All financial figures are in Canadian dollars unless otherwise

noted. This news release refers to certain financial measures and

ratios that are not specified, defined or determined in accordance

with Generally Accepted Accounting Principles ("GAAP"), including

net revenue; adjusted earnings before interest, taxes, depreciation

and amortization ("adjusted EBITDA"); adjusted cash flow from

operating activities; adjusted cash flow from operating activities

per common share; and proportionately consolidated debt-to-adjusted

EBITDA. For more information see "Non-GAAP and Other Financial

Measures" herein.

Pembina Pipeline Corporation ("Pembina" or the "Company") (TSX:

PPL; NYSE: PBA) announced today its financial and operating results

for the third quarter of 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241105833864/en/

Highlights

- Quarterly Results - reported quarterly earnings of $385

million, quarterly adjusted EBITDA of $1,019 million, and quarterly

adjusted cash flow from operating activities of $724 million.

- Guidance - 2024 adjusted EBITDA guidance range has been

narrowed to $4.225 billion to $4.325 billion (previously $4.2

billion to $4.35 billion).

- Recent Business Updates - developments during and

following the third quarter included:

- Effective August 1, 2024, Pembina acquired a 14.6 percent

interest in Aux Sable's U.S. operations thereby fully consolidating

ownership of all Aux Sable assets.

- Pembina Gas Infrastructure Inc. ("PGI") announced a $420

million (gross) transaction (the "Whitecap Transaction") with

Whitecap Resources Inc. ("Whitecap"), including the acquisition of

a 50 percent interest in Whitecap's Kaybob Complex and an

obligation to fund future infrastructure development. PGI also

entered into agreements with Veren Inc. and certain affiliates

thereof ("Veren") that include the $400 million (gross) acquisition

of Veren’s Gold Creek and Karr area oil batteries and support for

future infrastructure development. Further to the agreement with

Veren, PGI and Veren are progressing a new battery facility and

associated pipelines in the Gold Creek area.

- Common Share Dividend Declared - the board of directors

declared a common share cash dividend for the fourth quarter of

2024 of $0.69 per share to be paid, subject to applicable law, on

December 31, 2024, to shareholders of record on December 16,

2024.

- Strong Balance Sheet - at September 30, 2024, the ratio

of proportionately consolidated debt-to-adjusted EBITDA on a

trailing twelve-month basis was 3.6 times, at the low end of the

Company's targeted range and reflecting only two quarters of

contribution from the Alliance/Aux Sable Acquisition.

Financial and Operational Overview

3 Months Ended September

30

9 Months Ended September

30

($ millions, except where noted)

2024

2023

2024

2023

Revenue(1)

1,844

1,455

5,239

4,495

Net revenue(1)(2)

1,259

989

3,393

2,831

Gross profit

747

659

2,292

1,990

Adjusted EBITDA(2)

1,019

1,021

3,154

2,791

Earnings

385

346

1,302

1,078

Earnings per common share – basic

(dollars)

0.60

0.58

2.08

1.79

Earnings per common share – diluted

(dollars)

0.60

0.57

2.08

1.78

Cash flow from operating activities

922

644

2,312

1,755

Cash flow from operating activities per

common share – basic (dollars)

1.59

1.17

4.06

3.19

Adjusted cash flow from operating

activities(2)

724

659

2,343

1,899

Adjusted cash flow from operating

activities per common share – basic (dollars)(2)

1.25

1.20

4.11

3.45

Capital expenditures

262

169

713

429

(1)

Comparative 2023 period has been

adjusted. See "Accounting Policies & Estimates - Change in

Accounting Policies" in Pembina's Management's Discussion and

Analysis dated November 5, 2024 for the three and nine months ended

September 30, 2024 and Note 2 to the Interim Financial Statements

for the three and nine months ended September 30, 2024.

(2)

Refer to "Non-GAAP and Other

Financial Measures".

Financial and Operational Overview by Division

3 Months Ended September

30

9 Months Ended September

30

2024

2023

2024

2023

($ millions, except where noted)

Volumes(1)

Earnings (Loss)

Adjusted EBITDA(2)

Volumes(1)

Earnings (Loss)

Adjusted EBITDA(2)

Volumes(1)

Earnings (Loss)

Adjusted EBITDA(2)

Volumes(1)

Earnings (Loss)

Adjusted EBITDA(2)

Pipelines

2,738

433

593

2,595

437

591

2,684

1,373

1,847

2,500

1,163

1,617

Facilities

810

131

324

803

179

319

823

489

974

757

467

889

Marketing & New Ventures

344

125

159

255

(4)

159

319

324

490

261

231

424

Corporate

—

(215)

(57)

—

(170)

(48)

—

(1,210)

(157)

—

(487)

(139)

Income tax expense/recovery

—

(89)

—

—

(96)

—

—

326

—

—

(296)

—

Total

385

1,019

346

1,021

1,302

3,154

1,078

2,791

(1)

Volumes for the Pipelines and

Facilities divisions are revenue volumes, which are physical

volumes plus volumes recognized from take-or-pay commitments.

Volumes are stated in mboe/d, with natural gas volumes converted to

mboe/d from MMcf/d at a 6:1 ratio. Volumes for Marketing & New

Ventures are marketed crude and NGL volumes.

(2)

Refer to "Non-GAAP and Other

Financial Measures".

For further details on the Company's significant assets,

including definitions for capitalized terms used herein that are

not otherwise defined, refer to Pembina's Annual Information Form

for the year ended December 31, 2023, and Pembina's Management's

Discussion and Analysis dated November 5, 2024 for the three and

nine months ended September 30, 2024, filed at www.sedarplus.ca

(filed with the U.S. Securities and Exchange Commission at

www.sec.gov under Form 40-F) and on Pembina's website at

www.pembina.com.

Financial & Operational Highlights

Adjusted EBITDA

Pembina reported third quarter adjusted EBITDA of $1,019

million, consistent with the same period in the prior year. As

discussed further below, the positive impacts of increased

ownership of Alliance and Aux Sable combined with growing volumes

on certain systems, and higher natural gas liquids ("NGL") margins,

were offset predominantly by the impacts of lower recontracted

tolls and lower volumes on Cochin Pipeline ($44 million), the

earlier recognition of deferred take-or-pay revenue in the first

half of 2024 compared to the prior period ($15 million), lower

realized gains on derivatives ($21 million) and certain other

one-time items, including an unplanned outage at Aux Sable in the

current period ($13 million), and a gain on the recognition of a

finance lease in the prior period ($16 million).

