

| § | The U.S. federal tax consequences of an assumption of the notes are unclear. The notes may be assumed by a successor issuer,

as discussed in “Additional Terms of the Notes.” The law regarding whether or not such an assumption would be considered a

taxable modification of the notes is not entirely clear and, if the Internal Revenue Service (the “IRS”) were to treat the

assumption as a taxable modification, a U.S. Holder would generally be required to recognize gain (if any) on the notes and the timing

and character of income recognized with respect to the notes after the assumption could be affected significantly. You should read carefully

the discussion under “United States Federal Income Tax Considerations” in this pricing supplement. You should also consult

your tax adviser regarding the U.S. federal tax consequences of an assumption of the notes. |

Additional Terms of the Notes

The notes are intended to qualify as eligible debt securities for purposes

of the Federal Reserve's total loss-absorbing capacity (“TLAC”) rule. As a result, in the event of a Citigroup Inc. bankruptcy,

Citigroup Inc.'s losses and any losses incurred by its subsidiaries would be imposed first on Citigroup Inc.’s shareholders and

then on its unsecured creditors, including the holders of the notes. Further, in a bankruptcy proceeding of Citigroup Inc. any value realized

by holders of the notes may not be sufficient to repay the amounts owed on the notes. For more information about the consequences of “TLAC”

on the notes, you should refer to the “Citigroup Inc.” section beginning on page 12 of the accompanying prospectus.

Upon at least 15 business days’ notice, any wholly owned subsidiary

(the “successor issuer”) of Citigroup Inc. may, without the consent of any holder of the notes, assume all of Citigroup Inc.’s

obligations under the notes, and in such event Citigroup Inc. shall be released from its obligations under the notes (in each case, except

as described below), subject to the following conditions:

| (a) | Citigroup Inc. shall enter into a supplemental indenture under which Citigroup Inc. fully and unconditionally guarantees all payments

on the notes when due, agrees to comply with the covenants described in the section “Description of Debt Securities—Covenants—Limitations

on Liens” and “—Limitations on Mergers and Sales of Assets” in the accompanying prospectus as applied to itself

and retains certain reporting obligations under the indenture; |

| (b) | the successor issuer shall be organized under the laws of the United States of America, any State thereof or the District of Columbia;

and |

| (c) | immediately after giving effect to such assumption of obligations, no default or event of default shall have occurred and be continuing. |

Upon any such assumption, the successor issuer shall succeed to and

be substituted for, and may exercise every right and power of, Citigroup Inc. under the notes with the same effect as if such successor

issuer had been named as the original issuer of the notes, and Citigroup Inc. shall be relieved from all obligations and covenants under

the notes, except that Citigroup Inc. shall have the obligations described in clause (a) above. For the avoidance of doubt, the successor

issuer shall not be responsible for Citigroup Inc.’s compliance with the covenants described in clause (a) above.

If a successor issuer assumes the obligations of Citigroup Inc. under

the notes as described above, events of bankruptcy or insolvency or resolution proceedings relating to Citigroup Inc. will not constitute

an event of default with respect to the notes, nor will any breach of a covenant by Citigroup Inc. (other than payment default). Therefore,

if a successor issuer assumes the obligations of Citigroup Inc. under the notes as described above, events of bankruptcy or insolvency

or resolution proceedings relating to Citigroup Inc. (in the absence of any such event occurring with respect to the successor issuer)

will not give holders the right to declare the notes to be due and payable, and a breach of a covenant by Citigroup Inc. (including the

covenants described in the section “Description of Debt Securities—Covenants—Limitations on Liens” and “—Limitations

on Mergers and Sales of Assets” in the accompanying prospectus), other than payment default, will not give holders the right to

declare the notes to be due and payable. Furthermore, if a successor issuer assumes the obligations of Citigroup Inc. under the notes

as described above, it will not be an event of default under the notes if the guarantee of the notes by Citigroup Inc. ceases to be in

full force and effect or if Citigroup Inc. repudiates the guarantee.

There are no restrictions on which subsidiary of Citigroup Inc. may

be a successor issuer other than as specifically set forth above. The successor issuer may be less creditworthy than Citigroup Inc. and/or

may have no or nominal assets. If Citigroup Inc. is resolved in bankruptcy, insolvency or other resolution proceedings and the notes are

not contemporaneously declared due and payable, and if the successor issuer is subsequently resolved in later bankruptcy, insolvency or

other resolution proceedings, the value you receive on the notes may be significantly less than what you would have received had the notes

been declared due and payable immediately upon certain events of bankruptcy or insolvency or resolution proceedings relating to Citigroup

Inc. or the breach of a covenant by Citigroup Inc.

