Ero Copper Corp. (TSX: ERO, NYSE: ERO) ("Ero" or the “Company”) is

pleased to announce an initial National Instrument 43-101 ("NI

43-101") compliant mineral resource estimate for the Furnas

Copper-Gold Project ("Furnas" or the "Project"), located in the

Carajás Mineral Province ("Carajás") in Pará State, Brazil.

The initial mineral resource estimate highlights

significant potential for the Project. At a 1.00% copper equivalent

("CuEq") cut-off grade, the mineral resource estimate, effective

June 30, 2024, totals:

-

Indicated Mineral Resource: 35.2 million tonnes

grading 1.04% copper and 0.69 grams per tonne ("gpt") gold (1.36%

CuEq1), containing an estimated 364,700 tonnes of copper and

775,300 ounces of gold

- Inferred

Mineral Resource: 61.3 million tonnes grading 1.06% copper

and 0.63 gpt gold (1.36% CuEq1), containing an estimated 647,400

tonnes of copper and 1,235,600 ounces of gold

This estimate is supported by more than 90,000

meters of historic drilling on the Project, conducted by Vale S.A.

and Anglo American plc, as well as a resampling and database

validation program undertaken by the Company.

"We are extremely pleased with this initial

mineral resource estimate for Furnas. It provides a solid

foundation upon which we can focus, over the coming months, on

unlocking further potential," said David Strang, Chief Executive

Officer. "Our Phase 1 drill program will target two key objectives:

improving the definition of high-grade zones through infill

drilling and extending known mineralization within these zones

beyond the historically drilled depth of approximately 300 vertical

meters from surface.

"Furnas presents a tremendous opportunity to

define a major copper-gold mineral resource capable of supporting a

large-scale underground mine. Our experience in underground mining

in Brazil, coupled with the successful construction of our new

Tucumã mine and processing plant in the Carajás, positions us well

to advance this Project.

"Together with our partners at Vale Base Metals,

we are committed to progressing Furnas in a manner that delivers

sustainable benefits for all stakeholders and reinforces Brazil's

position as a global leader in the responsible, low-carbon

production of critical minerals."

1. CuEq grade calculated as Cu grade + (Au grade x 0.03215 x

($1,900 gold price x 61.50% gold metallurgical recovery / (0.01 x

$9,259/tonne copper price x 85.00% copper metallurgical

recovery)).

MINERAL RESOURCE ESTIMATE AND CUT-OFF

GRADE SENSITIVITY

|

Cut-Off Grade |

|

|

|

|

|

Grade |

|

Contained Metal |

|

CuEq1 |

|

|

|

Tonnes |

|

Cu |

|

Au |

|

CuEq1 |

|

Cu |

|

Au |

|

CuEq |

|

(%) |

|

Category |

|

(Mt) |

|

(%) |

|

(gpt) |

|

(%) |

|

(kt) |

|

(koz) |

|

(kt) |

|

0.60 |

|

Indicated |

|

66.4 |

|

0.84 |

|

0.55 |

|

1.10 |

|

555.3 |

|

1,179.9 |

|

730.5 |

| |

Inferred |

|

114.8 |

|

0.85 |

|

0.51 |

|

1.10 |

|

978.9 |

|

1,877.3 |

|

1,257.6 |

|

0.80 |

|

Indicated |

|

51.2 |

|

0.93 |

|

0.60 |

|

1.22 |

|

477.9 |

|

984.5 |

|

624.1 |

| |

Inferred |

|

88.0 |

|

0.96 |

|

0.55 |

|

1.22 |

|

840.7 |

|

1,558.1 |

|

1,072.0 |

|

1.00 |

|

Indicated |

|

35.2 |

|

1.04 |

|

0.69 |

|

1.36 |

|

364.7 |

|

775.3 |

|

479.8 |

|

|

Inferred |

|

61.3 |

|

1.06 |

|

0.63 |

|

1.36 |

|

647.4 |

|

1,235.6 |

|

830.8 |

Note: The Canadian Institute of Mining,

Metallurgy and Petroleum ("CIM") Definition Standards (2014) were

used for reporting Mineral Resources, which are effective as at

June 30, 2024 and presented on a 100% ownership basis. All figures

have been rounded to reflect the relative accuracy of the

estimates. Summed amounts may not add due to rounding. Mineral

resources that are not mineral reserves do not have a demonstrated

economic viability. See "Notes on Mineral Resources" below for

additional technical and scientific information.1. CuEq grade

calculated as Cu grade + (Au grade x 0.03215 x ($1,900 gold price x

61.50% gold metallurgical recovery / (0.01 x $9,259/tonne copper

price x 85.00% copper metallurgical recovery)).