Pipelines reported adjusted EBITDA of $593 million for the third

quarter, consistent with the same period in the prior year,

reflecting the net impact of the following factors:

- higher contribution from Alliance due to increased ownership

following the Alliance/Aux Sable Acquisition;

- higher contribution from Alliance due to higher demand on

seasonal contracts;

- the reactivation of the Nipisi Pipeline in late 2023;

- lower contribution from Cochin Pipeline due to lower tolls on

new long-term contracts, which replaced contracts that expired in

mid-July 2024 ($21 million); lower volumes resulting from a

contracting gap from mid-July to August 1 associated with the

return of linefill to certain customers; lower interruptible demand

resulting from a narrower condensate price differential between

western Canada and the U.S. Gulf Coast; and higher integrity

spending; and

- lower net revenue on the Peace Pipeline system due to the

earlier recognition of take-or-pay deferred revenue in the first

half of 2024 compared to 2023, which more than offset higher

contracted volumes.

Facilities reported adjusted EBITDA of $324 million for the

third quarter, representing a $5 million or two percent increase

over the same period in the prior year, reflecting the net impact

of the following factors:

- the inclusion within Facilities of adjusted EBITDA from Aux

Sable following the Alliance/Aux Sable Acquisition; and

- a gain on the recognition of a finance lease in the third

quarter of 2023.

Marketing & New Ventures reported adjusted EBITDA of $159

million for the third quarter, consistent with the same period in

the prior year, reflecting the net impact of the following

factors:

- higher net revenue from contracts with customers due to

increased ownership interest in Aux Sable following the

Alliance/Aux Sable Acquisition;

- higher NGL margins;

- the impact of a nine-day unplanned outage at Aux Sable;

and

- lower realized gains on commodity-related derivatives.

Corporate reported adjusted EBITDA of negative $57 million for

the third quarter, representing a $9 million or 19 percent decrease

compared to the same period in the prior year, primarily reflecting

higher long-term incentive costs driven by Pembina's share price

performance, partially offset by lower consulting fees.

Earnings

Pembina reported third quarter earnings of $385 million,

representing a $39 million or eleven percent increase over the same

period in the prior year.

Pipelines had earnings in the third quarter of $433 million,

representing a $4 million or one percent decrease over the prior

period. The decrease was primarily due to the same factors

impacting adjusted EBITDA, as noted above, as well as higher

depreciation and amortization expense largely due to the

Alliance/Aux Sable Acquisition.

Facilities had earnings in the third quarter of $131 million,

representing a $48 million or 27 percent decrease over the prior

period. In addition to the factors impacting adjusted EBITDA, as

noted above, the decrease was due to unrealized losses recognized

by PGI on interest rate derivative financial instruments compared

to gains in the third quarter of 2023, and higher depreciation and

amortization expense largely due to the Alliance/Aux Sable

Acquisition.

Marketing & New Ventures had earnings in the third quarter

of $125 million, representing a $129 million increase over the

prior period. In addition to the factors impacting adjusted EBITDA,

as noted above, the increase was due to unrealized gains on

NGL-based derivatives and crude-oil based derivatives compared to

losses in the third quarter of 2023, larger unrealized losses on

power purchase agreements, unrealized losses on interest rate

derivative financial instruments recognized by Cedar LNG Partners

LP ("Cedar LNG") and a cost recovery related to a storage insurance

settlement.

In addition to the factors impacting adjusted EBITDA in the

Corporate segment, as noted above, the change in third quarter

earnings compared to the prior period was primarily due to higher

net finance costs, primarily as a result of additional debt

associated with the Alliance/Aux Sable Acquisition.

Cash Flow From Operating Activities

Cash flow from operating activities of $922 million for the

third quarter represents a 43 percent increase over the same period

in the prior year. The increase was primarily driven by higher

operating results, as discussed above, the change in non-cash

working capital, an increase in payments collected through contract

liabilities, and lower taxes paid, partially offset by lower

distributions from equity accounted investees and higher net

interest paid.

On a per share (basic) basis, cash flow from operating

activities was $1.59 per share for the third quarter, representing

an increase of 36 percent compared to the same period in the prior

year, due to the same factors, as well as additional common shares

issued in connection with the Alliance/Aux Sable Acquisition

financing.

Adjusted Cash Flow From Operating Activities

Adjusted cash flow from operating activities of $724 million for

the third quarter represents a ten percent increase over the same

period in the prior year. The increase was primarily driven by the

same items impacting cash flow from operating activities, discussed

above, excluding the change in non-cash working capital and taxes

paid, as well as lower current income tax expense, partially offset

by higher accrued share-based payment expense.

On a per share (basic) basis, adjusted cash flow from operating

activities was $1.25 per share for the third quarter representing a

four percent increase over the same period in the prior year, due

to the same factors, as well as additional common shares issued in

connection with the Alliance/Aux Sable Acquisition financing.

Volumes

Pipelines volumes of 2,738 mboe/d in the third quarter represent

a six percent increase compared to the same period in the prior

year. The increase was primarily due to the increased ownership

interest in Alliance and the reactivation of the Nipisi Pipeline.

These factors were partially offset by lower volumes on the Peace

Pipeline system, Cochin Pipeline, and the Drayton Valley Pipeline.

Lower volumes on the Peace Pipeline system were a result of the

earlier recognition of take-or-pay deferred revenue in the first

half of 2024, compared to the first half of 2023, which more than

offset higher contracted volumes. Lower volumes on the Cochin

Pipeline were largely due to a contracting gap from mid-July to

August 1 associated with the return of linefill to certain

customers, and lower interruptible demand during the quarter

resulting from a narrower condensate price differential between

western Canada and the U.S. Gulf Coast.

Facilities volumes of 810 mboe/d in the third quarter represent

a one percent increase compared to the same period in the prior

year. The increase was primarily due to the recognition of Aux

Sable volumes following the Alliance/Aux Sable Acquisition; lower

volumes at the Redwater Complex and at Younger due to planned

outages and a rail strike impacting the Redwater Complex resulting

in volume curtailments; and lower volumes on certain PGI assets due

to the earlier recognition of take-or-pay deferred revenue in the

first half of 2024, which more than offset higher PGI interruptible

volumes.

