0000018230false00000182302024-02-042024-02-040000018230us-gaap:CommonStockMember2024-02-042024-02-040000018230cat:A5.3DebenturesDueSeptember152035Member2024-02-042024-02-04

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

|

| | | | | FORM | 8-K | | | | | |

| Current Report |

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| Date of Report (Date of earliest event reported): | | February 5, 2024 |

| CATERPILLAR INC. |

| (Exact name of registrant as specified in its charter) | |

| Delaware | 1-768 | 37-0602744 | |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S Employer Identification No.) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 5205 N. O'Connor Blvd. | Suite 100, | Irving, | Texas | 75039 |

| (Address of principal executive offices) | | (Zip Code) | |

| Registrant’s telephone number, including area code: | (972) | 891-7700 |

| Former name or former address, if changed since last report: | N/A |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| | | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

| | | | |

Securities registered pursuant to Section 12(b) of the Act:

|

| Title of each class | Trading Symbol (s) | Name of each exchange which registered |

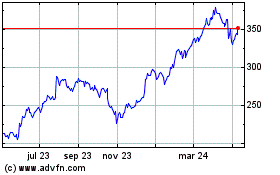

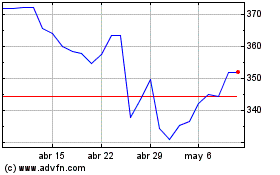

| Common Stock ($1.00 par value) | CAT | The New York Stock Exchange |

| 5.3% Debentures due September 15, 2035 | CAT35 | The New York Stock Exchange |

| |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | |

| Indicate by check mark whether the registrant is an emerging growth company as defined by Rule 405 of the Securities Act of |

| 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter). | |

| Emerging growth company | ☐ | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period | |

| for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | |

Item 2.02. Results of Operations and Financial Condition.

On February 5, 2024, Caterpillar Inc. issued a press release reporting its financial results for the quarter ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated into this Item 2.02 by reference.

Item 7.01. Regulation FD Disclosure.

Caterpillar Inc. is furnishing supplemental information concerning (i) retail sales of machines to end users and (ii) retail sales of power systems (including reciprocating and turbine engines and locomotives) to end users and Original Equipment Manufacturers ("OEMs"). This supplemental information is attached hereto as Exhibit 99.2 and incorporated into this Item 7.01 by reference.

The information in this Current Report on Form 8-K, including Exhibit 99.1, is being furnished in accordance with the provisions of General Instruction B.2 of Form 8-K.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | | | | |

| (d) | Exhibits: |

| | The following is furnished as an exhibit to this report: |

| | 99.1 | |

| | 99.2 | |

| | 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

| | | | | | | | |

SIGNATURES

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

| CATERPILLAR INC. |

| |

| |

| February 5, 2024 | By: | /s/ Derek Owens |

| | Derek Owens

Chief Legal Officer and General Counsel |

| | |

Exhibit 99.1

Caterpillar Inc.

4Q 2023 Earnings Release

FOR IMMEDIATE RELEASE

Caterpillar Reports Fourth-Quarter and Full-Year 2023 Results

| | | | | |

| ● | Fourth-quarter 2023 sales and revenues up 3%; full-year sales and revenues up 13% |

| ● | Fourth-quarter 2023 profit per share of $5.28; adjusted profit per share of $5.23 |

| ● | Full-year profit per share of $20.12; adjusted profit per share of $21.21 |

| ● | Strong operating cash flow of $12.9 billion; ended the year with $7.0 billion of enterprise cash |

| ● | Returned $7.5 billion to shareholders through share repurchases and dividends in 2023 |

| | | | | | | | | | | | | | | | | | | | |

| | Fourth Quarter | | Full Year |

| ($ in billions except profit per share) | | 2023 | 2022 | | 2023 | 2022 |

| Sales and Revenues | | $17.1 | $16.6 | | $67.1 | $59.4 |

| Profit Per Share | | $5.28 | $2.79 | | $20.12 | $12.64 |

| Adjusted Profit Per Share | | $5.23 | $3.86 | | $21.21 | $13.84 |

IRVING, Texas, Feb. 5, 2024 – Caterpillar Inc. (NYSE: CAT) announced fourth-quarter and full-year results for 2023.

Sales and revenues for the fourth quarter of 2023 were $17.1 billion, a 3% increase compared with $16.6 billion in the fourth quarter of 2022. Operating profit margin was 18.4% for the fourth quarter of 2023, compared with 10.1% for the fourth quarter of 2022. Adjusted operating profit margin was 18.9% for the fourth quarter of 2023, compared with 17.0% for the fourth quarter of 2022. Fourth-quarter 2023 profit per share was $5.28, compared with $2.79 profit per share in the fourth quarter of 2022. Adjusted profit per share in the fourth quarter of 2023 was $5.23, compared with fourth-quarter 2022 adjusted profit per share of $3.86.

Full-year sales and revenues in 2023 were $67.1 billion, up 13% compared with $59.4 billion in 2022. The increase reflected favorable price realization and higher sales volume, driven by higher sales of equipment to end users, partially offset by the impact from changes in dealer inventories. Operating profit margin was 19.3% in 2023, compared with 13.3% in 2022. Adjusted operating profit margin was 20.5% in 2023, compared with 15.4% in 2022. Full-year profit was $20.12 per share in 2023, compared with profit of $12.64 per share in 2022. Adjusted profit per share in 2023 was $21.21, compared with adjusted profit per share of $13.84 in 2022.

“I'm very proud of our global team's strong performance as they achieved the best year in our 98-year history, including record full-year sales and revenues, record adjusted profit per share and record ME&T free cash flow,” said Caterpillar Chairman and CEO Jim Umpleby. “We remain committed to serving our customers, executing our strategy and investing for long-term profitable growth.”

In 2023, adjusted operating profit margin and adjusted profit per share excluded restructuring costs, which included the impact of the divestiture of the company's Longwall business and other restructuring costs. 2023 adjusted profit per share also excluded a benefit for certain deferred tax valuation allowance adjustments and mark-to-market gains for remeasurement of pension and other postemployment benefit (OPEB) plans. In 2022, adjusted operating profit margin and adjusted profit per share excluded a goodwill impairment charge and restructuring costs related to the Rail division and other restructuring costs. 2022 adjusted profit per share also excluded mark-to-market gains for remeasurement of pension and OPEB plans. Please see a reconciliation of GAAP to non-GAAP financial measures in the appendix on page 13.

For the full year of 2023, enterprise operating cash flow was $12.9 billion. During the year, the company repurchased $5.0 billion of Caterpillar common stock and paid dividends of $2.6 billion. Liquidity remained strong with an enterprise cash balance of $7.0 billion at the end of 2023.

CONSOLIDATED RESULTS

Consolidated Sales and Revenues

The chart above graphically illustrates reasons for the change in consolidated sales and revenues between the fourth quarter of 2022 (at left) and the fourth quarter of 2023 (at right). Caterpillar management utilizes these charts internally to visually communicate with the company’s board of directors and employees.

Total sales and revenues for the fourth quarter of 2023 were $17.070 billion, an increase of $473 million, or 3%, compared with $16.597 billion in the fourth quarter of 2022. The increase was due to favorable price realization, higher Financial Products' segment revenues and favorable currency impacts primarily related to the euro, partially offset by lower sales volume. The decrease in sales volume was driven by the impact from changes in dealer inventories, partially offset by higher sales of equipment to end users. Dealer inventory decreased by $900 million during the fourth quarter of 2023, compared with an increase of $700 million during the fourth quarter of 2022.

In the three primary segments, sales were higher in Energy & Transportation and lower in Construction Industries and Resource Industries.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales and Revenues by Segment |

| (Millions of dollars) | Fourth Quarter 2022 | | Sales

Volume | | Price

Realization | | Currency | | Inter-Segment / Other | | Fourth Quarter 2023 | | $

Change | | %

Change |

| | | | | | | | | | | | | | | |

| Construction Industries | $ | 6,845 | | | $ | (809) | | | $ | 445 | | | $ | 38 | | | $ | — | | | $ | 6,519 | | | $ | (326) | | | (5%) |

| Resource Industries | 3,436 | | | (440) | | | 239 | | | 8 | | | (1) | | | 3,242 | | | (194) | | | (6%) |

| Energy & Transportation | 6,823 | | | 561 | | | 305 | | | 54 | | | (74) | | | 7,669 | | | 846 | | | 12% |

| All Other Segment | 111 | | | 5 | | | (7) | | | 1 | | | 6 | | | 116 | | | 5 | | | 5% |

| Corporate Items and Eliminations | (1,344) | | | (38) | | | — | | | 4 | | | 69 | | | (1,309) | | | 35 | | | |

| Machinery, Energy & Transportation | 15,871 | | | (721) | | | 982 | | | 105 | | | — | | | 16,237 | | | 366 | | | 2% |

| | | | | | | | | | | | | | | |

| Financial Products Segment | 853 | | | — | | | — | | | — | | | 128 | | | 981 | | | 128 | | | 15% |

| Corporate Items and Eliminations | (127) | | | — | | | — | | | — | | | (21) | | | (148) | | | (21) | | | |

| Financial Products Revenues | 726 | | | — | | | — | | | — | | | 107 | | | 833 | | | 107 | | | 15% |

| | | | | | | | | | | | | | | |

| Consolidated Sales and Revenues | $ | 16,597 | | | $ | (721) | | | $ | 982 | | | $ | 105 | | | $ | 107 | | | $ | 17,070 | | | $ | 473 | | | 3% |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales and Revenues by Geographic Region |

