Form N-CSRS - Certified Shareholder Report, Semi-Annual

08 Agosto 2024 - 1:57PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05767

DWS Strategic Municipal Income Trust

(Exact Name of Registrant as Specified in Charter)

875 Third Avenue

New York, NY 10022-6225

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area

Code: (212) 454-4500

Diane Kenneally

100 Summer Street

Boston, MA 02110

(Name and Address of Agent for Service)

| Date of fiscal year end: |

11/30 |

| |

|

| Date of reporting period: |

5/31/24 |

| Item 1. |

Reports to Stockholders. |

| |

|

| |

(a) |

May 31, 2024

to Shareholders

DWS Strategic Municipal Income Trust

The Fund’s investment objective is to provide a high level of current income exempt from federal income tax.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such

as DWS Distributors, Inc. which offers investment products or DWS Investment Management

Americas, Inc. and RREEF America L.L.C. which offer advisory services.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE

NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

|

|

|

DWS Strategic Municipal Income Trust

|

Closed-end funds, unlike open-end funds, are not continuously offered. There is a

one time public offering and once issued, shares of closed-end funds are sold in the open

market through a stock exchange. Shares of closed-end funds frequently trade at a

discount to net asset value. The price of the Fund’s shares is determined by a number of factors, several of which are beyond the control of the Fund. Therefore, the Fund

cannot predict whether its shares will trade at, below or above net asset value.

Bond investments are subject to interest-rate, credit, liquidity and market risks

to varying degrees. When interest rates rise, bond prices generally fall. Credit risk

refers to the ability of an issuer to make timely payments of principal and interest. Municipal

securities are subject to the risk that litigation, legislation or other political

events, local business or economic conditions or the bankruptcy of the issuer could have a significant effect on an issuer’s ability to make payments of principal and/or interest. The market for municipal bonds may be less liquid than for taxable bonds and there

may be less information available on the financial condition of issuers of municipal

securities than for public corporations. Investing in derivatives entails special

risks relating to liquidity, leverage and credit that may reduce returns and/or increase

volatility. Leverage results in additional risks and can magnify the effect of any

gains or losses. Although the Fund seeks income that is exempt from federal income taxes, a

portion of the Fund’s distributions may be subject to federal, state and local taxes, including the alternative minimum tax.

War, terrorism, sanctions, economic uncertainty, trade disputes, public health crises,

natural disasters, climate change and related geopolitical events have led and, in

the future, may lead to significant disruptions in U.S. and world economies and markets,

which may lead to increased market volatility and may have significant adverse effects

on the Fund and its investments.

DWS Strategic Municipal Income Trust

|

|

|

Performance SummaryMay 31, 2024 (Unaudited)

Performance is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when sold, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please visit dws.com for the Fund’s most recent month-end performance.

Fund specific data and performance are provided for informational purposes only and are not intended for trading purposes.

Average Annual Total Returns as of 5/31/24

|

DWS Strategic Municipal

Income Trust

|

|

|

|

|

Based on Net Asset Value(a)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Morningstar Closed-End High-Yield

Municipal Funds Category(c)

|

|

|

|

|

Growth of an Assumed $10,000 Investment

Yearly periods ended May 31

The growth of $10,000 is cumulative.

|

|

Total returns shown for periods less than one year are not annualized.

|

|

|

|

DWS Strategic Municipal Income Trust

|

|

|

Total return based on net asset value reflects changes in the Fund’s net asset value

during each period. Total return based on market price reflects changes in market

price.

Each figure assumes that dividend and capital gain distributions, if any, were reinvested.

These figures will differ depending upon the level of any discount from or premium

to

net asset value at which the Fund’s shares traded during the period. Expenses of the

Fund include management fee, interest expense and other fund expenses. Total returns

shown take into account these fees and expenses. The expense ratio of the Fund for

the

six months ended May 31, 2024 was 3.72% (1.12% excluding interest expense).

|

|

|

The unmanaged, unleveraged Bloomberg Municipal Bond Index covers the

U.S. dollar-denominated long-term tax exempt bond market. The index has four main

sectors: state and local general obligation bonds, revenue bonds, insured bonds and

pre-refunded bonds. Index returns do not reflect any fees or expenses and it is not

possible to invest directly into an index.

|

|

|

Morningstar’s Closed-End High-Yield Municipal Funds category represents high-yield

muni portfolios that typically invest at least 50% of assets in high-income municipal

securities that are not rated or that are rated by a major agency such as Standard

&

Poor’s or Moody’s at the level of BBB and below (considered part of the high-yield

universe within the municipal industry). Morningstar figures represent the average

of

the total returns based on net asset value reported by all of the closed-end funds

designated by Morningstar, Inc. as falling into the Closed-End High-Yield Municipal

Funds category. Category returns assume reinvestment of all distributions. It is not

possible to invest directly in a Morningstar category.

|

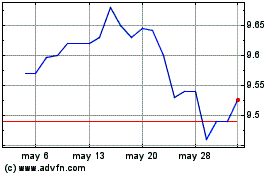

Net Asset Value and Market Price

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prices and net asset value fluctuate and are not guaranteed.

DWS Strategic Municipal Income Trust

|

|

|

|

|

|

Six Months as of 5/31/24:

Income Dividends (common shareholders)

|

|

May Income Dividend (common shareholders)

|

|

Current Annualized Distribution Rate (based on Net Asset Value)

|

|

Current Annualized Distribution Rate (based on Market Price)

|

|

Tax Equivalent Distribution Rate (based on Net Asset Value)

|

|

Tax Equivalent Distribution Rate (based on Market Price)

|

|

|

|

Current annualized distribution rate is the latest monthly dividend shown as an annualized

percentage of net asset value/market price on May 31, 2024. Distribution rate simply

measures the level of dividends and is not a complete measure of performance. Tax

equivalent distribution rate is based on the Fund’s distribution rate and a federal marginal

income tax rate of 40.8%. Distribution rates are historical, not guaranteed and will

fluctuate. Distributions do not include return of capital or other non-income sources.

|

On March 28, 2024, the Fund’s Board of Trustees approved the termination of the Fund, pursuant to which the Fund will make a liquidating distribution to shareholders no later than November 30, 2024.

On July 19, 2024, the Board of Trustees approved a Plan of Liquidation and Termination for the Fund (the “Plan” ) related to the previously announced liquidation of the Fund to occur no later than November 30, 2024. A final liquidating distribution is expected to be made on or about November 20, 2024, for the Fund. See also “Plan of Liquidation and Termination for the Fund.”

|

|

|

DWS Strategic Municipal Income Trust

|

Portfolio Management Team

Chad H. Farrington, CFA, Head of Investment Strategy Fixed Income

Portfolio Manager of the Fund. Began managing the Fund in 2018.

—Joined DWS in 2018 with 20 years of industry experience; previously, worked as Portfolio

Manager, Head of Municipal Research, and Senior Credit Analyst at Columbia Threadneedle.

—Co-Head of Municipal Bond Department.

—BS, Montana State University.

Michael J. Generazo, Senior Portfolio Manager Fixed Income

Portfolio Manager of the Fund. Began managing the Fund in 2018.

—BS, Bryant College; MBA, Suffolk University.

DWS Strategic Municipal Income Trust

|

|

|

Portfolio Summary(Unaudited)

Asset Allocation (As a % of Investment Portfolio excluding

Open-End Investment Companies)

|

|

|

|

|

|

|

|

|

|

|

Variable Rate Demand Notes

|

|

|

|

|

|

|

|

|

|

|

Escrow to Maturity/Prerefunded Bonds

|

|

|

|

|

|

|

Quality (As a % of Investment Portfolio excluding Open-End

Investment Companies)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The quality ratings represent the higher of Moody’s Investors Service, Inc. (“Moody’s” ), Fitch Ratings, Inc. (“Fitch” ) or S&P Global Ratings (“S&P” ) credit ratings. The ratings of Moody’s, Fitch and S&P represent their opinions as to the quality of the securities they rate.

