Alphamin Resources Corp. (AFM:TSXV, APH:JSE AltX)( “Alphamin” or

the “Company”), a producer of 4% of the world’s mined tin1 from its

high grade operation in the Democratic Republic of Congo, is

pleased to provide the following update for the year and quarter

ended December 2023:

- FY2023 tin production of

12,568 tonnes, up 1% from the prior year

- Q4 tin production of 3,126

tonnes

- Q4 tin sales of 2,046

tonnes impacted by poor road conditions, which have

subsequently improved

- FY2023

EBITDA3,4

guidance of US$136m at an average tin price of

US$26,009/t, with EBITDA negatively affected by a temporary delay

in Q4 tin sales volumes

- US$50 million tin

prepayment arrangement and lower marketing commission

secured

Operational and Financial Summary for the

Year and Quarter ended December 20232

|

Description |

Units |

Year ended December 2023 |

Year ended December 2022 |

Change |

Quarter ended December 2023 |

Quarter ended September 2023 |

Change |

|

Ore Processed |

Tonnes |

400,691 |

436,400 |

-8% |

105,510 |

100,395 |

5% |

|

Tin Grade Processed |

% Sn |

4.15 |

3.82 |

9% |

3.98 |

4.08 |

-3% |

|

Overall Plant Recovery |

% |

75 |

75 |

1% |

75 |

76 |

-2% |

|

Contained Tin Produced |

Tonnes |

12,568 |

12,493 |

1% |

3,126 |

3,104 |

1% |

|

Contained Tin Sold |

Tonnes |

11,385 |

12,764 |

-11% |

2,046 |

3,110 |

-34% |

|

EBITDA3,4 (FY2023 and Q4 2023 guidance) |

US$'000 |

135,541 |

222,215 |

-39% |

20,321 |

38,429 |

-47% |

|

AISC3, 4 (FY2023 and Q4 2023 guidance) |

US$/t sold |

14,259 |

14,237 |

0% |

14,645 |

14,625 |

0% |

|

Dividends paid (cents per share) |

C$ cps |

6 |

6 |

0% |

0 |

3 |

n/a |

|

Average Tin Price Achieved |

US$/t |

26,009 |

30,636 |

-15% |

25,157 |

26,557 |

-5% |

__________________________________________________________________________________________

1Data obtained from International Tin

Association Tin Industry Review 2022 2Information is disclosed on a

100% basis. Alphamin indirectly owns 84.14% of its operating

subsidiary to which the information relates. 3FY2023 and Q4 2023

EBITDA and AISC represent management’s guidance. 4This is not a

standardized financial measure and may not be comparable to similar

financial measures of other issuers.See “Use of Non-IFRS Financial

Measures” below for the composition and calculation of this

financial measure.

Operational and Financial

Performance

Contained tin production of 3,126 tonnes for the

quarter ended December 2023 was in line with the previous quarter.

Tin production of 12,568 tonnes for the year ended December 2023

exceeded market guidance of 12,000 tonnes. The Mpama North

underground mine continues to deliver ore at tin grades and volumes

in line with expectations. The Mpama North processing facility

performed well, achieving overall recoveries of 75% during FY2023

(FY2022: 75%).

As previously reported, poor road conditions

resulting from record heavy rainfall, had a negative impact on

truck transit times and export revenue receipts during Q4 2023. The

rains have subsided significantly from mid December 2023 with

rainfall now averaging ~10% of that recorded in October/November

2023. As a result of increased truck transit times, Q4 2023

contained tin sales of 2,046 tonnes was 1,080 tonnes less than the

quarter’s production and resulted in high levels of tin in stock.

The delay in tin sales should catch-up during Q1 2024 and

accordingly only then report to EBITDA and revenue receipts.

Guidance for AISC per tonne of tin sold is

US$14,259 and US$14,645 for the year and quarter ended December

2023 respectively. This is in line with that of the prior periods.

On-mine operating expenditure increased by 5% compared to the prior

year mainly due to a 32% increase in underground development metres

at Mpama North and higher diesel prices. Additional Mpama North

underground development has resulted in increased developed

reserves, higher run-of-mine ore stockpiles and improved future

operational flexibility.

