As filed with the Securities and Exchange Commission on June 30, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ENTRAVISION COMMUNICATIONS CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

|

95-4783236 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

2425 Olympic Boulevard

Suite 6000 West

Santa Monica, California 90404

(310) 447-3870

(Address of Principal Executive Offices)

Entravision Communications Corporation 2023 Inducement Plan

(Full Title of the Plan)

Mark Boelke

General Counsel and Secretary

Entravision Communications Corporation

2425 Olympic Boulevard, Suite 6000 West

Santa Monica, California 90404

(310) 447-3870

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

W. Stuart Ogg Cisco Palao-Ricketts |

Goodwin Procter LLP |

601 Marshall Street |

Redwood City, CA 94063 |

(650) 752-3100 |

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☒ |

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Part I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information.

The documents containing the information specified in this Item 1 will be sent or given to participants as specified by Rule 428(b)(1) under the Securities Act of 1933, as amended (the “Securities Act”). In accordance with the rules and regulations of the U.S. Securities and Exchange Commission (the “Commission”) and the instructions to Form S-8, such documents are not being filed with the Commission either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act. These documents and the documents incorporated by reference in the Registration Statement pursuant to Item 3 of Part II of this form, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

Item 2. Registrant Information and Employee Plan Annual Information.

The documents containing the information specified in this Item 2 will be sent or given to participants as specified by Rule 428(b)(1) under the Securities Act. In accordance with the rules and regulations of the Commission and the instructions to Form S-8, such documents are not being filed with the Commission either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act.

Part II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

Entravision Communications Corporation (the “Registrant”) hereby incorporates by reference into this Registration Statement the following documents filed with the Commission:

(a) The Registrant’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the Commission on March 16, 2023, as amended by Amendment No. 1 filed with the Commission on May 1, 2023 (File No. 001-15997);

(b) The Registrant’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, filed with the Commission on May 5, 2023;

(c) The Registrant’s Current Reports on Form 8-K filed with the Commission on January 3, 2023, January 6, 2023, March 3, 2023, March 20, 2023, April 7, 2023, April 26, 2023, May 5, 2023, May 17, 2023, June 12, 2023, June 20, 2023, and June 30, 2023; and

(d) The description of the Registrant's Class A Common Stock, $0.0001 par value per share (“Class A Common Stock”) contained in the Registrant's Registration Statement on Form 8-A filed on July 20, 2000 (File No. 001-15997) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including any amendments or reports (including any exhibit thereto) filed for the purpose of updating such description, including Exhibit 4.1 to the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

All documents that the Registrant subsequently files pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act prior to the filing of a post-effective amendment to this Registration Statement which indicates that all of the shares of Class A Common Stock offered have been sold or which deregisters all of such shares then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of the filing of such documents.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Under no circumstances will any information “furnished” to the Commission, including without limitation, under current items 2.02 or 7.01 of Form 8-K, be deemed incorporated herein by reference unless such Form 8-K or other report expressly provides to the contrary.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Under the provisions of Section 145 of the Delaware General Corporation Law, the Registrant is required to indemnify any present or former officer or director against expenses arising out of legal proceedings in which the director or officer becomes involved by reason of being a director or officer if the director or officer is successful in the defense of such proceedings. Section 145 also provides that the Registrant may indemnify a director or officer in connection with a proceeding in which he is not successful in defending if it is determined that he acted in good faith and in a manner reasonably believed to be in or not opposed to the best interests of the Registrant or, in the case of a criminal action, if it is determined that he had no reasonable cause to believe his conduct was unlawful. Liabilities for which a director or officer may be indemnified include amounts paid in satisfaction of settlements, judgments, fines and other expenses (including attorneys’ fees incurred in connection with such proceedings). In a stockholder derivative action, no indemnification may be paid in respect of any claim, issue or matter as to which the director or officer has been adjudged to be liable to the Registrant (except for expenses allowed by a court).

In accordance with the Delaware General Corporation Law, the Registrant’s Third Amended and Restated Certificate of Incorporation (the “Charter”) contains a provision to limit the personal liability of the directors of the Registrant for violations of their fiduciary duty. This provision eliminates each director’s liability to the Registrant or its stockholders, for monetary damages except (i) for breach of the director’s duty of loyalty to the Registrant or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the Delaware General Corporation Law providing for liability of directors for unlawful payment of dividends or unlawful stock purchases or redemptions or (iv) for any transaction from which a director derived an improper personal benefit. The effect of this provision is to eliminate the personal liability of directors for monetary damages for actions involving a breach of their fiduciary duty of care, including any such actions involving gross negligence. Any amendment to, or repeal of, these provisions will not eliminate or reduce the effect of these provisions in respect of any act, omission or claim that occurred or arose prior to that amendment or repeal. If the Delaware General Corporation Law is amended to provide for further limitations on the personal liability of directors of corporations, then the personal liability of the Registrant’s directors will be further limited to the fullest extent permitted by the Delaware General Corporation Law.