Credit quality measures a bond issuer’s ability to repay interest and principal in a timely manner. Ratings are relative and subjective and are not absolute standards of quality. Credit

quality does not remove market risk and is subject to change.

Top Five State/Territory Allocations (As a % of

Investment Portfolio excluding Open-End Investment Companies)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Rate Sensitivity

|

|

|

|

|

|

|

Modified Duration to Worst

|

|

|

Leverage (As a % of Total Assets)

|

|

|

|

|

|

|

|

|

|

DWS Strategic Municipal Income Trust

|

Effective maturity is the weighted average of the maturity date of bonds held by the

Fund taking into consideration any available maturity shortening features.

Modified duration to worst is the measure of sensitivity of the price of a bond to

a change in interest rates, computed using the bond’s nearest call or maturity date.

Leverage results in additional risks and can magnify the effect of any gains or losses

to a greater extent than if leverage were not used.

Portfolio holdings and characteristics are subject to change.

For more complete details about the Fund’s investment portfolio, see page 10. A quarterly Fact Sheet is available on dws.com or upon request. Please see the Additional Information

section on page 50 for contact information.

DWS Strategic Municipal Income Trust

|

|

|

Investment Portfolioas of May 31, 2024 (Unaudited)

|

|

|

|

Municipal Investments 152.7%

|

|

|

|

|

Alabama, Black Belt Energy Gas District, Gas Project

Revenue, Series D-1, 5.5% (a), 6/1/2049, GTY: Goldman

Sachs Group, Inc.

|

|

|

|

Jefferson County, AL, Sewer Revenue, 5.5%, 10/1/2053

|

|

|

|

|

|

|

|

|

|

|

|

Alaska, Industrial Development & Export Authority Revenue,

Tanana Chiefs Conference Project, Series A, 4.0%,

10/1/2049

|

|

|

|

|

|

|

Arizona, Sierra Vista Industrial Development Authority

Revenue, American Leadership Academy Inc., 144A,

5.75%, 6/15/2058

|

|

|

|

Arizona, State Industrial Development Authority, Education

Facility Revenue, Odyssey Preparatory Academy Project,

144A, 5.0%, 7/1/2049

|

|

|

|

Maricopa County, AZ, Industrial Development Authority,

Education Revenue, Legacy Traditional Schools Project,

Series B, 144A, 5.0%, 7/1/2049

|

|

|

|

Pima County, AZ, Industrial Development Authority,

Education Revenue, American Leadership Academy

Project, Series 2022, 144A, 4.0%, 6/15/2057

|

|

|

|

Yavapai County, AZ, Industrial Development Authority,

Hospital Facility, Regional Medical Center, 4.0%, 8/1/2043

|

|

|

|

|

|

|

|

|

|

|

|

California, Community Housing Agency, Essential Housing

Revenue, Verdant at Green Valley Project, Series A, 144A,

5.0%, 8/1/2049

|

|

|

|

California, CSCDA Community Improvement Authority,

Essential Housing Revenue, Series A, 144A, 5.0%,

7/1/2051

|

|

|

|

California, Morongo Band of Mission Indians Revenue,

Series B, 144A, 5.0%, 10/1/2042

|

|

|

|

California, M-S-R Energy Authority, Series B, 7.0%,

11/1/2034, GTY: Citigroup Global Markets

|

|

|

|

California, Public Finance Authority Revenue, Enso VIillage

Project, Series A, 144A, 5.0%, 11/15/2036

|

|

|

|

The accompanying notes are an integral part of the financial statements.

|

|

|

DWS Strategic Municipal Income Trust

|

|

|

|

|

California, River Islands Public Financing Authority, Special

Tax, Community Facilities District No. 2003-1, Public

Improvements, Series B-2, 5.0%, 9/1/2052

|

|

|

|

California, State Municipal Finance Authority Revenue,

Catalyst Impact Fund 1 LLC, “II” , 144A, 7.0%, 1/1/2039

|

|

|

|

California, State Municipal Finance Authority Revenue, LAX

Integrated Express Solutions LLC, LINXS

Apartment Project:

|

|

|

|

Series A, AMT, 5.0%, 12/31/2043

|

|

|

|

Series B, AMT, 5.0%, 6/1/2048

|

|

|

|

California, State Public Finance Authority Revenue, ENSO

Village Project, Series A, 144A, 5.0%, 11/15/2046

|

|

|

|

California, Statewide Communities Development Authority

Revenue, Loma Linda University Medical Center,

Series A, 144A, 5.25%, 12/1/2056

|

|

|

|

California, Statewide Communities Development Authority,

Multi-Family Housing Revenue, Foxwood Apartments

Project, Series J, 3.13% (b), 6/7/2024, LOC: Wells Fargo

Bank NA

|

|

|

|

California, University of California Revenue, Series Z-2,

5.37% (b), 6/7/2024

|

|

|

|

San Francisco City & County, CA, Airports Commission,

International Airport Revenue, Series 2ND, AMT, 5.0%,

5/1/2048

|

|

|

|

San Joaquin Hills, CA, Transportation Corridor Agency, Toll

Road Revenue, Series A, Prerefunded, 5.0%, 1/15/2050

|

|

|

|

|

|

|

|

|

|

|

|

Colorado, Public Energy Authority, Natural Gas Purchased

Revenue, 6.25%, 11/15/2028, GTY: Merrill Lynch & Co.

|

|

|

|

Colorado, State Health Facilities Authority, Hospital

Revenue, Covenant Retirement Communities Obligated

Group, Series A, 5.0%, 12/1/2048

|

|

|

|

Denver City & County, CO, Airport System Revenue,

Series D, AMT, 5.75%, 11/15/2045

|

|

|

|

Denver City & County, CO, Special Facilities Airport

Revenue, United Airlines, Inc. Project, AMT, 5.0%,

10/1/2032

|

|

|

|

Denver, CO, City & County Airport Revenue, Series A, AMT,

5.25%, 12/1/2043

|

|

|

|

Denver, CO, Health & Hospital Authority, Healthcare

Revenue, Series A, 4.0%, 12/1/2040

|

|

|

|

Douglas County, CO, Rampart Range Metropolitan District

No. 5, 4.0%, 12/1/2051

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS Strategic Municipal Income Trust

|

|

|

|

|

|

|

District of Columbia 1.6%

|

|

District of Columbia, Latin American Montessori Bilingual

Public Charter School, 5.0%, 6/1/2050

|

|

|

|

District of Columbia, Metropolitan Airport Authority, Dulles

Toll Road Revenue, Dulles Metrorail & Capital

Improvement Project, Series B, 4.0%, 10/1/2049

|

|

|

|

Metropolitan Washington, DC, Airport Authority, Dulles Toll

Road Revenue, Series B, 3.0%, 10/1/2050, INS: AGMC

|

|

|

|

|

|

|

|

|

|

|

|

Brevard County, FL, Health Facilities Authority, Hospital

Revenue, Health First, Inc., Series A, 4.0%, 4/1/2052

|

|

|

|

Broward County, FL, Airport System Revenue:

|

|

|

|

Series A, AMT, 4.0%, 10/1/2044

|

|

|

|

Series A, AMT, 4.0%, 10/1/2049

|

|

|

|

Charlotte County, FL, Industrial Development Authority,

Utility System Revenue, Town & Country Utilities Project,

Series A, 144A, AMT, 4.0%, 10/1/2051, GTY: Babcock

Ranch IRR LLC

|

|

|

|

Collier County, FL, Industrial Development Authority,

Continuing Care Community Revenue, Arlington of

Naples Project, Series A, 144A, 8.125%, 5/15/2044* (c)