| North America | | Latin America | | EAME | | Asia/Pacific | | External Sales and Revenues | | Inter-Segment | | Total Sales and Revenues |

| (Millions of dollars) | $ | | % Chg | | $ | | % Chg | | $ | | % Chg | | $ | | % Chg | | $ | | % Chg | | $ | | % Chg | | $ | | % Chg |

| Fourth Quarter 2023 | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Construction Industries | $ | 3,689 | | | 4% | | $ | 587 | | | (25%) | | $ | 1,129 | | | (18%) | | $ | 1,083 | | | (4%) | | $ | 6,488 | | | (5%) | | $ | 31 | | | —% | | $ | 6,519 | | | (5%) |

| Resource Industries | 1,240 | | | (9%) | | 529 | | | 5% | | 445 | | | (25%) | | 939 | | | 6% | | 3,153 | | | (6%) | | 89 | | | (1%) | | 3,242 | | | (6%) |

| Energy & Transportation | 3,324 | | | 31% | | 684 | | | 10% | | 1,638 | | | 5% | | 942 | | | (1%) | | 6,588 | | | 16% | | 1,081 | | | (6%) | | 7,669 | | | 12% |

| All Other Segment | 15 | | | 25% | | — | | | (100%) | | 5 | | | 106% | | 12 | | | (88%) | | 32 | | | (3%) | | 84 | | | 8% | | 116 | | | 5% |

| Corporate Items and Eliminations | (18) | | | | | (2) | | | | | (2) | | | | | (2) | | | | | (24) | | | | | (1,285) | | | | | (1,309) | | | |

| Machinery, Energy & Transportation | 8,250 | | | 11% | | 1,798 | | | (6%) | | 3,215 | | | (7%) | | 2,974 | | | (3%) | | 16,237 | | | 2% | | — | | | —% | | 16,237 | | | 2% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Products Segment | 645 | | | 18% | | 100 | | | 2% | | 127 | | | 23% | | 109 | | | 5% | | 981 | | | 15% | | | | —% | | 981 | | | 15% |

| Corporate Items and Eliminations | (88) | | | | | (17) | | | | | (22) | | | | | (21) | | | | | (148) | | | | | | | | | (148) | | | |

| Financial Products Revenues | 557 | | | 17% | | 83 | | | 6% | | 105 | | | 21% | | 88 | | | 2% | | 833 | | | 15% | | — | | | —% | | 833 | | | 15% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Sales and Revenues | $ | 8,807 | | | 11% | | $ | 1,881 | | | (5%) | | $ | 3,320 | | | (6%) | | $ | 3,062 | | | (3%) | | $ | 17,070 | | | 3% | | $ | — | | | —% | | $ | 17,070 | | | 3% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fourth Quarter 2022 | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Construction Industries | $ | 3,535 | | | | | $ | 782 | | | | | $ | 1,373 | | | | | $ | 1,124 | | | | | $ | 6,814 | | | | | $ | 31 | | | | | $ | 6,845 | | | |

| Resource Industries | 1,364 | | | | | 503 | | | | | 596 | | | | | 883 | | | | | 3,346 | | | | | 90 | | | | | 3,436 | | | |

| Energy & Transportation | 2,538 | | | | | 624 | | | | | 1,553 | | | | | 953 | | | | | 5,668 | | | | | 1,155 | | | | | 6,823 | | | |

| All Other Segment | 12 | | | | | 2 | | | | | (80) | | | | | 99 | | | | | 33 | | | | | 78 | | | | | 111 | | | |

| Corporate Items and Eliminations | 14 | | | | | — | | | | | (3) | | | | | (1) | | | | | 10 | | | | | (1,354) | | | | | (1,344) | | | |

| Machinery, Energy & Transportation | 7,463 | | | | | 1,911 | | | | | 3,439 | | | | | 3,058 | | | | | 15,871 | | | | | — | | | | | 15,871 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Products Segment | 548 | | | | | 98 | | | | | 103 | | | | | 104 | | | | | 853 | | | | | — | | | | | 853 | | | |

| Corporate Items and Eliminations | (73) | | | | | (20) | | | | | (16) | | | | | (18) | | | | | (127) | | | | | — | | | | | (127) | | | |

| Financial Products Revenues | 475 | | | | | 78 | | | | | 87 | | | | | 86 | | | | | 726 | | | | | — | | | | | 726 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Sales and Revenues | $ | 7,938 | | | | | $ | 1,989 | | | | | $ | 3,526 | | | | | $ | 3,144 | | | | | $ | 16,597 | | | | | $ | — | | | | | $ | 16,597 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consolidated Operating Profit

The chart above graphically illustrates reasons for the change in consolidated operating profit between the fourth quarter of 2022 (at left) and the fourth quarter of 2023 (at right). Caterpillar management utilizes these charts internally to visually communicate with the company’s board of directors and employees. The bar titled Other includes consolidating adjustments and Machinery, Energy & Transportation’s other operating (income) expenses.

Operating profit for the fourth quarter of 2023 was $3.134 billion, an increase of $1.454 billion, or 87%, compared with $1.680 billion in the fourth quarter of 2022. The increase was primarily due to favorable price realization and the absence of a 2022 goodwill impairment charge related to the Rail division, partially offset by higher selling, general and administrative (SG&A) and research and development (R&D) expenses. The increase in SG&A/R&D expenses was primarily driven by higher short-term incentive compensation expense and investments aligned with strategic initiatives.

Operating profit margin was 18.4% for the fourth quarter of 2023, compared with 10.1% for the fourth quarter of 2022. Adjusted operating profit margin was 18.9% for the fourth quarter of 2023, compared with 17.0% for the fourth quarter of 2022. Operating profit margin was 19.3% for 2023, compared with 13.3% for 2022. Adjusted operating profit margin was 20.5% for 2023, compared with 15.4% for 2022.

| | | | | | | | | | | | | | | | | | | | | | | |

| Profit (Loss) by Segment |

| (Millions of dollars) | Fourth Quarter 2023 | | Fourth Quarter 2022 | | $

Change | | % Change |

| Construction Industries | $ | 1,535 | | | $ | 1,488 | | | $ | 47 | | | 3 | % |

| Resource Industries | 600 | | | 605 | | | (5) | | | (1 | %) |

| Energy & Transportation | 1,429 | | | 1,177 | | | 252 | | | 21 | % |

| All Other Segment | (24) | | | (53) | | | 29 | | | 55 | % |

| Corporate Items and Eliminations | (438) | | | (1,588) | | | 1,150 | | | |

| Machinery, Energy & Transportation | 3,102 | | | 1,629 | | | 1,473 | | | 90 | % |

| | | | | | | |

| Financial Products Segment | 234 | | | 189 | | | 45 | | | 24 | % |

| Corporate Items and Eliminations | (46) | | | (4) | | | (42) | | | |

| Financial Products | 188 | | | 185 | | | 3 | | | 2 | % |

| | | | | | | |

| Consolidating Adjustments | (156) | | | (134) | | | (22) | | | |

| | | | | | | |

| Consolidated Operating Profit | $ | 3,134 | | | $ | 1,680 | | | $ | 1,454 | | | 87 | % |

| | | | | | | |

Other Profit/Loss and Tax Items

•Other income (expense) in the fourth quarter of 2023 was income of $241 million, compared with income of $536 million in the fourth quarter of 2022. The change was primarily driven by lower mark-to-market gains for remeasurement of pension and OPEB plans (see a reconciliation of GAAP to non-GAAP financial measures in the appendix on page 13) and unfavorable impacts from pension and OPEB plan costs, partially offset by favorable impacts from foreign currency exchange and higher investment and interest income.

•The provision for income taxes for the fourth quarter of 2023 reflected a global annual effective tax rate of 21.4%, excluding discrete items. The comparative tax rate for the fourth quarter of 2022 and full-year 2022 was 23.2%. The decrease from 2022 was primarily related to changes in the geographic mix of profits. In addition, the company recorded a $112 million benefit in the fourth quarter of 2023 for the change from the third-quarter estimated annual tax rate.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONSTRUCTION INDUSTRIES |

| (Millions of dollars) | | | | | | | | | | | | | | | | |

| Segment Sales | | | | | | | | | | | | | | |

| | Fourth Quarter 2022 | | Sales Volume | | Price Realization | | Currency | | Inter-Segment | | Fourth Quarter 2023 | | $

Change | | %

Change |

| Total Sales | | $ | 6,845 | | | $ | (809) | | | $ | 445 | | | $ | 38 | | | $ | — | | | $ | 6,519 | | | $ | (326) | | | (5 | %) |

| | | | | | | | | | | | | | | | |

| Sales by Geographic Region | | | | | | | | |

| | Fourth Quarter 2023 | | Fourth Quarter 2022 | | $

Change | | %

Change | | | | | | | | |

| North America | | $ | 3,689 | | | $ | 3,535 | | | $ | 154 | | | 4 | % | | | | | | | | |

| Latin America | | 587 | | | 782 | | | (195) | | | (25 | %) | | | | | | | | |

| EAME | | 1,129 | | | 1,373 | | | (244) | | | (18 | %) | | | | | | | | |

| Asia/Pacific | | 1,083 | | | 1,124 | | | (41) | | | (4 | %) | | | | | | | | |

| External Sales | | 6,488 | | | 6,814 | | | (326) | | | (5 | %) | | | | | | | | |

| Inter-segment | | 31 | | | 31 | | | — | | | — | % | | | | | | | | |

| Total Sales | | $ | 6,519 | | | $ | 6,845 | | | $ | (326) | | | (5 | %) | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Segment Profit | | | | | | | | |

| | Fourth Quarter 2023 | | Fourth Quarter 2022 | |

Change | | %

Change | | | | | | | | |

| Segment Profit | | $ | 1,535 | | | $ | 1,488 | | | $ | 47 | | | 3 | % | | | | | | | | |

| Segment Profit Margin | | 23.5 | % | | 21.7 | % | | 1.8 | pts | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Construction Industries’ total sales were $6.519 billion in the fourth quarter of 2023, a decrease of $326 million, or 5%, compared with $6.845 billion in the fourth quarter of 2022. The decrease was due to lower sales volume, partially offset by favorable price realization. The decrease in sales volume was driven by the impact from changes in dealer inventories, partially offset by higher sales of equipment to end users. Dealer inventory decreased during the fourth quarter of 2023, compared with an increase during the fourth quarter of 2022.