The notes are “specified securities” for purposes of the

indenture. The terms set forth above do not apply to all securities issued under the indenture, but only to the notes offered by this

pricing supplement (and similar terms may apply to other securities issued by Citigroup Inc. that are identified as “specified securities”

in the applicable pricing supplement).

You should read carefully the discussion of U.S. federal tax consequences

of any such assumption under “United States Federal Tax Considerations” in this pricing supplement.

| General Information |

| Temporary adjustment period: |

For a period of approximately six months following issuance of the notes, the price, if any, at which CGMI would be willing to buy the notes from investors, and the value that will be indicated for the notes on any brokerage account statements prepared by CGMI or its affiliates (which value CGMI may also publish through one or more financial information vendors), will reflect a temporary upward adjustment from the price or value that would otherwise be determined. This temporary upward adjustment represents a portion of the hedging profit expected to be realized by CGMI or its affiliates over the term of the notes. The amount of this temporary upward adjustment will decline to zero on a straight-line basis over the six-month temporary adjustment period. However, CGMI is not obligated to buy the notes from investors at any time. See “Risk Factors—The notes will not be listed on any securities exchange and you may not be able to sell them prior to maturity.” |

| U.S. federal income tax considerations: |

The notes will be treated for U.S. federal income tax purposes as fixed

rate debt instruments that are issued without original issue discount.

Under their terms, the notes may be assumed by a successor issuer, in

which case we will guarantee the successor issuer’s payment obligations under the notes. See “Additional Terms of the Notes.”

We intend to treat such an assumption as not giving rise to a taxable modification of the notes. While our counsel, Davis Polk & Wardwell

LLP, believes this treatment of such an assumption is reasonable under current law and based on the expected circumstances of the assumption,

it has not rendered an opinion regarding such treatment in light of the lack of clear authority addressing the consequences of such an

assumption. Provided that an assumption of the notes is not a taxable modification, the U.S. federal income tax treatment of the notes

would not be affected by the assumption. However, if the IRS were to treat an assumption of the notes as a taxable modification, the timing

and character of income recognized with respect to the notes after the assumption could be affected significantly, depending on circumstances

at the time of the assumption. Moreover, a U.S. Holder (as defined in the accompanying prospectus supplement) would generally be required

to recognize gain (if any) with respect to the notes at the time of the assumption in the same manner as described in the accompanying

prospectus supplement in respect of a sale or other taxable disposition of the notes. You should consult your tax adviser regarding the

consequences of an assumption of the notes.

Both U.S. and non-U.S. persons considering an investment in the

notes should read the discussion under “United States Federal Tax Considerations,” and in particular the sections entitled

“United States Federal Tax Considerations—Tax Consequences to U.S. Holders,” “—Tax Consequences to Non-U.S.

Holders” and “—FATCA” in the accompanying prospectus supplement for more information regarding the U.S. federal

income tax consequences of an investment in the notes. |

| Trustee: |

The Bank of New York Mellon (as trustee under an indenture dated November 13, 2013) will serve as trustee for the notes. |

| Use of proceeds and hedging: |

The net proceeds received from the sale of the notes will be used for

general corporate purposes and, in part, in connection with hedging our obligations under the notes through one or more of our affiliates.

Hedging activities related to the notes by one or more of our affiliates

involves trading in one or more instruments, such as options, swaps and/or futures, and/or taking positions in any other available securities

or instruments that we may wish to use in connection with such hedging and may include adjustments to such positions during the term of

the notes. It is possible that our affiliates may profit from this hedging activity, even if the value of the notes declines. Profit or

loss from this hedging activity could affect the price at which Citigroup Inc.’s affiliate, CGMI, may be willing to purchase your

notes in the secondary market. For further information on our use of proceeds and hedging, see “Use of Proceeds and Hedging”

in the accompanying prospectus.

|

| ERISA and IRA purchase considerations: |

Please refer to “Benefit Plan Investor Considerations” in the accompanying prospectus supplement for important information for investors that are ERISA or other benefit plans or whose underlying assets include assets of such plans. |

| Fees and selling concessions: |

The issue price is $1,000 per note; provided that the issue price for

an eligible institutional investor or an investor purchasing the notes in a fee-based advisory account will vary based on then-current

market conditions and the negotiated price determined at the time of each sale. The issue price for such investors will not be less than

$970.00 per note and will not be more than $1,000 per note. The issue price for such investors reflects a forgone selling concession with

respect to such sales as described in the next paragraph.