EBITDA for FY2023 and Q4 2023 is estimated at

US$136m (FY2022: US$222m) and US$20m (Q3 2023: US$38m),

respectively. The EBITDA variance compared to prior periods is

attributable to lower tin prices and a delay in tin sales in Q4

2023 (Q4 sales delay has a ~US$14 million impact on EBITDA for the

quarter and year ended December 2023).

Alphamin’s audited consolidated financial

statements and accompanying Management’s Discussion and Analysis

for the year and quarter ended 31 December 2023 are expected to be

released on or about March 14, 2024.

Mpama South update and production

guidance for the year ending December 2024

The initial development of the Mpama South

underground mine has been completed on time. In addition, the

underground development should ensure sufficient developed mineral

resources to ensure adequate stockpiles ahead of the processing

plant’s commissioning. This should allow for a rapid ramp-up of tin

production following plant commissioning. As was previously

reported, logistical delays due to poor inbound road conditions

have deferred the commencement of processing to the end of March

2024. The processing plant mechanical erection and installation is

essentially complete with the main outstanding work relating to

completion of the installation of electrical cabling, the

installation of instrumentation and the commissioning of the

plant.

On the basis of incremental tin production from

the Mpama South plant from 1 April 2024, we expect contained tin

production of between 17,000 tonnes and 18,000 tonnes for the year

ending December 2024 (FY2023: 12,568 tonnes).

The Mpama South capital expenditure cost to

steady state production, including operational readiness costs, are

expected to exceed the US$116 million budget by approximately 10%

primarily as a result of weather-related delays, higher logistical

and import costs as well as minor scope changes.

Figure 1: Mpama South portal – ore being trammed

to surface

Please click here to view image

Figure 2: Gravity processing plant

Please click here to view image

Figure 3: Crushing plant

Please click here to view image

US$50 million tin prepayment arrangement

secured

Alphamin is pleased to announce that it has

secured a four-year extension (1 October 2024 to 30 September 2028)

to its current off-take agreement with the Gerald Group on the

basis of a ~60% reduction in tin marketing costs and an up to US$50

million tin prepayment arrangement. The tin prepayment arrangement

is effective immediately and may be utilised for tin concentrates

in transit but not yet exported as well as up to US$10 million for

tin concentrates produced not yet loaded for departure. The

facility carries an interest rate of CME 3M Term SOFR plus 5%

(calculated at 10,3% currently).

Capital allocation

Alphamin’s vision is to become one of the

world’s largest sustainable tin producers. From a capital

allocation perspective, the Board considers the combination of

investment in growth, ongoing exploration, and a high dividend

yield a robust value proposition. The funding of the Mpama South

expansion project, shareholder distributions and DRC income tax

payments were a priority during the year ended December 2023. The

allocation of capital in FY2024 will be prioritised towards

completion of the Mpama South project in Q1 2024, significantly

lower DRC income taxes on the basis of large advance provisional

payments made during FY2023 and ongoing shareholder distributions.

As previously reported, the Company intends to make a final FY2023

dividend decision in April 2024 to align with the timing of holding

the annual general meeting of Alphamin Bisie Mining SA (ABM), the

Company’s DRC subsidiary, to approve ABM’s annual financial

statements and consideration of the declaration of a dividend for

distribution to the Company and other minority shareholders.

Qualified Person

Mr. Clive Brown, Pr. Eng., B.Sc. Engineering

(Mining), is a qualified person (QP) as defined in National

Instrument 43-101 and has reviewed and approved the scientific and

technical information contained in this news release. He is a

Principal Consultant and Director of Bara Consulting Pty Limited,

an independent technical consultant to the

Company._________________________________________________________________________________________

FOR MORE INFORMATION, PLEASE CONTACT:

Maritz

Smith CEO Alphamin

Resources

Corp. Tel:

+230 269 4166E-mail: msmith@alphaminresources.com

CAUTION REGARDING FORWARD LOOKING

STATEMENTS

Information in this news release that is not a

statement of historical fact constitutes forward-looking

information. Forward-looking statements contained herein include,

without limitation, statements relating to expected EBITDA and AISC

guidance for Q4 and financial year 2023; annual production guidance

for 2024; planned incremental production resulting from Mpama

South; the timing for commissioning of the Mpama South processing

plant; timing and plans regarding underground development and the

total development cost of the Mpama South project; the expected

allocation of capital during the 2024 financial year; and expected

reversal of the temporary Q4 2023 sales lag by Q1 2024.