|

|

|

|

Collier County, FL, State Educational Facilities Authority

Revenue, Ave Maria University Inc., 5.0%, 6/1/2043

|

|

|

|

Florida, Capital Projects Finance Authority Revenue,

Provident Group - Continuum Properties LLC:

|

|

|

|

Series A-1, 5.0%, 11/1/2053

|

|

|

|

Series A-1, 5.0%, 11/1/2058

|

|

|

|

Florida, Capital Trust Agency, Educational Facilities Authority,

Charter Educational Foundation Project, Series A, 144A,

5.375%, 6/15/2048

|

|

|

|

Florida, Capital Trust Agency, Educational Growth Fund LLC,

Charter School Portfolio Project, Series A-1, 144A, 5.0%,

7/1/2056

|

|

|

|

Florida, Capital Trust Agency, Southeastern University

Obligated Group Project:

|

|

|

|

Series A, 144A, 6.25%, 5/1/2048

|

|

|

|

Series A, 144A, 6.375%, 5/1/2053

|

|

|

|

Florida, Development Finance Corp., Educational Facilities

Revenue, Mater Academy Projects:

|

|

|

|

Series A, 5.0%, 6/15/2050

|

|

|

|

Series A, 5.0%, 6/15/2052

|

|

|

|

Series A, 5.0%, 6/15/2055

|

|

|

|

The accompanying notes are an integral part of the financial statements.

|

|

|

DWS Strategic Municipal Income Trust

|

|

|

|

|

Florida, Development Finance Corp., Educational Facilities

Revenue, River City Science Academy Project:

|

|

|

|

Series A-1, 5.0%, 7/1/2042

|

|

|

|

|

|

|

|

|

Series A-1, 5.0%, 7/1/2051

|

|

|

|

|

|

|

|

|

Series A-1, 5.0%, 2/1/2057

|

|

|

|

|

|

|

|

|

Florida, State Atlantic University Finance Corp., Capital

Improvements Revenue, Student Housing Project,

Series B, 4.0%, 7/1/2044

|

|

|

|

Florida, State Development Finance Corp., Senior Living

Revenue, The Cabana at Jensen Dunes Project, Series A,

144A, 5.25%, 11/15/2056

|

|

|

|

Florida, State Higher Educational Facilities Financial

Authority Revenue, Florida Institute of Technology, 4.0%,

10/1/2049

|

|

|

|

Florida, Tolomato Community Development District,

Special Assessment:

|

|

|

|

Series 2015-2, 0%–6.61%, 5/1/2040 (d)

|

|

|

|

Series 2015-3, 6.61%, 5/1/2040* (c)

|

|

|

|

Florida, Village Community Development District No. 12,

Special Assessment Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida, Village Community Development District No. 13,

Special Assessment Revenue, 3.25%, 5/1/2052

|

|

|

|

Florida, Village Community Development District No. 14,

5.5%, 5/1/2053

|

|

|

|

Florida, Village Community Development District No. 15,

Special Assessment Revenue, 144A, 5.25%, 5/1/2054

|

|

|

|

Greater Orlando, FL, Aviation Authority Airport Facilities

Revenue, Series A, AMT, 5.0%, 10/1/2047

|

|

|

|

Hillsborough County, FL, Aviation Authority, Tampa

International Airport, Series A, AMT, 5.0%, 10/1/2048

|

|

|

|

Miami Beach, FL, Health Facilities Authority, Mount Sinai

Medical Center, 5.0%, 11/15/2044

|

|

|

|

Miami-Dade County, FL, Aviation Revenue, Series B, AMT,

5.0%, 10/1/2040

|

|

|

|

Miami-Dade County, FL, Health Facilities Authority Hospital

Revenue, Nicklaus Children’s Hospital, 5.0%, 8/1/2047

|

|

|

|

Miami-Dade County, FL, Seaport Revenue, Series A, AMT,

5.0%, 10/1/2047

|

|

|

|

Palm Beach County, FL, Health Facilities Authority Revenue,

Lifespace Communities, Inc. Obligated Group:

|

|

|

|

Series C, 7.5%, 5/15/2053

|

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS Strategic Municipal Income Trust

|

|

|

|

|

|

|

Series C, 7.625%, 5/15/2058

|

|

|

|

Pinellas County, FL, Industrial Development Authority

Revenue, Foundation For Global Understanding, Inc.

Project, 5.0%, 7/1/2039

|

|

|

|

Seminole County, FL, Industrial Development Authority,

Legacy Pointe At UCF Project, Series A, 5.5%,

11/15/2049

|

|

|

|

|

|

|

|

|

|

|

|

Atlanta, GA, Development Authority Revenue Bonds,

Series A-1, 5.0%, 7/1/2027

|

|

|

|

Cobb County, GA, Kennestone Hospital Authority, Revenue

Anticipation Certificates, Wellstar Health System, Inc.

Project, Series A, 4.0%, 4/1/2052

|

|

|

|

Fulton County, GA, Development Authority Hospital

Revenue, Revenue Anticipation Certificates, Wellstar

Health System, Series A, 5.0%, 4/1/2042

|

|

|

|

Fulton County, GA, Development Authority Hospital

Revenue, Wellstar Health System, Obligated Inc. Project,

Series A, 4.0%, 4/1/2050

|

|

|

|

George L Smith II, GA, Congress Center Authority,

Convention Center Hotel First Tier, Series A, 4.0%,

1/1/2054

|

|

|

|

George L Smith II, GA, Congress Center Authority,

Convention Center Hotel Second Tier, Series B, 144A,

5.0%, 1/1/2054

|

|

|

|

Georgia, Main Street Natural Gas, Inc., Gas Project

Revenue, Series A, 5.5%, 9/15/2024, GTY: Merrill Lynch &

Co.

|

|

|

|

Georgia, Municipal Electric Authority Revenue, Project One,

Series A, 5.0%, 1/1/2049

|

|

|

|

Georgia, Private Colleges & Universities Authority Revenue,

Mercer University Project, 4.0%, 10/1/2047

|

|

|

|

|

|

|

|

|

|

|

|

Hawaii, State Airports Systems Revenue, Series A, AMT,

5.0%, 7/1/2041

|

|

|

|

|

|

|

Chicago, IL, Board of Education:

|

|

|

|

Series A, 5.0%, 12/1/2032

|

|

|

|

Series A, 5.0%, 12/1/2033

|

|

|

|

Series H, 5.0%, 12/1/2036

|

|

|

|

Series A, 6.0%, 12/1/2049

|

|

|

|

The accompanying notes are an integral part of the financial statements.

|

|

|

DWS Strategic Municipal Income Trust

|

|

|

|

|

Chicago, IL, General Obligation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chicago, IL, Metropolitan Pier & Exposition Authority,