•In North America, sales increased due to favorable price realization, partially offset by lower sales volume. Lower sales volume was driven by the impact from changes in dealer inventories, partially offset by higher sales of equipment to end users. Dealer inventory increased during the fourth quarter of 2022, compared with a decrease during the fourth quarter of 2023.

•Sales decreased in Latin America primarily due to lower sales volume. Lower sales volume was driven by the impact from changes in dealer inventories. Dealer inventory increased during the fourth quarter of 2022, compared with a decrease during the fourth quarter of 2023.

•In EAME, sales decreased primarily due to lower sales volume, partially offset by favorable price realization and favorable currency impacts primarily related to the euro. Lower sales volume was primarily due to the impact from changes in dealer inventories. Dealer inventory decreased more during the fourth quarter of 2023 than during the fourth quarter of 2022.

•Sales decreased in Asia/Pacific primarily due to lower sales volume. Decreased sales volume was driven by the impact from changes in dealer inventories, partially offset by higher aftermarket parts sales volume. Dealer inventory decreased more during the fourth quarter of 2023 than during the fourth quarter of 2022.

Construction Industries’ profit was $1.535 billion in the fourth quarter of 2023, an increase of $47 million, or 3%, compared with $1.488 billion in the fourth quarter of 2022. The increase was primarily due to favorable price realization, partially offset by the profit impact from lower sales volume.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RESOURCE INDUSTRIES |

| (Millions of dollars) | | | | | | | | | | | | | | | | |

| Segment Sales | | | | | | | | | | | | | | |

| | Fourth Quarter 2022 | | Sales Volume | | Price Realization | | Currency | | Inter-Segment | | Fourth Quarter 2023 | | $

Change | | %

Change |

| Total Sales | | $ | 3,436 | | | $ | (440) | | | $ | 239 | | | $ | 8 | | | $ | (1) | | | $ | 3,242 | | | $ | (194) | | | (6 | %) |

| | | | | | | | | | | | | | | | |

| Sales by Geographic Region | | | | | | | | |

| | Fourth Quarter 2023 | | Fourth Quarter 2022 | | $

Change | | %

Change | | | | | | | | |

| North America | | $ | 1,240 | | | $ | 1,364 | | | $ | (124) | | | (9 | %) | | | | | | | | |

| Latin America | | 529 | | | 503 | | | 26 | | | 5 | % | | | | | | | | |

| EAME | | 445 | | | 596 | | | (151) | | | (25 | %) | | | | | | | | |

| Asia/Pacific | | 939 | | | 883 | | | 56 | | | 6 | % | | | | | | | | |

| External Sales | | 3,153 | | | 3,346 | | | (193) | | | (6 | %) | | | | | | | | |

| Inter-segment | | 89 | | | 90 | | | (1) | | | (1 | %) | | | | | | | | |

| Total Sales | | $ | 3,242 | | | $ | 3,436 | | | $ | (194) | | | (6 | %) | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Segment Profit | | | | | | | | |

| | Fourth Quarter 2023 | | Fourth Quarter 2022 | |

Change | | %

Change | | | | | | | | |

| Segment Profit | | $ | 600 | | | $ | 605 | | | $ | (5) | | | (1 | %) | | | | | | | | |

| Segment Profit Margin | | 18.5 | % | | 17.6 | % | | 0.9 | pts | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Resource Industries’ total sales were $3.242 billion in the fourth quarter of 2023, a decrease of $194 million, or 6%, compared with $3.436 billion in the fourth quarter of 2022. The decrease was primarily due to lower sales volume, partially offset by favorable price realization. The decrease in sales volume was driven by the impact from changes in dealer inventories and lower aftermarket parts sales volume. Dealer inventory increased during the fourth quarter of 2022, compared with a decrease during the fourth quarter of 2023.

Resource Industries’ profit was $600 million in the fourth quarter of 2023, a decrease of $5 million, or 1%, compared with $605 million in the fourth quarter of 2022. Favorable price realization and manufacturing costs were offset by lower sales volume, higher SG&A/R&D expenses and currency impacts. Favorable manufacturing costs largely reflected lower freight. The increase in SG&A/R&D expenses was primarily driven by higher short-term incentive compensation expense and investments aligned with strategic initiatives.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ENERGY & TRANSPORTATION |

| (Millions of dollars) | | | | | | | | | | | | | | | | |

| Segment Sales | | | | | | | | | | | | | | |

| | Fourth Quarter 2022 | | Sales Volume | | Price Realization | | Currency | | Inter-Segment | | Fourth Quarter 2023 | | $

Change | | %

Change |

| Total Sales | | $ | 6,823 | | | $ | 561 | | | $ | 305 | | | $ | 54 | | | $ | (74) | | | $ | 7,669 | | | $ | 846 | | | 12 | % |

| | | | | | | | | | | | | | | | |

| Sales by Application | | | | | | | | |

| | Fourth Quarter 2023 | | Fourth Quarter 2022 | | $

Change | | %

Change | | | | | | | | |

| Oil and Gas | | $ | 2,247 | | | $ | 1,827 | | | $ | 420 | | | 23 | % | | | | | | | | |

| Power Generation | | 1,835 | | | 1,422 | | | 413 | | | 29 | % | | | | | | | | |

| Industrial | | 1,078 | | | 1,131 | | | (53) | | | (5 | %) | | | | | | | | |

| Transportation | | 1,428 | | | 1,288 | | | 140 | | | 11 | % | | | | | | | | |

| External Sales | | 6,588 | | | 5,668 | | | 920 | | | 16 | % | | | | | | | | |

| Inter-segment | | 1,081 | | | 1,155 | | | (74) | | | (6 | %) | | | | | | | | |

| Total Sales | | $ | 7,669 | | | $ | 6,823 | | | $ | 846 | | | 12 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Segment Profit | | | | | | | | |

| | Fourth Quarter 2023 | | Fourth Quarter 2022 | |

Change | | %

Change | | | | | | | | |

| Segment Profit | | $ | 1,429 | | | $ | 1,177 | | | $ | 252 | | | 21 | % | | | | | | | | |

| Segment Profit Margin | | 18.6 | % | | 17.3 | % | | 1.3 | pts | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Energy & Transportation’s total sales were $7.669 billion in the fourth quarter of 2023, an increase of $846 million, or 12%, compared with $6.823 billion in the fourth quarter of 2022. Sales increased across all applications except Industrial. The increase in sales was primarily due to higher sales volume and favorable price realization.

•Oil and Gas – Sales increased for turbines and turbine-related services. Sales also increased in reciprocating engines used in well servicing and gas compression applications.

•Power Generation – Sales increased in large reciprocating engines, primarily data center applications.

•Industrial – Sales decreased primarily in EAME, partially offset by increased sales in Latin America and Asia/Pacific.

•Transportation – Sales increased in rail services and marine. International locomotive deliveries were also higher.

Energy & Transportation’s profit was $1.429 billion in the fourth quarter of 2023, an increase of $252 million, or 21%, compared with $1.177 billion in the fourth quarter of 2022. The increase was primarily due to favorable price realization and higher sales volume, partially offset by higher SG&A/R&D expenses, currency impacts and unfavorable manufacturing costs. The increase in SG&A/R&D expenses was primarily driven by investments aligned with strategic initiatives and higher short-term incentive compensation expense. Unfavorable manufacturing costs reflected lower freight being more than offset by increased period manufacturing costs, higher material costs, unfavorable cost absorption and the impact of manufacturing inefficiencies. Cost absorption was unfavorable as inventory decreased more during the fourth quarter of 2023 than during the fourth quarter of 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FINANCIAL PRODUCTS SEGMENT |

| (Millions of dollars) | | | | | | | | | | | | | | | | |

| Revenues by Geographic Region | | | | | | | | |

| | Fourth Quarter 2023 | | Fourth Quarter 2022 | | $

Change | | %

Change | | | | | | | | |

| North America | | $ | 645 | | | $ | 548 | | | $ | 97 | | | 18 | % | | | | | | | | |

| Latin America | | 100 | | | 98 | | | 2 | | | 2 | % | | | | | | | | |

| EAME | | 127 | | | 103 | | | 24 | | | 23 | % | | | | | | | | |

| Asia/Pacific | | 109 | | | 104 | | | 5 | | | 5 | % | | | | | | | | |

| Total Revenues | | $ | 981 | | | $ | 853 | | | $ | 128 | | | 15 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Segment Profit | | | | | | | | |

| | Fourth Quarter 2023 | | Fourth Quarter 2022 | |

Change | | %

Change | | | | | | | | |

| Segment Profit | | $ | 234 | | | $ | 189 | | | $ | 45 | | | 24 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

Financial Products’ segment revenues were $981 million in the fourth quarter of 2023, an increase of $128 million, or 15%, compared with $853 million in the fourth quarter of 2022. The increase was primarily due to higher average financing rates across all regions and higher average earning assets in North America.