CGMI, an affiliate of Citigroup Inc., is the underwriter of the

sale of the notes and is acting as principal. CGMI may resell the notes to other securities dealers at the issue price of $1,000 per

note less a selling concession not in excess of the underwriting fee. CGMI will receive an underwriting fee of up to $30.00 per note,

and from such underwriting fee will allow selected dealers a selling concession of up to $30.00 per note depending on market conditions

that are relevant to the value of the notes at the time an order to purchase the notes is submitted to CGMI. Dealers who purchase the

notes for sales to eligible institutional investors and/or to investors purchasing the notes in fee-based advisory accounts may forgo

some or all selling concessions, and CGMI may forgo some or all of the underwriting fee for sales to it makes to eligible institutional

investors and/or to investors purchasing the notes in fee-based advisory accounts. |

| Supplemental information regarding plan of |

The terms and conditions set forth in the Amended and Restated Global

Selling Agency Agreement dated April 7, 2017 among Citigroup Inc. and the agents named therein, including CGMI, govern the sale and purchase

of the notes.

|

| distribution; conflicts of interest: |

In order to hedge its obligations under the notes, Citigroup Inc. expects to enter into one or more swaps or other derivatives transactions with one or more of its affiliates. You should refer to the section “General Information—Use of proceeds and hedging” in this pricing supplement and the section “Use of Proceeds and Hedging” in the accompanying prospectus.CGMI is an affiliate of Citigroup Inc. Accordingly, the offering of the notes will conform with the requirements addressing conflicts of interest when distributing the securities of an affiliate set forth in Rule 5121 of the Conduct Rules of the Financial Industry Regulatory Authority, Inc. Client accounts over which Citigroup Inc., its subsidiaries or affiliates of its subsidiaries have investment discretion are not permitted to purchase the notes, either directly or indirectly, without the prior written consent of the client.

See “Plan of Distribution; Conflicts of Interest” in the accompanying prospectus supplement for more information.

|

| Paying agent: |

Citibank, N.A. will serve as paying agent and registrar and will also hold the global security representing the notes as custodian for The Depository Trust Company (“DTC”). |

| Contact: |

Clients may contact their local brokerage representative. Third party distributors may contact Citi Structured Investment Sales at (212) 723-7005. |

We encourage you to also read the accompanying prospectus supplement

and prospectus, which can be accessed via the hyperlink on the cover page of this pricing supplement.

Determination of Interest Payments

The amount of the interest payment payable with respect to each interest

payment date and, if we call the notes for mandatory redemption on a redemption date that is not also an interest payment date, the applicable

redemption date will equal (i) the stated principal amount of the notes multiplied by the interest rate, multiplied by (ii)

day count fraction, where day count fraction will be calculated based on the following formula:

where:

“Y1” is the year, expressed as a number,

in which the first day of the interest calculation period falls;

“Y2” is the year, expressed as a number,

in which the day immediately following the last day included in the interest calculation period falls;

“M1” is the calendar month, expressed

as a number, in which the first day of the interest calculation period falls;

“M2” is the calendar month, expressed

as a number, in which the day immediately following the last day included in the interest calculation period falls;

“D1” is the first calendar day, expressed

as a number, of the interest calculation period, unless such number would be 31, in which case D1 will be 30; and

“D2” is the calendar day, expressed

as a number, immediately following the last day included in the interest calculation period, unless such number would be 31 and D1

is greater than 29, in which case D2 will be 30.

For purposes of the above formula, the “interest calculation period”

(a) with respect to any interest payment date is the immediately preceding interest period and (b) with respect to any redemption date

that is not also an interest payment date is the period from, and including, the immediately preceding interest payment date (or, if there

is no preceding interest payment date, the original issue date) to, but excluding, the applicable redemption date.

Hypothetical Examples

The following examples illustrate how the payments on the notes will

be calculated with respect to various hypothetical interest payment dates and redemption dates, depending on whether we exercise our right

in our sole discretion to redeem the notes on a redemption date or, if we do not redeem the notes prior to the maturity date, whether

the interest payment date is the maturity date. The examples below assume that the day count fraction with respect to the applicable interest

payment date or redemption date is the number indicated below. The hypothetical payments in the following examples are for illustrative

purposes only, do not illustrate all possible payments on the notes and may not correspond to the actual payment applicable to a holder

of the notes with respect to any interest payment date or redemption date. The numbers appearing in the following examples have been rounded

for ease of analysis.

Example 1: The interest payment date is not a redemption date, or

it is a redemption date but we choose not to exercise our right to redeem the notes on that date.

In this example, we would pay you an interest payment on the interest

payment date per note calculated as follows:

($1,000 × 4.85%) × day count fraction

($1,000 × 4.85%) × (180/360) = $24.25

Because the notes are not redeemed on the interest payment date, the

notes would remain outstanding and would continue to accrue interest.

Example 2: We elect to exercise our right to redeem the notes on

the second redemption date, which is not an interest payment date.

