0001373715false00013737152024-10-212024-10-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_____________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 21, 2024

___________

SERVICENOW, INC.

(Exact name of registrant as specified in its charter)

___________

| | | | | | | | | | | | | | |

Delaware | | 001-35580 | | 20-2056195 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

2225 Lawson Lane

Santa Clara, California 95054

(Address of Principal Executive Offices and Zip Code)

(408) 501-8550

(Registrant's telephone number, including area code)

| | |

Not Applicable |

(Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | | NOW | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 23, 2024, ServiceNow, Inc. (“ServiceNow” or the “Company”) issued a press release announcing financial results for the three months ended September 30, 2024.

A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The information above, including Exhibit 99.1, is furnished pursuant to Item 2.02 of Form 8-K and is not deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities of that section, nor shall it be deemed incorporated by reference in any filing of ServiceNow under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any filings.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 21, 2024, the Board of Directors (the "Board") of the Company appointed Amit Zavery, age 53, as President, Chief Product Officer and Chief Operating Officer of the Company, effective October 28, 2024.

Mr. Zavery joins the Company from Alphabet Inc., a multinational technology company, where he served as VP/GM and Head of Platform, Google Cloud from March 2019. Prior to joining Google Cloud, Mr. Zavery served in various leadership roles at Oracle Corporation, a multinational computer technology company, from December 1994 to March 2019 - most recently as its Executive Vice President and Corporate Officer, Product Development. In addition, Mr. Zavery has served on the Board of Directors of Broadridge Financial Solutions, Inc., a financial technology company, since June 2019. Mr. Zavery studied electrical and computer engineering at the University of Texas at Austin, received his M.S. in information networking from Carnegie Mellon University and completed the Advanced Management Program at Harvard Business School.

In connection with his appointment, Mr. Zavery and the Company entered into an Employment Agreement dated September 17, 2024 (the “Employment Agreement”). Pursuant to the Employment Agreement, Mr. Zavery will receive an initial annual base salary of $900,000 and a target annual cash bonus opportunity equal to 125% of his base salary. The Employment Agreement further provides Mr. Zavery a sign-on cash bonus of $3,000,000, subject to repayment under certain conditions.

In addition, to replace the estimated value of outstanding equity from his prior employer that will be forfeited upon his departure, the Employment Agreement provides that Mr. Zavery is eligible to receive a grant of Company equity with a grant date value of $29,000,000 that will consist of a time-based restricted stock unit award (the “RSU Grant”) and a performance-based restricted stock unit award (the “PRSU Grant”). All of the outstanding equity Mr. Zavery forfeited had been subject solely to time-based vesting conditions.

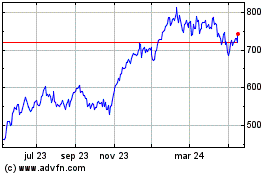

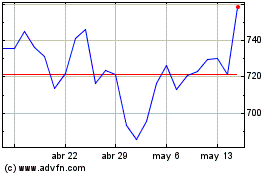

The Employment Agreement provides that the number of shares of the Company’s common stock subject to the RSU Grant shall be equal to $23,200,000 divided by the average daily closing price of the Company’s common stock for the 20 trading days ending on the third day before the date of grant. The RSU Grant will vest as follows: 67% and 33% of the shares shall vest in equal quarterly installments on the quarterly anniversary of the grant date on each of the four quarters of 2025 and 2026, respectively, subject to Mr. Zavery’s continued employment with the Company through each vesting date. This vesting schedule was established based on the vesting schedule of the forfeited awards.

The number of shares of the Company’s common stock subject to the PRSU Grant shall be equal to $5,800,000 divided by the average daily closing price of the Company’s common stock for the 20 trading days ending on the third day before the date of grant. The PRSU Grant shall be subject to the same performance metrics and vesting schedule as the fiscal year 2024 performance-based restricted stock units granted to other executive officers of the Company, with 100% of the PRSU Grant to be measured on the two-year performance period running from January 1, 2024 through December 31, 2025, subject to Mr. Zavery’s continued employment with the Company through each vesting date.

The foregoing description of the Employment Agreement does not purport to be complete and is qualified in its entirety by reference to such agreement, which is filed as Exhibit 10.1 hereto and is incorporated by reference herein.

In addition, Mr. Zavery executed the Company’s standard form of indemnity agreement for officers, filed as Exhibit 10.1 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as filed with the SEC on February 27, 2015.

There are no arrangements or understandings between Mr. Zavery and any other persons, pursuant to which he was appointed President, Chief Product Officer and Chief Operating Officer. There are no family relationships among Mr. Zavery and any of the Company’s directors or executive officers. Mr. Zavery is not a party to any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| (d) | Exhibits. | |

| | |

| | |

| | |

| 104 | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | SERVICENOW, INC. |

| | | | |

| | | By: | /s/ Russell S. Elmer |

| | | | Russell S. Elmer

General Counsel |

| | | | |

| Date: October 23, 2024 | | |

September 17, 2024

Amit Zavery

Dear Amit:

On behalf of ServiceNow, Inc. (the “Company”), this letter agreement (the “Agreement”) sets forth the terms and conditions of your employment as President, Chief Product Officer, and Chief Operating Officer of the Company.

1.Position. Effective on your Start Date (as defined below), you will serve as the Company’s President, Chief Product Officer, and Chief Operating Officer reporting directly to the Company’s Chief Executive Officer (the “CEO”). You will have all of the duties, responsibilities and authority commensurate with the position. Your employment with the Company will commence as soon as practicable on a date to be determined by you and the CEO, which shall be no later than November 4, 2024 (such start date, your “Start Date”). You will be expected to devote your full working time and attention to the business of the Company. Notwithstanding the foregoing, you may manage personal investments, participate in civic, charitable, professional and academic activities (including serving on boards and committees), and, subject to prior approval, serve on the board of directors (and any committees) of outside entities, provided that such activities do not at the time the activity or activities commence or thereafter (i) create an actual or potential business or fiduciary conflict of interest or

(ii) individually or in the aggregate, interfere materially with the performance of your duties to the Company. As a matter of policy, the Company does not permit executive officers to serve on more than one outside board of directors for a for-profit company.

2.Term. Subject to the terms of this Agreement, this Agreement will remain in effect for a period commencing on the Start Date and continuing until termination of your employment as set forth herein (the “Employment Term”).

3.Cash Compensation.

a.Base Salary. Your initial annual base salary (the “Base Salary”) will be Nine Hundred Thousand Dollars ($900,000), less required deductions and withholdings, payable in accordance with the Company’s normal payroll practices. Thereafter, your annual base salary will be determined by the Leadership Development and Compensation Committee of the Company’s Board of Directors (the “Compensation Committee”). Your Base Salary will be pro-rated for any partial years of employment during your Employment Term.

b.Sign-on Bonus: Provided that you remain employed until the first anniversary of your Start Date, other than stated herein, you will earn a sign-on bonus in the amount of Three Million Dollars ($3,000,000) (your “Sign-On Bonus”), which will be paid in two installments as follows:

i. In the first payroll period following the one-month anniversary of your Start Date, you will receive a one-time bonus payment of One Million Dollars ($1,000,000); and

ii. In the first payroll period following the six-month anniversary of your Start Date, you will receive a one-time bonus payment of Two Million Dollars ($2,000,000),

The Sign-On Bonus is subject to clawback or repayment only pursuant to Section 5 of this Agreement.

c.Annual Target Bonus. During the Employment Term, you will be eligible to participate in our executive corporate bonus program. Your initial annual bonus target will be One Hundred Twenty-Five percent (125%) of your Base Salary which equals One Million One Hundred and Twenty-Five Thousand Dollars ($1,125,000) for the applicable fiscal year (your “Target Bonus”). Whether you receive the Target Bonus, and the amount of actual bonus amount awarded (your “Actual Bonus”) will be determined by the Compensation Committee based in all cases upon the achievement of both Company and individual performance objectives as established by the Compensation Committee. To earn any Actual Bonus, you must be employed by the Company on the last day of the period to which such bonus relates and at the time bonuses are paid, except as otherwise provided herein. Your bonus participation will be subject to all the terms, conditions and restrictions of the applicable Company bonus plan, as amended from time to time. The Actual Bonus shall be subject to required deductions and withholdings.

i. For fiscal year 2024, you will be eligible to receive a pro-rata portion of your Annual Target Bonus based on achievement of performance objectives.