In September 2024, the Company received drilling

permits from the Pará State environmental agency, allowing for the

commencement of the Phase 1 drill program in October 2024. This

minimum 28,000-meter program will focus on two identified

high-grade zones – the NW and SE Zones – within the broader

deposit. The program is designed to support a preliminary economic

assessment on the Project. The drill plan comprises:

- Infill drilling

to upgrade inferred mineral resources and increase continuity of

the high- grade zones

- Extensional

drilling to depth, where limited prior drilling suggests increasing

grade and thickness

FURNAS COPPER-GOLD PROJECT DETAILS AND

EARN-IN AGREEMENT

Furnas is an iron oxide copper-gold deposit

located approximately 50 kilometers southeast of Vale Base Metal's

("VBM") Salobo operations and approximately 190 kilometers

northeast of Ero's Tucumã Operations. Covering an area of

approximately 2,400 hectares, the Project sits within fifteen

kilometers of extensive regional infrastructure, including paved

roads, an industrial-scale cement plant, a power substation and

Vale S.A.'s railroad loadout facility.

In July 2024, the Company signed a definitive

earn-in agreement ("Agreement") with Salobo Metais S.A, a

subsidiary of VBM, to earn a 60% interest in the Project upon

completion of several exploration, engineering and development

milestones over a five-year period. In exchange for its 60%

interest, Ero will solely fund a phased work program during the

earn-in period and grant VBM up to an 11.0% "free carry" on future

Project construction capital expenditures. For additional details

on the key terms and execution of the Agreement, please refer to

the Company's press releases dated October 30, 2023 and July 22,

2024.

NOTES ON MINERAL

RESOURCES

CIM Definition Standards (2014) were used for

reporting mineral resources, which are effective as at June 30,

2024 and presented on a 100% ownership basis. All figures have been

rounded to the relative accuracy of the estimates. Summed amounts

may not add due to rounding. Mineral resources that are not mineral

reserves do not have a demonstrated economic viability.

Mineral resource estimates are prepared by or

under the supervision of and verified by Mr. Cid Gonçalves Monteiro

Filho, SME RM (04317974), MAIG (No. 8444), FAusIMM (No. 329148).

Mr. Monteiro is Resource Manager of the Company and is a “qualified

person” within the meanings of NI 43-101.

Mineral resources have been estimated using a

copper price of US$9,259/tonne, a gold price of US$1,900/oz, a

USD:BRL foreign exchange rate of 5.10, and copper and gold

metallurgical recovery rates of 85.00% and 61.50%, respectively.

The estimation was constrained using Datamine's Mineable Shape

Optimizer ("MSO") at a 0.55% break-even copper cut-off grade.

Mineral resources were estimated using ordinary kriging within a

25-meter by 25-meter by 4- meter block size (X, Y, Z), with a

minimum sub-block size of 6.25 meters by 6.25 meters by2.0

meters.

QUALIFIED PERSONS AND THE NI 43-101

TECHNICAL REPORT

Mr. Cid Gonçalves Monteiro Filho, SME RM

(04317974), MAIG (No. 8444), FAusIMM (No. 329148) has reviewed,

verified and approved the scientific and technical information

contained in this press release, including the sampling, analytical

and test data underlying the information contained in this press

release. Mr. Monteiro is Resource Manager of the Company and is a

“qualified person” within the meanings of NI 43-101.

The Company will file the associated NI 43-101

compliant report on SEDAR+ (www.sedarplus.ca/landingpage/) and

EDGAR (www.sec.gov), and publish this report on the Company's

website (www.erocopper.com), within 45 days of this press

release.

QUALITY ASSURANCE & QUALITY

CONTROL

Four diamond exploration drilling campaigns were

previously carried out on Furnas, with control sample protocols

applied to each campaign. Historical QA/QC data was evaluated,

including duplicates, blanks and standard samples from the most

recent drilling campaign.

In all drilling campaigns, a quarter of the

recovered core sample was collected. In the first three exploration

campaigns, one-meter sampling intervals were predominately used. In

the fourth exploration campaign one-meter sampling intervals were

predominately used in the mineralized zone and two-meter sampling

intervals were used in the transition zone and in waste rock.

Physical preparation of the quarter-core samples

was performed in the following laboratories: Vale/Carajás,

Intertek-Parauapebas-PA, Intertek-Nova Lima-MG, SGS GEOSOL, or

Lakefield-Geosol. Chemical analysis was performed by ACME,

Lakefield-Geosol in Belo Horizonte/MG, and SGS Geosol Laboratories

in Vespasiano/MG. The selection of analytical methods and the

number of elements analyzed varied across exploration

campaigns.

To verify the accuracy of older sampling

campaigns, a post-mortem QA/QC program was performed on copper and

gold for select assay intervals. The post-mortem program undertaken

by the Company demonstrates good performance, particularly for

copper and gold, allowing for the inclusion of historical

exploration campaign data for the purposes of this press

release.