In this example, we would pay you on the second redemption date the

stated principal amount of the notes plus an interest payment per note calculated as follows:

($1,000 × 4.85%) × day count fraction

($1,000 × 4.85%) × (90/360) = $12.125

Therefore, you would receive a total of $1,012.125 per note (the stated

principal amount plus $12.125 of interest) on the second redemption date. Because the notes are redeemed on the second redemption

date, you would not receive any further payments from us.

Example 3: The notes are not redeemed prior to the maturity

date and the interest payment date is the maturity date.

In this example, we would pay you on the maturity date, the stated principal

amount of the notes plus an interest payment per note calculated as follows:

($1,000 × 4.85%) × day count fraction

($1,000 × 4.85%) × (180/360) = $24.25

Therefore, you would receive a total of $1,024.25 per note (the stated

principal amount plus $24.25 of interest) on the maturity date, and you will not receive any further payments from us.

Because we have the right to redeem the notes prior to the maturity

date, there is no assurance that the notes will remain outstanding until the maturity date. You should expect the notes to remain outstanding

after the first redemption date only if the interest rate payable on the notes is unfavorable to you as compared to other market rates

on comparable investments at that time.

Certain Selling Restrictions

Notice to Canadian Investors

The notes may be sold in Canada only to purchasers purchasing, or deemed

to be purchasing, as principal that are accredited investors, as defined in National Instrument 45-106 Prospectus Exemptions or subsection

73.3(1) of the Securities Act (Ontario), and are permitted clients, as defined in National Instrument 31-103 Registration Requirements,

Exemptions and Ongoing Registrant Obligations. Any resale of the notes must be made in accordance with an exemption from, or in a transaction

not subject to, the prospectus requirements of applicable securities laws.

Securities legislation in certain provinces or territories of Canada

may provide a purchaser with remedies for rescission or damages if this pricing supplement or an accompanying product supplement, prospectus

supplement or prospectus (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or

damages are exercised by the purchaser within the time limit prescribed by the securities legislation of the purchaser’s province

or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province

or territory for particulars of these rights or consult with a legal advisor.

Pursuant to section 3A.3 of National Instrument 33-105 Underwriting

Conflicts (“NI 33-105”), the underwriters are not required to comply with the disclosure requirements of NI 33-105

regarding underwriter conflicts of interest in connection with this offering.

Prohibition of Sales to EEA Retail Investors

The notes may not be offered, sold or otherwise made available to any

retail investor in the European Economic Area. For the purposes of this provision:

| (a) | the expression “retail investor” means a person who is one (or more) of the following: |

| (i) | a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”); or |

| (ii) | a customer within the meaning of Directive 2002/92/EC, where that customer would not qualify as a professional client as defined in

point (10) of Article 4(1) of MiFID II; or |

| (iii) | not a qualified investor as defined in Directive 2003/71/EC; and |

| (b) | the expression “offer” includes the communication in any form and by any means of sufficient information on the terms

of the offer and the notes offered so as to enable an investor to decide to purchase or subscribe the notes. |

Prohibition of Sales to United Kingdom Retail Investors

The notes may not be offered, sold or otherwise made available to any

retail investor in the United Kingdom. For the purposes of this provision:

| (a) | the expression “retail investor” means a person who is one (or more) of the following: |

| (i) | a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of United Kingdom domestic law

by virtue of the European Union (Withdrawal) Act 2018 (the “EUWA”) and the regulations made under the EUWA; or |

| (ii) | a customer within the meaning of the provisions of the Financial Services and Markets Act 2000 (as amended) (the “FSMA”)

and any rules or regulations made under the FSMA to implement Directive (EU) 2016/97, where that customer would not qualify as a professional

client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of United Kingdom domestic law by virtue

of the EUWA and the regulations made under the EUWA; or |

| (iii) | not a qualified investor as defined in Regulation (3)(e) of the Prospectus Regulation; and |

| (b) | the expression “offer” includes the communication in any form and by any means of sufficient information on the terms

of the offer and the notes offered so as to enable an investor to decide to purchase or subscribe the notes. |

Additional Information

We reserve the right to withdraw, cancel or modify any offering of the

notes and to reject orders in whole or in part prior to their issuance.

© 2024 Citigroup Global Markets Inc. All rights reserved. Citi

and Citi and Arc Design are trademarks and service marks of Citigroup Inc. or its affiliates and are used and registered throughout the

world.

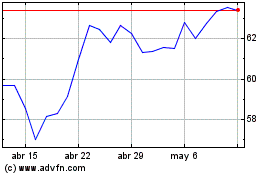

Citigroup (NYSE:C)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Citigroup (NYSE:C)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024