0000049071false00000490712024-12-032024-12-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 3, 2024 (December 3, 2024)

Humana Inc.

| | |

| (Exact name of registrant as specified in its charter) |

|

| | | | | | | | |

| Delaware | 001-5975 | 61-0647538 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

500 West Main Street, Louisville, Kentucky 40202

(Address of principal executive offices, including zip code)

(502) 580-1000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock | HUM | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b), (c) and (e)

On December 3, 2024, Humana Inc. (the “Company”) announced that in order to pursue personal and professional goals, Susan M. Diamond will be transitioning from her current role as Chief Financial Officer on January 10, 2025 (the “Transition Date”), after which she has agreed to serve in an advisory capacity to the Company through December 31, 2025 (the “Transition Period”). Ms. Diamond’s departure is not related to any disagreement with the Company, including with respect to the Company’s operations, policies or practices.

In connection with the transition, Ms. Diamond entered into an agreement with the Company (the “Agreement”), the material terms of which are summarized below. The payments and benefits to which Ms. Diamond is entitled under the Agreement are generally subject to Ms. Diamond’s compliance with the terms and conditions of the Agreement.

Pursuant to the terms of the Agreement, Ms. Diamond agreed to continue to provide strategic advisory services after the Transition Date until December 31, 2025, and thereafter transition to the Company’s variable staffing pool (“VSP”) (temporary worker status) until March 1, 2027 (the “VSP Period”). Until December 31, 2025, Ms. Diamond will continue to receive her current base salary, annual incentive plan opportunity and benefits. During the VSP Period, Ms. Diamond will not receive a salary, but will be paid an hourly rate for any work performed for the Company, including: (i) continuing to serve on the boards of various joint venture and minority investment companies in the Company’s investment portfolio, (ii) advising the Company’s business teams as requested regarding ongoing operational and regulatory matters, including participating in public policy matters, and (iii) serving as a strategic consultant to the Company to assist in the transition.

Under the Agreement, Ms. Diamond will not receive any additional compensation or benefits, other than continued vesting of equity in accordance with applicable provisions under the Company’s stock incentive plan, and other existing compensation and benefits programs generally available to the Company’s associates, including VSP associates.

At the end of the Transition Period, Ms. Diamond will receive, subject to her execution of a general release of claims and compliance with applicable non-compete and non-solicit covenants, benefits pursuant to Section 3 of the Company’s Executive Severance Policy.

On December 3, 2024, the Company also announced the appointment of Celeste Mellet, age 48, to serve as the Company’s Chief Financial Officer, effective as of January 11, 2025. See the attached press release for additional biographical information concerning Ms. Mellet.

There are no arrangements or understandings between Ms. Mellet and any other persons pursuant to which she will be appointed the Company’s Chief Financial Officer. There is no family relationship between Ms. Mellet and any director, executive officer, or person nominated or chosen by the Company to become a director or executive officer of the Company. The Company has not entered into any transactions with Ms. Mellet that would require disclosure pursuant to Item 404(a) of Regulation S−K under the Exchange Act.

The terms of Ms. Mellet’s employment with the Company are described in an offer letter (the “Offer Letter”), which provides for a base salary of $975,000 and eligibility to participate at the 125% level in the Company’s short-term incentive plan under the same terms as other Company executive officers. Under the Offer Letter, upon commencement of her employment Ms. Mellet will receive an initial equity award comprised of restricted stock units with a value equal to approximately $6,000,000 on the date of grant. In connection with the Company’s annual long-term incentive compensation program for 2025, Ms. Mellet will receive a total annual equity grant value of $4,000,000 (the “2025 Annual Grant”), made in the ordinary course of business in connection with the Company’s customary granting practices, and will include the same grant date, vesting schedule, and award mix (performance-based stock units, restricted stock units, and stock options) as approved by the Company’s Organization & Compensation Committee for all of the Company’s executive officers. Ms. Mellet will also receive

a cash sign-on payment (“Sign-On”) in the aggregate amount of $7,300,000, payable in three installments as follows: (1) the first installment of $6,000,000, within 45 days of Ms. Mellet’s first date of employment, (2) the second installment of $700,000, on or near the first anniversary of Ms. Mellet’s first date of employment, and (3) the third installment of $600,000, on or near the second anniversary of Ms. Mellet’s first date of employment. The Offer Letter provides for the repayment of some or all of the Sign-On if Ms. Mellet voluntarily leaves employment by the Company prior to completing certain service time requirements. These payments and grants to Ms. Mellet are intended to replace certain elements of compensation to which Ms. Mellet was entitled to or eligible for in connection with her prior employment.