4.Benefits. Vacation & Expenses.

a.You will be entitled to participate in all employee retirement, welfare, insurance, benefit and vacation programs of the Company as are in effect from time to time and in which other senior executives of the Company are eligible to participate, on the same terms as such other senior executives, pursuant to the governing plan documents.

b.The Company will, in accordance with applicable Company policies and guidelines, reimburse you for all reasonable and necessary expenses incurred by you in connection with your performance of services on behalf of the Company.

2

The Company will, in accordance with applicable Company policies and guidelines, reimburse you for all reasonable and necessary expenses incurred by you in connection with your performance of services on behalf of the Company. In addition, the Company shall directly pay your reasonable legal fees and expenses incurred in the negotiation of this Agreement, in an amount not to exceed $15,000.

5.Clawback. The Sign-On Bonus shall be subject to clawback or repayment to the Company in full if you are terminated by the Company for Cause or you voluntarily resign without Good Reason, in either case before the first anniversary of the Start Date.

6.Equity Awards. Subject to this Section 6 and subject to the approval of the Company’s Board of Directors (the “Board”) or the Compensation Committee, we will recommend that you be granted equity awards as follows:

a.Replacement Grant. The Company acknowledges that you have been granted equity awards from your current employer with a significant value, which you would continue to vest in if you remained with that employer. In recognition of this, on the first regularly scheduled new hire grant date following your Start Date (the “Grant Date”), the Company will grant you awards with a total grant date value of Twenty-Nine Million Dollars ($29,000,000), as follows:

i. a restricted stock unit award to acquire such number of shares of the Company’s common stock equal to Twenty-Three Million Two Hundred Thousand Dollars ($23,200,000) divided by the average daily closing price of the Company’s common stock on the New York Stock Exchange for the twenty (20) trading days ending on the third trading day immediately prior to the Grant Date, rounded up to the nearest whole share (the “Replacement RSU Award”) under the Company’s 2021 Equity Incentive Plan, as amended and restated (the “Equity Plan”). The Replacement RSU Award will vest as follows: 67% of the shares subject to the Replacement RSU Award shall vest in equal quarterly installments on the quarterly anniversary of the grant date on each of the four quarters of 2025; and 33% of the shares subject to the Replacement RSU Award shall vest in equal quarterly installments on the quarterly anniversary of the grant date on each of the four quarters of 2026; provided that, subject to Section 8 below, vesting will be contingent on your continued employment with the Company on the applicable time-based vesting dates, and will be subject to the terms and conditions of the written agreement governing such grant, the Equity Plan and this Agreement; and

ii. a Fiscal Year 2024 Performance-Based Restricted Stock Unit (“PRSU”) Award to acquire such number of shares of the Company’s common stock equal to Five Million Eight Hundred Thousand Dollars ($5,800,000) divided by the average daily closing price of the Company’s common stock on the New York Stock Exchange for the

3

twenty (20) trading days ending on the third trading day immediately prior to the Grant Date, rounded up to the nearest whole share (the “Replacement PRSU Award”) under the Equity Plan. The Replacement PRSU Award shall be subject to the same performance metrics and vesting schedule as the Fiscal Year 2024 performance restricted stock units granted to other executive officers of the Company, with 100 percent of the Replacement PRSU Award to be measured on the Two Year Performance Period running from January 1, 2024 through December 31, 2025. For purposes of determining performance under the Replacement PRSU Award, the performance period and award determination will not be pro-rated based on your Start Date being after January 1, 2024 and otherwise will be deemed subject to Section 8 below. Vesting will depend on your continued employment by the Company on the applicable performance-based vesting dates, and will be subject to the terms and conditions of the written agreement governing such grant, the Equity Plan and this Agreement.

b.Future Equity. You shall be eligible for future equity grants as determined by and pursuant to the terms established by the Compensation Committee.

7.Definitions. As used in this Agreement, the following terms have the following meanings.

a.Cause. For purposes of this Agreement, “Cause” for the Company to terminate your employment hereunder shall mean the occurrence of any of the following events, as determined by the Company in its good faith discretion:

i. your conviction of, or plea of nolo contendere to, any felony or any crime involving fraud, dishonesty or moral turpitude;

ii. your commission of or participation in a fraud or act of dishonesty against the Company that results in (or would reasonably be expected to result in) material harm to the business of the Company;

iii.your intentional, material violation of any contract or agreement between you and the Company or any statutory duty you owe to the Company or the improper disclosure of confidential information (as defined in the Company’s standard confidentiality agreement);

iv.your conduct that constitutes gross insubordination or habitual neglect of duties and that results in (or would reasonably be expected to result in) material harm to the business of the Company;

v.your material failure to follow the Company’s material policies; or

4

vi.your failure to cooperate with the Company in any investigation or formal proceeding;

provided, however, that the action or conduct described in clauses (iii), (iv), (v), and (vi) above will constitute “Cause” only if such action or conduct continues after the Company has provided you with written notice thereof and thirty (30) days to cure the same if such action or conduct is curable.

b.Change in Control. For purposes of this Agreement, “Change in Control” means the occurrence, in a single transaction or in a series of related transactions, of any one or more of the following events (excluding in any case transactions in which the Company or its successors issues securities to investors primarily for capital raising purposes):

i. the acquisition by a third party of securities of the Company representing fifty percent (50%) or more of the combined voting power of the Company’s then outstanding securities other than by virtue of a merger, consolidation or similar transaction;

ii. a merger, consolidation or similar transaction following which the stockholders of the Company immediately prior thereto do not own at least fifty percent (50%) of the combined outstanding voting power of the surviving entity (or that entity’s parent) in such merger, consolidation or similar transaction;

iii. the dissolution or liquidation of the Company; or

iv. the sale, lease, exclusive license or other disposition of all or substantially all of the assets of the Company.

Notwithstanding any of the foregoing, any transaction or transactions effected solely for purposes of changing the Company’s domicile will not constitute a Change in Control pursuant to the foregoing definition.

c.COBRA. For purposes of this Agreement, “COBRA” means the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended.

d.Code. For purposes of this Agreement, “Code” means the Internal Revenue Code of 1986, as amended.

e.Disability. For purposes of this Agreement, “Disability” shall have that meaning set forth in Section 22(e)(3) of the Code.

f.Good Reason. For purposes of this Agreement, “Good Reason” for you to terminate your employment hereunder shall mean the occurrence of any of the following events without your consent:

5

i. any material diminution in your title, authority, duties or responsibilities as in effect immediately prior to such reduction or a material diminution in the authority, duties or responsibilities of the person to whom you are required to report;

ii. a material reduction by the Company in your annual Base Salary or Annual Target Bonus, as initially set forth herein or as increased thereafter; provided, however, that Good Reason shall not be deemed to have occurred in the event of a reduction in your annual Base Salary or Annual Target Bonus that is pursuant to a salary or bonus reduction program affecting substantially all of the employees of the Company or substantially all similarly situated executive employees and that does not adversely affect you to a greater extent than other similarly situated employees;

iii.a relocation of your business office to a location that would increase your one-way commute distance by more than thirty-five (35) miles from the location at which you principally performed your duties immediately prior to the relocation, except for required travel by you on the Company’s business to an extent substantially consistent with your business travel obligations prior to the relocation;

iv.material breach of this Agreement by the Company; or

v.failure of a successor entity to assume this Agreement;

provided, however, that, any such termination by you shall only be deemed for Good Reason pursuant to this definition if: (1) you give the Company written notice of your intent to resign for Good Reason within ninety (90) days following the first occurrence of the condition(s) that you believe constitute(s) Good Reason, which notice shall describe such condition(s); (2) the Company fails to remedy such condition(s) within thirty (30) days following receipt of the written notice (the “Cure Period”); and (3) you voluntarily resign your employment within one hundred twenty ( 120) days following the end of the Cure Period.