Financial Products’ segment profit was $234 million in the fourth quarter of 2023, an increase of $45 million, or 24%, compared with $189 million in the fourth quarter of 2022. The increase was mainly due to lower provision for credit losses at Cat Financial, higher average earning assets and higher net yield on average earning assets. These favorable impacts were partially offset by an increase in SG&A expenses.

At the end of 2023, past dues at Cat Financial were 1.79%, compared with 1.89% at the end of 2022. Write-offs, net of recoveries, were $65 million for 2023, compared with $46 million for 2022. As of December 31, 2023, Cat Financial's allowance for credit losses totaled $331 million, or 1.18% of finance receivables, compared with $346 million, or 1.29% of finance receivables, at December 31, 2022.

Corporate Items and Eliminations

Expense for corporate items and eliminations was $484 million in the fourth quarter of 2023, a decrease of $1.108 billion from the fourth quarter of 2022, primarily driven by the absence of a 2022 goodwill impairment charge related to the Rail division.

Notes

i.Glossary of terms is included on the Caterpillar website at https://investors.caterpillar.com/overview/default.aspx.

ii.Sales of equipment to end users is demonstrated by the company’s Rolling 3 Month Retail Sales Statistics filed in a Form 8-K on Monday, Feb. 5, 2024.

iii.Information on non-GAAP financial measures is included in the appendix on page 13.

iv.Some amounts within this report are rounded to the millions or billions and may not add.

v.Caterpillar will conduct a teleconference and live webcast, with a slide presentation, beginning at 7:30 a.m. Central Time on Monday, Feb. 5, 2024, to discuss its 2023 fourth-quarter and full-year results. The accompanying slides will be available before the webcast on the Caterpillar website at https://investors.caterpillar.com/events-presentations/default.aspx.

About Caterpillar

With 2023 sales and revenues of $67.1 billion, Caterpillar Inc. is the world’s leading manufacturer of construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. For nearly 100 years, we’ve been helping customers build a better, more sustainable world and are committed and contributing to a reduced-carbon future. Our innovative products and services, backed by our global dealer network, provide exceptional value that helps customers succeed. Caterpillar does business on every continent, principally operating through three primary segments – Construction Industries, Resource Industries and Energy & Transportation – and providing financing and related services through our Financial Products segment. Visit us at caterpillar.com or join the conversation on our social media channels at caterpillar.com/en/news/social-media.html.

Caterpillar’s latest financial results are also available online:

https://investors.caterpillar.com/overview/default.aspx

https://investors.caterpillar.com/financials/quarterly-results/default.aspx (live broadcast/replays of quarterly conference call)

Caterpillar investor relations contact: Ryan Fiedler, +1 224-551-4074 or Fiedler_Ryan_S@cat.com

Caterpillar media contact: Tiffany Heikkila, +1 832-573-0958 or Tiffany.Heikkila@cat.com

Forward-Looking Statements

Certain statements in this press release relate to future events and expectations and are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “believe,” “estimate,” “will be,” “will,” “would,” “expect,” “anticipate,” “plan,” “forecast,” “target,” “guide,” “project,” “intend,” “could,” “should” or other similar words or expressions often identify forward-looking statements. All statements other than statements of historical fact are forward-looking statements, including, without limitation, statements regarding our outlook, projections, forecasts or trend descriptions. These statements do not guarantee future performance and speak only as of the date they are made, and we do not undertake to update our forward-looking statements.

Caterpillar’s actual results may differ materially from those described or implied in our forward-looking statements based on a number of factors, including, but not limited to: (i) global and regional economic conditions and economic conditions in the industries we serve; (ii) commodity price changes, material price increases, fluctuations in demand for our products or significant shortages of material; (iii) government monetary or fiscal policies; (iv) political and economic risks, commercial instability and events beyond our control in the countries in which we operate; (v) international trade policies and their impact on demand for our products and our competitive position, including the imposition of new tariffs or changes in existing tariff rates; (vi) our ability to develop, produce and market quality products that meet our customers’ needs; (vii) the impact of the highly competitive environment in which we operate on our sales and pricing; (viii) information technology security threats and computer crime; (ix) inventory management decisions and sourcing practices of our dealers and our OEM customers; (x) a failure to realize, or a delay in realizing, all of the anticipated benefits of our acquisitions, joint ventures or divestitures; (xi) union disputes or other employee relations issues; (xii) adverse effects of unexpected events; (xiii) disruptions or volatility in global financial markets limiting our sources of liquidity or the liquidity of our customers, dealers and suppliers; (xiv) failure to maintain our credit ratings and potential resulting increases to our cost of borrowing and adverse effects on our cost of funds, liquidity, competitive position and access to capital markets; (xv) our Financial Products segment’s risks associated with the financial services industry; (xvi) changes in interest rates or market liquidity conditions; (xvii) an increase in delinquencies, repossessions or net losses of Cat Financial’s customers; (xviii) currency fluctuations; (xix) our or Cat Financial’s compliance with financial and other restrictive covenants in debt agreements; (xx) increased pension plan funding obligations; (xxi) alleged or actual violations of trade or anti-corruption laws and regulations; (xxii) additional tax expense or exposure, including the impact of U.S. tax reform; (xxiii) significant legal proceedings, claims, lawsuits or government investigations; (xxiv) new regulations or changes in financial services regulations; (xxv) compliance with environmental laws and regulations; (xxvi) catastrophic events, including global pandemics such as the COVID-19 pandemic; and (xxvii) other factors described in more detail in Caterpillar’s Forms 10-Q, 10-K and other filings with the Securities and Exchange Commission.

APPENDIX

NON-GAAP FINANCIAL MEASURES

The following definitions are provided for the non-GAAP financial measures. These non-GAAP financial measures have no standardized meaning prescribed by U.S. GAAP and therefore are unlikely to be comparable to the calculation of similar measures for other companies. Management does not intend these items to be considered in isolation or as a substitute for the related GAAP measures.

The company believes it is important to separately quantify the profit impact of five significant items in order for the company’s results to be meaningful to readers. These items consist of (i) restructuring costs related to the divestiture of the company's Longwall business, (ii) other restructuring costs, (iii) pension and OPEB mark-to-market gains/losses resulting from plan remeasurements, (iv) certain deferred tax valuation allowance adjustments and (v) goodwill impairment in 2022. The company does not consider these items indicative of earnings from ongoing business activities and believes the non-GAAP measure provides investors with useful perspective on underlying business results and trends and aids with assessing the company’s period-over-period results.

Reconciliations of adjusted results to the most directly comparable GAAP measure are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions except per share data) | | Operating Profit | | Operating Profit Margin | | Profit Before Taxes | | Provision (Benefit) for Income Taxes | | Effective Tax Rate | | Profit | | Profit per Share |

| | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 - U.S. GAAP | | $ | 3,134 | | | 18.4 | % | | $ | 3,249 | | | $ | 587 | | | 18.1 | % | | $ | 2,676 | | | $ | 5.28 | |

| Restructuring costs | | 92 | | | 0.5 | % | | 92 | | | 27 | | | 29.3 | % | | 65 | | | 0.13 | |

| Pension/OPEB mark-to-market (gains) losses | | — | | | — | % | | (97) | | | (26) | | | 26.8 | % | | (71) | | | (0.14) | |

| Deferred tax valuation allowance adjustments | | — | | | — | % | | — | | | 18 | | | — | % | | (18) | | | (0.04) | |

| Three Months Ended December 31, 2023 - Adjusted | | $ | 3,226 | | | 18.9 | % | | $ | 3,244 | | | $ | 606 | | | 18.7 | % | | $ | 2,652 | | | $ | 5.23 | |

| | | | | | | | | | | | | | |

| Three Months Ended December 31, 2022 - U.S. GAAP | | $ | 1,680 | | | 10.1 | % | | $ | 2,099 | | | $ | 644 | | | 30.7 | % | | $ | 1,454 | | | $ | 2.79 | |

| Goodwill impairment | | 925 | | | 5.6 | % | | 925 | | | 36 | | | 3.9 | % | | 889 | | | 1.71 | |

| Restructuring costs | | 209 | | | 1.3 | % | | 209 | | | 59 | | | 28.2 | % | | 150 | | | 0.29 | |

| Pension/OPEB mark-to-market (gains) losses | | — | | | — | % | | (606) | | | (124) | | | 20.5 | % | | (482) | | | (0.93) | |

| Three Months Ended December 31, 2022 - Adjusted | | $ | 2,814 | | | 17.0 | % | | $ | 2,627 | | | $ | 615 | | | 23.4 | % | | $ | 2,011 | | | $ | 3.86 | |

| | | | | | | | | | | | | | |

| Twelve Months Ended December 31, 2023 - U.S. GAAP | | $ | 12,966 | | | 19.3 | % | | $ | 13,050 | | | $ | 2,781 | | | 21.3 | % | | $ | 10,335 | | | $ | 20.12 | |

| Restructuring costs - Longwall divestiture | | 586 | | | 0.9 | % | | 586 | | | — | | | — | % | | 586 | | | 1.14 | |

| Other restructuring costs | | 194 | | | 0.3 | % | | 194 | | | 48 | | | 25.0 | % | | 146 | | | 0.30 | |

| Pension/OPEB mark-to-market (gains) losses | | — | | | — | % | | (97) | | | (26) | | | 26.8 | % | | (71) | | | (0.14) | |

| Deferred tax valuation allowance adjustments | | — | | | — | % | | — | | | 106 | | | — | % | | (106) | | | (0.21) | |

| Twelve Months Ended December 31, 2023 - Adjusted | | $ | 13,746 | | | 20.5 | % | | $ | 13,733 | | | $ | 2,909 | | | 21.2 | % | | $ | 10,890 | | | $ | 21.21 | |

| | | | | | | | | | | | | | |

| Twelve Months Ended December 31, 2022 - U.S. GAAP | | $ | 7,904 | | | 13.3 | % | | $ | 8,752 | | | $ | 2,067 | | | 23.6 | % | | $ | 6,705 | | | $ | 12.64 | |

| Goodwill impairment | | 925 | | | 1.6 | % | | 925 | | | 36 | | | 3.9 | % | | 889 | | | 1.68 | |

| Restructuring costs | | 299 | | | 0.5 | % | | 299 | | | 72 | | | 24.0 | % | | 227 | | | 0.43 | |

| Pension/OPEB mark-to-market (gains) losses | | — | | | — | % | | (606) | | | (124) | | | 20.5 | % | | (482) | | | (0.91) | |

| Twelve Months Ended December 31, 2022 - Adjusted | | $ | 9,128 | | | 15.4 | % | | $ | 9,370 | | | $ | 2,051 | | | 21.9 | % | | $ | 7,339 | | | $ | 13.84 | |