The Offer Letter also describes Ms. Mellet’s participation in the Company’s Executive Severance Policy, Change in Control Policy, and other standard benefits and perquisites under the Company’s current policies and procedures, including health, dental and vision coverage, and a matching charitable contribution benefit of $30,000 annually.

The foregoing summaries of the Offer Letter and the Agreement do not purport to be complete and are qualified in their entirety by reference to the full text of the Agreement and the Offer Letter, as applicable, a copy of each of which is expected to be filed as an exhibit to the Company’s Annual Report on Form 10-K for the period ending December 31, 2024.

Item 7.01 Regulation FD Disclosure.

Members of the Company’s senior management team are scheduled to meet with investors and analysts at various meetings between December 3, 2024 and December 31, 2024. During these meetings, the Company intends to reaffirm its guidance of at least $12.89 in diluted earnings per common share (“EPS”) or at least $16.00 in adjusted earnings per common share (“Adjusted EPS”), in each case for the year ending December 31, 2024 (“FY 2024”). This guidance is consistent with the guidance issued in Humana’s press release dated October 30, 2024.

The Company has included Adjusted EPS in this current report, a financial measure that is not in accordance with Generally Accepted Accounting Principles (“GAAP”). Management believes that this measure, when presented in conjunction with the comparable measure of GAAP EPS, provides a comprehensive perspective to more accurately compare and analyze the Company’s core operating performance over time. Consequently, management uses Adjusted EPS as a consistent and uniform indicator of the Company’s core business operations from period to period, as well as for planning and decision-making purposes and in determination of incentive compensation. Adjusted EPS should be considered in addition to, but not as a substitute for, or superior to, GAAP EPS. A reconciliation of GAAP EPS to Adjusted EPS follows:

| | | | | |

| Diluted earnings per common share | FY 2024 Guidance |

| GAAP | approximately $12.89 |

| Amortization of identifiable intangibles | 0.50 |

| Put/call valuation adjustments associated with Company's non-consolidating minority interest investments | 1.17 |

| Impact of exit of employer group commercial medical products business | 1.14 |

| Value creation initiatives | 1.25 |

| Cumulative net tax impact of non-GAAP adjustments | (0.95) | |

| Adjusted (non-GAAP) – FY 2024 projected | approximately $16.00 |

Cautionary Statement

This Current Report on Form 8-K includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, generally including the words or phrases like “expects,” “believes,” “anticipates,” “intends,” “likely will result,” “estimates,” “projects” or variations of such words and similar expressions that are intended to identify such forward-looking statements. These forward-looking statements are not

guarantees of future performance and are subject to risks, uncertainties, and assumptions, including, among other things, information set forth in the “Risk Factors” section of the Company’s SEC filings.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

| | | | | |

| Exhibit No. | Description |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| HUMANA INC. |

| |

| BY: | /s/ Joseph M. Ruschell |

| Joseph M. Ruschell |

| Vice President, Associate General Counsel & Corporate Secretary |

| |

Dated: December 3, 2024

Exhibit 99.1

| | | | | |

| FOR MORE INFORMATION, CONTACT: |

Kelley Murphy

Humana Corporate Communications

kmurphy26@humana.com | |

|

Lisa Stoner

Investor Relations

lstamper@humana.com |

Humana Announces CFO Transition

LOUISVILLE, Ky. — December 3, 2024 — Leading health and well-being company Humana Inc. (NYSE: HUM) announced today that Celeste Mellet will be appointed to succeed Susan Diamond as Chief Financial Officer (CFO), effective January 11, 2025. Diamond is stepping down after a successful 18-year career at Humana, including over three years as CFO, and will serve in an advisory role through the end of 2025 to ensure a smooth transition.

