UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

N-CSR

CERTIFIED

SHAREHOLDER REPORT OF

REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment

Company Act file number: 811-22438

Voya

Emerging Markets High Dividend Equity Fund

(Exact

name of registrant as specified in charter)

| 7337

East Doubletree Ranch Road, Suite 100, Scottsdale, AZ |

|

85258 |

| (Address

of principal executive offices) |

|

(Zip

code) |

Huey

P. Falgout Jr., 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, AZ 85258

(Name

and address of agent for service)

Registrant’s

telephone number, including area code: 1-800-992-0180

Date

of fiscal year end: February 28

Date

of reporting period: March 1, 2023 to August 31, 2023

Item

1. Reports to Stockholders.

(a) The

following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Semi-Annual

Report

August

31, 2023

Voya

Emerging Markets High Dividend Equity Fund

| As

permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the fund’s annual and

semi-annual shareholder reports, like this semi-annual report, are not sent by mail, unless you specifically request paper

copies of the reports. Instead, the reports will be made available on the Voya funds’ website (www.voyainvestments.com/literature),

and you will be notified by mail each time a report is posted and provided with a website link to access the report. |

| If

you already elected to receive shareholder reports electronically, you need not take any action. You may elect to receive

shareholder reports and other communications from a fund electronically anytime by contacting your financial intermediary

(such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-992-0180 or by sending an e-mail request

to Voyaim_literature@voya.com. |

| You

may elect to receive all future reports in paper free of charge. If you received this document in the mail, please follow

the instructions to elect to continue receiving paper copies of your shareholder reports. If you received this document through

a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies

of your shareholder reports. If you invest directly with us, you can call 1-800-992-0180 or send an email request to Voyaim_literature@voya.com

to let a fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports

in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held

with the Voya funds complex if you invest directly with the funds. |

| This

report is submitted for general information to shareholders of the Voya mutual funds. It is not authorized for distribution

to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the fund’s

investment objectives, risks, charges, expenses and other information. This information should be read carefully. |

|  | E-Delivery

Sign-up – details inside |

INVESTMENT

MANAGEMENT

voyainvestments.com |

|

TABLE

OF CONTENTS

| Go Paperless with E-Delivery! |

|

Sign up now for on-line prospectuses, fund reports, and proxy statements.

Just go to individuals.voya.com/page/e-delivery, follow the directions and complete the quick 5 Steps to Enroll.

You will be notified by e-mail when these communications become available on the internet. |

PROXY

VOTING INFORMATION

A

description of the policies and procedures that the Fund uses to determine how to vote proxies related to portfolio securities

is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the Fund’s

website at www.voyainvestments.com and (3) on the U.S. Securities and Exchange Commission’s (“SEC’s”)

website at www.sec.gov. Information regarding how the Fund voted proxies related to portfolio securities during the most recent

12-month period ended June 30 is available without charge on the Fund’s website at www.voyainvestments.com and on the SEC’s

website at www.sec.gov.

QUARTERLY

PORTFOLIO HOLDINGS

The

Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form

NPORT-P. The Fund’s Forms NPORT-P are available on the SEC’s website at www.sec.gov. The Fund’s complete schedule

of portfolio holdings is available at: www.voyainvestments.com and without charge upon request from the Fund by calling Shareholder

Services toll-free at (800) 992-0180.

STATEMENT

OF ASSETS AND LIABILITIES as of August 31, 2023 (Unaudited)

| ASSETS: | |

|

| |

| Investments in securities at fair value* | |

|

$ |

107,189,118 | |

| Short-term investments at fair value† | |

|

339,000 | |

| Cash | |

|

226,652 | |

| Cash pledged as collateral for OTC derivatives

(Note 2) | |

|

500,000 | |

| Foreign currencies at value‡ | |

|

53,597 | |

| Receivables: | |

|

| |

| Investment securities and currencies

sold | |

|

31,193 | |

| Dividends | |

|

240,635 | |

| Interest | |

|

5,279 | |

| Foreign tax reclaims | |

|

16,765 | |

| Prepaid expenses | |

|

| 134 | |

| Reimbursement due

from Investment Adviser | |

|

| 2,266 | |

| Other

assets | |

|

| 5,967 | |

| Total

assets | |

|

| 108,610,606 | |

| | |

|

| | |

| LIABILITIES: | |

|

| | |

| Payable for investment

securities and currencies purchased | |

|

| 30,994 | |

| Payable for investment

management fees | |

|

| 105,897 | |

| Payable to trustees

under the deferred compensation plan (Note 6) | |

|

| 5,967 | |

| Payable for trustee

fees | |

|

| 272 | |

| Payable for foreign

capital gains tax | |

|

| 521,511 | |

| Other accrued expenses

and liabilities | |

|

| 127,857 | |

| Written

options, at fair value^ | |

|

| 295,814 | |

| Total

liabilities | |

|

| 1,088,312 | |

| NET

ASSETS | |

|

$ | 107,522,294 | |

| | |

|

| | |

| NET

ASSETS WERE COMPRISED OF: | |

|

| | |

| Paid-in capital | |

|

$ | 188,242,456 | |

| Total

distributable loss | |

|

| (80,720,162 | ) |

| NET

ASSETS | |

|

$ | 107,522,294 | |

| | |

|

| | |

| * Cost

of investments in securities | |

|

$ | 109,181,795 | |

| † Cost

of short-term investments | |

|

$ | 339,000 | |

| ‡ Cost

of foreign currencies | |

|

$ | 54,021 | |

| ^ Premiums

received on written options | |

|

$ | 475,107 | |

| | |

|

| | |

| Net assets | |

|

$ | 107,522,294 | |

| Shares authorized | |

|

| unlimited | |

| Par value | |

|

$ | 0.010 | |

| Shares outstanding | |

|

| 18,255,207 | |

| Net asset value † | |

|

$ | 5.89 | |

See

Accompanying Notes to Financial Statements

STATEMENT

OF OPERATIONS for the six months ended August 31, 2023 (Unaudited)

