Green Growth Brands Inc. (“Green Growth”) (CSE: GGB) reaffirms its

commitment to launch an offer (the “Offer”) to purchase all of the

issued and outstanding common shares of Aphria Inc.

(“

Aphria”) (TSX:

APHA and

NYSE:

APHA) which it does not already own and welcomes

early expressions of interest from Aphria shareholders who are

frustrated with Aphria’s performance and absence of compelling

future plans for the company.

“Since we announced our intention to launch the takeover of

Aphria we have seen two things. First, Aphria shareholders are

welcoming a 45%+ premium offer because they understand the

significant value that can be unleashed by our combined teams,

assets and geographies. Second, a real interest in the market to

understand Green Growth and our valuation,” said Peter Horvath, CEO

of Green Growth. “When investors consider our trailing revenue,

recent license wins in Nevada, and a buildout in the new market of

Massachusetts they agree that it is not a question of if Green

Growth reaches C$7.00 per share, but when. We understand that there

are some in the market who want to focus on destroying value at

Aphria, but we are committed to creating it.”

Why Green Growth and Aphria are the Right

Match

By acquiring Aphria, Green Growth represents a way for

shareholders of Aphria to participate in the much larger U.S.

market, with significantly greater long-term sales potential. The

combination of the two companies will create an unparalleled North

American player with operations on both sides of the border,

combining Aphria’s Canadian supply and wholesale agreements with

Green Growth’s vertically integrated operations including

cultivation, manufacturing and retail. The combination also marries

the talent of Aphria’s veterans in the greenhouse industry and

pharmaceutical operations with Green Growth’s team of retail

experts from well-known retailers including Designer Shoe Warehouse

Inc. and L Brands Inc. (Victoria’s Secret). Together the combined

company will be the largest U.S. operator by market capitalization

and the only North American cannabis operator.

Green Growth’s Record of Success and Why a C$7.00

Valuation Makes Sense

Green Growth has a strong track record of success, doing in

months what has taken other cannabis companies years to achieve.

Green Growth has a current fully-diluted1 market capitalization of

over C$1.1 billion.

Management believes that the additional value creation from

recent announcements and near-term business initiatives expected to

be executed shortly have not yet been reflected in its share price

and has confidence in a minimum C$7.00 per share valuation for the

following reasons:

- Green Growth has raised more than C$150 million in capital

since inception and, in late 2018, went public by way of a reverse

takeover. Today, Green Growth owns, operates and/or licenses two

premier retail cannabis stores under the banner “The+Source”2 as

well as a cultivation and processing facility, all of which are

located in Las Vegas, Nevada. The cultivation and processing

facility comprises 12,000 sq. ft. and has a potential annual

capacity of ~1,600 kg. Additionally, Green Growth, subject to

regulatory approval, has an irrevocable purchase agreement to

acquire a cultivation facility in Pahrump, Nevada. The Pahrump

facility will be producing product in the near future.

- Green Growth was recently awarded seven additional licenses in

Nevada for retail dispensaries, which, together with its current

operations and the Pahrump facility, are expected to generate total

revenue of ~C$275 million by 2020.

- Green Growth has a first-to-market cannabidiol (CBD)

business.

- Green Growth recently announced the acquisition of Just Healthy

LLC, which holds provisional certificates of registration for a

registered medical marijuana dispensary in Northampton,

Massachusetts, and a cultivation and processing site, also located

in Northampton. The license allows for up to three total medical

dispensaries. Just Healthy LLC is expected to generate an

incremental ~C$130 million in revenue by 2020.

- Green Growth has an extensive pipeline of value-creating

initiatives and strategic partnerships, including working with six

different large developers who represent a vast network of malls in

the U.S., to launch over 450 mall kiosks in prime locations.

Moreover, to illustrate confidence in the value of the C$7.00

consideration under the Offer, Green Growth expects to complete a

concurrent brokered financing of C$300 million at that same per

share price, with Green Growth insiders committing to backstop the

entire financing.

At a C$7.00 per share valuation, Green Growth would have a

fully-diluted3 total enterprise value of ~C$1.6 billion. Based

solely on Green Growth’s current Nevada operations, the Pahrump

facility, and Just Healthy LLC, Green Growth would trade at an

implied 12x TEV/2020E EBITDA, which is a discount of over 50% to

current large cannabis peer multiples. Furthermore, factoring in

the value creation from its near-term business initiatives expected

to be executed shortly (including mall kiosks, e-commerce, and

wholesale), Green Growth would trade materially below the 12x

TEV/2020E EBITDA.

Aphria shareholders will continue to maintain control of the pro

forma entity, with ~60% ownership. Green Growth shareholders will

have a ~34% ownership interest, with subscribers to the C$300

million financing holding a ~6% ownership interest.