The Registrant’s Charter also provides mandatory indemnification for the benefit of our directors and officers and discretionary indemnification for the benefit of our employees and agents, in each instance to the fullest extent permitted by Delaware law. In addition, the Registrant has entered into individual indemnification agreements with each of its directors and officers providing additional indemnification benefits. The indemnification provisions in the Charter, the Registrant’s Bylaws, and the indemnification agreements entered into or to be entered into between the Registrant and each of its directors and executive officers may be sufficiently broad to permit indemnification of the Registrant’s directors and executive officers for liabilities arising under the Securities Act. The Registrant also maintains insurance policies that provide coverage to its directors and officers against certain liabilities.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the Registrant pursuant to the foregoing provisions, the Registrant has been informed that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

EXHIBIT INDEX

Item 9. Undertakings.

(a) The Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement.

Provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) herein do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act (15 U.S.C. 78m or 78o(d)) that are incorporated by reference in the Registration Statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new Registration Statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be a new Registration Statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Santa Monica, California, on June 30, 2023.

|

|

|

|

Entravision Communications Corporation |

|

|

|

|

By: |

/s/ Christopher T. Young |

|

Name: |

Christopher T. Young |

|

Title: |

Interim Chief Executive Officer, Chief Financial Officer and Treasurer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Christopher T. Young and Mark A. Boelke, and each of them, as his or her true and lawful attorneys-in-fact and agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments to this Registration Statement on Form S-8, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the United States Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or their or his substitutes or substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

Name |

|

Position |

|

Date |

|

|

|

|

|

/s/ Christopher T. Young |

|

Interim Chief Executive Officer, Chief Financial Officer and Treasurer |

|

June 30, 2023 |

Christopher T. Young |

|

(Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer) |

|

|

|

|

|

|

|

/s/ Paul A. Zevnik |

|

Director and Chair |

|

June 30, 2023 |

Paul A. Zevnik |

|

|

|

|

|

|

|

|

|

/s/ Brad Bender |

|

Director |

|

June 30, 2023 |

Brad Bender |

|

|

|

|

|

|

|

|

|

/s/ Martha Elena Diaz |

|

Director |

|

June 30, 2023 |

Martha Elena Diaz |

|

|

|

|

|

|

|

|

|

/s/ Thomas Strickler |

|

Director |

|

June 30, 2023 |

Thomas Strickler |

|

|

|

|

|

|

|

|

|

/s/ Gilbert R. Vasquez |

|

Director |

|

June 30, 2023 |

Gilbert R. Vasquez |

|

|

|

|

|

|

|

|

|

/s/ Juan Saldivar von Wuthenau |

|

Director |

|

June 30, 2023 |

Juan Saldivar von Wuthenau |

|

|

|

|

|

|

|

|

|

/s/ Fehmi Zeko |

|

Director |

|

June 30, 2023 |

Fehmi Zeko |

|

|

|

|

Exhibit 4.1

THIRD AMENDED AND RESTATED CERTIFICATE OF

INCORPORATION

OF

ENTRAVISION COMMUNICATIONS CORPORATION

Entravision Communications Corporation, a corporation organized and existing under and by virtue of the provisions of the Delaware General Corporation Law, does hereby certify:

FIRST: That the name of the corporation is Entravision Communications Corporation and that the corporation was originally incorporated on February 11, 2000 under the name “Entravision Communications Corporation.”

SECOND: That the Board of Directors duly adopted resolutions proposing to amend and restate the Second Restated Certificate of Incorporation of the corporation filed with the Delaware Secretary of State on May 18, 2023, declaring said amendment and restatement to be advisable and in the best interests of the corporation, which resolution setting forth the proposed amendment and restatement is as follows:

RESOLVED, that the Second Restated Certificate of Incorporation of the corporation be amended and restated in its entirety as follows:

ARTICLE 1.

The name of the corporation is Entravision Communications Corporation.

ARTICLE 2.

The address of the registered office of the corporation in the State of Delaware is Corporation Service Company, 251 Little Falls Drive, City of Wilmington 19808, County of New Castle. The name of its registered agent at such address is Corporation Service Company.

ARTICLE 3.

The nature of the business or purposes to be conducted or promoted is to engage in any lawful act or activity for which corporations may be organized under the Delaware General Corporation Law.

ARTICLE 4.

4.1. Classes of Stock. The total number of shares of capital stock the corporation is authorized to issue is 350,000,000. The Corporation is authorized to issue three classes of stock to be designated, respectively, “Class A Common Stock,” “Class U Common Stock,” and “Preferred Stock.” The Corporation is authorized to issue 260,000,000 shares of Class A Common Stock, par value $0.0001 per share, 40,000,000 shares of Class U Common Stock, par value $0.0001 per share, and 50,000,000 shares of Preferred Stock, par value $0.0001 per share.