In Marketing & New Ventures, crude oil sales volumes of 117

mboe/d in the third quarter represent a 31 percent increase

compared to the same period in the prior year, primarily due to

higher blending opportunities due to favourable price

differentials. NGL sales volumes of 227 mboe/d in the third quarter

represent a 37 percent increase compared to the same period in the

prior year, primarily due to higher ethane, propane, and butane

sales as a result of the increased ownership interest in Aux

Sable.

Executive Overview

Following solid third quarter results, and based on the outlook

for the remainder of 2024, Pembina is poised to deliver a record

financial year reflecting the positive impact of recent

acquisitions, growing volumes in the Western Canadian Sedimentary

Basin ("WCSB"), and a strong contribution from the marketing

business.

Pembina has narrowed its 2024 adjusted EBITDA guidance range to

$4.225 billion to $4.325 billion (previously $4.2 billion to $4.35

billion). Pembina is currently trending towards the mid-point of

the guidance range based on prevailing forward commodity prices and

the outlook for fourth quarter volumes.

Year-to-date, conventional pipeline volumes have been modestly

impacted by various Pembina and third-party outages and lower than

expected interruptible volumes on certain systems, leading to

slightly lower volume growth in 2024 than originally anticipated.

However, the broader outlook for growth in the WCSB, and Pembina's

business, remains strong and the revised guidance is based on an

expectation for the fourth quarter of higher interruptible volumes

on certain systems and the impact of new contracts.

At September 30, 2024, the ratio of proportionately consolidated

debt-to-adjusted EBITDA on a trailing twelve-month basis was 3.6

times, at the low end of the Company's targeted range, and

reflecting only two quarters of contribution from the Alliance/Aux

Sable Acquisition. Pembina expects to exit the year with a ratio of

3.4 to 3.6 times.

Other highlights during, and subsequent to, the third quarter

included:

Aux Sable Transaction

As previously announced, effective August 1, 2024, Pembina

acquired a 14.6 percent interest in Aux Sable's U.S. operations

from certain subsidiaries of The Williams Companies, Inc. The

Company is pleased to have fully consolidated ownership of all Aux

Sable assets, thereby further simplifying corporate reporting and

enhancing its ability to pursue long-term synergies.

PGI Transactions

As previously announced, during the quarter, PGI, jointly owned

by Pembina and KKR, entered into two exciting transactions with

growth-focused companies operating in the Montney and Duvernay.

The first was the $420 million (gross) Whitecap Transaction that

included the acquisition of a 50 percent interest in Whitecap's

Kaybob Complex and an obligation to fund future Lator area

infrastructure development. Closing of the Whitecap Transaction is

pending final regulatory approval.

In the second transaction, PGI entered into agreements with

Veren that include the $400 million (gross) acquisition of Veren’s

Gold Creek and Karr area oil batteries and support for future

infrastructure development. We are pleased to have closed this

transaction, effective October 9, 2024, and look forward to growing

alongside Veren in the years to come. Subsequent to the third

quarter, further to the agreement with Veren, and PGI's commitment

to fund up to $300 million of future infrastructure, PGI and Veren

are progressing a new battery and associated pipelines,

representing more than half of the funding commitment.

Through these two transactions, we are realizing the vision set

forth with the creation of PGI in 2022. PGI and Pembina have a

compelling service offering and ability to provide tailored and

value-added solutions to support the specific needs of our

customers. PGI and Pembina have further aligned themselves with two

strong growth companies, creating opportunities with attractive

economics that are expected to enhance asset utilization, capture

future volumes, and benefit Pembina’s full value chain.

Cedar LNG

Following the positive final investment decision last quarter

with respect to the Cedar LNG Project, we reached an exciting early

milestone with the start of the on-shore construction activities,

including site clearing and other civil works. Detailed engineering

is underway on the floating liquefied natural gas ("FLNG")

facility, with the EPC contractor reporting that progress on that

workstream is on track. We are looking forward to the start of

construction of the FLNG facility in mid-2025.

The process to assign Pembina's capacity in Cedar LNG to a third

party is ongoing. This represents the only capacity currently

available for contracting from a sanctioned west coast LNG project,

and as such, there is broad interest in the capacity. As a function

of the interest from multiple counterparties, Pembina expects this

process to extend into 2025.

Pembina occupies a strong and unique position within the

Canadian energy industry. The Company's extensive asset base and

integrated value chain allow it to provide a full suite of

transportation and midstream services across multiple hydrocarbons

– natural gas, crude oil, condensate, and NGL. In combination with

a strong financial position and fully funded business model,

Pembina is positioned to benefit from a robust, multi-year growth

outlook for the WCSB. This growth is being driven by

transformational developments that include the recent completion of

the Trans Mountain Pipeline expansion, new West Coast liquefied

natural gas ("LNG") and NGL export capacity, and the development of

new petrochemical facilities creating significant demand for ethane

and propane. Throughout the remainder of 2024 and into 2025,

Pembina is focused on capitalizing on the opportunities arising

from this growth and delivering long-term and sustainable value to

our shareholders.

Projects and New Developments

Pipelines

- The ongoing NEBC MPS Expansion includes a new mid-point pump

station, terminal upgrades, and additional storage, which will

support approximately 40,000 bpd of incremental capacity on the

NEBC Pipeline system. This expansion will fulfill customer demand

in light of growing production volumes from northeastern British

Columbia ("NEBC") and previously announced long-term midstream

service agreements with three premier NEBC Montney producers.

Terminal upgrades and additional storage were completed in October

and the mid-point pump station is expected to be completed by the

end of 2024. The NEBC MPS Expansion is trending on time and under

the $90 million budget, adding to Pembina's record of strong

project execution.

- On April 23, 2024, Pembina filed its project application for

the Taylor to Gordondale Project (an expansion of the Pouce Coupe

system) with the Canada Energy Regulator ("CER"). The CER has

determined the application is complete and can proceed to the

assessment phase of the regulatory process.

- Pembina continues to advance further expansions to support

volume growth in NEBC, including new pipelines and terminal

upgrades.

Facilities

- Pembina is constructing a new 55,000 bpd propane-plus

fractionator ("RFS IV") at its existing Redwater Complex. RFS IV

will leverage the design, engineering and operating best practices

of the existing facilities at the Redwater Complex. The project

includes additional rail loading capacity at the Redwater Complex.

