This release includes business updates and unaudited interim

financial results for the three ("Q3", "Q3 2024" or the "Quarter")

and nine months ("9M 2024") ended September 30, 2024 of Cool

Company Ltd. ("CoolCo" or the "Company") (NYSE:CLCO / CLCO.OL).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241120414649/en/

Q3 Highlights and Subsequent Events

- Generated total operating revenues of $82.4 million in Q3,

compared to $83.4 million for the second quarter of 2024 ("Q2" or

"Q2 2024"), due to three vessels undergoing scheduled drydocking

during the Quarter;

- Net income of $8.11 million in Q3, compared to $26.51 million

for Q2 with the decrease primarily related to a loss in our

mark-to-market interest rate swaps;

- Achieved average Time Charter Equivalent Earnings ("TCE")2 of

$81,600 per day for Q3, compared to $78,400 per day for Q2,

primarily due to contribution from one vessel that recently started

a higher rate charter;

- Adjusted EBITDA2 of $53.7 million for Q3, compared to $55.7

million for Q2;

- Took delivery of newbuild vessel, Kool Tiger, from shipyard in

October which was repositioned in the Atlantic Basin for spot

market employment on an interim basis until a long-term charter is

secured;

- Completed drydocks for two vessels during Q3 2024, taking

around 21 days and ahead of schedule. Subsequent to the Quarter, a

drydock for another vessel was completed, which included LNGe

upgrades;

- Obtained commercial bank approval for a refinancing of our $570

million bank facility into a reducing revolving credit facility,

which will provide approximately $120 million in additional

borrowing capacity, while lowering margin and extending maturity to

late 2029;

- Declared a quarterly dividend of $0.15 per share, payable to

shareholders of record on December 2, 2024;

- Subsequent to Quarter end, the Board approved a share

repurchase program of up to $40 million to be executed over a

24-month period.

Richard Tyrrell, CEO, commented:

“Our contracted fleet and efficient dry-docking enabled us to

reach the upper end of TCE guidance for the third quarter, despite

a soft market backdrop that is expected to impact us in the fourth

quarter. While we work to secure their long-term employment, the

newly delivered Kool Tiger and the available Kool Glacier are

currently subject to weaker rates in the short-term market.

However, by design, our backlog from our remaining 10 vessels and

one newbuild vessel, set for delivery in January, limits our

exposure.

This winter's market is expected to be impacted by unfavorable

short-term trading dynamics and the delivery of orderbook vessels

in the fourth quarter ahead of the new LNG supply they are intended

to serve. LNG prices for immediate delivery have remained high,

encouraging prompt delivery rather than the contango-driven

floating storage that is customary at the onset of winter.

Additionally, high prices in Europe have closed the East-West

arbitrage that would result in a greater number of cargoes shipping

to the distant East. While these trading dynamics could quickly

reverse, we nevertheless expect vessels delivered ahead of their

intended liquefaction projects to be absorbed in stages throughout

2025 as those projects and their associated LNG volumes come

online. If the current market has a silver lining, it is the

knocking out of the steam-turbine vessels from the fleet. These are

falling off charter at a rate of 20-30 per year (in addition to the

92 that have already reached this age), not being extended, and

exiting the active market in a way that cannot be easily

reversed.

Longer-term, LNG remains the transition fuel of choice with

well-established geopolitical credentials that are highly

supportive of future development. It is expected that the

moratorium on new LNG export projects in the US will soon be

relaxed, resulting in material additional shipping demand towards

the end of this decade.

CoolCo anticipates that current market conditions will provide

growth opportunities, which it intends to seize from a position of

strength. We are in the process of refinancing our $570 million

bank facility into a reducing revolving credit facility, further

increasing our liquidity by approximately $120 million while

lowering the margin and extending the maturity from early 2027 to

late 2029 (with options for two one-year extensions). After the

transaction closes, our nearest debt maturity will come due in 4.5

years.

In connection with our current drydocking cycle (with 3

dry-dockings either finishing or starting during the third

quarter), we have also reduced the quarterly dividend payment in

line with our variable dividend policy's parameters and expanded

this policy to include a share repurchase program as a capital

return alternative, approving a buyback program of up to $40

million over 24 months. By targeting repurchases of shares trading

well below our Net Asset Value, and our own assessment of the

inherent value and prospects of the business, we aim to capitalize

on the current market price of our shares and deliver enhanced

value to our shareholders.”

