Perseus Mining Limited: A$ 32 Million Institutional Placement

17 Febrero 2014 - 6:45PM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Perseus Mining Limited ("Perseus" or the "Company") (TSX:PRU)(ASX:PRU) is

pleased to announce the successful placement to institutional and sophisticated

investors of about 68.7 million ordinary shares, representing 15% of Perseus's

existing capital to raise approximately A$32 million (the "Placement").

The price under the Placement was set at A$0.47 ("Placement Price") per new

share issued. The Placement Price represents a 6.9% discount to the last ASX

closing price of Perseus shares of A$0.505 on February 14, 2014 and a 2.3%

discount to the ASX five-day volume weighted average price of A$0.48 (up to and

including February 14, 2014).

The proceeds of the Placement will be used for capital expenditure to accelerate

productivity improvements and access to the eastern pits at the Edikan Gold Mine

in Ghana and to provide for further balance sheet flexibility.

Managing Director and CEO of Perseus, Jeff Quartermaine said, "We were extremely

pleased with the level of interest in the Placement which was well supported by

new and existing institutions. The Placement will help provide us with balance

sheet strength, keeping us debt free as we continue to implement the

re-optimised Edikan Life of Mine Plan focused on maximising cash margins,

increasing gold production, reducing unit costs and ensuring efficient capital

deployment. During the December 2013 quarter, we produced 48.4koz from Edikan

for an all-in site unit cost of US$1,228/oz, 8.5% lower than the previous

quarter."

UBS AG, Australia Branch acted as sole lead manager and book runner for the

Placement supported by GMP as co-manager.

Settlement of the Placement is subject to TSX approval and is expected to occur

on February 21, 2014, with the new shares expected to be allotted through the

ASX and commence trading on February 24, 2014. The new shares will rank equally

with existing shares.

Jeff Quartermaine, Managing Director and Chief Executive Officer

The securities referred to in this news release have not been, nor will they be,

registered under the United States Securities Act of 1933, as amended, and may

not be offered or sold within the United States or to, or for the account or

benefit of, U.S. persons absent U.S. registration or an applicable exemption

from the U.S. registration requirements. This news release does not constitute

an offer for sale of, nor a solicitation for offers to buy, any securities in

the United States. Any public offering of securities in the United States must

be made by means of a prospectus containing detailed information about the

issuer and its management, as well as financial statements.

Caution Regarding Forward Looking Information: This report contains

forward-looking information which is based on the assumptions, estimates,

analysis and opinions of management made in light of its experience and its

perception of trends, current conditions and expected developments, as well as

other factors that management of the Company believes to be relevant and

reasonable in the circumstances at the date that such statements are made, but

which may prove to be incorrect. Assumptions have been made by the Company

regarding, among other things: the price of gold, continuing commercial

production at the Edikan Gold Mine without any major disruption, development of

a mine at Tengrela, the receipt of required governmental approvals, the accuracy

of capital and operating cost estimates, the ability of the Company to operate

in a safe, efficient and effective manner and the ability of the Company to

obtain financing as and when required and on reasonable terms. Readers are

cautioned that the foregoing list is not exhaustive of all factors and

assumptions which may have been used by the Company. Although management

believes that the assumptions made by the Company and the expectations

represented by such information are reasonable, there can be no assurance that

the forward-looking information will prove to be accurate.

Forward-looking information involves known and unknown risks, uncertainties, and

other factors which may cause the actual results, performance or achievements of

the Company to be materially different from any anticipated future results,

performance or achievements expressed or implied by such forward-looking

information. Such factors include, among others, the actual market price of

gold, the actual results of current exploration, the actual results of future

exploration, changes in project parameters as plans continue to be evaluated, as

well as those factors disclosed in the Company's publicly filed documents. The

Company believes that the assumptions and expectations reflected in the

forward-looking information are reasonable. Assumptions have been made

regarding, among other things, the Company's ability to carry on its exploration

and development activities, the timely receipt of required approvals, the price

of gold, the ability of the Company to operate in a safe, efficient and

effective manner and the ability of the Company to obtain financing as and when

required and on reasonable terms. Readers should not place undue reliance on

forward-looking information. Perseus does not undertake to update any

forward-looking information, except in accordance with applicable securities

laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Perseus Mining Limited

Jeff Quartermaine

Managing Director

+61 8 6144 1700 (Perth)

jeff.quartermaine@perseusmining.com

www.perseusmining.com

Nathan Ryan

Investor Relations

+61 (0) 420 582 887 (Sydney)

nathan.ryan@nwrcommunications.com.au

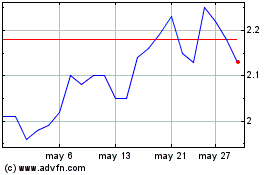

Perseus Mining (TSX:PRU)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Perseus Mining (TSX:PRU)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024