Supplemental Consolidating Data

The company is providing supplemental consolidating data for the purpose of additional analysis. The data has been grouped as follows:

Consolidated – Caterpillar Inc. and its subsidiaries.

Machinery, Energy & Transportation (ME&T) – The company defines ME&T as it is presented in the supplemental data as Caterpillar Inc. and its subsidiaries, excluding Financial Products. ME&T’s information relates to the design, manufacturing and marketing of its products.

Financial Products – The company defines Financial Products as it is presented in the supplemental data as its finance and insurance subsidiaries, primarily Caterpillar Financial Services Corporation (Cat Financial) and Caterpillar Insurance Holdings Inc. (Insurance Services). Financial Products’ information relates to the financing to customers and dealers for the purchase and lease of Caterpillar and other equipment.

Consolidating Adjustments – Eliminations of transactions between ME&T and Financial Products.

The nature of the ME&T and Financial Products businesses is different, especially with regard to the financial position and cash flow items. Caterpillar management utilizes this presentation internally to highlight these differences. The company believes this presentation will assist readers in understanding its business.

Pages 15 to 25 reconcile ME&T and Financial Products to Caterpillar Inc. consolidated financial information.

Caterpillar Inc.

Condensed Consolidated Statement of Results of Operations

(Unaudited)

(Dollars in millions except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Sales and revenues: | | | | | | | |

| Sales of Machinery, Energy & Transportation | $ | 16,237 | | | $ | 15,871 | | | $ | 63,869 | | | $ | 56,574 | |

| Revenues of Financial Products | 833 | | | 726 | | | 3,191 | | | 2,853 | |

| Total sales and revenues | 17,070 | | | 16,597 | | | 67,060 | | | 59,427 | |

| | | | | | | |

| Operating costs: | | | | | | | |

| Cost of goods sold | 11,016 | | | 11,614 | | | 42,767 | | | 41,350 | |

| Selling, general and administrative expenses | 1,756 | | | 1,479 | | | 6,371 | | | 5,651 | |

| Research and development expenses | 554 | | | 401 | | | 2,108 | | | 1,814 | |

| Interest expense of Financial Products | 288 | | | 188 | | | 1,030 | | | 565 | |

| Goodwill impairment charge | — | | | 925 | | | — | | | 925 | |

| Other operating (income) expenses | 322 | | | 310 | | | 1,818 | | | 1,218 | |

| Total operating costs | 13,936 | | | 14,917 | | | 54,094 | | | 51,523 | |

| | | | | | | |

| Operating profit | 3,134 | | | 1,680 | | | 12,966 | | | 7,904 | |

| | | | | | | |

| Interest expense excluding Financial Products | 126 | | | 117 | | | 511 | | | 443 | |

| Other income (expense) | 241 | | | 536 | | | 595 | | | 1,291 | |

| | | | | | | |

| Consolidated profit before taxes | 3,249 | | | 2,099 | | | 13,050 | | | 8,752 | |

| | | | | | | |

| Provision (benefit) for income taxes | 587 | | | 644 | | | 2,781 | | | 2,067 | |

| Profit of consolidated companies | 2,662 | | | 1,455 | | | 10,269 | | | 6,685 | |

| | | | | | | |

| Equity in profit (loss) of unconsolidated affiliated companies | 11 | | | (1) | | | 63 | | | 19 | |

| | | | | | | |

| Profit of consolidated and affiliated companies | 2,673 | | | 1,454 | | | 10,332 | | | 6,704 | |

| | | | | | | |

| Less: Profit (loss) attributable to noncontrolling interests | (3) | | | — | | | (3) | | | (1) | |

| | | | | | | |

Profit 1 | $ | 2,676 | | | $ | 1,454 | | | $ | 10,335 | | | $ | 6,705 | |

| | | | | | | |

| | | | | | | |

| Profit per common share | $ | 5.31 | | | $ | 2.81 | | | $ | 20.24 | | | $ | 12.72 | |

Profit per common share — diluted 2 | $ | 5.28 | | | $ | 2.79 | | | $ | 20.12 | | | $ | 12.64 | |

| | | | | | | |

| Weighted-average common shares outstanding (millions) | | | | | | | |

| – Basic | 504.4 | | | 517.4 | | | 510.6 | | | 526.9 | |

– Diluted 2 | 507.0 | | | 520.9 | | | 513.6 | | | 530.4 | |

| | | | | | | |

| | | | | |

| 1 | Profit attributable to common shareholders. |

| 2 | Diluted by assumed exercise of stock-based compensation awards using the treasury stock method. |

Caterpillar Inc.

Condensed Consolidated Statement of Financial Position

(Unaudited)

(Millions of dollars)

| | | | | | | | | | | |

| December 31,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 6,978 | | | $ | 7,004 | |

| Receivables – trade and other | 9,310 | | | 8,856 | |

| Receivables – finance | 9,510 | | | 9,013 | |

| Prepaid expenses and other current assets | 4,586 | | | 2,642 | |

| Inventories | 16,565 | | | 16,270 | |

| Total current assets | 46,949 | | | 43,785 | |

| | | |

| Property, plant and equipment – net | 12,680 | | | 12,028 | |

| Long-term receivables – trade and other | 1,238 | | | 1,265 | |

| Long-term receivables – finance | 12,664 | | | 12,013 | |

| Noncurrent deferred and refundable income taxes | 2,816 | | | 2,213 | |

| Intangible assets | 564 | | | 758 | |

| Goodwill | 5,308 | | | 5,288 | |

| Other assets | 5,257 | | | 4,593 | |

| Total assets | $ | 87,476 | | | $ | 81,943 | |

| | | |

| Liabilities | | | |

| Current liabilities: | | | |

| Short-term borrowings: | | | |

| -- Machinery, Energy & Transportation | $ | — | | | $ | 3 | |

| -- Financial Products | 4,643 | | | 5,954 | |

| Accounts payable | 7,906 | | | 8,689 | |

| Accrued expenses | 4,958 | | | 4,080 | |

| Accrued wages, salaries and employee benefits | 2,757 | | | 2,313 | |

| Customer advances | 1,929 | | | 1,860 | |

| Dividends payable | 649 | | | 620 | |

| Other current liabilities | 3,123 | | | 2,690 | |

| Long-term debt due within one year: | | | |

| -- Machinery, Energy & Transportation | 1,044 | | | 120 | |

| -- Financial Products | 7,719 | | | 5,202 | |

| Total current liabilities | 34,728 | | | 31,531 | |

| | | |

| Long-term debt due after one year: | | | |

| -- Machinery, Energy & Transportation | 8,579 | | | 9,498 | |

| -- Financial Products | 15,893 | | | 16,216 | |

| Liability for postemployment benefits | 4,098 | | | 4,203 | |

| Other liabilities | 4,675 | | | 4,604 | |

| Total liabilities | 67,973 | | | 66,052 | |

| | | |

| Shareholders’ equity | | | |

| Common stock | 6,403 | | | 6,560 | |

| Treasury stock | (36,339) | | | (31,748) | |

| Profit employed in the business | 51,250 | | | 43,514 | |

| Accumulated other comprehensive income (loss) | (1,820) | | | (2,457) | |

| Noncontrolling interests | 9 | | | 22 | |

| Total shareholders’ equity | 19,503 | | | 15,891 | |

| Total liabilities and shareholders’ equity | $ | 87,476 | | | $ | 81,943 | |

Caterpillar Inc.