Financial Highlights

The table below sets forth certain key financial information for

Q3 2024, Q2 2024, Q3 2023, and for the nine months ended September

30, 2024 (“9M 2024”) and 2023 (“9M 2023”).

(in thousands of $, except average daily

TCE)

Q3 2024

Q2 2024

Q3 2023

9M 2024

9M 2023

Time and voyage charter revenues

77,745

76,401

84,523

232,856

257,761

Total operating revenues

82,434

83,372

92,901

253,931

281,864

Operating income

38,948

41,361

48,336

124,406

145,844

Net income 1

8,124

26,478

39,170

71,414

153,952

Adjusted EBITDA2

53,722

55,679

62,754

167,942

190,466

Average daily TCE2 (to the closest

$100)

81,600

78,400

82,400

79,000

82,400

LNG and LNG Shipping Market Review

The average Japan/Korea Marker gas price ("JKM") for the Quarter

was $13.10/MMBtu compared to $11.10/MMBtu for Q2 2024; with average

JKM for Q4 2024 at $13.31/MMBtu as of November 12, 2024. The

Quarter began with Dutch Title Transfer Facility gas price ("TTF")

at $10.40/MMBtu and quoted TFDE headline spot rates of $62,250 per

day. By Quarter-end, TTF prices had risen to $12.08/MMBtu, while

TFDE headline spot rates had fallen to $46,250 per day.

Subsequently, the TFDE headline spot rates have decreased further

to a quoted $18,750 per day as of November 12, 2024.

While robust LNG prices would typically support shipping rates

in many markets, the lack of associated price volatility has had

the opposite effect in this case. Near-term LNG prices in Europe

have been bolstered by pipeline gas supply outages, capacity

remaining in onshore storage, and security supply concerns related

to the remaining Russian gas flowing into Europe. This has led to

two main consequences: a lack of contango in the market, which

would otherwise limit LNG carrier availability by encouraging

charterers to store cargoes on ships at this time of year; and

fairly minimal redirection of destination flexible cargoes from the

Atlantic Basin to the more distant Pacific Basin.

Despite LNG pricing, capacity for the markets to take on

additional cargoes is variable, opening a potential need for

shipborne storage, especially in Asia. Following two unusually warm

winters, an onset of cold weather would also be anticipated to add

impetus to the shipping rates as charterers seek to achieve

associated delivery windows.

In addition to these challenging trading dynamics, newbuild

deliveries arriving ahead of the LNG supply for which they were

ordered are impacting rates. During Q3, 21 ships were delivered,

compared to 28 during the first half of 2024. This relative

increase in deliveries has not been matched by a corresponding rise

in LNG production, which has seen only a 1.2% year-on-year increase

as of September 30, 2024. Annual LNG production is forecast at 410

MTPA, with the run-rate increasing by 50 MTPA, or 12%, as numerous

projects are expected to come online during 2025, including the

following: Corpus Christi (4.2MTPA), Plaquemines LNG (13.3 MTPA),

LNG Canada (14 MTPA), Tortu FLNG (2.5MTPA), Energia Costa Azul (2.4

MTPA), North Field Expansion (7.8MTPA) , Eni Congo (2.4 MTPA), and

Nigeria LNG (4.2 MTPA).

As of September 30, 2024, there were 233 steam turbine-powered

vessels, of which 22 are currently idling, according to Clarksons

Research. These idled vessels, mostly built in the 2000s and

originally chartered on 20-year contracts as prevalent at the time,

are expected to be replaced by more modern tonnage as they

redeliver over the next few years. With today’s low prevailing

charter rates and customers increasingly disfavoring older, less

efficient tonnage, this trend is likely to accelerate, which we

expect will lead to nearly all steam turbine vessels being idled

and scrapped in the relative near term.

Operational Review

CoolCo's fleet maintained strong performance, achieving 98%

fleet utilization in Q3, the same level as Q2 2024. The minor

off-hire period was due to the repositioning of a vessel between

charters. Both the Kool Frost and the Kool Ice completed their

drydocks ahead of schedule in Q3, with average costs in line with

estimates at approximately $5 million per vessel. Additionally, the

Kool Husky entered drydock during September which was completed

along with upgrades for LNGe specifications ahead of schedule in

October. These LNGe upgrades included a high-capacity sub-cooler

retrofit, a passive air lubrication system, and various smaller

performance enhancements.

Business Development

Chartering activity in the third quarter was subdued and this

has extended beyond the end of the Quarter. Long-term charterers

have responded by pushing out their requirements in the expectation

that nearer-term cargos can be transported with vessels from the

spot market.