| INVESTMENT INCOME: | |

| |

| Dividends, net of foreign taxes withheld* | |

$ |

2,628,221 | |

| Interest | |

|

6,227 | |

| Other | |

|

371 | |

| Total investment

income | |

|

2,634,819 | |

| | |

|

| |

| EXPENSES: | |

| | |

| Investment management

fees | |

| 638,214 | |

| Transfer agent fees | |

| 5,549 | |

| Shareholder reporting

expense | |

| 23,184 | |

| Professional fees | |

| 32,105 | |

| Custody and accounting

expense | |

| 74,897 | |

| Trustee fees | |

| 1,363 | |

| Miscellaneous

expense | |

| 18,137 | |

| Total expenses | |

| 793,449 | |

| Waived

and reimbursed fees | |

| (15,230 | ) |

| Net

expenses | |

| 778,219 | |

| Net

investment income | |

| 1,856,600 | |

| REALIZED

AND UNREALIZED GAIN (LOSS): | |

| | |

| Net realized gain

(loss) on: | |

| | |

| Investments

(net of foreign capital gains taxes withheld^) | |

| (909,232 | ) |

| Forward foreign currency

contracts | |

| (2,853 | ) |

| Foreign currency related

transactions | |

| (38,738 | ) |

| Written

options | |

| 1,192,717 | |

| Net

realized gain | |

| 241,894 | |

| | |

| | |

| Net change in unrealized

appreciation (depreciation) on: | |

| | |

| Investments

(net of foreign capital gains taxes accrued#) | |

| 1,379,020 | |

| Foreign currency related

transactions | |

| 14,361 | |

| Written

options | |

| (273,609 | ) |

| Net

change in unrealized appreciation (depreciation) | |

| 1,119,772 | |

| Net

realized and unrealized gain | |

| 1,361,666 | |

| Increase

in net assets resulting from operations | |

$ | 3,218,266 | |

| | |

| | |

| * Foreign

taxes withheld | |

$ | 338,417 | |

| ^ Foreign

capital gains taxes withheld | |

$ | 68,769 | |

| # Change

in foreign capital gains taxes accrued | |

$ | 113,331 | |

See

Accompanying Notes to Financial Statements

STATEMENTS

OF CHANGES IN NET ASSETS

| | |

Six

Months Ended August

31, 2023 (Unaudited) | | |

Year

Ended February

28, 2023 | |

| FROM OPERATIONS: | |

| | | |

| | |

| Net investment income | |

$ | 1,856,600 | | |

$ | 3,406,530 | |

| Net realized gain (loss) | |

| 241,894 | | |

| (1,977,003 | ) |

| Net change in unrealized appreciation (depreciation) | |

| 1,119,772 | | |

| (18,471,884 | ) |

| Increase (decrease) in net assets resulting

from operations | |

| 3,218,266 | | |

| (17,042,357 | ) |

| | |

| | | |

| | |

| FROM DISTRIBUTIONS TO SHAREHOLDERS: | |

| | | |

| | |

| Total distributions (excluding return of capital) | |

| (1,631,959 | ) | |

| (3,318,963 | ) |

| Return of capital | |

| (3,304,659 | ) | |

| (10,132,204 | ) |

| Total distributions | |

| (4,936,618 | ) | |

| (13,451,167 | ) |

| | |

| | | |

| | |

| FROM CAPITAL SHARE TRANSACTIONS: | |

| | | |

| | |

| Cost of shares repurchased | |

| (606,825 | ) | |

| (3,845,843 | ) |

| Net decrease in net assets resulting from capital

share transactions | |

| (606,825 | ) | |

| (3,845,843 | ) |

| Net decrease in net assets | |

| (2,325,177 | ) | |

| (34,339,367 | ) |

| | |

| | | |

| | |

| NET ASSETS: | |

| | | |

| | |

| Beginning of year or period | |

| 109,847,471 | | |

| 144,186,838 | |

| End of year or period | |

$ | 107,522,294 | | |

$ | 109,847,471 | |

See

Accompanying Notes to Financial Statements

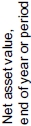

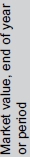

FINANCIAL

HIGHLIGHTS

Selected

data for a share of beneficial interest outstanding throughout each year or period.

| | |

Per

Share Operating Performance | |

Ratios

and Supplemental Data |

| | |

| |

Income

(loss) from

investment

operations | |

| |

Less

Distributions | |

| |

| |

| |

| |

| |

| |

| |

Ratios

to average

net assets | |

|

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

Year

or

period ended | |

($) | |

($) | |

($) | |

($) | |

($) | |

($) | |

($) | |

($) | |

($) | |

($) | |

($) | |

(%) | |

(%) | |

($000’s) | |

(%) | |

(%) | |

(%) | |

(%) |

| 08-31-23+ | |

5.98 | |

0.10• | |

0.08 | |

0.18 | |

0.09 | |

— | |

0.18 | |

0.27 | |

— | |

5.89 | |

5.09 | |

3.60 | |

1.98 | |

107,522 | |

1.43 | |

1.40 | |

3.35 | |

38 |

| 02-28-23 | |

7.57 | |

0.18• | |

(1.05) | |

(0.87) | |

0.18 | |

— | |

0.54 | |

0.72 | |

— | |

5.98 | |

5.25 | |

(10.21) | |

(14.26) | |

109,847 | |

1.43 | |

1.40 | |

2.85 | |

70 |

| 02-28-22 | |

8.49 | |

0.14• | |

(0.34) | |

(0.20) | |

0.11 | |

— | |

0.61 | |

0.72 | |

— | |

7.57 | |

6.96 | |

(2.15) | |

(3.93) | |

144,187 | |

1.35 | |

1.35 | |

1.68 | |

66 |

| 02-28-21 | |

7.61 | |

0.11• | |

1.49 | |

1.60 | |

0.09 | |

— | |

0.63 | |

0.72 | |

— | |

8.49 | |

7.95 | |

24.24 | |

32.34 | |

161,564 | |

1.36 | |

1.36 | |

1.46 | |

55 |

| 02-29-20 | |

8.89 | |

0.19 | |

(0.74) | |

(0.55) | |

0.28 | |

— | |

0.45 | |

0.73 | |

— | |

7.61 | |

6.69 | |

(6.03) | |

(12.67) | |

144,923 | |

1.39 | |

1.39 | |

2.29 | |

103 |

| 02-28-19 | |

9.87 | |

0.20 | |

(0.44) | |

(0.24) | |

0.17 | |

— | |

0.57 | |

0.74 | |

— | |

8.89 | |

8.41 | |

(1.39) | |

(2.23) | |

169,189 | |

1.47 | |

1.47 | |

2.21 | |

53 |

| 02-28-18 | |

9.24 | |

0.18 | |

1.19 | |

1.37 | |

0.18 | |

— | |

0.56 | |

0.74 | |

— | |

9.87 | |

9.42 | |

15.77 | |

22.67 | |

187,770 | |

1.44 | |

1.44 | |

1.82 | |

41 |

| 02-28-17 | |

7.81 | |

0.18 | |

2.13 | |

2.31 | |

0.19 | |

— | |

0.69 | |

0.88 | |

— | |

9.24 | |

8.32 | |

32.30 | |

38.66 | |

175,716 | |

1.43 | |

1.43 | |

2.06 | |

39 |

| 02-29-16 | |

11.57 | |

0.20 | |

(2.92) | |

(2.72) | |

0.21 | |

— | |

0.83 | |

1.04 | |

— | |

7.81 | |

6.71 | |

(23.98)(5) | |

(28.30) | |

152,682 | |

1.47 | |

1.47 | |

1.99 | |

30 |

| 02-28-15 | |

12.50 | |

0.30• | |

(0.08) | |

0.22 | |

0.34 | |

— | |

0.81 | |

1.15 | |

— | |

11.57 | |

10.54 | |

2.21 | |

2.01 | |

226,152 | |

1.42 | |

1.42 | |

2.35 | |

40 |

| 02-28-14 | |

14.53 | |

0.34• | |

(1.17) | |

(0.83) | |

0.29 | |

— | |

1.00 | |

1.29 | |

0.09 | |

12.50 | |

11.41 | |

(4.89)(a) | |

(16.62) | |

244,220 | |

1.41 | |

1.41 | |

2.58 | |

50 |

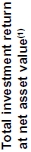

| (1) | Total

investment return at net asset value has been calculated assuming a purchase at net asset

value at the beginning of each period and a sale at net asset value at the end of each

period and assumes reinvestment of dividends, capital gain distributions and return of

capital distributions/allocations, if any, in accordance with the provisions of the dividend

reinvestment plan. Total investment return at net asset value is not annualized for periods

less than one year. |

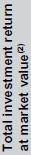

| (2) | Total

investment return at market value measures the change in the market value of your investment

assuming reinvestment of dividends, capital gain distributions and return of capital

distributions/allocations, if any, in accordance with the provisions of the Fund’s

dividend reinvestment plan. Total investment return at market value is not annualized

for periods less than one year. |

| (3) | Annualized

for periods less than one year. |

| (4) | The

Investment Adviser has entered into a written expense limitation agreement with the Fund

under which it will limit the expenses of the Fund (excluding interest, taxes, investment-related

costs, leverage expenses, extraordinary expenses and acquired fund fees and expenses)

subject to possible recoupment by the Investment Adviser within three years of being

incurred. |

| (5) | Excluding

amounts related to a foreign currency settlement recorded in the fiscal year ended February

29, 2016, total return would have been (24.08)%. |

| (a) | On

April 23, 2013, NNIP Advisers B.V. made a payment of $1,730,621 to reimburse the Fund

for the foregone investment opportunities attributable to available cash amounts not

properly reported on their portfolio management reporting system. Excluding this payment

by affiliate for the year ended February 28, 2014, total investment return at net asset

value would have been (5.57)%. |

| • | Calculated

using average number of shares outstanding throughout the year or period. |

See

Accompanying Notes to Financial Statements

NOTES

TO FINANCIAL STATEMENTS as of August 31, 2023 (Unaudited)

NOTE

1 — ORGANIZATION

Voya

Emerging Markets High Dividend Equity Fund (the “Fund”) is a diversified, closed-end management investment company

registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund is organized as a Delaware

statutory trust.