8.Effect of Termination of Employment.

a.Termination by the Company for Cause or Disability, or Resignation without Good Reason. In the event your employment is terminated by the Company for Cause, your employment terminates due to your Disability (which termination may be implemented by written notice by the Company if you have a

Disability), or you resign your employment other than for Good Reason, you

will be paid only: (i) any earned but unpaid Base Salary; (ii) except in the case

of termination for Cause or resignation without Good Reason. the amount of

any Actual Bonus earned and payable from a prior bonus period which remains unpaid by the Company as of the date of the termination of employment

6

determined in good faith in accordance with customary practice, to be paid at the same time as bonuses are paid for that period to other eligible executives;

(iii) other unpaid and then-vested amounts, including any amount payable to you under the specific terms of any agreements, plans or awards, including insurance and health and benefit plans in which you participate, unless otherwise specifically provided in this Agreement; and (iv) reimbursement for all reasonable and necessary expenses incurred by you in connection with your performance of services on behalf of the Company in accordance with applicable Company policies and guidelines, in each case as of the effective date of such termination of employment (the “Accrued Compensation”).

b.Termination without Cause or Resignation for Good Reason, Absent a Change in Control.

i. If the Company terminates your employment without Cause or you resign your employment for Good Reason, in either case not in connection with a Change in Control (which is dealt with in Section 8(c) below), provided that (except with respect to the Accrued Compensation) you deliver to the Company a signed general release of claims in favor of the Company on the Company’s standard form of release, but which shall neither release any right to indemnification nor impose any restrictive covenants other than those to which you are already subject, (the “Release”) and satisfy all conditions to make the Release effective within sixty (60) days following your termination of employment, then, you shall be entitled to:

1.immediate acceleration of one hundred percent (100%) of the number of then-unvested shares subject to the Replacement RSU Award and the Replacement PRSU Award. In the event the date of termination is prior to the completion of the performance period for the Replacement PRSU Award, the grant will be accelerated presuming the achievement of 100 percent of target for any metric for which the performance period is not complete;

2.the remaining portion of the Sign-On Bonus, if not yet paid;

3.the Accrued Compensation;

4.a lump sum payment equal to twelve (12) months of your then current Base Salary, less required deductions and withholdings;

5.a lump sum payment equal to one hundred percent (100%) of your Actual Bonus for the then-current fiscal year based on: (x) actual achievement of Company performance objectives and (y) deemed 100% achievement of personal performance objectives, if any, less any payment previously paid, if any, subject to required deductions and withholdings and paid when annual

7

bonuses are otherwise paid to active employees, but no later than March 15 of the year following the year in which the termination of employment occurs; and

6.a payment of the COBRA premiums (or reimbursement to you of such premiums) for continued health coverage for you and your dependents for a period of twelve (12) months.

a.Termination without Cause or Resignation for Good Reason, in Connection with a Change in Control. In the event a Change in Control occurs and if the Company terminates your employment without Cause or if you resign your employment for Good Reason, in either case within the period beginning three

(3) months before, and ending twelve (12) months following, such Change in Control; and provided that (except with respect to the Accrued Compensation) you deliver to the Company the signed Release and satisfy all conditions to make the Release effective within sixty (60) days following your termination of employment, then, (in lieu of any benefits pursuant to Section 8(b)), you shall be entitled to:

i. the Accrued Compensation;

ii. a lump sum payment equal to eighteen (18) months of your then-current Base Salary, less required deductions and withholdings;

iii.the remaining portion of the Sign-On Bonus, if not yet paid.

iv.a lump sum payment equal to one hundred percent (I 00%) of your Annual Target Bonus for the then-current fiscal year less any quarterly payment previously paid, if any, subject to required deductions and withholdings;

v.a payment of the COBRA premiums (or reimbursement to you of such premiums) for continued health coverage for you and your dependents for a period of eighteen (18) months; and

vi.immediate acceleration of one hundred percent (100%) of the number of then-unvested shares subject to equity grants, unless otherwise provided (and to the extent specified) by the terms of such grants.

b.Miscellaneous. For the avoidance of doubt, the benefits payable pursuant to Sections 8(b) through (c) are mutually exclusive and not cumulative. All lump sum payments provided in this Section 8 shall be made no later than the 60th day following your termination of employment (unless explicitly provided otherwise above). Notwithstanding anything to the contrary in this Agreement,

(i) any reference herein to a termination of your employment is intended to constitute a “separation from service” within the meaning of Section 409A of the Code, and Section l.409A-l(h) of the regulations promulgated thereunder, and shall be so construed, and (ii) no payment will be made or become due to

8

you during any period that you continue in a role with the Company that does not constitute a separation from service, and will be paid once you experience a “separation from service” from the Company within the meaning of Section 409A of the Code. In addition, notwithstanding anything to the contrary in this Agreement, upon a termination of your employment, you agree to resign prior to the time you deliver the Release from all positions you may hold with the Company and any of its subsidiaries or affiliated entities at such time, and no payment will be made or become due to you until you resign from all such positions, unless requested otherwise by the Board.

7.Parachute Payments. In the event that the severance and other benefits provided for in this Agreement or otherwise payable to you (i) constitute “parachute payments” within the meaning of Section 280G of the Code and (ii) but for this Section, would be subject to the excise tax imposed by Section 4999 of the Code, then, at your discretion, your severance and other benefits under this Agreement shall be payable either (i) in full, or

(ii) as to such lesser amount which would result in no portion of such severance and other benefits being subject to the excise tax under Section 4999 of the Code, whichever of the foregoing amounts, taking into account the applicable federal, state and local income taxes and the excise tax imposed by Section 4999, results in the receipt by you on an after-tax basis, of the greatest amount of severance benefits under this Agreement, notwithstanding that all or some portion of such severance benefits may be taxable under Section 4999 of the Code. Any reduction shall be made in the following manner: first a pro-rata reduction of (i) cash payments subject to Section 409A of the Code as deferred compensation and (ii) cash payments not subject to Section 409A of the Code, and second a pro rata cancellation of (i) equity-based compensation subject to Section 409A of the Code as deferred compensation and (ii) equity-based compensation not subject to Section 409A of the Code, with equity all being reduced in reverse order of vesting and equity not subject to treatment under Treasury regulation l .280G- Q & A 24(c) being reduced before equity that is so subject. Unless the Company and you otherwise agree in writing, any determination required under this Section shall be made in writing by the Company’s independent public accountants (the “Accountants”), whose determination shall be conclusive and binding upon you and the Company for all purposes. For purposes of making the calculations required by this Section, the Accountants may make reasonable assumptions and approximations concerning applicable taxes and may rely on reasonable, good faith interpretations concerning the application of Sections 280G and 4999 of the Code. The Company and you shall furnish to the Accountants such information and documents as the Accountants may reasonably request in order to make a determination under this Section. The Accountants shall deliver to the Company and you sufficient documentation for you to rely on it for purpose of filing your tax returns. The Company shall bear all costs the Accountants may reasonably incur in connection with any calculations contemplated by this Section.