Green Growth is Not a Related Party to

Aphria

To our knowledge, Aphria does not own any shares of Green

Growth, nor do any of Aphria’s directors sit on Green Growth’s

board. As those who participate in the small, yet growing, cannabis

industry know, there are many overlapping informal relationships

between participants. Any informal relationships that may exist are

separate from Green Growth’s business decisions and Green Growth

has no related party influence with Aphria, nor does Aphria have a

related party influence over Green Growth.

For further clarity, Aphria’s CEO, Vic Neufeld, who is listed as

one of many advisors to Green Acre Capital through its Green Acre

Opportunity Corp. fund has no influence over Green Growth. Green

Acre has invested in multiple cannabis entities and many are

considered competitors to Aphria. There is nothing noteworthy about

Green Acre investing in another up-and-coming cannabis entity,

regardless of overlap in a small, emerging industry.

The clearest evidence for lack of influence in Green Growth’s

acquisition of Aphria is the fact Aphria’s board has refused to

engage and rejected Green Growth’s premium offer thus making a

transaction much more difficult and expensive to achieve.

Misinformation from Self-Interested Market Participants

Does Not Change the Merits of the Premium Offer

Certain market participants have spread misinformation related

to Green Growth with the objective of destroying value in Aphria.

This misinformation was generated by comments from those with a

stated short position in Aphria and whose trade will be impeded by

Green Growth’s premium offer. Shareholders should be aware of the

facts related to a number of incorrect statements made.

Specifically:

- Green Growth has confirmed the Schottenstein family does not

own Aphria shares. The Schottensteins applied for a cultivation,

processing and dispensary license with an affiliate of Aphria,

Liberty Health Sciences, in the state of Ohio. The venture was

awarded a processing and dispensary provisional license in Ohio. At

such time that state law permits transfers, the JV will be

dissolved. Subsequent to making the application in Ohio, Aphria

divested its interest in Liberty Health Sciences.

- Shawn Dym is not a director on Green Growth’s board.

Green Growth Will Launch its Offer for

Aphria

Green Growth has been willing to work with Aphria’s board to

find ways to enhance value for shareholders of both companies.

Green Growth is confident in the certainty of a C$300 million

financing at C$7.00 per share. Over 10% of Aphria’s shareholders

have already indicated their support of the Offer. Aphria’s board

has two options: Engage with Green Growth as a serious buyer to

create real value or continue their endless analysis which will

result in the destruction of shareholder value.

We look forward to continued direct engagement with Aphria’s

shareholders as we work together to build the leading cannabis

company in the world.

Questions? Need more help? Aphria shareholders should contact

Kingsdale Advisors, the information agent and depositary for the

Offer, at 1-866-851-3214 (North American Toll-Free Number) or

+1-416-867-2272 (Outside North America) or via email

at contactus@kingsdaleadvisors.com.

Intention to Make an Offer

Full details of the Offer are expected to be set out in the

formal Offer and take-over bid circular which is expected to be

mailed to Aphria shareholders, a copy of which is expected to be

available at www.sedar.com under Aphria’s profile. Green Growth

expects to formally commence the Offer and mail the Offer and

take-over bid circular to Aphria shareholders in the coming

weeks.

Readers are cautioned that Green Growth may determine

not to make the Offer if (i) Aphria implements or attempts to

implement defensive tactics in relation to the Offer, (ii) Green

Growth uncovers or its contemplated funding sources uncover or

otherwise identify information suggesting that the business,

affairs, prospects or assets of Aphria have been impaired or

uncovers or otherwise identifies other undisclosed material adverse

information concerning Aphria or (iii) Aphria determines to engage

with Green Growth to negotiate the terms of a combination

transaction and Aphria and Green Growth determine to undertake that

transaction utilizing a structure other than a take-over bid such

as a plan of arrangement. Accordingly, there can be no assurance

that the Offer will be made or that the final terms of the Offer

will be as set out in this news release. In

addition, the contemplated consummation of a concurrent brokered

financing of C$300 million, at a price per share of C$7.00, and the

contemplated backstop commitment in that regard, are subject to a

variety of contingencies and conditions, including satisfactory

completion of customary due diligence as to both Aphria and Green

Growth, agreement on mutually agreeable definitive documentation,

and other customary undertakings and conditions. No binding

commitment of any kind has yet been made in this regard, and

readers should not assume any such commitment will be made unless

and until reflected in a binding instrument agreed by the

contemplated funding sources, which cannot and should not be

assumed or assured.