4.2. Certain Definitions. As used in this Third Amended and Restated Certificate of Incorporation, the following terms have the meanings indicated:

“Affiliate” means any person or entity directly or indirectly controlling or controlled by or under direct or indirect common control with another Person (as defined below).

“Board” means the Board of Directors of the corporation.

ACTIVE/122219207.8

“Communications Act” means the Communications Act of 1934, and the rules, regulations, decisions and written policies of the Federal Communications Commission (the “FCC”) thereunder (as the same may be amended from time to time).

“Permitted Transferee” means: (i) any entity all of the equity (other than directors’ qualifying shares) of which is directly or indirectly owned by the transferor that is not an Affiliate of any other Person; and (ii) in the case of a transferor who is an individual, (a) such transferor’s spouse, lineal descendants, adopted children and minor children supported by such transferor, (b) any trustee of any trust created primarily for the benefit of any) or some of or all of such spouse or lineal descendants (but which may include beneficiaries that are charities) or any revocable trust created by such transferor, (c) the transferor, in the case of a transfer from any “Permitted Transferee” back to its transferor and (d) any entity all of the equity of which is directly or indirectly owned by any of the foregoing which is not an Affiliate of any Person other than the Persons described in clauses (a) through (c) above.

“Person” means any individual, a corporation, a partnership, an association, a limited liability company or a trust.

“Transfer” means any direct or indirect sale, pledge, hypothecation, voluntary or involuntary, and whether by merger or other operation of law other than a bona fide pledge of shares to secure financing; provided that a foreclosure on such pledged shares shall constitute a Transfer.

“Univision” means Univision Communications Inc.

4.3. Class A Common Stock. Except as otherwise provided by law or by this Third Amended and Restated Certificate of Incorporation, each of the shares of Class A Common Stock shall be identical in all respects, including with respect to dividends and upon liquidation.

(a) Dividends. Subject to the rights of the holders of any outstanding series of Preferred Stock, the holders of shares of Class A Common Stock shall be entitled to receive dividends to the extent permitted by law when, as and if declared by the Board.

(b) Voting Rights.

(i) The holders of the Class A Common Stock shall have one (1) vote for each share held.

(ii) Members of the Board shall be elected as set forth in Section 4.6 below.

4.4 Class U Common Stock.

(a) Liquidation, Dividends and Distributions. Except as otherwise provided by law or by this Third Amended and Restated Certificate of Incorporation, each of the shares of Class U Common Stock shall be treated in an identical manner in all respects, including with respect to dividends and treatment upon liquidation, to shares of Class A Common Stock.

(b) Stock Dividends; Stock Splits.

(i) A dividend of Class A or Class U Common Stock on any share of such common stock shall be declared and paid only in an equal per share amount on the then outstanding shares of each class of such common stock and only in shares of the same class of such common stock as the shares on which the dividend is being declared and paid. For example, if and when a dividend of Class A Common Stock is declared and paid to the then outstanding shares of common stock: (i) the dividend of Class A Common Stock shall be paid solely to the outstanding shares of Class A Common Stock; and (ii) a dividend of Class U Common Stock shall similarly be declared and paid in an equal per share amount solely to the then outstanding shares of Class U Common Stock.

(ii) If the corporation shall in any manner subdivide or combine, or make a rights offering with respect to, the outstanding shares of Class A Common Stock, the outstanding shares of Class U Common Stock shall be

proportionally subdivided or combined, or a rights offering shall be made, in the same manner and on the same basis as the outstanding shares of Class A Common Stock that have been subdivided or combined or made subject to a rights offering. If the corporation shall in any manner subdivide or combine, or make a rights offering with respect to, the outstanding shares of Class U Common Stock, the outstanding shares of Class A Common Stock shall be proportionally subdivided or combined, or a rights offering shall be made, in the same manner and on the same basis as the outstanding shares of Class U Common Stock that have been subdivided or combined or made subject to a rights offering.

(c) Voting. Except as provided in this Third Amended and Restated Certificate of Incorporation, the holders of shares of Class U Common Stock will have no right to vote on any matters, questions or proceedings of the corporation including, without limitation, the election of directors.