Forward-looking statements are based on assumptions management

believes to be reasonable at the time such statements are made.

There can be no assurance that such statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements. Although Alphamin has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking statements, there may be other

factors that cause results not to be as anticipated, estimated or

intended. Factors that may cause actual results to differ

materially from expected results described in forward-looking

statements include, but are not limited to: uncertainties regarding

Mpama North and Mpama South estimates of the expected mined tin

grades, processing plant performance and recoveries, uncertainties

regarding the underground conditions for development, uncertainties

regarding supply chain and logistics for purposes of Mpama South

equipment deliveries and the impact on the timing thereof,

uncertainties regarding global supply and demand for tin and market

and sales prices, uncertainties with respect to social, community

and environmental impacts, uninterupted access to required

infrastructure and third party service providers, adverse political

events and risks of security related incidents which may impact the

operation or safety of its people, uncertainties regarding the

legislative requirements in the Democratic Republic of the Congo

which may result in unexpected fines and penalties, impacts of the

global Covid-19 pandemic or other health crises on mining

operations and commodity prices as well as those risk factors set

out in the Company’s annual Management Discussion and Analysis and

other disclosure documents available under the Company’s profile at

www.sedarplus.ca. Forward-looking statements contained herein are

made as of the date of this news release and Alphamin disclaims any

obligation to update any forward-looking statements, whether as a

result of new information, future events or results or otherwise,

except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its

regulation services provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

USE OF NON-IFRS FINANCIAL PERFORMANCE

MEASURES

This announcement refers to the following

non-IFRS financial performance measures:

EBITDA

EBITDA is profit before net finance expense,

income taxes and depreciation, depletion, and amortization. EBITDA

provides insight into our overall business performance (a

combination of cost management and growth) and is the corresponding

flow driver towards the objective of achieving industry-leading

returns. This measure assists readers in understanding the ongoing

cash generating potential of the business including liquidity to

fund working capital, servicing debt, and funding capital

expenditures and investment opportunities.

This measure is not recognized under IFRS as it

does not have any standardized meaning prescribed by IFRS and is

therefore unlikely to be comparable to similar measures presented

by other issuers. EBITDA data is intended to provide additional

information and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS.

EBITDA MARGIN

EBITDA margin is EBITDA divided by gross

revenue.

NET CASH

Net cash is defined as cash and cash equivalents

less total current and non-current portions of interest-bearing

debt and lease liabilities.

AISC

This measures the costs to produce and sell a

tonne of contained tin plus the capital sustaining costs to

maintain the mine, processing plant and infrastructure. AISC

includes mine operating production expenses such as mining,

processing, administration, indirect charges (including surface

maintenance and camp and tailings dam construction costs), smelting

costs and deductions, refining and freight, distribution, royalties

and product marketing fees and corporate costs. AISC does not

include depreciation, depletion, and amortization, reclamation

expenses, borrowing costs and exploration expenses.

Sustaining capital expenditures are defined as

those expenditures which do not increase contained tin production

at a mine site and excludes all expenditures at the Company’s

projects and certain expenditures at the Company’s operating sites

which are deemed expansionary in nature.

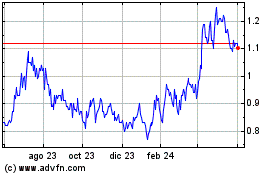

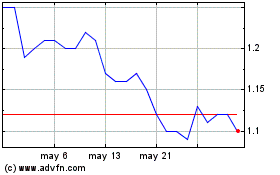

Alphamin Resources (TSXV:AFM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Alphamin Resources (TSXV:AFM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024