Voya

Investments, LLC (“Voya Investments” or the “Investment Adviser”), an Arizona limited liability company,

serves as the Investment Adviser to the Fund. The Investment Adviser has engaged Voya Investment Management Co. LLC (“Voya

IM” or the “Sub-Adviser”), a Delaware limited liability company, to serve as the Sub-Adviser to the Fund.

NOTE

2 — SIGNIFICANT ACCOUNTING POLICIES

The

following significant accounting policies are consistently followed by the Fund in the preparation of its financial statements.

The Fund is considered an investment company under U.S. generally accepted accounting principles (“GAAP”) and follows

the accounting and reporting guidance applicable to investment companies.

A.

Security Valuation. The Fund is open for business every day the New York Stock Exchange (“NYSE”) opens

for regular trading (each such day, a “Business Day”). The net asset value (“NAV”) per share for each

class of the Fund is determined each Business Day as of the close of the regular trading session (“Market Close”),

as determined by the Consolidated Tape Association (“CTA”), the central distributor of transaction prices for exchange-traded

securities (normally 4:00 p.m. Eastern time unless otherwise designated by the CTA). The NAV per share of each class of the Fund

is calculated by taking the value of the Fund’s assets attributable to that class, subtracting the Fund’s liabilities

attributable to that class, and dividing by the number of shares of that class that are outstanding. On days when the Fund is

closed for business, Fund shares will not be priced and the Fund does not transact purchase and redemption orders. To the extent

the Fund’s assets are traded in other markets on days when the Fund does not price its shares, the value of the Fund’s

assets will likely change and you will not be able to purchase or redeem shares of the Fund.

Portfolio

securities for which market quotations are readily available are valued at market value. Investments in open-end registered investment

companies that do not trade on an exchange are valued at the end of day NAV per share. The prospectuses of the open-end registered

investment companies in which the Fund may invest explain the circumstances under which they will use fair value pricing and the

effects of using fair value pricing. Foreign securities’ prices are converted into U.S. dollar amounts using the

applicable

exchange rates as of Market Close.

When

a market quotation for a portfolio security is not readily available or is deemed unreliable (for example when trading has been

halted or there are unexpected market closures or other material events that would suggest that the market quotation is unreliable)

and for purposes of determining the value of other Fund assets, the asset is priced at its fair value. The Board has designated

the Investment Adviser, as the valuation designee, to make fair value determinations in good faith. In determining the fair value

of the Fund’s assets, the Investment Adviser, pursuant to its fair valuation policy, may consider inputs from pricing service

providers, broker-dealers, or the Fund’s sub-adviser(s). Issuer specific events, transaction price, position size, nature

and duration of restrictions on disposition of the security, market trends, bid/ask quotes of brokers and other market data may

be reviewed in the course of making a good faith determination of an asset’s fair value. Because trading hours for certain

foreign securities end before Market Close, closing market quotations may become unreliable. The prices of foreign securities

will generally be adjusted based on inputs from an independent pricing service that are intended to reflect valuation changes

through the NYSE close. Because of the inherent uncertainties of fair valuation, the values used to determine the Fund’s

NAV may materially differ from the value received upon actual sale of those investments. Thus, fair valuation may have an unintended

dilutive or accretive effect on the value of shareholders’ investments in the Fund.

The

Fund’s financial instruments are valued at the close of the NYSE and are reported at fair value, which GAAP defines as the

price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants

at the measurement date.

Various

valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following

fair value hierarchy that categorizes the inputs used to measure fair value:

Level

1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting

date.

Level

2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited

to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments

in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads).

Level

3 – unobservable inputs (including the fund’s own assumptions in determining fair value).

NOTES

TO FINANCIAL STATEMENTS as of August 31, 2023 (Unaudited) (continued)

NOTE

2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

Observable

inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect

the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which

market data are not available and are developed using the best information available about the assumptions that market participants

would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs

and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned

to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial

instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that

level but rather the degree of judgment used in determining those values.

A

table summarizing the Fund’s investments under these levels of classification is included within the Portfolio of Investments.

Each

investment asset or liability of the Fund is assigned a level at measurement date based on the significance and source of the

inputs to its valuation. Quoted prices in active markets for identical securities are classified as “Level 1,” inputs

other than quoted prices for an asset or liability that are observable are classified as “Level 2” and significant

unobservable inputs, including the Sub-Adviser’s or Pricing Committee’s judgment about

the assumptions that a market participant would use in pricing an asset or liability are classified as “Level 3.”

The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

Short-term securities of sufficient credit quality are generally considered to be Level 2 securities under applicable accounting

rules. A table summarizing the Fund’s investments under these levels of classification is included within the Portfolio

of Investments.

GAAP

requires a reconciliation of the beginning to ending balances for reported fair values that presents changes attributable to total

realized and unrealized gains or losses, purchases and sales, and transfers in or out of the Level 3 category during the period.

A reconciliation of Level 3 investments within the Portfolio of Investments is presented only when the Fund has a significant

amount of Level 3 investments.

B.

Securities Transactions and Revenue Recognition. Securities transactions are recorded on the trade date. Realized

gains or losses on sales of investments are calculated on the identified cost basis. Interest income is

recorded on the accrual

basis. Premium amortization and discount accretion are determined using the effective yield method. Dividend income is recorded

on the ex-dividend date, or in the case of some foreign dividends, when the information becomes available to the Fund.

C.

Foreign Currency Translation. The books and records of the Fund are maintained in U.S. dollars. Any foreign currency

amounts are translated into U.S. dollars on the following basis:

| (1) | Market

value of investment securities, other assets and liabilities — at the exchange

rates prevailing at Market Close. |

| (2) | Purchases

and sales of investment securities, income and expenses — at the rates of exchange

prevailing on the respective dates of such transactions. |

Although

the net assets and the market values are presented at the foreign exchange rates at Market Close, the Fund does not isolate the

portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising

from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gains or

losses from investments. For securities, which are subject to foreign withholding tax upon disposition, liabilities are recorded

on the Statement of Assets and Liabilities for the estimated tax withholding based on the securities’ current market value.

Upon disposition, realized gains or losses on such securities are recorded net of foreign withholding tax.

Reported

net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between

the trade and settlement dates on securities transactions, the difference between the amounts of dividends, interest, and foreign

withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid.

Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments

in securities, resulting from changes in the exchange rate. Foreign security and currency transactions may involve certain considerations

and risks not typically associated with investing in U.S. companies and U.S. government securities. These risks include, but are

not limited to, revaluation of currencies and future adverse political and economic developments which could cause securities

and their markets to be less liquid and prices more volatile than those of comparable U.S. companies and U.S. government securities.

The foregoing risks are even greater with respect to securities of issuers in emerging markets.

NOTES

TO FINANCIAL STATEMENTS as of August 31, 2023 (Unaudited) (continued)

NOTE

2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

D.

Distributions to Shareholders. The Fund intends to make quarterly distributions from its cash available for distribution,

which consists of the Fund’s dividends and interest income after payment of Fund expenses, net option premiums and net realized

and unrealized gains on investments. Such quarterly distributions may also consist of return of capital. At least annually, the

Fund intends to distribute all or substantially all of its net realized capital gains. Distributions are recorded on the ex-dividend

date. Distributions are determined annually in accordance with federal tax regulations, which may differ from GAAP for investment

companies.

The

tax treatment and characterization of the Fund’s distributions may vary significantly from time to time depending on whether

the Fund has gains or losses on the call options written in its portfolio versus gains or losses on the equity securities in the

portfolio. Each quarter, the Fund will provide disclosures with distribution payments made that estimate the percentages of that

distribution that represent net investment income, other income or capital gains, and return of capital, if any. The final composition

of the tax characteristics of the distributions cannot be determined with certainty until after the end of the Fund’s tax

year, and will be reported to shareholders at that time. A significant portion of the Fund’s distributions may constitute

a return of capital. The amount of quarterly distributions will vary, depending on a number of factors. As portfolio and market

conditions change, the rate of dividends on the common shares will change. There can be no assurance that the Fund will be able

to declare a dividend in each period.