Condensed Consolidated Statement of Cash Flow

(Unaudited)

(Millions of dollars)

| | | | | | | | | | | |

| Twelve Months Ended

December 31, |

| 2023 | | 2022 |

| Cash flow from operating activities: | | | |

| Profit of consolidated and affiliated companies | $ | 10,332 | | | $ | 6,704 | |

| Adjustments for non-cash items: | | | |

| Depreciation and amortization | 2,144 | | | 2,219 | |

| Actuarial (gain) loss on pension and postretirement benefits | (97) | | | (606) | |

| Provision (benefit) for deferred income taxes | (592) | | | (377) | |

| Loss on divestiture | 572 | | | — | |

| Goodwill impairment charge | — | | | 925 | |

| Other | 375 | | | 701 | |

| Changes in assets and liabilities, net of acquisitions and divestitures: | | | |

| Receivables – trade and other | (437) | | | (220) | |

| Inventories | (364) | | | (2,589) | |

| Accounts payable | (754) | | | 798 | |

| Accrued expenses | 796 | | | 317 | |

| Accrued wages, salaries and employee benefits | 486 | | | 90 | |

| Customer advances | 80 | | | 768 | |

| Other assets – net | (95) | | | (210) | |

| Other liabilities – net | 439 | | | (754) | |

| Net cash provided by (used for) operating activities | 12,885 | | | 7,766 | |

| Cash flow from investing activities: | | | |

| Capital expenditures – excluding equipment leased to others | (1,597) | | | (1,296) | |

| Expenditures for equipment leased to others | (1,495) | | | (1,303) | |

| Proceeds from disposals of leased assets and property, plant and equipment | 781 | | | 830 | |

| Additions to finance receivables | (15,161) | | | (13,239) | |

| Collections of finance receivables | 14,034 | | | 13,177 | |

| Proceeds from sale of finance receivables | 63 | | | 57 | |

| Investments and acquisitions (net of cash acquired) | (75) | | | (88) | |

| Proceeds from sale of businesses and investments (net of cash sold) | (4) | | | 1 | |

| Proceeds from maturities and sale of securities | 1,891 | | | 2,383 | |

| Investments in securities | (4,405) | | | (3,077) | |

| Other – net | 97 | | | 14 | |

| Net cash provided by (used for) investing activities | (5,871) | | | (2,541) | |

| Cash flow from financing activities: | | | |

| Dividends paid | (2,563) | | | (2,440) | |

| Common stock issued, including treasury shares reissued | 12 | | | 51 | |

| Common shares repurchased | (4,975) | | | (4,230) | |

| | | |

| Proceeds from debt issued (original maturities greater than three months) | 8,257 | | | 6,674 | |

| Payments on debt (original maturities greater than three months) | (6,318) | | | (7,728) | |

| Short-term borrowings – net (original maturities three months or less) | (1,345) | | | 402 | |

| Other – net | — | | | (10) | |

| Net cash provided by (used for) financing activities | (6,932) | | | (7,281) | |

| Effect of exchange rate changes on cash | (110) | | | (194) | |

| Increase (decrease) in cash, cash equivalents and restricted cash | (28) | | | (2,250) | |

| Cash, cash equivalents and restricted cash at beginning of period | 7,013 | | | 9,263 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 6,985 | | | $ | 7,013 | |

| | | |

| | |

| Cash equivalents primarily represent short-term, highly liquid investments with original maturities of generally three months or less. |

Caterpillar Inc.

Supplemental Data for Results of Operations

For the Three Months Ended December 31, 2023

(Unaudited)

(Millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Supplemental Consolidating Data | |

| | Consolidated | | Machinery, Energy & Transportation | | Financial

Products | | Consolidating

Adjustments | |

| Sales and revenues: | | | | | | | | |

| Sales of Machinery, Energy & Transportation | $ | 16,237 | | | $ | 16,237 | | | $ | — | | | $ | — | | |

| Revenues of Financial Products | 833 | | | — | | | 1,020 | | | (187) | | 1 |

| Total sales and revenues | 17,070 | | | 16,237 | | | 1,020 | | | (187) | | |

| | | | | | | | |

| Operating costs: | | | | | | | | |

| Cost of goods sold | 11,016 | | | 11,018 | | | — | | | (2) | | 2 |

| Selling, general and administrative expenses | 1,756 | | | 1,557 | | | 197 | | | 2 | | 2 |

| Research and development expenses | 554 | | | 554 | | | — | | | — | | |

| Interest expense of Financial Products | 288 | | | — | | | 290 | | | (2) | | 2 |

| | | | | | | | |

| Other operating (income) expenses | 322 | | | 6 | | | 345 | | | (29) | | 2 |

| Total operating costs | 13,936 | | | 13,135 | | | 832 | | | (31) | | |

| | | | | | | | |

| Operating profit | 3,134 | | | 3,102 | | | 188 | | | (156) | | |

| | | | | | | | |

| Interest expense excluding Financial Products | 126 | | | 126 | | | — | | | — | | |

| Other income (expense) | 241 | | | 322 | | | 33 | | | (114) | | 3 |

| | | | | | | | |

| Consolidated profit before taxes | 3,249 | | | 3,298 | | | 221 | | | (270) | | |

| | | | | | | | |

| Provision (benefit) for income taxes | 587 | | | 567 | | | 20 | | | — | | |

| Profit of consolidated companies | 2,662 | | | 2,731 | | | 201 | | | (270) | | |

| | | | | | | | |

| Equity in profit (loss) of unconsolidated affiliated companies | 11 | | | 12 | | | — | | | (1) | | 4 |

| | | | | | | | |

| Profit of consolidated and affiliated companies | 2,673 | | | 2,743 | | | 201 | | | (271) | | |

| | | | | | | | |

| Less: Profit (loss) attributable to noncontrolling interests | (3) | | | (2) | | | — | | | (1) | | 5 |

| | | | | | | | |

Profit 6 | $ | 2,676 | | | $ | 2,745 | | | $ | 201 | | | $ | (270) | | |

| | | | | |

| 1 | Elimination of Financial Products’ revenues earned from ME&T. |

| 2 | Elimination of net expenses recorded between ME&T and Financial Products. |

| 3 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. |

| 4 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. |

| 5 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. |

| 6 | Profit attributable to common shareholders. |

Caterpillar Inc.

Supplemental Data for Results of Operations

For the Three Months Ended December 31, 2022

(Unaudited)

(Millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Supplemental Consolidating Data | |

| | Consolidated | | Machinery, Energy & Transportation | | Financial

Products | | Consolidating

Adjustments | |

| Sales and revenues: | | | | | | | | |

| Sales of Machinery, Energy & Transportation | $ | 15,871 | | | $ | 15,871 | | | $ | — | | | $ | — | | |

| Revenues of Financial Products | 726 | | | — | | | 883 | | | (157) | | 1 |

| Total sales and revenues | 16,597 | | | 15,871 | | | 883 | | | (157) | | |

| | | | | | | | |

| Operating costs: | | | | | | | | |

| Cost of goods sold | 11,614 | | | 11,615 | | | — | | | (1) | | 2 |

| Selling, general and administrative expenses | 1,479 | | | 1,285 | | | 197 | | | (3) | | 2 |

| Research and development expenses | 401 | | | 401 | | | — | | | — | | |

| Interest expense of Financial Products | 188 | | | — | | | 188 | | | — | | |

| Goodwill impairment charge | 925 | | | 925 | | | — | | | — | | |

| Other operating (income) expenses | 310 | | | 16 | | | 313 | | | (19) | | 2 |

| Total operating costs | 14,917 | | | 14,242 | | | 698 | | | (23) | | |

| | | | | | | | |

| Operating profit | 1,680 | | | 1,629 | | | 185 | | | (134) | | |

| | | | | | | | |

| Interest expense excluding Financial Products | 117 | | | 117 | | | — | | | — | | |

| Other income (expense) | 536 | | | 877 | | | — | | | (341) | | 3 |

| | | | | | | | |

| Consolidated profit before taxes | 2,099 | | | 2,389 | | | 185 | | | (475) | | |

| | | | | | | | |

| Provision (benefit) for income taxes | 644 | | | 608 | | | 36 | | | — | | |

| Profit of consolidated companies | 1,455 | | | 1,781 | | | 149 | | | (475) | | |

| | | | | | | | |

| Equity in profit (loss) of unconsolidated affiliated companies | (1) | | | — | | | — | | | (1) | | 4 |

| | | | | | | | |

| Profit of consolidated and affiliated companies | 1,454 | | | 1,781 | | | 149 | | | (476) | | |

| | | | | | | | |

| Less: Profit (loss) attributable to noncontrolling interests | — | | | — | | | 1 | | | (1) | | 5 |

| | | | | | | | |

Profit 6 | $ | 1,454 | | | $ | 1,781 | | | $ | 148 | | | $ | (475) | | |

| | | | | | | | |

| | | | | |

| 1 | Elimination of Financial Products’ revenues earned from ME&T. |

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. |

| 3 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. |

| 4 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. |

| 5 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. |

| 6 | Profit attributable to common shareholders. |

| |

Caterpillar Inc.