CoolCo has successfully chartered its one TFDE vessel available

in the fourth quarter on a spot voyage and anticipates continuing

with similar employment until the vessel enters drydock in early

February. This vessel will be upgraded with LNGe specifications and

is scheduled to be in the yard for approximately 50 days.

CoolCo’s other available vessel in the quarter is the newly

delivered Kool Tiger. She was delivered from the shipyard in

October and repositioned to the Atlantic Basin for spot market

employment on an interim basis, while pursuing a long-term

charter.

Financing and Liquidity

As of September 30, 2024, CoolCo had cash and cash equivalents

of $142.4 million and total short and long-term debt, net of

deferred finance charges, amounting to $1,063.7 million. Total

Contractual Debt2 stood at $1,169.2 million, which is comprised of

$456.7 million in respect of the $570 million bank facility

maturing in March 2027, $442.5 million in respect of the $520

million term loan facility maturing in May 2029, $155.2 million of

sale and leaseback financing in respect of the two vessels maturing

in the first quarter of 2025 (Kool Ice and Kool Kelvin) and $114.8

million in respect of the Newbuilds' pre-delivery financing.

Overall, the Company’s interest rate on its debt is currently

fixed or hedged for approximately 80% of the notional amount of net

debt, adjusting for existing cash on hand.

Subsequent to the end of the Quarter, the Company obtained

commercial bank approval for a refinancing of its existing $570

million bank facility into a reducing revolving credit facility.

The refinancing will provide approximately $120 million in

additional borrowing capacity, while lowering the margin and

extending the maturity to late 2029, including two one-year

extension options. With this refinancing, the Company’s first debt

maturity will come due in 4.5 years.

Corporate and Other Matters

As of September 30, 2024, CoolCo had 53,702,846 shares issued

and outstanding. Of these, 31,254,390 shares (58.2%) were owned by

EPS Ventures Ltd ("EPS") and 22,448,456 (41.8%) were owned by other

investors in the public markets.

In line with the Company’s variable dividend policy, the Board

has declared a Q3 dividend of $0.15 per common share. The record

date is December 2, 2024 and the dividend will be distributed to

DTC-registered shareholders on or around December 9, 2024, while

due to the implementation of the Central Securities Depositories

Regulation in Norway, the dividend will be distributed to Euronext

VPS-registered shareholders on or around December 13, 2024.

The Board has further approved a share repurchase program that

authorizes the Company to conduct buy-backs at times when the

Company’s common stock trades at a material discount to its Net

Asset Value (“NAV”).

Under the repurchase program, the Company may at its discretion,

repurchase outstanding common shares worth up to approximately $40

million over the next 24 months. Repurchases under the share

repurchase program may be made from time to time through open

market repurchases or through privately negotiated transactions

subject to market conditions, applicable legal requirements and

other relevant factors. Repurchases are expected to be conducted

through a combination of a non-discretionary plan and a

discretionary plan during open trading windows in accordance with

applicable securities laws.

The Company is not obligated under the share repurchase program

to acquire any particular amount of common shares. The manner,

timing, pricing and amount of any repurchases will depend on a

number of factors including market conditions, the Company’s

financial position and capital requirements, financial conditions,

competing uses of cash and other factors. The repurchase program

may be initiated, suspended or discontinued at the Company’s

discretion at any time and may not be completed in full.

Outlook

With the current charter market weakness being driven by a

combination of seasonal factors and a temporary oversupply of

vessels that are expected to be absorbed as their related

liquefaction projects come online throughout 2025, there remains a

material disconnect between conditions and sentiment in the spot

and short-term charter markets and those in the more stable,

long-term time charter market. Prevailing rates in the long-term

market remain within a narrower and materially higher range,

reflecting the fundamentals of the LNG shipping sector. While

charterers have less interest in near-term deliveries, rates for

later start dates remain strong.

In addition to the anticipated 2025 absorption of newbuilds

currently operating in the sub-let market, the supply-demand

balance of the sector is expected to be materially supported by

increasing pressure on legacy steam turbine vessels. Steam turbine

vessels, which represent approximately 30% of the global LNG

carrier fleet, are increasingly redelivering from long-term initial

charters and either idling or struggling to achieve a competitive

level of utilization. While this phenomenon is currently in its

early stages, such redeliveries are set to sharply ramp in the

near-term, at which point many or all of those older vessels would

be expected to leave the mainstream trading fleet, whether due to

scrapping, conversion into floating infrastructure, or redeployment

into niche regional trades.