10. Section 409A. To the extent (i) any payments to which you become entitled under this Agreement, or any agreement or plan referenced herein, in connection with your termination of employment with the Company constitute deferred compensation subject to Section 409A of the Code and (ii) you are deemed at the time of such

9

termination of employment to be a “specified” employee under Section 409A of the Code, then such payment or payments shall not be made or commence until the earlier of (i) the expiration of the six (6)-month period measured from the date of your “separation from service” (as such term is at the time defined in regulations under Section 409A of the Code) with the Company; or (ii) the date of your death following such separation from service; provided, however, that such deferral shall only be effected to the extent required to avoid adverse tax treatment to you, including (without limitation) the additional twenty percent (20%) tax for which you would otherwise be liable under Section 409A(a)(l)(B) of the Code in the absence of such deferral. Upon the expiration of the applicable deferral period, any payments which would have otherwise been made during that period (whether in a single sum or in installments) in the absence of this paragraph shall be paid to you or your beneficiary in one lump sum (without interest).

Except as otherwise expressly provided herein, to the extent any expense reimbursement or the provision of any in-kind benefit under this Agreement (or otherwise referenced herein) is determined to be subject to (and not exempt from) Section 409A of the Code, the amount of any such expenses eligible for reimbursement, or the provision of any in-kind benefit, in one calendar year shall not affect the expenses eligible for reimbursement or in kind benefits to be provided in any other calendar year, in no event shall any expenses be reimbursed after the last day of the calendar year following the calendar year in which you incurred such expenses, and in no event shall any right to reimbursement or the provision of any in-kind benefit be subject to liquidation or exchange for another benefit.

To the extent that any provision of this Agreement is ambiguous as to its exemption or compliance with Section 409A, the provision will be read in such a manner so that all payments hereunder are exempt from Section 409A to the maximum permissible extent, and for any payments where such construction is not tenable, that those payments comply with Section 409A to the maximum permissible extent. To the extent any payment under this Agreement may be classified as a “short-term deferral” within the meaning of Section 409A, such payment shall be deemed a short-term deferral, even if it may also qualify for an exemption from Section 409A under another provision of Section 409A. Payments pursuant to this Agreement (or referenced in this Agreement), and each installment thereof, are intended to constitute separate payments for purposes of Section l.409A-2(b)(2) of the regulations under Section 409A.

11.At Will Employment. Employment with the Company is for no specific period of time. Your employment with the Company will be “at will,” meaning that either you or the Company may terminate your employment at any time, with or without cause. and with or without advance notice. Any contrary representations that may have been made to you are superseded by this Agreement. This is the full and complete agreement between you and the Company on this term. Although your compensation and benefits, as well as the Company’s personnel policies and procedures, may change from time to time, the “at will” nature of your employment may only be changed in an express written agreement signed by you and a duly authorized officer of the Company (other than you).

10

12.Confidential Information and Other Company Policies. You will be bound by and comply fully with the Company’s standard confidentiality agreement (a form of which has been provided to you), insider trading policy, code of conduct, and any other policies and programs adopted by the Company regulating the behavior of its employees, as such policies and programs may be amended from time to time to the extent the same are not inconsistent with this Agreement, unless you consent to the same at the time of such amendment.

13.Company Records and Confidential Information.

a.Records. All records, files, documents and the like, or abstracts, summaries or copies thereof, relating to the business of the Company or the business of any subsidiary or affiliated companies, which the Company or you prepare or use or come into contact with, will remain the sole property of the Company or the affiliated or subsidiary company, as the case may be, and will be promptly returned upon termination of employment. You may retain any documents evidencing your terms of employment and compensation without violation hereto.

b.Confidentiality. You acknowledge that you have acquired and will acquire knowledge regarding confidential, proprietary and/or trade secret information in the course of performing your responsibilities for the Company, and you further acknowledge that such knowledge and information is the sole and exclusive property of the Company. You recognize that disclosure of such knowledge and information, or use of such knowledge and information, to or by a competitor could cause serious and irreparable harm to the Company.

14.Indemnification. You and the Company will, by no later than your Start Date, enter into the form of indemnification agreement provided to other similarly situated officers of the Company.

15.Arbitration. You and the Company agree to submit to mandatory binding arbitration, in Santa Clara County, California, before a single neutral arbitrator, any and all claims arising out of or related to this Agreement and your employment with the Company and the termination thereof, except that each party may, at its or his option, seek injunctive relief in court prior to such arbitration proceeding pursuant to applicable law. YOU AND THE COMPANY HEREBY WAIVE ANY RIGHTS TO TRIAL BY

JURY IN REGARD TO SUCH CLAIMS. This agreement to arbitrate does not restrict your right to file administrative claims you may bring before any government agency where, as a matter of law, the parties may not restrict your ability to file such claims (including, but not limited to, the National Labor Relations Board, the Equal Employment Opportunity Commission and the Department of Labor). However, you and the Company agree that, to the fullest extent permitted by law, arbitration shall be the exclusive remedy for the subject matter of such administrative claims. The arbitration shall be conducted through the American Arbitration Association (the “AAA”). The arbitrator shall issue a written decision that contains the essential findings and conclusions on which the decision is based. The arbitration will be conducted in

11

accordance with the AAA employment arbitration rules then in effect. The AAA rules may be found and reviewed at http://www.adr.org. If you are unable to access these rules, please let me know and I will provide you with a hardcopy. The parties acknowledge that they are hereby waiving any rights to trial by jury in any action, proceeding or counterclaim brought by either of the parties against the other in connection with any matter whatsoever arising out of or in any way connected with this Agreement.

16.Compensation Recoupment. All amounts payable to you hereunder shall be subject to recoupment pursuant to the Company’s current compensation recoupment policy, and any additional compensation recoupment policy or amendments to the current policy adopted by the Board or the Compensation Committee from time to time hereafter, as allowed by applicable law.

17.Miscellaneous.

a.Employment Eligibility Verification. For purposes of federal immigration law, you will be required to provide to the Company documentary evidence of your identity and eligibility for employment in the United States. Such documentation must be provided to us within three (3) business days of your Start Date, or our employment relationship with you may be terminated.

b.Background Check. This offer is contingent upon successful completion of a criminal background check and a standard pre-employment drug test, if applicable. The Company reserves the right to withdraw its job offer based on information discovered during the pre-employment screening process, provided it provides the information discovered to you and is not satisfied with any explanation you provide. Until you have been informed in writing by the Company that such checks have been completed and the results satisfactory, you should defer reliance on this offer.

c.At-Will Employment, Confidential Information and Invention Assignment Agreement and Arbitration Agreement. This offer is also contingent on you signing the Company’s At-Will Employment, Confidential Information and Invention Assignment Agreement and Arbitration Agreement.

d.Absence of Conflicts; Competition with Prior Employer. You represent that your performance of your duties under this Agreement will not breach any other agreement as to which you are a party. You agree that you have disclosed to the Company all of your existing employment and/or business relationships, including, but not limited to, any consulting or advising relationships, outside directorships, investments in privately held companies, and any other relationships that may create a conflict of interest. You are not to bring with you to the Company, or use or disclose to any person associated with the Company, any confidential or proprietary information belonging to any former employer or other person or entity with respect to which you owe an obligation of confidentiality under any agreement or otherwise. The Company does not

12

need and will not use such information and we will assist you in any way possible to preserve and protect the confidentiality of proprietary information belonging to third parties. Also, we expect you to abide by any obligations to refrain from soliciting any person employed by or otherwise associated with any former employer and suggest that you refrain from having any contact with such persons until such time as any non-solicitation obligation expires.

e.Successors. This Agreement is binding on and may be enforced by the Company and its successors and permitted assigns and is binding on and may be enforced by you and your heirs and legal representatives. Any successor to the Company or substantially all of its business (whether by purchase, merger, consolidation or otherwise) will in advance assume in writing and be bound by all of the Company’s obligations under this Agreement and shall be the only permitted assignee.

f.Notices. Notices under this Agreement must be in writing and will be deemed to have been given when personally delivered or two days after mailed by U.S. registered or certified mail, return receipt requested and postage prepaid.