E.

Federal Income Taxes. It is the policy of the Fund to comply with the requirements of subchapter M of the Internal

Revenue Code that are applicable to regulated investment companies and to distribute substantially all of its net investment income

and any net realized capital gains to its shareholders. Therefore, a federal income tax or excise tax provision is not required.

Management has considered the sustainability of the Fund’s tax positions taken on federal income tax returns for all open

tax years in making this determination. The Fund may utilize equalization accounting for tax purposes, whereby a portion of redemption

payments are treated as distributions of income or gain.

F.

Use of Estimates. The preparation of financial statements in conformity with GAAP requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent

assets

and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from

operations during the reporting period. Actual results could differ from those estimates.

G.

Risk Exposures and the Use of Derivative Instruments. The Fund’s investment objectives permit the Fund to

enter into various types of derivatives contracts, including, but not limited to, forward foreign currency exchange contracts

and purchased and written options. In doing so, the Fund will employ strategies in differing combinations to permit it to increase

or decrease the level of risk, or change the level or types of exposure to risk factors. This may allow the Fund to pursue its

objectives more quickly and efficiently than if it were to make direct purchases or sales of securities capable of affecting a

similar response to market or credit factors.

In

pursuit of its investment objectives, the Fund may seek to increase or decrease its exposure to the following market or credit

risk factors:

Credit

Risk. The price of a bond or other debt instrument is likely to fall if the issuer’s actual or perceived financial

health deteriorates, whether because of broad economic or issuer-specific reasons. In certain cases, the issuer could be late

in paying interest or principal, or could fail to pay its financial obligations altogether.

Equity

Risk. Stock prices may be volatile or have reduced liquidity in response to real or perceived impacts of factors including,

but not limited to, economic conditions, changes in market interest rates, and political events. Stock markets tend to be cyclical,

with periods when stock prices generally rise and periods when stock prices generally decline. Any given stock market segment

may remain out of favor with investors for a short or long period of time, and stocks as an asset class may underperform bonds

or other asset classes during some periods. Additionally, legislative, regulatory or tax policies or developments in these areas

may adversely impact the investment techniques available to a manager, add to costs and impair the ability of the Fund to achieve

its investment objectives.

Foreign

Exchange Rate Risk. To the extent that the Fund invests directly in foreign (non-U.S.) currencies or in securities denominated

in, or that trade in, foreign (non-U.S.) currencies, it is subject to the risk that those foreign (non-U.S.) currencies will decline

in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative

to the currency being hedged by the Fund through foreign currency exchange transactions.

Currency

rates may fluctuate significantly over short periods of time. Currency rates may be affected by changes in market interest rates,

intervention (or the failure

NOTES

TO FINANCIAL STATEMENTS as of August 31, 2023 (Unaudited) (continued)

NOTE

2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

to

intervene) by U.S. or foreign governments, central banks or supranational entities such as the International Monetary Fund, by

the imposition of currency controls, or other political or economic developments in the United States or abroad.

Interest

Rate Risk. Changes in short-term market interest rates will directly affect the yield on Common Shares. If short-term

market interest rates fall, the yield on Common Shares will also fall. To the extent that the interest rate spreads on loans in

the Fund’s portfolio experience a general decline, the yield on the Common Shares will fall and the value of the Fund’s

assets may decrease, which will cause the Fund’s NAV to decrease. Conversely, when short-term market interest rates rise,

because of the lag between changes in such short-term rates and the resetting of the floating rates on assets in the Fund’s

portfolio, the impact of rising rates will be delayed to the extent of such lag. With respect to investments in fixed rate instruments,

a rise in market interest rates generally causes values of such instruments to fall. The values of fixed rate instruments with

longer maturities or duration are more sensitive to changes in market interest rates.

As

of the date of this report, the United States experiences a rising market interest rate environment, which may increase the Fund’s

exposure to risks associated with rising market interest rates. Rising market interest rates have unpredictable effects on the

markets and may expose fixed-income and related markets to heightened volatility which could reduce liquidity for certain investments,

adversely affect values, and increase costs. If dealer capacity in fixed-income and related markets is insufficient for market

conditions, it may further inhibit liquidity and increase volatility in the fixed-income and related markets. Further, recent

and potential changes in government policy may affect interest rates.

Risks

of Investing in Derivatives. The Fund’s use of derivatives can result in losses due to unanticipated changes in

the market or credit risk factors and the overall market. In instances where the Fund is using derivatives to decrease, or hedge,

exposures to market or credit risk factors for securities held by the Fund, there are also risks that those derivatives may not

perform as expected, resulting in losses for the combined or hedged positions.

Derivative

instruments are subject to a number of risks, including the risk of changes in the market price of the underlying securities,

credit risk with respect to the counterparty, risk of loss due to changes in market interest rates and liquidity and volatility

risk. The amounts required to purchase certain derivatives may be small relative to the magnitude of exposure assumed by the Fund.

Therefore,

the

purchase of certain derivatives may have an economic leveraging effect on the Fund and exaggerate any increase or decrease in

the NAV. Derivatives may not perform as expected, so the Fund may not realize the intended benefits. When used for hedging purposes,

the change in value of a derivative may not correlate as expected with the currency, security or other risk being hedged. When

used as an alternative or substitute for direct cash investments, the return provided by the derivative may not provide the same

return as direct cash investment. In addition, given their complexity, derivatives expose the Fund to the risk of improper valuation.

Generally,

derivatives are sophisticated financial instruments whose performance is derived, at least in part, from the performance of an

underlying asset or assets. Derivatives include, among other things, swap agreements, options, forwards and futures. Investments

in derivatives are generally negotiated over-the-counter (“OTC”), with a single counterparty and as a result are subject

to credit risks related to the counterparty’s ability or willingness to perform its obligations; any deterioration in the

counterparty’s creditworthiness could adversely affect the value of the derivative. In addition, derivatives and their underlying

securities may experience periods of illiquidity which could cause the Fund to hold a security it might otherwise sell, or to

sell a security it otherwise might hold at inopportune times or at an unanticipated price. A manager might imperfectly judge the

direction of the market. For instance, if a derivative is used as a hedge to offset investment risk in another security, the hedge

might not correlate to the market’s movements and may have unexpected or undesired results such as a loss or a reduction

in gains.

Counterparty

Credit Risk and Credit Related Contingent Features. Certain derivative positions are subject to counterparty credit risk,

which is the risk that the counterparty will not fulfill its obligation to the Fund. The Fund’s derivative counterparties

are financial institutions who are subject to market conditions that may weaken their financial position. The Fund intends to

enter into financial transactions with counterparties that it believes to be creditworthy at the time of the transaction. To reduce

this risk, the Fund generally enters into master netting arrangements, established within the Fund’s International Swap

and Derivatives Association, Inc. (“ISDA”) Master Agreements (“Master Agreements”). These agreements are

with select counterparties and they govern transactions, including certain OTC derivative and forward foreign currency contracts,

entered into by the Fund and the counterparty. The Master Agreements maintain provisions for general obligations, representations,

agreements, collateral, and events of default or termination. The occurrence of a specified event of termination may give a counterparty

the right to terminate all of its contracts and

NOTES

TO FINANCIAL STATEMENTS as of August 31, 2023 (Unaudited) (continued)

NOTE

2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

affect

settlement of all outstanding transactions under the applicable Master Agreement.

The

Fund may also enter into collateral agreements with certain counterparties to further mitigate counterparty credit risk associated

with OTC derivative and forward foreign currency contracts. Subject to established minimum levels, collateral is generally determined

based on the net aggregate unrealized gain or loss on contracts with a certain counterparty. Collateral pledged to the Fund is

held in a segregated account by a third-party agent and can be in the form of cash or debt securities issued by the U.S. government

or related agencies.