(d) Protective Provisions. So long as Univision, or any Permitted Transferee of Univision, owns at least 6,595,000 shares of Class U Common Stock (which number shall be increased to give effect to stock dividends and stock splits and shall be decreased to give effect to reverse stock splits and repurchases by the corporation of the Class U Common Stock approved by the Board in accordance with the bylaws and in accordance with this Third Amended and Restated Certificate of Incorporation), without the consent of the holders of at least a majority of the shares of Class U Common Stock then outstanding, in their sole discretion, voting as a separate class, given in writing or by vote at a meeting of such called for such purpose, the corporation will not:

(i) merge, consolidate or enter into a business combination, or otherwise reorganize the corporation with or into one or more entities (other than a merger of a wholly-owned subsidiary of the corporation into another wholly-owned subsidiary of the corporation);

(ii) dissolve, liquidate or terminate the corporation;

(iii) directly or indirectly dispose of any interest in any FCC license with respect to television stations which are affiliates of Univision;

(iv) amend, alter or repeal any provision of the certificate of incorporation or bylaws of the corporation, each as amended, so as to adversely affect any of the rights, privileges, limitations or restrictions provided for the benefit of the holders of the Class U Common Stock; or

(v) issue or sell, or obligate itself to issue or sell, any additional shares of Class U Common Stock, or any securities that are convertible into or exchangeable for shares of Class U Common Stock.

(e) Conversion.

(i) Voluntary Conversion. Each share of Class U Common Stock shall convert automatically without any further action by the holder thereof into a number of shares of Class A Common Stock determined in accordance with Section 4.4(d)(ii) upon its sale, conveyance, assignment, hypothecation, disposition or other transfer (each a “Class U Transfer”) to any third party other than an “affiliate” (as such term is defined in Rule 405 promulgated under the Securities Act of 1933, as amended) of the transferor and may be so converted at the option of the holder thereof in connection with any such Class U Transfer.

(ii) Conversion Rate. Each share of Class U Common Stock shall be convertible in accordance with Section 4.4(d)(ii) into the number of shares of Class A Common Stock that results from multiplying (x) 1 by (y) the conversion rate for the Class U Common Stock that is in effect at the time of conversion (the “Conversion Rate”). The Conversion Rate for the Class U Common Stock initially shall be 1. The Conversion Rate shall be subject to adjustment from time to time as provided in this Third Amended and Restated Certificate of Incorporation. All references to the Conversion Rate herein mean the Conversion Rate as so adjusted.

(iii) Subdivisions; Combinations. In the event the corporation should at any time prior to the conversion of the Class U Common Stock fix a record date for the effectuation of a split or subdivision of the outstanding shares of Class A Common Stock or the determination of holders of Class A Common Stock entitled to receive a dividend or other distribution payable in additional shares of common stock, then, as of such record

date (or the date of such dividend, distribution, split or subdivision if no record date is fixed), the Conversion Rate shall be appropriately increased so that the number of shares of Class A Common Stock issuable on conversion of each share of such class shall be increased in proportion to such increase in the aggregate number of shares of Class A Common Stock outstanding. If the number of shares of Class A Common Stock outstanding at any time prior to the conversion of the Class U Common Stock is decreased by a reverse split or combination of the outstanding shares of Class A Common Stock, then, following the record date for such reverse split or combination, the Conversion Rate shall be appropriately decreased so that the number of shares of Class A Common Stock issuable on conversion of each share of such class shall be decreased in proportion to such decrease in outstanding shares.

(iv) Recapitalizations. If at any time or from time to time there is a recapitalization, reclassification, reorganization or similar event, then in any such event each holder of a share of Class U Common Stock shall have the right thereafter to convert such share into the kind and amount of stock and other securities and property receivable upon such recapitalization, reclassification, reorganization or other change by a holder of the number of shares of Class A Common Stock into which such share of Class U Common Stock could have been converted immediately prior to such recapitalization, reclassification, reorganization or other change, all subject to further adjustment as provided herein or with respect to such other securities or property by the terms thereof.

(v) No Impairment. The corporation will not, by amendment of this Third Amended and Restated Certificate of Incorporation (except in accordance with applicable law) or through any reorganization, recapitalization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed under this Section 4.4(d) by the corporation, but will in good faith assist in the carrying out of all the provisions of this Section 4.4(d) and in the taking of all such action as may be necessary or appropriate in order to protect the conversion rights of the holders of Class U Common Stock against impairment.

(vi) Unconverted Shares. If less than all of the outstanding shares of Class U Common Stock are converted pursuant to Section 4.4(d)(i) above, and such shares are evidenced by a certificate representing shares in excess of the shares being converted and surrendered to the corporation in accordance with the procedures as the Board may determine, the corporation shall execute and deliver to or upon the written order of the holder of such certificate, without charge to the holder, a new certificate evidencing the number of shares of Class U Common Stock not converted. No fractional shares shall be issued upon the conversion of any share or shares of Class U Common Stock, and the number of shares to be issued shall be rounded to the nearest whole share.