McCormick Place Expansion Project, Zero Coupon,

6/15/2044, INS: AGMC

|

|

|

|

Chicago, IL, O’Hare International Airport Revenue, Series C,

AMT, 5.0%, 1/1/2046

|

|

|

|

Chicago, IL, O’Hare International Airport Revenue, Senior

Lien, Series D, AMT, 5.0%, 1/1/2047

|

|

|

|

Chicago, IL, Transit Authority, Sales Tax Receipts Revenue,

Second Lien, Series A, 4.0%, 12/1/2050

|

|

|

|

Illinois, Metropolitan Pier & Exposition Authority Revenue,

McCormick Place Expansion Project, Series A, 5.0%,

6/15/2057

|

|

|

|

Illinois, Metropolitan Pier & Exposition Authority, Dedicated

State Tax Revenue, Capital Appreciation-McCormick,

Series A, Zero Coupon, 6/15/2036, INS: NATL

|

|

|

|

Illinois, State Finance Authority Revenue, Evangelical

Retirement Homes, 5.0%, 2/15/2037* (c)

|

|

|

|

Illinois, State Finance Authority Revenue, OSF Healthcare

Systems, Series A, 5.0%, 11/15/2045

|

|

|

|

Illinois, State Finance Authority Revenue, The University of

Chicago Medical Center, Series B, 3.9% (b), 6/3/2024,

LOC: TD Bank NA

|

|

|

|

Illinois, State Finance Authority, Health Services Facilities

Lease Revenue, University of Health Services Facility

Project, 4.0%, 10/1/2055

|

|

|

|

Illinois, State General Obligation:

|

|

|

|

|

|

|

|

|

Series A, 5.0%, 10/1/2033

|

|

|

|

Series B, 5.0%, 10/1/2033

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series A, 5.0%, 12/1/2042

|

|

|

|

|

|

|

|

|

Series C, 5.5%, 10/1/2045

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indiana, Finance Authority Revenue, DePauw University,

Series A, 5.5%, 7/1/2052

|

|

|

|

Indiana, State Finance Authority, Tippecanoe LLC Student

Housing Project, Series A, 5.0%, 6/1/2053

|

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS Strategic Municipal Income Trust

|

|

|

|

|

|

|

Indiana, State Housing & Community Development

Authority, Single Family Mortgage Revenue, Series C-1,

5.0%, 7/1/2053

|

|

|

|

Indianapolis, IN, Local Public Improvement Bond Bank,

Airport Authority Project:

|

|

|

|

|

|

|

|

|

Series E, 6.125%, 3/1/2057

|

|

|

|

|

|

|

|

|

|

|

|

Iowa, Higher Education Loan Authority, Des Moines

University Project, 5.375%, 10/1/2052

|

|

|

|

Iowa, State Finance Authority Revenue, Lifespace

Communities, Inc. Obligated Group, Series B, 7.5%,

5/15/2053

|

|

|

|

Iowa, State Higher Education Loan Authority Revenue, Des

Moines University Project, 4.0%, 10/1/2050

|

|

|

|

Iowa, Tobacco Settlement Authority Revenue:

|

|

|

|

“2", Series B-2, Zero Coupon, 6/1/2065

|

|

|

|

“2", Series B1, 4.0%, 6/1/2049

|

|

|

|

|

|

|

|

|

|

|

|

Kentucky, State Economic Development Finance Authority,

Owensboro Health, Inc., Obligated Group, Series A,

5.25%, 6/1/2041

|

|

|

|

Louisville & Jefferson County, KY, Metro Government

Hospital Revenue, UOFL Health Project, Series A, 5.0%,

5/15/2052

|

|

|

|

|

|

|

|

|

|

|

|

Calcasieu Parish, LA, Memorial Hospital Service, District

Hospital Revenue, 5.0%, 12/1/2039

|

|

|

|

Louisiana, Public Facilities Authority Revenue, Ochsner

Clinic Foundation Project, 5.0%, 5/15/2046

|

|

|

|

Louisiana, Public Facilities Authority Revenue, Tulane

University, Series A, 5.0%, 10/15/2052

|

|

|

|

|

|

|

|

|

|

|

|

Maryland, Stadium Authority Built To Learn Revenue,

Series A, 4.0%, 6/1/2047

|

|

|

|

Maryland, State Community Development Administration,

Series B, 5.35% (b), 6/7/2024, SPA: TD Bank NA

|

|

|

|

The accompanying notes are an integral part of the financial statements.

|

|

|

DWS Strategic Municipal Income Trust

|

|

|

|

|

Maryland, State Community Development Administration,

Department of Housing & Community Development,

Residential Revenue, Series D, 5.05%, 3/1/2047

|

|

|

|

Maryland, State Economic Development Corp., Student

Housing Revenue, Morgan State University Project,

5.0%, 7/1/2056

|

|

|

|

Maryland, State Health & Higher Educational Facilities

Authority Revenue, Adventist Healthcare, Obligated

Group, Series A, 5.5%, 1/1/2046

|

|

|

|

Maryland, State Health & Higher Educational Facilities

Authority Revenue, Meritus Medical Center Obligated

Group, 5.0%, 7/1/2040

|

|

|

|

|

|

|

|

|

|

|

|

Massachusetts, Educational Financing Authority Education

Loan Revenue, Series B, AMT, 2.0%, 7/1/2037

|

|

|

|

Massachusetts, Educational Financing Authority, Issue M:

|

|

|

|

Series C, AMT, 3.0%, 7/1/2051

|

|

|

|

Series C, AMT, 4.125%, 7/1/2052

|

|

|

|

Massachusetts, State Development Finance Agency

Revenue, Partners Healthcare System, Inc., Series Q,

5.0%, 7/1/2035

|

|

|

|

Massachusetts, State Educational Financing Authority,

Educational Loan Revenue Bonds, Issue M, Series B,

AMT, 3.625%, 7/1/2038

|

|

|

|

Massachusetts, State Health & Educational Facilities

Authority Revenue, Baystate Medical Center,

Series J-2-R, 4.0% (b), 6/3/2024, LOC: TD Bank NA

|

|

|

|

|

|

|

|

|

|

|

|

Michigan, Economic Development Corp., Holland Home

Obligated Group, Series 2021, 4.0%, 11/15/2045

|

|

|

|

Michigan, State Finance Authority Revenue, Detroit Water &

Sewer Department, Series C, 5.0%, 7/1/2035

|

|

|

|

Michigan, State Finance Authority Revenue, Tobacco

Settlement Revenue, “1” , Series A, 4.0%, 6/1/2049

|

|

|

|

|

|

|

|

|

|

|

|

Minnesota, Duluth Economic Development Authority

Revenue, Essentia Health Obligated Group, Series A,

5.0%, 2/15/2058

|

|

|

|

Minnesota, State Housing Finance Agency, Series L, AMT,

5.35%, 7/1/2036

|

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS Strategic Municipal Income Trust

|

|

|

|

|

|

|

Minnesota, State Office of Higher Education Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kansas City, MO, Industrial Development Authority, Airport

Special Obligation, International Airport Terminal

Modernization Project, Series B, AMT, 5.0%, 3/1/2046

|

|

|

|

Missouri, State Health & Educational Facilities Authority

Revenue, Lutheran Senior Services Projects, Series B,

5.0%, 2/1/2046

|

|

|

|

Missouri, State Health & Educational Facilities Authority

Revenue, Medical Research, Lutheran Senior Services:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Missouri, State Health & Educational Facilities Authority

Revenue, St Louis University, Series B, 4.1% (b),

6/3/2024, LOC: U.S. Bank NA

|

|

|

|

Missouri, State Health & Educational Facilities Authority,

Health Facilities Revenue, Lester E Cox Medical Centers,

Series A, 5.0%, 11/15/2048

|

|

|

|

St. Louis, MO, Industrial Development Authority Financing

Revenue, Ballpark Village Development Project, Series A,

4.75%, 11/15/2047

|

|

|

|

|

|

|

|

|

|

|

|

Nebraska, Central Plains Energy Project, Gas Project

Revenue, Series A, 5.0%, 9/1/2029, GTY: Goldman Sachs

Group, Inc.

|

|

|

|

|

|

|

Reno, NV, Sales Tax Revenue, Transportation Rail Access,

Series C, 144A, Zero Coupon, 7/1/2058

|

|

|

|

|

|

|

New Hampshire, Business Finance Authority Revenue, “A” ,

Series 2, 4.0%, 10/20/2036

|

|

|

|

New Hampshire, State Health & Educational Facilities

Authority Revenue, Hillside Village:

|

|

|

|

Series A, 144A, 6.125%, 7/1/2037* (c)

|

|

|

|

Series A, 144A, 6.25%, 7/1/2042* (c)

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of the financial statements.

|

|

|

DWS Strategic Municipal Income Trust

|

|

|

|

|

|

|

|

Camden County, NJ, Improvement Authority School

Revenue, KIPP Cooper Norcross Obligated Group, 6.0%,

6/15/2062

|

|

|

|

New Jersey, State Economic Development Authority

Revenue, Series BBB, Prerefunded, 5.5%, 6/15/2030

|

|

|

|

New Jersey, State Economic Development Authority

Revenue, Black Horse EHT Urban Renewal LLC Project,

Series A, 144A, 5.0%, 10/1/2039* (c)

|

|

|

|

New Jersey, State Economic Development Authority

Revenue, White Horse HMT Urban Renewal LLC Project,

144A, 5.0%, 1/1/2040* (c)

|

|

|

|

New Jersey, State Economic Development Authority,

Special Facilities Revenue, Continental Airlines, Inc.