With the addition of RFS IV, the fractionation capacity at the

Redwater Complex will total 256,000 bpd. As previously announced,

the estimated project cost has been revised to $525 million

(previously $460 million), reflecting project scope changes as well

as higher equipment, material and labour costs in light of Alberta

construction activity. Pembina has entered into a lump-sum

engineering, procurement and construction agreement for more than

70 percent of the project cost. Site clearing activities have been

completed, engineering and procurement activities and site

construction continued in the third quarter of 2024. RFS IV is

expected to be in-service in the first half of 2026, subject to

regulatory and environmental approvals.

- PGI is developing an expansion (the "Wapiti Expansion") that

will increase natural gas processing capacity at the Wapiti Plant

by 115 mmcf/d (gross to PGI). The Wapiti Plant is fully integrated

into Pembina’s value chain and the liquids processed at the plant

are transported on the Peace Pipeline system. The Wapiti Expansion

is being driven by strong customer demand supported by growing

Montney production and is fully underpinned by long-term,

take-or-pay contracts. The Wapiti Expansion, which includes a new

sales gas pipeline and other related infrastructure, is expected to

cost $230 million ($140 million net to Pembina) with an estimated

in-service date in the first half of 2026, subject to regulatory

and environmental approval. All permits necessary to begin

construction have been received.

- PGI is developing a 28 MW cogeneration facility at its K3 Plant

(the "K3 Cogeneration Facility"), which is expected to cost $115

million ($70 million net to Pembina). The K3 Cogeneration Facility

is expected to reduce overall operating costs by providing power

and heat to the gas processing facility, while reducing customers’

exposure to power prices. The K3 Cogeneration Facility is expected

to fully supply the K3 Plant's power requirements, with excess

power sold to the grid at market rates. Further, through the

utilization of the cogeneration waste heat and the low-emission

power generated, the K3 Cogeneration Facility is expected to

contribute to a reduction in annual emissions compliance costs at

the K3 Plant. The K3 Cogeneration Facility is expected to be

in-service in the first half of 2026, subject to regulatory and

environmental approvals. The project is trending on time and on

budget.

Marketing & New Ventures

- Pembina and its partner, the Haisla Nation, in June 2024

announced a positive final investment decision in respect of the

Cedar LNG Project, a 3.3 million tonne per annum ("mtpa") floating

LNG facility in Kitimat, British Columbia, within the traditional

territory of the Haisla Nation. The Cedar LNG Project will provide

a valuable outlet for WCSB natural gas to access global markets and

is expected to achieve higher prices for Canadian producers and

enhance global energy security. Given it will be a floating LNG

facility, manufactured in the controlled conditions of a shipyard,

it is expected that the Cedar LNG Project will have lower

construction and execution risk. Further, powered by BC Hydro, the

Cedar LNG Project is expected to be one of the lowest emissions LNG

facilities in the world. Cedar LNG has secured a 20-year

take-or-pay, fixed toll contract with ARC Resources Ltd. for 1.5

mtpa of LNG. As part of the agreement, ARC Resources Ltd. will

supply Cedar LNG approximately 200 million cubic feet per day of

natural gas via the Coastal GasLink pipeline from its production

base in the Montney. Pembina has also entered into an identical

bridging agreement with Cedar LNG for 1.5 mtpa of capacity. The

process to assign Pembina's capacity in Cedar LNG to a third party

is ongoing and expected to extend into 2025. The Cedar LNG Project

has an estimated cost of approximately US$3.4 billion (gross),

including US$2.3 billion (gross), or approximately 70 percent, for

the floating LNG production unit, which is being constructed under

a fixed-price, lump-sum agreement with Samsung Heavy Industries and

Black & Veatch, and US$1.1 billion (gross) related to onshore

infrastructure, owner’s costs, commissioning and start-up costs,

financial assurances during construction, and other costs. The

total Cedar LNG Project cost, including US$0.6 billion (gross) of

interest during construction and transaction costs, is expected to

be approximately US$4.0 billion (gross). The anticipated in-service

date of the Cedar LNG Project is in late 2028. Site clearing and

civil works on the marine terminal site commenced in the third

quarter of 2024 and construction of the floating LNG vessel is

expected to begin in mid-2025.

Third Quarter 2024 Conference Call & Webcast

Pembina will host a conference call on Wednesday, November 6,

2024, at 8:00 a.m. MT (10:00 a.m. ET) for interested investors,

analysts, brokers and media representatives to discuss results for

the third quarter of 2024. The conference call dial-in numbers for

Canada and the U.S. are 1-289-819-1520 or 1-800-549-8228. A

recording of the conference call will be available for replay until

Wednesday, November 13, 2024, at 11:59 p.m. ET. To access the

replay, please dial either 1-289-819-1325 or 1-888-660-6264 and

enter the password 33188 #.

A live webcast of the conference call can be accessed on

Pembina's website at www.pembina.com under Investor

Centre/Presentations & Events, or by entering:

https://events.q4inc.com/attendee/912654252 in your web browser.

Shortly after the call, an audio archive will be posted on the

website for a minimum of 90 days.

Quarterly Common Share Dividend

Pembina's board of directors has declared a common share cash

dividend for the fourth quarter of 2024 of $0.69 per share to be

paid, subject to applicable law, on December 31, 2024, to

shareholders of record on December 16, 2024. The common share

dividends are designated as "eligible dividends" for Canadian

income tax purposes. For non-resident shareholders, Pembina's

common share dividends should be considered "qualified dividends"

and may be subject to Canadian withholding tax.

For shareholders receiving their common share dividends in U.S.

funds, the cash dividend is expected to be approximately US$0.4966

per share (before deduction of any applicable Canadian withholding

tax) based on a currency exchange rate of 0.7197. The actual U.S.

dollar dividend will depend on the Canadian/U.S. dollar exchange

rate on the payment date and will be subject to applicable

withholding taxes.

Quarterly dividend payments are expected to be made on the last

business day of March, June, September and December to shareholders

of record on the 15th day of the corresponding month, if, as and

when declared by the board of directors. Should the record date

fall on a weekend or on a statutory holiday, the record date will

be the next succeeding business day following the weekend or

statutory holiday.