(vii) Reservation. The corporation shall at all times reserve and keep available out of its authorized but unissued shares of Class A Common Stock, to effect conversions, such number of duly authorized shares of Class A Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding shares of Class U Common Stock; and if at any time the number of authorized but unissued shares of Class A Common Stock shall not be sufficient to effect the conversion of all then outstanding shares of the Class U Common Stock, in addition to such other remedies as shall be available to the holder of the Class U Common Stock, the corporation will take such corporate action as may, in the opinion of counsel, be necessary to increase its authorized but unissued shares of Class A Common Stock to such number of shares as shall be sufficient for such purposes, including, without limitation, engaging in best efforts to obtain the requisite stockholder approval of any necessary amendment to this Third Amended and Restated Certificate of Incorporation.

4.5. Preferred Stock. The Board is authorized, subject to limitations prescribed by law and the provisions of this Third Amended and Restated Certificate of Incorporation and the bylaws, by resolution or resolutions of the Board, from time to time to provide for the issuance of the shares of the Preferred Stock in one or more series and to establish the number of shares to be included in each such series and to fix the designation, powers, preferences and rights of the shares of each such series and the qualifications, limitations or restrictions thereof.

The authority of the Board with respect to each series shall include, without limitation, determination of the following: (i) the number of shares constituting that series and the distinctive designation of that series; (ii) the dividend rate, if any, on the shares of that series, whether dividends shall be cumulative, and, if so, from which date or dates, and the relative rights of priority, if any, of payment of dividends on shares of that series; (iii) whether that series shall have voting rights, in addition to the voting rights provided by law, and, if so, the terms of such voting rights; (iv) whether that series shall be subject to conversion or exchange, and, if so, the terms and conditions of such conversion or exchange, including provision for adjustment of the conversion or exchange rate in such events as the Board shall determine; (v) whether or not the shares of that series shall be redeemable, and, if so, the terms and conditions of such redemption, including the date or dates upon or after which they shall be redeemable, and the type and amount of consideration per share payable in case of redemption, which amount may vary under different conditions and at different redemption dates; (vi) whether that series shall have a sinking fund for the redemption or purchase of shares of that series, and, if so, the terms and amount of such sinking fund; (vii) the rights, if any, of the shares of that series in the event of voluntary or involuntary liquidation, dissolution or winding up of the corporation, and the relative rights of priority, if any, of payment of shares of that series; and (viii) any other relative rights, preferences and limitations, if any, of that series.

4.6. Election of Directors and Vacancies.

(a) Subject to the rights, if any, of the holders of any series of Preferred Stock, the directors of the corporation shall be elected by the holders of the Class A Common Stock, voting as a separate class.

(b) Subject to the rights, if any, of the holders of any series of Preferred Stock to elect directors and to fill vacancies in the Board relating thereto, any and all vacancies in the Board, however occurring, including, without limitation, by reason of an increase in the size of the Board, or the death, resignation, disqualification or removal of a director, may be filled by the affirmative vote of a majority of the remaining directors then in office, even if less than a quorum of the Board, or by a sole remaining director, or by the stockholders. Any director appointed in accordance with the preceding sentence shall hold office until such director’s successor shall have been duly elected and qualified or until his or her earlier resignation, death or removal.

ARTICLE 5.

Except as otherwise provided herein, in furtherance and not in limitation of the powers conferred by statute, the Board is expressly authorized to make, repeal, alter, amend and rescind any or all of the bylaws of the corporation, but the stockholders may make additional bylaws and may repeal, alter, amend or rescind any bylaw whether adopted by them or otherwise.

ARTICLE 6.

The number of directors of the corporation shall be fixed from time to time by, or in the manner provided in, the bylaws or amendment thereof duly adopted by the Board or by the stockholders.

ARTICLE 7.

Elections of directors need not be by written ballot except and to the extent provided in the bylaws of the corporation.

ARTICLE 8.

Meetings of the stockholders may be held within or without the State of Delaware, as the bylaws may provide. The books of the corporation may be kept (subject to any provisions contained in applicable statutes) outside the State of Delaware at such place or places as may be designated from time to time by the Board or in the bylaws of the corporation.

ARTICLE 9.

Directors of the corporation shall, to the fullest extent permitted by the Delaware General Corporation Law as it now exists or as it may hereafter be amended; not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except for liability (i) for any breach of duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the Delaware General Corporation Law or (iv) for any transaction from which the director derived any improper personal benefit. If the Delaware General Corporation Law is amended after approval by the stockholders of this Article 9 to authorize corporate action further eliminating or limiting the personal liability of directors, then the personal liability of directors of the corporation shall be further eliminated or limited to the fullest extent permitted by the Delaware General Corporation Law. Any repeal or modification of any of the foregoing provisions by the stockholders of the corporation, or the adoption of any provision hereof inconsistent with this Article 9, shall not adversely affect any right or protection of directors of the corporation existing at the time of, or increase the liability of directors of the corporation with respect to any acts or omissions of such director occurring prior to, such repeal or modification.