Mailed notices to you will be addressed to you at the home address which you have most recently communicated to the Company in writing, with a copy (which shall not constitute notice) to Evan Belosa, Esq. McDermott Will & Emery, LLP, 1 Vanderbilt Avenue, New York, New York 10017. Notices to the Company will be addressed to the CEO at the Company’s corporate headquarters.

g.Waiver. No provision of this Agreement will be modified or waived except in writing signed by you and an officer of the Company duly authorized by its Board. No waiver by either party of any breach of this Agreement by the other party will be considered a waiver of any other breach of this Agreement.

h.Severability. In the event that any provision hereof becomes or is declared by a court of competent jurisdiction to be illegal, unenforceable or void, this Agreement shall continue in full force and effect without said provision.

i. Withholding. All sums payable to you hereunder shall be reduced by all federal, state, local and other withholding and similar taxes and payments required by applicable law.

j. Entire Agreement. This Agreement represents the entire agreement between the parties concerning the subject matter herein and supersedes all prior agreements and understandings between you and the Company. It may be amended, or any of its provisions waived, only by a written document executed by both parties in the case of an amendment, or by the party against whom the waiver is asserted.

k. Governing Law. This Agreement will be governed by the laws of the State of California without reference to conflict of laws provisions.

13

l. Survival. The provisions of this Agreement shall survive the termination of your employment for any reason to the extent necessary to enable the parties to enforce their respective rights under this Agreement.

[SIGNATURE PAGE TO AGREEMENT FOLLOWS]

14

Please sign and date this Agreement, and return it to me if you wish to accept employment at the Company under the terms described above.

Best regards,

/s/ Bill McDermott

Bill McDermott

Chief Executive Officer ServiceNow, Inc.

I, the undersigned, hereby accept and agree to the terms and conditions of my employment

with the Company as set forth in this Agreement.

Accepted and agreed to this 18 day of September, 2024:

By: /s/ Amit Zavery

Amit Zavery

[SIGNATURE PAGE TO AGREEMENT]

15

ServiceNow Reports Third Quarter 2024 Financial Results

•ServiceNow exceeds guidance across all Q3 2024 topline growth and profitability metrics; raises 2024 subscription revenues guidance

•Subscription revenues of $2,715 million in Q3 2024, representing 23% year-over-year growth, 22.5% in constant currency

•Total revenues of $2,797 million in Q3 2024, representing 22% year-over-year growth, 22% in constant currency

•Current remaining performance obligations of $9.36 billion as of Q3 2024, representing 26% year-over-year growth, 23.5% in constant currency

•Remaining performance obligations of $19.5 billion as of Q3 2024, representing 36% year-over-year growth, 33% in constant currency

•15 transactions over $5 million in net new ACV in Q3 2024, up 50% year-over-year

SANTA CLARA, Calif. - October 23, 2024 - ServiceNow (NYSE: NOW), the AI platform for business transformation, today announced financial results for its third quarter ended September 30, 2024, with subscription revenues of $2,715 million in Q3 2024, representing 23% year-over-year growth and 22.5% in constant currency.

“ServiceNow raised our full year topline guidance on the strength of our Q3 results, once again going beyond expectations,” said ServiceNow Chairman and CEO Bill McDermott. “This remarkable momentum stems from both existing and new customers doubling down on their investments in ServiceNow as the AI platform for business transformation. The mandate to put AI to work for people represents a generational technology shift. We have never been more confident in ServiceNow’s team, our platform, and our position as the ultimate growth company in enterprise software.”

As of September 30, 2024, current remaining performance obligations (“cRPO”), contract revenue that will be recognized as revenue in the next 12 months, was $9.36 billion, representing 26% year-over-year growth and 23.5% in constant currency. The company now has 2,020 total customers with more than $1 million in annual contract value (“ACV”), representing 14% year-over-year growth in customers.

“Q3 was another spectacular quarter driven by robust demand for the Now Platform and exceptional team execution,” said ServiceNow CFO Gina Mastantuono. “With Now Assist already delivering fantastic results, our latest Xanadu release marks our most comprehensive set of new AI innovations yet, further fueling our durable topline growth and margin expansion.”

ServiceNow also named enterprise software industry veteran Amit Zavery as president, chief product officer (CPO), and chief operating officer (COO) to lead product and engineering, effective October 28, 2024. With more than three decades in enterprise technology and previous leadership roles at Google Cloud and Oracle, Zavery is a visionary leader who brings extensive experience in enterprise innovation, transformation, and scale. Zavery’s responsibilities will include ServiceNow’s platform, products, engineering, cloud infrastructure, user experience, and enterprise-wide operations, ensuring all solutions meet the real-world business needs of ServiceNow customers.

Recent Business Highlights

Innovation

•ServiceNow is putting AI to work for customers. In Q3, the Now Platform Xanadu release, ServiceNow’s largest AI release to date, introduced hundreds of additional, new AI capabilities including Now Assist Skill Kit and purpose-built GenAI industry solutions for telecom, media, and technology; financial services; the public sector; and more.

•Alongside Xanadu, the company announced its plans to integrate Agentic AI into the ServiceNow platform and unlock 24/7 productivity at massive scale. With advanced reasoning and grounded in cross‑enterprise data through the Now Platform, ServiceNow AI Agents evolve from the more familiar prompt‑based activity to deep contextual comprehension, keeping people in the loop for robust oversight and governance. First use cases will be available in November for Customer Service Management (CSM) and IT Service Management (ITSM).

•Today, the company announced ServiceNow Workflow Data Fabric, an integrated data layer that unifies business and technology data across the enterprise, powering all workflows and AI agents with real-time, secure access to data from any source. Powered by Automation Engine and RaptorDB Pro high-performance database, Workflow Data Fabric unlocks value with orchestration and automation at ultra-speed and scale.

•At the United Nations General Assembly last month, ServiceNow demonstrated its commitment to building a better world through greater access to technology, knowledge, and opportunity. Through efforts such as ServiceNow.org and others, ServiceNow has set a bold ambition to partner with nonprofits and customers to accelerate impact and reach 1 billion people. This includes the company’s ambition to positively reach 20 million people through its philanthropy efforts.

Partnerships

•Today, the company made several partnership announcements designed to expand the ServiceNow ecosystem and accelerate business transformation. ServiceNow and NVIDIA will co-develop native AI Agents using NVIDIA NIM Agent Blueprints within the ServiceNow platform, creating use cases fueled by business knowledge that customers can simply choose to turn on; ServiceNow and Siemens announced a collaboration designed to bolster industrial cybersecurity and integrate GenAI into shop floor operations; ServiceNow and Rimini Street announced a partnership to help enable organizations to unlock value in legacy ERP systems; and ServiceNow and Pearson announced plans to supercharge workforce development and employee experiences in the age of AI.

•Earlier in October, ServiceNow and Zoom announced an expanded strategic alliance to integrate the companies’ GenAI technologies – ServiceNow Now Assist and Zoom AI Companion – to offer organizations advanced workflow automation for tasks and activities.