Project, Series B, AMT, 5.625%, 11/15/2030

|

|

|

|

New Jersey, State Educational Facilities Authority Revenue,

Steven Institute of Technology, Series A, 4.0%, 7/1/2050

|

|

|

|

New Jersey, State Educational Facilities Authority Revenue,

Stockton University, Series A, 5.0%, 7/1/2041

|

|

|

|

New Jersey, State Higher Education Assistance Authority,

Student Loan Revenue, Series B, AMT, 3.5%, 12/1/2039

|

|

|

|

New Jersey, State Housing & Mortgage Finance Agency,

Single Family Housing Revenue, Series I, 5.0%,

10/1/2053

|

|

|

|

New Jersey, State Transportation Trust Fund Authority,

Transportation Program, Series AA, 5.0%, 6/15/2046

|

|

|

|

New Jersey, State Transportation Trust Fund Authority,

Transportation Systems, Series AA, 4.0%, 6/15/2050

|

|

|

|

New Jersey, Tobacco Settlement Financing Corp., Series A,

5.25%, 6/1/2046

|

|

|

|

|

|

|

|

|

|

|

|

New Mexico, State Mortgage Finance Authority, “I” ,

Series D, 3.25%, 7/1/2044

|

|

|

|

|

|

|

Monroe County, NY, Industrial Development Corp. Revenue,

St. Ann’s Community Project, 5.0%, 1/1/2050

|

|

|

|

New York, Metropolitan Transportation Authority Revenue:

|

|

|

|

Series G-1, 3.41% (b), 6/7/2024, LOC: TD Bank NA

|

|

|

|

Series 2012-G1, 4.0% (b), 6/3/2024, LOC: Barclays Bank

PLC

|

|

|

|

Series E-1, 4.0% (b), 6/3/2024, LOC: Barclays Bank PLC

|

|

|

|

Series D, 5.0%, 11/15/2027

|

|

|

|

Series D, 5.0%, 11/15/2033

|

|

|

|

Series C-1, 5.25%, 11/15/2055

|

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS Strategic Municipal Income Trust

|

|

|

|

|

|

|

New York, Metropolitan Transportation Authority Revenue,

Green Bond, Series D3, 4.0%, 11/15/2049

|

|

|

|

New York, State Dormitory Authority Revenue, State

University, Series A, 5.0%, 7/1/2053

|

|

|

|

New York, State Dormitory Authority Revenues, Non-State

Supported Debt, The New School:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York, State Transportation Development Corp., Special

Facilities Revenue, American Airlines, Inc., John F.

Kennedy International Airport Project, Series A, AMT,

5.0%, 8/1/2031, GTY: American Airlines Group, Inc.

|

|

|

|

New York, State Transportation Development Corp., Special

Facilities Revenue, Delta Air Lines, Inc., LaGuardia Airport

C&D Redevelopment:

|

|

|

|

Series A, AMT, 5.0%, 1/1/2031

|

|

|

|

|

|

|

|

|

New York, State Transportation Development Corp., Special

Facilities Revenue, John F. Kennedy International

Airport Project:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York, State Transportation Development Corp., Special

Facilities Revenue, Laguardia Gateway Partners LLC,

Redevelopment Project, Series A, AMT, 5.0%, 7/1/2041

|

|

|

|

New York, Triborough Bridge & Tunnel Authority Revenue:

|

|

|

|

Series B, 4.0% (b), 6/3/2024, LOC: TD Bank NA

|

|

|

|

Series B-4C, 4.15% (b), 6/3/2024, LOC: U.S. Bank NA

|

|

|

|

New York, TSASC, Inc., Series A, 5.0%, 6/1/2041

|

|

|

|

New York City, NY, Housing Development Corp., Series C-1,

4.25%, 11/1/2052

|

|

|

|

New York City, NY, Transitional Finance Authority Revenue,

Future Tax Secured, Series B, 5.0%, 5/1/2048

|

|

|

|

Port Authority of New York & New Jersey, Series 207, AMT,

5.0%, 9/15/2048

|

|

|

|

|

|

|

|

|

|

|

|

North Carolina, State Education Assistance Authority

Revenue, Series A, AMT, 5.0%, 6/1/2043

|

|

|

|

|

|

|

City of Grand Forks, ND, Altru Health System Obligated

Group Revenue, Series A, 5.0%, 12/1/2053, INS: AGMC

|

|

|

|

The accompanying notes are an integral part of the financial statements.

|

|

|

DWS Strategic Municipal Income Trust

|

|

|

|

|

|

|

|

Buckeye, OH, Tobacco Settlement Financing Authority, “2” ,

Series B-2, 5.0%, 6/1/2055

|

|

|

|

Cleveland-Cuyahoga County, OH, Port Authority, Cultural

Facility Revenue, Playhouse Square Foundation Project,

5.5%, 12/1/2043

|

|

|

|

Hamilton County, OH, Health Care Revenue, Life Enriching

Communities Project, Series A, 5.75%, 1/1/2053

|

|

|

|

Ohio, Akron, Bath & Copley Joint Township Hospital District

Revenue, 5.25%, 11/15/2046

|

|

|

|

Ohio, State Housing Finance Agency Revenue, Series B,

4.95%, 9/1/2054

|

|

|

|

|

|

|

|

|

|

|

|

Oklahoma, State Development Finance Authority, Health

System Revenue, OU Medicine Project:

|

|

|

|

Series B, 5.25%, 8/15/2048

|

|

|

|

Series A, 5.5%, 8/15/2041

|

|

|

|

Series A, 5.5%, 8/15/2044

|

|

|

|

|

|

|

|

|

|

|

|

Oregon, Portland Airport Revenue, Series 25B, AMT, 5.0%,

7/1/2049

|

|

|

|

Oregon, State Facilities Authority Revenue, Peacehealth

Systems, Series A, 4.1% (b), 6/3/2024, LOC: U.S. Bank

NA

|

|

|

|

|

|

|

|

|

|

|

|

Franklin County, PA, Industrial Development Authority

Revenue, Menno Haven, Inc. Project:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lancaster County, PA, Hospital Authority, Brethren

Village Project:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pennsylvania, Certificate of Participations, Series A, 5.0%,

7/1/2043

|

|

|

|

Pennsylvania, Commonwealth Financing Authority, Series A,

5.0%, 6/1/2035

|

|

|

|

Pennsylvania, Commonwealth Financing Authority, Tobacco

Master Settlement Payment Revenue Bonds:

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS Strategic Municipal Income Trust

|

|

|

|

|

|

|

|

|

|

|

|

Pennsylvania, Geisinger Authority Health System Revenue,

Series A-1, 5.0%, 2/15/2045

|

|

|

|

Pennsylvania, State Economic Development Financing

Authority Revenue, Bridges Finco LP, 5.0%, 12/31/2038

|

|

|

|

Pennsylvania, State Economic Development Financing

Authority, The Penndot Major Bridges, AMT, 6.0%,

6/30/2061

|

|

|

|

Pennsylvania, State Housing Finance Agency, Single Family

Mortgage Revenue, Series 141A, 5.75%, 10/1/2053

|

|

|

|

Pennsylvania, State Turnpike Commission Revenue:

|

|

|

|

Series FIRST, 5.0%, 12/1/2039

|

|

|

|

Series FIRST, 5.0%, 12/1/2040

|

|

|

|

Series FIRST, 5.0%, 12/1/2041

|

|

|

|

Series C, 5.0%, 12/1/2044

|

|

|

|

Philadelphia, PA, Authority For Industrial Development,

Philadelphia Electrical and Technology Charter High School

Project, Series A, 4.0%, 6/1/2051

|

|

|

|

Philadelphia, PA, School District, Series B, 5.0%, 9/1/2043

|

|

|

|

|

|

|

|

|

|

|

|

South Carolina, State Ports Authority Revenue, Series B,

AMT, 4.0%, 7/1/2059

|

|

|

|

South Carolina, State Public Service Authority Revenue,

Series E, 5.25%, 12/1/2055

|

|

|

|

|

|

|

|

|

|

|

|

Lincon County, SD, Economic Development Revenue,

Augustana College Association Project, Series A, 4.0%,

8/1/2056

|

|

|

|

|

|

|

Greeneville, TN, Health & Educational Facilities Board

Hospital Revenue, Ballad Health Obligation Group:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Knox, TN, Health Educational & Housing Facility Board

Revenue, Provident Group - UTK Properties LLC:

|

|

|

|

Series A-1, 5.5%, 7/1/2054, INS: BAM

|

|

|

|

Series A-1, 5.5%, 7/1/2059, INS: BAM

|

|

|

|

Nashville & Davidson County, TN, Metropolitan

Development & Housing Agency, Tax Increment Revenue,

Fifth Broadway Development District, 144A, 5.125%,

6/1/2036

|

|

|

|

The accompanying notes are an integral part of the financial statements.

|

|

|

DWS Strategic Municipal Income Trust

|

|

|

|

|

Nashville & Davidson County, TN, Metropolitan Government

Health & Education Facilities Board Revenue, Blakeford At

Green Hills Corp., Series A, 4.0%, 11/1/2055

|

|

|

|

Sevier County, TN, Public Building Authority, Local

Government Public Improvement Bonds, Series B-1,

3.38% (b), 6/7/2024, LOC: Bank of America NA

|

|

|

|

Tennessee, State Energy Acquisition Corporation Revenue,

Series A, 5.0% (a), 5/1/2052, GTY: Goldman Sachs Group,

Inc.

|

|

|

|

|

|

|

|

|

|

|

|

Central Texas, Regional Mobility Authority Revenue, Senior

Lien, Series A, Prerefunded, 5.0%, 1/1/2040

|

|

|

|

Dallas, TX, Kay Bailey Hutchison Convention Center Project,

Senior Lien, Special Tax, 144A, 6.0% (a), 8/15/2053

|

|

|

|

Houston, TX, Airport System Revenue, Series A, AMT,

5.0%, 7/1/2041

|

|

|

|

Matagorda County, TX, Navigation District No. 1, Pollution

Control Revenue, AEP Texas Central Co. Project, Series A,

4.4%, 5/1/2030, INS: AMBAC

|

|

|

|

Newark, TX, Higher Education Finance Corp., Texas

Revenue, Abilene Christian University Project, Series A,

4.0%, 4/1/2057

|

|

|

|

North Texas, Tollway Authority Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

San Antonio, TX, Education Facilities Corp. Revenue,

University of the Incarnate Word Project:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

San Antonio, TX, Education Facilities Corp., Higher

Education Revenue, Hallmark University Project:

|

|

|

|

Series A, 5.0%, 10/1/2041

|

|

|

|

Series A, 5.0%, 10/1/2051

|

|

|

|

Tarrant County, TX, Cultural Education Facilities Finance

Corp. Revenue, Christus Health Obligated Group,

Series B, 5.0%, 7/1/2048

|

|

|

|

Tarrant County, TX, Cultural Education Facilities Finance

Corp., Buckner Retirement Services Revenue, 5.0%,

11/15/2046

|

|

|

|

Tarrant County, TX, Cultural Education Facilities Finance

Corp., Hospital Revenue, Baylor Scott & White Health

Project, Series D, 5.0%, 11/15/2051

|

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS Strategic Municipal Income Trust

|

|

|

|

|

|

|

Tarrant County, TX, Cultural Education Facilities Finance

Corp., Hospital Revenue, Methodist Hospitals of

Dallas Project, Series A, 4.0% (b), 6/3/2024, LOC: TD

Bank NA

|

|

|

|

Temple, TX, Tax Increment, Reinvestment Zone No. 1:

|

|

|

|

Series A, 4.0%, 8/1/2041, INS: BAM

|

|

|

|

|

|

|

|

|

Texas, New Hope Cultural Education Facilities Finance Corp.

Revenue, Bridgemoor Plano Project:

|

|

|

|

Series A-2, Zero Coupon, 12/31/2030

|

|

|

|

Series A-1, 7.25%, 12/31/2030

|

|

|

|

Texas, New Hope Cultural Education Facilities Finance

Corp., Educational Revenue, Cumberland Academy

Project, Series A, 144A, 5.0%, 8/15/2050

|

|

|

|

Texas, Private Activity Bond, Surface Transportation Corp.

Revenue, North Tarrant Express, AMT, 5.5%, 12/31/2058

|

|

|

|

Texas, Private Activity Bond, Surface Transportation Corp.

Revenue, Senior Lien, North Mobility Partners Segments

3 LLC, AMT, 5.5%, 6/30/2040

|

|

|

|

Texas, State Transportation Commission, Turnpike Systems

Revenue, Series C, 5.0%, 8/15/2034

|

|

|

|

|

|

|

|

|

|

|

|

Salt Lake City, UT, Airport Revenue:

|

|

|

|

Series A, AMT, 5.0%, 7/1/2042

|

|

|

|

Series A, AMT, 5.0%, 7/1/2043

|

|

|

|

Series A, AMT, 5.0%, 7/1/2048

|

|

|

|

Utah, Infrastructure Agency Telecommunication Revenue:

|

|

|

|

Series A, 4.0%, 10/15/2036

|

|

|

|

Series A, 4.0%, 10/15/2041

|

|

|

|

Series A, 4.0%, 10/15/2042

|

|

|

|

Utah, Infrastructure Agency Telecommunications &

Franchise Tax Revenue, Pleasant Gove City Project:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vermont, State Educational & Health Buildings Financing

Agency Revenue, St Michael’s College Inc., 144A, 5.25%,

10/1/2052

|

|

|

|

|

|

|

Roanoke County, VA, Economic Development Authority

Revenue, Richfield Living, Series A, 5.25%, 9/1/2049

|

|

|

|

The accompanying notes are an integral part of the financial statements.

|

|

|

DWS Strategic Municipal Income Trust

|

|

|

|

|

Roanoke County, VA, Economic Development Authority,

RSDL Care Facilities Revenue, Richfield Living, Series A,

5.375%, 9/1/2054

|

|

|

|

Virginia, Housing Development Authority Revenue,

Series G, 5.15%, 11/1/2052

|

|

|

|

Virginia, Peninsula Town Center, Community Development

Authority Revenue, Special Obligation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Virginia, Small Business Financing Authority Revenue,

