Joby Aviation, Inc. Launches Public Offering of Common Stock

24 Octubre 2024 - 3:19PM

Business Wire

Joby Aviation, Inc. (NYSE: JOBY), a company developing electric

air taxis for commercial passenger service, announced today that it

has launched an underwritten public offering to sell up to $200.0

million of its shares of common stock. All of the shares of common

stock are being offered by Joby. In addition, Joby intends to grant

the underwriters a 30-day option to purchase up to an additional

$30.0 million of its shares of common stock. Joby currently intends

to use the net proceeds that it will receive from the offering,

together with existing cash, cash equivalents and short-term

investments, to fund its certification and manufacturing efforts,

prepare for commercial operations and for general working capital

and other general corporate purposes. The offering is subject to

market and other conditions, and there can be no assurance as to

whether or when the offering may be completed or as to the actual

size or terms of the offering.

Morgan Stanley and Allen & Company LLC are acting as joint

book-running managers for the proposed offering.

A registration statement on Form S-3 relating to the shares to

be sold in the proposed offering was filed with the U.S. Securities

and Exchange Commission (the “SEC”) on October 24, 2024 and became

automatically effective upon filing. This offering will be made

only by means of a prospectus. A copy of the preliminary prospectus

supplement and the accompanying prospectus relating to this

offering, when available, may be obtained for free by visiting

EDGAR on the SEC’s website at www.sec.gov. Alternatively, a copy of

the preliminary prospectus supplement and the accompanying

prospectus relating to this offering, when available, may be

obtained from: Morgan Stanley & Co. LLC, Attention: Prospectus

Department, 180 Varick Street, 2nd Floor, New York, New York 10014;

or Allen & Company LLC, Attention: Prospectus Department, 711

Fifth Avenue, New York, New York 10022.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Joby

Joby Aviation, Inc. (NYSE: JOBY) is a California-based

transportation company developing an all-electric, vertical

take-off and landing air taxi which it intends to operate as part

of a fast, quiet and convenient service in cities around the

world.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including statements

regarding the completion, timing and size of the proposed offering

and the intended use of proceeds. You can identify forward-looking

statements by the fact that they do not relate strictly to

historical or current facts. These statements may include words

such as “anticipate”, “estimate”, “expect”, “project”, “plan”,

“intend”, “believe”, “may”, “will”, “should”, “can have”, “likely”

and other words and terms of similar meaning. Forward-looking

statements represent Joby’s current expectations regarding future

events and are subject to known and unknown risks and uncertainties

that could cause actual results to differ materially from those

implied by the forward-looking statements. Among those risks and

uncertainties are market conditions, including the trading price

and volatility of Joby’s common stock and risks relating to Joby’s

business and, if the offering is priced, risks related to the

satisfaction of closing conditions in the underwriting agreement

related to the offering. Joby may not consummate the proposed

offering described in this press release and, if the proposed

offering is consummated, cannot provide any assurances regarding

the final terms of the offering. For a further description of the

risks and uncertainties relating to Joby’s business in general, see

the preliminary prospectus supplement related to the proposed

public offering and Joby’s current and future reports filed with

the SEC, including its Annual Report on Form 10-K for the year

ended December 31, 2023, filed with the SEC on February 27, 2024.

The forward-looking statements included in this press release speak

only as of the date of this press release, and Joby does not

undertake to update the statements included in this press release

for subsequent developments, except as may be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024026190/en/

Investors: investors@jobyaviation.com

Media: press@jobyaviation.com

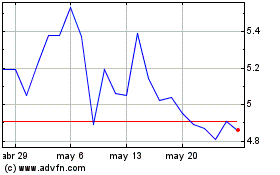

Joby Aviation (NYSE:JOBY)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

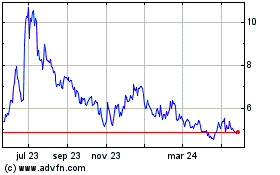

Joby Aviation (NYSE:JOBY)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024