About Pembina

Pembina Pipeline Corporation is a leading energy transportation

and midstream service provider that has served North America's

energy industry for 70 years. Pembina owns an integrated network of

hydrocarbon liquids and natural gas pipelines, gas gathering and

processing facilities, oil and natural gas liquids infrastructure

and logistics services, and an export terminals business. Through

our integrated value chain, we seek to provide safe and reliable

energy solutions that connect producers and consumers across the

world, support a more sustainable future and benefit our customers,

investors, employees and communities. For more information, please

visit www.pembina.com.

Purpose of Pembina: We deliver extraordinary energy solutions so

the world can thrive.

Pembina is structured into three Divisions: Pipelines Division,

Facilities Division and Marketing & New Ventures Division.

Pembina's common shares trade on the Toronto and New York stock

exchanges under PPL and PBA, respectively. For more information,

visit www.pembina.com.

Forward-Looking Statements and Information

This news release contains certain forward-looking statements

and forward-looking information (collectively, "forward-looking

statements"), including forward-looking statements within the

meaning of the "safe harbor" provisions of applicable securities

legislation, that are based on Pembina's current expectations,

estimates, projections and assumptions in light of its experience

and its perception of historical trends. In some cases,

forward-looking statements can be identified by terminology such as

"continue", "anticipate", "will", "expects", "estimate",

"potential", "planned", "future", "outlook", "strategy", "project",

"plan", "commit", "maintain", "focus", "ongoing", "believe" and

similar expressions suggesting future events or future

performance.

In particular, this news release contains forward-looking

statements, including certain financial outlooks, pertaining to,

without limitation, the following: future pipeline, processing,

fractionation and storage facility and system operations and

throughput levels; Pembina's strategy and the development of new

business initiatives and growth opportunities, including the

anticipated benefits therefrom and the expected timing thereof;

expectations about current and future market conditions, industry

activities and development opportunities, as well as the

anticipated benefits thereof, including general market conditions

outlooks and industry developments; expectations regarding future

credit ratings; expectations about future demand for Pembina's

infrastructure and services, including expectations in respect of

customer contracts, future volume growth in the WCSB, increased

utilization and future tolls and volumes; expectations relating to

the development of Pembina's new projects and developments,

including the Cedar LNG Project, RFS IV, the NEBC MPS Expansion,

the Wapiti Expansion and the K3 Cogeneration Facility, including

the timing and anticipated benefits thereof; expectations relating

to the Whitecap Transaction and the impacts of the Company's

acquisition of the remaining interests in Aux Sable and PGI's

transaction with Veren, including expected funding and future

opportunities related thereto and the anticipated benefits thereof;

Pembina's updated 2024 guidance, including with respect to its

updated 2024 adjusted EBITDA guidance range, and expected

proportionally consolidated debt to adjusted EBITDA; statements

regarding commercial discussions regarding the assignment of

Pembina's contracted capacity for Cedar LNG, including the timing

and outcome thereof; Pembina's future common share dividends,

including the timing, amount and expected tax treatment thereof;

planning, construction, locations, capital expenditure estimates,

schedules, regulatory and environmental applications and

anticipated approvals, expected capacity, incremental volumes,

contractual arrangements, completion and in-service dates, rights,

sources of product, activities, benefits and operations with

respect to new construction of, or expansions on existing

pipelines, systems, gas services facilities, processing and

fractionation facilities, terminalling, storage and hub facilities

and other facilities or energy infrastructure, as well as the

impact of Pembina's new projects on its future financial

performance; and expectations regarding commercial agreements,

including the expected timing and benefit thereof.

The forward-looking statements are based on certain factors and

assumptions that Pembina has made in respect thereof as at the date

of this news release regarding, among other things: oil and gas

industry exploration and development activity levels and the

geographic region of such activity; the success of Pembina's

operations; prevailing commodity prices, interest rates, carbon

prices, tax rates, exchange rates and inflation rates; the ability

of Pembina to maintain current credit ratings; the availability and

cost of capital to fund future capital requirements relating to

existing assets, projects and the repayment or refinancing of

existing debt as it becomes due; future operating costs;

geotechnical and integrity costs; that any third-party projects

relating to Pembina's growth projects will be sanctioned and

completed as expected; conditions to closing of the Whitecap

Transaction in a timely manner, including receipt of all necessary

approvals, that the Whitecap Transaction will be completed on terms

consistent with management's current expectations; assumptions with

respect to our intention to complete share repurchases, including

the funding thereof, existing and future market conditions,

including with respect to Pembina's common share trading price, and

compliance with respect to applicable securities laws and

regulations and stock exchange policies; that any required

commercial agreements can be reached in the manner and on the terms

expected by Pembina; that all required regulatory and environmental

approvals can be obtained on the necessary terms and in a timely

manner; that counterparties will comply with contracts in a timely

manner; that there are no unforeseen events preventing the

performance of contracts or the completion of the relevant

projects; prevailing regulatory, tax and environmental laws and

regulations; maintenance of operating margins; the amount of future

liabilities relating to lawsuits and environmental incidents; and

the availability of coverage under Pembina's insurance policies

(including in respect of Pembina's business interruption insurance

policy).

Although Pembina believes the expectations and material factors

and assumptions reflected in these forward-looking statements are

reasonable as of the date hereof, there can be no assurance that

these expectations, factors and assumptions will prove to be

correct. These forward-looking statements are not guarantees of

future performance and are subject to a number of known and unknown

risks and uncertainties including, but not limited to: the

regulatory environment and decisions and Indigenous and landowner

consultation requirements; the impact of competitive entities and

pricing; reliance on third parties to successfully operate and

maintain certain assets; reliance on key relationships, joint

venture partners and agreements; labour and material shortages; the

strength and operations of the oil and natural gas production

industry and related commodity prices; non-performance or default

by contractual counterparties ; actions by governmental or

regulatory authorities, including changes in tax laws and

treatment, changes in royalty rates, changes in regulatory

processes or increased environmental regulation; the ability of

Pembina to acquire or develop the necessary infrastructure in

respect of future development projects; the ability of Pembina and

Whitecap to receive all necessary approvals and satisfy all other

conditions to the Whitecap Transaction on a timely basis or at all;

Pembina's ability to realize the anticipated benefits of the

Whitecap Transaction, its acquisition of the remaining interests in

Aux Sable and PGI's transaction with Veren; fluctuations in

operating results; adverse general economic and market conditions,

including potential recessions in Canada, North America and

worldwide resulting in changes, or prolonged weaknesses, as

applicable, in interest rates, foreign currency exchange rates,

inflation, commodity prices, supply/demand trends and overall

industry activity levels; constraints on the, or the unavailability

of, adequate supplies, infrastructure or labour; the political

environment in North American and elsewhere, and public opinion;

the ability to access various sources of debt and equity capital;

adverse changes in credit ratings; counterparty credit risk;

technology and cyber security risks; natural catastrophes; and

certain other risks detailed in Pembina's Annual Information Form

and Management's Discussion and Analysis, each dated February 22,

2024 for the year ended December 31, 2023 and from time to time in

Pembina's public disclosure documents available at

www.sedarplus.ca, www.sec.gov and through Pembina's website at

www.pembina.com.