Global Expansion

•Continuing efforts to expand AI and technology skills, during the quarter, ServiceNow announced a new National Academic Partnership with Singapore’s Republic Polytechnic to provide hundreds of early-in-career and lifelong learners access to emerging AI and cloud computing roles in support of the government's Smart Nation agenda.

•Later this month, the company plans to launch a new data center pair located in Milan and Rome in response to growing demand for data center infrastructure in the region. The data center pair will help enhance customer agility, boost productivity, and promote innovation.

•In October, ServiceNow announced plans to invest $1.5 billion cumulatively in its UK business over the next five years. This includes plans to increase headcount, office space, and AI skills programs.

Investment

•ServiceNow repurchased approximately 272,000 shares of its common stock for $225 million as part of its share repurchase program, with the primary objective of managing the impact of dilution. Of the original authorized amount, approximately $562 million remains available for future share repurchases under the existing program.

Recognition

•As a testament to ServiceNow’s workplace culture, ServiceNow was awarded 10th place on the Fortune Best Workplaces in Technology list1, in addition to placing on the TIME World's Best Companies, PEOPLE Companies that Care, Fast Company 100 Best Workplaces for Innovators, and more.

(1) ©2024 Fortune Media IP Limited All rights reserved. Used under license. Fortune and Fortune Media IP Limited are not affiliated with, and do not endorse products or services of, ServiceNow.

Third Quarter 2024 GAAP and Non-GAAP Results:

The following table summarizes our financial results for the third quarter 2024:

| | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Third Quarter 2024 GAAP Results | | Third Quarter 2024 Non-GAAP Results(1) | |

| Amount

($ millions) | Year/Year

Growth (%) | | Amount ($ millions)(3) | Year/Year

Growth (%) | | |

| Subscription revenues | $2,715 | 23 | % | | $2,711 | 22.5 | % | | |

| Professional services and other revenues | $82 | 14 | % | | $81 | 13.5 | % | | |

| Total revenues | $2,797 | 22 | % | | $2,792 | 22 | % | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Amount

($ billions) | Year/Year

Growth (%) | | Amount

($ billions)(3) | Year/Year

Growth (%) | | |

| cRPO | $9.36 | 26 | % | | $9.18 | 23.5 | % | | |

| RPO | $19.5 | 36 | % | | $19.1 | 33 | % | | |

| | | | | | | |

| Amount

($ millions) | Margin (%) | | Amount ($ millions)(2) | Margin (%)(2) | | |

| Subscription gross profit | $2,219 | 82 | % | | $2,305 | 85 | % | | |

Professional services and other gross (loss) profit | ($6) | (7 | %) | | $5 | 7 | % | | |

| Total gross profit | $2,213 | 79 | % | | $2,310 | 83 | % | | |

| Income from operations | $418 | 15 | % | | $872 | 31 | % | | |

| Net cash provided by operating activities | $671 | 24 | % | | | | | |

| Free cash flow | | | | $471 | 17 | % | | |

| | | | | | | |

| Amount

($ millions) | Earnings per Basic/Diluted Share ($) | | Amount ($ millions)(2) | Earnings per Basic/Diluted Share ($)(2) | | |

| Net income | $432 | $2.09 / $2.07 | | $775 | $3.76 / $3.72 | | |

(1)We report non-GAAP financial measures in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. See the section entitled “Statement Regarding Use of Non-GAAP Financial Measures” for an explanation of non-GAAP measures.

(2)Refer to the table entitled “GAAP to Non-GAAP Reconciliation” for a reconciliation of GAAP to non-GAAP measures.

(3)Non-GAAP subscription revenues and total revenues are adjusted for constant currency by excluding effects of foreign currency rate fluctuations and any gains or losses from foreign currency hedge contracts. Professional services and other revenues, cRPO, and RPO are adjusted only for constant currency. See the section entitled “Statement Regarding Use of Non-GAAP Financial Measures” for an explanation of non-GAAP measures.

Note: Numbers rounded for presentation purposes and may not foot.

Financial Outlook

Our guidance includes GAAP and non-GAAP financial measures. The non-GAAP growth rates for subscription revenues are adjusted for constant currency by excluding effects of foreign currency rate fluctuations and any gains or losses from foreign currency hedge contracts, and cRPO are adjusted only for constant currency to provide better visibility into the underlying business trends.

The following table summarizes our guidance for the fourth quarter 2024:

| | | | | | | | | | | | | | | | | | | |

| Fourth Quarter 2024 GAAP Guidance | | Fourth Quarter 2024 Non-GAAP Guidance(1) | | |

| Amount

($ millions)(3) | Year/Year Growth (%)(3) | | Constant Currency Year/Year Growth (%) | | | |

| Subscription revenues | $2,875 - $2,880 | 21.5% - 22% | | 20.5 | % | | | |

| | | | | | | |

cRPO | | 21.5 | % | | 21.5 | % | | | |

| | | | | | | |

| | | | | | | |

| | | | Margin (%)(2) | | | |

| Income from operations | | | | 29 | % | | | |

| | | | | | | |

| | Amount

(millions) | | | | | |

| Weighted-average shares used to compute diluted net income per share | | 209 | | | | | |

(1)We report non-GAAP financial measures in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. See the section entitled “Statement Regarding Use of Non-GAAP Financial Measures” for an explanation of non-GAAP measures.

(2)Refer to the table entitled “Reconciliation of Non-GAAP Financial Guidance” for a reconciliation of GAAP to non-GAAP measures.

(3)Guidance for GAAP subscription revenues and GAAP subscription revenues and cRPO growth rates are based on the 30-day average of foreign exchange rates for September 2024 for entities reporting in currencies other than U.S. Dollars.

The following table summarizes our guidance for the full-year 2024:

| | | | | | | | | | | | | | | | |

| Full-Year 2024 GAAP Guidance | | Full-Year 2024 Non-GAAP Guidance(1) | | |

| Amount

($ millions)(3) | Year/Year Growth (%)(3) | | Constant Currency Year/Year Growth (%) | | |

| Subscription revenues | $10,655 - $10,660 | 23 | % | | 22.5 | % | | |

| | | | | | |

| | | | Margin (%)(2) | | |

| Subscription gross profit | | | | 84.5 | % | | |

| Income from operations | | | | 29.5 | % | | |

| Free cash flow | | | | 31 | % | | |

| | | | | | |

| | Amount

(millions) | | | | |

| Weighted-average shares used to compute diluted net income per share | | 208 | | | | | |

(1)We report non-GAAP financial measures in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. See the section entitled “Statement Regarding Use of Non-GAAP Financial Measures” for an explanation of non-GAAP measures.

(2)Refer to the table entitled “Reconciliation of Non-GAAP Financial Guidance” for a reconciliation of GAAP to non-GAAP measures.

(3)GAAP subscription revenues and related growth rate for the future quarter included in our full-year 2024 guidance are based on the 30-day average of foreign exchange rates for September 2024 for entities reporting in currencies other than U.S. Dollars.

Note: Numbers are rounded for presentation purposes and may not foot.

Conference Call Details

The conference call will begin at 2 p.m. Pacific Time (“PT”) (21:00 GMT) on October 23, 2024. Interested parties may listen to the call by dialing (888) 330‑2455 (Passcode: 8135305), or if outside North America, by dialing (240) 789‑2717 (Passcode: 8135305). Individuals may access the live teleconference from this webcast.

https://events.q4inc.com/attendee/941960692

An audio replay of the conference call and webcast will be available two hours after its completion and will be accessible for 30 days. To hear the replay, interested parties may go to the investor relations section of the ServiceNow website or dial (800) 770‑2030 (Passcode: 8135305), or if outside North America, by dialing (609) 800‑9909 (Passcode: 8135305).