The

Fund’s maximum risk of loss from counterparty credit risk on OTC derivatives is generally the aggregate unrealized gain

in excess of any collateral pledged by the counterparty to the Fund. For purchased OTC options, the Fund bears the risk of loss

in the amount of the premiums paid and the change in market value of the options should the counterparty not perform under the

contracts. The Fund did not enter into any purchased OTC options during the period ended August 31, 2023.

The

Fund’s master agreements with derivative counterparties have credit related contingent features that if triggered would

allow its derivatives counterparties to close out and demand payment or additional collateral to cover their exposure from the

Fund. Credit related contingent features are established between the Fund and its derivatives counterparties to reduce the risk

that the Fund will not fulfill its payment obligations to its counterparties. These triggering features include, but are not limited

to, a percentage decrease in the Fund’s net assets and/or a percentage decrease in the Fund’s NAV, which could cause

the Fund to accelerate payment of any net liability owed to the counterparty. The contingent features are established within the

Fund’s Master Agreements.

Written

options by the Fund do not give rise to counterparty credit risk, as written options obligate the Fund to perform and not the

counterparty. As of August 31, 2023, the total value of open written OTC call options subject to Master Agreements in a liability

position was $295,814. If a contingent feature had been triggered, the Fund could have been required to pay this amount in cash

to its counterparties. At August 31, 2023, the Fund pledged $500,000 in cash collateral for its open written OTC call options

at period end. There were no credit events during the period ended August 31, 2023 that triggered any credit related contingent

features.

H.

Options Contracts. The Fund may purchase put and call options and may write (sell) put options and covered call

options. The premium received by the Fund upon the writing of a put or call option is included in the Statement of Assets and

Liabilities as a liability which is subsequently marked-to-market until it is exercised or closed, or it expires. The Fund will

realize a gain or loss upon the expiration or closing of the option contract. When an option is exercised, the proceeds on sales

of the underlying security for a written call option or purchased put option or the purchase cost of the security for a written

put option or a purchased call option is adjusted by the amount of premium received or paid. The risk in writing a call option

is that the Fund gives up the opportunity for profit if the market price of the security increases and the option is exercised.

The risk in buying an option is that the Fund pays a premium whether or not the option is exercised. Risks may also arise from

an illiquid secondary market or from the inability of counterparties to meet the terms of the contract.

The

Fund seeks to generate gains from the OTC call options writing strategy over a market cycle to supplement the dividend yield of

its underlying portfolio of high dividend yield equity securities.

During

the period ended August 31, 2023, the Fund had an average notional amount of $21,579,354 on written equity options. Please refer

to the table within the Portfolio of Investments for open written equity options at August 31, 2023.

I.

Indemnifications. In the normal course of business, the Fund may enter into contracts that provide certain indemnifications.

The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and,

therefore, cannot be estimated; however, based on experience, management considers the risk of loss from such claims remote.

NOTE

3 — INVESTMENT TRANSACTIONS

The

cost of purchases and the proceeds from sales of investments for the period ended August 31, 2023, excluding short-term securities,

were $41,094,099 and $43,138,054, respectively.

NOTE

4 — INVESTMENT MANAGEMENT FEES

The

Fund has entered into an investment management agreement (“Management Agreement”) with the Investment Adviser. The

Investment Adviser has overall responsibility for the management of the Fund. The Investment Adviser oversees all investment management

and portfolio management services for the Fund and assists in managing and supervising all aspects of the general day-to-day business

activities and operations of the Fund, including custodial, transfer agency, dividend

NOTES

TO FINANCIAL STATEMENTS as of August 31, 2023 (Unaudited) (continued)

NOTE

4 — INVESTMENT MANAGEMENT FEES (continued)

disbursing,

accounting, auditing, compliance and related services. This Management Agreement compensates the Investment Adviser with a management

fee, payable monthly, based on an annual rate of 1.15% of the Fund’s average daily managed assets. For purposes of the Management

Agreement, managed assets are defined as the Fund’s average daily gross asset value, minus the sum of the Fund’s accrued

and unpaid dividends on any outstanding preferred shares and accrued liabilities (other than liabilities for the principal amount

of any borrowings incurred, commercial paper or notes issued by the Fund and the liquidation preference of any outstanding preferred

shares). As of August 31, 2023, there were no preferred shares outstanding.

The

Investment Adviser has entered into a sub-advisory agreement with Voya IM. Voya IM provides investment advice for the Fund and

is paid by the Investment Adviser based on the average daily managed assets of the Fund. Subject to policies as the Board or the

Investment Adviser may determine, Voya IM manages the Fund’s assets in accordance with the Fund’s investment objectives,

policies and limitations.

NOTE

5 — EXPENSE LIMITATION AGREEMENT

The

Investment Adviser has entered into a written expense limitation agreement (“Expense Limitation Agreement”) with the

Fund under which it will limit the expenses of the Fund, excluding interest, taxes, investment-related costs, leverage expenses,

extraordinary expenses, and acquired fund fees and expenses to 1.40% of average daily managed assets.

The

Investment Adviser may at a later date recoup from the Fund for fees waived and/or other expenses reimbursed by the Investment

Adviser during the previous 36 months, but only if, after such recoupment, the Fund’s expense ratio does not exceed the

percentage described above.

Waived

and reimbursed fees net of any recoupment by the Investment Adviser of such waived and reimbursed fees are reflected on the accompanying

Statement of Operations. Amounts payable by the Investment Adviser are reflected on the accompanying Statement of Assets and Liabilities.

As

of August 31, 2023, the amounts of waived and/or reimbursed fees that are subject to possible recoupment by the Investment Adviser

and the related expiration dates are as follows:

| August

31, | | |

| |

| 2024 | | |

2025 | | |

2026 | | |

Total | |

| $ | — | | |

$ | 4,597 | | |

$ | 41,256 | | |

$ | 45,853 | |

The

Expense Limitation Agreement is contractual through March 1, 2024 and shall renew automatically for one-year terms. Termination

or modification of this obligation requires approval by the Board.

NOTE

6 — OTHER TRANSACTIONS WITH AFFILIATES AND RELATED PARTIES

The

Fund has adopted a deferred compensation plan (the “DC Plan”), which allows eligible independent trustees, as described

in the DC Plan, to defer the receipt of all or a portion of the trustees’ fees that they are entitled to receive from the

Fund. For purposes of determining the amount owed to the trustee under the DC Plan, the amounts deferred are invested in shares

of the funds selected by the trustee (the “Notional Funds”). When the Fund purchases shares of the Notional Funds,

which are all advised by Voya Investments, in amounts equal to the trustees’ deferred fees, this results in a Fund asset

equal to the deferred compensation liability. Such assets, if applicable, are included as a component of “Other assets”

on the accompanying Statement of Assets and Liabilities. Deferral of trustees’ fees under the DC Plan will not affect net

assets of the Fund, and will not materially affect the Fund’s assets, liabilities or net investment income per share. Amounts

will be deferred until distributed in accordance with the DC Plan.

NOTE

7 — CAPITAL SHARES

Transactions

in capital shares and dollars were as follows:

| | |

Shares

repurchased | |

Net

increase

(decrease)

in

shares

outstanding | |

Shares

repurchased | |

Net

increase

(decrease) |

| Year

or period ended | |

# | |

# | |

($) | |

($) |

| 8/31/2023 | |

(115,044) | |

(115,044) | |

(606,825) | |

(606,825) |

| 2/28/2023 | |

(669,038) | |

(669,038) | |

(3,845,843) | |

(3,845,843) |

NOTES

TO FINANCIAL STATEMENTS as of August 31, 2023 (Unaudited) (continued)

NOTE

7 — CAPITAL SHARES (continued)

Share

Repurchase Program

Effective

April 1, 2023, pursuant to an open-market share repurchase program, the Fund may purchase, over the period ending March 31, 2024,

up to 10% of its stock in open-market transactions. Previously, pursuant to an open-market share repurchase program effective

April 1, 2022, the Fund could have purchased, over the one year period ended March 31, 2023, up to 10% of its stock in open-market

transactions. The amount and timing of the repurchases will be at the discretion of the Fund’s management, subject to market

conditions and investment considerations. There is no assurance that the Fund will purchase shares at any particular discount

level or in any particular amounts. Any repurchases made under this program would be made on a national securities exchange at

the prevailing market price, subject to exchange requirements and volume, timing and other limitations under federal securities

laws. The share repurchase program seeks to enhance shareholder value

by

purchasing shares trading at a discount from their NAV per share. The open-market share repurchase program does not obligate the

Fund to repurchase any dollar amount or number of shares of its stock.

