Canterra Minerals Corporation (CTM-TSX.V)

(“Canterra” or the “Company”) is pleased to announce that it has

entered into a binding share exchange agreement (the “Agreement”)

pursuant to which, subject to receipt of all applicable regulatory

approvals, the Company has agreed to acquire (the “Acquisition”)

all of the issued and outstanding securities of Teton Opportunities

Inc. (“Teton”). Teton is a private, arm’s‐length British Columbia

company led by a team of geologists which holds an option with a

subsidiary of Altius Minerals Corp. (together with the subsidiary,

“Altius”) (ALS:TSX) to acquire the Wilding Lake Project located in

central Newfoundland, Canada.

Wilding Lake Project Highlights:

- Property package encompassing approximately 104 km2 of highly

prospective geology coincident with 30 km of strike along the

Rogerson Lake structural corridor in Newfoundland

- Located on strike with Marathon Gold’s Valentine Lake project

as well as the Cape Ray gold deposit owned by Matador Mining

- Five zones of gold mineralization identified through a 30 hole

drill campaign in 2017, including: 10.01 g/t gold over 5.3m

- Low cost of exploration with all projects road accessible

The Wilding Lake Project is comprised of the

Wilding Lake, Noel Paul, Crystal Lake and Intersection gold

properties, totaling approximately 104 km2, and includes 30 km of

the Rogerson Lake structural corridor which runs for 200 kilometres

diagonally across Newfoundland. The Rogerson Lake corridor hosts

Marathon Gold’s Valentine Lake project as well as the Cape Ray gold

deposit owned by Matador Mining. New gold discoveries on the

Wilding Lake Project and continued success at Marathon Gold’s

Valentine Lake project, directly southwest of Wilding Lake,

indicate that the Rogerson Lake corridor is only recently emerging

as a major area of gold endowment.

Gold was first discovered at the Wilding Lake

Project through forestry activity in 2016. Five zones of gold

mineralization were identified by a previous operator through an

initial 30 hole drill campaign in 2017, with highlights

including:

- 10.01 g/t Au over 5.3m in hole WL-17-24

- 40.85 g/t Au over 0.5m in hole WL-17-01

- 0.98 g/t Au over 17.0m in hole WL-17-12

- 1.44 g/t Au over 5.1m in hole WL-17-08

- 11.14 g/t Au over 0.5m in hole WL-17-03

- 0.54 g/t Au over 12.7m in hole WL-17-28

The 2017 initial drill hole program successfully

demonstrated strong gold endowment at the Wilding Lake Project with

gold mineralization in 27 of the 30 holes in a proximal and

geologically similar setting to the Valentine Lake project to the

southwest. Gold mineralization occurred in shear-related orogenic

style quartz veins and quartz stockworks underneath shallow

overburden in an area that has not been previously systematically

explored for gold. Follow-up drilling on the gold mineralized zones

and yet to be drilled targets is warranted.

Click here to view the Wilding Lake Project

Property Map.

Acquisition Transaction

StructureAs at the date hereof, Teton has an aggregate of

15,000,000 common shares (the “Teton Shares”) and warrants to

acquire 6,250,000 common shares (the “Teton Warrants”) issued and

outstanding. In addition, pursuant to the terms of the Option

Agreement (as defined below) Altius shall be issued 12,500,000

Teton Shares and 6,250,000 Teton Warrants prior to closing of the

Acquisition (the “Payment Securities”). After giving effect to the

issuance of the Payment Securities, Teton shall have an aggregate

of 27,500,000 Teton Shares and 12,500,000 Teton Warrants

outstanding. Pursuant to the terms of the Agreement, subject to the

receipt of all requisite corporate, shareholder, and regulatory

approvals, in connection with the completion of the Acquisition,

Canterra intends to acquire all of the currently issued and

outstanding Teton Shares in exchange for an aggregate of 9,677,250

common shares of Canterra (the “Acquisition Shares”) based on an

exchange ratio of 0.3519 Canterra shares for each one Teton Share

acquired (the “Exchange Ratio”) and warrants (the “Acquisition

Warrants”) to acquire an aggregate of 4,398,750 common shares of

Canterra, with each Acquisition Warrant exercisable to acquire one

common share of Canterra at a price of $0.24 for a period of 24

months from the closing of the Acquisition. No fractional

Acquisition Shares or Acquisition Warrants will be issued.

