FICX Secures $8M in Funding to Launch No-Code CX Automation Platform

17 Agosto 2021 - 7:40AM

FICX (http://www.ficx.io), innovator in CX Automation, today

announced that it has secured $8 million in venture capital funding

to accelerate the development of its software to automate customer

processes and deliver them over any customer channel. The lead

investors in the Series B funding round include NAventures, the

corporate venture capital arm of National Bank of Canada, and

Prytek, a multinational technology group delivering enterprise

technology and managed services in finance and insurance. Previous

investor Liberty Global Ventures also participated in the round.

FICX is the new trading name for CallVU, a digital CX pioneer

that has historically focused on solutions specifically for call

centers. The new name better reflects how the company’s no-code CX

automation platform is solving complex process challenges across a

broad range of customer channels, touchpoints and use cases.

“Managing the customer experience has moved beyond a

nice-to-have and is now arguably one of the most critical

components of competitive advantage,” said Michael Oiknine, CEO of

FICX. “The global market for customer experience software

management is expected to reach $14.45 billion by 2025, but there

are surprisingly few companies providing the no-code tools needed

to rapidly digitize and automate broken customer journeys. With

this new investment round, FICX will be able to expand our core

platform as well as drive market adoption of our CX Automation

tools.”

FICX’s no-code approach to customer experience rapidly digitizes

and automates broken customer journeys, transforming them into

frictionless, end-to-end digital experiences. Using FICX, companies

can easily add custom digital workflows in any customer channel

including websites, apps, chat, IVR, call centers, and in-store.

FICX integrates with existing enterprise technology to facilitate

automation with prebuilt connectors and robust APIs that sync

front-end experiences with backend CRM, Contact Center, Service

Desk, and Payment systems. FICX customers include National Bank of

Canada, Bank Leumi, Banca Transylvania, and the Israeli Ministry of

Health.

Over the last few years, there has been significant interest and

investment in RPA (robotic process automation) to automate internal

workflows. Customer-facing workflows can benefit as much, or more,

from process automation. However, customer-facing process are more

unpredictable and complex. The ability to build no-code digital

interfaces, integrations and automations makes FICX ideal for rapid

automation of customer-facing processes. FICX makes it easy for

brands to design and build secure, automated CX workflows without

writing code.

According to Gartner's research, more than 80% of organizations

say they expect to compete primarily on customer experience.

Gartner also reports a substantial increase in CX spending, with

74% of companies polled indicating they expected to increase their

CX budget. Forrester notes that an increase of one point on their

proprietary Customer Experience Index can increase revenue by more

than $1 billion, with additional CX improvements driving even

greater revenue growth.

“Demand for CX technology is rising as more organizations

allocate capital to deliver the effortless digital experiences that

customers have come to expect from service providers,” said Igal

Ohayon, Investment Director at NAventures. “There are few

best-of-breed software tools available capable of automating and

customizing the customer journey the way that FICX can. Investing

in FICX gives us a stake in a burgeoning market as well as access

to cutting edge CX Automation technology.”

About FICXFICX is reimagining the way leading

brands digitally transform their customer experience. As a pioneer

and a leader in no-code CX app development and automation, FICX

empowers modern enterprises to rapidly digitize and automate CX

journeys and deploy them anywhere they engage customers. By

removing friction from sales and service interactions, our clients

cut costs, convert more sales and keep customers happy. For more

information, visit www.ficx.io.

About National Bank of Canada and

NAventuresWith $351 billion in assets as at

April 30, 2021, National Bank of Canada, together with

its subsidiaries, forms one of Canada's leading integrated

financial groups. It has more than 26,000 employees in

knowledge-intensive positions and has been recognized numerous

times as a top employer and for its commitment to diversity. Its

securities are listed on the Toronto Stock Exchange (TSX: NA).

Follow the Bank’s activities at nbc.ca or via social

media such

as Facebook, LinkedIn and Twitter.

NAventures, the corporate venture capital arm of National Bank

of Canada, takes equity stakes in startups and growing businesses

to foster growth in companies that will shape the financial

institutions of the future. Follow NAventures activities at

nbc.ca/naventures.

About PrytekPrytek is a multinational

technology group that builds deep technology and SaaS solutions

through a BOPaaS (Business Operating Platform-as-a-Service) which

is a combination of Deep Tech Solutions with Managed Services and

Capital, providing the capability to lift out entire operations to

create more efficient businesses of the future. Headed by industry

experts, Prytek builds businesses and ecosystems in the Financial

Services, Cyber & Tech Education and HR sectors.

Contact:Tom WoolfWoolf Media &

Marketingtomw@woolfmedia.com

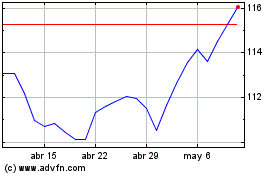

National Bank of Canada (TSX:NA)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

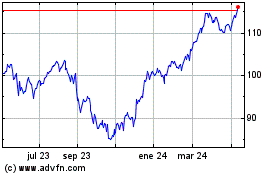

National Bank of Canada (TSX:NA)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025