This list of risk factors should not be construed as exhaustive.

Readers are cautioned that events or circumstances could cause

results to differ materially from those predicted, forecasted or

projected by forward-looking statements contained herein. The

forward-looking statements contained in this news release speak

only as of the date of this news release. Pembina does not

undertake any obligation to publicly update or revise any

forward-looking statements or information contained herein, except

as required by applicable laws. Management approved the updated

2024 guidance contained herein on November 5, 2024. The purpose of

the updated 2024 guidance is to assist readers in understanding

Pembina's expected and targeted financial results, and this

information may not be appropriate for other purposes. The

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

Non-GAAP and Other Financial Measures

Throughout this news release, Pembina has disclosed certain

financial measures and ratios that are not specified, defined or

determined in accordance with GAAP and which are not disclosed in

Pembina's financial statements. Non-GAAP financial measures either

exclude an amount that is included in, or include an amount that is

excluded from, the composition of the most directly comparable

financial measure specified, defined and determined in accordance

with GAAP. Non-GAAP ratios are financial measures that are in the

form of a ratio, fraction, percentage or similar representation

that has a non-GAAP financial measure as one or more of its

components. These non-GAAP financial measures and non-GAAP ratios,

together with financial measures and ratios specified, defined and

determined in accordance with GAAP, are used by management to

evaluate the performance and cash flows of Pembina and its

businesses and to provide additional useful information respecting

Pembina's financial performance and cash flows to investors and

analysts.

In this news release, Pembina has disclosed the following

non-GAAP financial measures and non-GAAP ratios: net revenue,

adjusted EBITDA, adjusted EBITDA from equity accounted investees,

adjusted cash flow from operating activities, adjusted cash flow

from operating activities per common share, and proportionately

consolidated debt-to-adjusted EBITDA. The non-GAAP financial

measures and non-GAAP ratios disclosed in this news release do not

have any standardized meaning under International Financial

Reporting Standards ("IFRS") and may not be comparable to similar

financial measures or ratios disclosed by other issuers. Such

financial measures and ratios should not, therefore, be considered

in isolation or as a substitute for, or superior to, measures and

ratios of Pembina's financial performance, or cash flows specified,

defined or determined in accordance with IFRS, including revenue,

earnings, cash flow from operating activities and cash flow from

operating activities per share.

Except as otherwise described herein, these non-GAAP financial

measures and non-GAAP ratios are calculated on a consistent basis

from period to period. Specific reconciling items may only be

relevant in certain periods.

Below is a description of each non-GAAP financial measure and

non-GAAP ratio disclosed in this news release, together with, as

applicable, disclosure of the most directly comparable financial

measure that is determined in accordance with GAAP to which each

non-GAAP financial measure relates and a quantitative

reconciliation of each non-GAAP financial measure to such directly

comparable GAAP financial measure. Additional information relating

to such non-GAAP financial measures and non-GAAP ratios, including

disclosure of the composition of each non-GAAP financial measure

and non-GAAP ratio, an explanation of how each non-GAAP financial

measure and non-GAAP ratio provides useful information to investors

and the additional purposes, if any, for which management uses each

non-GAAP financial measure and non-GAAP ratio; an explanation of

the reason for any change in the label or composition of each

non-GAAP financial measure and non-GAAP ratio from what was

previously disclosed; and a description of any significant

difference between forward-looking non-GAAP financial measures and

the equivalent historical non-GAAP financial measures, is contained

in the "Non-GAAP & Other Financial Measures" section of the

management's discussion and analysis of Pembina dated February 22,

2024 for the year ended December 31, 2023 (the "MD&A"), which

information is incorporated by reference in this news release. The

MD&A is available on SEDAR+ at www.sedarplus.ca, EDGAR at

www.sec.gov and Pembina's website at www.pembina.com.

Net Revenue

Net revenue is a non-GAAP financial measure which is defined as

total revenue less cost of goods. The most directly comparable

financial measure to net revenue that is determined in accordance

with GAAP and disclosed in Pembina's financial statements is

revenue.

3 Months Ended September 30

Pipelines

Facilities

Marketing & New

Ventures(1)

Corporate &

Inter-segment

Eliminations

Total(1)

($ millions)

2024

2023

2024

2023

2024

2023

2024

2023

2024

2023

Revenue

860

734

282

233

938

675

(236)

(187)

1,844

1,455

Cost of goods sold

9

6

—

—

732

594

(156)

(134)

585

466

Net revenue

851

728

282

233

206

81

(80)

(53)

1,259

989

(1)

Comparative 2023 period has been

adjusted. See "Accounting Policies & Estimates - Change in

Accounting Policies" in Pembina's Management's Discussion and

Analysis dated November 5, 2024 for the three and nine months ended

September 30, 2024 and Note 2 to the Interim Financial Statements

for the three and nine months ended September 30, 2024.

9 Months Ended September 30

Pipelines

Facilities

Marketing & New

Ventures(1)

Corporate &

Inter-segment

Eliminations

Total(1)

($ millions)

2024

2023

2024

2023

2024

2023

2024

2023

2024

2023

Revenue

2,438

1,970

807

661

2,663

2,263

(669)

(399)

5,239

4,495

Cost of goods sold

35

6

—

—

2,279

1,915

(468)

(257)

1,846

1,664

Net revenue

2,403

1,964

807

661

384

348

(201)

(142)

3,393

2,831

(1)

Comparative 2023 period has been

adjusted. See "Accounting Policies & Estimates - Change in

Accounting Policies" in Pembina's Management's Discussion and

Analysis dated November 5, 2024 for the three and nine months ended

September 30, 2024 and Note 2 to the Interim Financial Statements

for the three and nine months ended September 30, 2024.

