Consolidated Financial Highlights

(unaudited)

|

(in thousands of dollars except per

share amounts) |

Three months ended |

Nine months ended |

|

September

30,2019 |

September

30,2018 |

September

30,2019 |

September

30,2018 |

|

Net earnings (continuing) |

7,322 |

8,846 |

45 |

5,770 |

|

Net earnings (discontinued operations) |

- |

211,587 |

- |

214,434 |

|

Net earnings |

7,322 |

220,433 |

45 |

220,204 |

|

Basic and diluted earnings per share (continuing) |

0.27 |

0.32 |

0.00 |

0.21 |

|

Basic and diluted earnings per share (discontinued operations) |

- |

7.74 |

- |

7.84 |

|

Basic and diluted earnings per share |

0.27 |

8.06 |

0.00 |

8.05 |

Operating Data

|

|

Three months ended |

Nine months ended |

|

|

September

30, 2019 |

September

30, 2018 |

September

30, 2019 |

September

30, 2018 |

|

ClubLink |

|

Canadian Full Privilege Golf Members |

|

|

14,755 |

15,588 |

|

Championship rounds – Canada |

607,000 |

558,000 |

954,000 |

926,000 |

|

18-hole equivalent championship golf courses – Canada |

|

|

41.5 |

42.5 |

|

18-hole equivalent managed championship golf courses – Canada |

|

|

1.0 |

|

|

Championship rounds – U.S. |

43,000 |

44,000 |

254,000 |

252,000 |

|

18-hole equivalent championship golf courses – U.S. |

|

|

11.0 |

11.0 |

The following is a breakdown of net operating

income by segment:

|

|

For the three months ended |

|

(thousands of Canadian dollars) |

September 30, 2019 |

September 30, 2018 |

|

|

|

|

|

|

Net operating income (loss) by segment |

|

|

|

Canadian golf club operations |

$ |

17,346 |

$ |

16,913 |

|

US golf club operations |

|

|

|

(2019 - US loss $930,000; 2018 - US loss $926,000) |

(1,231) |

(1,210) |

|

Corporate operations |

(939) |

(940) |

|

|

|

|

|

|

Net operating income (1) |

|

$ |

15,176 |

$ |

14,763 |

| |

|

For the nine months ended |

|

(thousands of Canadian dollars) |

September 30, 2019 |

September 30, 2018 |

|

|

|

|

|

|

Net operating income (loss) by segment |

|

|

|

Canadian golf club operations |

$ |

25,668 |

$ |

27,878 |

|

US golf club operations |

|

|

|

(2019 - US $828,000; 2018 - US $158,000) |

1,106 |

147 |

|

Corporate operations |

(2,673) |

(2,472) |

|

|

|

|

|

|

Net operating income (1) |

$ |

24,101 |

$ |

25,553 |

The following is an analysis of net earnings:

| |

For the three months

ended |

|

(thousands of Canadian dollars) |

September 30

2019, |

|

September 30,

2018 |

|

|

|

|

|

|

Operating revenue |

$ |

65,260 |

|

$ |

65,351 |

|

|

Direct operating expenses (1) |

|

50,084 |

|

|

50,588 |

|

| Net

operating income (1) |

|

15,176 |

|

|

14,763 |

|

| Amortization

of membership fees |

|

1,480 |

|

|

1,807 |

|

| Depreciation

and amortization |

|

(4,993 |

) |

|

(4,040 |

) |

| Land lease

rent |

|

- |

|

|

(1,097 |

) |

| Interest,

net and investment income |

|

(1,317 |

) |

|

(2,522 |

) |

| Other

items |

|

357 |

|

|

3,169 |

|

|

Income taxes |

|

(3,381 |

) |

|

(3,234 |

) |

| Net earnings

(continuing) |

|

7,322 |

|

|

8,846 |

|

|

Net earnings (discontinued operations) |

|

- |

|

|

211,587 |

|

|

Net earnings |

$ |

7,322 |

|

$ |

220,433 |

|

| |

For the nine months

ended |

|

(thousands of Canadian dollars) |

September 30,

2019 |

|

September 30,

2018 |

|

|

|

|

|

|

Operating revenue |

$ |

134,496 |

|

$ |

136,906 |

|

|

Direct operating expenses (1) |

|

110,395 |

|

|

111,353 |

|

| Net

operating income (1) |

|

24,101 |

|

|

25,553 |

|

| Amortization

of membership fees |

|

4,033 |

|

|

5,145 |

|

| Depreciation

and amortization |

|

(15,177 |

) |

|

(12,153 |

) |

| Land lease

rent |

|

- |

|

|

(3,292 |

) |

| Interest,

net and investment income |

|

(4,126 |

) |

|

(10,030 |

) |

| Other

items |

|

(7,594 |

) |

|

3,105 |

|

|

Income taxes |

|

(1,192 |

) |

|

(2,558 |

) |

| Net earnings

(continuing) |

|

45 |

|

|

5,770 |

|

|

Net earnings (discontinued operations) |

|

- |

|

|

214,434 |

|

|

Net earnings |

$ |

45 |

|

$ |

220,204 |

|

| |

|

|

Non-IFRS Measures

TWC uses non-IFRS measures as a benchmark

measurement of our own operating results and as a benchmark

relative to our competitors. We consider these non-IFRS

measures to be a meaningful supplement to net earnings. We also

believe these non-IFRS measures are commonly used by securities

analysts, investors and other interested parties to evaluate our

financial performance. These measures, which included direct

operating expenses and net operating income do not have

standardized meaning under IFRS. While these non-IFRS measures have

been disclosed herein to permit a more complete comparative

analysis of the Company’s operating performance and debt servicing

ability relative to other companies, readers are cautioned that

these non-IFRS measures as reported by TWC may not be comparable in

all instances to non-IFRS measures as reported by other

companies.

The glossary of financial terms is as follows:

Direct operating expenses =

expenses that are directly attributable to company’s business units

and are used by management in the assessment of their performance.

These exclude expenses which are attributable to major corporate

decisions such as impairment.

Net operating income =

operating revenue – direct operating expenses

Net operating income is an important metric used

by management in evaluating the Company’s operating performance as

it represents the revenue and expense items that can be directly

attributable to the specific business unit’s ongoing operations. It

is not a measure of financial performance under IFRS and should not

be considered as an alternative to measures of performance under

IFRS. The most directly comparable measure specified under

IFRS is net earnings.

Third Quarter 2019 Consolidated Operating

Highlights

On June 6, 2018, TWC announced that it entered

into a purchase and sale agreement to sell the White Pass rail and

port operations to a joint venture for proceeds of US$290,000,000.

Closing on July 31, 2018, the transaction represented a sale of the

complete operations of White Pass. Consequently, this segment is

being presented as discontinued operations in the financial

statements.

On December 14, 2018, the Company sold Club de

Golf Le Fontainebleau to the shareholders of Club de Golf Rosemère

for net proceeds of $8,589,000. ClubLink retains a management fee

arrangement of Fontainebleau. This sale has resulted in a decrease

of 458 members.

As of January 1, 2019, the Company adopted IFRS

16, Leases. As part of this guidance, land lease rent for operating

leases will no longer be expensed directly. Instead, these leases

are set up on the balance sheet and right-of-use depreciation

expense and interest expense is reflected instead.

Consolidated operating revenue decreased 0.1% to

$65,260,000 for the three month period ended September 30, 2019

from $65,351,000 in 2018.

Direct operating expenses decreased 1.0% to

$50,084,000 for the three month period ended September 30, 2019

from $50,588,000 in 2018.

Net operating income increased 2.8% to

$15,176,000 for the three month period ended September 30, 2019

from $14,763,000 in 2018 due to improvements in golf net operating

income resulting from higher guest and green fee revenue for the

quarter.

Amortization of membership fees decreased 18.1%

to $1,480,000 from $1,807,000 in 2018.

Interest, net and investment income decreased

47.8% to an expense of $1,317,000 for the three month period ended

September 30, 2019 from $2,522,000 in 2018 due to interest income

earned on funds from the sale of White Pass and a decrease in

borrowings.

Other items have decreased to income of $357,000

for the three month period ended September 30, 2019 from income of

$3,169,000 in 2018 due to insurance proceeds received in 2018 for

the insurance claim relating to the clubhouse at Le Maître.

Net earnings decreased to $7,322,000 for the

three month period ended September 30, 2019 from earnings of

$220,433,000 in 2018 due to the disposition of White Pass. Basic

and diluted loss per share changed to 27 cents per share in 2019,

compared to basic and diluted earnings per share of $8.06 in

2018.

Eligible Dividend

Today, TWC Enterprises Limited announced an

eligible cash dividend of 2 cents per common share to be paid on

December 13, 2019 to shareholders of record as at November 29,

2019.

Corporate Profile

TWC is engaged in golf club operations under the

trademark, “ClubLink One Membership More Golf.” TWC is Canada’s

largest owner, operator and manager of golf clubs with 53.5 18-hole

equivalent championship and 3.5 18-hole equivalent academy courses

(including one managed property) at 41 locations in Ontario, Quebec

and Florida.

For further information please contact:

Andrew TamlinChief Financial Officer15675

Dufferin StreetKing City, Ontario L7B 1K5Tel: 905-841-5372 Fax:

905-841-8488atamlin@clublink.ca

Management’s discussion and analysis, financial statements and

other disclosure information relating to the Company is available

through SEDAR and at www.sedar.com and on the Company website at

www.twcenterprises.ca

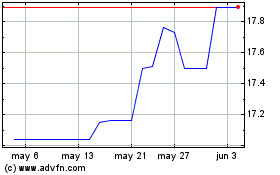

TWC Enterprises (TSX:TWC)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

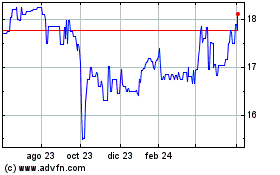

TWC Enterprises (TSX:TWC)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024