For

the six-month period ended August 31, 2023, the Fund repurchased 115,044 shares, representing approximately 0.63% of the Fund’s

outstanding shares for a net purchase price of $606,825 (including commissions of $2,876). Shares were repurchased at a weighted-average

discount from NAV per share of 13.12% and a weighted-average price per share of $5.25.

For

the year ended February 28, 2023, the Fund repurchased 669,038 shares, representing approximately 3.64% of the Fund’s outstanding

shares for a net purchase price of $3,845,843 (including commissions of $16,726). Shares were repurchased at a weighted-average

discount from NAV per share of 12.03% and a weighted-average price per share of $5.72.

NOTE

8 — FEDERAL INCOME TAXES

The

amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income

tax regulations, which may differ from GAAP for investment companies. These book/ tax differences may be either temporary or permanent.

Permanent differences are reclassified within the capital accounts based on their federal tax-basis treatment; temporary differences

are not reclassified. Key differences include the treatment of foreign currency transactions, income from passive foreign investment

companies (PFICs), and wash sale deferrals. Distributions in excess of net investment income and/or net realized capital gains

for tax purposes are reported as return of capital.

Dividends

paid by the Fund from net investment income and distributions of net realized short-term capital gains are, for federal income

tax purposes, taxable as ordinary income to shareholders.

The

tax composition of dividends and distributions in the current period will not be determined until after the Fund’s tax year-end

of December 31, 2023. The composition of distributions presented below may differ from amounts presented elsewhere in this report

due to differences in calculations between GAAP (book) and tax. The tax composition of dividends and distributions as of the Fund’s

most recent tax year-ends was as follows:

The

tax composition of dividends and distributions paid as of the Fund’s most recent tax year-ends was as follows:

Tax Year Ended

December 31, 2022 | | |

Tax Year Ended

December 31, 2021 | |

Ordinary

Income | | |

Return of

Capital | | |

Ordinary

Income | | |

Return of

Capital | |

| $ | 3,318,963 | | |

$ | 10,235,915 | | |

$ | 2,867,466 | | |

$ | 10,840,822 | |

The

tax-basis components of distributable earnings and the capital loss carryforwards which may be used to offset future realized

capital gains for federal income tax purposes as of December 31, 2022 were:

| Unrealized | | |

| | |

| | |

| | |

| | |

Total | |

| Appreciation/ | | |

Capital

Loss Carryforwards | | |

| | |

Distributable | |

| (Depreciation) | | |

Amount | | |

Character | | |

Expiration | | |

Other | | |

Earnings/(Loss) | |

| $ | (6,683,023) | | |

$ | (6,373,344) | | |

Short-term | | |

None | | |

$ | (3,532,268) | | |

$ | (86,914,823) | |

| | | | |

| (70,326,188) | | |

Long-term | | |

None | | |

| | | |

| | |

| | | | |

$ | (76,699,532) | | |

| | |

| | |

| | | |

| | |

The

Fund’s major tax jurisdictions are U.S. federal and Arizona state.

NOTES

TO FINANCIAL STATEMENTS as of August 31, 2023 (Unaudited) (continued)

NOTE

8 — FEDERAL INCOME TAXES (continued)

As

of August 31, 2023, no provision for income tax is required in the Fund’s financial statements as a result of tax positions

taken on federal and state income tax returns for open tax years. The Fund’s federal and state income and federal excise

tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the

Internal Revenue Service and state department of revenue. Generally, the preceding four tax years remain subject to examination

by these jurisdictions.

NOTE

9 — LONDON INTERBANK OFFERED RATE (“LIBOR”)

In

2017, the UK Financial Conduct Authority announced its intention to cease compelling banks to provide the quotations needed to

sustain LIBOR after 2021. On March 5, 2021, ICE Benchmark Administration, the administrator of LIBOR, stated that non-U.S. dollar

LIBOR reference rates and the one-week and two-month LIBOR reference rates ceased to be provided or no longer be representative

immediately after December 31, 2021 and the remaining more commonly used LIBOR settings ceased to be provided or no longer be

representative immediately after June 30, 2023. In addition, global regulators have announced that, with limited exceptions, no

new LIBOR-based contracts should be entered into after 2021. Actions by regulators have resulted in the establishment of alternative

reference rates to LIBOR in most major currencies (e.g., the Secured Overnight Financing Rate for U.S. Dollar LIBOR and the Sterling

Overnight Interbank Average Rate for Sterling LIBOR).

Discontinuance

of LIBOR and adoption/implementation of alternative rates pose a number of risks, including among others whether any substitute

rate will experience the market participation and liquidity necessary to provide a workable substitute for LIBOR; the effect on

parties’ existing contractual arrangements, hedging transactions, and investment strategies generally from a conversion

from LIBOR to alternative rates; the effect on the Fund’s existing investments (including, for example, fixed-income investments,

senior loans, CLOs and CDOs, and derivatives transactions), including the possibility that some of those investments may terminate

or their terms may be adjusted to the disadvantage of the Fund; and the risk of general market disruption during the period of

the conversion. It is difficult to predict at this time the likely impact of the transition away from LIBOR on the Fund.

NOTE

10 — MARKET DISRUPTION

The

Fund is subject to the risk that geopolitical events will disrupt securities markets and adversely affect global economies and

markets. Due to the increasing interdependence among global economies and markets, conditions in one country, market, or region

might adversely impact markets, issuers and/or foreign exchange rates in other countries, including the United States. Wars,

terrorism,

global health crises and pandemics, and other geopolitical events that have led, and may continue to lead, to increased market

volatility and may have adverse short-or long-term effects on U.S. and global economies and markets generally. For example, the

COVID-19 pandemic has resulted, and may continue to result, in significant market volatility, exchange suspensions and closures,

declines in global financial markets, higher default rates, supply chain disruptions, and a substantial economic downturn in economies

throughout the world. Natural and environmental disasters and systemic market dislocations are also highly disruptive to economies

and markets. In addition, military action by Russia in Ukraine has, and may continue to, adversely affect global energy and financial

markets and therefore could affect the value of a Fund’s investments, including beyond a Fund’s direct exposure to

Russian issuers or nearby geographic regions. The extent and duration of the military action, sanctions and resulting market disruptions

are impossible to predict and could be substantial. A number of U.S. domestic banks and foreign (non-U.S.) banks have recently

experienced financial difficulties and, in some cases, failures. There can be no certainty that the actions taken by regulators

to limit the effect of those financial difficulties and failures on other banks or other financial institutions or on the U.S.

or foreign (non-U.S.) economies generally will be successful. It is possible that more banks or other financial institutions will

experience financial difficulties or fail, which may affect adversely other U.S. or foreign (non-U.S.) financial institutions

and economies. These events as well as other changes in foreign (non-U.S.) and domestic economic, social, and political conditions

also could adversely affect individual issuers or related groups of issuers, securities markets, interest rates, credit ratings,

inflation, investor sentiment, and other factors affecting the value of the Fund’s investments. Any of these occurrences

could disrupt the operations of the Fund and of the Fund’s service providers.

NOTE

11 — OTHER ACCOUNTING PRONOUCEMENTS

In

June 2022, the FASB issued Accounting Standards Update (ASU), ASU 2022-03, Fair Value Measurement (Topic 820) — Fair Value

Measurement of Equity Securities Subject to Contractual Sale Restrictions, which clarifies that a contractual restriction on the

sale of an equity security is not considered part of the unit of account of the equity security and, therefore, is not considered

in measuring fair value. The amendments under this ASU are effective for

NOTES

TO FINANCIAL STATEMENTS as of August 31, 2023 (Unaudited) (continued)

NOTE

11 — OTHER ACCOUNTING PRONOUCEMENTS (continued)

fiscal

years beginning after December 15, 2023; however, early adoption is permitted. The amendment was early adopted. Management expects

that the adoption of the guidance will not have a material impact on the Fund’s financial statements.