The Company reprocessed all historical QA/QC

data from the Project, according to the Company's internal

guidelines, and achieved exceptional results aligned with industry

standards. Error rates for pulp and coarse duplicates remained

significantly below the conventional limit of 10%, demonstrating

the effectiveness of historical data preparation and analytical

procedures. Global biases across all drilling phases and

laboratories stayed well within acceptable parameters, confirming

the analytical accuracy of the primary laboratories associated with

the historical database. Additionally, the absence of significant

contamination in all laboratories further validates the reliability

and integrity of the reprocessed data.

ABOUT ERO COPPER

CORP

Ero is a high-margin, high-growth, low

carbon-intensity copper producer with operations in Brazil and

corporate headquarters in Vancouver, B.C. The Company's primary

asset is a 99.6% interest in the Brazilian copper mining company,

Mineração Caraíba S.A. ("MCSA"), 100% owner of the Company's

Caraíba Operations (formerly known as the MCSA Mining Complex),

which are located in the Curaçá Valley, Bahia State, Brazil and

include the Pilar and Vermelhos underground mines and the Surubim

open pit mine, and the Tucumã Operation (formerly known as Boa

Esperança), an open pit copper mine located in Pará, Brazil. The

Company also owns 97.6% of NX Gold S.A. ("NX Gold") which owns the

Xavantina Operations (formerly known as the NX Gold Mine),

comprised of an operating gold and silver mine located in Mato

Grosso, Brazil. Additional information on the Company and its

operations, including technical reports on the Caraíba Operations,

Xavantina Operations and Tucumã Operation, can be found on SEDAR+

(www.sedarplus.ca/landingpage/) and on EDGAR (www.sec.gov). The

Company’s shares are publicly traded on the Toronto Stock Exchange

and the New York Stock Exchange under the symbol “ERO”.

FOR MORE INFORMATION, PLEASE

CONTACT

Courtney Lynn, SVP, Corporate Development, Investor Relations

& Sustainability (604) 335-7504info@erocopper.com

CAUTION REGARDING FORWARD LOOKING INFORMATION AND STATEMENTS

This press release contains “forward-looking

statements” within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and “forward-looking

information” within the meaning of applicable Canadian securities

legislation (collectively, “forward-looking statements”).

Forward-looking statements include statements that use

forward-looking terminology such as “may”, “could”, “would”,

“will”, “should”, “intend”, “target”, “plan”, “expect”, “budget”,

“estimate”, “forecast”, “schedule”, “anticipate”, “believe”,

“continue”, “potential”, “view” or the negative or grammatical

variation thereof or other variations thereof or comparable

terminology. Forward-looking statements may include, but are not

limited to, statements with respect to Ero's ability, in

partnership with VBM, to create value at and/or maximize the value

of the Project; Ero's ability to successfully design an economic

high-grade underground mine or other development and operating

scenario for Furnas; Ero's ability to commence and complete the

required 28,000 meters of drilling during the 18-month Phase 1 work

program; and any other statement that may predict, forecast,

indicate or imply future plans, intentions, levels of activity,

results, performance or achievements.

Forward-looking statements are not a guarantee

of future performance. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Forward-looking statements involve

statements about the future and are inherently uncertain, and the

Company’s actual results, achievements or other future events or

conditions may differ materially from those reflected in the

forward-looking statements due to a variety of risks, uncertainties

and other factors, including, without limitation, those referred to

herein and in the Company's most recent Annual Information Form

under the heading “Risk Factors”.

The Company’s forward-looking statements are

based on the assumptions, beliefs, expectations and opinions of

management on the date the statements are made, many of which may

be difficult to predict and beyond the Company’s control. In

connection with the forward-looking statements contained in this

press release and in the AIF, the Company has made certain

assumptions about, among other things: continued effectiveness of

the measures taken by the Company to mitigate the possible impact

of COVID-19 on its workforce and operations; favourable equity and

debt capital markets; the ability to raise any necessary additional

capital on reasonable terms to advance the production, development

and exploration of the Company’s properties and assets; future

prices of copper, gold and other metal prices; the timing and

results of exploration and drilling programs; the accuracy of any

mineral reserve and mineral resource estimates; the geology of the

Caraíba Operations, the Xavantina Operations and the Tucumã Project

being as described in the respective technical report for each

property; production costs; the accuracy of budgeted exploration,

development and construction costs and expenditures; the price of

other commodities such as fuel; future currency exchange rates and

interest rates; operating conditions being favourable such that the

Company is able to operate in a safe, efficient and effective

manner; work force continuing to remain healthy in the face of

prevailing epidemics, pandemics or other health risks (including

COVID-19), political and regulatory stability; the receipt of

governmental, regulatory and third party approvals, licenses and

permits on favourable terms; obtaining required renewals for

existing approvals, licenses and permits on favourable terms;

requirements under applicable laws; sustained labour stability;

stability in financial and capital goods markets; availability of

equipment; positive relations with local groups and the Company’s

ability to meet its obligations under its agreements with such

groups; and satisfying the terms and conditions of the Company’s

current loan arrangements. Although the Company believes that the

assumptions inherent in forward-looking statements are reasonable

as of the date of this press release, these assumptions are subject

to significant business, social, economic, political, regulatory,

competitive and other risks and uncertainties, contingencies and

other factors that could cause actual actions, events, conditions,

results, performance or achievements to be materially different

from those projected in the forward-looking statements. The Company

cautions that the foregoing list of assumptions is not exhaustive.