ARTICLE 10.

The corporation reserves the right to amend, alter, change or repeal any provision contained herein in the manner now or hereafter prescribed by statute, and all rights conferred upon stockholders, directors and officers of the corporation herein are granted subject to such revision.

ARTICLE 11.

11.1. Right to Indemnification. Each person who was or is made party or is threatened to be made a party to or is otherwise involved (including involvement as a witness) in any action, suit or proceeding, whether civil, criminal, administrative or investigative (a “proceeding”) by reason of the fact that he or she is or was a director or officer of the corporation or, while a director or officer of the corporation, is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation (including any subsidiary of the corporation) or of a partnership, joint venture, trust or other enterprise, including service with respect to an employee benefit plan (an “indemnitee”), whether the basis of such proceeding is alleged action in an official capacity as a director or officer or in any other capacity while serving as a director or officer, shall be indemnified and held harmless by the corporation to the fullest extent authorized by the Delaware General Corporation Law, as the same exists or may hereafter be amended (but, in the case of any such amendment, only to the extent that such amendment permits the corporation to provide for broader indemnification rights than permitted as of the date this Third Amended and Restated Certificate of Incorporation is filed with the State of Delaware), against all expense, liability and loss (including attorney’s fees, judgments, fines, excise taxes or penalties and amounts paid in settlement) reasonably incurred or suffered by such indemnitee in connection therewith and such indemnification shall continue as to an indemnitee who has ceased to be a director, officer, employee or agent and shall inure to the benefit of the indemnitee’s heirs, executors and administrators; provided, however, that except as provided in Section 11.2 below, with respect to proceedings to enforce rights to indemnification, the corporation shall indemnify any such indemnitee in connection with a proceeding (or part thereof) initiated by such indemnitee only if such proceeding (or part thereof) was authorized by the Board. The right to indemnification conferred in this Section 11.1 shall be a contract right and shall include the obligation of the corporation to pay the expenses incurred in defending any such proceeding in advance of its final disposition (an “advance of expenses”); provided, however, that if and to the extent that the Board requires, an advance of expenses included by an indemnitee in his or her capacity as a director or officer (and not in any other capacity in which service was or is rendered by such indemnitee, including, without limitation, service to an employee benefit plan) shall be made only upon delivery to the corporation of an undertaking (an “undertaking”), by or on behalf of such indemnitee, to repay all amounts so advanced if it shall ultimately be determined by final judicial decision from which there is no further right to appeal (hereinafter a “final adjudication”) that such indemnitee is not entitled to be indemnified for such expenses under this Section 11.1 or otherwise. The corporation may, by action of its Board, provide indemnification to employees and agents of the corporation with the same or lesser scope and effect as the foregoing indemnification of directors and officers.

11.2. Procedure for Indemnification. Any indemnification of a director or officer of the corporation or advance of expenses under Section 11.1 above shall be made promptly, and in any event within forty-five (45) days (or, in the case of an advance of expenses, twenty (20) days) upon the written request of the director or officer. If a determination by the corporation that the director or officer is entitled to indemnification pursuant to this Article 11 is required, and

the corporation fails to respond within sixty (60) days to a written request for indemnity, the corporation shall be deemed to have approved the request. If the corporation denies a written request for indemnification or advance of expenses, in whole or in part, or if payment in full pursuant to such request is not made within forty-five (45) days (or, in the case of an advance of expenses, twenty (20) days), the right to indemnification or advances as granted by this Article 11 shall be enforceable by the director or officer in any court of competent jurisdiction. Such person’s costs and expenses incurred in connection with successfully establishing his or her right to indemnification, in whole or in part, in such action shall also be indemnified by the corporation. It shall be a defense to any such action (other than an action brought to enforce a claim for the advance of expenses where the undertaking required pursuant to Section 11.1 above, if any, has been tendered to the corporation) that the claimant has not met the standards of conduct which make it permissible under the Delaware General Corporation Law for the corporation to indemnify the claimant for the amount claimed, but the burden of such defense shall be on the corporation. Neither the failure of the corporation (including its Board, independent legal counsel or its stockholders) to have made a determination prior to the commencement of such action that indemnification of the claimant is proper in the circumstances because he or she has met the applicable standard of conduct set forth in Delaware General Corporation Law, nor an actual determination by the corporation (including its Board, independent legal counsel or its stockholders) that the claimant has not met such applicable standard of conduct, shall be a defense to the action or create a presumption that the claimant has not met the applicable standard of conduct.

The procedure for indemnification of other employees and agents for whom indemnification is provided pursuant to Section 11.1 above shall be the same procedure set forth in this Section 11.2 for directors or officers, unless otherwise set forth in the action of the Board providing for indemnification for such employee or agent.