In contrast to the volatility and uncertainties of the near-term

market, we believe longer-term sector prospects remain strongly

supported by the pipeline of new liquefaction projects that have

already reached Final Investment Decision (FID) and are set to

increase the total volume of LNG on the water by more than 50% in

the coming years. The sizable current newbuild orderbook consists

mainly of vessels secured on a long-term basis to transport these

new volumes, with a significant portion of that orderbook destined

for charterers who have traditionally been disinclined to maximize

vessel utilization through the out-charter/sub-let market. Coupled

with the expected departure of steam turbine ships from mainstream

trades, net fleet growth in the years ahead is expected to be well

matched and potentially outpaced by expected increased demand for

modern LNG carrier tonnage. With both an energy security focus and

winter market factors capable of absorbing even more tonnage beyond

underlying transportation demand, we anticipate that the multi-year

outlook remains highly favorable for independent owners of

high-quality modern vessels.

1 Net income includes a mark-to market

loss on interest rate swaps amounting to $12.5 million for Q3 2024,

compared to gain of $4.1 million for Q2 2024, of which $15.5

million was unrealized loss for Q3 2024 compared to $1.0 million

unrealized gain for Q2 2024 .

2 Refer to 'Appendix A' - Non-GAAP

financial measures and definitions, for definitions of these

measures and a reconciliation to the nearest GAAP measure.

Forward Looking Statements

This press release and any other written or oral statements made

by us in connection with this press release include forward-looking

statements within the meaning of and made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. All statements, other than statements of historical facts,

that address activities and events that will, should, could, are

expected to or may occur in the future are forward-looking

statements. You can identify these forward-looking statements by

words or phrases such as “believe,” “anticipate,” “intend,”

“estimate,” “forecast,” “outlook,” “project,” “plan,” “potential,”

“will,” “may,” “should,” “expect,” “could,” “would,” “predict,”

“propose,” “continue,” or the negative of these terms and similar

expressions. These forward-looking statements include statements

relating to our outlook, industry trends, expected results, plans

to upsize and/or refinance the existing facilities, expectations on

LNG prices, chartering and charter rates, chartering plan and

expectations, expected drydockings including the cost, timing and

duration thereof, and impact of performance enhancements on our

vessels, dividends and dividend policy, statements about our share

repurchase program, potential growth opportunities in light of

current market conditions, expected growth in LNG supply and the

impact of new LNG and liquefaction projects on LNG volume, expected

industry and business trends and prospects including expected

trends in LNG demand and market trends expectations of

steam-turbine vessels leaving the market, anticipated rates of net

fleet growth, LNG vessel supply and demand factors impacting supply

and demand of vessels, rates and expected trends in charter rates,

contracting, market outlook and LNG vessel newbuild order-book and

expectations that newbuilds will be absorbed in the market in 2025,

statements made under “LNG and LNG Shipping Market Review” and

“Outlook” and other non-historical matters.

The forward-looking statements in this document are based upon

management’s current expectations, estimates and projections. These

statements involve significant risks, uncertainties, contingencies

and factors that are difficult or impossible to predict and are

beyond our control, and that may cause our actual results,

performance or achievements to be materially different from those

expressed or implied by the forward-looking statements. Numerous

factors could cause our actual results, level of activity,

performance or achievements to differ materially from the results,

level of activity, performance or achievements expressed or implied

by these forward-looking statements including:

- general economic, political and business conditions, including

sanctions and other measures;

- general LNG market conditions, including fluctuations in

charter hire rates and vessel values;

- changes in demand in the LNG shipping industry, including the

market for our vessels;

- changes in the supply of LNG vessels, including whether older

steam vessels leave the market as expected;

- our ability to successfully employ our vessels;

- changes in our operating expenses, including fuel or cooling

down prices and lay-up costs when vessels are not on charter,

drydocking and insurance costs;

- compliance with, and our liabilities under, governmental, tax,

environmental and safety laws and regulations;

- risks related to climate change, including climate-change or

greenhouse gas related legislation or regulations and the impact on

our business from physical climate-change related to changes in

weather patterns, and the potential impact of new regulations

relating to climate change and the potential impact on the demand

for the LNG shipping industry;

- changes in governmental regulation, tax and trade matters and

actions taken by regulatory authorities;