NOTE

12 — SUBSEQUENT EVENTS

Dividends:

Subsequent to August 31, 2023, the Fund made a distribution of:

Per

Share

Amount |

|

Declaration

Date |

|

Payable

Date |

|

Record

Date |

| $0.135

|

|

9/15/2023

|

|

10/16/2023

|

|

10/3/2023

|

Each

quarter, the Fund will provide disclosures with distribution payments made that estimate the percentages of that distribution

that represent net investment income, capital gains, and return of capital, if any. A significant portion of the quarterly distribution

payments made by the Fund may constitute a return of capital.

The

Fund has evaluated events occurring after the Statement of Assets and Liabilities date through the date that the financial statements

were issued (“subsequent events”) to determine whether any subsequent events necessitated adjustment to or disclosure

in the financial statements. Other than the above, no such subsequent events were identified.

| Voya

Emerging Markets High Dividend |

PORTFOLIO

OF INVESTMENTS |

| Equity

Fund |

as

of August 31, 2023 (Unaudited) |

| Shares | | |

| |

Value | | |

Percentage

of Net

Assets | |

| COMMON

STOCK: 93.1% |

| | | |

Brazil:

3.2% | |

| | | |

| |

| 75,682 | | |

BB Seguridade Participacoes SA | |

$ | 465,672 | | |

0.4 | |

| 179,495 | | |

Cia Siderurgica Nacional SA | |

| 440,396 | | |

0.4 | |

| 65,021 | | |

Cosan SA | |

| 230,171 | | |

0.2 | |

| 11,242 | | |

Engie Brasil Energia SA | |

| 95,370 | | |

0.1 | |

| 14,272 | | |

Equatorial Energia SA | |

| 90,150 | | |

0.1 | |

| 124,718 (1)(2) | | |

Hapvida Participacoes e Investimentos S/A | |

| 107,792 | | |

0.1 | |

| 17,360 | | |

Hypera SA | |

| 135,948 | | |

0.1 | |

| 82,605 (1) | | |

Natura & Co. Holding SA | |

| 254,218 | | |

0.3 | |

| 55,035 | | |

Rumo SA | |

| 247,722 | | |

0.2 | |

| 21,315 | | |

Telefonica Brasil SA | |

| 179,359 | | |

0.2 | |

| 96,756 | | |

TOTVS SA | |

| 538,874 | | |

0.5 | |

| 43,426 | | |

Vale SA - Foreign | |

| 573,249 | | |

0.5 | |

| 11,731 | | |

WEG SA | |

| 84,784 | | |

0.1 | |

| | | |

| |

| 3,443,705 | | |

3.2 | |

| | | |

Chile:

0.4% | |

| | | |

| |

| 164,075 | | |

Cencosud SA | |

| 351,219 | | |

0.3 | |

| 692,547 (1) | | |

Enel Americas

SA | |

| 82,303 | | |

0.1 | |

| | | |

| |

| 433,522 | | |

0.4 | |

| | | |

China:

27.8% | |

| | | |

| |

| 10,700 | | |

AIMA Technology Group Co. Ltd. - Class A | |

| 41,631 | | |

0.0 | |

| 239,100 (1) | | |

Alibaba Group Holding Ltd. | |

| 2,775,029 | | |

2.6 | |

| 366,000 | | |

Aluminum Corp. of China Ltd. - Class H | |

| 176,572 | | |

0.2 | |

| 17,178 | | |

Anhui Yingjia Distillery Co. Ltd. - Class A | |

| 180,658 | | |

0.2 | |

| 30,600 | | |

ANTA Sports Products Ltd. | |

| 344,960 | | |

0.3 | |

| 7,820 | | |

Autohome, Inc., ADR | |

| 225,998 | | |

0.2 | |

| 254,000 | | |

AviChina Industry & Technology Co. Ltd.

- Class H | |

| 113,827 | | |

0.1 | |

| 35,600

(1) | | |

Baidu, Inc. - Class A | |

| 635,789 | | |

0.6 | |

| 1,840,000 | | |

Bank of China Ltd. - Class H | |

| 623,608 | | |

0.6 | |

| 209,100 | | |

Bank of Jiangsu Co. Ltd. - Class A | |

| 204,650 | | |

0.2 | |

| 16,000 | | |

Beijing New Building Materials PLC - Class

A | |

| 65,640 | | |

0.1 | |

| 20,000 | | |

BYD Co. Ltd. - Class H | |

| 628,214 | | |

0.6 | |

| 42,500 | | |

BYD Electronic International Co. Ltd. | |

| 196,839 | | |

0.2 | |

| 64,400 | | |

By-health Co. Ltd. - Class A | |

| 170,686 | | |

0.2 | |

| 229,800 | | |

CECEP Solar Energy Co. Ltd. - Class A | |

| 189,911 | | |

0.2 | |

| 392,300 | | |

CECEP Wind-Power Corp. - Class A | |

| 180,738 | | |

0.2 | |

| 2,630,000 | | |

China Cinda Asset Management Co. Ltd. - Class

H | |

| 257,910 | | |

0.2 | |

| 449,000 | | |

China CITIC Bank Corp. Ltd. - Class H | |

| 199,836 | | |

0.2 | |

| 934,000 | | |

China Communications Services Corp. Ltd. -

Class H | |

| 420,497 | | |

0.4 | |

| 42,500 | | |

China Conch Venture Holdings Ltd. | |

| 41,758 | | |

0.0 | |

| 1,479,000 | | |

China Construction Bank Corp. - Class H | |

| 791,340 | | |

0.7 | |

| Shares | | |

| |

Value | | |

Percentage

of Net

Assets | |

| COMMON

STOCK: (continued) |

| | | |

China

(continued) | |

| | | |

| |

| 173,000 | | |

China Longyuan Power Group Corp.

