Form 8-K/A - Current report: [Amend]

23 Julio 2024 - 4:07PM

Edgar (US Regulatory)

0001001250trueAmendment No. 100010012502024-02-012024-02-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 8-K/A

Amendment No. 1

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 1, 2024

The Estée Lauder Companies Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | 1-14064 | 11-2408943 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | |

767 Fifth Avenue, New York, New York | | 10153 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code

212-572-4200

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $.01 par value | EL | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

| | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Item 2.05. Costs Associated with Exit or Disposal Activities.

On February 5, 2024, The Estée Lauder Companies Inc. (the “Company”) filed a Current Report on Form 8-K regarding a restructuring program associated with the previously announced Profit Recovery Plan, now named the Profit Recovery and Growth Plan (the “Restructuring Program”). The Restructuring Program is expected to include a number of initiatives, and the Company indicated that restructuring and other charges to implement those initiatives are expected to total between $500 million and $700 million (before tax). At that time, the Company was unable to make a determination of the estimated amount or range of amounts to be incurred by major cost type and future cash expenditures pursuant to the Restructuring Program.

The Company has since disclosed information about specific initiatives approved under the Restructuring Program, including in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024 filed on May 1, 2024, which provided information about specific initiatives approved cumulatively through April 24, 2024. The Company is filing this Form 8-K/A to provide details about specific initiatives approved since then.

Subsequent to April 24, 2024, the Company approved the following initiatives under the Restructuring Program to reorganize and right-size certain areas of the Company to drive future sales growth and productivity to rebuild gross and operating margin profitability:

•Value Chain Optimization – The Company approved initiatives to reduce spans and layers and right-size organizational capability within its supply chain. These actions will primarily result in employee severance through a net reduction in workforce, as well as costs to decommission and relocate activities, and asset write-offs.

•Enabling Function Re-Invention - The Company approved initiatives to reorganize and right-size its go-to market structure, including across various corporate functions. These activities will primarily result in employee severance through a net reduction in workforce.

•Future of Brand-led Model – The Company approved initiatives to focus on spans and layers to begin to develop a leaner, faster, and more agile marketing and creative organization. These activities will primarily result in employee severance through a net reduction in workforce.

•Go-to-Market Operating Model Acceleration – The Company approved initiatives to exit unprofitable brands from specific markets and distribution channels. These activities will result in inventory write-offs, employee severance through a net reduction in workforce, as well as costs associated with sales returns.

•The Company has also approved incremental costs to maintain a Project Management Office.

Once the relevant accounting criteria have been met, the Company expects to record restructuring and other charges of approximately $137 million (before tax) in connection with these initiatives, which other than the non-cash charges, are expected to result in future cash expenditures funded from cash provided by operations.

Of the $500 million to $700 million restructuring and other charges expected to be incurred in connection with the Restructuring Program, total cumulative charges approved by the Company through July 19, 2024 were:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sales

Returns

(included in

Net Sales) | | Cost of Sales | | Operating Expenses | | Total |

| (In millions) | | | | Restructuring

Charges | | Other

Charges | |

| Approval Period | | | | | | | | | | |

| Cumulative through April 24, 2024 | | $ | — | | | $ | — | | | $ | 24 | | | $ | 72 | | | $ | 96 | |

April 25, 2024 - June 30, 2024 | | — | | | — | | | 85 | | | 6 | | | 91 | |

| July 1, 2024 - July 19, 2024 | | 1 | | | 9 | | | 24 | | | 12 | | | 46 | |

Cumulative through July 19, 2024 | | $ | 1 | | | $ | 9 | | | $ | 133 | | | $ | 90 | | | $ | 233 | |

Included in the above table, cumulative restructuring initiatives approved by the Company through July 19, 2024 were:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | | Employee-

Related

Costs | | Asset-

Related

Costs | | Contract

Terminations | | Other Exit

Costs | | Total |

| Approval Period | | | | | | | | | | |

| Cumulative through April 24, 2024 | | $ | 15 | | | $ | 5 | | | $ | — | | | $ | 4 | | | $ | 24 | |

April 25, 2024 - June 30, 2024 | | 78 | | | 2 | | | — | | | 5 | | | 85 | |

| July 1, 2024 - July 19, 2024 | | 23 | | | — | | | — | | | 1 | | | 24 | |

Cumulative through July 19, 2024 | | $ | 116 | | | $ | 7 | | | $ | — | | | $ | 10 | | | $ | 133 | |

The Company will continue to file additional disclosures in connection with initiatives associated with the Restructuring Program that individually or collectively are determined to be significant. Such disclosures would be filed after the Company is able to make good faith determinations of the estimated amount or range of amounts by each major type of cost and future cash expenditures relating to such initiatives.

The forward-looking statements contained herein, including those relating to our expectations regarding restructuring and other charges, involve risks and uncertainties. Factors that could cause actual results to differ materially from those forward-looking statements include current economic and other conditions in the global marketplace, actions by retailers and consumers, competition, the Company’s ability to successfully implement its long-term strategic plan and those factors described in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | | | | |

| Exhibit No. | | Description | |

| | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | THE ESTÉE LAUDER COMPANIES INC. |

| | | |

| | | |

| Date: | July 23, 2024 | By: | /s/ Tracey T. Travis |

| | | Tracey T. Travis |

| | | Executive Vice President and Chief Financial Officer |

| | | (Principal Financial and Accounting Officer) |

v3.24.2

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

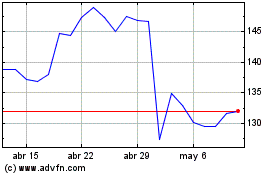

Estee Lauder Companies (NYSE:EL)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Estee Lauder Companies (NYSE:EL)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024