- potential disruption of shipping routes and demand due to

accidents, piracy or political events and/or instability, including

the ongoing conflicts in the Middle East and changes in political

leadership in the US and other countries;

- vessel breakdowns and instances of loss of hire;

- vessel underperformance and related warranty claims;

- our ability to procure or have access to financing and

refinancing and to complete the upsize and/or refinancing of our

facilities;

- continued borrowing availability under our credit facilities

and compliance with the financial covenants therein;

- fluctuations in foreign currency exchange and interest

rates;

- potential conflicts of interest involving our significant

shareholders;

- our ability to pay dividends and repurchase shares;

- information system failures, cyber incidents or breaches in

security;

- amounts repurchased under share repurchase programs; and

- other risks indicated in the risk factors included in our

Annual Report on Form 20-F for the year ended December 31, 2023 and

other filings with and submission to the U.S. Securities and

Exchange Commission.

The foregoing factors that could cause our actual results to

differ materially from those contemplated in any forward-looking

statement included in this report should not be construed as

exhaustive. Moreover, we operate in a very competitive and rapidly

changing environment. New risks and uncertainties emerge from time

to time, and it is not possible for us to predict all risks and

uncertainties that could have an impact on the forward-looking

statements contained in this press release. The results, events and

circumstances reflected in the forward-looking statements may not

be achieved or occur, and actual results, events or circumstances

could differ materially from those described in the forward-looking

statements.

As a result, you are cautioned not to place undue reliance on

any forward-looking statements which speak only as of the date of

this press release. The Company undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise unless

required by law.

Responsibility Statement

We confirm that, to the best of our knowledge, the interim

unaudited condensed consolidated financial statements for the nine

months ended September 30, 2024, which have been prepared in

accordance with accounting principles generally accepted in the

United States (US GAAP) give a true and fair view of the Company’s

consolidated assets, liabilities, financial position and results of

operations. To the best of our knowledge, the financial report for

the nine months ended September 30, 2024 includes a fair review of

important events that have occurred during the period and their

impact on the interim unaudited condensed consolidated financial

statements, the principal risks and uncertainties, and major

related party transactions.

November 21, 2024 Cool Company Ltd. London, UK

Questions should be directed to: c/o Cool Company Ltd - +44 20

7659 1111

Richard Tyrrell (Chief Executive Officer

& Director)

Cyril Ducau (Chairman of the Board)

John Boots (Chief Financial Officer)

Antoine Bonnier (Director)

Joanna Huipei Zhou (Director)

Sami Iskander (Director)

Neil Glass (Director)

Peter Anker (Director)

Cool Company Ltd.

Unaudited Condensed Consolidated

Statements of Operations

For the three months

ended

For the nine months

ended

(in thousands of $)

Jul-Sep

2024

Apr-Jun

2024

Jul-Sep

2023

Jan-Sep

2024

Jan-Sep

2023

Time and voyage charter revenues

77,745

76,401

84,523

232,856

257,761

Vessel and other management fee

revenues

767

2,479

3,860

8,169

10,993

Amortization of intangible assets and

liabilities - charter agreements, net

3,922

4,492

4,518

12,906

13,110

Total operating revenues

82,434

83,372

92,901

253,931

281,864

Vessel operating expenses

(17,950

)

(17,037

)

(18,556

)

(52,581

)

(55,979

)

Voyage, charter hire and commission

expenses, net

(1,179

)

(900

)

(1,137

)

(3,518

)

(3,512

)

Administrative expenses

(5,661

)

(5,264

)

(5,936

)

(16,984

)

(18,797

)

Depreciation and amortization

(18,696

)

(18,810

)

(18,936

)

(56,442

)

(57,732

)

Total operating expenses

(43,486

)

(42,011

)

(44,565

)

(129,525

)

(136,020

)

Operating income

38,948

41,361

48,336

124,406

145,844

Other non-operating income

—

—

—

—

42,549

Financial income/(expense):

Interest income

1,186

1,357

2,176

4,248

6,484

Interest expense

(18,825

)

(19,180

)

(20,379

)

(57,683

)

(59,727

)

(Losses)/Gains on derivative

instruments

(12,485

)

4,065

9,689

2,881

20,393

Other financial items, net

(533

)

(972

)

(605

)

(1,985

)

(1,411

)

Financial expenses, net

(30,657

)

(14,730

)

(9,119

)

(52,539

)

(34,261

)

Income before income taxes and

non-controlling interests

8,291

26,631

39,217

71,867

154,132

Income taxes, net

(167

)

(153

)

(47

)

(453

)

(180

)

Net income

8,124

26,478

39,170

71,414

153,952

Net loss/(income) attributable to

non-controlling interests

25

(411

)

(340

)

(624

)

(1,283

)

Net income attributable to the Owners

of Cool Company Ltd.

