MetLife Investment Management Agrees to Acquire Traditional Fixed Income and Equity Portfolio Management Teams Managing $6 Billion From Mesirow

08 Enero 2025 - 7:30AM

Business Wire

Acquisition includes high yield, strategic

fixed income and small-cap equity teams

MetLife Investment Management (MIM), the institutional asset

management business of MetLife, Inc. (NYSE: MET), today announced

that it has reached a definitive agreement to acquire three

investment teams and assets managed by Mesirow, an independent,

employee-owned financial services firm. MIM is acquiring the high

yield and bank loan, strategic fixed income and small-cap equity

teams and certain related investment products.

Under the terms of the transaction, about $6 billion of assets

managed by the acquired teams will transfer to MIM, subject to

customary approvals and consents. The acquisition is consistent

with MetLife’s New Frontier strategy to accelerate growth in asset

management and MIM’s efforts to expand offerings and channels and

adding higher yield capabilities. MIM is a top 25 institutional

investment manager globally by assets under management.1

The acquisition will advance the development of MIM’s leveraged

finance platform, adding opportunistic high yield and bank loan

strategies with risk-return profiles that complement MIM’s current

offering, including the strategies anticipated to be added through

the recently announced acquisition of PineBridge Investments. The

acquired teams consist of about 20 investment professionals, all of

whom are expected to join MIM on completion of the transaction.

“Building businesses with investment talent is a core belief,”

said MIM President Jude Driscoll. “As fundamental, bottom-up

investors, these investment teams are excellent strategic fits and

bring seasoned talent to MIM. By leveraging the power of the MIM

platform, we believe we can accelerate growth in these strategies

through investment performance and the breadth of our distribution

capabilities.”

“We are confident that MetLife will deliver scaled resources

well suited to these three traditional investment strategies,” said

Natalie Brown, Mesirow Chief Executive Officer. “Going forward,

Mesirow will continue to focus on growing our alternatives

capabilities and core Wealth Management, Fiduciary Solutions, and

Capital Markets/Investment Banking offerings, which have over $300

billion in total assets under supervision.”

Third Street Partners served as advisor to MetLife in this

transaction.

About MetLife MetLife, Inc. (NYSE:

MET), through its subsidiaries and affiliates (“MetLife”), is one

of the world’s leading financial services companies, providing

insurance, annuities, employee benefits and asset management to

help individual and institutional customers build a more confident

future. Founded in 1868, MetLife has operations in more than 40

markets globally and holds leading positions in the United States,

Japan, Latin America, Asia, Europe and the Middle East. For more

information, visit www.metlife.com.

About MetLife Investment Management

MetLife Investment Management, the institutional asset management

business of MetLife, Inc. (NYSE: MET), is a global public fixed

income, private capital and real estate investment manager

providing tailored investment solutions to institutional investors

worldwide. MetLife Investment Management provides public and

private pension plans, insurance companies, endowments, funds and

other institutional clients with a range of bespoke investment and

financing solutions that seek to meet a range of long-term

investment objectives and risk-adjusted returns over time. MetLife

Investment Management has over 150 years of investment experience

and as of September 30, 2024, had $609.3 billion in total assets

under management. For more information, see the total assets under

management fact sheet for the quarter ended September 30, 2024

available on MetLife’s Investor Relations webpage

(https://investor.metlife.com).

Forward-Looking Statements The

forward-looking statements in this news release, using words such

as “continue,” “look forward,” “seek,” “well-positioned” and “will”

are based on assumptions and expectations that involve risks and

uncertainties, including the “Risk Factors” MetLife, Inc. describes

in its U.S. Securities and Exchange Commission filings. MetLife’s

future results could differ, and it does not undertake any

obligation to publicly correct or update any of these

statements.

Endnotes 1Pensions &

Investments Managers Ranked by Total Worldwide Institutional Assets

Under Management as of 12/31/23

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250107320509/en/

Media Dave Franecki 973-264-7465

Dave.Franecki@metlife.com

Investors John Hall 212-578-7888

John.A.Hall@metlife.com

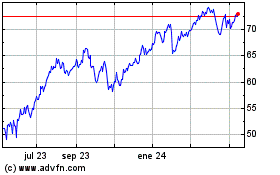

MetLife (NYSE:MET)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

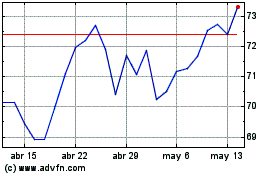

MetLife (NYSE:MET)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025