Supplemental Data for Results of Operations

For the Twelve Months Ended December 31, 2023

(Unaudited)

(Millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Supplemental Consolidating Data | |

| | Consolidated | | Machinery, Energy & Transportation | | Financial

Products | | Consolidating

Adjustments | |

| Sales and revenues: | | | | | | | | |

| Sales of Machinery, Energy & Transportation | $ | 63,869 | | | $ | 63,869 | | | $ | — | | | $ | — | | |

| Revenues of Financial Products | 3,191 | | | — | | | 3,927 | | | (736) | | 1 |

| Total sales and revenues | 67,060 | | | 63,869 | | | 3,927 | | | (736) | | |

| | | | | | | | |

| Operating costs: | | | | | | | | |

| Cost of goods sold | 42,767 | | | 42,776 | | | — | | | (9) | | 2 |

| Selling, general and administrative expenses | 6,371 | | | 5,696 | | | 704 | | | (29) | | 2 |

| Research and development expenses | 2,108 | | | 2,108 | | | — | | | — | | |

| Interest expense of Financial Products | 1,030 | | | — | | | 1,032 | | | (2) | | 2 |

| | | | | | | | |

| Other operating (income) expenses | 1,818 | | | 630 | | | 1,268 | | | (80) | | 2 |

| Total operating costs | 54,094 | | | 51,210 | | | 3,004 | | | (120) | | |

| | | | | | | | |

| Operating profit | 12,966 | | | 12,659 | | | 923 | | | (616) | | |

| | | | | | | | |

| Interest expense excluding Financial Products | 511 | | | 511 | | | — | | | — | | |

| Other income (expense) | 595 | | | 340 | | | (16) | | | 271 | | 3 |

| | | | | | | | |

| Consolidated profit before taxes | 13,050 | | | 12,488 | | | 907 | | | (345) | | |

| | | | | | | | |

| Provision (benefit) for income taxes | 2,781 | | | 2,560 | | | 221 | | | — | | |

| Profit of consolidated companies | 10,269 | | | 9,928 | | | 686 | | | (345) | | |

| | | | | | | | |

| Equity in profit (loss) of unconsolidated affiliated companies | 63 | | | 67 | | | — | | | (4) | | 4 |

| | | | | | | | |

| | | | | | | | |

| Profit of consolidated and affiliated companies | 10,332 | | | 9,995 | | | 686 | | | (349) | | |

| | | | | | | | |

| Less: Profit (loss) attributable to noncontrolling interests | (3) | | | (4) | | | 5 | | | (4) | | 5 |

| | | | | | | | |

Profit 6 | $ | 10,335 | | | $ | 9,999 | | | $ | 681 | | | $ | (345) | | |

| | | | | |

| 1 | Elimination of Financial Products’ revenues earned from ME&T. |

| 2 | Elimination of net expenses recorded between ME&T and Financial Products. |

| 3 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. |

| 4 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. |

| 5 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. |

| 6 | Profit attributable to common shareholders. |

| |

Caterpillar Inc.

Supplemental Data for Results of Operations

For the Twelve Months Ended December 31, 2022

(Unaudited)

(Millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Supplemental Consolidating Data | |

| | Consolidated | | Machinery, Energy & Transportation | | Financial

Products | | Consolidating

Adjustments | |

| Sales and revenues: | | | | | | | | |

| Sales of Machinery, Energy & Transportation | $ | 56,574 | | | $ | 56,574 | | | $ | — | | | $ | — | | |

| Revenues of Financial Products | 2,853 | | | — | | | 3,376 | | | (523) | | 1 | |

| Total sales and revenues | 59,427 | | | 56,574 | | | 3,376 | | | (523) | | |

| | | | | | | | |

| Operating costs: | | | | | | | | |

| Cost of goods sold | 41,350 | | | 41,356 | | | — | | | (6) | | 2 | |

| Selling, general and administrative expenses | 5,651 | | | 4,999 | | | 672 | | | (20) | | 2 | |

| Research and development expenses | 1,814 | | | 1,814 | | | — | | | — | | |

| Interest expense of Financial Products | 565 | | | — | | | 565 | | | — | | |

| Goodwill impairment charge | 925 | | | 925 | | | — | | | — | | |

| Other operating (income) expenses | 1,218 | | | 47 | | | 1,249 | | | (78) | | 2 | |

| Total operating costs | 51,523 | | | 49,141 | | | 2,486 | | | (104) | | |

| | | | | | | | |

| Operating profit | 7,904 | | | 7,433 | | | 890 | | | (419) | | |

| | | | | | | | |

| Interest expense excluding Financial Products | 443 | | | 444 | | | — | | | (1) | | 3 | |

| Other income (expense) | 1,291 | | | 1,374 | | | (26) | | | (57) | | 4 | |

| | | | | | | | |

| Consolidated profit before taxes | 8,752 | | | 8,363 | | | 864 | | | (475) | | |

| | | | | | | | |

| Provision (benefit) for income taxes | 2,067 | | | 1,858 | | | 209 | | | — | | |

| Profit of consolidated companies | 6,685 | | | 6,505 | | | 655 | | | (475) | | |

| | | | | | | | |

| Equity in profit (loss) of unconsolidated affiliated companies | 19 | | | 26 | | | — | | | (7) | | 5 | |

| | | | | | | | |

| | | | | | | | |

| Profit of consolidated and affiliated companies | 6,704 | | | 6,531 | | | 655 | | | (482) | | |

| | | | | | | | |

| Less: Profit (loss) attributable to noncontrolling interests | (1) | | | (1) | | | 7 | | | (7) | | 6 | |

| | | | | | | | |

Profit 7 | $ | 6,705 | | | $ | 6,532 | | | $ | 648 | | | $ | (475) | | |

| | | | | |

| 1 | Elimination of Financial Products’ revenues earned from ME&T. |

| 2 | Elimination of net expenses recorded by ME&T paid to Financial Products. |

| 3 | Elimination of interest expense recorded between Financial Products and ME&T. |

| 4 | Elimination of discount recorded by ME&T on receivables sold to Financial Products and of interest earned between ME&T and Financial Products as well as dividends paid by Financial Products to ME&T. |

| 5 | Elimination of equity profit (loss) earned from Financial Products’ subsidiaries partially owned by ME&T subsidiaries. |

| 6 | Elimination of noncontrolling interest profit (loss) recorded by Financial Products for subsidiaries partially owned by ME&T subsidiaries. |

| 7 | Profit attributable to common shareholders. |

| |

Caterpillar Inc.

Supplemental Data for Financial Position

At December 31, 2023

(Unaudited)

(Millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Supplemental Consolidating Data | |

| | Consolidated | | Machinery,

Energy &

Transportation | | Financial

Products | | Consolidating

Adjustments | |

| Assets | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | $ | 6,978 | | | $ | 6,106 | | | $ | 872 | | | $ | — | | |

| Receivables – trade and other | 9,310 | | | 3,971 | | | 570 | | | 4,769 | | 1,2 |

| Receivables – finance | 9,510 | | | — | | | 14,499 | | | (4,989) | | 2 |

| | | | | | | | |

| Prepaid expenses and other current assets | 4,586 | | | 4,327 | | | 341 | | | (82) | | 3 |

| Inventories | 16,565 | | | 16,565 | | | — | | | — | | |

| Total current assets | 46,949 | | | 30,969 | | | 16,282 | | | (302) | | |

| | | | | | | | |

| Property, plant and equipment – net | 12,680 | | | 8,694 | | | 3,986 | | | — | | |

| Long-term receivables – trade and other | 1,238 | | | 565 | | | 85 | | | 588 | | 1,2 |

| Long-term receivables – finance | 12,664 | | | — | | | 13,299 | | | (635) | | 2 |

| | | | | | | | |

| | | | | | | | |

| Noncurrent deferred and refundable income taxes | 2,816 | | | 3,360 | | | 148 | | | (692) | | 4 |

| Intangible assets | 564 | | | 564 | | | — | | | — | | |

| Goodwill | 5,308 | | | 5,308 | | | — | | | — | | |

| Other assets | 5,257 | | | 4,218 | | | 2,082 | | | (1,043) | | 5 |

| Total assets | $ | 87,476 | | | $ | 53,678 | | | $ | 35,882 | | | $ | (2,084) | | |

| | | | | | | | |

| Liabilities | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Short-term borrowings | $ | 4,643 | | | $ | — | | | $ | 4,643 | | | $ | — | | |

| | | | | | | | |

| Accounts payable | 7,906 | | | 7,827 | | | 314 | | | (235) | | 6,7 |

| Accrued expenses | 4,958 | | | 4,361 | | | 597 | | | — | | |

| Accrued wages, salaries and employee benefits | 2,757 | | | 2,696 | | | 61 | | | — | | |

| Customer advances | 1,929 | | | 1,912 | | | 2 | | | 15 | | 7 |

| Dividends payable | 649 | | | 649 | | | — | | | — | | |

| Other current liabilities | 3,123 | | | 2,583 | | | 647 | | | (107) | | 4,8 |

| Long-term debt due within one year | 8,763 | | | 1,044 | | | 7,719 | | | — | | |

| Total current liabilities | 34,728 | | | 21,072 | | | 13,983 | | | (327) | | |

| | | | | | | | |

| Long-term debt due after one year | 24,472 | | | 8,626 | | | 15,893 | | | (47) | | 9 |

| Liability for postemployment benefits | 4,098 | | | 4,098 | | | — | | | — | | |

| Other liabilities | 4,675 | | | 3,806 | | | 1,607 | | | (738) | | 4 |

| Total liabilities | 67,973 | | | 37,602 | | | 31,483 | | | (1,112) | | |

| | | | | | | | |

| Shareholders’ equity | | | | | | | | |

| Common stock | 6,403 | | | 6,403 | | | 905 | | | (905) | | 10 |

| Treasury stock | (36,339) | | | (36,339) | | | — | | | — | | |

| Profit employed in the business | 51,250 | | | 46,783 | | | 4,457 | | | 10 | | 10 |

| Accumulated other comprehensive income (loss) | (1,820) | | | (783) | | | (1,037) | | | — | | |

| Noncontrolling interests | 9 | | | 12 | | | 74 | | | (77) | | 10 |

| Total shareholders’ equity | 19,503 | | | 16,076 | | | 4,399 | | | (972) | | |

| Total liabilities and shareholders’ equity | $ | 87,476 | | | $ | 53,678 | | | $ | 35,882 | | | $ | (2,084) | | |

| | | | | |

| 1 | Elimination of receivables between ME&T and Financial Products. |

| 2 | Reclassification of ME&T’s trade receivables purchased by Financial Products and Financial Products’ wholesale inventory receivables. |

| 3 | Elimination of ME&T's insurance premiums that are prepaid to Financial Products. |

| 4 | Reclassification reflecting required netting of deferred tax assets/liabilities by taxing jurisdiction. |

| 5 | Elimination of other intercompany assets between ME&T and Financial Products. |

| 6 | Elimination of payables between ME&T and Financial Products. |

| 7 | Reclassification of Financial Products' payables to accrued expenses or customer advances |

| 8 | Elimination of prepaid insurance in Financial Products’ other liabilities. |

| 9 | Elimination of debt between ME&T and Financial Products. |

| 10 | Eliminations associated with ME&T’s investments in Financial Products’ subsidiaries. |

| |

Caterpillar Inc.