8,149

26,067

38,830

70,790

152,669

Net (loss)/income attributable

to:

Owners of Cool Company Ltd.

8,149

26,067

38,830

70,790

152,669

Non-controlling interests

(25

)

411

340

624

1,283

Net income

8,124

26,478

39,170

71,414

153,952

Cool Company Ltd.

Unaudited Condensed Consolidated

Balance Sheets

At September 30,

At December 31,

(in thousands of $, except number of

shares)

2024

2023

(Audited)

ASSETS

Current assets

Cash and cash equivalents

142,439

133,496

Restricted cash and short-term

deposits

1,676

3,350

Intangible assets, net

—

825

Trade receivable and other current

assets

13,450

12,923

Inventories

909

3,659

Total current assets

158,474

154,253

Non-current assets

Restricted cash

476

492

Intangible assets, net

7,999

9,438

Newbuildings

209,206

181,904

Vessels and equipment, net

1,690,329

1,700,063

Other non-current assets

7,168

10,793

Total assets

2,073,652

2,056,943

LIABILITIES AND EQUITY

Current liabilities

Current portion of long-term debt and

short-term debt

245,427

194,413

Trade payable and other current

liabilities

118,501

98,917

Total current liabilities

363,928

293,330

Non-current liabilities

Long-term debt

818,291

866,671

Other non-current liabilities

77,853

90,362

Total liabilities

1,260,072

1,250,363

Equity

Owners' equity includes 53,702,846 (2023:

53,702,846) common shares of $1.00 each, issued and outstanding

742,366

735,990

Non-controlling interests

71,214

70,590

Total equity

813,580

806,580

Total liabilities and equity

2,073,652

2,056,943

Cool Company Ltd.

Unaudited Condensed Consolidated

Statements of Cash Flows

(in thousands of $)

Jan-Sep

2024

Jan-Sep

2023

Operating activities

Net income

71,414

153,952

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization expenses

56,442

57,732

Amortization of intangible assets and

liabilities arising from charter agreements, net

(12,906

)

(13,110

)

Amortization of deferred charges and fair

value adjustments

2,899

3,228

Gain on sale of vessel

—

(42,549

)

Drydocking expenditure

(14,636

)

(4,372

)

Compensation cost related to share-based

payment, net

1,640

1,792

Change in fair value of derivative

instruments

6,356

(13,043

)

Changes in assets and liabilities:

Trade accounts receivable

5,450

(4,294

)

Inventories

2,750

(2,961

)

Other current and other non-current

assets

(3,655

)

(4,098

)

Amounts due to related parties

(479

)

(1,270

)

Trade accounts payable

584

22,476

Accrued expenses

(7,545

)

(6,123

)

Other current and non-current

liabilities

6,096

1,935

Net cash provided by operating

activities

114,410

149,295

Investing activities

Additions to vessels and equipment

(15,085

)

(147,792

)

Additions to newbuildings

(23,391

)

—

Additions to intangible assets

(132

)

(997

)

Proceeds from sale of vessels &

equipment

—

184,300

Net cash (used in) / provided by

investing activities

(38,608

)

35,511

Financing activities

Proceeds from short-term and long-term

debt

74,848

70,000

Repayments of short-term and long-term

debt

(72,513

)

(164,296

)

Financing arrangement fees and other

costs

(4,830

)

(1,892

)

Cash dividends paid

(66,054

)

(65,499

)

Net cash used in financing

activities

(68,549

)

(161,687

)

Net increase in cash, cash equivalents

and restricted cash

7,253

23,119

Cash, cash equivalents and restricted

cash at beginning of period

137,338

133,077

Cash, cash equivalents and restricted

cash at end of period

144,591

156,196

Cool Company Ltd.

