UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2024

Commission File Number 001-34175

| ECOPETROL S.A. |

|

(Exact name of registrant as specified in its charter)

|

| N.A. |

|

(Translation of registrant’s name into English)

|

| COLOMBIA |

|

(Jurisdiction of incorporation or organization)

|

| Carrera 13 No. 36 – 24 |

| BOGOTA D.C. – COLOMBIA |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Yes ¨ No x

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Ecopetrol S.A. |

|

| |

|

|

| |

By: |

/s/ Alfonso Camilo Barco |

|

| |

|

Name: |

Alfonso Camilo Barco |

|

| |

|

Title: |

Chief

Financial Officer |

|

Date: November 29,

2024

The Ecopetrol Group is expected to invest between

24 and 28 trillion pesos in 2025

Ecopetrol S.A. (BVC: ECOPETROL; NYSE: EC)

(the “Company”) announces that the Board of Directors approved the annual investment budget of the Ecopetrol Group for 2025

for an amount between 24 and 28 trillion pesos[1], in line with

the strategy, this annual budget increases investment levels compared to 2024, under capital discipline criteria and is expected to have

the following implications:

- Approximatey 20.3 trillion pesos are expected to

be allocated in 2025, corresponding to 76% of the annual budget, for profitable production between 740,000 and 745,000 barrels of oil

equivalent per day, an average refinery load between 415,000 and 420,000 barrels per day, and transportation between 1,130,000 and 1,170,000

barrels per day.

- At an estimated Brent price of US$73/barrel for

2025, the financial plan estimates competitive returns with an approximate EBITDA margin of 39%, transfers to the Nation of approximately

35 trillion pesos, and a commitment to generate greater efficiencies to improve its indicators, such as lifting cost, total refining cost,

and cost per barrel transported, allowing ROACE to remain at competitive levels.

- Approximately 6.5 trillion pesos (24% of the annual

budget) is expected to be directed to projects in the Energy Transition and Energy Transmission and Roads businesses and other corporate

investments.

- Approximately 2.3 trillion pesos in 2025 are expected

to be allocated to SosTECnibilidad® projects and activities, mainly in the areas of climate change, sustainable territory, innovation,

science and technology, biodiversity, and ecosystem services.

- This budget is expected to leverage the additional

reduction of about 300,000 tons of CO2 equivalent emissions by 2025, contributing to the achievement of the GE emissions reduction target

by 2030.

The following are some excerpts from the

annual investment budget approved by the Board of Directors, disaggregated by business line:

Hydrocarbons Line

For 2025, investments in the exploration

and production segment are expected to be approximately 17.2 trillion pesos (approximately 52% of the annual budget for crude oil-related

investments and around 12% for gas-related investments) and are expected to allow organic production levels in 2025 between 740,000

and 745,000 barrels of oil equivalent per day (78% crude, 17% gas, and 5% white products), seeking to implement recovery technologies

to optimize the use of available resources and maintain production levels. Crude oil production in Colombia is expected to continue growing

and compensating for the natural decline of gas fields.

[1]

Exchange rate USD/COP 4,100

In 2025, the Company has planned to drill

between 455 and 465 development wells, of which 79% would be executed in Colombia and the remaining 21% in the United States. In terms

of exploration, the Company has planned to drill 10 wells mainly in the Llanos area and Offshore Caribbean of Colombia. Gas investments

are estimated between 3.1 and 3.3 trillion pesos in 2025, mainly in the Piedemonte Llanero and Offshore, to develop Caribbean Colombia

gas, contributing to a production of approximately 123,000 barrels of oil equivalent per day (which represents about ~700 million cubic

feet of natural gas), of which 85% would represent gas supply for the country.

Investments in the transportation segment

are expected to reach approximately 1.5 trillion pesos, corresponding to 5% of the total budget for 2025, mainly in integrity and reliability

projects concerning the infrastructure developed by Cenit Transporte y Logística

de Hidrocarburos S.A.S., Oleoducto Central S.A., Oleoducto de Colombia S.A., and Oleoducto de los Llanos S.A. Transported volumes

are expected to reach between 1,130,000 and 1,170,000 barrels per day, in line with the country's production expectations and refined

product demand.