Other events or circumstances could cause actual results to differ

materially from those estimated or projected and expressed in, or

implied by, the forward-looking statements contained in this press

release. There can be no assurance that forward-looking statements

will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on

forward-looking statements.

Forward-looking statements contained herein are

made as of the date of this press release and the Company disclaims

any obligation to update or revise any forward-looking statement,

whether as a result of new information, future events or results or

otherwise, except as and to the extent required by applicable

securities laws.

CAUTIONARY NOTES REGARDING MINERAL RESOURCE AND

MINERAL RESERVE ESTIMATES

Unless otherwise indicated, all reserve and

resource estimates included in this press release and the documents

incorporated by reference herein have been prepared in accordance

with National Instrument 43-101, Standards of Disclosure for

Mineral Projects (“NI 43-101") and the Canadian Institute of

Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition

Standards on Mineral Resources and Mineral Reserves, adopted by the

CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule

developed by the Canadian Securities Administrators that

establishes standards for all public disclosure an issuer makes of

scientific and technical information concerning mineral projects.

Canadian standards, including NI 43-101, differ significantly from

the requirements of the United States Securities and Exchange

Commission (the “SEC”), and reserve and resource information

included herein may not be comparable to similar information

disclosed by U.S. companies. In particular, and without limiting

the generality of the foregoing, this press release and the

documents incorporated by reference herein use the terms “measured

resources,” “indicated resources” and “inferred resources” as

defined in accordance with NI 43-101 and the CIM Standards.

Further to recent amendments, mineral property

disclosure requirements in the United States (the “U.S. Rules”) are

governed by subpart 1300 of Regulation S-K of the U.S. Securities

Act of 1933, as amended (the “U.S. Securities Act”) which differ

from the CIM Standards. As a foreign private issuer that is

eligible to file reports with the SEC pursuant to the

multi-jurisdictional disclosure system (the “MJDS”), Ero is not

required to provide disclosure on its mineral properties under the

U.S. Rules and will continue to provide disclosure under NI 43-101

and the CIM Standards. If Ero ceases to be a foreign private issuer

or loses its eligibility to file its annual report on Form 40-F

pursuant to the MJDS, then Ero will be subject to the U.S. Rules,

which differ from the requirements of NI 43-101 and the CIM

Standards.

Pursuant to the new U.S. Rules, the SEC

recognizes estimates of “measured mineral resources”, “indicated

mineral resources” and “inferred mineral resources.” In addition,

the definitions of “proven mineral reserves” and “probable mineral

reserves” under the U.S. Rules are now “substantially similar” to

the corresponding standards under NI 43-101. Mineralization

described using these terms has a greater amount of uncertainty as

to its existence and feasibility than mineralization that has been

characterized as reserves. Accordingly, U.S. investors are

cautioned not to assume that any measured mineral resources,

indicated mineral resources, or inferred mineral resources that Ero

reports are or will be economically or legally mineable. Further,

“inferred mineral resources” have a greater amount of uncertainty

as to their existence and as to whether they can be mined legally

or economically. Under Canadian securities laws, estimates of

“inferred mineral resources” may not form the basis of feasibility

or pre-feasibility studies, except in rare cases. While the above

terms under the U.S. Rules are “substantially similar” to the

standards under NI 43-101 and CIM Standards, there are differences

in the definitions under the U.S. Rules and CIM Standards.

Accordingly, there is no assurance any mineral reserves or mineral

resources that Ero may report as “proven mineral reserves”,

“probable mineral reserves”, “measured mineral resources”,

“indicated mineral resources” and “inferred mineral resources”

under NI 43-101 would be the same had Ero prepared the reserve or

resource estimates under the standards adopted under the U.S.

Rules.

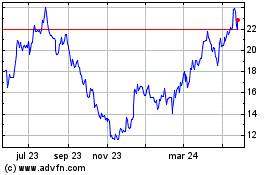

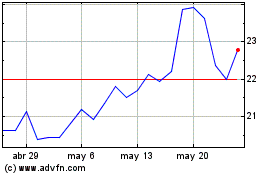

Ero Copper (NYSE:ERO)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Ero Copper (NYSE:ERO)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024