Unaudited Condensed Consolidated

Statements of Changes in Equity

For the nine months ended

September 30, 2024

(in thousands of $, except number of

shares)

Number of common

shares

Owners’ Share Capital

Additional Paid-in

Capital(1)

Retained Earnings

Owners' Equity

Non- controlling

Interests

Total Equity

Consolidated balance at December 31,

2023

53,702,846

53,703

509,327

172,960

735,990

70,590

806,580

Net income for the period

—

—

—

70,790

70,790

624

71,414

Share based payments contribution

—

—

1,773

—

1,773

—

1,773

Forfeitures of share based

compensation

—

—

(133

)

—

(133

)

—

(133

)

Dividends

—

—

—

(66,054

)

(66,054

)

—

(66,054

)

Consolidated balance at

September 30, 2024

53,702,846

53,703

510,967

177,696

742,366

71,214

813,580

(1) Additional paid-in capital refers to

the amount of capital contributed or paid-in over and above the par

value of the Company's issued share capital.

For the nine months ended

September 30, 2023

(in thousands of $, except number of

shares)

Number of common

shares

Owners’ Share Capital

Additional Paid-in

Capital(1)

Retained Earnings

Owners' Equity

Non- controlling

Interests

Total Equity

Consolidated balance at December 31,

2022

53,688,462

53,688

507,127

85,742

646,557

68,956

715,513

Net income for the period

—

—

—

152,669

152,669

1,283

153,952

Share based payments contribution

—

—

1,792

—

1,792

—

1,792

Dividends

—

—

—

(65,499

)

(65,499

)

—

(65,499

)

Consolidated balance at

September 30, 2023

53,688,462

53,688

508,919

172,912

735,519

70,239

805,758

(1) Additional paid-in capital refers to

the amount of capital contributed or paid-in over and above the par

value of the Company's issued share capital.

Appendix A - Non-GAAP Financial Measures and Definitions

Non-GAAP Financial Metrics Arising from How Management Monitors

the Business

In addition to disclosing financial results in accordance with

U.S. generally accepted accounting principles (US GAAP), this

earnings release and the associated investor presentation and

discussion contain references to the non-GAAP financial measures

which are included in the table below. We believe these non-GAAP

financial measures provide investors with useful supplemental

information about the financial performance of our business, enable

comparison of financial results between periods where certain items

may vary independent of business performance, and allow for greater

transparency with respect to key metrics used by management in

operating our business and measuring our performance. These

non-GAAP financial measures should not be considered a substitute

for, or superior to, financial measures calculated in accordance

with US GAAP, and the financial results calculated in accordance

with US GAAP. Non-GAAP measures are not uniformly defined by all

companies, and may not be comparable with similar titles, measures

and disclosures used by other companies. The reconciliations from

these results should be carefully evaluated.

Non-GAAP measure

Closest equivalent US GAAP

measure

Adjustments to reconcile to

primary financial statements prepared under US GAAP

Rationale for presentation of

the non-GAAP measure

Performance Measures

Adjusted EBITDA

Net income

+/- Other non-operating income

+/- Net financial expense, representing:

Interest income, Interest expense, (Gains)/Losses on derivative

instruments and Other financial items, net

+/- Income taxes, net

+ Depreciation and amortization

- Amortization of intangible assets and

liabilities - charter agreements, net

Increases the comparability of total

business performance from period to period and against the

performance of other companies by removing the impact of other

non-operating income, depreciation, amortization of intangible

assets and liabilities - charter agreements, net, financing and tax

items.

Average daily TCE

Time and voyage charter revenues

- Voyage, charter hire and commission

expenses, net

The above total is then divided by

calendar days less scheduled off-hire days.

Measure of the average daily net revenue

performance of a vessel.

Standard shipping industry performance

measure used primarily to compare period-to-period changes in the

vessel’s net revenue performance despite changes in the mix of

charter types (i.e. spot charters, time charters and bareboat

charters) under which the vessel may be employed between the

periods.

Assists management in making decisions

regarding the deployment and utilization of its fleet and in

evaluating financial performance.

Liquidity measures

Total Contractual Debt

Total debt (current and non-current), net

of deferred finance charges

+ VIE Consolidation and fair value

adjustments upon acquisition

+ Deferred Finance Charges

We consolidate two lessor VIEs for our

sale and leaseback facilities (for the vessels Ice and Kelvin).

This means that on consolidation, our contractual debt is

eliminated and replaced with the Lessor VIEs’ debt.

Contractual debt represents our actual

debt obligations under our various financing arrangements before

consolidating the Lessor VIEs.

The measure enables investors and users of

our financial statements to assess our liquidity and the split of

our debt (current and non-current) based on our underlying

contractual obligations.

Total Company Cash

CoolCo cash based on GAAP measures:

+ Cash and cash equivalents

+ Restricted cash and short-term deposits

(current and non-current)

- VIE restricted cash and short-term

deposits (current and non-current)

We consolidate two lessor VIEs for our

sale and leaseback facilities. This means that on consolidation, we

include restricted cash held by the lessor VIEs.