“On behalf of the entire Board and management team, I want to extend my thanks to Susan for her leadership as CFO and in prior roles during her nearly two decades at Humana,” said Jim Rechtin, Humana’s President and Chief Executive Officer. “Susan’s contributions spanned across our Medicare, Home Solutions and finance teams and she was instrumental in helping navigate complex environments including COVID-19 and dynamic utilization trends. On a personal note, I’m grateful for her partnership as I transitioned into the CEO role. We appreciate her willingness to help ensure a smooth transition and are grateful that she has agreed to remain a resource to the company.”

“It’s been an honor to work with such talented colleagues during my time at Humana. I am grateful for the opportunity to have served as CFO and help the company navigate a challenging period for the industry, as well as support Jim’s transition into the CEO role,” said Diamond. “As I prepare for the next chapter, both personally and professionally, and the company works to establish new forward-looking commitments, it became clear that this is the right time to initiate a CFO transition. It is important to have a leadership team that will be in place for the next several years to deliver against those commitments, and I look forward to helping set the team up for success.”

Mellet currently serves as CFO of Global Infrastructure Partners (GIP), a leading infrastructure fund manager recently acquired by BlackRock. Prior to joining GIP, she was CFO, senior managing director and executive vice president of Evercore, responsible for the firm’s financial, strategy, tax, information technology and facilities functions. Before joining Evercore, Mellet was Fannie Mae’s executive vice president and CFO responsible for corporate strategy and financial management functions. Before her tenure at Fannie Mae, she spent more than 18 years at Morgan Stanley, last serving as global treasurer and previously head of investor, creditor and counterparty relations. Mellet was also previously an equity research analyst covering financial, media, and gaming and lodging.

“Celeste is a highly accomplished CFO and brings first-hand experience navigating dynamic and highly regulated industries. She has a proven track record of working with cross-functional teams to drive improved performance throughout the complex organizations where she has served as a leader. I am excited to partner with Celeste as we execute against our strategy, unlock the earnings power of the business, and deliver long-term shareholder value,” said Rechtin.

“I am thrilled for the opportunity to join Humana,” said Mellet. “This is a leading company with clearly differentiated capabilities, a strong value proposition, and a compelling long-term outlook. I am excited to join this talented team as Humana enters its next chapter of growth and value creation.”

The Company reiterates its 2024 adjusted earnings per share (EPS) guidance of ‘at least $16.00’ and its 2025 adjusted EPS commentary of ‘at least in line with final 2024 results.’ Humana continues to target an Investor Day in May 2025.

Cautionary Statement

This news release includes forward-looking statements regarding Humana within the meaning of the Private Securities Litigation Reform Act of 1995. When used in investor presentations, press releases, Securities and Exchange Commission (SEC) filings, and in oral statements made by or with the approval of one of Humana’s executive officers, the words or phrases like “expects,” “believes,” “anticipates,” “assumes,” “intends,” “likely will result,” “estimates,” “projects” or variations of such words and similar expressions are intended to identify such forward-looking statements.

These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, and assumptions, including, among other things, information set forth in the “Risk Factors” section of the company’s SEC filings set forth below.

In making forward-looking statements, Humana is not undertaking to address or update them in future filings or communications regarding its business or results. In light of these risks, uncertainties, and assumptions, the forward-looking events discussed herein may or may not occur. There also may be other risks that the company is unable to predict at this time. Any of these risks and uncertainties may cause actual results to differ materially from the results discussed in the forward-looking statements.

Humana advises investors to read the following documents as filed by the company with the SEC for further discussion both of the risks it faces and its historical performance:

•Form 10-K for the year ended December 31, 2023;

•Form 10-Q for the quarter ended March 31, 2024, June 30, 2024, and September 30, 2024; and

•Form 8-Ks filed during 2024.

About Humana

Humana Inc. is committed to putting health first – for our teammates, our customers, and our company. Through our Humana insurance services, and our CenterWell health care services, we make it easier for the millions of people we serve to achieve their best health – delivering the care and service they need, when they need it. These efforts are leading to a better quality of life for people with Medicare, Medicaid, families, individuals, military service personnel, and communities at large. Learn more about what we offer at Humana.com and at CenterWell.com

###

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

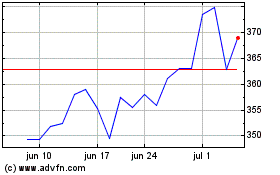

Humana (NYSE:HUM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Humana (NYSE:HUM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024