95 Express Lanes LLC Project, AMT, 4.0%, 1/1/2048

|

|

|

|

Virginia, Small Business Financing Authority, Elizabeth River

Crossings OPCO LLC Project, AMT, 4.0%, 1/1/2039

|

|

|

|

Virginia, Small Business Financing Authority, Private Activity

Revenue, Transform 66 P3 Project:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Virginia Beach, VA, State Beach Development Authority

Residential Care Facility, Westminster-Canterbury on

Chesapeake Bay Obligated Group, Series B-3, 5.375%,

9/1/2029

|

|

|

|

|

|

|

|

|

|

|

|

Port of Seattle, WA, Revenue Bonds, Series A, AMT, 5.0%,

5/1/2043

|

|

|

|

Skagit County, WA, Public Hospital District No. 1 Revenue,

5.5%, 12/1/2054

|

|

|

|

Washington, State Convention Center Public Facilities

District, 4.0%, 7/1/2031

|

|

|

|

Washington, State Health Care Facilities Authority,

CommonSpirit Health Obligation Group, Series A2, 5.0%,

8/1/2044

|

|

|

|

Washington, State Housing Finance Commission,

Emerald Heights:

|

|

|

|

Series B-2, 4.0%, 7/1/2026

|

|

|

|

Series B-1, 4.75%, 7/1/2027

|

|

|

|

Washington, State Housing Finance Commission, Horizon

House Project, 144A, 5.0%, 1/1/2038

|

|

|

|

Washington, State Housing Finance Commission,

Non-Profit Housing Revenue, Rockwood Retirement

Communities Project, Series A, 144A, 5.0%, 1/1/2051

|

|

|

|

Washington, State Housing Finance Commission, The

Hearthstone Project:

|

|

|

|

Series A, 144A, 5.0%, 7/1/2038

|

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS Strategic Municipal Income Trust

|

|

|

|

|

|

|

Series A, 144A, 5.0%, 7/1/2048

|

|

|

|

Series A, 144A, 5.0%, 7/1/2053

|

|

|

|

|

|

|

|

|

|

|

|

West Virginia, State Economic Development Authority, Solid

Waste Disposal Facility, Arch Resources Project, AMT,

4.125% (a), 7/1/2045

|

|

|

|

West Virginia, State Hospital Finance Authority, State

University Health System Obligated Group:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wisconsin, Health Educational Facilities Authority, Covenant

Communities, Inc. Project:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wisconsin, Public Finance Authority Revenue, Triad

Educational Services Ltd., 5.5%, 6/15/2062

|

|

|

|

Wisconsin, Public Finance Authority, Eastern Michigan

University, Series A-1, 5.625%, 7/1/2055, INS: BAM

|

|

|

|

Wisconsin, Public Finance Authority, Education Revenue,

Mountain Island Charter School Ltd.:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wisconsin, Public Finance Authority, Fargo-Moorhead

Metropolitan Area Flood Risk Management Project, AMT,

4.0%, 9/30/2051

|

|

|

|

Wisconsin, Public Finance Authority, Hospital Revenue,

Series A, 5.0%, 10/1/2044

|

|

|

|

Wisconsin, Public Finance Authority, Hospital Revenue,

Carson Valley Medical Center, Series A, 144A, 4.0%,

12/1/2051

|

|

|

|

Wisconsin, Public Finance Authority, Roseman University of

Health Sciences Project, 144A, 4.0%, 4/1/2042

|

|

|

|

Wisconsin, Public Finance Authority, Senior Living

Community First Mortgage Revenue, Cedars Obligated

Group, 144A, 5.5%, 5/1/2039

|

|

|

|

Wisconsin, Public Finance Authority, Senior Living Revenue,

Mary’s Woods at Marylhurst Project, Series A, 144A,

5.25%, 5/15/2052

|

|

|

|

Wisconsin, Public Finance Authority, Wisconsin Hotel

Revenue, Senior Lien Grand Hyatt San Antonio Hotel,

Series B, 144A, 6.0%, 2/1/2062

|

|

|

|

The accompanying notes are an integral part of the financial statements.

|

|

|

DWS Strategic Municipal Income Trust

|

|

|

|

|

Wisconsin, Public Financing Authority, Retirement Facilities

Revenue, Southminster, Inc.:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wisconsin, State Health & Educational Facilities Authority

Revenue, Marshfield Clinic Health System, Inc., Series A,

4.0% (b), 6/3/2024, LOC: Barclays Bank Plc

|

|

|

|

Wisconsin, State Housing & Economic Development

Authority Home Ownership Revenue, Series A, 6.0%,

3/1/2054

|

|

|

|

|

|

|

|

|

|

|

|

Guam, Government Waterworks Authority, Water &

Wastewater System Revenue, Series A, 5.0%, 1/1/2050

|

|

|

|

|

|

|

Puerto Rico, Commonwealth Aqueduct and Sewer

Authority, Series A, 144A, 5.0%, 7/1/2047

|

|

|

|

Puerto Rico, General Obligation:

|

|

|

|

Series A1, 4.0%, 7/1/2041

|

|

|

|

Series A1, 4.0%, 7/1/2046

|

|

|

|

Puerto Rico, Sales Tax Financing Corp., Sales Tax Revenue:

|

|

|

|

Series A-1, Zero Coupon, 7/1/2046

|

|

|

|

Series A-1, 4.75%, 7/1/2053

|

|

|

|

|

|

|

|

|

|

|

|

Freddie Mac Multi-Family ML Certificates, “A-CA” ,

Series 2021-ML10, 2.046%, 6/25/2038

|

|

|

|

Total Municipal Investments (Cost $168,629,660)

|

|

|

|

|

|

Open-End Investment Companies 0.0%

|

|

BlackRock Liquidity Funds MuniCash Portfolio, Institutional

Shares, 3.23% (e) (Cost $29,387)

|

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS Strategic Municipal Income Trust

|

|

|

|

|

|

|

|

Total Investment Portfolio (Cost $168,659,047)

|

|

|

|

|

|

|

Other Assets and Liabilities, Net

|

|

|

Net Assets Applicable to Common Shareholders

|

|

|

|

|

Non-income producing security.

|

|

|

Variable or floating rate security. These securities are shown at their current rate

as of

May 31, 2024. For securities based on a published reference rate and spread, the

reference rate and spread are indicated within the description above. Certain variable

rate securities are not based on a published reference rate and spread but adjust

periodically based on current market conditions, prepayment of underlying positions

and/or other variables. Securities with a floor or ceiling feature are disclosed at

the

inherent rate, where applicable.

|

|

|

Variable rate demand notes are securities whose interest rates are reset periodically

(usually daily mode or weekly mode) by remarketing agents based on current market

levels, and are not directly set as a fixed spread to a reference rate. These securities

may be redeemed at par by the holder through a put or tender feature, and are shown

at their current rates as of May 31, 2024. Date shown reflects the earlier of demand

date or stated maturity date.

|

|

|

Defaulted security or security for which income has been deemed uncollectible.

|

|

|

Security is a “step-up” bond where the coupon increases or steps-up at a

predetermined date. The range of rates shown is the current coupon rate through the

final coupon rate, date shown is the final maturity date.

|

|

|

Current yield; not a coupon rate.

|

144A: Security exempt from registration under Rule 144A of the Securities Act of 1933.

These securities may be resold in transactions exempt from registration, normally

to

qualified institutional buyers.

|

AGMC: Assured Guaranty Municipal Corp.

|

AMBAC: Ambac Financial Group, Inc.

|

AMT: Subject to alternative minimum tax.

|

BAM: Build America Mutual

|

|

|

|

|

|

|

NATL: National Public Finance Guarantee Corp.

|

Prerefunded: Bonds which are prerefunded are collateralized usually by U.S. Treasury

securities which are held in escrow and used to pay principal and interest on tax-exempt

issues and to retire the bonds in full at the earliest refunding date.

|

SPA: Standby Bond Purchase Agreement

|

The accompanying notes are an integral part of the financial statements.

|

|

|

DWS Strategic Municipal Income Trust

|

Fair Value Measurements

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets

for identical securities. Level 2 includes other significant observable inputs (including

quoted prices for similar securities, interest rates, prepayment speeds and credit risk).

Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations

may not be an indication of the risk or liquidity associated with investing in those

securities.

The following is a summary of the inputs used as of May 31, 2024 in valuing the Fund’s investments. For information on the Fund’s policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes

to Financial Statements.

|

|

|

|

|

|

Municipal Investments (a)

|

|

|

|

|

Open-End Investment Companies

|

|

|

|

|

|

|

|

|

|

|

|

|

See Investment Portfolio for additional detailed categorizations.

|

The accompanying notes are an integral part of the financial statements.

DWS Strategic Municipal Income Trust

|

|

|

Statement of Assets and Liabilities

as of May 31, 2024 (Unaudited)

|

|

|

Investment in securities, at value (cost $168,659,047)

|

|

Receivable for investments sold

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense payable on preferred shares

|

|

|

|

|

|

|

|

Other accrued expenses and payables

|

|

Series 2020-1 VMTPS (liquidation value $60,000,000, see page 41 for

more details)

|

|

|

|

|

Net assets applicable to common shareholders, at value

|

|

Net Assets Applicable to Common Shareholders Consist of

|

|

Distributable earnings (loss)

|

|

|

|

|

Net assets applicable to common shareholders, at value

|

|

|

|

|

Net Asset Value per common share

($108,664,369 ÷ 11,047,862 outstanding shares of beneficial interest,

$.01 par value, unlimited number of common shares authorized)

|

|

The accompanying notes are an integral part of the financial statements.

|

|

|

DWS Strategic Municipal Income Trust

|

Statement of Operations

for the six months ended May 31, 2024 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trustees' fees and expenses

|

|

|

|

|

Stock Exchange listing fees

|

|

|

|

|

|

|

|

|

|

|

Realized and Unrealized Gain (Loss)

|

|

Net realized gain (loss) from investments

|

|

Change in net unrealized appreciation (depreciation) on investments

|

|

|

|

|

Net increase (decrease) in net assets resulting from operations

|

|

The accompanying notes are an integral part of the financial statements.

DWS Strategic Municipal Income Trust

|

|

|

Statement of Cash Flows

for the six months ended May 31, 2024 (Unaudited)

Increase (Decrease) in Cash:

Cash Flows from Operating Activities

|

|

Net increase (decrease) in net assets resulting from operations

|

|

Adjustments to reconcile net increase (decrease) in net assets resulting

from operations to net cash provided by (used in) operating activities:

|

|

Purchases of long-term investments

|

|

Net amortization of premium/(accretion of discount)

|

|

Proceeds from sales and maturities of long-term investments

|

|

(Increase) decrease in interest receivable

|

|

(Increase) decrease in other assets

|

|

(Increase) decrease in receivable for investments sold

|

|

Increase (decrease) in payable for investments purchased - when

issued securities

|

|

Increase (decrease) in other accrued expenses and payables

|

|

Change in unrealized (appreciation) depreciation on investments

|

|

Net realized (gain) loss from investments

|

|

Cash provided by (used in) operating activities

|

|

Cash Flows from Financing Activities

|

|

Distributions paid (net of reinvestment of distributions)

|

|

Cash provided by (used in) financing activities

|

|

Increase (decrease) in cash

|

|

Cash at beginning of period

|

|

|

|

|

|

|

|

Interest expense paid on preferred shares

|

|

The accompanying notes are an integral part of the financial statements.

|

|

|

DWS Strategic Municipal Income Trust

|

Statements of Changes in Net Assets

|

|

Six Months

Ended

May 31, 2024

|

|

Increase (Decrease) in Net Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in net unrealized appreciation

(depreciation)

|

|

|

Net increase (decrease) in net assets applicable to

common shareholders

|

|

|

Distributions to common shareholders

|

|

|

|

|

|

|

Payments for shares repurchased

|

|

|

Net increase (decrease) in net assets from Fund

share transactions

|

|

|

Increase (decrease) in net assets

|

|

|

Net assets at beginning of period applicable to

common shareholders

|

|

|

Net assets at end of period applicable to

common shareholders

|

|

|

|

|

|

|

Common shares outstanding at beginning of period

|

|

|

|

|

|

|

Net increase (decrease) in Fund shares

|

|

|

Common shares outstanding at end of period

|

|

|

The accompanying notes are an integral part of the financial statements.

DWS Strategic Municipal Income Trust

|

|

|

Financial Highlights

|

|

|

|

|

|

|

|

|

|

|

|

Selected Per Share Data Applicable to Common Shareholders

|

Net asset value,

beginning of period

|

|

|

|

|

|

|

Income (loss) from

investment operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net realized and

unrealized gain (loss)

|

|

|

|

|

|

|

Total from

investment operations

|

|

|

|

|

|

|

Less distributions

applicable to common

shareholders from:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, end

of period

|

|

|

|

|

|

|

Market price, end

of period

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of the financial statements.

|

|

|

DWS Strategic Municipal Income Trust

|

Financial Highlights (continued)

|

|

|

|

|

|

|

|

|

|

|

|

Ratios to Average Net Assets Applicable to Common Shareholders and

Supplemental Data

|

Net assets, end of period

($ millions)

|

|

|

|

|

|

|

Ratio of expenses before

expense

reductions (%)

(including interest

|

|

|

|

|

|

|

Ratio of expenses after

expense

reductions (%)

(including interest

|

|

|

|

|

|

|

Ratio of expenses after

expense

reductions (%)

(excluding interest

|

|

|

|

|

|

|

Ratio of net investment

income (%)

|

|

|

|

|

|

|

Portfolio turnover

rate (%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Shares

information at period

end, aggregate

amount outstanding:

|

|

|

|

|

|

|

Series 2018 MTPS

($ millions)

|

|

|

|

|

|

|

Series 2020-1 VMTPS

($ millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liquidation and market

price per share ($)

|

|

|

|

|

|

|

|

|

Based on average common shares outstanding during the period.

|

|

|

Total return based on net asset value reflects changes in the Fund’s net asset value

during each period. Total return based on market price reflects changes in market

price.

Each figure assumes that dividend and capital gain distributions, if any, were reinvested.

These figures will differ depending upon the level of any discount from or premium

to

net asset value at which the Fund’s shares traded during the period.

|

|

|

For the year ended November 30, 2020, the Advisor had agreed to voluntarily reduce

its

management fee. Total return would have been lower had expenses not been reduced.

|

The accompanying notes are an integral part of the financial statements.

DWS Strategic Municipal Income Trust

|

|

|

Financial Highlights (continued)

|

|

Interest expense represents interest and fees on short-term floating rate notes issued

in

conjunction with inverse floating rate securities and interest paid to shareholders

of

Series 2018 MTPS and Series 2020-1 VMTPS.

|

|

|

The ratio of expenses before expense reductions (based on net assets of common and

Preferred Shares, including interest expense) was 2.41%, 2.62%, 1.65%, 1.25%, 1.54%

and 1.92% for the periods ended May 31, 2024, November 30, 2023, 2022, 2021,

2020 and 2019, respectively.

|

|

|

The ratio of expenses after expense reductions (based on net assets of common and

Preferred Shares, including interest expense) was 2.41%, 2.62%, 1.65%, 1.25%, 1.48%

and 1.92% for the periods ended May 31, 2024, November 30, 2023, 2022, 2021,

2020 and 2019, respectively.

|

|

|

The ratio of expenses after expense reductions (based on net assets of common and