$3.25 Million Concurrent Financing In connection

with the completion of the Acquisition, subject to receipt of TSX

Venture Exchange (the “Exchange”) approval, Canterra intends to

complete an equity financing (the “Financing”) comprised of: i)

19,250,000 flow-through common shares (the “FT Shares”) at a price

of $0.13 per FT Share, for aggregate proceeds of $2,502,500; and

ii) 6,250,000 units (each a “Unit”) at a price of $0.12 per Unit

for aggregate proceeds of $750,000. Each Unit will consist of one

common share of the Company (a “Share”) and one half of one common

share purchase warrant (a “Warrant”). Each Warrant will entitle the

holder to purchase one additional Share at an exercise price of

$0.24 per common share for a period of 24 months. Subject to

compliance with applicable securities laws and the approval of the

Exchange, cash finders’ fees may be payable to eligible arm’s

length persons with respect to certain subscriptions accepted by

the Company.

Debt SettlementIn addition, subject to receipt of

Exchange approval, Canterra intends to issue an aggregate of

2,841,530 common shares (the “Shares”) at a price of $0.12 per

Share in settlement (the “Debt Settlement”) of an aggregate of

$340,984 in outstanding debt (the “Debt”), including the settlement

of accrued management fees owing to a company controlled by a

director of the Company, and general and shareholder loans for

administrative expenses owing to a company that has a common

director with the Company.

Effect of TransactionsIt is anticipated that upon

completion of the Acquisition, assuming completion of the Financing

and Debt Settlement (the “Transactions”), it is anticipated that

the Company will have an aggregate of 47.0 million common shares,

share purchase warrants to acquire an aggregate of 4.4 million

common shares and 107,000 options to purchase common shares. Altius

will hold 4.4 million common shares which is anticipated to be 9.4%

of the common shares outstanding after giving effect to the

Transactions.

All shares issued under the Financing and the Debt

Settlement will be subject to a hold period of four months and one

day from the date of issuance under applicable Canadian securities

law or, as applicable, the policies of the Exchange.

The Acquisition constitutes a “Fundamental

Acquisition” within the policies of the Exchange and as a result,

trading in Canterra’s common shares on the Exchange will remain

halted until all materials required under Exchange policies in

connection with the Acquisition have been filed. Closing of the

Acquisition is subject to a number of conditions including

completion of the Debt Settlement, the Financing, completion of

satisfactory due diligence, receipt of all required corporate,

regulatory and third party consents, including Exchange approval,

and satisfaction of other customary closing conditions. The

Acquisition cannot close until the required approvals are obtained.

There can be no assurance that the Acquisition will be completed as

proposed or at all.

Director AppointmentIn connection with the closing

of the Acquisition and the transition from diamond exploration to

gold exploration, Mr. Turner will transition from Chief Executive

Officer to Chair of the Board of Directors and Christopher

Pennimpede, P.Geo., Teton’s founder, shall be appointed to

Canterra’s board of directors and assume the President and Chief

Executive Officer position upon closing of the Acquisition. Mr.

Turner commented, “I look forward to partnering with Chris to

transition Canterra from diamond to gold exploration. We believe

the transition will provide Canterra shareholders an exciting

opportunity to benefit from exposure to a highly prospective

structural corridor in Newfoundland while the market investor

interest for gold exploration companies continues to improve.”

Mr. Pennimpede brings to the Company 13 years of

experience as a professional geologist in mineral exploration and

mining. Chris has been instrumental in leading exploration teams on

projects throughout the Americas. He has been involved in the early

exploration and discovery of deposits in northern Canada and Alaska

and has acted as VP Exploration and Director for several junior

mining companies over the years. Mr. Pennimpede gained global

experience evaluating and consulting to numerous projects while

acting as Operations Manager for CSA Global. Chris is currently the

VP Corporate Development at Contact Gold and is a graduate of Simon

Fraser University with a Bachelor of Science degree in Earth

Sciences.

A technical report for the Winding Lake Project is

being prepared in connection Acquisition and in accordance with

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects and the policies of the Exchange.

Qualified PersonAll scientific and technical

information in this press release, has been reviewed and approved

by Christopher Pennimpede, P.Geo., a Founder of Teton, who is a

“qualified person” within the meaning of NI 43-101.

The Option AgreementPursuant to a property purchase

agreement dated August 27, 2020 between Teton and Altius, as

amended October 30, 2020 (the “Option Agreement”), Altius has

granted Teton an option (the “Option”) to acquire a 100% right

title and interest in and to the Wilding Lake Project, subject to

2% net smelter royalty payable to Altius and the original property

owners.