Adjusted Earnings Before Interest, Taxes,

Depreciation and Amortization

Adjusted EBITDA is a non-GAAP financial measure and is

calculated as earnings before net finance costs, income taxes,

depreciation and amortization (included in operations and general

and administrative expense), and unrealized gains or losses from

derivative instruments. The exclusion of unrealized gains or losses

from derivative instruments eliminates the non-cash impact of such

gains or losses.

Adjusted EBITDA also includes adjustments to earnings for

non-controlling interest, losses (gains) on disposal of assets,

transaction costs incurred in respect of acquisitions, dispositions

and restructuring, impairment charges or reversals in respect of

goodwill, intangible assets, investments in equity accounted

investees and property, plant and equipment, certain non-cash

provisions and other amounts not reflective of ongoing operations.

These additional adjustments are made to exclude various non-cash

and other items that are not reflective of ongoing operations.

Following completion of the Alliance/Aux Sable Acquisition,

Pembina revised the definition of adjusted EBITDA to deduct

earnings for the 14.6 percent non-controlling interest in the Aux

Sable U.S. operations. Pembina's subsequent acquisition of the

remaining interest in Aux Sable's U.S. operations in the third

quarter of 2024 resulted in all of Aux Sable's results being

included in the adjusted EBITDA calculation beginning on August 1,

2024.

3 Months Ended September 30

Pipelines

Facilities

Marketing & New

Ventures

Corporate &

Inter-segment

Eliminations

Total

($ millions, except per share amounts)

2024

2023

2024

2023

2024

2023

2024

2023

2024

2023

Earnings (loss)

433

437

131

179

125

(4)

(215)

(170)

385

346

Income tax expense

—

—

—

—

—

—

—

—

89

96

Adjustments to share of profit from equity

accounted investees and other

2

42

139

100

49

65

—

—

190

207

Net finance cost

6

7

3

2

1

11

139

110

149

130

Depreciation and amortization

153

104

50

38

15

11

13

11

231

164

Unrealized loss (gain) from derivative

instruments

—

—

—

—

(18)

78

—

—

(18)

78

Non-controlling interest(1)

—

—

—

—

(2)

—

—

—

(2)

—

Transaction and integration costs in

respect of acquisitions

—

—

—

—

—

—

4

—

4

—

Gain on disposal of assets, other non-cash

provisions, and other

(1)

1

1

—

(11)

(2)

2

1

(9)

—

Adjusted EBITDA

593

591

324

319

159

159

(57)

(48)

1,019

1,021

(1)

Presented net of adjusting

items.

9 Months Ended September 30

Pipelines

Facilities

Marketing & New

Ventures

Corporate &

Inter-segment

Eliminations

Total

($ millions, except per share amounts)

2024

2023

2024

2023

2024

2023

2024

2023

2024

2023

Earnings (loss)

1,373

1,163

489

467

324

231

(1,210)

(487)

1,302

1,078

Income tax (recovery) expense

—

—

—

—

—

—

—

—

(326)

296

Adjustments to share of profit from equity

accounted investees and other

46

127

350

303

58

78

—

—

454

508

Net finance costs

19

22

8

6

4

8

367

314

398

350

Depreciation and amortization

412

305

128

113

47

34

40

33

627

485

Unrealized loss from derivative

instruments

—

—

—

—

129

78

—

—

129

78

Non-controlling interest(1)

—

—

—

—

(12)

—

—

—

(12)

—

Loss on Alliance/Aux Sable Acquisition

—

—

—

—

—

—

616

—

616

—

Derecognition of insurance contract

provision

—

—

—

—

(34)

—

—

—

(34)

—

Transaction and integration costs in

respect of acquisition

—

—

—

—

—

—

18

—

18

—

Gain on disposal of assets, other non-cash

provisions, and other

(3)

—

(1)

—

(26)

(5)

12

1

(18)

(4)

Adjusted EBITDA

1,847

1,617

974

889

490

424

(157)

(139)

3,154

2,791

(1)

Presented net of adjusting

items.

2024 Adjusted EBITDA Guidance

The equivalent historical non-GAAP financial measure to 2024

adjusted EBITDA guidance is adjusted EBITDA for the year ended

December 31, 2023.

12 Months Ended December 31,

2023

Pipelines

Facilities

Marketing & New

Ventures

Corporate &

Inter-segment

Eliminations

Total

($ millions, except per share amounts)

Earnings (loss)

1,840

610

435

(696)

1,776

Income tax expense

—

—

—

—

413

Adjustments to share of profit from equity

accounted investees and other

172

438

84

—

694

Net finance costs

28

9

4

425

466

Depreciation and amortization

414

159

46

44

663

Unrealized loss from derivative

instruments

—

—

32

—

32

Impairment reversal

(231)

—

—

—

(231)

Transaction costs incurred in respect of

acquisitions, gain on disposal of assets and non-cash

provisions

11

(3)

(4)

7

11

Adjusted EBITDA

2,234

1,213

597

(220)

3,824

Adjusted EBITDA from Equity Accounted

Investees

In accordance with IFRS, Pembina's jointly controlled

investments are accounted for using equity accounting. Under equity

accounting, the assets and liabilities of the investment are

presented net in a single line item in the Consolidated Statement

of Financial Position, "Investments in Equity Accounted Investees".

Net earnings from investments in equity accounted investees are

recognized in a single line item in the Consolidated Statement of

Earnings and Comprehensive Income "Share of Profit from Equity

Accounted Investees". The adjustments made to earnings, in adjusted

EBITDA above, are also made to share of profit from investments in

equity accounted investees. Cash contributions and distributions

from investments in equity accounted investees represent Pembina's

share paid and received in the period to and from the investments

in equity accounted investees.

To assist in understanding and evaluating the performance of

these investments, Pembina is supplementing the IFRS disclosure

with non-GAAP proportionate consolidation of Pembina's interest in

the investments in equity accounted investees. Pembina's

proportionate interest in equity accounted investees has been

included in adjusted EBITDA.

