Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

13 Noviembre 2024 - 4:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2024

Commission File Number 001-34175

| ECOPETROL S.A. |

|

(Exact name of registrant as specified in its charter)

|

| N.A. |

|

(Translation of registrant’s name into English)

|

| COLOMBIA |

|

(Jurisdiction of incorporation or organization)

|

| Carrera 13 No. 36 – 24 |

| BOGOTA D.C. – COLOMBIA |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Yes ¨ No x

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Ecopetrol S.A. |

|

| |

|

|

| |

By: |

/s/ Alfonso Camilo Barco |

|

| |

|

Name: |

Alfonso Camilo Barco |

|

| |

|

Title: |

Chief

Financial Officer |

|

Date: November 13,

2024

|

For

the nine months of 2024 (9M24), the Ecopetrol Group has proved once again its ability to overcome challenges and turn them into opportunities

through determination and resilience. Despite a defiant global environment, marked by fluctuations in international oil prices and adjustments

in global supply and demand, the company has delivered an outstanding operational performance, achieving the third-highest results in

its history in terms of EBITDA and revenue.

During 9M24, Ecopetrol reported revenues of COP 98.5

trillion, an EBITDA of COP 42.3 trillion, net income of COP 11 trillion, and an EBITDA margin of 43%. By the end of 9M24, the Ecopetrol

Group has accomplished 86% the execution of its annual investment plan. We also successfully issued bonds in the international capital

markets for USD 1,750 million, to refinance the bonds maturing in 2026 and the prepayment of loans, with an oversubscription of ~2.6 times.

This ratifies the international market's confidence in our financial strength and proactive debt refinancing.

In the Hydrocarbons business line, during 9M24

we highlight our operational resilience in the traditional business, closing with a production of 752 kboed (+22.2), transported volumes

of 1,126 kbd (+21.1), refinery throughput of 418 kbd (+1.5) and a strengthening of the crude oil differential compared to the same period

in 2023.

I want to confirm the success of the discovery of the

Sirius-2 appraisal well as its continuity without affecting the schedule initially planned thanks to the favorable ruling of the Santa

Marta court. I would like to highlight the entry of the Orotoy station that will leverage the future reserves of the CPO-09 block, as

well as the successful test to produce 32 thousand barrels of co-processed jet SAF (Sustainable Aviation Fuel).

I would like to congratulate our different teams across

the company for their quick response to the electrical blackout presented at the Cartagena Refinery, achieving the normalization of the

electrical system 2 days later and guaranteeing the supply of fuels for the country at all the time.

|

|

These results are supported by an effective commercial

management that has allowed us to diversify markets, reaching new destinations and implementing new logistic strategies. In this sense,

we carried out i) the first sale of Oriente crude to Peru, ii) the first gasoline import from Europe

In the Energies for the Transition business

line, by 9M24, we had reached a cumulative energy optimization of 14.24 petajoules. The La Cira Infantas solar farm, which has an installed

capacity of 56 MW for self-consumption, this plant will provide up to 76.3 gigawatt hours annually, which is equivalent to the average

consumption of 40,500 Colombian homes. By the end of 2024, our renewable energy portfolio is expected to have more than 500 MW of total

capacity distributed across multiple projects under execution, construction, and operation, contributing to our emissions reduction goal.

Finally, in the Transmission and Toll Roads

business line, ISA CTEEP in Brazil has been awarded 44 transmission network reinforcements, of which 8 were awarded during the third quarter

of this year.

On the Governance front, we highlight the capacity

of our consolidated and appointed management team with extensive experience, where 65% of the directors come from the company's internal

talent.

I would like to thank all our employees for their contribution

and daily effort, which allow us to maintain the solid results presented at the end of the 9M24 in this report.

I would like to close by highlighting Ecopetrol’s

outstanding participation in the COP16, organizing and participating in 33 events in the Green and Blue zones. Three stands were set up

that highlighted the Ecopetrol Group commitment to biodiversity, attracting more than 3,000 visits. This event highlights Ecopetrol’s

commitment to environmental conservation and sustainability.

Ricardo Roa Barragán

President, Ecopetrol S.A.

|

Bogotá D.C., November 13, 2024,

Ecopetrol S.A. (BVC: ECOPETROL; NYSE: EC) announced today the Ecopetrol Group’s financial results for the third quarter, prepared

in accordance with International Financial Reporting Standards in Colombia.