The Offer will be undertaken in accordance with National

Instrument 62-104 – Take-Over Bids and Issuer Bids and will be

subject to a number of customary conditions, including: (i) there

being deposited under the Offer, and not withdrawn, at least 66

2/3% of the outstanding Aphria Shares (calculated on a fully

diluted basis), excluding Aphria Shares held by Green Growth; (ii)

receipt of all governmental, regulatory, stock exchange and third

party approvals that Green Growth considers necessary or desirable

in connection with the Offer; (iii) there being no legal

prohibition against Green Growth making the Offer or taking up and

paying for the Aphria Shares; (iv) Aphria not having adopted or

implemented a shareholder rights plan, disposed of any assets,

incurred any material debts, implemented any changes in its capital

structure or otherwise implemented or attempted to implement a

defensive tactic; (v) no material adverse change having occurred in

the business, affairs, prospects or assets of Aphria; (v) Green

Growth not becoming aware of Aphria having made any untrue

statement of a material fact or omitting to state a material fact

that is required to be made to any securities regulatory authority;

(vi) approval by the shareholders of Green Growth in accordance

with the policies of the Canadian Securities Exchange; and (vii)

the statutory minimum condition that 50% of the Aphria Shares

having been tendered to the Offer, excluding Aphria Shares held by

or over which control is exercised by Green Growth (which cannot be

waived). If the Offer proceeds, Green Growth expects to call during

the first quarter of 2019 a meeting of its shareholders to consider

a resolution to approve the issuance of the Green Growth Shares in

connection with the Offer. Green Growth expects the Offer,

when made, will remain open for an acceptance period of at least

105 days from the date of mailing its take-over bid circular. It is

within the power of the Board of Directors of Aphria to

significantly shorten this minimum bid period, allowing

shareholders to receive the benefits of Green Growth’s offer in

only 35 days. Shareholders of the Company are encouraged to contact

Aphria and to urge management and the Board to allow Green Growth’s

takeover bid to proceed in the minimum time frame

allowed.

Advisors

Green Growth Brands has retained Canaccord Genuity as its

financial advisor, Norton Rose Fulbright Canada LLP as its legal

advisor, and Kingsdale Advisors as its strategic shareholder and

communications advisor and depositary.

About Green Growth Brands Green Growth brands

expects to dominate the cannabis and CBD market with a portfolio of

emotion-driven brands that people love. Led by renowned

retailer Peter Horvath, the GGB team is full of retail

renegades with decades of experience building successful brands.

Join the movement at GreenGrowthBrands.com.

Media Contact:Ian Robertson Executive

Vice President, Communication Strategy Kingsdale

Advisors Direct: 416-867-2333 Cell: 647-621-2646

Email: irobertson@kingsdaleadvisors.com

Investor Contact: Peter HorvathCEO, Green

Growth Brands Inc. Email: PHorvath@greengrowthbrands.com

Cautionary Statement in Forward-Looking

Information

This press release contains certain statements and information

which constitute “forward-looking information” within the meaning

of applicable securities laws. Wherever possible, forward-looking

information can be identified by the expressions "seeks",

"expects", "believes", "estimates", "will", “plans”, “may”,

“believes”, “anticipates,” "target" and similar expressions (or the

negative of such expressions). The forward-looking statements are

not historical facts, but reflect the current expectations of Green

Growth regarding future results or events and are based on

information currently available to it. The forward-looking events

and circumstances discussed in this release include, but are not

limited to, (i) the Offer, the terms of the Offer and the

anticipated timing of commencement of the Offer, (ii) the benefit

of the Offer to both Green Growth and the Company, including the

creation of wealth and value and the synergies that may be created

by the Offer, (iii) the C$300 financing, its timing and terms, (iv)

expectations regarding the ownership, management, operation and

size of Green Growth following completion of the Offer, (v) the

future strategy and plans of Green Growth, including following the

Offering, and (vi) the cannabis industry and regulatory

environment. Certain material factors and assumptions were applied

in providing this forward-looking information. All material

assumptions used in making forward-looking statements are based on

Green Growth’s knowledge of its business and the business of

Aphria, and, in some cases, information supplied by third parties,

including the public disclosure made by the Company. Certain

material factors or assumptions include, but are not limited to,

(i) the current business conditions and expectations of future

business conditions and trends affecting Green Growth and Aphria,

including the US and Canadian economy, the cannabis industry in

Canada, the US and elsewhere, and capital markets, and (ii) that

there have been no material changes in the business, affairs,

capital, prospects or assets of the Company, except as publicly

disclosed by the Company before the date hereof. All

forward-looking statements in this press release are qualified by

these cautionary statements. Green Growth believes that the

expectations reflected in forward-looking statements are based upon

reasonable assumptions; however, Green Growth can give no assurance

that the actual results or developments will be realized by certain

specified dates or at all. These forward-looking statements are

subject to a number of risks and uncertainties that could cause

actual results or events to vary materially from current

expectations. In addition to risks noted elsewhere in this news

release, material risks include, but are not limited to, (i) the

risk that the Offer will not be commenced or that the conditions to

the Offer will not be met, or met on a timely basis, or that the

transaction will not be consummated for any other reason, (ii)