Investor Presentation Details

An investor presentation providing additional information, including forward-looking guidance, and analysis can be found at https://investors.servicenow.com.

Upcoming Investor Conferences

ServiceNow today announced that it will attend and have executives present at four upcoming investor conferences.

These include:

•ServiceNow Global Executive Committee Member Nick Tzitzon will participate in a fireside chat at the RBC Capital Markets 2024 Global TIMT Conference on Wednesday, November 20, 2024 at 10:20am PT.

•ServiceNow Chief Financial Officer Gina Mastantuono will participate in a keynote presentation at the UBS Global Technology Conference on Tuesday, December 3, 2024 at 9:15am PT.

•ServiceNow Chief Financial Officer Gina Mastantuono will participate in a keynote presentation at the Wells Fargo TMT Summit on Wednesday, December 4, 2024 at 12:00pm PT.

•ServiceNow Chief Financial Officer Gina Mastantuono will participate in a keynote presentation at the Barclays Global Technology Conference on Wednesday, December 11, 2024 at 12:10pm PT.

The live webcast will be accessible on the investor relations section of the ServiceNow website at https://investors.servicenow.com and archived on the ServiceNow site for a period of 30 days.

Statement Regarding Use of Non-GAAP Financial Measures

We use the following non-GAAP financial measures in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

•Revenues. We adjust revenues and related growth rates for constant currency to provide a framework for assessing how our business performed excluding the effect of foreign currency rate fluctuations and any gains or losses from foreign currency hedge contracts that are reported in the current and comparative period. To exclude the effect of foreign currency rate fluctuations, current period results for entities reporting in currencies other than U.S. Dollars (“USD”) are converted into USD at the average exchange rates in effect during the comparison period (for Q3 2023, the average exchange rates in effect for our major currencies were 1 USD to 0.92 Euros and 1 USD to 0.79 British Pound Sterling (“GBP”)), rather than the actual average exchange rates in effect during the current period (for Q3 2024, the average exchange rates in effect for our major currencies were 1 USD to 0.91 Euros and 1 USD to 0.77 GBP). Guidance for related growth rates is derived by applying the average exchange rates in effect during the comparison period, rather than the exchange rates for the guidance period, adjusted for any foreign currency hedging effects. We believe the presentation of revenues and related growth rates adjusted for constant currency facilitates the comparison of revenues year-over-year.

•Remaining performance obligations and current remaining performance obligations. We adjust cRPO and remaining performance obligations (“RPO”) and related growth rates for constant currency to provide a framework for assessing how our business performed. To present this information, current period results for entities reporting in currencies other than USD are converted into USD at the exchange rates in effect at the end of the comparison period (for Q3 2023, the end of the period exchange rates in effect for our major currencies were 1 USD to 0.95 Euros and 1 USD to 0.82 GBP), rather than the actual end of the period exchange rates in effect during the current period (for Q3 2024, the end of the period exchange rates in effect for our major currencies were 1 USD to 0.90 Euros and 1 USD to 0.75 GBP). Guidance for the related growth rate is derived by applying the end of period exchange rates in effect during the comparison period rather than the exchange rates in effect during the guidance period. We believe the presentation of cRPO and RPO and related growth rates adjusted for constant currency facilitates the comparison of cRPO and RPO year-over-year, respectively.

•Gross profit, Income from operations, Net income and Net income per share - diluted. Our non-GAAP presentation of gross profit, income from operations, and net income measures exclude certain non-cash or non-recurring items, including stock-based compensation expense, amortization of debt discount and issuance costs related to our convertible senior notes, loss on early note conversions, amortization of purchased intangibles, legal settlements, business combination and other related costs, income tax effects and adjustments, and the income tax benefit from the release of a valuation allowance on deferred tax assets. The non-GAAP weighted-average shares used to compute our non-GAAP net income per share - diluted excludes the dilutive effect of the in-the-money portion of convertible senior notes as they are covered by our note hedges, and includes the dilutive effect of time-based stock awards, the dilutive effect of warrants and the potentially dilutive effect of our stock awards with performance conditions not yet satisfied at forecasted attainment levels to the extent we believe it is probable that the performance condition will be met. We believe these adjustments provide useful supplemental information to investors and facilitates the analysis of our operating results and comparison of operating results across reporting periods.

•Free cash flow. Free cash flow is defined as net cash provided by operating activities plus cash outflows for legal settlements, repayments of convertible senior notes attributable to debt discount and business combination and other related costs including compensation expense, reduced by purchases of property and equipment. Free cash flow margin is calculated as free cash flow as a percentage of total revenues. We believe information regarding free cash flow and free cash flow margin provides useful information to investors because it is an indicator of the strength and performance of our business operations.

Our presentation of non-GAAP financial measures may not be comparable to similar measures used by other companies. We encourage investors to carefully consider our results under GAAP, as well as our supplemental non-GAAP information and the reconciliation between these presentations, to more fully understand our business. Please see the tables included at the end of this release for the reconciliation of GAAP and non-GAAP results for gross profit, income from operations, net income, net income per share, and free cash flow.

Use of Forward-Looking Statements

This release contains “forward-looking statements” regarding our performance, including but not limited to statements in the section entitled “Financial Outlook” and statements regarding the expected benefits of our announced partnerships. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, our results could differ materially from the results expressed or implied by the forward-looking statements we make.

Factors that may cause actual results to differ materially from those in any forward-looking statements include, among others, experiencing an actual or perceived cyber-security event or weakness; our ability to comply with evolving privacy laws, data transfer restrictions, and other foreign and domestic standards related to data and the Internet; errors, interruptions, delays or security breaches in or of our service or data centers; our ability to maintain and attract key employees and manage workplace culture; alleged violations of laws and regulations, including those relating to anti-bribery and anti-corruption and those relating to public sector contracting requirements; our ability to compete successfully against existing and new competitors; our ability to predict, prepare for and respond promptly to rapidly evolving technological, market and customer developments; our ability to grow our business, including converting remaining performance obligations into revenue, adding and retaining customers, selling additional subscriptions to existing customers, selling to larger enterprises, government and regulated organizations with complex sales cycles and certification processes, and entering new geographies and markets; our ability to develop and gain customer demand for and acceptance of existing, new and improved products and services; our ability to expand and maintain our partnerships and partner programs, including expected market opportunity from such relationships, and realize the anticipated benefits thereof; global economic conditions; fluctuations in the value of foreign currencies relative to the U.S. Dollar; fluctuations in interest rates; our ability to consummate and realize the benefits of any strategic transactions or acquisitions; the impact of armed conflicts and bank failures on macroeconomic conditions; inflation; and fluctuations and volatility in our stock price.

Further information on these and other factors that could affect our financial results are included in our Form 10-K for the year ended December 31, 2023, and in other filings we make with the Securities and Exchange Commission from time to time.

We undertake no obligation, and do not intend, to update these forward-looking statements, to review or confirm analysts’ expectations, or to provide interim reports or updates on the progress of the current financial quarter.

About ServiceNow

ServiceNow (NYSE: NOW) is putting AI to work for people. We move with the pace of innovation to help customers transform organizations across every industry while upholding a trustworthy, human centered approach to deploying our products and services at scale. Our AI platform for business transformation connects people, processes, data, and devices to increase productivity and maximize business outcomes. For more information, visit: www.servicenow.com.

© 2024 ServiceNow, Inc. All rights reserved. ServiceNow, the ServiceNow logo, Now, and other ServiceNow marks are trademarks and/or registered trademarks of ServiceNow, Inc. in the United States and/or other countries. Other company names, product names, and logos may be trademarks of the respective companies with which they are associated.

