UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) September 26, 2023

PIMCO Corporate & Income Opportunity Fund

(Exact Name of Registrant as Specified in Its Charter)

Massachusetts

(State or Other Jurisdiction of Incorporation)

|

|

|

| 811-21238 |

|

466121513 |

| (Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 1633 Broadway, New York, NY |

|

10019 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(844) 337-4626

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common shares |

|

PTY |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Effective October 2, 2023, Alfred T. Murata, Mohit Mittal, and Giang Bui are primarily responsible for the day-to-day management of PIMCO Corporate & Income Opportunity Fund.

Mr. Murata is a managing

director and portfolio manager in the Newport Beach office, managing income-oriented, multisector credit, opportunistic and securitized strategies. Morningstar named him Fixed- Income Fund Manager of the Year (U.S.) for 2013. Prior to joining PIMCO

in 2001, he researched and implemented exotic equity and interest rate derivatives at Nikko Financial Technologies. He has 21 years of investment experience and holds a Ph.D. in engineering-economic systems and operations research from Stanford

University. He also earned a J.D. from Stanford Law School and is a member of the State Bar of California.

Mr. Mittal is a managing director and

portfolio manager in the Newport Beach office, and a senior member of the liability driven investment and credit portfolio management teams. He manages multi-sector portfolios with added specialization in long credit, investment grade credit, and

unconstrained bond portfolios. In addition, he is the head of U.S. investment grade trading desk. Previously, he was a specialist on PIMCO’s interest rates and derivatives desk. Mr. Mittal joined the firm in 2007 and holds an MBA in

finance from the Wharton School of the University of Pennsylvania and an undergraduate degree in computer science from Indian Institute of Technology (IIT) in Delhi, India.

Ms. Bui is an executive vice president in the Newport Beach office and a portfolio manager and trader of securitized debt instruments, focusing on

collateralized loan obligations (CLOs), asset-backed collateralized debt obligations, and off-the-run sectors within structured products. Ms. Bui joined PIMCO in

2000 and was previously a member of the bank loan portfolio management team, responsible for bank loan investments and the management of PIMCO-issued CLOs. She has 24 years of investment experience and holds an MBA from the Anderson School of

Management at the University of California, Los Angeles and an undergraduate degree from the University of California, San Diego.

Item 9.01

Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

| PIMCO Corporate & Income Opportunity Fund |

|

|

| By: |

|

/s/ Ryan G. Leshaw |

| Name: |

|

Ryan G. Leshaw |

| Title: |

|

Chief Legal Officer |

Date: September 26, 2023

PIMCO Corporate & Income Opportunity Fund

(the “Fund”)

Supplement dated September 26, 2023 to the Fund’s Prospectus and Statement of Additional

Information (“SAI”), each dated November 23, 2020, as supplemented from time to time

As of October 2, 2023, Giang Bui will serve as co-Portfolio Manager of the

Fund, sharing responsibilities with current Portfolio Managers Alfred T. Murata and Mohit Mittal. Accordingly, effective October 2, 2023, the following changes are made to the Fund’s Prospectus and SAI:

| |

(1) |

The third sentence of the first paragraph in the “Investment Manager” section in the

Fund’s Prospectus is deleted and replaced with the following: |

Alfred T. Murata, Mohit Mittal and Giang Bui are

jointly and primarily responsible for the day-to-day management of the Fund.

| |

(2) |

The disclosure concerning the Fund’s portfolio managers in the table in the “Management of the

Fund—Investment Manager” section of the Prospectus is deleted and replaced with the following: |

|

|

|

|

|

|

|

| Portfolio Manager |

|

Since |

|

Title |

|

Recent Professional Experience |

| Alfred T. Murata |

|

2014 |

|

Portfolio

Manager

and

Managing

Director |

|

Mr. Murata is a managing director and portfolio manager in the Newport Beach office, managing income-oriented,

multisector credit, opportunistic and securitized strategies. Morningstar named him Fixed- Income Fund Manager of the Year (U.S.) for 2013. Prior to joining PIMCO in 2001, he researched and implemented exotic equity and interest rate derivatives at

Nikko Financial Technologies. He has 21 years of investment experience and holds a Ph.D. in engineering-economic systems and operations research from Stanford University. He also earned a J.D. from Stanford Law School and is a member of the State

Bar of California. |

|

|

|

|

| Mohit Mittal |

|

2014 |

|

Portfolio

Manager

and

Managing

Director |

|

Mr. Mittal is a managing director and portfolio manager in the Newport Beach office, and a senior member of the

liability driven investment and credit portfolio management teams. He manages multi-sector portfolios with added specialization in long credit, investment grade credit, and unconstrained bond portfolios. In addition, he is the head of U.S.