changes in general economic conditions in Canada, the United States

and elsewhere, (iii) changes in operating conditions (including

changes in the regulatory environment) affecting the cannabis

industry, (iv) fluctuations in currency and interest rates,

availability materials and personnel, and (v) Green Growth’s

ability to successfully integrate the operations of Green Growth

and Aphria following completion of the Offer, including ability to

retain key Aphria personnel and renegotiate certain contracts to

obtain economies of scale or other synergies. Readers, therefore,

should not place undue reliance on any such forward-looking

information. Further, forward-looking information speaks only as of

the date on which such statement is made. Green Growth undertakes

no obligation to publicly update any such statement or to reflect

new information or the occurrence of future events or circumstances

except as required by securities laws. These forward-looking

statements are made as of the date of this press release.

Cautionary Statement Respecting the Proposed Offer

GREEN GROWTH HAS NOT YET COMMENCED THE OFFER NOTED ABOVE. UPON

COMMENCEMENT OF THE OFFER, GREEN GROWTH WILL DELIVER THE TAKE-OVER

BID CIRCULAR TO HOLDERS OF THE SHARES IN ACCORDANCE WITH APPLICABLE

CANADIAN SECURITIES LAWS AND WILL FILE A TAKE-OVER BID CIRCULAR

WITH THE SECURITIES COMMISSIONS IN EACH OF THE PROVINCES AND

TERRITORIES OF CANADA. THE TAKE-OVER BID CIRCULAR WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE OFFER AND SHOULD BE READ IN ITS

ENTIRETY BY APHRIA’S SHAREHOLDERS. AFTER THE OFFER IS COMMENCED,

APHRIA’S SHAREHOLDERS WILL BE ABLE TO OBTAIN, AT NO CHARGE, A COPY

OF THE TAKE-OVER BID CIRCULAR AND VARIOUS ASSOCIATED DOCUMENTS

UNDER APHRIA’S PROFILE ON THE SYSTEM FOR ELECTRONIC DOCUMENT

ANALYSIS AND RETRIEVAL (SEDAR) AT WWW.SEDAR.COM. THIS ANNOUNCEMENT

IS FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSTITUTE OR FORM

PART OF ANY OFFER TO BUY OR INVITATION TO SELL, OTHERWISE ACQUIRE,

OR SUBSCRIBE FOR ANY SECURITY. THE OFFER WILL ONLY BE MADE PURSUANT

TO A FORMAL OFFER AND TAKE-OVER BID CIRCULAR. THE OFFER WILL NOT BE

MADE IN, NOR WILL DEPOSITS OF SECURITIES BE ACCEPTED FROM A PERSON

IN, ANY JURISDICTION IN WHICH THE MAKING OR ACCEPTANCE THEREOF

WOULD NOT BE IN COMPLIANCE WITH THE LAWS OF SUCH JURISDICTION.

HOWEVER, GREEN GROWTH MAY, IN ITS SOLE DISCRETION, TAKE SUCH ACTION

AS IT DEEMS NECESSARY TO EXTEND THE OFFER IN ANY SUCH

JURISDICTION.

Additional Information for U.S. Investors

This communication does not constitute an offer to buy or

solicitation of an offer to sell any securities. This communication

relates to a potential transaction with Aphria proposed by Green

Growth, which may become the subject of a registration statement

filed with the U.S. Securities and Exchange Commission (“SEC”).

This material is not a substitute for any prospectus or other

document Green Growth would file with the SEC regarding the

proposed transaction if a negotiated transaction is agreed between

Green Growth and Aphria or if the Offer is commenced or for any

other document that Green Growth may file with the SEC and send to

Aphria shareholders in connection with the proposed transaction. No

tender or exchange offer for the common shares of Aphria has

commenced at this time. In connection with the proposed

transaction, Green Growth may file Offer documents with the SEC,

including a registration statement. Any definitive Offer documents

will be mailed to shareholders of Aphria. U.S. INVESTORS AND

SECURITY HOLDERS OF APHRIA ARE URGED TO READ THESE AND OTHER

DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY IN THEIR

ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain free copies

of these documents (if and when available) and other documents

filed with the SEC by Green Growth through the web site maintained

by the SEC at http://www.sec.gov.

__________________________________

1 Treasury method.

2 Includes Henderson, where Green Growth has an irrevocable

option to acquire all of its membership interests.

3 Treasury method.

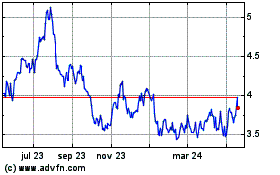

Gerdau (NYSE:GGB)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

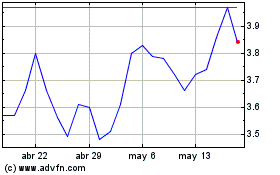

Gerdau (NYSE:GGB)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024