In accordance with the terms of the Property Option

Agreement, in order to exercise the Option, Teton is required

to:

- issue Altius

12,500,000 common shares of Teton and warrants to acquire a further

6,250,000 Teton common shares (together, the “Payment Securities”),

which securities shall be issued immediately prior to the closing

of the Acquisition;

- incur cumulative

exploration expenditures of at least $1,000,000 in connection with

the Wilding Lake Project before August 27, 2022; and,

- complete a

transaction with a publicly listed company (a “Public Company”),

pursuant to which the outstanding securities of Teton are exchanged

with the securities of the Public Company before August 27,

2022.

In connection with the issuance of the Payment

Securities granting the royalty rights to Altius, Altius will

transfer title to the Wilding Lake Property to Teton.

ON BEHALF OF THE BOARD OF

CANTERRA MINERALS CORPORATION

“Randy Turner”Randy Turner, President

& CEO

For further information, contact Randy Turner,

President at 604-687-6644 or info@canterraminerals.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This press release contains statements that

constitute “forward-looking information” (collectively,

“forward-looking statements”) within the meaning of the applicable

Canadian securities legislation. All statements, other than

statements of historical fact, are forward-looking statements and

are based on expectations, estimates and projections as at the date

of this news release. Any statement that discusses predictions,

expectations, beliefs, plans, projections, objectives, assumptions,

future events or performance (often but not always using phrases

such as “expects”, or “does not expect”, “is expected”,

“anticipates” or “does not anticipate”, “plans”, “budget”,

“scheduled”, “forecasts”, “estimates”, “believes” or “intends” or

variations of such words and phrases or stating that certain

actions, events or results “may” or “could”, “would”, “might” or

“will” be taken to occur or be achieved) are not statements of

historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include,

without limitation, statements regarding: the terms, conditions,

and completion of the Acquisition, the Financing and the Debt

Settlement; the business and operations of the Company;

unprecedented market and economic risks associated with current

unprecedented market and economic circumstances due to the COVID-19

pandemic, as well as those risks and uncertainties identified and

reported in the Company's public filings under its respective SEDAR

profile at www.sedar.com. In making the forward-looking statements

contained in this press release, the Company has made certain

assumptions, including that: due diligence will be satisfactory;

the Debt Settlement and Financing will be completed on acceptable

terms; all applicable corporate, shareholder, and regulatory

approvals for the Acquisition will be received. Although the

Company believes that the expectations reflected in forward-looking

statements are reasonable, it can give no assurance that the

expectations of any forward-looking statements will prove to be

correct. Known and unknown risks, uncertainties, and other factors

which may cause the actual results and future events to differ

materially from those expressed or implied by such forward-looking

statements. Such factors include, but are not limited to: results

of due diligence; availability of financing; delay or failure to

receive board, shareholder or regulatory approvals; and general

business, economic, competitive, political and social

uncertainties. Accordingly, readers should not place undue reliance

on the forward-looking statements and information contained in this

press release. Except as required by law, the Company disclaims any

intention and assumes no obligation to update or revise any

forward-looking statements to reflect actual results, whether as a

result of new information, future events, changes in assumptions,

changes in factors affecting such forward-looking statements or

otherwise.

United States AdvisoryThe securities referred to

herein have not been and will not be registered under the United

States Securities Act of 1933, as amended (the "U.S. Securities

Act"), have been or will be offered and sold outside the United

States to eligible investors pursuant to Regulation S promulgated

under the U.S. Securities Act, and may not be offered, sold, or

resold in the United States or to, or for the account of or benefit

of, a U.S. Person (as such term is defined in Regulation S under

the United States Securities Act) unless the securities are

registered under the U.S. Securities Act, or an exemption from the

registration requirements of the U.S. Securities Act is available.

Hedging transactions involving the securities must not be conducted

unless in accordance with the U.S. Securities Act. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy any securities, nor shall there be any sale of

securities in the state in the United States in which such offer,

solicitation or sale would be unlawful.

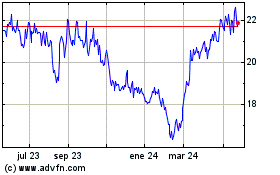

Altius Minerals (TSX:ALS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

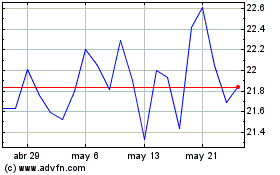

Altius Minerals (TSX:ALS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024