3 Months Ended September 30

Pipelines

Facilities

Marketing & New

Ventures

Total

($ millions)

2024

2023

2024

2023

2024

2023

2024

2023

Share of (loss) profit from equity

accounted investees

(1)

23

34

68

(50)

(48)

(17)

43

Adjustments to share of profit from equity

accounted investees:

Net finance costs

1

5

69

22

49

1

119

28

Income tax (recovery) expense

—

(1)

9

20

—

—

9

19

Depreciation and amortization

1

38

53

51

—

6

54

95

Unrealized loss on commodity-related

derivative financial instruments

—

—

8

—

—

—

8

—

Transaction costs incurred in respect of

acquisitions and non-cash provisions

—

—

—

7

—

58

—

65

Total adjustments to share of profit from

equity accounted investees

2

42

139

100

49

65

190

207

Adjusted EBITDA from equity accounted

investees

1

65

173

168

(1)

17

173

250

9 Months Ended September 30

Pipelines

Facilities

Marketing & New

Ventures

Total

($ millions)

2024

2023

2024

2023

2024

2023

2024

2023

Share of profit (loss) from equity

accounted investees

42

78

172

185

(19)

(41)

195

222

Adjustments to share of profit from equity

accounted investees:

Net finance costs

7

15

138

76

51

1

196

92

Income tax expense

—

—

50

54

—

—

50

54

Depreciation and amortization

39

112

155

147

7

19

201

278

Unrealized loss on commodity-related

derivative financial instruments

—

—

5

9

—

—

5

9

Transaction costs incurred in respect of

acquisitions and non-cash provisions

—

—

2

17

—

58

2

75

Total adjustments to share of profit from

equity accounted investees

46

127

350

303

58

78

454

508

Adjusted EBITDA from equity accounted

investees

88

205

522

488

39

37

649

730

Adjusted Cash Flow from Operating

Activities and Adjusted Cash Flow from Operating Activities per

Common Share

Adjusted cash flow from operating activities is a non-GAAP

financial measure which is defined as cash flow from operating

activities adjusting for the change in non-cash operating working

capital, adjusting for current tax and share-based compensation

payment, and deducting distributions to non-controlling interest

and preferred share dividends paid. Adjusted cash flow from

operating activities deducts distributions to non-controlling

interest and preferred share dividends paid because they are not

attributable to common shareholders. The calculation has been

modified to include current tax and share-based compensation

payment as it allows management to better assess the obligations

discussed below.

Following completion of the Alliance/Aux Sable Acquisition,

Pembina revised the definition of adjusted cash flow from operating

activities to deduct distributions related to non-controlling

interest in the Aux Sable U.S. operations. On August 1, 2024,

Pembina acquired the remaining interest in Aux Sable's U.S.

operations.

Management believes that adjusted cash flow from operating

activities provides comparable information to investors for

assessing financial performance during each reporting period.

Management utilizes adjusted cash flow from operating activities to

set objectives and as a key performance indicator of the Company's

ability to meet interest obligations, dividend payments and other

commitments.

Adjusted cash flow from operating activities per common share is

a non-GAAP ratio which is calculated by dividing adjusted cash flow

from operating activities by the weighted average number of common

shares outstanding.

3 Months Ended September

30

9 Months Ended September

30

($ millions, except per share amounts)

2024

2023

2024

2023

Cash flow from operating activities

922

644

2,312

1,755

Cash flow from operating activities per

common share – basic (dollars)

1.59

1.17

4.06

3.19

Add (deduct):

Change in non-cash operating working

capital

(136)

76

(30)

264

Current tax expense

(48)

(94)

(188)

(271)

Taxes paid, net of foreign exchange

62

74

352

187

Accrued share-based payment expense

(40)

(10)

(79)

(23)

Share-based compensation payment

—

—

86

77

Preferred share dividends paid

(34)

(31)

(98)

(90)

Distributions to non-controlling

interest

(2)

—

(12)

—

Adjusted cash flow from operating

activities

724

659

2,343

1,899

Adjusted cash flow from operating

activities per common share – basic (dollars)

1.25

1.20

4.11

3.45

Proportionately Consolidated

Debt-to-Adjusted EBITDA

Proportionately Consolidated Debt-to-Adjusted EBITDA is a

non-GAAP ratio that management believes is useful to investors and

other users of Pembina’s financial information in the evaluation of

the Company’s debt levels and creditworthiness.

12 Months Ended

($ millions, except as noted)

September 30, 2024

December 31, 2023

Loans and borrowings (current)

946

650

Loans and borrowings (non-current)

11,182

9,253

Loans and borrowings of equity accounted

investees

2,770

2,805

Proportionately consolidated debt

14,898

12,708

Adjusted EBITDA

4,187

3,824

Proportionately consolidated

debt-to-adjusted EBITDA (times)

3.6

3.3

($ millions)

12 Months Ended September 30,

2024

9 Months Ended September 30,

2024

12 Months Ended December 31,

2023

9 Months Ended September 30,

2023

Earnings before income tax

1,791

976

2,189

1,374

Adjustments to share of profit from equity

accounted investees and other

640

454

694

508

Net finance costs

514

398

466

350

Depreciation and amortization

805

627

663

485

Unrealized loss on derivative

instruments

83

129

32

78

Non-controlling interest(1)

(12)

(12)

—

—

Loss on Alliance/Aux Sable Acquisition

616

616

—

—

Derecognition of insurance contract

provision

(34)

(34)

—

—

Transaction and integration costs in

respect of acquisitions

20

18

2

—

Gain on disposal of assets, other non-cash

provisions, and other

(5)

(18)

9

(4)

Impairment reversal

(231)

—

(231)

—

Adjusted EBITDA

4,187

3,154

3,824

2,791

=A+B-C

A

B

C

(1)

Presented net of adjusting

items.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105833864/en/

For further information: Investor Relations (403) 231-3156

1-855-880-7404 e-mail: investor-relations@pembina.com

www.pembina.com

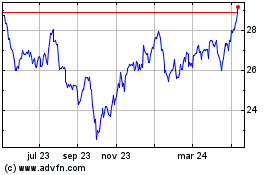

PPL (NYSE:PPL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

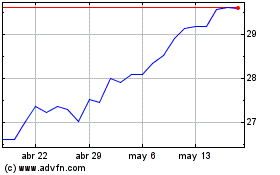

PPL (NYSE:PPL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024