Ltd. - Class H | |

$ | 136,946 | | |

0.1 | |

| 149,000 | | |

China Medical System Holdings Ltd. | |

| 214,599 | | |

0.2 | |

| 102,000 | | |

China Meidong Auto Holdings Ltd. | |

| 76,821 | | |

0.1 | |

| 31,000 | | |

China Mengniu Dairy Co. Ltd. | |

| 104,237 | | |

0.1 | |

| 134,000 | | |

China Merchants Bank Co. Ltd. - Class H | |

| 530,616 | | |

0.5 | |

| 10,700 | | |

China National Medicines Corp. Ltd. - Class

A | |

| 47,819 | | |

0.0 | |

| 256,000 | | |

China Oilfield Services Ltd. - Class H | |

| 289,929 | | |

0.3 | |

| 42,500 | | |

China Overseas Land & Investment Ltd. | |

| 89,594 | | |

0.1 | |

| 126,200 | | |

China Pacific Insurance Group Co. Ltd. - Class

H | |

| 288,626 | | |

0.3 | |

| 448,000 | | |

China Railway Group Ltd. - Class H | |

| 237,006 | | |

0.2 | |

| 20,000 | | |

China Resources Beer Holdings Co. Ltd. | |

| 117,427 | | |

0.1 | |

| 50,000 | | |

China Resources Land Ltd. | |

| 211,335 | | |

0.2 | |

| 16,500 | | |

China Shenhua Energy Co. Ltd. - Class H | |

| 48,024 | | |

0.0 | |

| 2,832,000 (2) | | |

China Tower Corp. Ltd. - Class H | |

| 274,002 | | |

0.3 | |

| 90,000 | | |

Chinasoft International Ltd. | |

| 59,651 | | |

0.1 | |

| 102,500 | | |

CITIC Securities Co. Ltd. - Class H | |

| 200,144 | | |

0.2 | |

| 285,000 | | |

CMOC Group Ltd. - Class H | |

| 170,021 | | |

0.2 | |

| 4,500 | | |

Contemporary Amperex Technology Co. Ltd. -

Class A | |

| 145,922 | | |

0.1 | |

| 92,500 | | |

COSCO SHIPPING Holdings Co. Ltd. - Class H | |

| 94,857 | | |

0.1 | |

| 61,360 | | |

CSPC Pharmaceutical Group Ltd. | |

| 46,119 | | |

0.0 | |

| 43,200 | | |

Dong-E-E-Jiao Co. Ltd. - Class A | |

| 307,585 | | |

0.3 | |

| 424,000 | | |

Dongfeng Motor Group Co. Ltd. - Class H | |

| 155,532 | | |

0.1 | |

| 403,000 | | |

Far East Horizon Ltd. | |

| 275,318 | | |

0.3 | |

| 346,000 | | |

Fosun International Ltd. | |

| 216,279 | | |

0.2 | |

| 16,400

(2) | | |

Ganfeng Lithium Group Co. Ltd. - Class H | |

| 78,336 | | |

0.1 | |

| 277,000 | | |

Geely Automobile Holdings Ltd. | |

| 343,861 | | |

0.3 | |

| 2,400 | | |

GoodWe Technologies Co. Ltd. - Class A | |

| 45,609 | | |

0.0 | |

| 97,900 | | |

GRG Banking Equipment Co. Ltd. - Class A | |

| 168,578 | | |

0.2 | |

| 29,600 | | |

Henan Shenhuo Coal & Power Co. Ltd. - Class

A | |

| 64,422 | | |

0.1 | |

| 42,500 | | |

Hengan International Group Co. Ltd. | |

| 157,648 | | |

0.1 | |

| 80,500 | | |

Hengdian Group DMEGC Magnetics Co. Ltd. - Class

A | |

| 181,059 | | |

0.2 | |

See

Accompanying Notes to Financial Statements

| Voya

Emerging Markets High Dividend |

PORTFOLIO

OF INVESTMENTS |

| Equity

Fund |

as of August 31, 2023 (Unaudited) (continued) |

| Shares | | |

| |

Value | | |

Percentage

of Net

Assets | |

| COMMON

STOCK: (continued) |

| | | |

China

(continued) | |

| | | |

| |

| 19,000 | | |

Hubei Jumpcan Pharmaceutical Co.

Ltd. - Class A | |

$ | 68,231 | | |

0.1 | |

| 1,213,592 | | |

Industrial & Commercial Bank of China Ltd.

- Class H | |

| 556,404 | | |

0.5 | |

| 45,000

(1) | | |

Inner Mongolia Yitai Coal Co. Ltd. - Class

A | |

| 59,952 | | |

0.1 | |

| 34,852 | | |

JD.com, Inc. - Class A | |

| 578,826 | | |

0.5 | |

| 29,100 | | |

Jiangsu Yuyue Medical Equipment & Supply

Co. Ltd. - Class A | |

| 135,078 | | |

0.1 | |

| 78,499 | | |

Jiangsu Zhongtian Technology Co. Ltd. - Class

A | |

| 156,895 | | |

0.1 | |

| 150,700 | | |

Joincare Pharmaceutical Group Industry Co.

Ltd. - Class A | |

| 235,918 | | |

0.2 | |

| 17,780 | | |

Joinn Laboratories China Co. Ltd. - Class A | |

| 58,590 | | |

0.1 | |

| 34,200 | | |

Keda Industrial Group Co. Ltd. - Class A | |

| 47,211 | | |

0.0 | |

| 103,000 | | |

Kingboard Holdings Ltd. | |

| 233,733 | | |

0.2 | |

| 112,200 | | |

Kingsoft Corp. Ltd. | |

| 447,223 | | |

0.4 | |

| 132,000 | | |

Kunlun Energy Co. Ltd. | |

| 96,635 | | |

0.1 | |

| 54,000 | | |

Lenovo Group Ltd. | |

| 61,038 | | |

0.1 | |

| 33,000 | | |

Li Ning Co. Ltd. | |

| 155,968 | | |

0.1 | |

| 25,000

(2) | | |

Longfor Group Holdings Ltd. | |

| 52,765 | | |

0.0 | |

| 47,400 | | |

LONGi Green Energy Technology Co. Ltd. - Class

A | |

| 172,942 | | |

0.2 | |

| 79,720 (1)(2) | | |

Meituan - Class B | |

| 1,319,299 | | |

1.2 | |

| 95,900 | | |

Metallurgical Corp. of China Ltd. - Class A | |

| 47,877 | | |

0.0 | |

| 46,200 | | |

NetEase, Inc. | |

| 957,147 | | |

0.9 | |

| 33,600 (2) | | |

Nongfu Spring Co. Ltd. - Class H | |

| 188,711 | | |

0.2 | |

| 66,900 | | |

Offshore Oil Engineering Co. Ltd. - Class A | |

| 53,511 | | |

0.0 | |

| 1,062,000 | | |

People’s Insurance Co. Group of China Ltd.

- Class H | |

| 361,487 | | |

0.3 | |

| 436,000 | | |

PetroChina Co. Ltd. - Class H | |

| 314,516 | | |

0.3 | |

| 62,325 (2) | | |

Pharmaron Beijing Co. Ltd. - Class H | |

| 145,323 | | |

0.1 | |

| 334,000 | | |

PICC Property & Casualty Co. Ltd. - Class

H | |

| 384,086 | | |

0.4 | |

| 89,500 | | |

Ping An Insurance Group Co. of China Ltd. -

Class H | |

| 535,850 | | |

0.5 | |

| 6,284 | | |

Qifu Technology, Inc., ADR | |

| 106,828 | | |

0.1 | |

| 30,200 | | |

Risen Energy Co. Ltd. - Class A | |

| 83,183 | | |

0.1 | |

| 617,600 | | |

Shanghai Construction Group Co. Ltd. - Class

A | |

| 237,316 | | |

0.2 | |

| 19,500 | | |

Shanxi Lu’an Environmental Energy Development

Co. Ltd. - Class A | |

| 43,543 | | |

0.0 | |

| 4,400 | | |

Shanxi Xinghuacun Fen Wine Factory Co. Ltd.

- Class A | |

| 146,168 | | |

0.1 | |

| Shares | | |

| |

Value | | |

Percentage

of Net

Assets | |

| COMMON

STOCK: (continued) |

| | | |

China (continued) | |

| | | |

| |

| 15,600 | | |

Shenzhen Kstar Science And Technology

Co. Ltd. - Class A | |

$ | 64,843 | | |

0.1 | |

| 6,500 | | |

Shenzhen Mindray Bio- Medical Electronics Co.

Ltd. - Class A | |

| 240,980 | | |

0.2 | |

| 105,800 | | |

Shenzhen Senior Technology Material Co. Ltd.

- Class A | |

| 203,895 | | |

0.2 | |

| 44,000 | | |

Sinopharm Group Co. Ltd. - Class H | |

| 127,685 | | |

0.1 | |

| 25,100 | | |

Sunny Optical Technology Group Co. Ltd. | |

| 204,946 | | |

0.2 | |

| 22,200 | | |

Suzhou Dongshan Precision Manufacturing Co.

Ltd. - Class A | |

| 57,196 | | |

0.1 | |

| 94,200 | | |

Tencent Holdings Ltd. | |

| 3,903,683 | | |

3.6 | |

| 54,000 | | |

Tingyi Cayman Islands Holding Corp. | |

| 79,288 | | |

0.1 | |

| 263,000 (2) | | |

Topsports International Holdings Ltd. | |

| 214,180 | | |

0.2 | |

| 91,000 | | |

TravelSky Technology Ltd. - Class H | |

| 162,929 | | |

0.1 | |

| 25,852 | | |

Trina Solar Co. Ltd. - Class A | |

| 120,705 | | |

0.1 | |

| 148,000 | | |

Uni-President China Holdings Ltd. | |

| 109,457 | | |

0.1 | |

| 3,743 | | |

Weibo Corp., ADR | |

| 48,285 | | |

0.0 | |

| 220,700 | | |

Western Mining Co. Ltd. - Class A | |

| 385,775 | | |

0.4 | |

| 66,000 | | |

Xiamen C & D, Inc. - Class A | |

| 98,446 | | |