11.3. Insurance. The corporation may purchase and maintain insurance on its own behalf and on behalf of any person who is or was a director, officer, employee or agent of the corporation or was serving at the request of the corporation as a director, officer, employee or agent of another corporation (including any subsidiary of the corporation), partnership, joint venture, trust or other enterprise against any expense, liability or loss asserted against him or her and incurred by him or her in any such capacity, whether or not the corporation would have the power to indemnify such person against such expenses, liability or loss under the Delaware General Corporation Law.

11.4. Service for Subsidiaries. Any person serving as a director, officer, employee or agent of another corporation, partnership, limited liability company, joint venture or other enterprise, at least fifty percent (50%) of whose equity interests are owned by the corporation (a “subsidiary” for purposes of this Article 11) shall be conclusively presumed to be serving in such capacity at the request of the corporation.

11.5. Reliance. Persons who after the date of the adoption of this provision are directors or officers of the corporation or who, while a director or officer of the corporation, or a director, officer, employee or agent of a subsidiary, shall be conclusively presumed to have relied on the rights to indemnity, advance of expenses and other rights contained in this Article 11 in entering into or continuing such service. The rights to indemnification and to the advance of expenses conferred in this Article 11 shall apply to claims made against an indemnitee arising out of acts or omissions which occurred or occur both prior and subsequent to the adoption hereof.

11.6. Non-Exclusivity of Rights. The rights to indemnification and to the advance of expenses conferred in this Article 11 shall not be exclusive of any other right which any person may have or hereafter acquire under this Third Amended and Restated Certificate of Incorporation or under any statute, bylaw, agreement, vote of stockholders or disinterested directors or otherwise.

11.7. Merger or Consolidation. For purposes of this Article 11, references to “the corporation” shall include any constituent corporation (including any constituent of a constituent) absorbed into the corporation in a consolidation or merger which, if its separate existence had continued, would have had power and authority to indemnify its directors, officers and employees or agents, so that any person who is or was a director, officer, employee or agent of such constituent corporation, or is or was serving at the request of such constituent corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, shall stand in the same position under this Article 11 with respect to the resulting or surviving corporation as he or she would have with respect to such constituent corporation if its separate existence had continued.

ARTICLE 12.

12.1. Foreign Ownership Restrictions.

(a) The corporation shall at all times be in compliance with 47 U.S.C. § 310 and interpretations thereof by the FCC (the “Foreign Ownership Restrictions”). The Board shall have all powers necessary to insure compliance with this Article 12, including, without limitation, the redemption of shares of capital stock the transfer or ownership of which resulted in a violation of the Foreign Ownership Restrictions; provided, however, that the corporation may, at the request of a stockholder, first seek a waiver of such Foreign Ownership Restrictions from the FCC in the event that any violation thereof results from open-market purchases of publicly traded shares of the corporation, whether shares of capital stock in the corporation or shares of capital stock in an entity which holds capital stock of the corporation, the foreign ownership of which is attributed to the corporation by operation of the rules of the FCC. As a last resort, the Board shall be required to redeem the shares of capital stock the transfer or ownership of which resulted in the violation of the Foreign Ownership Restrictions to insure such compliance (subject, however, to Sections 12(b) and (c) below).

(b) In exercising powers or taking actions to achieve or preserve such compliance, the Board (acting in good faith and based upon advice of outside counsel expert in FCC matters) shall select the method that is least detrimental to the stockholders of the corporation affected by the action. In the case of redemption by the corporation of shares of different classes, the shares of the class having greater voting rights shall occur first.

(c) If the Board, pursuant to Section 12(a) above, should invoke its powers to redeem any of the capital stock held by a party in order to secure compliance with the Foreign Ownership Restrictions, such redemption shall be at fair market value as determined by a third party valuation expert retained by the Board, whose costs and expenses shall be charged to the party from whom the shares are redeemed.

12.2. FCC Compliance Restrictions. The corporation shall at all times be in compliance with, and shall not take any action, nor shall it cause any act to be done, that would cause it to be in violation of the limitations on ownership of mass media, cable television and newspaper (or such other interests as the legislation or the FCC shall require in the future) interests, as set forth in the Communications Act or the rules of the FCC.

THIRD: That the foregoing amendment and restatement was duly adopted in accordance with the provisions of Section 242 and Section 245 of the Delaware General Corporation Law.

IN WITNESS WHEREOF, this Third Amended and Restated Certificate of Incorporation has been executed by the Secretary of the corporation effective as of this 9th day of June, 2023.