Total Company Cash represents our cash and

cash equivalents and restricted cash and short-term deposits

(current and non-current) before consolidating the lessor VIEs.

Management believes that this measure

enables investors and users of our financial statements to assess

our liquidity and aids comparability with our competitors.

Reconciliations -

Performance Measures

Adjusted EBITDA

For the three months

ended

(in thousands of $)

Jul-Sep

2024

Apr-Jun

2024

Jul-Sep

2023

Net income

8,124

26,478

39,170

Interest income

(1,186

)

(1,357

)

(2,176

)

Interest expense

18,825

19,180

20,379

Losses/(Gains) on derivative

instruments

12,485

(4,065

)

(9,689

)

Other financial items, net

533

972

605

Income taxes, net

167

153

47

Depreciation and amortization

18,696

18,810

18,936

Amortization of intangible assets and

liabilities - charter agreements, net

(3,922

)

(4,492

)

(4,518

)

Adjusted EBITDA

53,722

55,679

62,754

For the nine months

ended

(in thousands of $)

Jan-Sep

2024

Jan-Sep

2023

Net income

71,414

153,952

Other non-operating income

—

(42,549

)

Interest income

(4,248

)

(6,484

)

Interest expense

57,683

59,727

Gains on derivative instruments

(2,881

)

(20,393

)

Other financial items, net

1,985

1,411

Income taxes, net

453

180

Depreciation and amortization

56,442

57,732

Amortization of intangible assets and

liabilities - charter agreements, net

(12,906

)

(13,110

)

Adjusted EBITDA

167,942

190,466

Average daily TCE

For the three months

ended

(in thousands of $, except number of days

and average daily TCE)

Jul-Sep

2024

Apr-Jun

2024

Jul-Sep

2023

Time and voyage charter revenues

77,745

76,401

84,523

Voyage, charter hire and commission

expenses, net

(1,179

)

(900

)

(1,137

)

76,566

75,501

83,386

Calendar days less scheduled off-hire

days

938

963

1,012

Average daily TCE (to the closest

$100)

$ 81,600

$ 78,400

$ 82,400

For the nine months

ended

(in thousands of $, except number of days

and average daily TCE)

Jan-Sep

2024

Jan-Sep

2023

Time and voyage charter revenues

232,856

257,761

Voyage, charter hire and commission

expenses, net

(3,518

)

(3,512

)

229,338

254,249

Calendar days less scheduled off-hire

days

2,902

3,084

Average daily TCE (to the closest

$100)

$ 79,000

$ 82,400

Reconciliations -

Liquidity measures

Total Contractual Debt

(in thousands of $)

At September 30,

2024

At December 31,

2023

Total debt (current and non-current) net

of deferred finance charges

1,063,718

1,061,084

Add: VIE consolidation and fair value

adjustments

99,054

97,245

Add: Deferred finance charges

6,472

5,563

Total Contractual Debt

1,169,244

1,163,892

Total Company Cash

(in thousands of $)

At September 30,

2024

At December 31,

2023

Cash and cash equivalents

142,439

133,496

Restricted cash and short-term

deposits

2,152

3,842

Less: VIE restricted cash

(1,676

)

(3,350

)

Total Company Cash

142,915

133,988

Other definitions

Contracted Revenue Backlog

Contracted revenue backlog is defined as the contracted daily

charter rate for each vessel multiplied by the number of scheduled

hire days for the remaining contract term. Contracted revenue

backlog is not intended to represent Adjusted EBITDA or future

cashflows that will be generated from these contracts. This measure

should be seen as a supplement to and not a substitute for our US

GAAP measures of performance.

This information is subject to the disclosure requirements in

Regulation EU 596/2014 (MAR) article 19 number 3 and section 5-12

of the Norwegian Securities Trading Act.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241120414649/en/

c/o Cool Company Ltd - +44 20 7659 1111

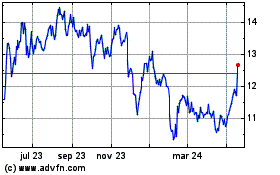

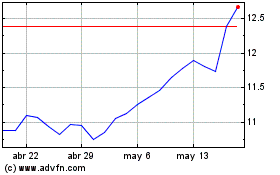

Cool (NYSE:CLCO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Cool (NYSE:CLCO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024