investment grade trading desk. Previously, he was a specialist on PIMCO’s interest rates and derivatives desk. Mr. Mittal joined the firm in 2007 and holds an MBA in finance from the Wharton School of the University of Pennsylvania and an

undergraduate degree in computer science from Indian Institute of Technology (IIT) in Delhi, India. |

|

|

|

|

|

|

|

| Portfolio Manager |

|

Since |

|

Title |

|

Recent Professional Experience |

| Giang Bui |

|

2023 |

|

Portfolio

Manager

and

Executive

Vice

President |

|

Ms. Bui is an executive vice president in the Newport Beach office and a portfolio manager and trader of securitized

debt instruments, focusing on collateralized loan obligations (CLOs), asset-backed collateralized debt obligations, and off-the-run sectors within structured products.

Ms. Bui joined PIMCO in 2000 and was previously a member of the bank loan portfolio management team, responsible for bank loan investments and the management of PIMCO-issued CLOs. She has 24 years of investment experience and holds an MBA from

the Anderson School of Management at the University of California, Los Angeles and an undergraduate degree from the University of California, San Diego. |

| |

(3) |

Disclosure concerning the Fund’s portfolio managers in the “Investment Manager—Portfolio

Managers—Other Accounts Managed” section of the SAI is deleted and replaced with the following: |

Alfred T.

Murata, Mohit Mittal and Giang Bui, the portfolio managers who are jointly and primarily responsible for the day-to-day management of the Fund, also manage other

registered investment companies, other pooled investment vehicles and other accounts, as indicated in the table below. The following table identifies, as of June 30, 2023 for Messrs. Murata and Mittal and as of August 31, 2023 for

Ms. Bui: (i) the number of other registered investment companies, pooled investment vehicles and other accounts managed by the portfolio manager (exclusive of the Fund); and (ii) the total assets of such other companies, vehicles and

accounts, and the number and total assets of such other companies, vehicles and accounts with respect to which the advisory fee is based on performance. The information includes amounts managed by a team, committee or other group that includes the

portfolio managers.

|

|

|

|

|

|

|

|

|

| Portfolio Manager |

|

Total

Number of

Other

Accounts |

|

Total Assets of

All Other

Accounts (in $

Millions) |

|

Number of

Other Accounts

Paying a Performance Fee |

|

Total Assets of

Other

Accounts Paying

a Performance

Fee (in $

Millions) |

| Alfred T. Murata |

| Registered Investment Companies |

|

21 |

|

$168,162.77 |

|

0 |

|

$0.00 |

| Other Pooled Investment Vehicles |

|

22 |

|

$45,379.20 |

|

5 |

|

$9,569.39 |

| Other Accounts |

|

5 |

|

$1,014.08 |

|

0 |

|

$0.00 |

| Mohit Mittal |

|

|

|

|

|

|

|

|

| Registered Investment Companies |

|

30 |

|

$96,420.59 |

|

0 |

|

N/A |

| Other Pooled Investment Vehicles |

|

26 |

|

$36,183.15 |

|

4 |

|

$2,518.13 |

| Other Accounts |

|

157 |

|

$87,612.71 |

|

12 |

|

$2,975.46 |

| Giang Bui |

|

|

|

|

|

|

|

|

| Registered Investment Companies |

|

1 |

|

$226.63 |

|

0 |

|

$0.00 |

| Other Pooled Investment Vehicles |

|

2 |

|

$6,723.26 |

|

2 |

|

$6,723.26 |

| Other Accounts |

|

1 |

|

$439.57 |

|

0 |

|

$0.00 |

| |

(4) |

Disclosure concerning the Fund’s portfolio managers in the “Investment Manager—Securities

Ownership” section of the SAI is deleted and replaced with the following: |

Securities Ownership

To the best of the Fund’s knowledge, the table below shows the dollar range of shares of the Fund beneficially owned by Alfred T. Murata

and Mohit Mittal as of June 30, 2023 and by Giang Bui as of August 31, 2023.

|

|

|

| Name of Portfolio Manager |

|

Dollar Range of Equity Securities in the Fund |

| Alfred T. Murata |

|

None |

| Mohit Mittal |

|

None |

| Giang Bui |

|

None |

Investors Should Retain This Supplement for Future Reference

PTY_SUPP1_092623

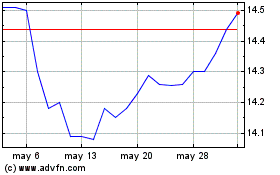

PIMCO Corporate and Inco... (NYSE:PTY)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

PIMCO Corporate and Inco... (NYSE:PTY)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024