Media Contact:

Johnna Hoff

(408) 250-8644

press@servicenow.com

Investor Contact:

Darren Yip

(925) 388-7205

ir@servicenow.com

ServiceNow, Inc.

Condensed Consolidated Statements of Operations

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| Revenues: | | | | | | | |

| Subscription | $ | 2,715 | | | $ | 2,216 | | | $ | 7,780 | | | $ | 6,315 | |

| Professional services and other | 82 | | | 72 | | | 247 | | | 219 | |

| Total revenues | 2,797 | | | 2,288 | | | 8,027 | | | 6,534 | |

Cost of revenues (1): | | | | | | | |

| Subscription | 496 | | | 420 | | | 1,406 | | | 1,163 | |

| Professional services and other | 88 | | | 76 | | | 250 | | | 242 | |

| Total cost of revenues | 584 | | | 496 | | | 1,656 | | | 1,405 | |

| Gross profit | 2,213 | | | 1,792 | | | 6,371 | | | 5,129 | |

Operating expenses (1): | | | | | | | |

| Sales and marketing | 944 | | | 799 | | | 2,827 | | | 2,454 | |

| Research and development | 626 | | | 549 | | | 1,875 | | | 1,562 | |

| General and administrative | 225 | | | 213 | | | 679 | | | 621 | |

| Total operating expenses | 1,795 | | | 1,561 | | | 5,381 | | | 4,637 | |

| Income from operations | 418 | | | 231 | | | 990 | | | 492 | |

| Interest income | 108 | | | 82 | | | 313 | | | 216 | |

| Other expense, net | (10) | | | (14) | | | (28) | | | (47) | |

| Income before income taxes | 516 | | | 299 | | | 1,275 | | | 661 | |

Provision for (benefit from) income taxes | 84 | | | 57 | | | 234 | | | (775) | |

| Net income | $ | 432 | | | $ | 242 | | | $ | 1,041 | | | $ | 1,436 | |

| Net income per share - basic | $ | 2.09 | | | $ | 1.18 | | | $ | 5.06 | | | $ | 7.04 | |

| Net income per share - diluted | $ | 2.07 | | | $ | 1.17 | | | $ | 5.00 | | | $ | 7.00 | |

| Weighted-average shares used to compute net income per share - basic | 206 | | | 204 | | | 206 | | | 204 | |

| Weighted-average shares used to compute net income per share - diluted | 209 | | | 206 | | | 208 | | | 205 | |

(1)Includes stock-based compensation as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| Cost of revenues: | | | | | | | |

| Subscription | $ | 64 | | | $ | 52 | | | $ | 184 | | | $ | 148 | |

| Professional services and other | 11 | | | 11 | | | 35 | | | 40 | |

| Operating expenses: | | | | | | | |

| Sales and marketing | 144 | | | 132 | | | 419 | | | 378 | |

| Research and development | 150 | | | 150 | | | 479 | | | 430 | |

| General and administrative | 57 | | | 68 | | | 175 | | | 195 | |

ServiceNow, Inc.

Condensed Consolidated Balance Sheets

(in millions)

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| (unaudited) | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,885 | | | $ | 1,897 | |

| Short-term investments | 3,410 | | | 2,980 | |

| Accounts receivable, net | 1,308 | | | 2,036 | |

| Current portion of deferred commissions | 502 | | | 461 | |

| Prepaid expenses and other current assets | 591 | | | 403 | |

| Total current assets | 7,696 | | | 7,777 | |

| Deferred commissions, less current portion | 946 | | | 919 | |

| Long-term investments | 3,829 | | | 3,203 | |

| Property and equipment, net | 1,718 | | | 1,358 | |

| Operating lease right-of-use assets | 661 | | | 715 | |

| Intangible assets, net | 214 | | | 224 | |

| Goodwill | 1,291 | | | 1,231 | |

| Deferred tax assets | 1,444 | | | 1,508 | |

| Other assets | 635 | | | 452 | |

| Total assets | $ | 18,434 | | | $ | 17,387 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 165 | | | $ | 126 | |

| Accrued expenses and other current liabilities | 1,058 | | | 1,365 | |

| Current portion of deferred revenue | 5,457 | | | 5,785 | |

| Current portion of operating lease liabilities | 106 | | | 89 | |

| | | |

| | | |

| Total current liabilities | 6,786 | | | 7,365 | |

| Deferred revenue, less current portion | 77 | | | 81 | |

| Operating lease liabilities, less current portion | 650 | | | 707 | |

| Long-term debt, net | 1,489 | | | 1,488 | |

| Other long-term liabilities | 142 | | | 118 | |

| Stockholders’ equity | 9,290 | | | 7,628 | |

| Total liabilities and stockholders’ equity | $ | 18,434 | | | $ | 17,387 | |

ServiceNow, Inc.

Condensed Consolidated Statements of Cash Flows

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| Cash flows from operating activities: | | | | | | | |

| Net income | $ | 432 | | | $ | 242 | | | $ | 1,041 | | | $ | 1,436 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | 144 | | | 146 | | | 410 | | | 408 | |

| | | | | | | |

| Amortization of deferred commissions | 140 | | | 115 | | | 403 | | | 333 | |

| | | | | | | |

| Stock-based compensation | 426 | | | 413 | | | 1,292 | | | 1,191 | |

| Deferred income taxes | (5) | | | 30 | | | 47 | | | (874) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other | (6) | | | (11) | | | (31) | | | (13) | |

| Changes in operating assets and liabilities, net of effect of business combinations: | | | | | | | |

| Accounts receivable | 228 | | | (83) | | | 727 | | | 552 | |

| Deferred commissions | (155) | | | (173) | | | (461) | | | (453) | |

| Prepaid expenses and other assets | (15) | | | (47) | | | (267) | | | (183) | |

| Accounts payable | (130) | | | (98) | | | 42 | | | (188) | |

| Deferred revenue | (263) | | | (128) | | | (355) | | | (217) | |

| Accrued expenses and other liabilities | (125) | | | (95) | | | (216) | | | (199) | |

| Net cash provided by operating activities | 671 | | | 311 | | | 2,632 | | | 1,793 | |

| Cash flows from investing activities: | | | | | | | |

| Purchases of property and equipment | (202) | | | (136) | | | (599) | | | (433) | |

Business combinations, net of cash acquired(1) | (41) | | | (279) | | | (82) | | | (279) | |

| Purchases of other intangibles | — | | | (3) | | | (30) | | | (3) | |

| Purchases of investments | (1,292) | | | (984) | | | (3,952) | | | (3,805) | |

| Purchases of non-marketable investments | (61) | | | (10) | | | (149) | | | (56) | |

| Sales and maturities of investments | 911 | | | 915 | | | 3,024 | | | 2,868 | |

| | | | | | | |

| Other | 27 | | | (28) | | | 25 | | | (15) | |

| Net cash used in investing activities | (658) | | | (525) | | | (1,763) | | | (1,723) | |

| Cash flows from financing activities: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Proceeds from employee stock plans | 106 | | | 76 | | | 237 | | | 193 | |

| Repurchases of common stock | (225) | | | (282) | | | (400) | | | (282) | |

| Taxes paid related to net share settlement of equity awards | (173) | | | (127) | | | (525) | | | (333) | |

Business combination (1) | — | | | — | | | (184) | | | — | |

| Net cash used in financing activities | (292) | | | (333) | | | (872) | | | (422) | |

| Foreign currency effect on cash, cash equivalents and restricted cash | 5 | | | (4) | | | (8) | | | (4) | |