Pembina Pipeline Corporation Announces Intention to Redeem its Series 19 Medium Term Notes

07 Noviembre 2024 - 4:35PM

Business Wire

Pembina Pipeline Corporation ("Pembina" or the "Company") (TSX:

PPL; NYSE: PBA) announced today that it intends to exercise its

option to redeem all of its outstanding $150,000,000 aggregate

principal amount of senior unsecured medium-term notes, series 19

(the "Series 19 Notes") due June 22, 2026 for cash on November 17,

2024 (the "Redemption Date") at a redemption price of approximately

$1,023.19 for each $1,000 principal amount of Series 19 Notes,

being equal to the outstanding principal amount thereof, plus

accrued but unpaid interest thereon to, but excluding, the

Redemption Date (the "Redemption"). The Redemption will be funded

through a combination of cash on hand and use of the Company’s

credit facility.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241107133989/en/

Additional terms and conditions regarding the Redemption will be

provided in the notice of the Redemption to be delivered to CDS

Clearing and Depository Services Inc. ("CDS"), the sole registered

holder of the Series 19 Notes, in accordance with the trust

indenture governing the Series 19 Notes. Non-registered holders of

Series 19 Notes who maintain their interest through CDS should

contact their CDS customer service representative with any

questions about the Redemption. Alternatively, non-registered

holders of Series 19 Notes with any questions about the Redemption

should contact the broker or other financial intermediary who holds

interests in the Series 19 Notes on their behalf.

The Series 19 Notes were issued pursuant to pricing supplement

no. 5 dated June 20, 2023 to the short form base shelf prospectus

of Pembina dated November 29, 2021, copies of which are available

on Pembina's SEDAR+ profile at www.sedarplus.ca.

About Pembina

Pembina Pipeline Corporation is a leading energy transportation

and midstream service provider that has served North America's

energy industry for 70 years. Pembina owns an integrated network of

hydrocarbon liquids and natural gas pipelines, gas gathering and

processing facilities, oil and natural gas liquids infrastructure

and logistics services, and an export terminals business. Through

our integrated value chain, we seek to provide safe and reliable

energy solutions that connect producers and consumers across the

world, support a more sustainable future and benefit our customers,

investors, employees and communities. For more information, please

visit www.pembina.com.

Purpose of Pembina: We deliver extraordinary energy solutions so

the world can thrive.

Pembina is structured into three Divisions: Pipelines Division,

Facilities Division and Marketing & New Ventures Division.

Pembina's common shares trade on the Toronto and New York stock

exchanges under PPL and PBA, respectively. For more information,

visit www.pembina.com.

Forward-Looking Information and Statements

This news release contains certain forward-looking statements

and forward-looking information (collectively, "forward-looking

statements"), including forward-looking statements within the

meaning of the "safe harbor" provisions of applicable securities

legislation that are based on Pembina's current expectations,

estimates, projections and assumptions in light of its experience

and its perception of historical trends. In some cases,

forward-looking statements can be identified by terminology such as

"expect", "intend", "will", "shall", and similar expressions

suggesting future events or future performance.

In particular, this news release contains forward-looking

statements relating to the Redemption, including the occurrence and

timing thereof, as well as Pembina's intentions with respect to

funding the Redemption. These forward-looking statements are based

on certain assumptions that Pembina has made in respect thereof as

at the date of this news release, including: oil and gas industry

exploration and development activity levels and the geographic

region of such activity; that favourable market conditions exist;

the success of Pembina's operations; prevailing commodity prices,

interest rates, carbon prices, tax rates and exchange rates; the

ability of Pembina to maintain current credit ratings; the

availability of capital to fund future capital requirements

relating to existing assets and projects; future operating costs;

geotechnical and integrity costs; that all required regulatory and

environmental approvals can be obtained on the necessary terms in a

timely manner; prevailing regulatory, tax and environmental laws

and regulations; maintenance of operating margins; and certain

other assumptions in respect of Pembina's forward-looking

statements detailed in Pembina's Annual Information Form for the

year ended December 31, 2023 (the "AIF") and Management's

Discussion and Analysis for the year ended December 31, 2023 (the

"Annual MD&A"), which were each filed on SEDAR+ on February 22,

2024, in Pembina's Management's Discussion and Analysis for the

three months and nine months ended September 30, 2024 (the "Interim

MD&A"), which was filed on SEDAR+ on November 5, 2024, and from

time to time in Pembina's public disclosure documents available at

www.sedarplus.ca, www.sec.gov and through Pembina's website at

www.pembina.com.

These forward-looking statements are not guarantees of future

performance and are subject to a number of known and unknown risks

and uncertainties, including, but not limited to: the regulatory

environment and decisions and Indigenous and landowner consultation

requirements; the impact of competitive entities and pricing;

reliance on third parties to successfully operate and maintain

certain assets; the strength and operations of the oil and natural

gas production industry and related commodity prices;

non-performance or default by counterparties to agreements with

Pembina or one or more of its affiliates; actions taken by

governmental or regulatory authorities; the ability of Pembina to

acquire or develop the necessary infrastructure in respect of

future development projects; fluctuations in operating results;

adverse general economic and market conditions in Canada, North

America and worldwide; the ability to access various sources of

debt and equity capital; changes in credit ratings; counterparty

credit risk; and certain other risks and uncertainties detailed in

the AIF, Annual MD&A, Interim MD&A and from time to time in

Pembina's public disclosure documents available at

www.sedarplus.ca, www.sec.gov and through Pembina's website at

www.pembina.com. In addition, closing of the Redemption may not

occur, or may be delayed, if the conditions to the Redemption are

not satisfied on the anticipated timeline or at all. Accordingly,

there is a risk that the Redemption will not be completed within

the anticipated time, on the terms currently proposed, or at all.

The Company's expectations with respect to funding the Redemption

may change if management or the board of directors of Pembina

determines that it would be in the best interests of Pembina to

utilize other sources of funding.

Accordingly, readers are cautioned that events or circumstances

could cause results to differ materially from those predicted,

forecasted or projected. The forward-looking statements contained

in this news release are expressly qualified by the above

statements. Pembina does not undertake any obligation to publicly

update or revise any forward-looking statements or information

contained herein, except as required by applicable laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107133989/en/

For further information: Investor Relations (403) 231-3156

1-855-880-7404 e-mail: investor-relations@pembina.com

www.pembina.com

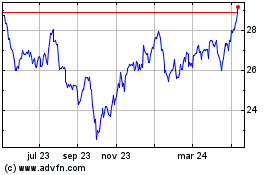

PPL (NYSE:PPL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

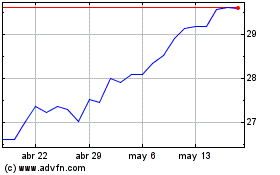

PPL (NYSE:PPL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024