ENTRAVISION COMMUNICATIONS CORPORATION

By: /s/ Mark Boelke

Name: Mark Boelke

Title: Secretary

Exhibit 5.1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwin Procter LLP 601 Marshall St. Redwood City, CA 94063 |

|

|

|

|

|

|

|

goodwinlaw.com +1 650 752 3100 |

June 30, 2023

Entravision Communications Corporation

2425 Olympic Blvd., Suite 6000 West

Santa Monica, California 90404

|

|

Re: |

Securities Being Registered under Registration Statement on Form S-8 |

We have acted as counsel to you in connection with your filing of a Registration Statement on Form S-8 (the “Registration Statement”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”), on or about the date hereof relating to an aggregate of 2,000,000 shares (the “Shares”) of Class A Common Stock, $0.0001 par value per share (“Class A Common Stock”), of Entravision Communications Corporation, a Delaware corporation (the “Company”), that may be issued pursuant to the Company’s 2023 Inducement Plan (the “Plan”).

We have reviewed such documents and made such examination of law as we have deemed appropriate to give the opinions set forth below. We have relied, without independent verification, on certificates of public officials and, as to matters of fact material to the opinion set forth below, on certificates of officers of the Company.

The opinion set forth below is limited to the Delaware General Corporation Law.

For purposes of the opinion set forth below, we have assumed that no event occurs that causes the number of authorized shares of Class A Common Stock available for issuance by the Company to be less than the number of then unissued Shares.

Based on the foregoing, we are of the opinion that the Shares have been duly authorized and, upon issuance and delivery against payment therefor in accordance with the terms of the Plan, will be validly issued, fully paid and nonassessable.

This opinion letter and the opinion it contains shall be interpreted in accordance with the Core Opinion Principles as published in 74 Business Lawyer 815 (Summer 2019).

We hereby consent to the inclusion of this opinion as Exhibit 5.1 to the Registration Statement. In giving our consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations thereunder.

|

|

Very truly yours, |

|

/s/ Goodwin Procter LLP |

|

GOODWIN PROCTER LLP |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement No. 333 on Form S-8 of our report dated March 16, 2023 relating to the consolidated financial statements of Entravision Communications Corporation and the effectiveness of Entravision Communications Corporation’s internal control over financial reporting, appearing in the Annual Report on Form 10-K of Entravision Communications Corporation for the year ended December 31, 2022.

/s/ DELOITTE & TOUCHE LLP

Los Angeles, California

June 30, 2023

Exhibit 23.2

Consent of Independent Registered Public Accounting Firm

Entravision Communications Corporation

Santa Monica, California

We hereby consent to the incorporation by reference in the prospectus constituting a part of this registration statement of our report dated March 16, 2022, relating to the consolidated financial statements and schedule of Entravision Communications Corporation (“Company”) appearing in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

/s/ BDO USA, LLP

Los Angeles, California

June 30, 2023

Exhibit 107

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Entravision Communications Corporation

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Security Type |

|

Security

Class

Title |

|

Fee

Calculation

Rule |

|

Amount

Registered(1) |

|

Proposed

Maximum

Offering

Price Per

Unit |

|

Maximum

Aggregate

Offering

Price |

|

Fee

Rate |

|

Amount of

Registration

Fee |

|

|

|

|

|

|

|

|

Equity |

|

Class A Common stock, par value $0.0001 per share |

|

Other(2) |

|

2,000,000 (3) |

|

$4.115 (2) |

|

$8,230,000 (2) |

|

0.00011020 |

|

$906.95 |

Total Offering Amounts |

|

|

|

$8,230,000 |

|

|

|

$906.95 |

Total Fee Offsets |

|

|

|

|

|

|

|

$0 |

Net Fee Due |

|

|

|

|

|

|

|

$906.95 |

|

|

(1) |

In accordance with Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall be deemed to cover any additional securities that may from time to time be offered or issued under the Entravision Communications Corporation 2023 Inducement Plan (the “Plan”) to prevent dilution resulting from stock splits, stock dividends, recapitalization or similar transactions that result in an increase in the number of outstanding securities. |

|

|

(2) |

Estimated in accordance with Rules 457(c) and 457(h) under the Securities Act, solely for the purpose of computing the amount of the registration fee, on the basis of the average of the high and low prices of shares of Entravision Communication Corporation’s Class A common stock, par value $0.0001 per share (“Class A Common Stock”), reported on the New York Stock Exchange on June 26, 2023, which is within five business days of this filing. |

|

|

(3) |

Represents 2,000,000 shares of Class A Common Stock reserved for issuance under the Plan. |

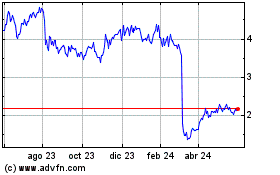

Entravision Communications (NYSE:EVC)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

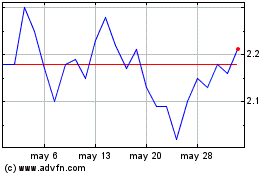

Entravision Communications (NYSE:EVC)

Gráfica de Acción Histórica

De May 2023 a May 2024