~ Easterly increases its 2024 full year Core

FFO per share guidance ~

Easterly Government Properties, Inc. (NYSE: DEA) (the “Company”

or “Easterly”), a fully integrated real estate investment trust

focused primarily on the acquisition, development and management of

Class A commercial properties leased to the U.S. Government and its

adjacent partners, announced today that it is acquiring a combined

77,260 square foot portfolio of two assets leased to the U.S.

Department of Homeland Security (DHS) and both located in Orlando,

Florida.

“HSI - Orlando” is a 27,840 square foot facility 100% leased to

Homeland Security Investigations (HSI), the principal investigation

arm within the DHS, with a 15-year lease that does not expire until

March 2036. HSI is the principal investigative arm within the DHS

and helps shield the nation from global threats to ensure Americans

are safe and secure. The agency maintains operations in 235 cities

nationwide and maintains an international presence that spans over

90 offices in more than 50 countries. HSI - Orlando also houses the

Central Florida Intelligence Exchange, which is an all crime and

all hazards fusion center, supporting nine counties with on-site

staffing from multiple federal, state, and local agencies. Easterly

acquired HSI - Orlando on May 7, 2024.

“ICE - Orlando” is a 49,420 square foot facility 100% leased to

the U.S. Immigration and Customs Enforcement (ICE). The

Orlando-based property features a 20-year lease that does not

expire until August 2040. As one of the country’s premier federal

law enforcement agencies, ICE is dedicated to detecting and

dismantling transnational criminal networks that target the

American people and threaten our industries, organizations, and

financial system. The critical operations housed in this facility

cover a significant portion of Central Florida. Easterly is

currently under contract to acquire ICE - Orlando and expects to

close on the property later this month, subject to customary

closing conditions.

In connection with the current and pending acquisition, the

Company is increasing its guidance for full-year 2024 Core FFO per

share on a fully diluted basis to a range of $1.15 - $1.17.

This guidance is forward-looking and reflects management’s view

of current and future market conditions. The Company’s actual

results may differ materially from this guidance.

Low

High

Net income (loss) per share – fully

diluted basis

$

0.22

0.24

Plus: Company’s share of real estate

depreciation and amortization

$

0.92

0.92

FFO per share – fully diluted basis

$

1.14

1.16

Plus: Company’s share of depreciation of

non-real estate assets

$

0.01

0.01

Core FFO per share – fully diluted

basis

$

1.15

1.17

This guidance assumes (i) the closing of VA - Jacksonville

through the Company’s joint venture (JV) at the Company’s pro rata

share of approximately $41 million, (ii) approximately $50 million

in wholly owned acquisitions throughout 2024, and (ii) $100 - $110

million of gross development-related investment during 2024.

“We are pleased to increase guidance in connection with these

strategic acquisitions and remain laser-focused on advancing our

external growth strategy,” said Darrell Crate, Easterly’s Chief

Executive Officer. “With the addition of these assets and our

ongoing emphasis on mission critical government real estate, we

believe Easterly is well positioned to deliver long term growth for

our shareholders.”

Pro forma for acquisitions completed subsequent to quarter end,

as well as the expected closing of ICE - Orlando, Easterly owns,

directly or through the Company’s joint venture, 93 properties

totaling 9.1 million square feet.

About Easterly Government Properties, Inc.

Easterly Government Properties, Inc. (NYSE: DEA) is based in

Washington, D.C., and focuses primarily on the acquisition,

development and management of Class A commercial properties that

are leased to the U.S. Government. Easterly’s experienced

management team brings specialized insight into the strategy and

needs of mission-critical U.S. Government agencies for properties

leased to such agencies either directly or through the U.S. General

Services Administration (GSA). For further information on the

company and its properties, please visit www.easterlyreit.com.

This press release contains forward-looking statements within

the meaning of federal securities laws and regulations. These

forward-looking statements are identified by their use of terms and

phrases such as “believe,” “expect,” “intend,” “project,”

“anticipate,” “position,” and other similar terms and phrases,

including references to assumptions and forecasts of future

results. Forward-looking statements are not guarantees of future

performance and involve known and unknown risks, uncertainties and

other factors which may cause the actual results to differ

materially from those anticipated at the time the forward-looking

statements are made. These risks include, but are not limited to

those risks and uncertainties associated with our business

described from time to time in our filings with the Securities and

Exchange Commission, including our Annual Report on Form 10-K filed

on February 27, 2024. Although we believe the expectations

reflected in such forward-looking statements are based upon

reasonable assumptions, we can give no assurance that the

expectations will be attained or that any deviation will not be

material. All information in this release is as of the date of this

release, and we undertake no obligation to update any

forward-looking statement to conform the statement to actual

results or changes in our expectations.

Non-GAAP Supplemental

Financial Measures

Definitions

Funds From Operations (FFO) is defined, in accordance

with the Nareit FFO White Paper - 2018 Restatement, as net income

(loss), calculated in accordance with GAAP, excluding depreciation

and amortization related to real estate, gains and losses from the

sale of certain real estate assets, gains and losses from change in

control and impairment write-downs of certain real estate assets

and investments in entities when the impairment is directly

attributable to decreases in the value of depreciable real estate

held by the entity. FFO includes the Company’s share of FFO

generated by unconsolidated affiliates. FFO is a widely recognized

measure of REIT performance. Although FFO is a non-GAAP financial

measure, the Company believes that information regarding FFO is

helpful to shareholders and potential investors.

Core Funds from Operations (Core FFO) adjusts FFO to

present an alternative measure of the Company's operating

performance, which, when applicable, excludes items which it

believes are not representative of ongoing operating results, such

as liability management related costs (including losses on

extinguishment of debt and modification costs), catastrophic event

charges, depreciation of non-real estate assets, and the

unconsolidated real estate venture's allocated share of these

adjustments. In future periods, the Company may also exclude other

items from Core FFO that it believes may help investors compare its

results. The Company believes Core FFO more accurately reflects the

ongoing operational and financial performance of the Company's core

business.

Fully diluted basis assumes the exchange of all

outstanding common units representing limited partnership interests

in the Company’s operating partnership, or common units, the full

vesting of all shares of restricted stock, and the exchange of all

earned and vested LTIP units in the Company’s operating partnership

for shares of common stock on a one-for-one basis, which is not the

same as the meaning of “fully diluted” under GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240508974470/en/

Easterly Government Properties, Inc. Lindsay S. Winterhalter

Senior Vice President, Investor Relations & Operations

202-596-3947 ir@easterlyreit.com

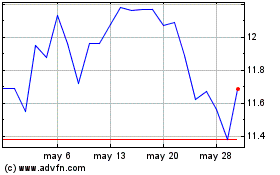

Easterly Government Prop... (NYSE:DEA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Easterly Government Prop... (NYSE:DEA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024