Supplemental Data for Financial Position

At December 31, 2022

(Unaudited)

(Millions of dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Supplemental Consolidating Data | |

| | Consolidated | | Machinery,

Energy &

Transportation | | Financial

Products | | Consolidating

Adjustments | |

| Assets | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | $ | 7,004 | | | $ | 6,042 | | | $ | 962 | | | $ | — | | |

| Receivables – trade and other | 8,856 | | | 3,710 | | | 519 | | | 4,627 | | 1,2 |

| Receivables – finance | 9,013 | | | — | | | 13,902 | | | (4,889) | | 2 |

| | | | | | | | |

| Prepaid expenses and other current assets | 2,642 | | | 2,488 | | | 290 | | | (136) | | 3 |

| Inventories | 16,270 | | | 16,270 | | | — | | | — | | |

| Total current assets | 43,785 | | | 28,510 | | | 15,673 | | | (398) | | |

| | | | | | | | |

| Property, plant and equipment – net | 12,028 | | | 8,186 | | | 3,842 | | | — | | |

| Long-term receivables – trade and other | 1,265 | | | 418 | | | 339 | | | 508 | | 1,2 |

| Long-term receivables – finance | 12,013 | | | — | | | 12,552 | | | (539) | | 2 |

| | | | | | | | |

| | | | | | | | |

| Noncurrent deferred and refundable income taxes | 2,213 | | | 2,755 | | | 115 | | | (657) | | 4 |

| Intangible assets | 758 | | | 758 | | | — | | | — | | |

| Goodwill | 5,288 | | | 5,288 | | | — | | | — | | |

| Other assets | 4,593 | | | 3,882 | | | 1,892 | | | (1,181) | | 5 |

| Total assets | $ | 81,943 | | | $ | 49,797 | | | $ | 34,413 | | | $ | (2,267) | | |

| | | | | | | | |

| Liabilities | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Short-term borrowings | $ | 5,957 | | | $ | 3 | | | $ | 5,954 | | | $ | — | | |

| Accounts payable | 8,689 | | | 8,657 | | | 294 | | | (262) | | 6 |

| Accrued expenses | 4,080 | | | 3,687 | | | 393 | | | — | | |

| Accrued wages, salaries and employee benefits | 2,313 | | | 2,264 | | | 49 | | | — | | |

| Customer advances | 1,860 | | | 1,860 | | | — | | | — | | |

| Dividends payable | 620 | | | 620 | | | — | | | — | | |

| Other current liabilities | 2,690 | | | 2,215 | | | 635 | | | (160) | | 4,7 |

| Long-term debt due within one year | 5,322 | | | 120 | | | 5,202 | | | — | | |

| Total current liabilities | 31,531 | | | 19,426 | | | 12,527 | | | (422) | | |

| | | | | | | | |

| Long-term debt due after one year | 25,714 | | | 9,529 | | | 16,216 | | | (31) | | 8 |

| Liability for postemployment benefits | 4,203 | | | 4,203 | | | — | | | — | | |

| Other liabilities | 4,604 | | | 3,677 | | | 1,638 | | | (711) | | 4 |

| Total liabilities | 66,052 | | | 36,835 | | | 30,381 | | | (1,164) | | |

| | | | | | | | |

| Shareholders’ equity | | | | | | | | |

| Common stock | 6,560 | | | 6,560 | | | 905 | | | (905) | | 9 |

| Treasury stock | (31,748) | | | (31,748) | | | — | | | — | | |

| Profit employed in the business | 43,514 | | | 39,435 | | | 4,068 | | | 11 | | 9 |

| Accumulated other comprehensive income (loss) | (2,457) | | | (1,310) | | | (1,147) | | | — | | |

| Noncontrolling interests | 22 | | | 25 | | | 206 | | | (209) | | 9 |

| Total shareholders’ equity | 15,891 | | | 12,962 | | | 4,032 | | | (1,103) | | |

| Total liabilities and shareholders’ equity | $ | 81,943 | | | $ | 49,797 | | | $ | 34,413 | | | $ | (2,267) | | |

| | | | | |

| 1 | Elimination of receivables between ME&T and Financial Products. |

| 2 | Reclassification of ME&T’s trade receivables purchased by Financial Products and Financial Products’ wholesale inventory receivables. |

| 3 | Elimination of ME&T’s insurance premiums that are prepaid to Financial Products. |

| 4 | Reclassification reflecting required netting of deferred tax assets/liabilities by taxing jurisdiction. |

| 5 | Elimination of other intercompany assets between ME&T and Financial Products. |

| 6 | Elimination of payables between ME&T and Financial Products. |

| 7 | Elimination of prepaid insurance in Financial Products’ other liabilities. |

| 8 | Elimination of debt between ME&T and Financial Products. |

| 9 | Eliminations associated with ME&T’s investments in Financial Products’ subsidiaries. |

Caterpillar Inc.

Supplemental Data for Cash Flow

For the Twelve Months Ended December 31, 2023

(Unaudited)

(Millions of dollars) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Supplemental Consolidating Data | |

| | Consolidated | | Machinery, Energy & Transportation | | Financial

Products | | Consolidating

Adjustments | |

| Cash flow from operating activities: | | | | | | | | |

| Profit of consolidated and affiliated companies | $ | 10,332 | | | $ | 9,995 | | | $ | 686 | | | $ | (349) | | 1,5 |

| Adjustments for non-cash items: | | | | | | | | |

| Depreciation and amortization | 2,144 | | | 1,361 | | | 783 | | | — | | |

| | | | | | | | |

| Actuarial (gain) loss on pension and postretirement benefits | (97) | | | (97) | | | — | | | — | | |

| Provision (benefit) for deferred income taxes | (592) | | | (576) | | | (16) | | | — | | |

| Loss on divestiture | 572 | | | 572 | | | — | | | — | | |

| | | | | | | | |

| Other | 375 | | | 444 | | | (577) | | | 508 | | 2 |

| | | | | | | | |

| Changes in assets and liabilities, net of acquisitions and divestitures: | | | | | | | | |

| Receivables – trade and other | (437) | | | (367) | | | 61 | | | (131) | | 2,3 |

| Inventories | (364) | | | (360) | | | — | | | (4) | | 2 |

| Accounts payable | (754) | | | (836) | | | 41 | | | 41 | | 2 |

| Accrued expenses | 796 | | | 690 | | | 106 | | | — | | |

| Accrued wages, salaries and employee benefits | 486 | | | 474 | | | 12 | | | — | | |

| Customer advances | 80 | | | 78 | | | 2 | | | — | | |

| Other assets – net | (95) | | | 94 | | | (110) | | | (79) | | 2 |

| Other liabilities – net | 439 | | | 216 | | | 118 | | | 105 | | 2 |

| Net cash provided by (used for) operating activities | 12,885 | | | 11,688 | | | 1,106 | | | 91 | | |

| Cash flow from investing activities: | | | | | | | | |

| Capital expenditures – excluding equipment leased to others | (1,597) | | | (1,624) | | | (22) | | | 49 | | 2 |

| Expenditures for equipment leased to others | (1,495) | | | (39) | | | (1,466) | | | 10 | | 2 |

| Proceeds from disposals of leased assets and property, plant and equipment | 781 | | | 55 | | | 781 | | | (55) | | 2 |

| Additions to finance receivables | (15,161) | | | — | | | (17,321) | | | 2,160 | | 3 |

| Collections of finance receivables | 14,034 | | | — | | | 15,634 | | | (1,600) | | 3 |

| Net intercompany purchased receivables | — | | | — | | | 1,080 | | | (1,080) | | 3 |

| Proceeds from sale of finance receivables | 63 | | | — | | | 63 | | | — | | |

| Net intercompany borrowings | — | | | — | | | 10 | | | (10) | | 4 |

| Investments and acquisitions (net of cash acquired) | (75) | | | (75) | | | — | | | — | | |

| Proceeds from sale of businesses and investments (net of cash sold) | (4) | | | (4) | | | — | | | — | | |

| Proceeds from maturities and sale of securities | 1,891 | | | 1,642 | | | 249 | | | — | | |

| Investments in securities | (4,405) | | | (3,982) | | | (423) | | | — | | |

| Other – net | 97 | | | 106 | | | (9) | | | — | | |

| Net cash provided by (used for) investing activities | (5,871) | | | (3,921) | | | (1,424) | | | (526) | | |

| Cash flow from financing activities: | | | | | | | | |

| Dividends paid | (2,563) | | | (2,563) | | | (425) | | | 425 | | 5 |

| | | | | | | | |

| Common stock issued, including treasury shares reissued | 12 | | | 12 | | | — | | | — | | |

| Common shares repurchased | (4,975) | | | (4,975) | | | — | | | — | | |

| Net intercompany borrowings | — | | | (10) | | | — | | | 10 | | 4 |

| Proceeds from debt issued > 90 days | 8,257 | | | — | | | 8,257 | | | — | | |

| Payments on debt > 90 days | (6,318) | | | (106) | | | (6,212) | | | — | | |