In 3Q24, Ecopetrol S.A.

and its subsidiaries on a consolidated basis (the “Ecopetrol Group”, the “Group” or “Eopetrol”) reported

a net income of COP 3.6 trillion and an EBITDA of COP 14.0 trillion, with an EBITDA margin of 40%. These results were driven by strong

operational and commercial performance, achieving record sales volumes in a single quarter, robust results in Interconexión Eléctrica

S.A. (“ISA”), an improved crude spread, and a reduced tax rate. This was accomplished despite lower price levels, inflationary

pressures and major maintenance at the Cartagena Refinery, which ensured the production of quality fuels along with safe and efficient

operations.

Table 1: Financial Summary Income Statement –

Ecopetrol Group

| Billion (COP) |

|

3Q 2024 |

3Q 2023 |

∆ ($) |

∆ (%) |

|

9M 2024 |

9M 2023 |

∆ ($) |

∆ (%) |

| Total sales |

|

34,607 |

35,130 |

(523) |

(1.5%) |

|

98,536 |

108,284 |

(9,748) |

(9.0%) |

| Depreciation and amortization |

|

3,811 |

3,417 |

394 |

11.5% |

|

10,856 |

9,665 |

1,191 |

12.3% |

| Variable cost |

|

13,611 |

12,617 |

994 |

7.9% |

|

36,452 |

41,682 |

(5,230) |

(12.5%) |

| Fixed cost |

|

5,222 |

4,571 |

651 |

14.2% |

|

14,980 |

13,524 |

1,456 |

10.8% |

| Cost of sales |

|

22,644 |

20,605 |

2,039 |

9.9% |

|

62,288 |

64,871 |

(2,583) |

(4.0%) |

| Gross income |

|

11,963 |

14,525 |

(2,562) |

(17.6%) |

|

36,248 |

43,413 |

(7,165) |

(16.5%) |

| Operating and exploratory expenses |

|

2,657 |

2,709 |

(52) |

(1.9%) |

|

7,605 |

7,378 |

227 |

3.1% |

| Operating income |

|

9,306 |

11,816 |

(2,510) |

(21.2%) |

|

28,643 |

36,035 |

(7,392) |

(20.5%) |

| Financial income (loss), net |

|

(2,051) |

(630) |

(1,421) |

225.6% |

|

(6,143) |

(4,180) |

(1,963) |

47.0% |

| Share of profit of companies |

|

116 |

109 |

7 |

6.4% |

|

502 |

607 |

(105) |

(17.3%) |

| Income before income tax |

|

7,371 |

11,295 |

(3,924) |

(34.7%) |

|

23,002 |

32,462 |

(9,460) |

(29.1%) |

| Income tax |

|

(2,264) |

(5,307) |

3,043 |

(57.3%) |

|

(8,418) |

(14,236) |

5,818 |

(40.9%) |

| Net income consolidated |

|

5,107 |

5,988 |

(881) |

(14.7%) |

|

14,584 |

18,226 |

(3,642) |

(20.0%) |

| Non-controlling interest |

|

(1,458) |

(902) |

(556) |

61.6% |

|

(3,547) |

(3,392) |

(155) |

4.6% |

| Net income attributable to owners of Ecopetrol |

|

3,649 |

5,086 |

(1,437) |

(28.3%) |

|

11,037 |

14,834 |

(3,797) |

(25.6%) |

| |

|

|

|

|

|

|

|

|

| EBITDA |

|

13,976 |

16,038 |

(2,062) |

(12.9%) |

|

42,266 |

48,466 |

(6,200) |

(12.8%) |

| EBITDA Margin |

|

40.4% |

45.7% |

- |

(5.3%) |

|

42.9% |

44.8% |

- |

(1.9%) |

The financial information included in this

report has not yet been audited. It is expressed in trillions of Colombian pesos (COP), U.S. dollars (USD), thousands of barrels of oil

equivalent per day (kboed), or tons, as noted. Certain figures in this report have been rounded to the nearest decimal place for presentation

purposes.

Forward-looking statements: This release

contains statements that may be considered forward-looking statements concerning Ecopetrol's business, operating and financial results,

and prospects for growth. These are forward-looking statements, and as such, are based solely on management's expectations regarding Ecopetrol's

future and its ongoing access to capital to fund its business plan. Such forward-looking statements depend primarily on market conditions,

government regulations, competitive pressures, and the performance of the Colombian economy and industry, to mention a few. Therefore,

they are subject to change without notice.

3

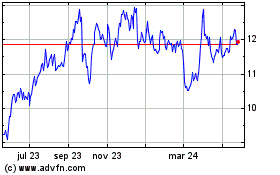

Ecopetrol (NYSE:EC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

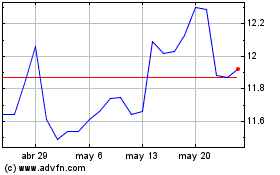

Ecopetrol (NYSE:EC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024