Investments in the refining segment are

expected to reach approximately 1.6 trillion pesos, corresponding to 6% of the total investment amount estimated for 2025, and are expected

to be focused on ensuring the reliability, availability, and sustainability of the operation of the Barrancabermeja and Cartagena refineries,

ensuring the development of programs that would reduce product imports, ensuring better quality fuels, and maturing renewable fuel (SAF)

projects. The joint load of the refineries is expected to be between 415,000 and 420,000 barrels per day.

Transmission and Roads Line

Interconexión Eléctrica S.A

E.S.P. (ISA), a subsidiary of Ecopetrol S.A., is expected to invest between 5.7 and 6.5 trillion pesos in 2025 (equivalent to approximately

21% of the annual budget of the Ecopetrol Group), of which approximately 90% is expected to be allocated to the electric transmission

business. The budgeted investment is expected to increase the electric power grid to achieve approximately 50,400 km in operation by 2025,

maintaining the Company as a leader in energy transmission in the region.

Energies for the Transition Line

To advance the energy transition in parallel

with the decarbonization of operations in the hydrocarbons business, the annual investment budget has also foreseen to allocate resources

to unconventional renewable energy and energy efficiency projects, among others.

An additional energy optimization of 2.6

Peta Joules (PJ) is expected to be achieved in 2025, reaching an accumulated energy saving of around 21 PJ by 2025, accelerating the achievement

of the 25 PJ optimization target by 2030. Additionally, the goal of 900 MW by 2025 is projected in line with the 2040 strategy "Energy

that Transforms."

In line with our goal of generating value

with SosTECnibilidad®, the investment budget has expected to allocate 2.3 trillion pesos in transition energies during 2025. Of this

amount, 29% is expected to be focused on climate change, 18% on sustainable territories, 12% on innovation, science and technology, 12%

on biodiversity and ecosystem services, and the remaining 29% on other material issues.

The financial plan for 2025 seeks to ensure

competitive returns in a scenario of Brent prices averaging US$73/barrel, generating an EBITDA margin at levels close to 39%. The plan

incorporates efficiency targets for 2025, exceeding 4 trillion pesos, aiming to capture savings in operational management and investment

projects, to achieve improvements in their lifting cost, total refining cost, and cost per barrel transported indicators.

Finally, the financial and investment plan

for 2025 assumes the collection of the account receivable from the Fuel Price Stabilization Fund (FEPC) corresponding to 2024. Considering

the above, the financing of the Plan for Ecopetrol S.A is expected to be carried out with operational resources and projects transfers

to the Nation (including dividends, payments to the ANH, and taxes) of approximately 35 trillion pesos.

Bogota D.C., November 29, 2024

-----------------------------------------

Ecopetrol is the largest

company in Colombia and one of the main integrated energy companies in the American continent, with more than 19,000 employees. In Colombia,

it is responsible for more than 60% of the hydrocarbon production of most transportation, logistics, and hydrocarbon refining systems,

and it holds leading positions in the petrochemicals and gas distribution segments. With the acquisition of 51.4% of ISA’s shares,

the company participates in energy transmission, the management of real-time systems (XM), and the Barranquilla - Cartagena coastal highway

concession. At the international level, Ecopetrol has a stake in strategic basins in the American continent, with Drilling and Exploration

operations in the United States (Permian basin and the Gulf of Mexico), Brazil, and, through ISA and its subsidiaries, Ecopetrol holds

leading positions in the power transmission business in Brazil, Chile, Peru, and Bolivia, road concessions in Chile, and the telecommunications

sector.

For more information, please contact:

Head of Capital Markets

Carolina Tovar Aragón

Email: investors@ecopetrol.com.co

Head of Corporate Communications

Marcela Ulloa

Email: marcela.ulloa@ecopetrol.com.co

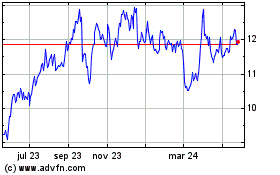

Ecopetrol (NYSE:EC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

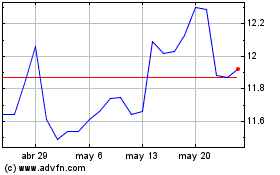

Ecopetrol (NYSE:EC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024